The June JOLTS report showed further weakening in US labor market momentum, reinforcing our overweight duration stance and preference for steepeners. Job openings fell more than expected to 7.4m from a downwardly revised 7.7m, while…

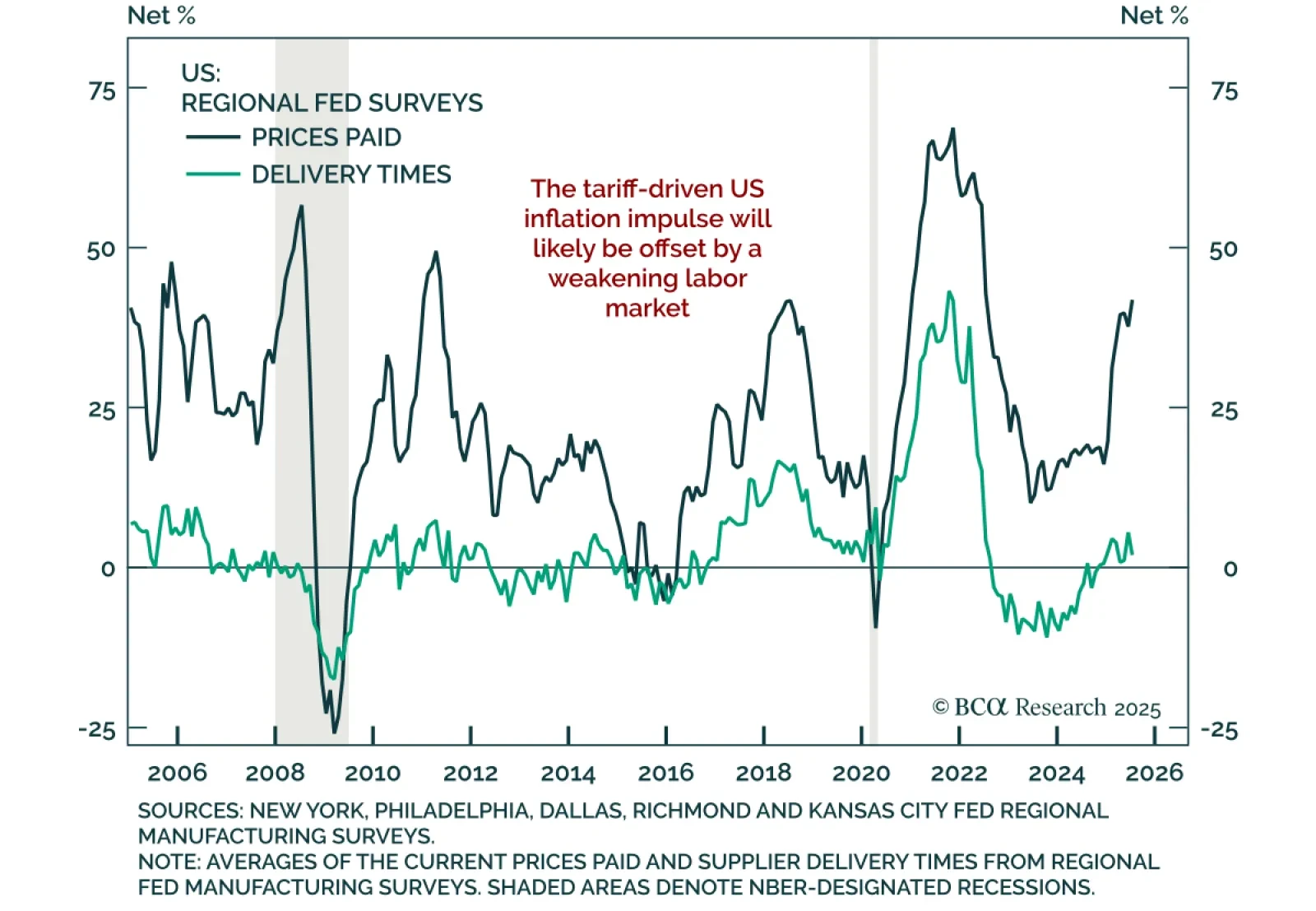

The July Dallas Fed survey beat expectations, pointing to a rebound in current activity, but the outlook remains subdued, supporting our modestly defensive asset allocation. The headline index rose to 0.9 from -12.7 in June, with…

