The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

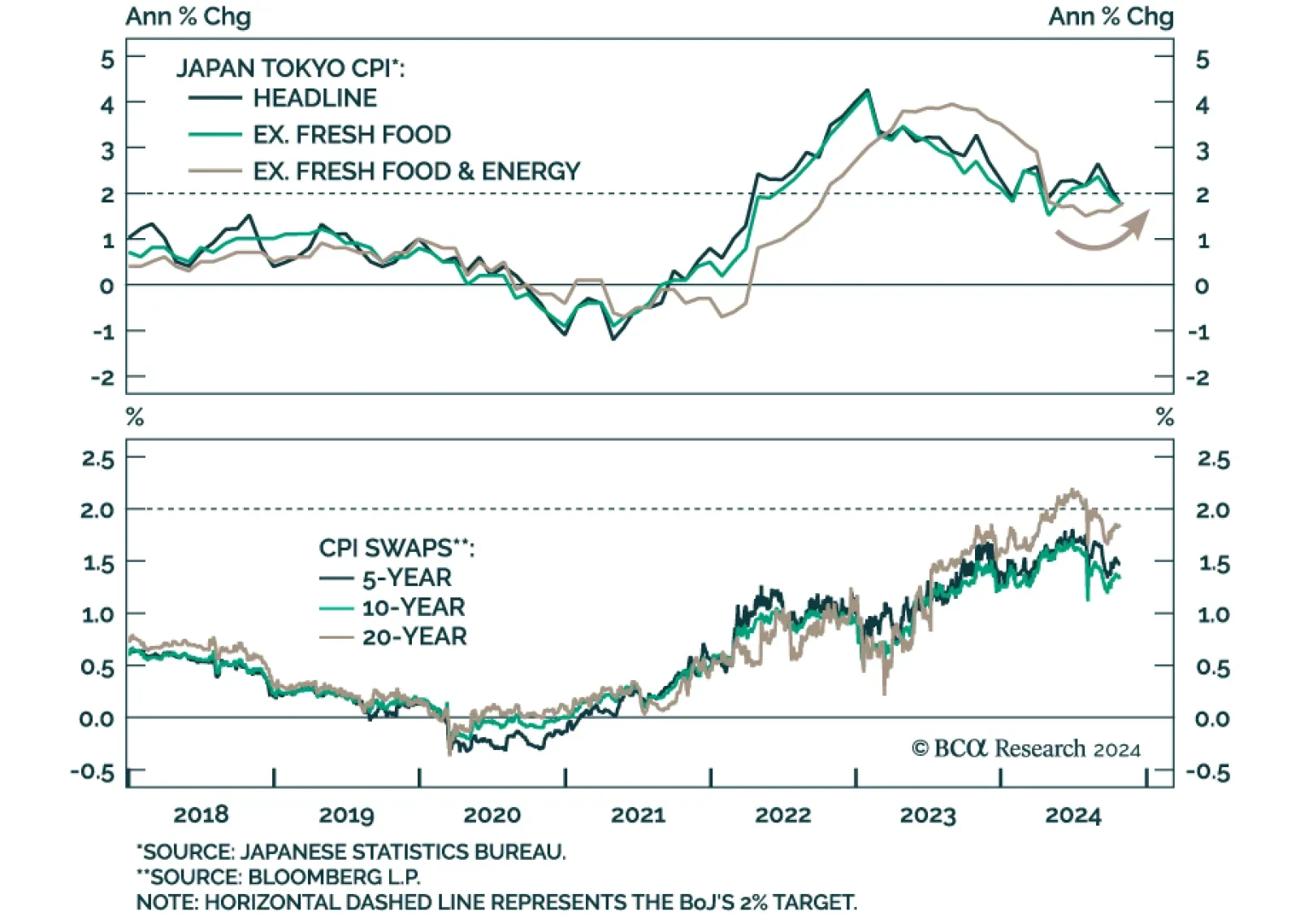

The “core core” (ex. fresh food & energy) segment of the Tokyo CPI basket beat expectations in October, printing at 1.8% year-over-year and accelerating from 1.6% in September after troughing at 1.5% in July. The…

