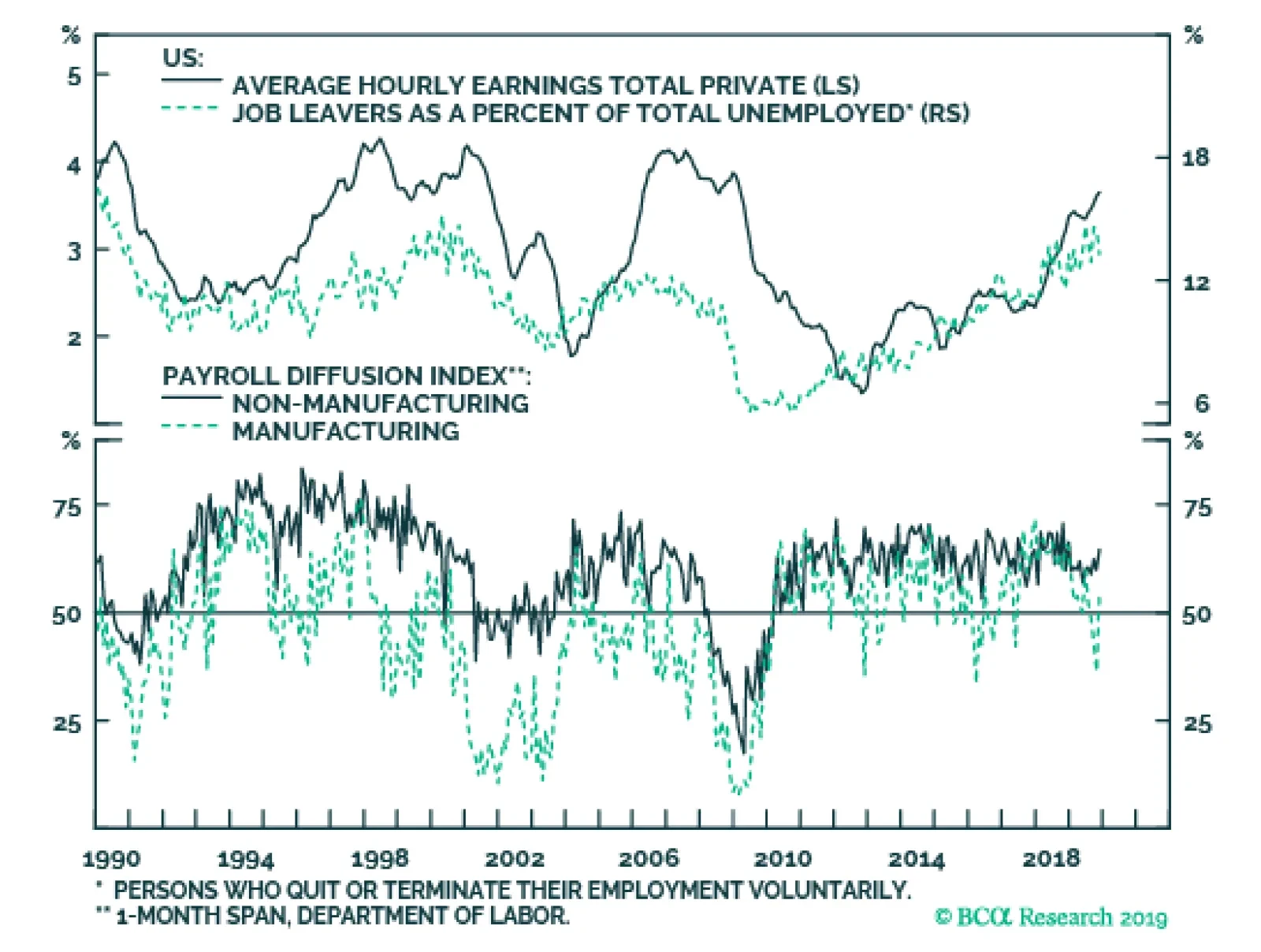

The US December job number was softer than anticipated, falling to 145 thousand, below expectations of 165 thousand. Moreover, the previous two months were revised down by 14 thousand. Also concerning, wage growth decelerated to…

Highlights Easy monetary policy is the linchpin of our 2020 market views and investment strategy, … : As we outlined in our 2020 Key Views report, easy monetary policy should extend the economic expansion and the bull markets in…

This morning’s US November job report points to the robustness of the US economy. The US created 266 thousand jobs, well above the 180 thousand expected. Moreover, the previous two months were revised up by 41 thousand jobs…

Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook for the year ahead. This report is an edited transcript of our recent…