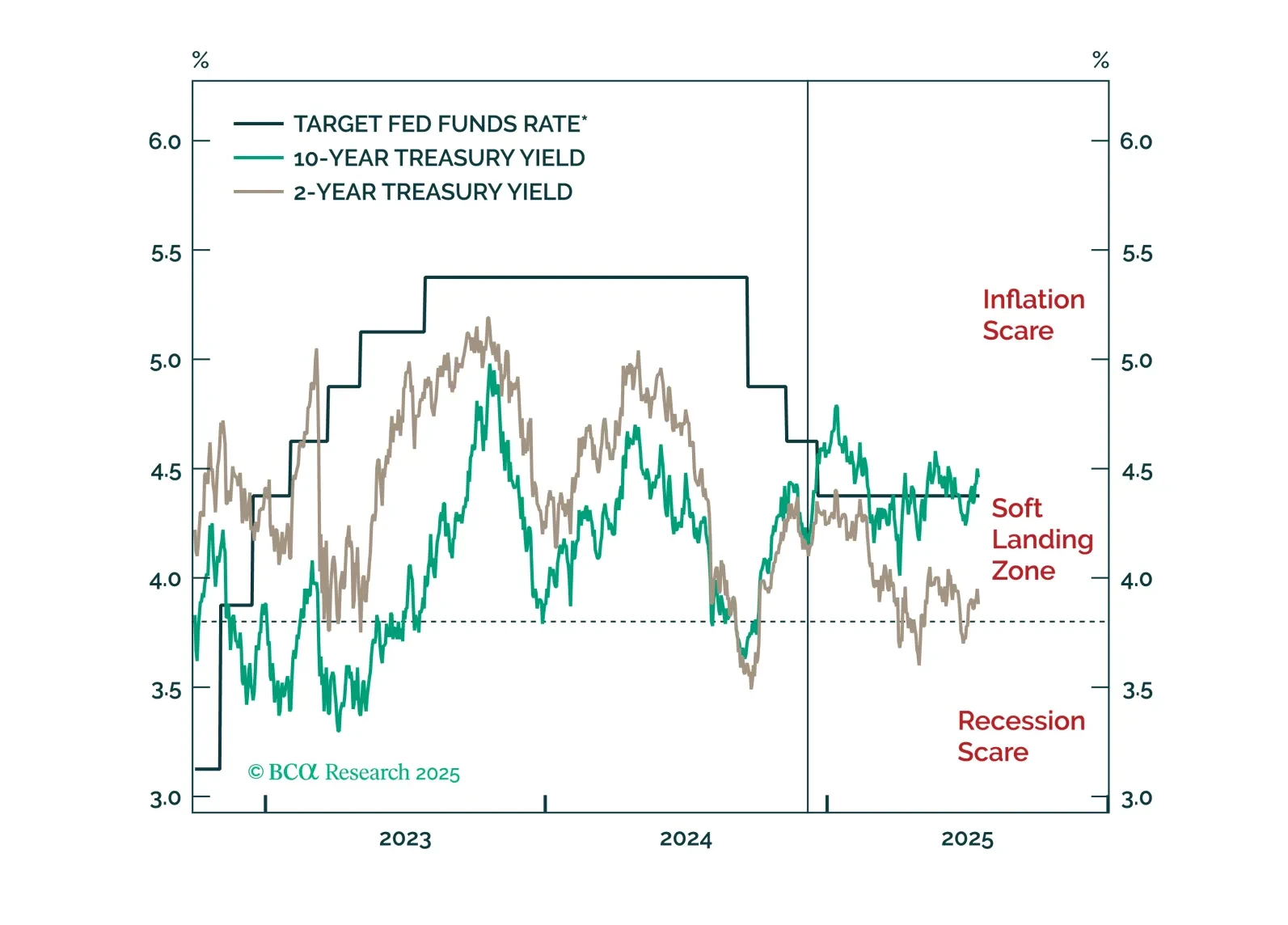

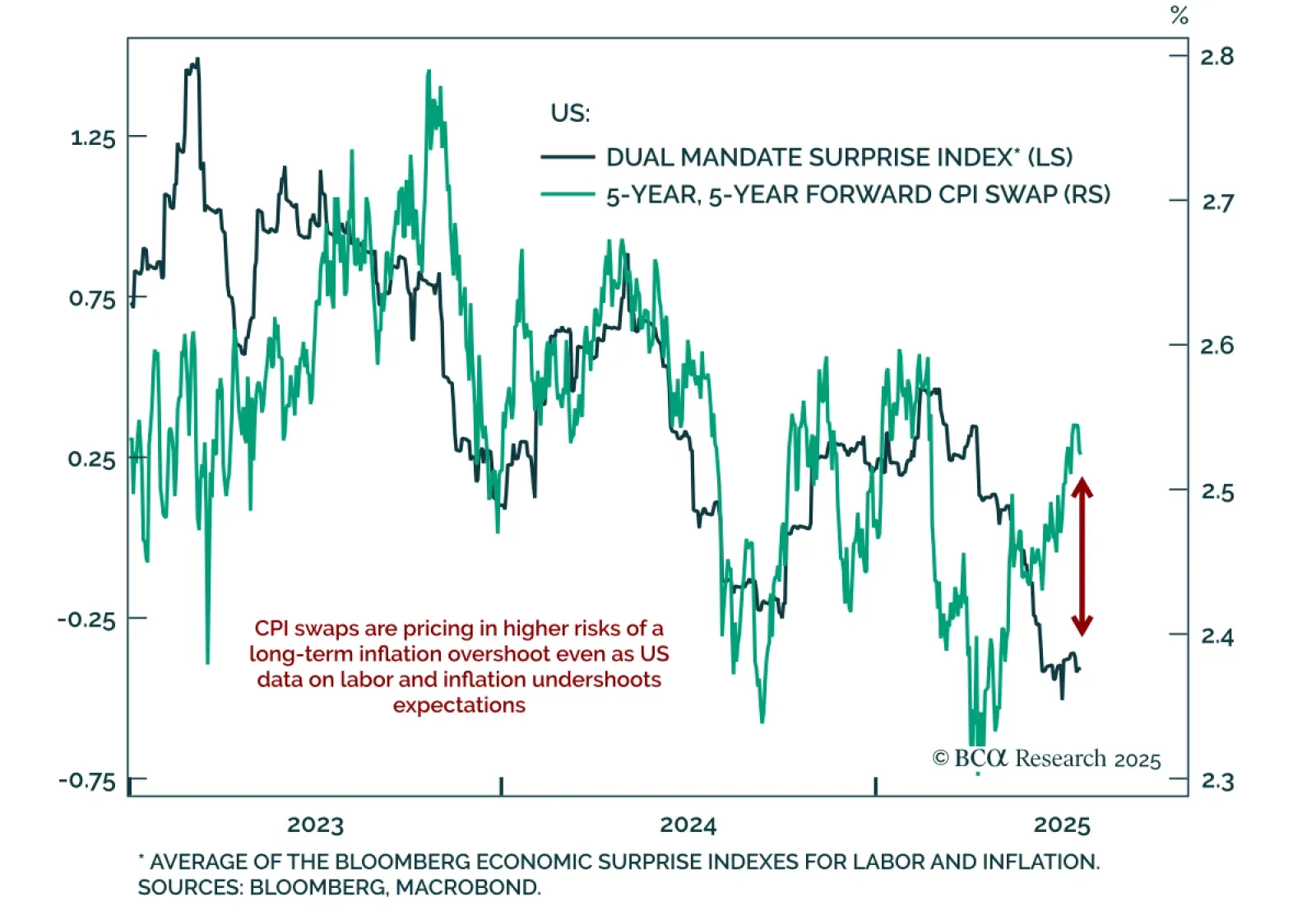

Rising political pressure on the Fed risks undermining policy credibility, risking a de-anchoring of long-term inflation expectations. The Trump administration keeps escalating attacks on Fed Chair Powell. While the Fed…

