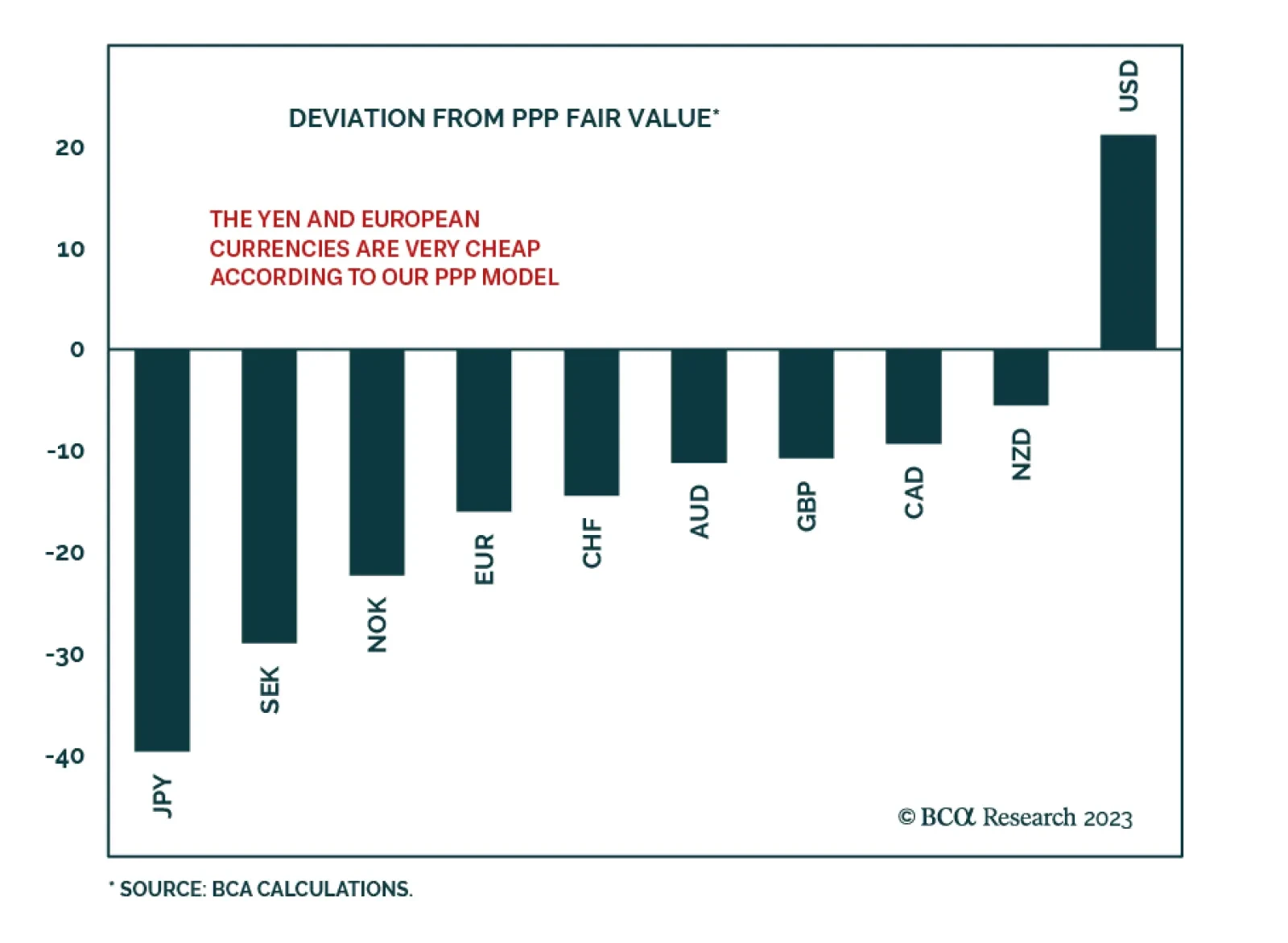

BCA Research’s Bank Credit Analyst service recently featured currency valuation models developed by our Foreign Exchange Strategy service. According to these models, the US dollar is extremely overvalued and thus vulnerable…

The DXY will continue to have near-term upside, as economic growth holds up in the US, while it deteriorates in other parts of the world. Remain constructive on the DXY at current levels, but pivot to a short position on evidence US…

The US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. Any further increase in inflation risk would prompt us to turn more cautious on stocks.

