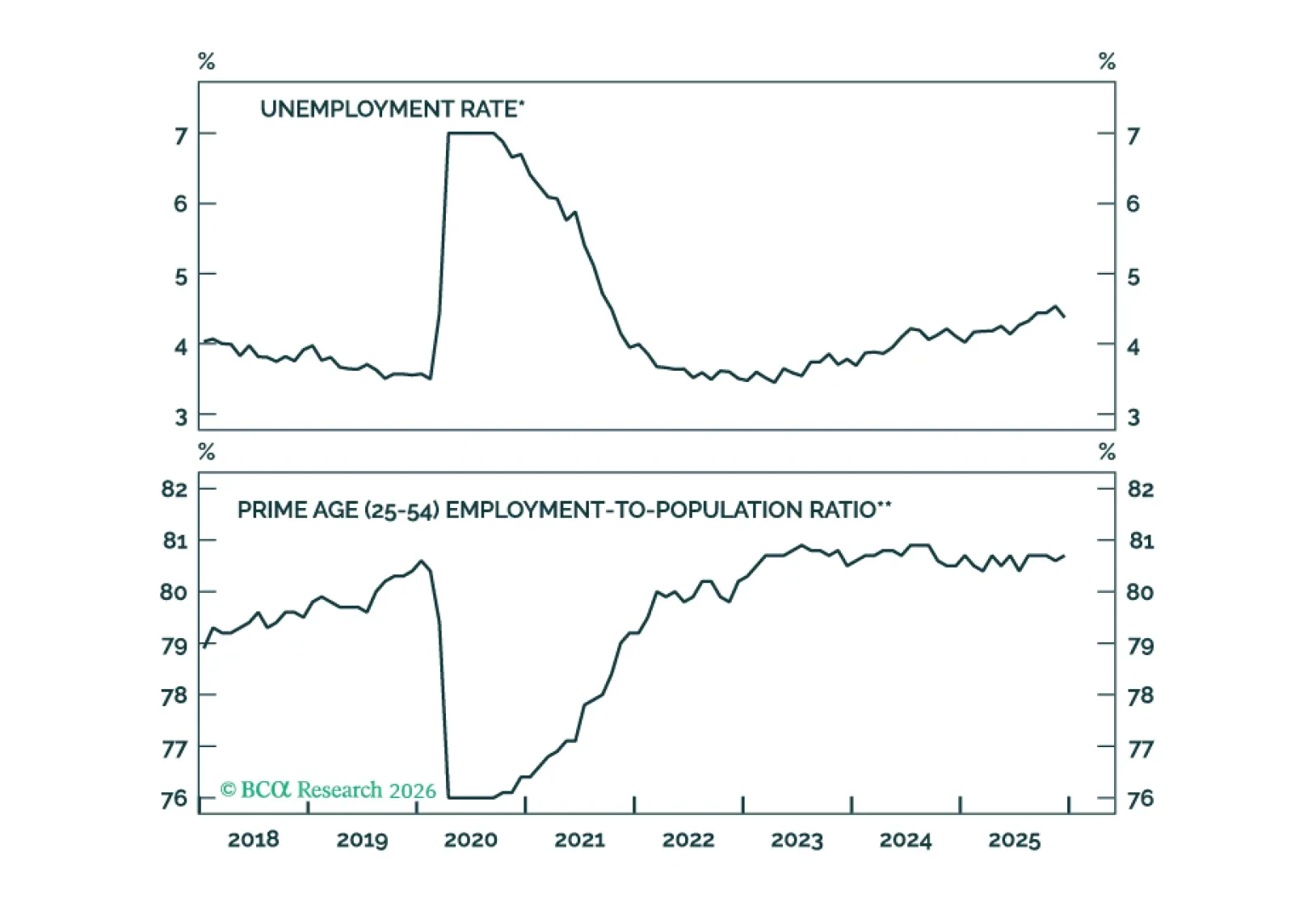

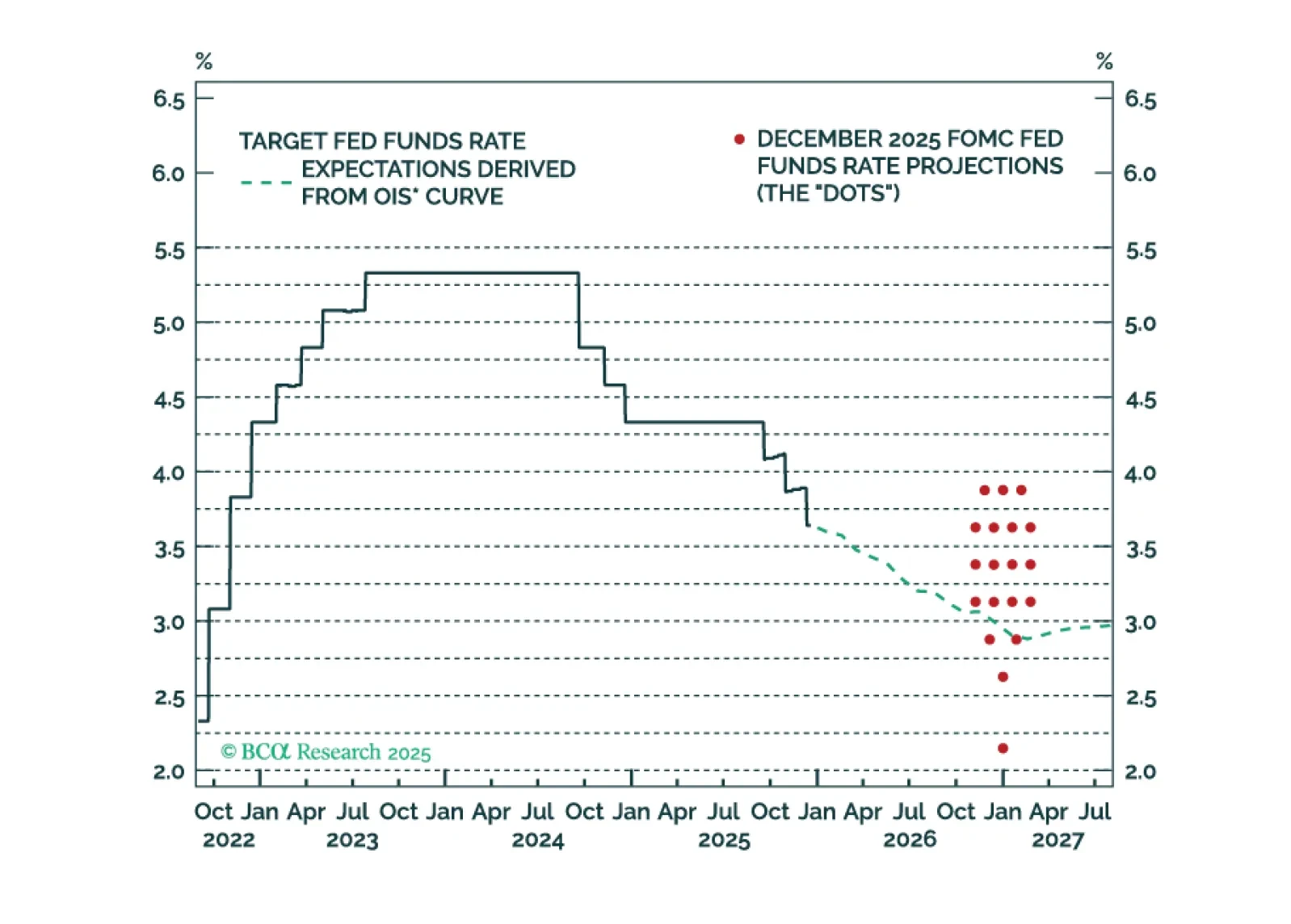

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

To start 2026, we answer what we believe are the most important questions facing investors surrounding the labor market, monetary and fiscal policy, and AI stocks. Overall, we reiterate our overweight views on risk assets and…

We have been surprised that consumption has held up well despite anemic payrolls growth. This brief considers ways that consumption might continue to beat our base-case expectations.