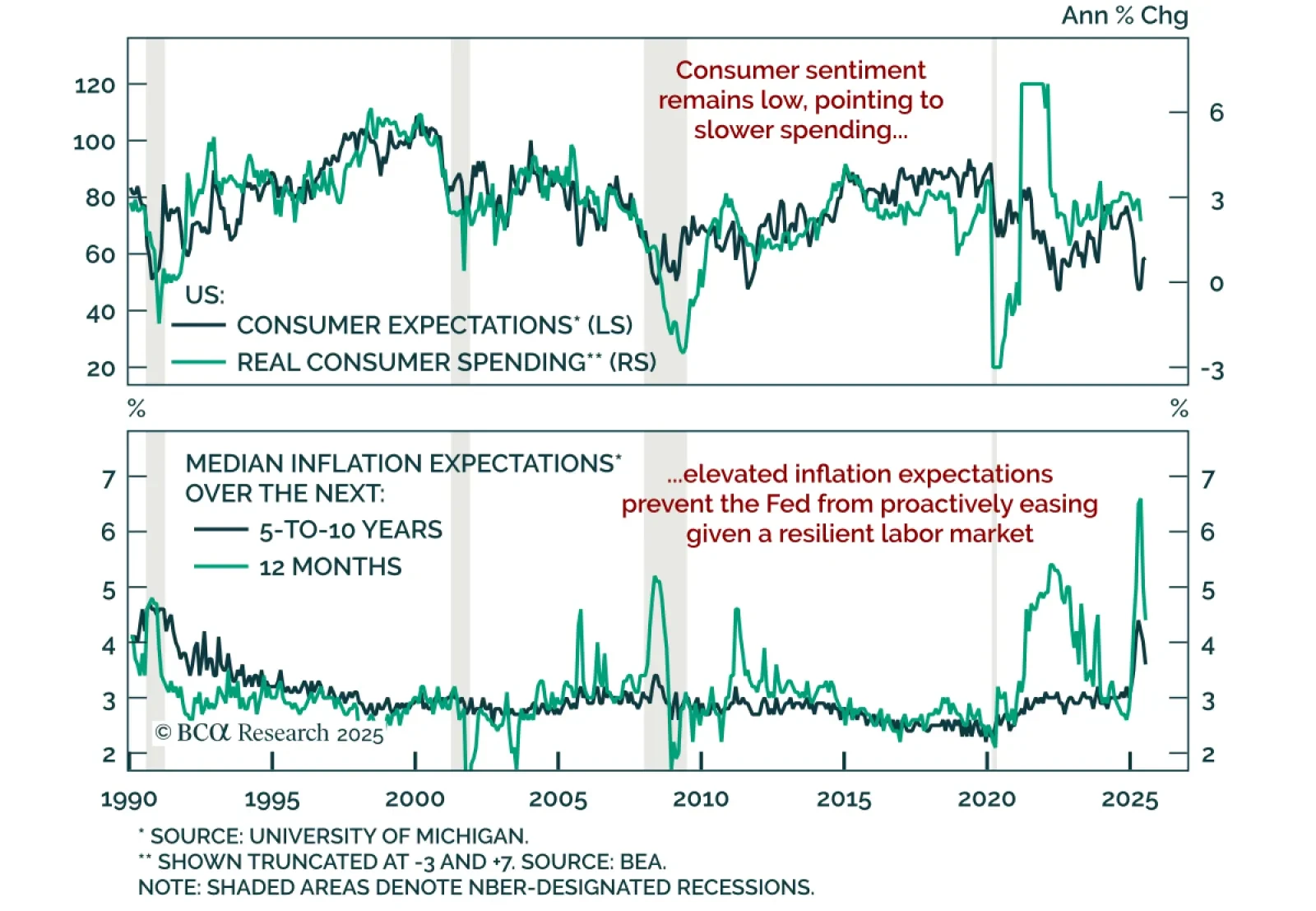

Consumer sentiment improved modestly in July, but remains at levels that still point to subdued spending, reinforcing our defensive stance. The preliminary University of Michigan index rose to 61.8 from 60.7 in June. Expectations…