Highlights Duration: The upturn in bond yields is not yet confirmed by our preferred global growth indicators. We anticipate that a reduction in trade uncertainty during the next few months will cause our indicators to rebound. But until…

Highlights The currency market is bifurcated in terms of shorter-term expectations versus longer-term factors. The Swedish krona, Norwegian krone, and British pound are solid long-term buys, but could remain very volatile in the short…

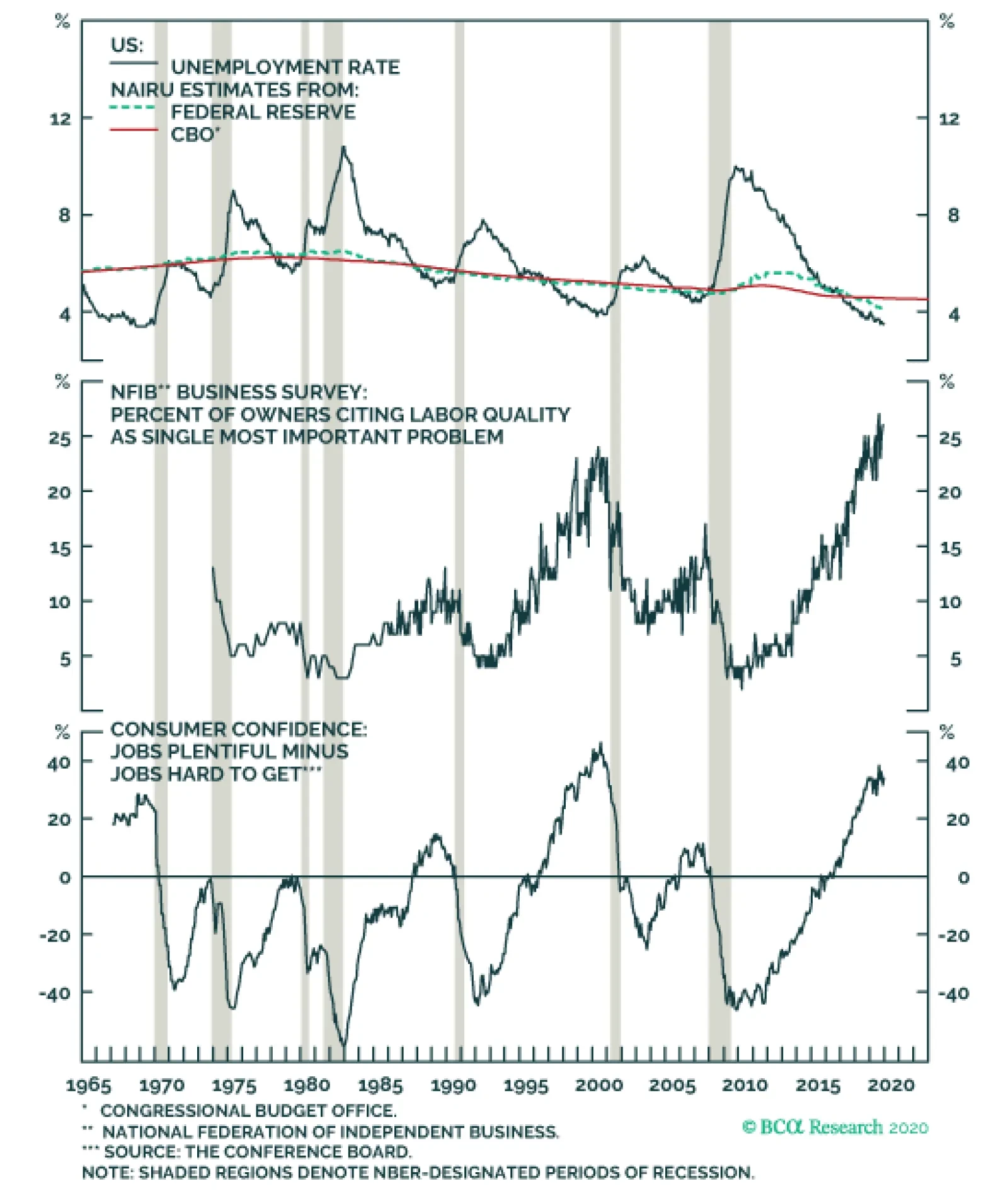

Highlights The manufacturing slowdown, on its own, is unlikely to tip the economy into a recession. The sector accounts for a small share of U.S. output and employment, and will gain a tailwind from a pick-up in global growth. A…

Business confidence peaked in March 2018 and has been in a freefall ever since, with the steepest drop taking place in recent months as the Sino-American trade war has re-escalated (CEO confidence shown inverted, top panel).…