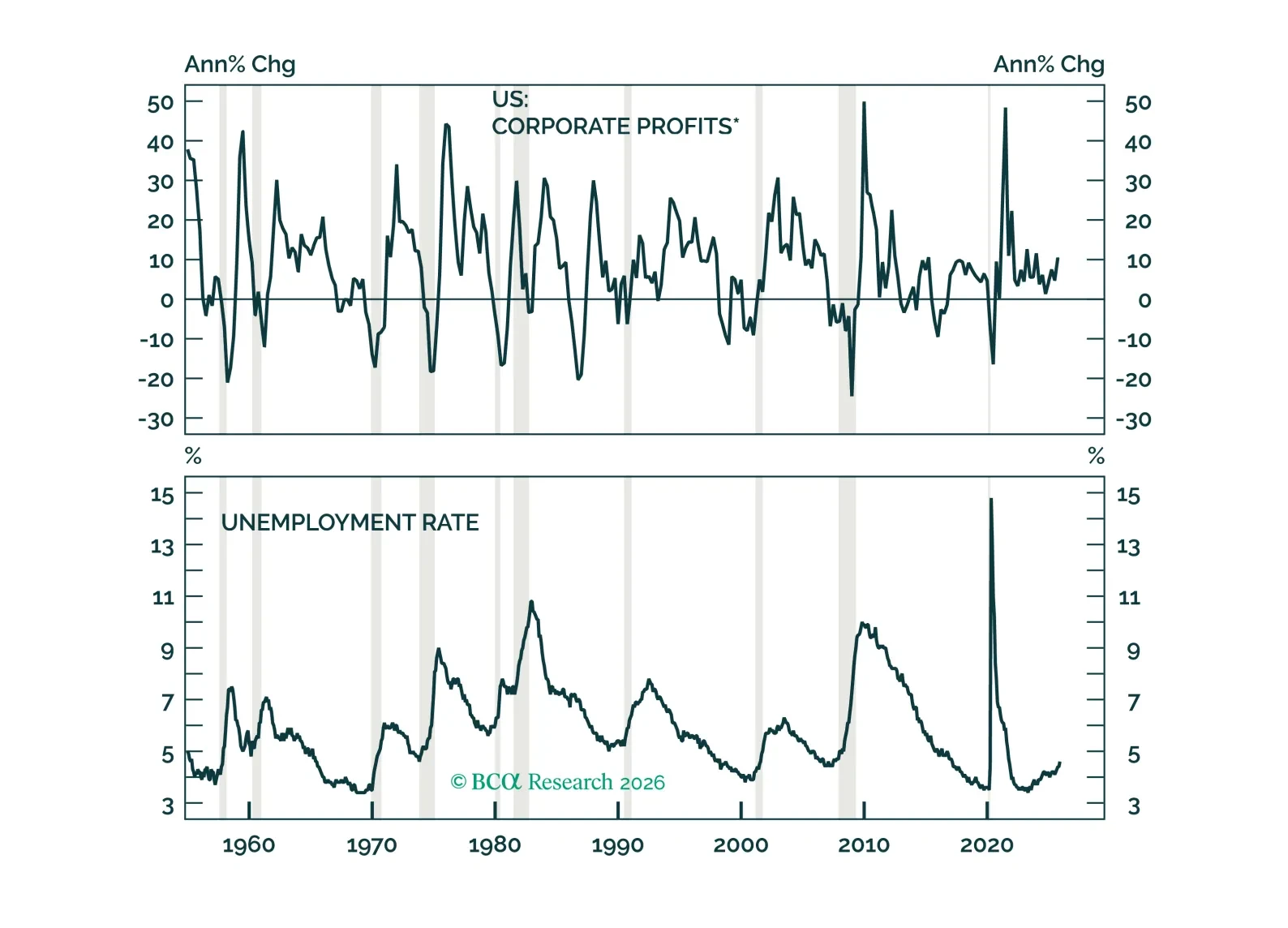

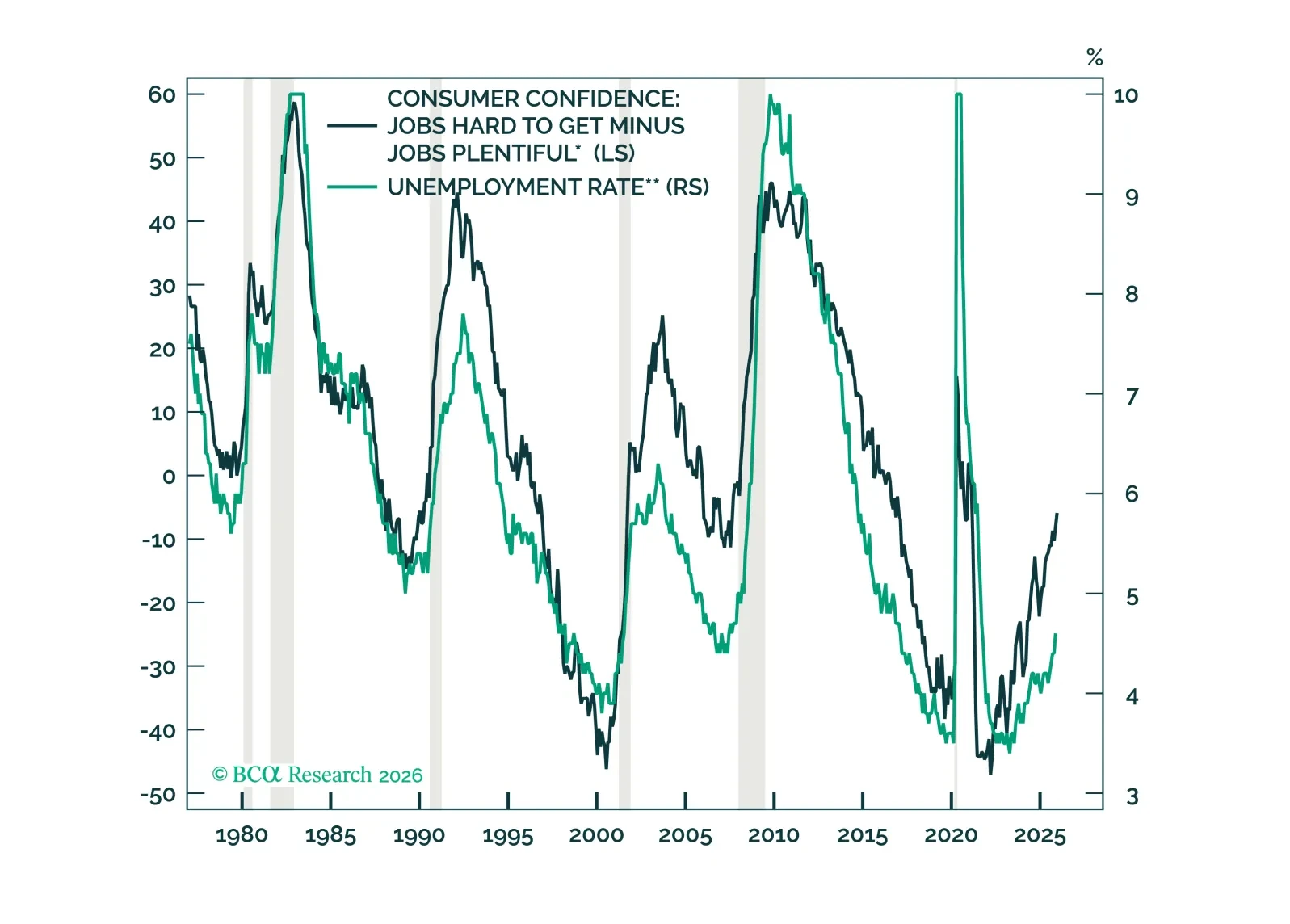

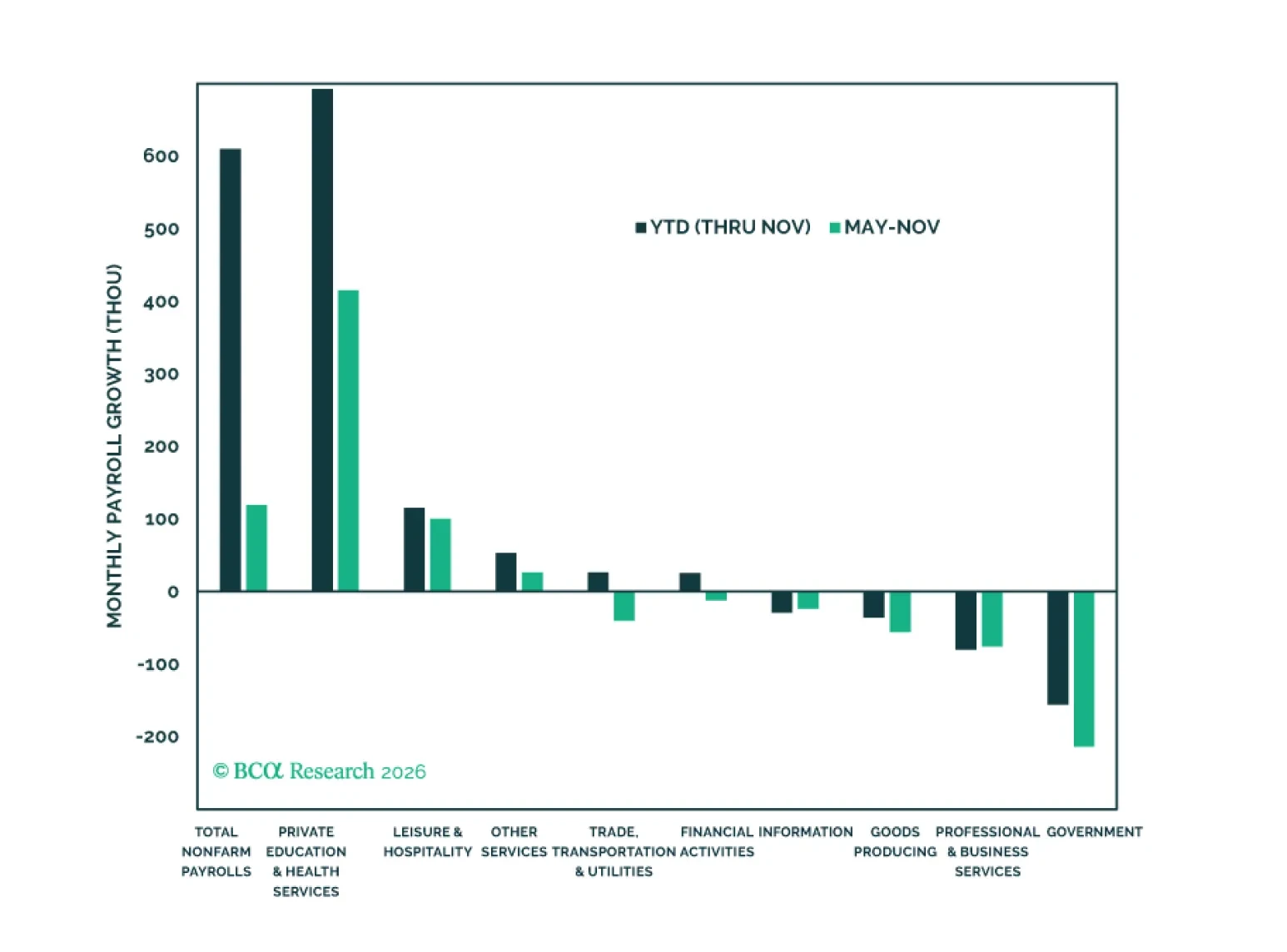

