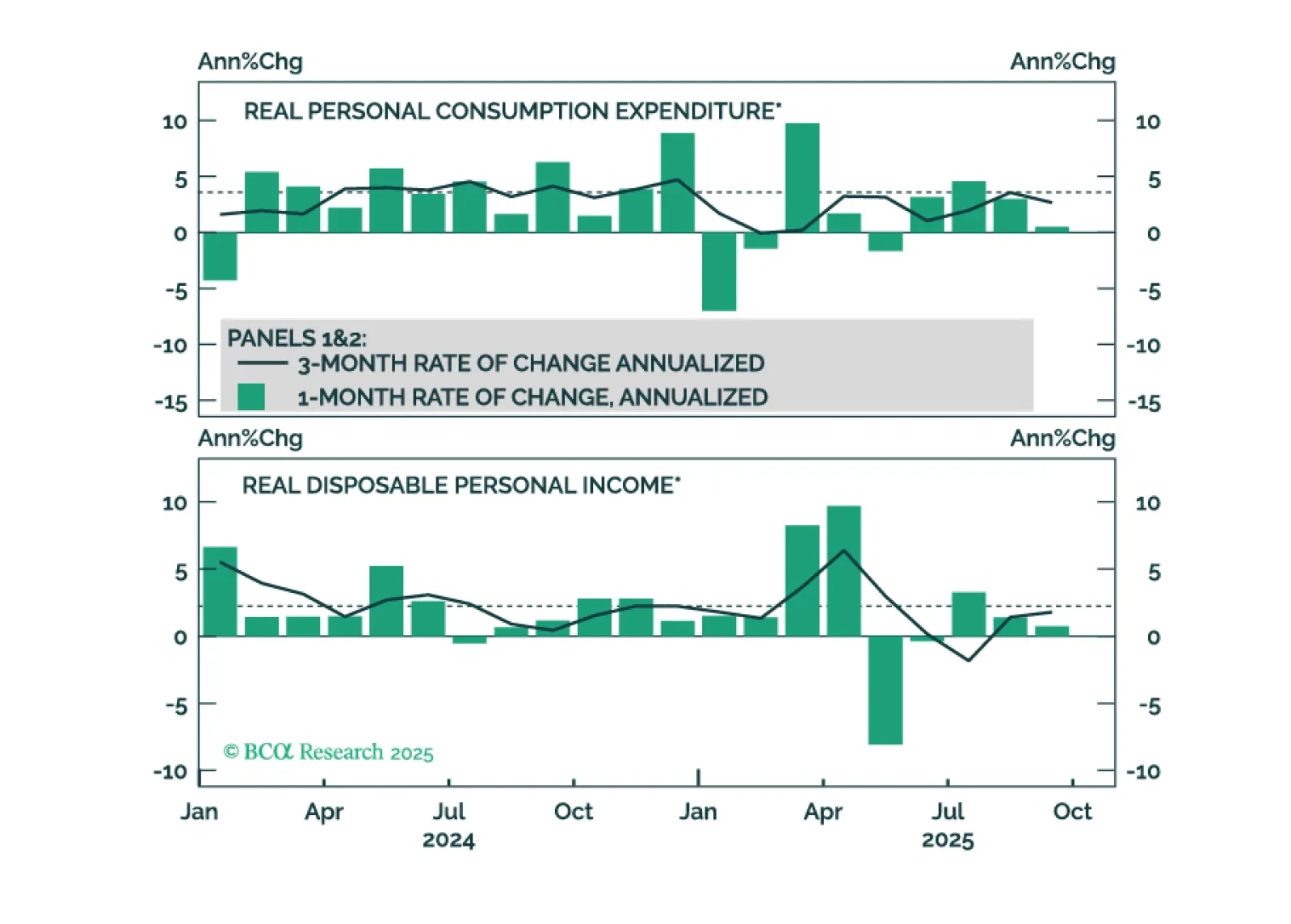

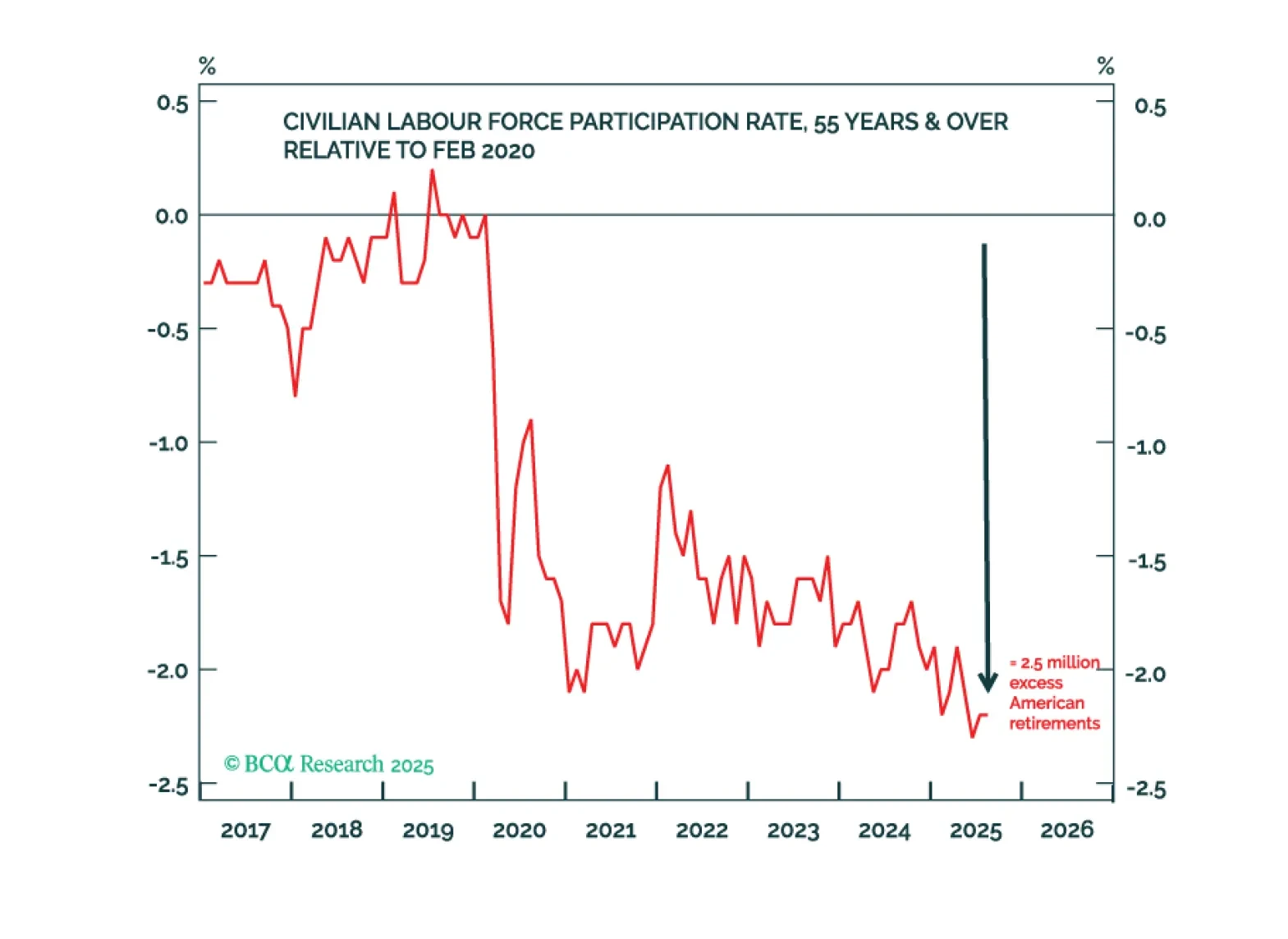

September’s weak consumer spending data challenge the K-shaped recovery narrative and suggest that spending will slow to match already-weak employment growth.

