After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

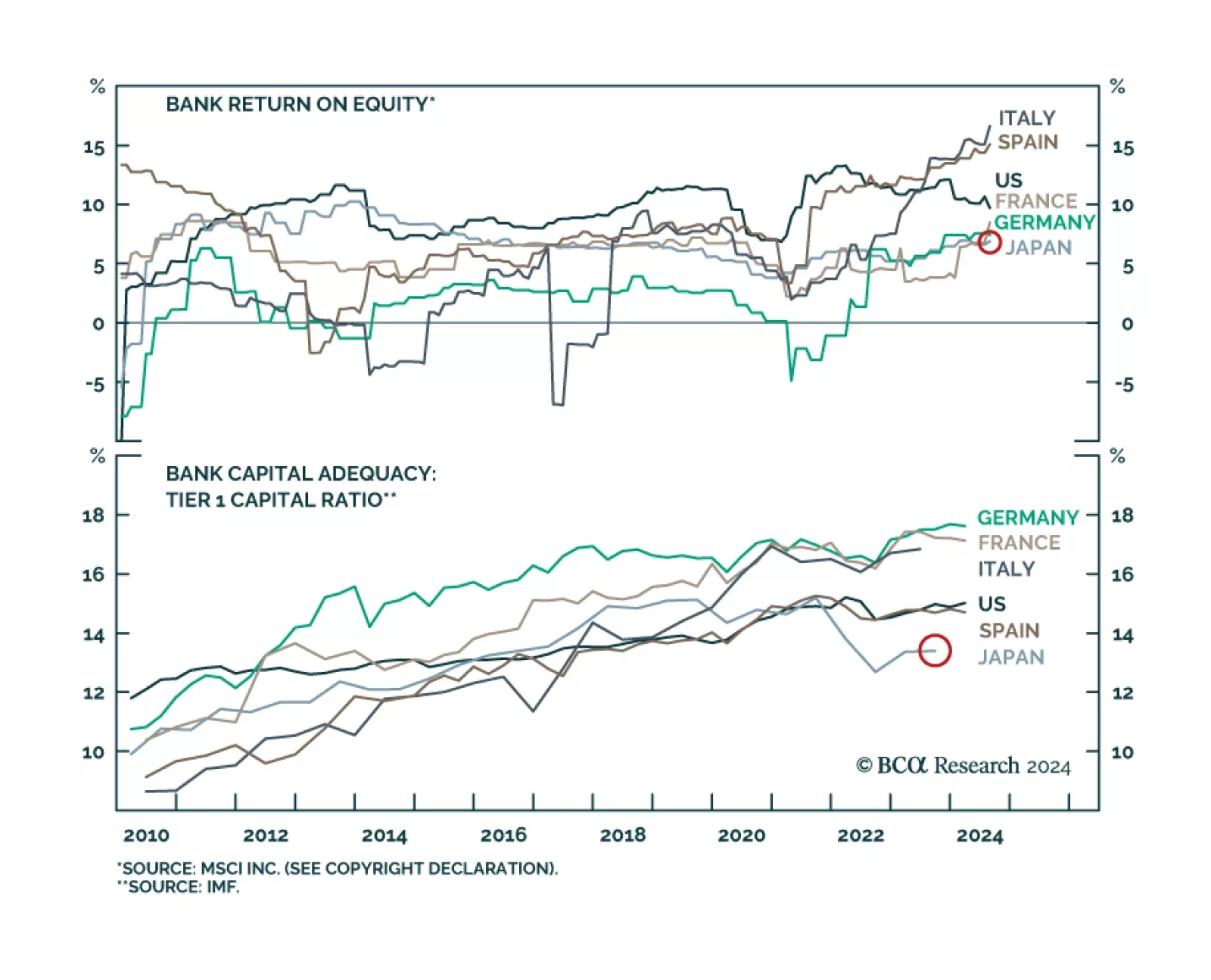

The Bank of Japan’s policy normalization has been accompanied by exceptional outperformance by Japanese banks. Japanese banks have outperformed both the country’s broader market as well as the MSCI ACW Banks index by…