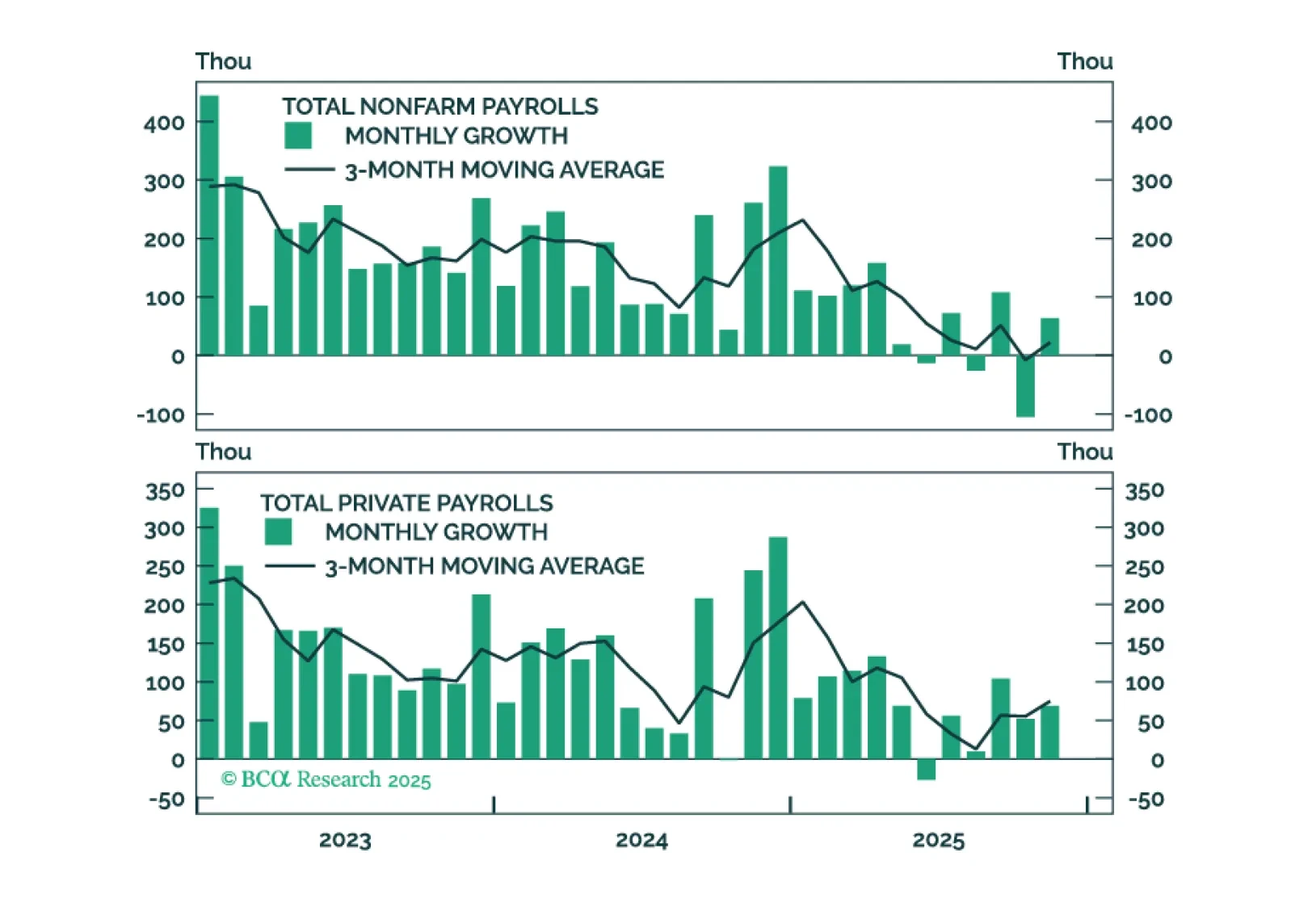

In Section I, Doug underscores that the US