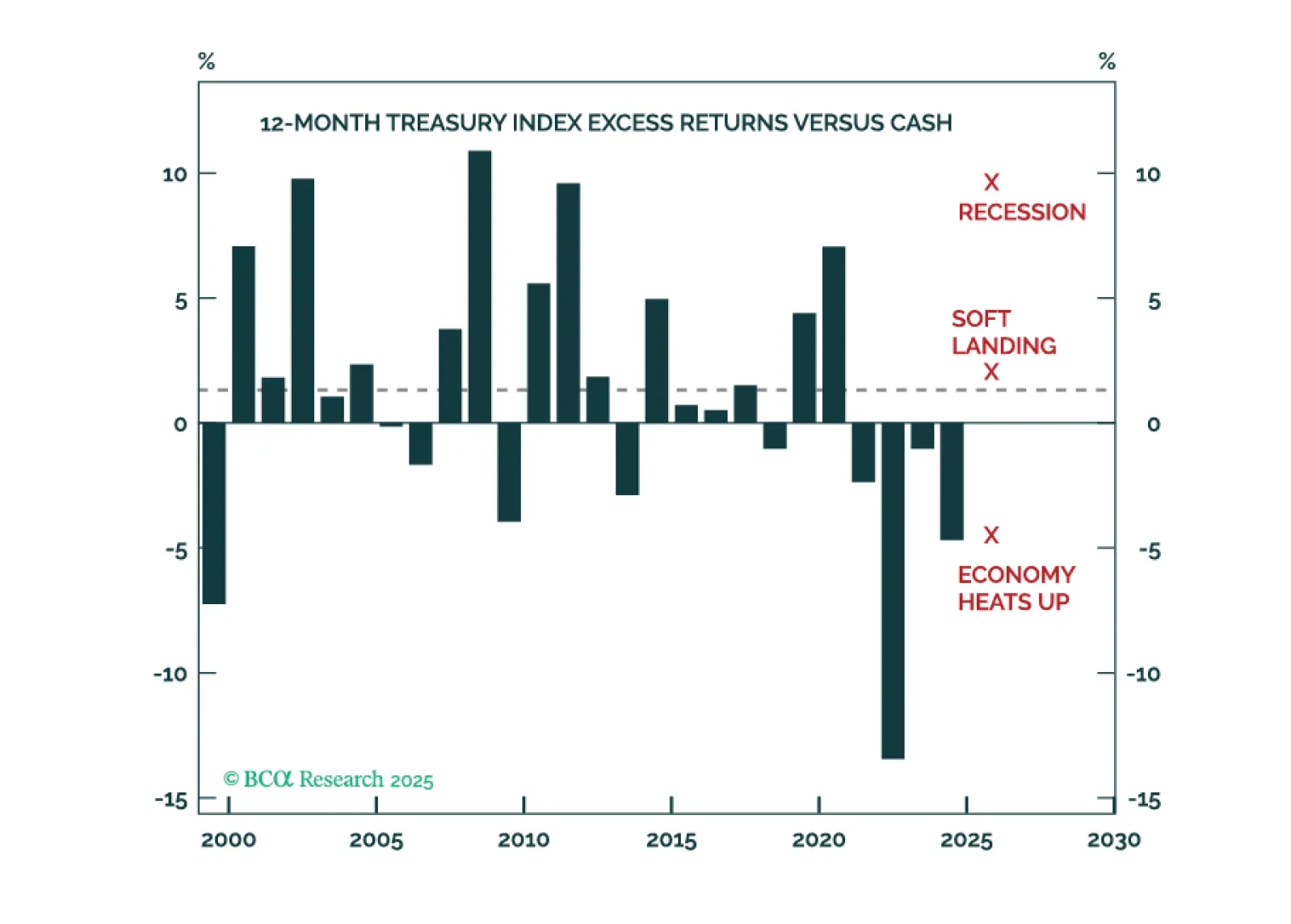

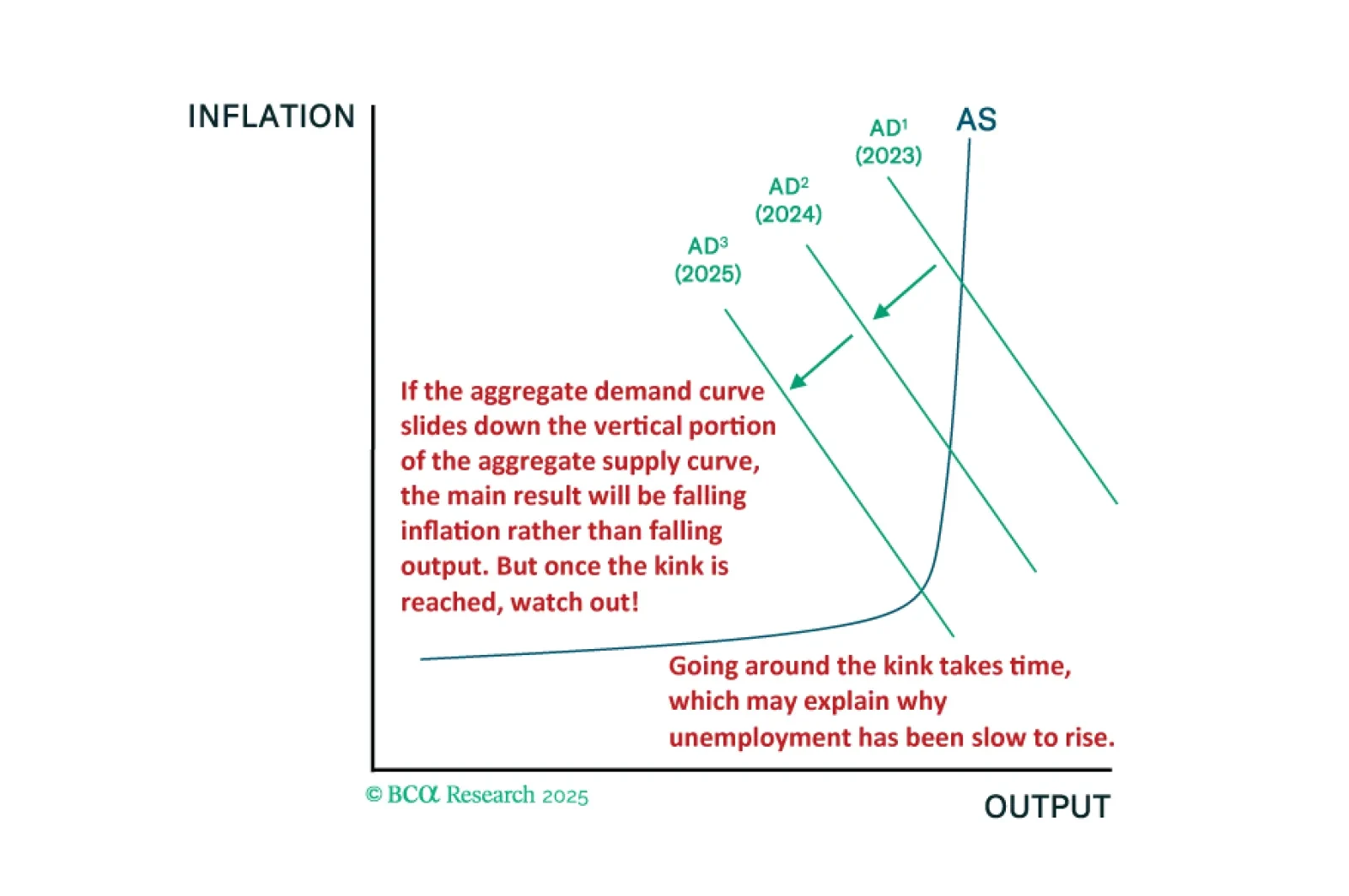

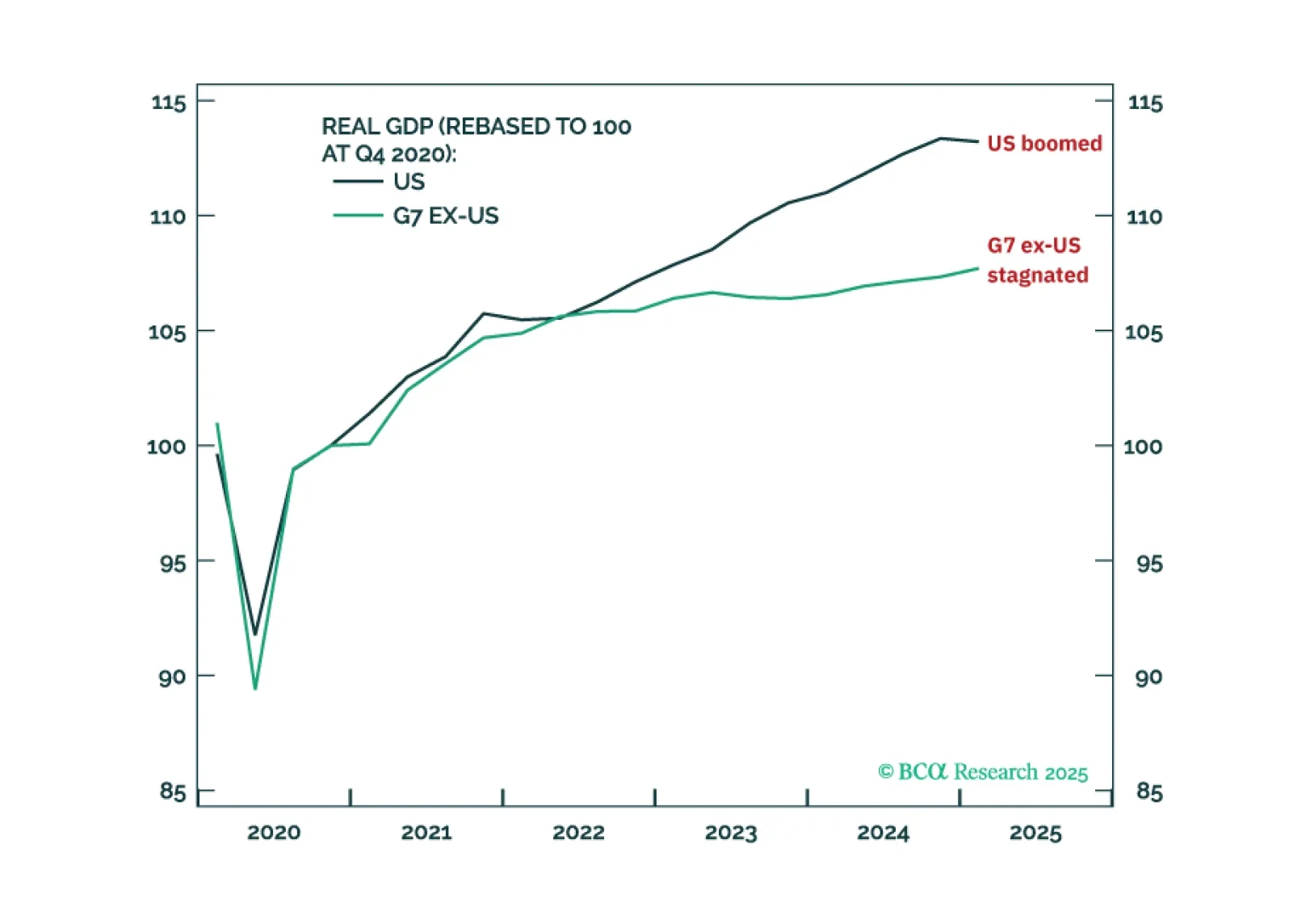

The fact that the US economy has been slower to deteriorate than in past cycles is entirely consistent with our kinked Phillips curve framework. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

Jay Powell won’t be removed as Fed Chair before the expiry of his term next May, but we will learn the identity of his replacement this year, setting up a potentially awkward “shadow Fed Chair” situation.