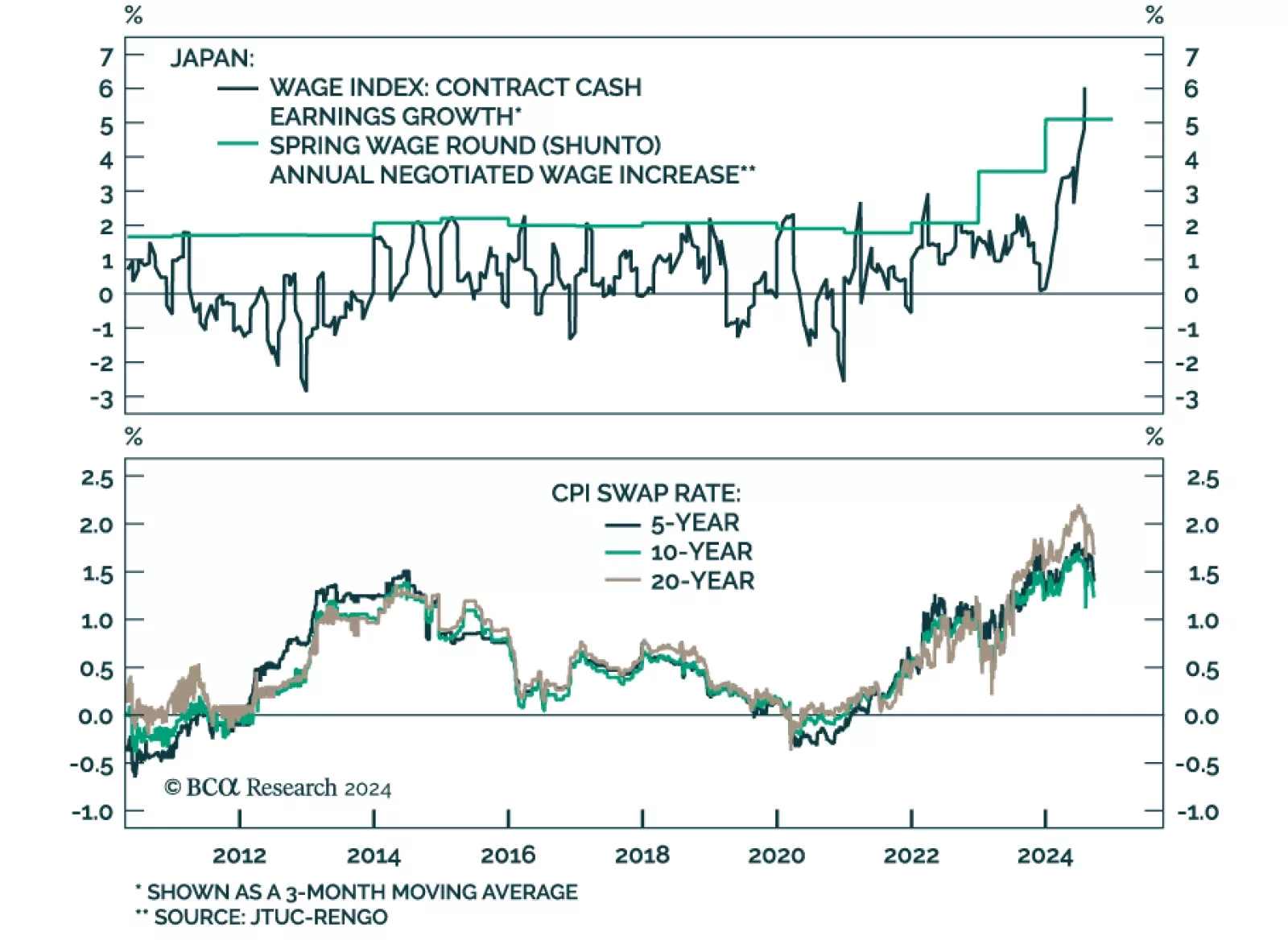

The Bank of Japan kept its policy rate unchanged at 0.25% in September and signaled it was in no rush to lift rates further. This move follows two hikes this year, one of them unanticipated. The signaling is consistent…