labor market remains weak, crimping the outlook for disposable income growth. It is too soon to decisively bet against the bull market, but downside risks remain quite elevated. In Section…

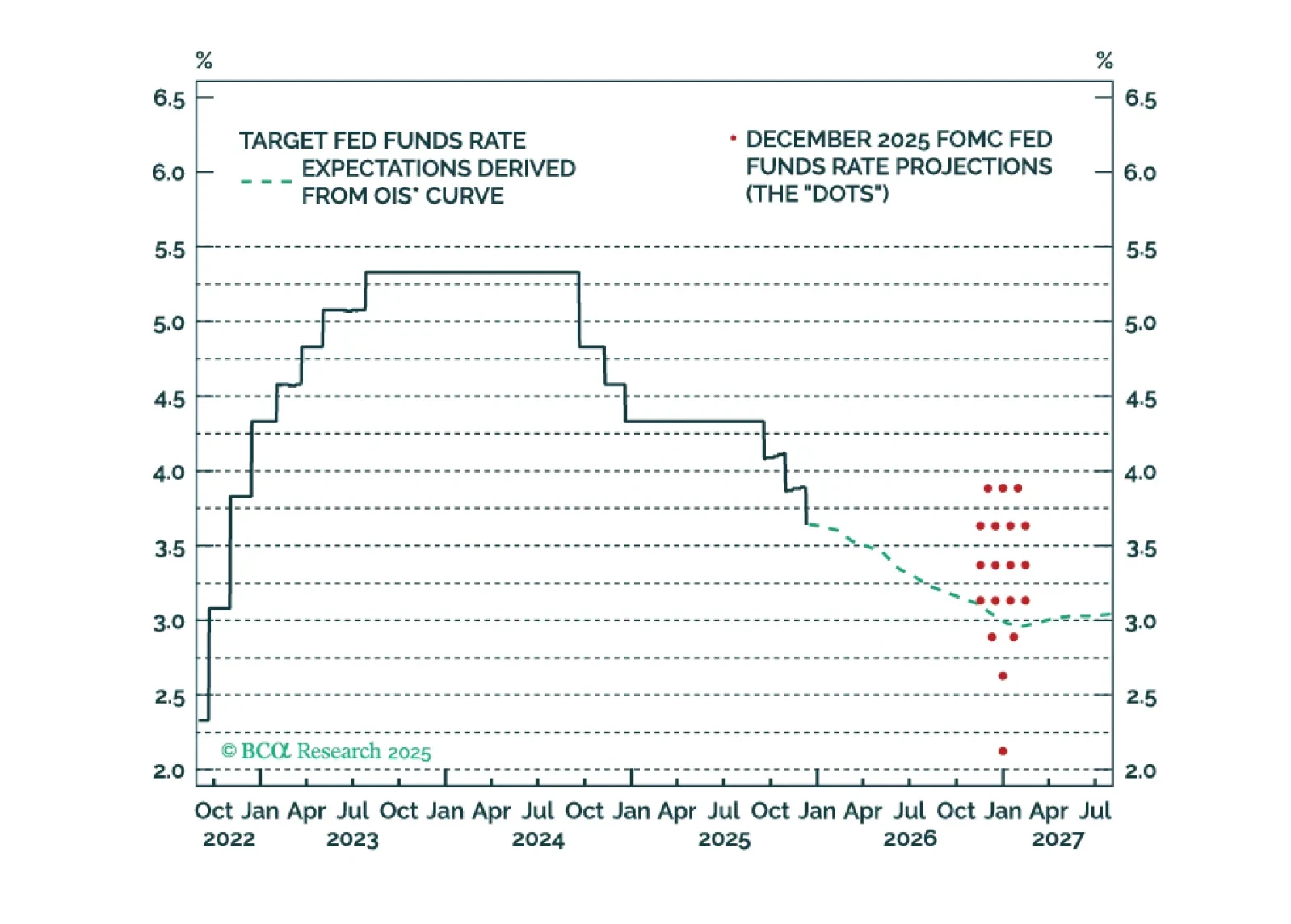