Euro area and Chinese interest rates must fall much further to prevent monetary policy from becoming ultra-restrictive. But Trump’s attempts to force unwarranted rate cuts from the Fed risks a vicious backlash from the bond…

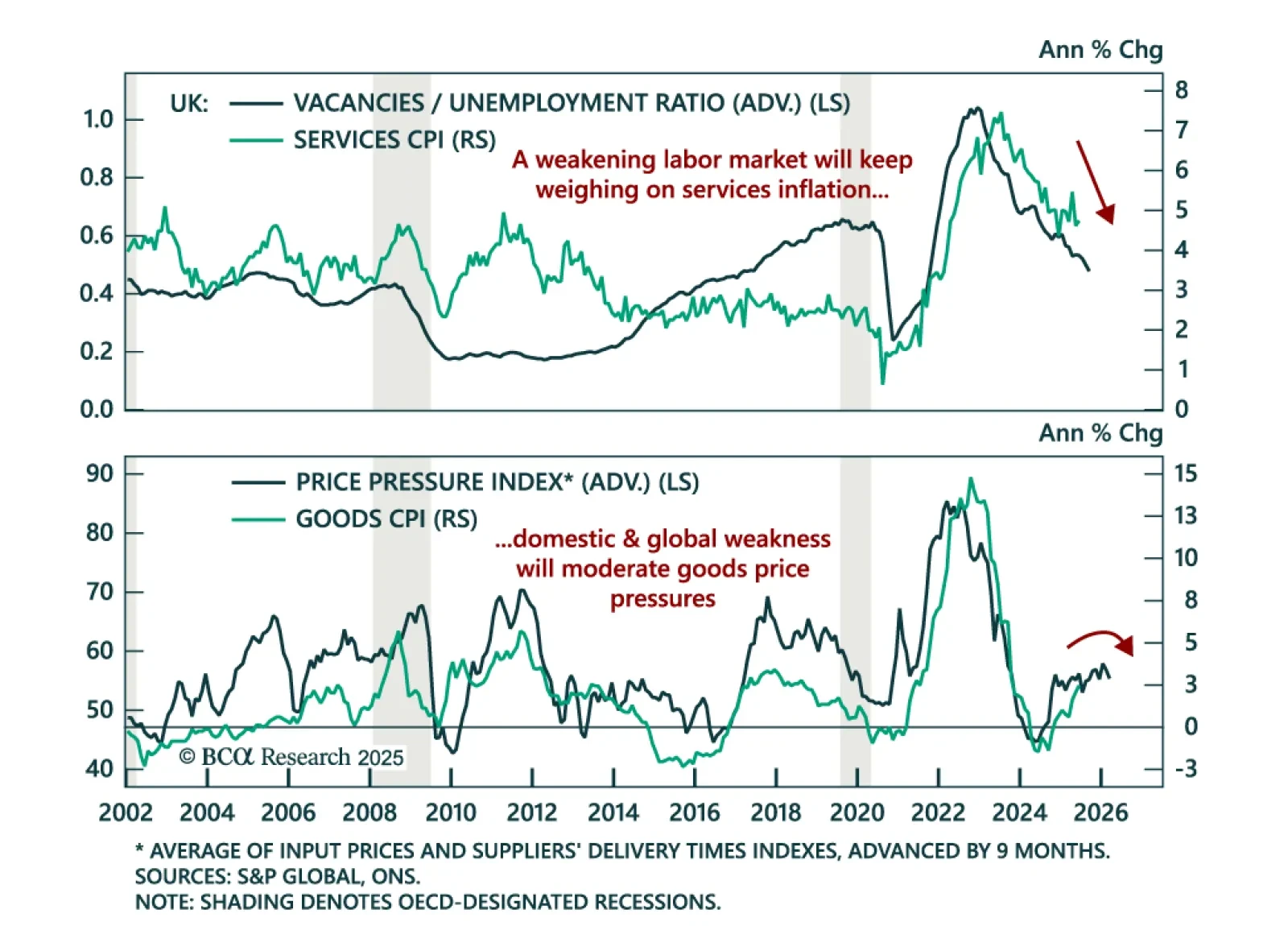

June UK CPI surprised to the upside, but weakening leading indicators point to disinflation ahead. Stay overweight Gilts. Headline inflation accelerated to 3.6% y/y from 3.4%, and core rose to 3.7% from 3.5%. Services inflation held…