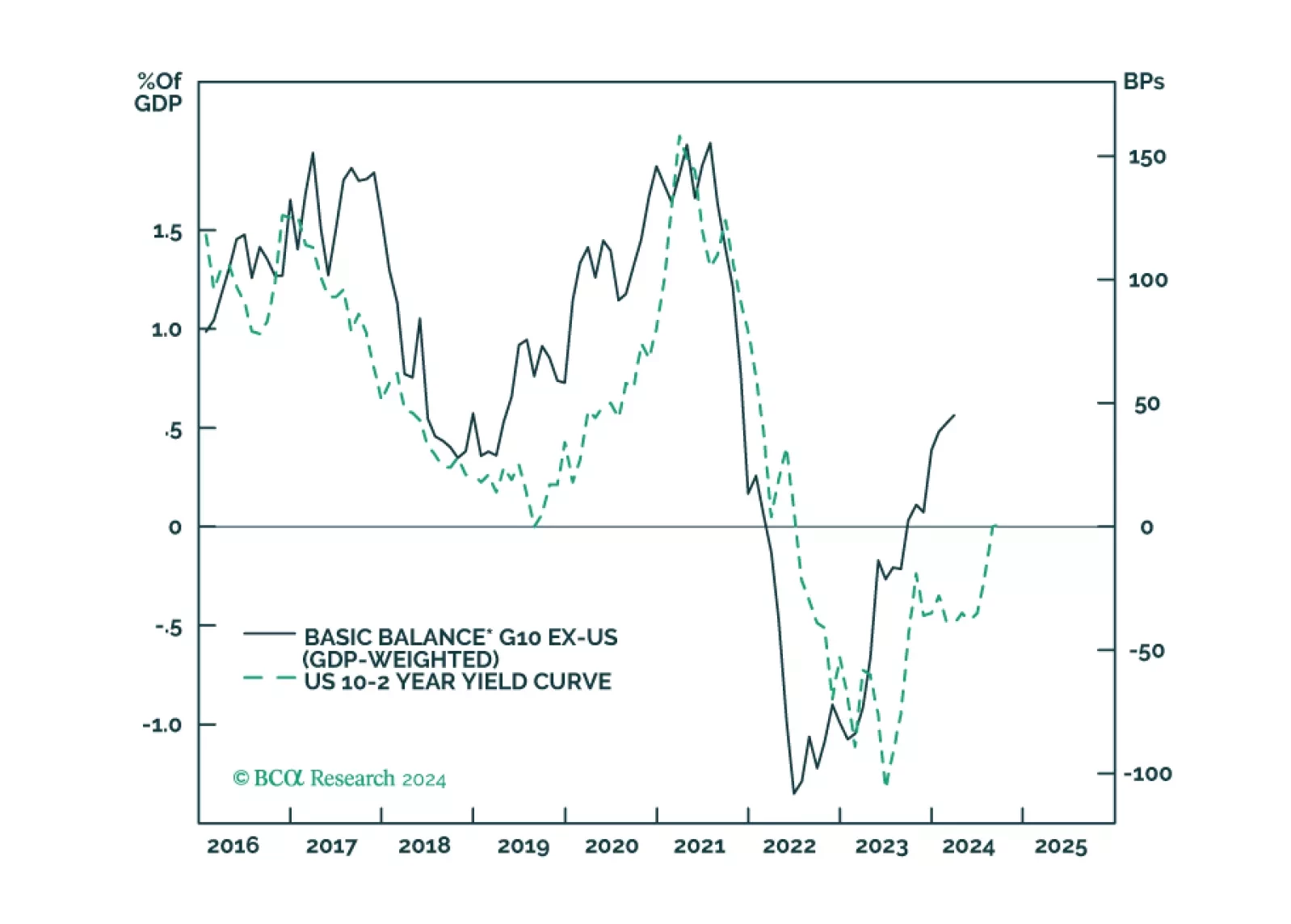

This report looks at the latest developments in G10 economies and implications for bond and FX market strategy.