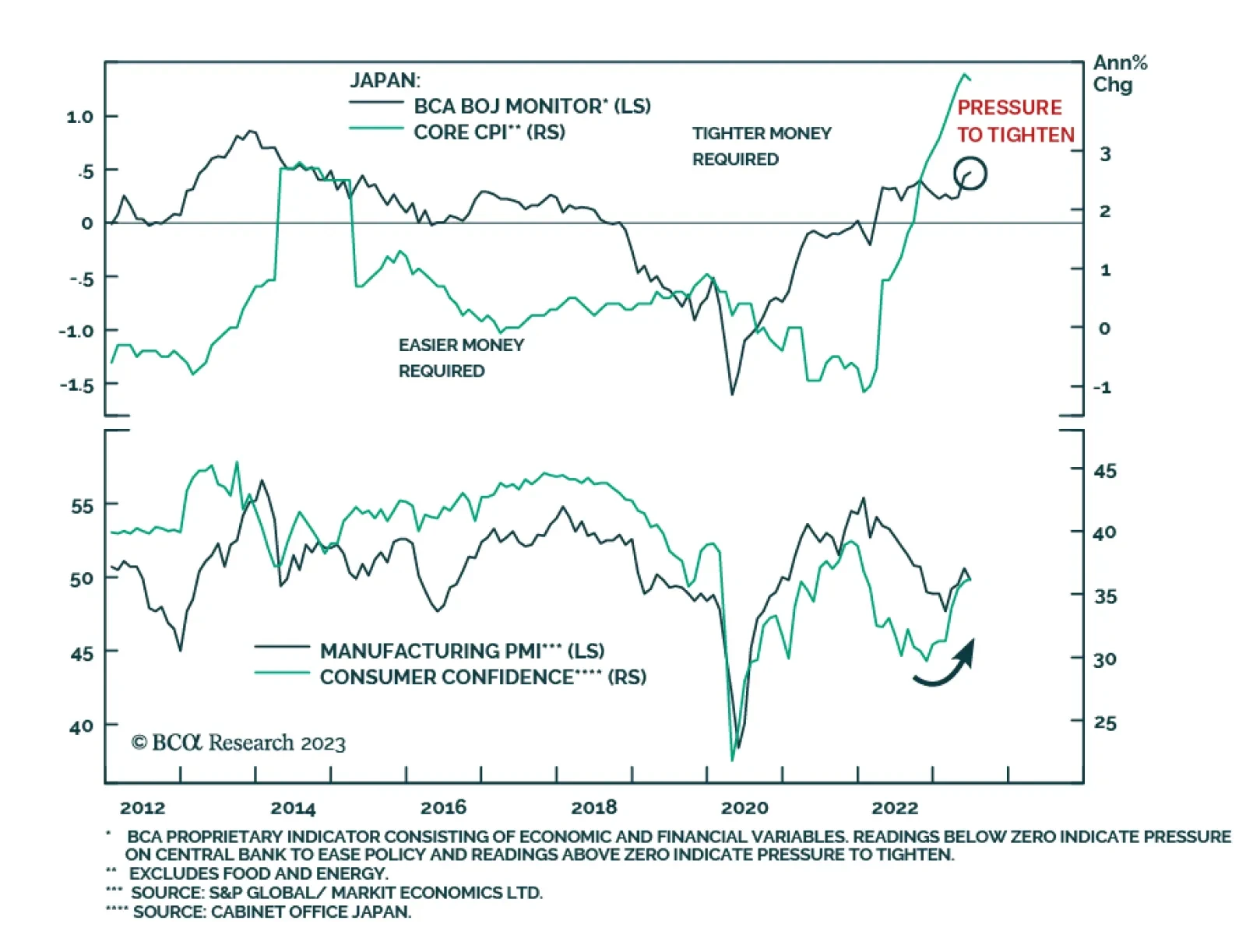

The Japanese yen slid by 2.1% vis-à-vis the US dollar last week, reversing the prior week’s rally. This latest bout of weakness comes on the back of speculation that the Bank of Japan will keep policy unchanged at…

In this short weekly report, we review some of the most common questions clients asked us in the last few weeks.

Recession is on track to start around year-end. Stocks usually peak shortly before recession begins. So, position defensively but be prepared for a few more months of the rally.

This report reviews our key calls for major currencies, in light of recent data releases.

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

In this Insight, we discuss the currency and bond market implications of last week’s ECB and Bank of Japan policy meetings. The conclusion: the ECB is on a path to an overly hawkish policy mistake, while the Bank of Japan’s dovish…

In this Insight, we discuss the currency and bond market implications of last week’s ECB and Bank of Japan policy meetings. The conclusion: the ECB is on a path to an overly hawkish policy mistake, while the Bank of Japan’s dovish…