Employment Data Point To Dovish Policy Surprises In 2026

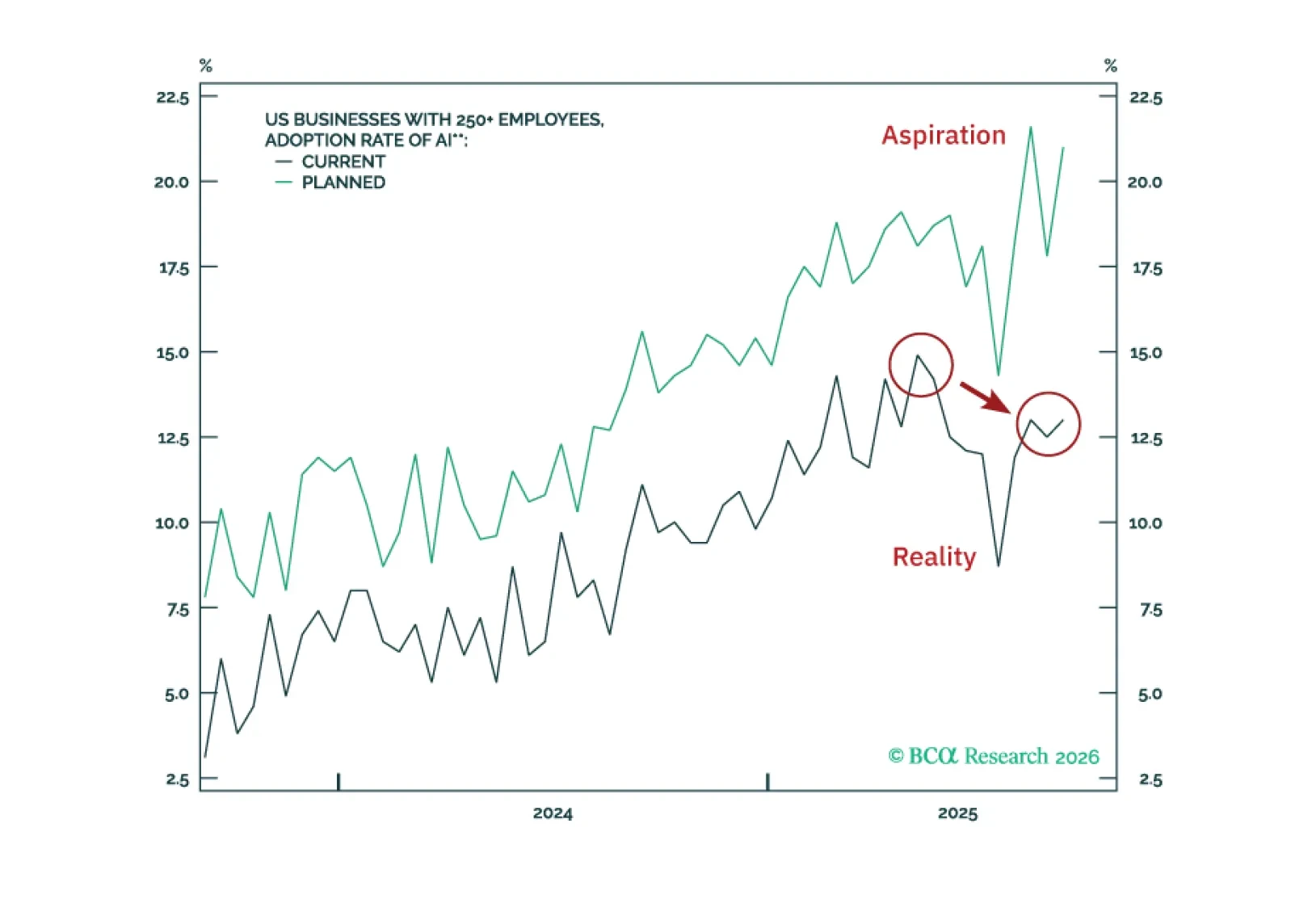