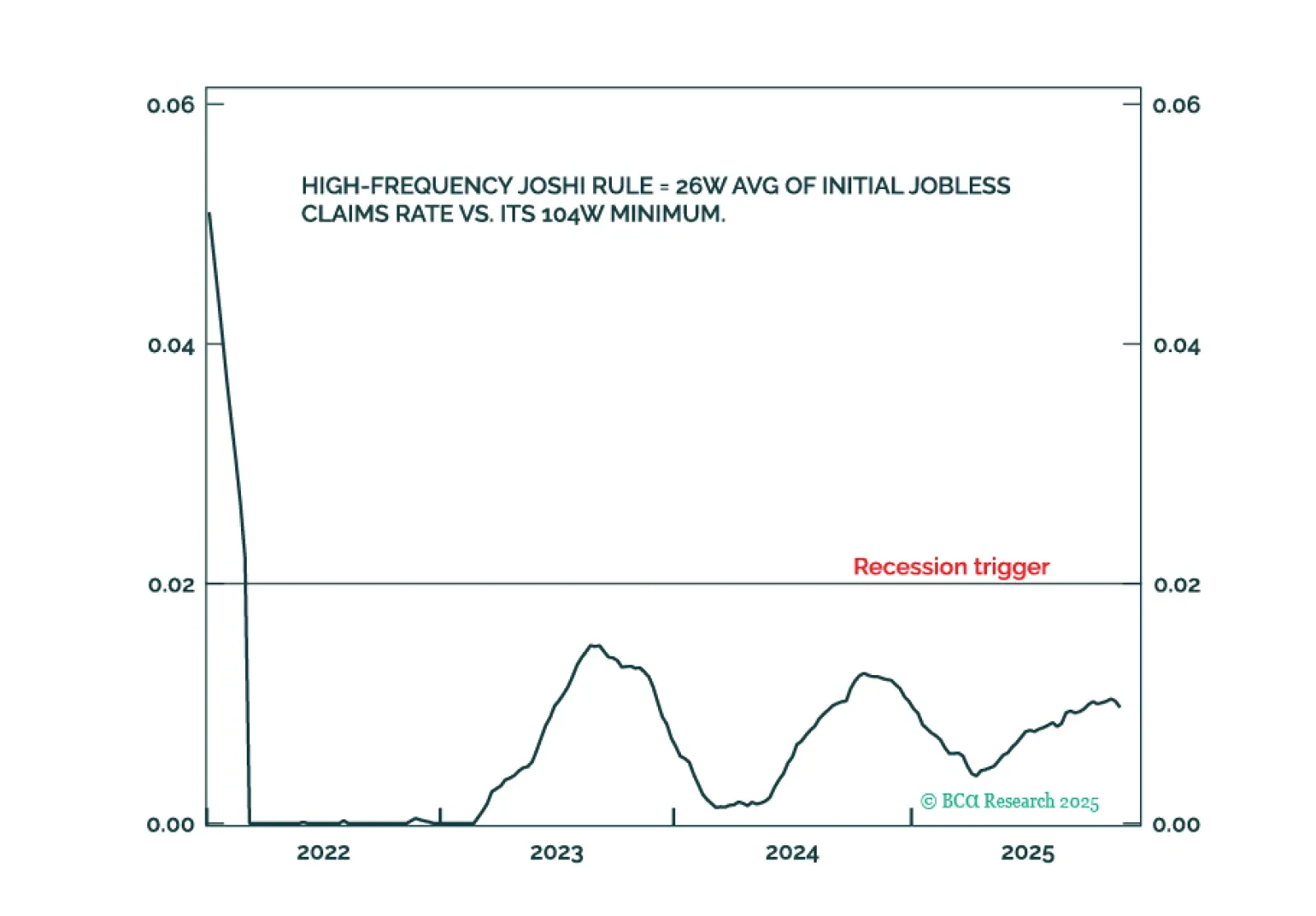

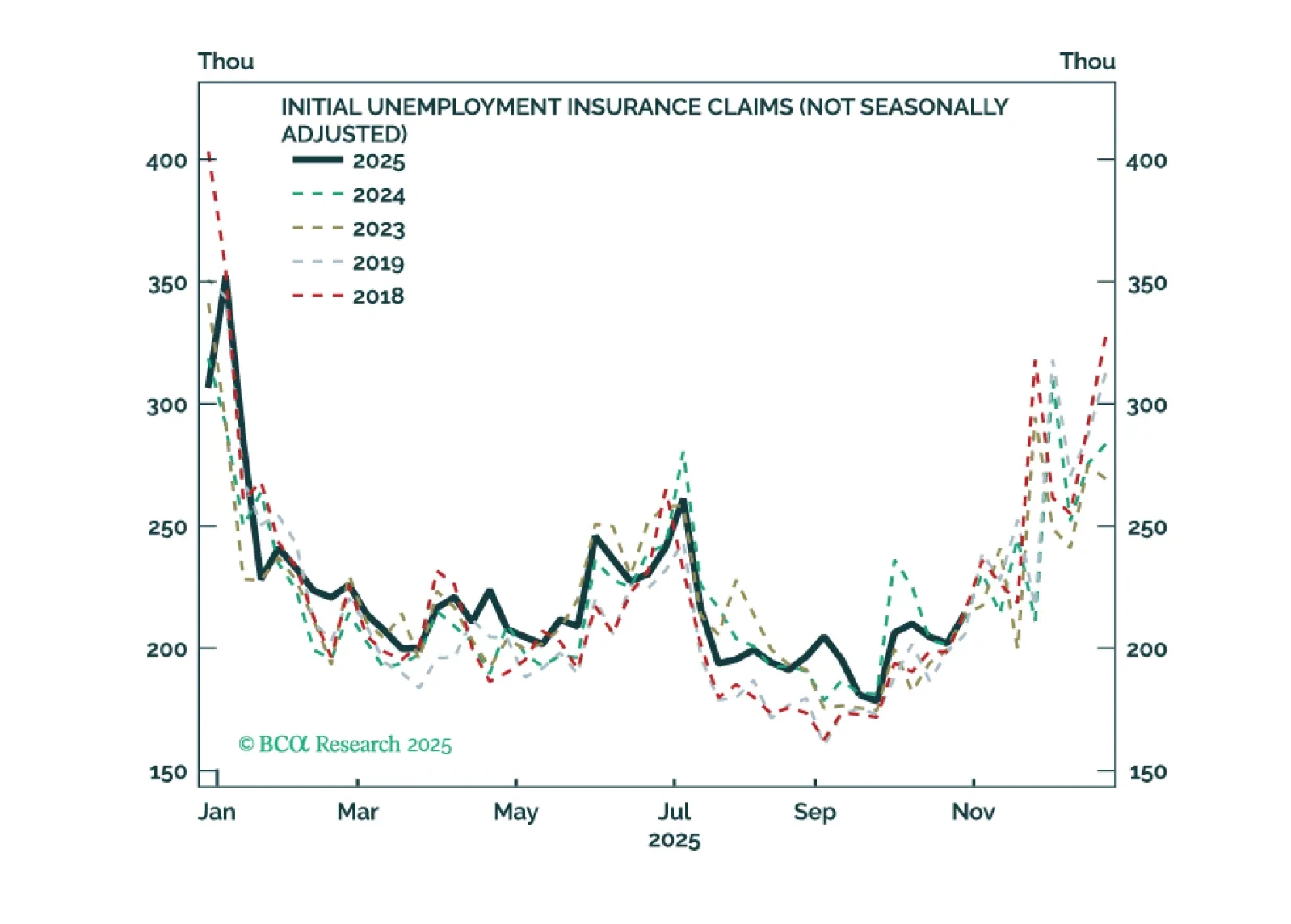

The high-frequency Joshi Rule confirms that the US labour market is holding up. Equity investors should regard 5-10 percent selloffs as tactical buying opportunities. Bond investors should stay underweight US duration. Plus, a new…