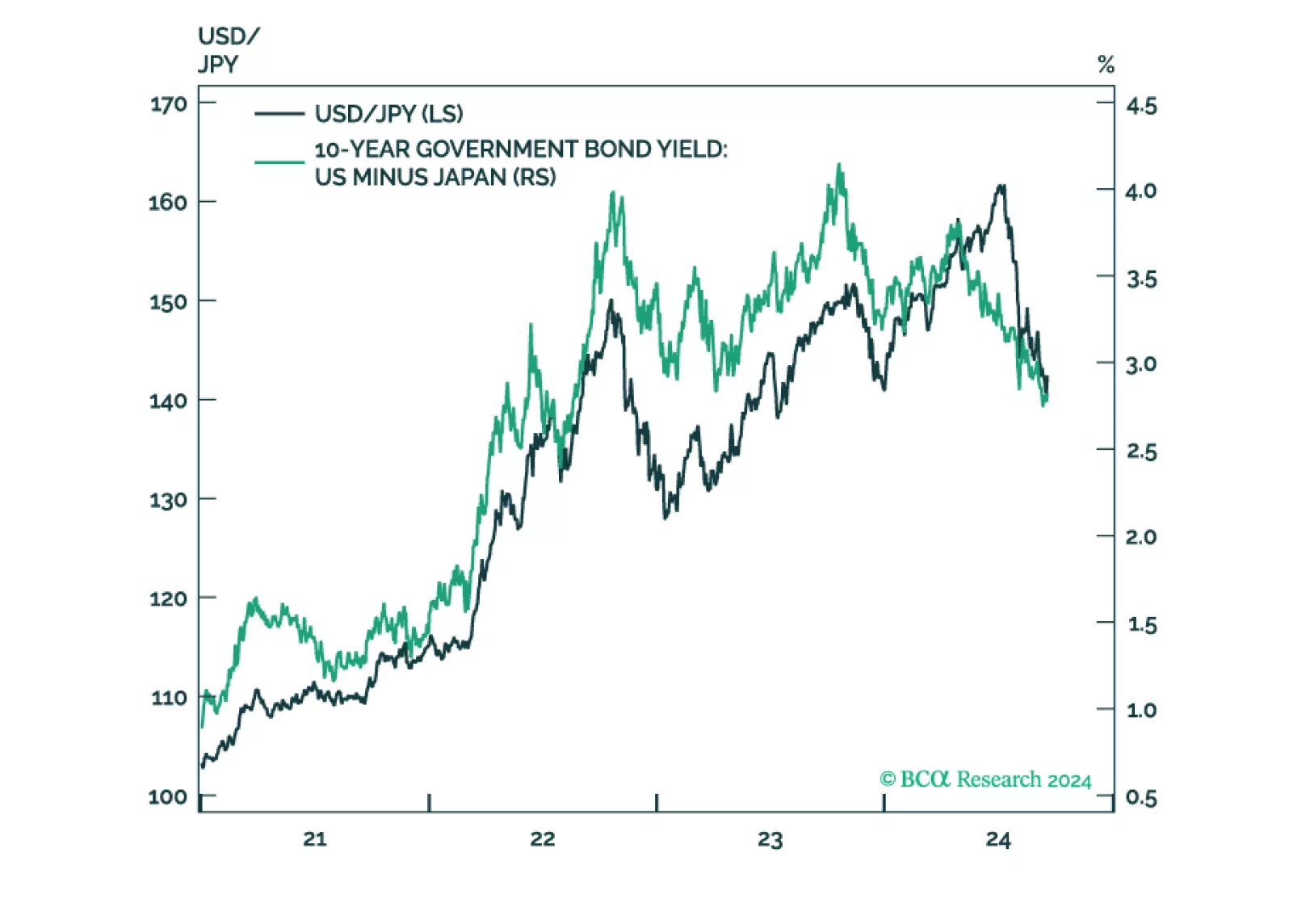

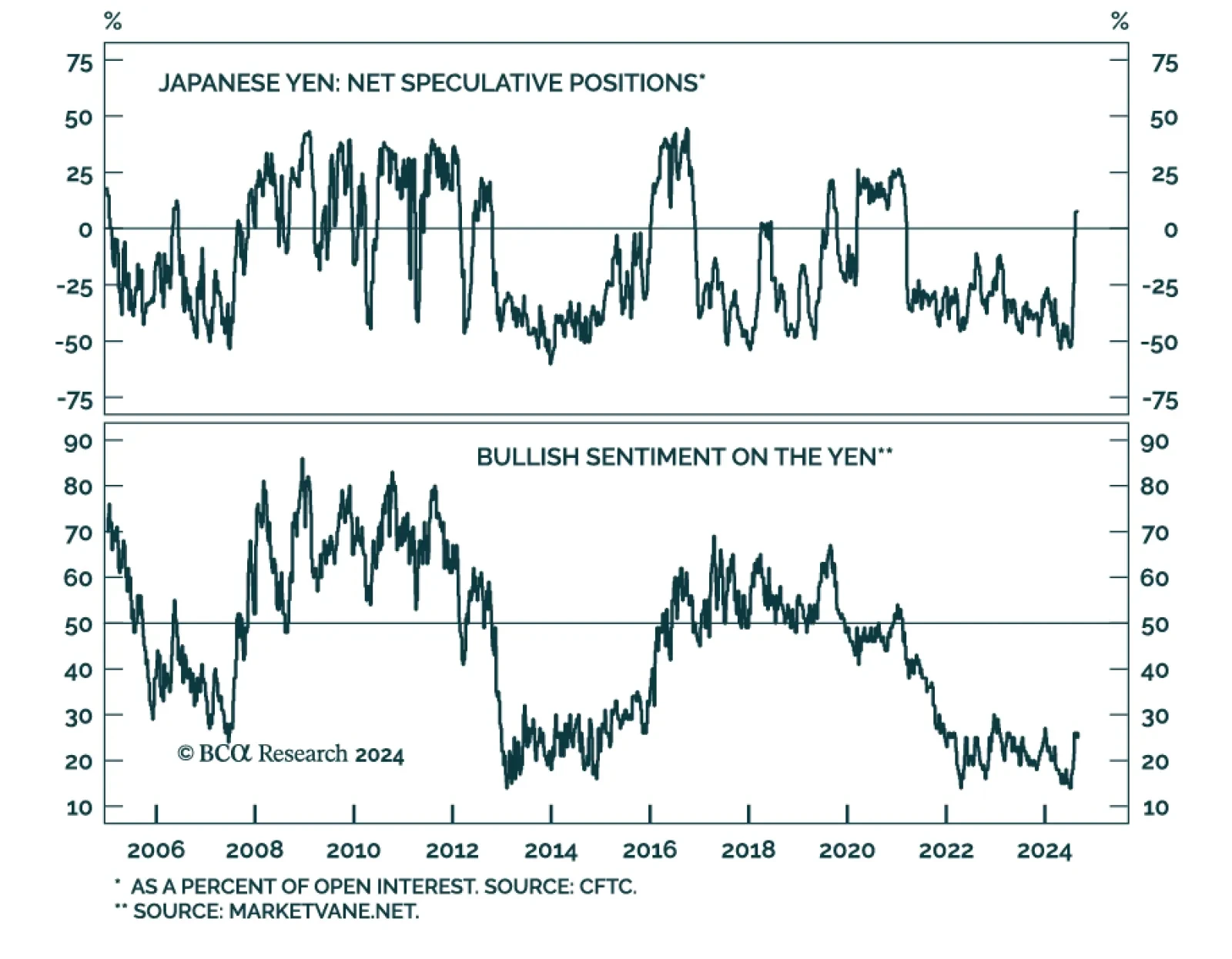

Many currencies have registered sizable gains against the US dollar over the last two months. Most notably, the yen has been one of the best G7 performers since the greenback began depreciating. It now trades at 143 against the…