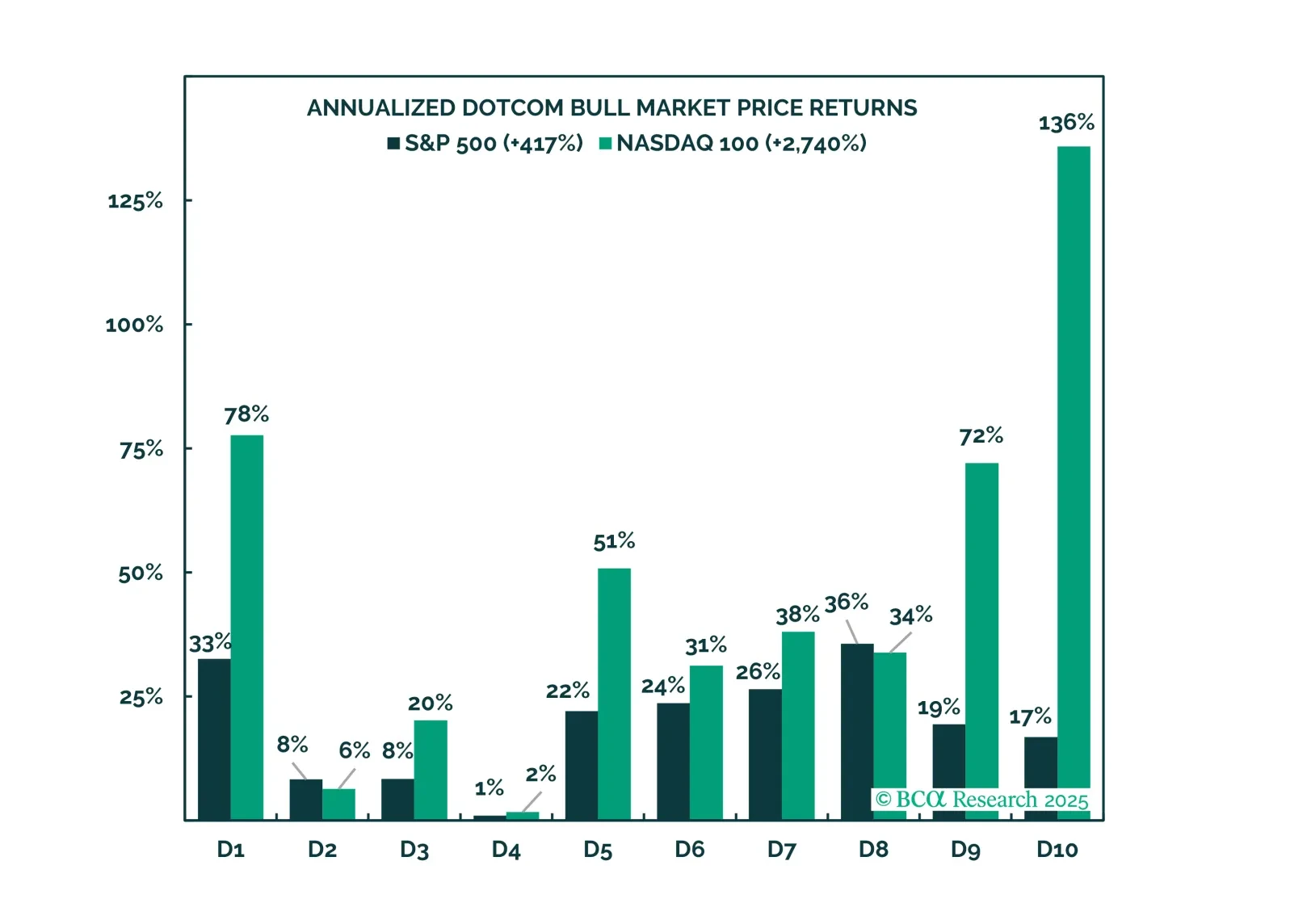

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.