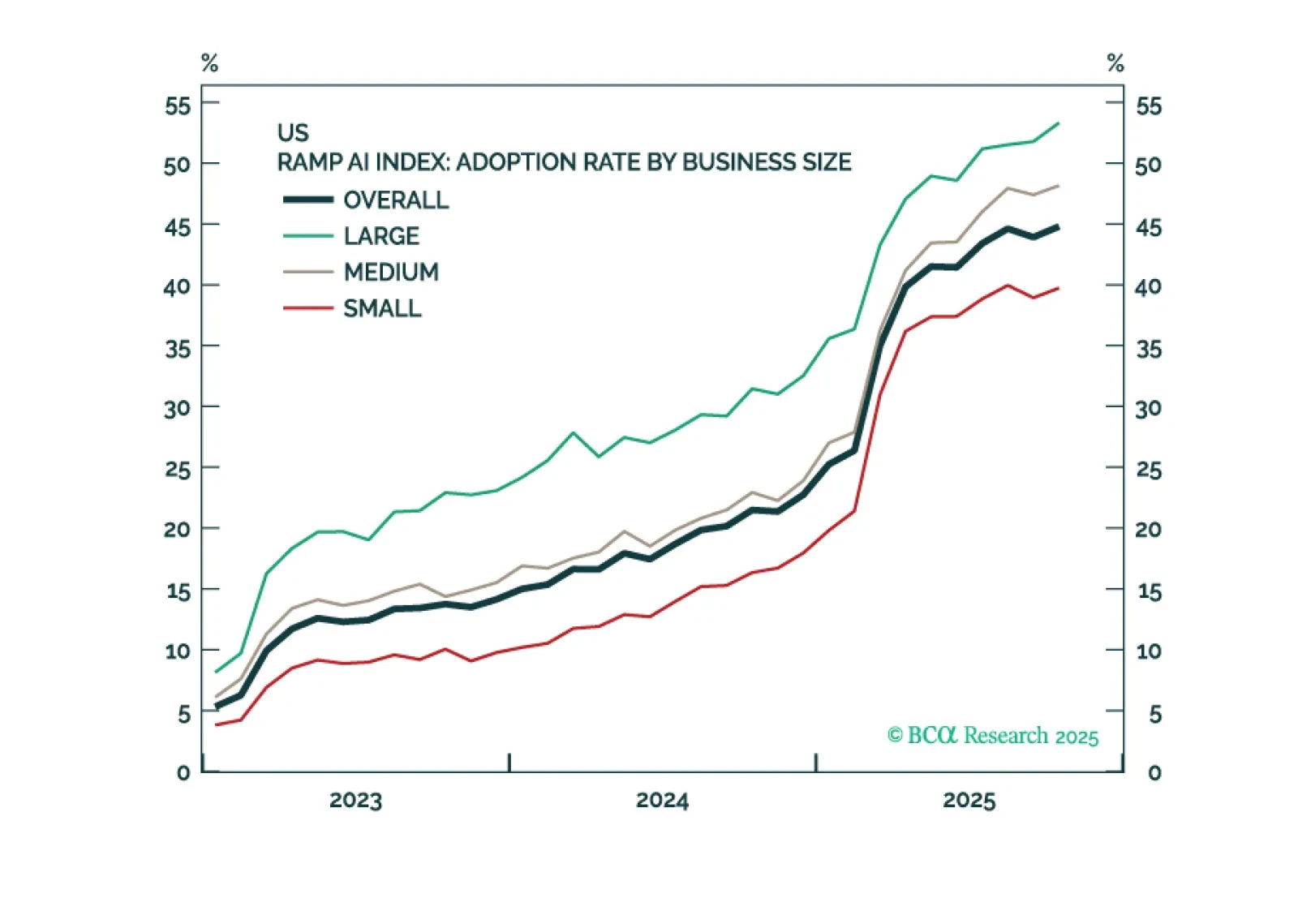

The odds have risen that we have reached a “Metaverse Moment” – a situation where investors punish AI companies for increasing capex. This warrants greater caution towards AI stocks specifically, and the broader S&P 500 more…