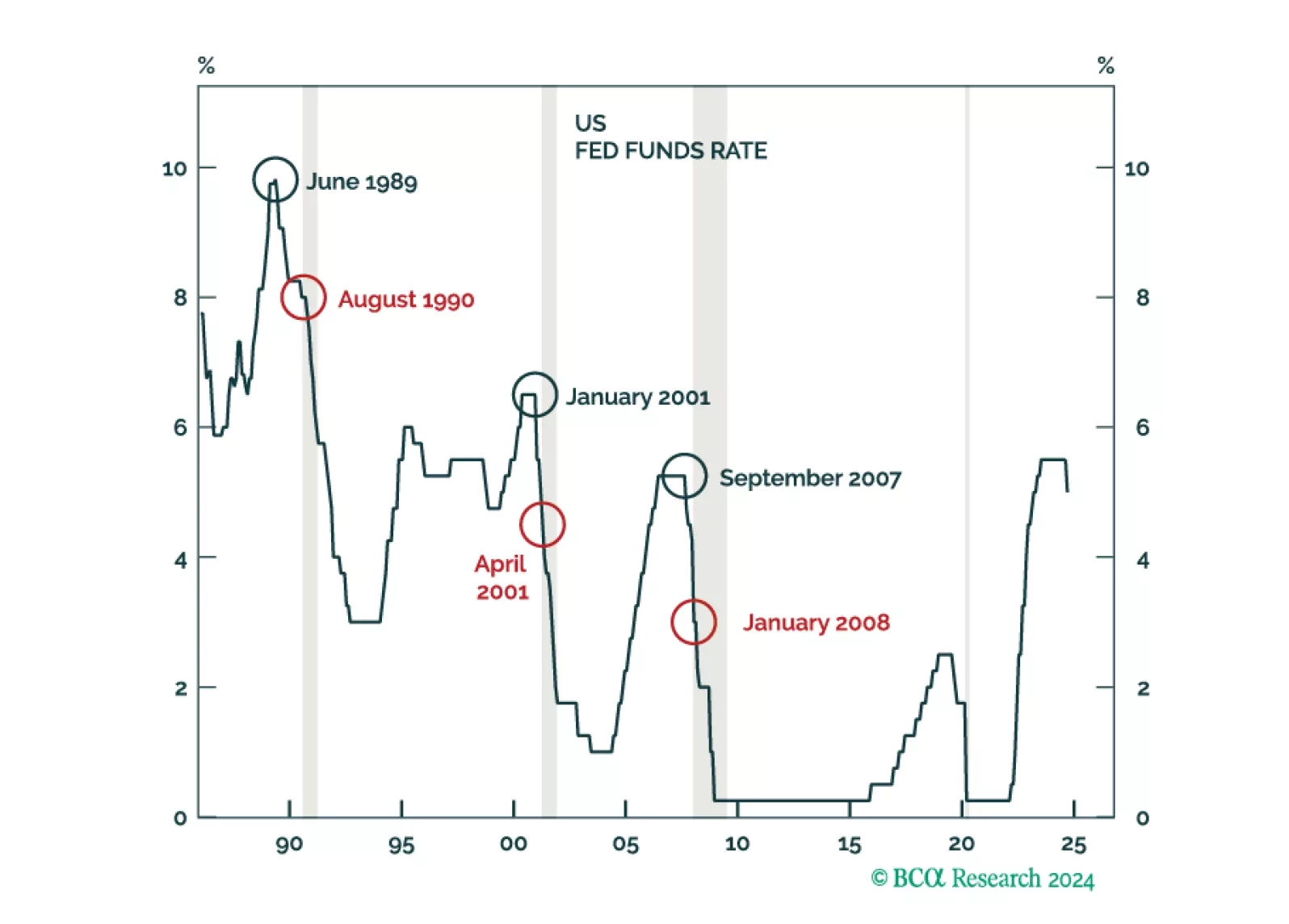

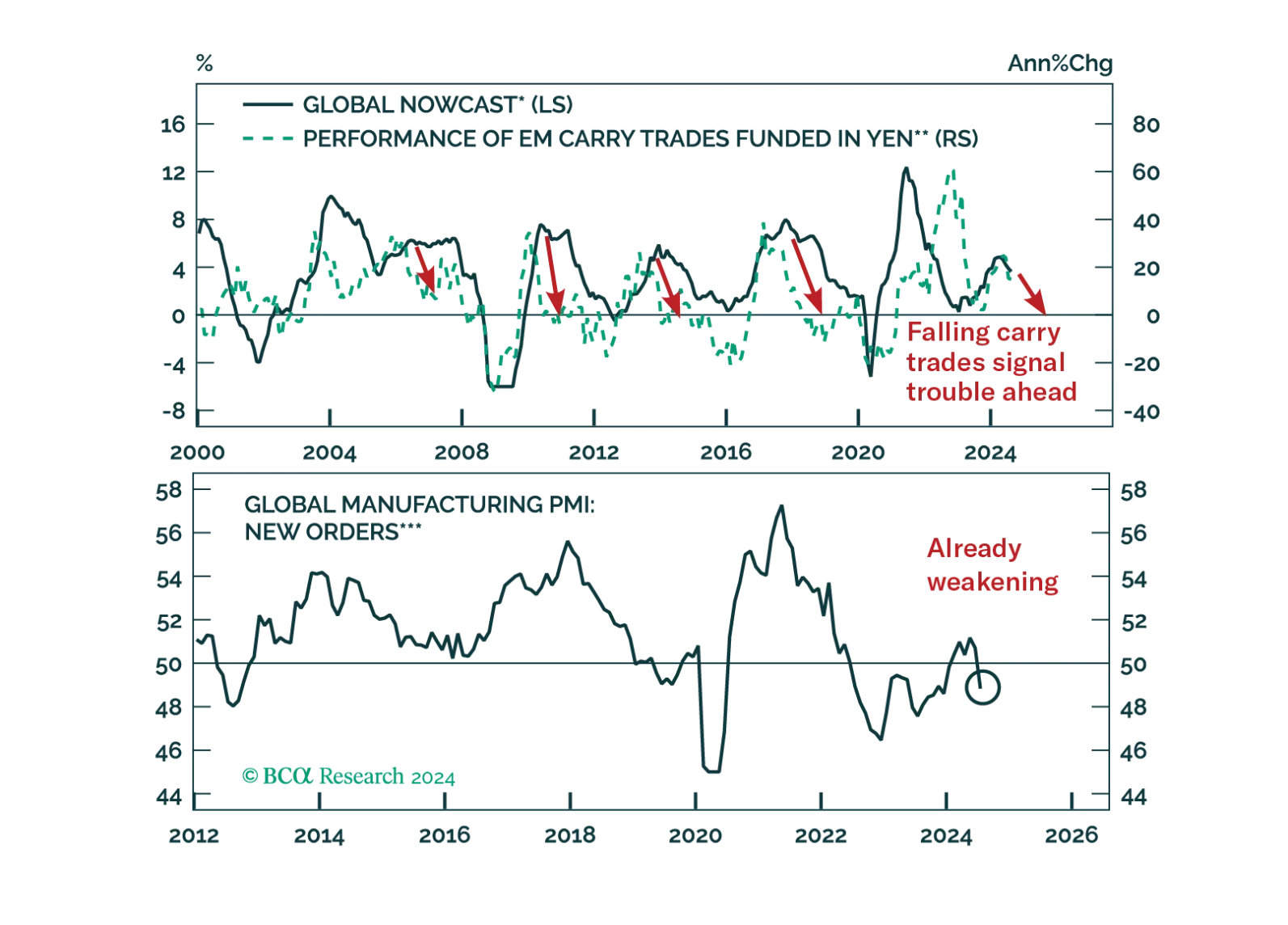

Even after the Fed cuts rates, policy will remain restrictive for some time. Moreover, in history, stocks have tended to fall around the first rate cut. We remain cautious on the outlook for the economy and risk assets.

