Highlights Our baseline view foresees a U-shaped recovery, as economies slowly relax lockdown measures. There are significant risks to this forecast, however. On the upside, a vaccine or effective treatment could hasten the reopening…

Highlights The Chinese economy is recovering at a slower rate than the equity market has priced in. There is a high likelihood of negative revisions to Q2 EPS estimates and an elevated risk of a near-term price correction in Chinese…

Highlights Social distancing makes it impossible to do jobs that require close personal interaction, yet these are the very job sectors that have kept jobs growth alive in recent decades. If social distancing persists, then AI will…

Highlights Risk assets have rallied thanks to a healthy dose of economic stimulus and mounting evidence that the number of new COVID-19 cases has peaked. Unfortunately, the odds of a second wave of infections remain high. In the…

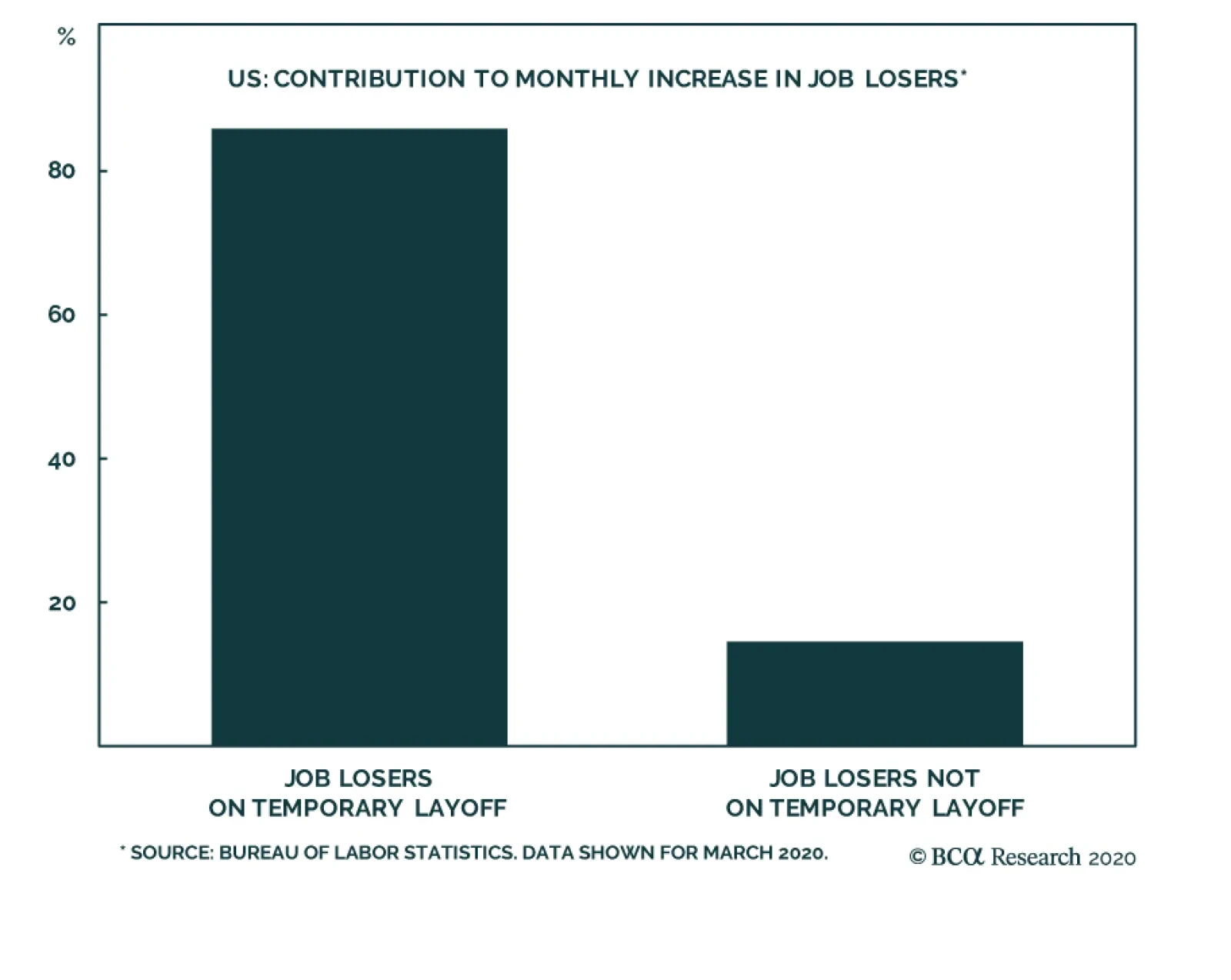

COVID-19 is inflicting great pain on the US labor market. The surge in initial job claims to 6.6 million indicates that over the coming months, the US unemployment rate will spike much higher than the 4.4% recorded in March. Such…

Dear Client, I will be discussing the economic and financial implications of the pandemic with my colleague Caroline Miller this Friday, March 27 at 8:00 AM EDT (12:00 PM GMT, 1:00 PM CET, 8:00 PM HKT). I hope you will be able to join…

Highlights Financial markets have experienced two weeks of wild swings: Following the negative 5-standard-deviation weekly move in the S&P 500 two weeks ago, the index moved at least 2.8% in each of last week’s first four…

Highlights Global growth will quickly recover if the Covid-19 outbreak is soon controlled. If the virus's spread doesn't slow, a worldwide recession will take hold in 2020. BCA remains cyclically bullish, but tactical caution…