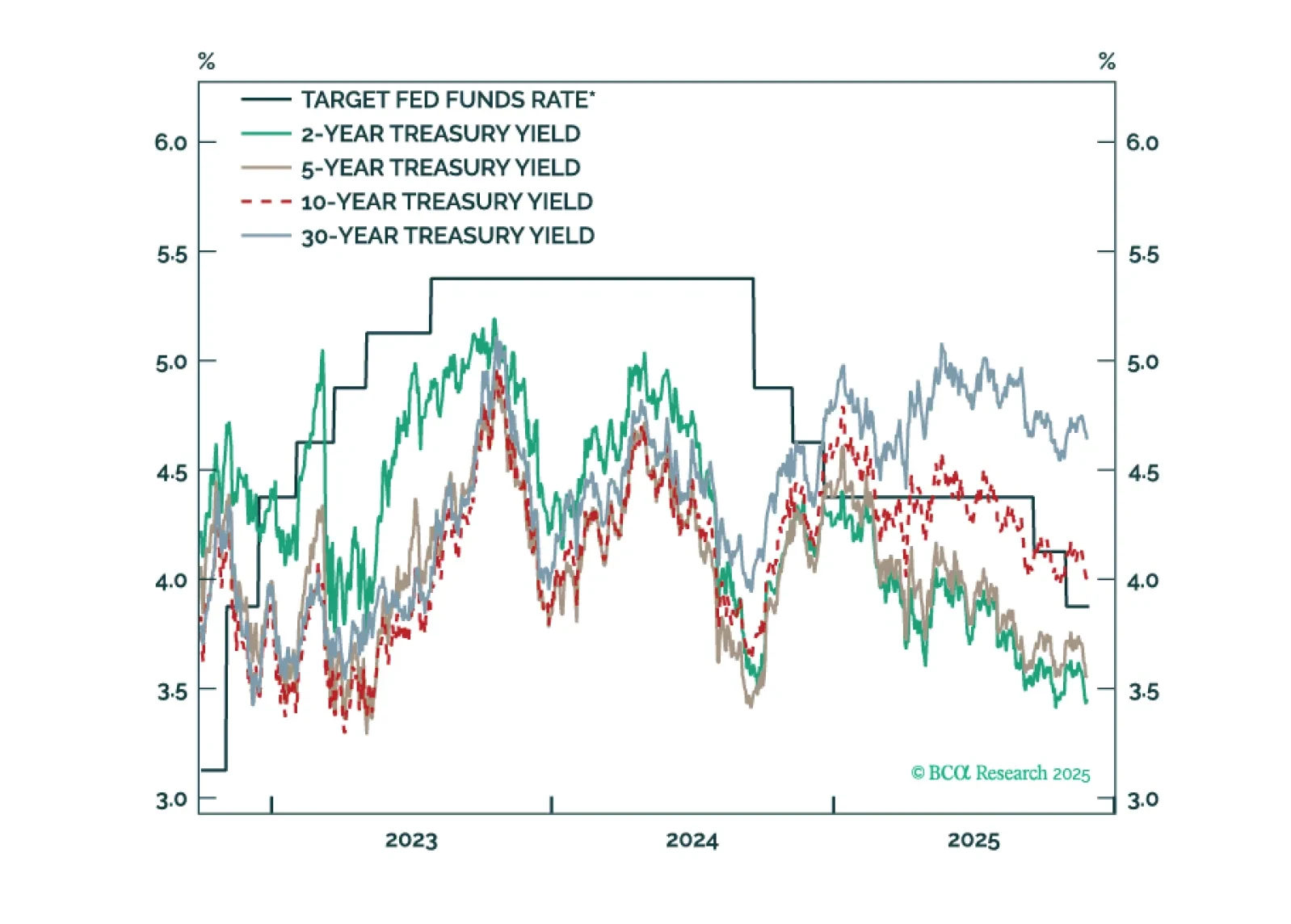

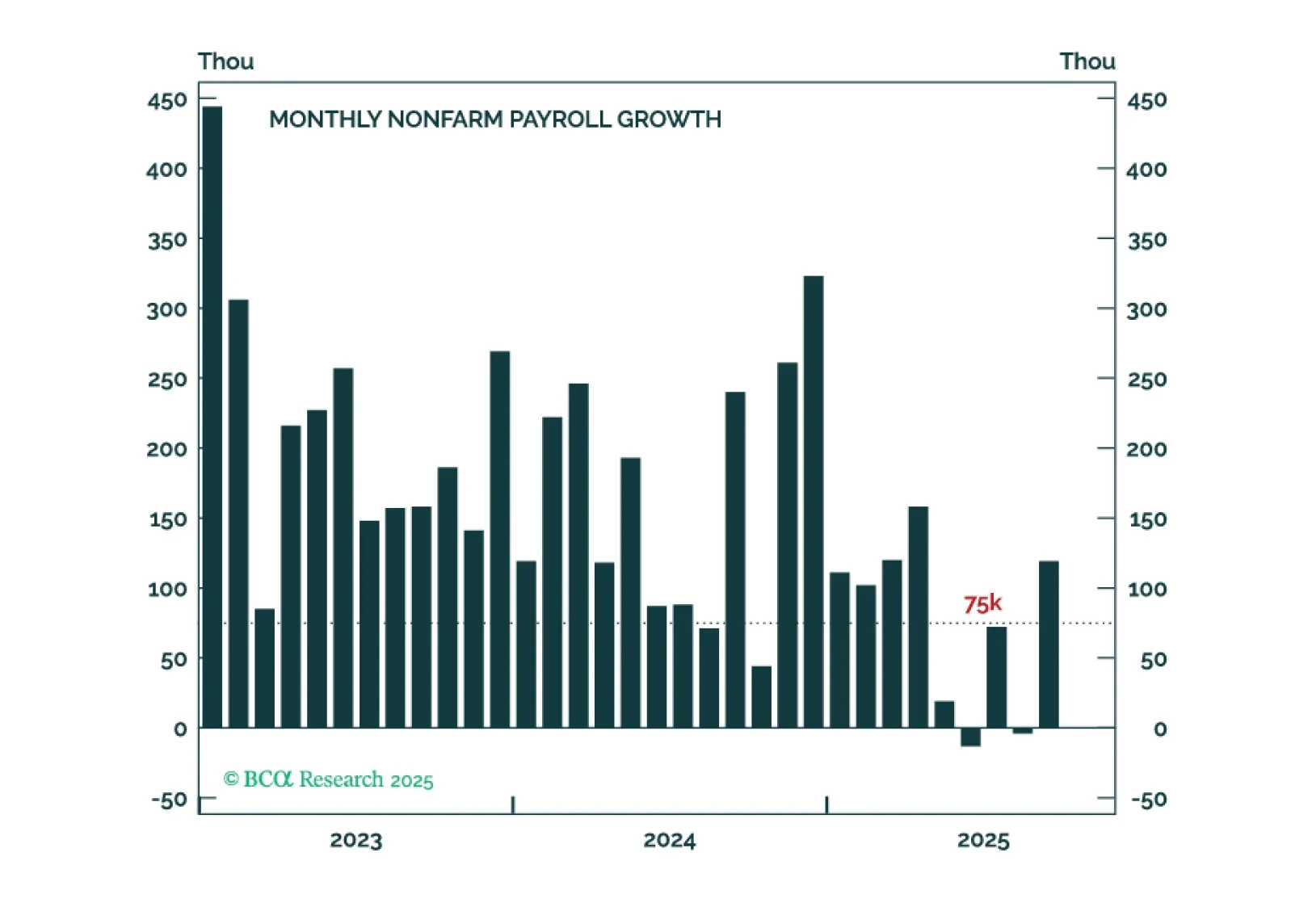

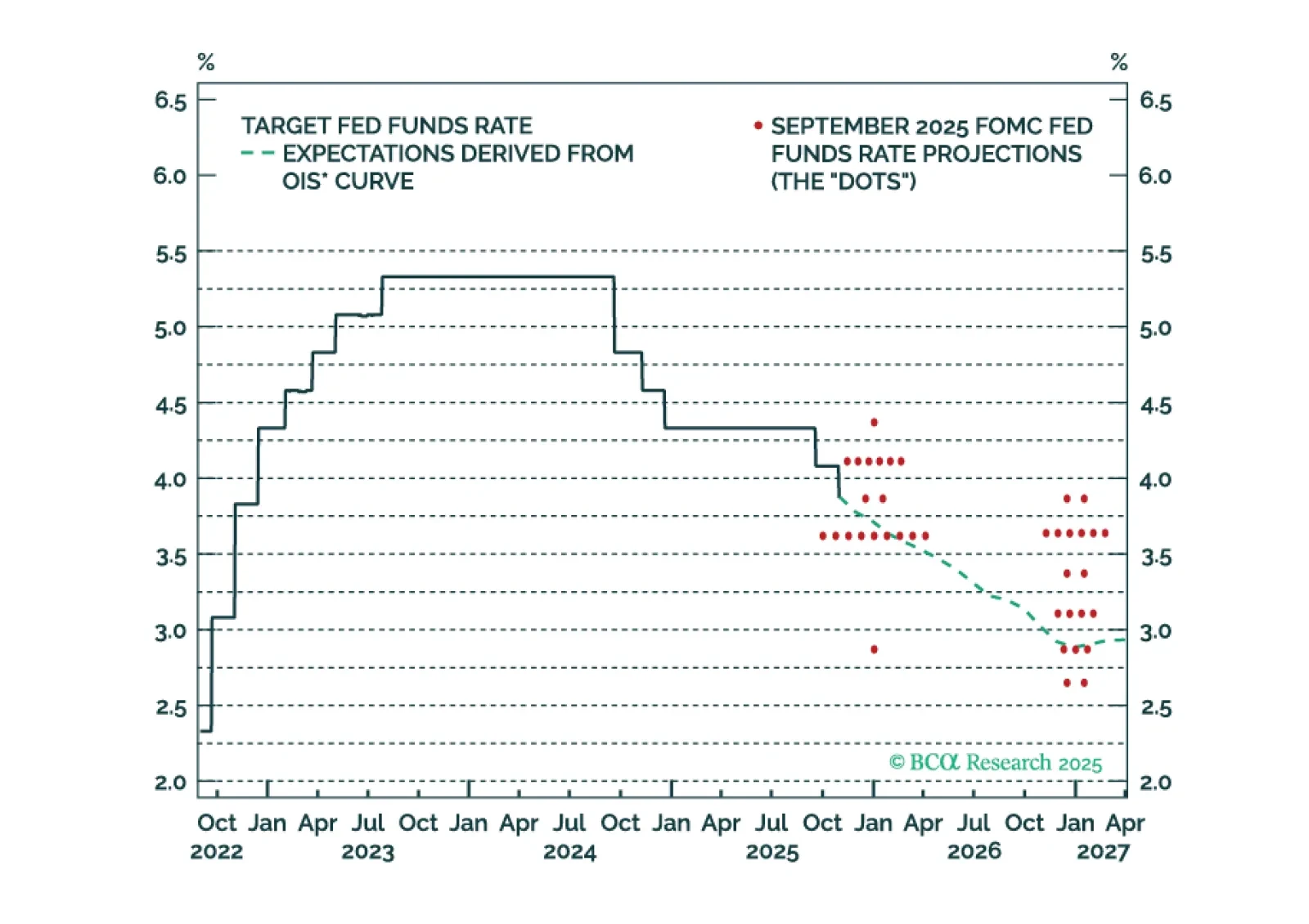

The September employment report probably won’t convince enough hawks to vote for a rate cut in December.