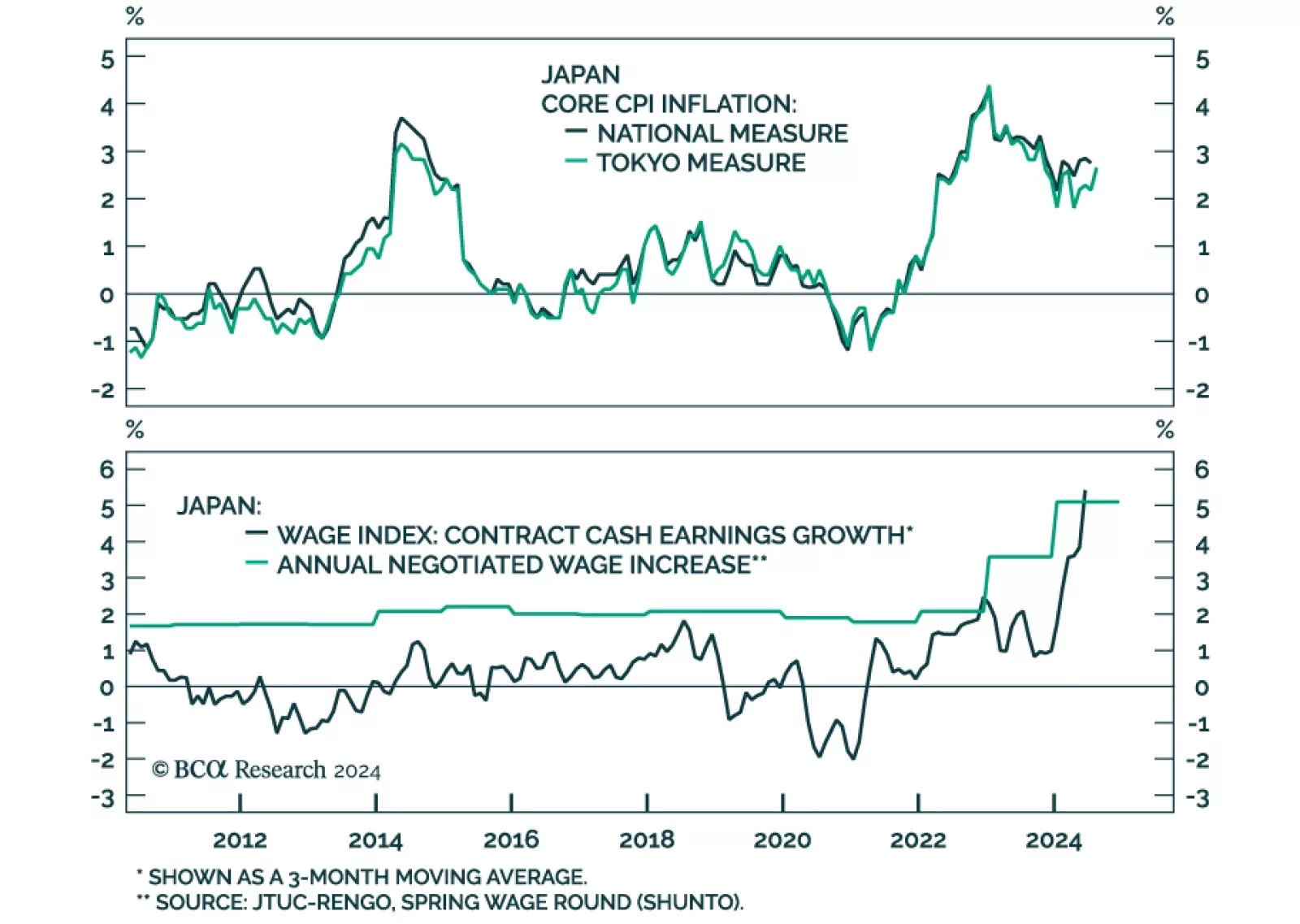

Tokyo’s CPI is a timely leading indicator of nationwide price pressures. In August, the headline, core (ex-food) and the “core core” (ex-food and energy) measures all accelerated by larger-than-expected margins…

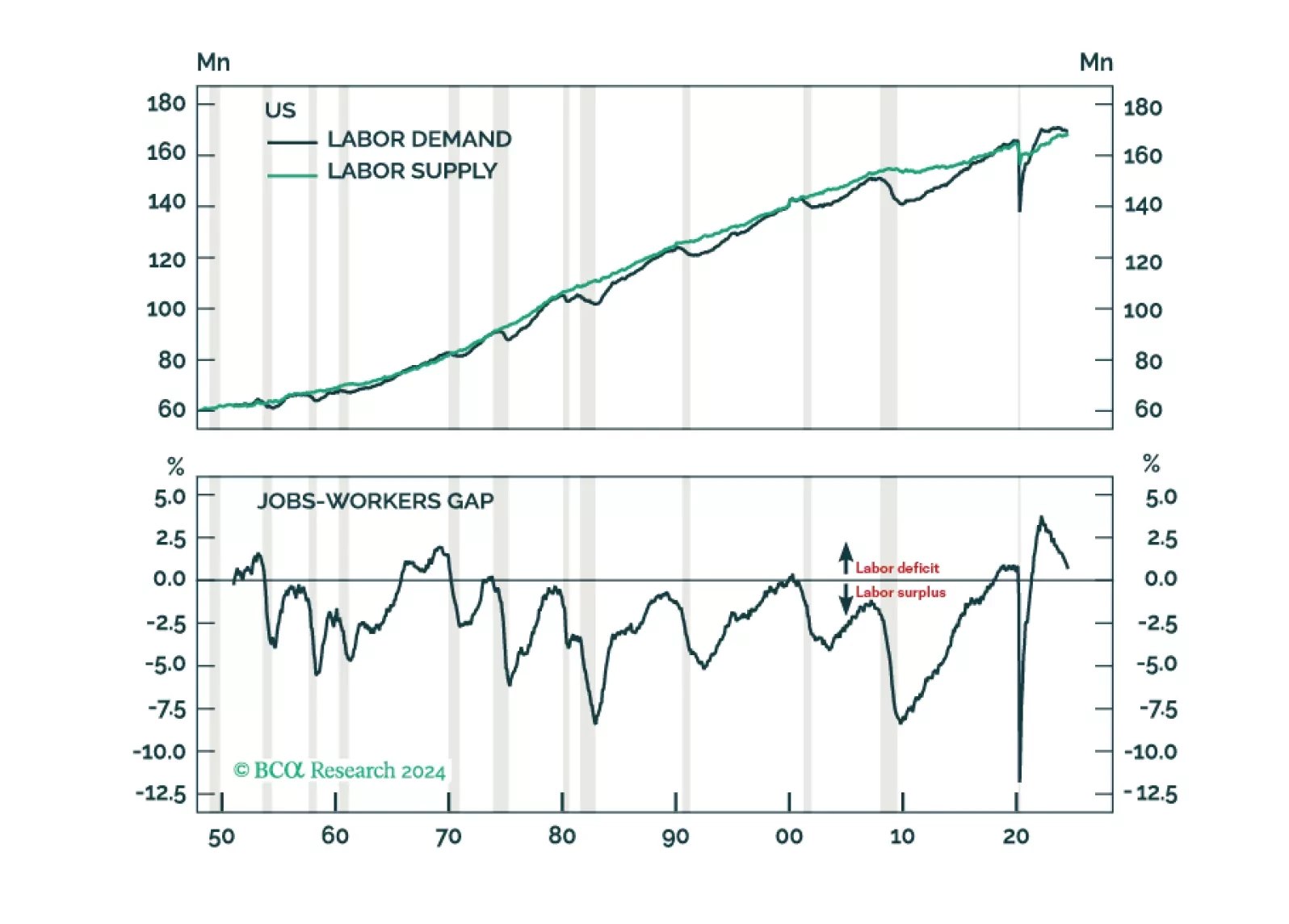

The great US labor market shortage is over. Labor demand will likely fall short of supply by the end of this year, causing unemployment to soar. Neither fiscal nor monetary policy will be able to prevent the coming recession.…

The unwind of yen carry trades caused violent tremors across the globe. Was this shock a one-off event or the prelude to more troubles?