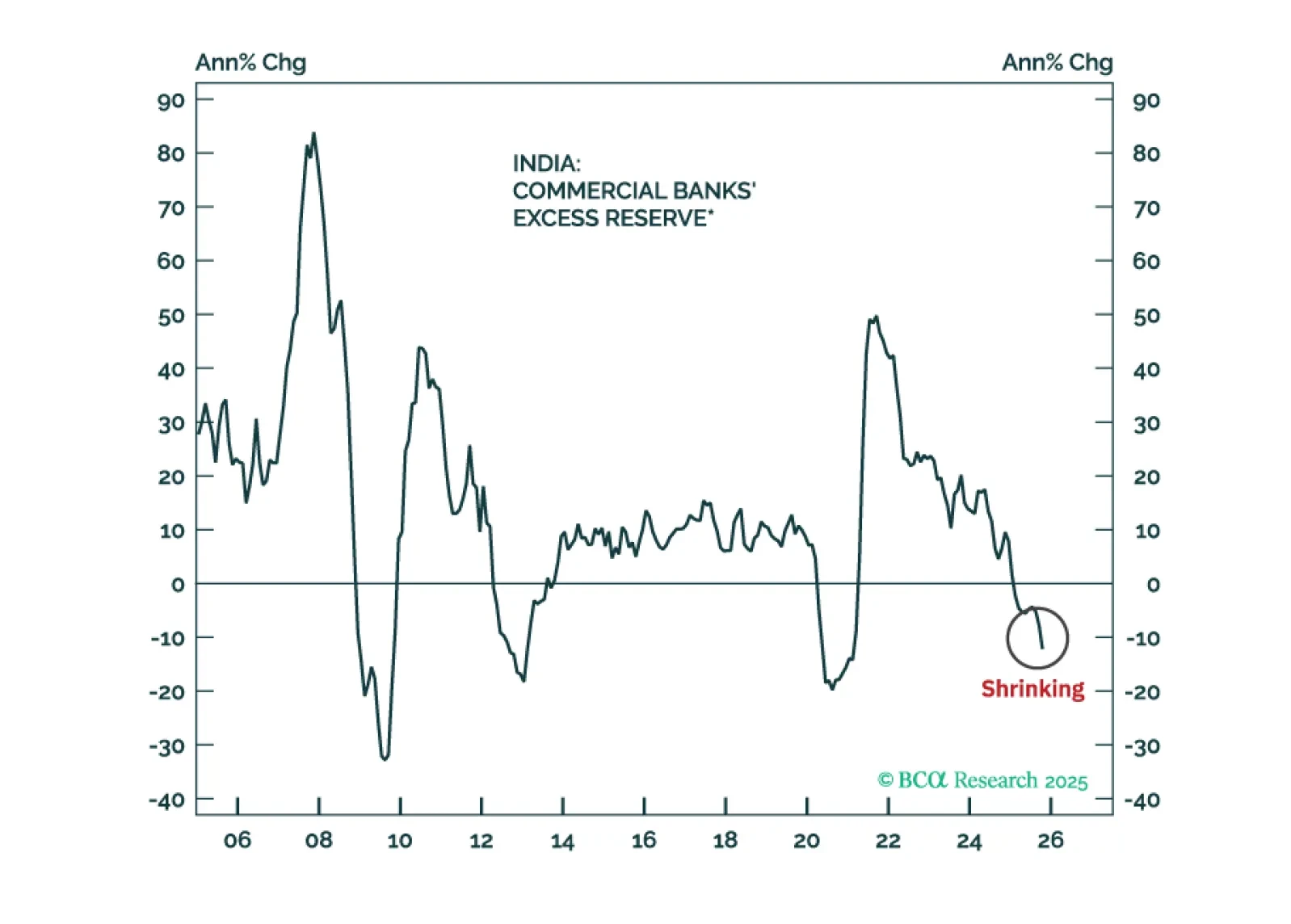

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

The greater risk to the world economy in 2026-27 is not that a recession triggers a market crash, but that a market crash triggers a recession. This is because a market crash will destroy the wealth that is funding the crucial…

Our Portfolio Allocation Summary for November 2025.

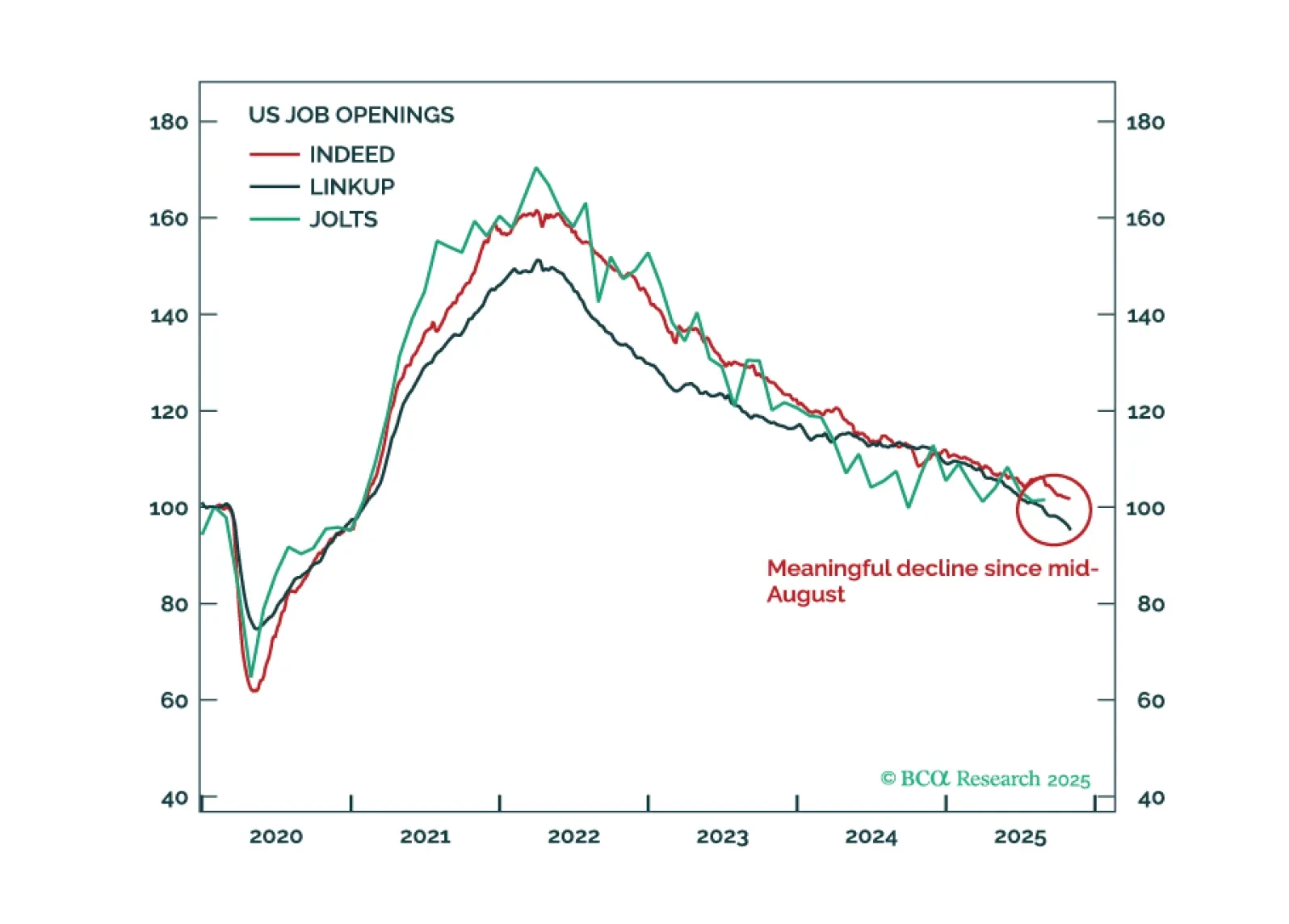

In the absence of official government data, investors are turning to alternative sources to gauge the direction of the US economy. Our analysis of this data suggests that the economy has continued to expand at a moderate pace over…

The Fed cut rates today, but a follow-up rate cut in December is uncertain. It will depend, in large part, on who wins a debate about the neutral rate of interest.