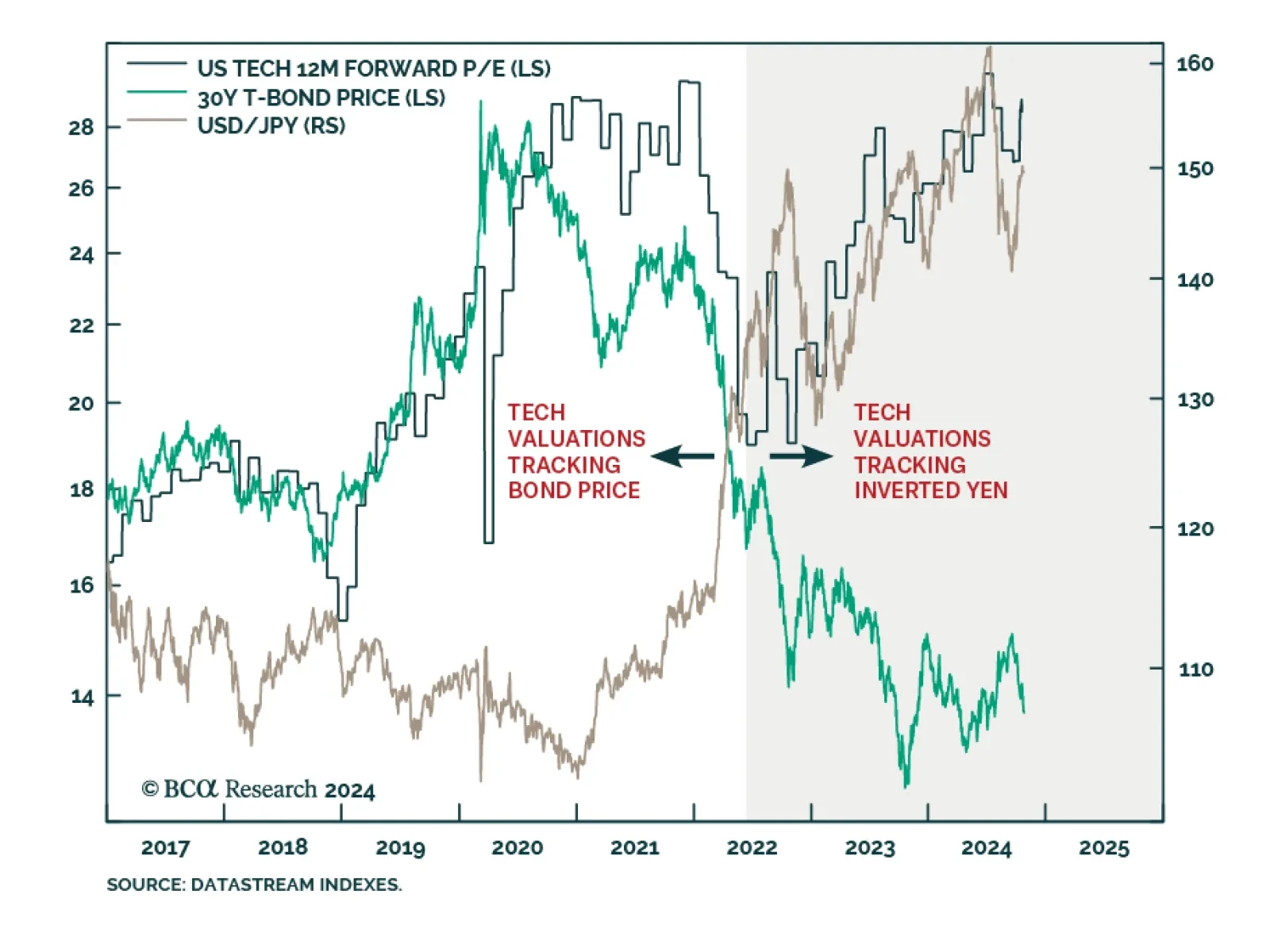

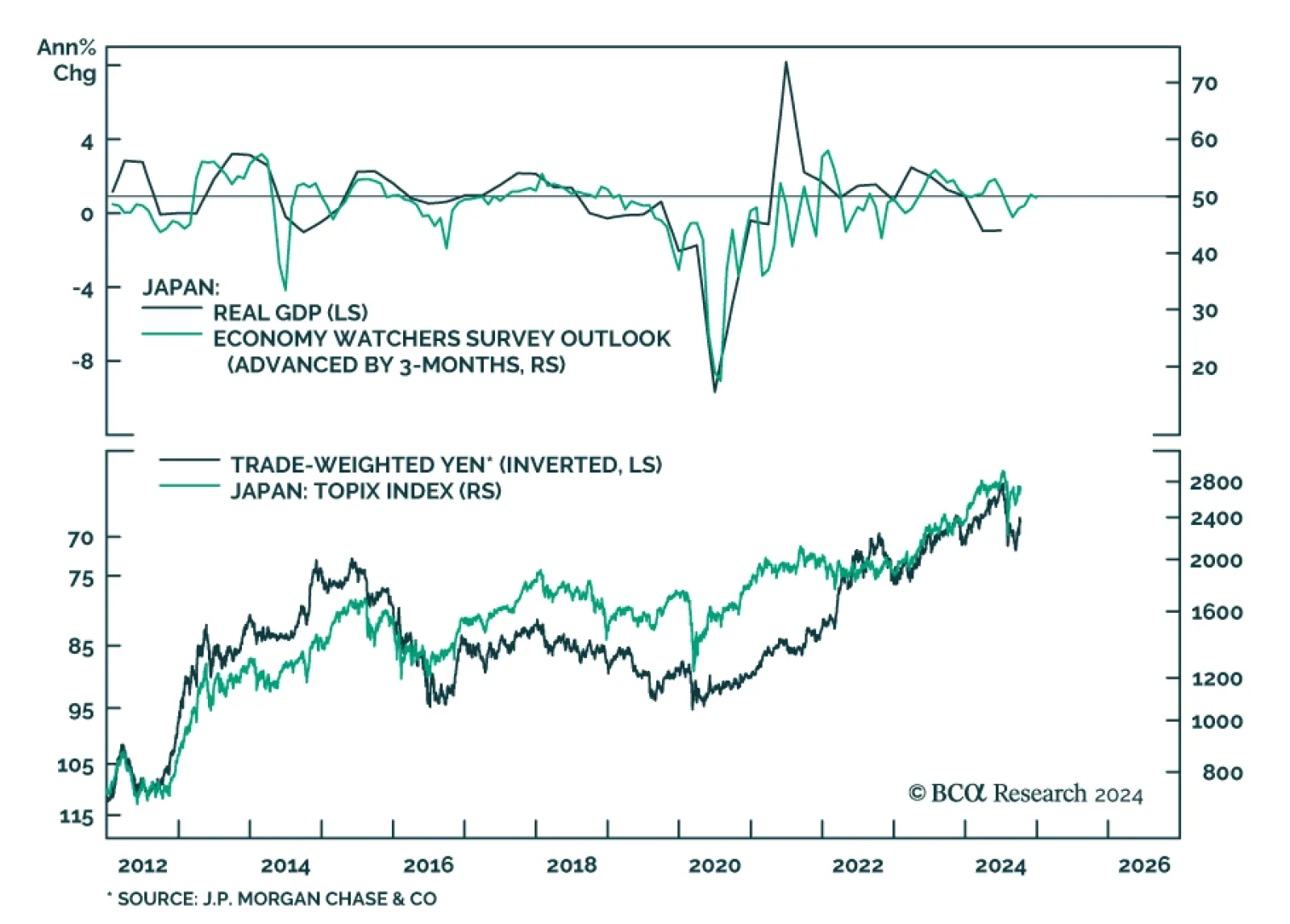

Our Counterpoint Strategy team believes the equity bull market’s biggest risk is the reversal of the divergence between Japanese and US real yields. Japan’s real policy interest rate differential versus the US…

Developed markets Flash PMIs estimates for October were mixed, with resilient US numbers and weakness elsewhere. The eurozone composite met expectations but remains below the 50-level expansion threshold. Germany…

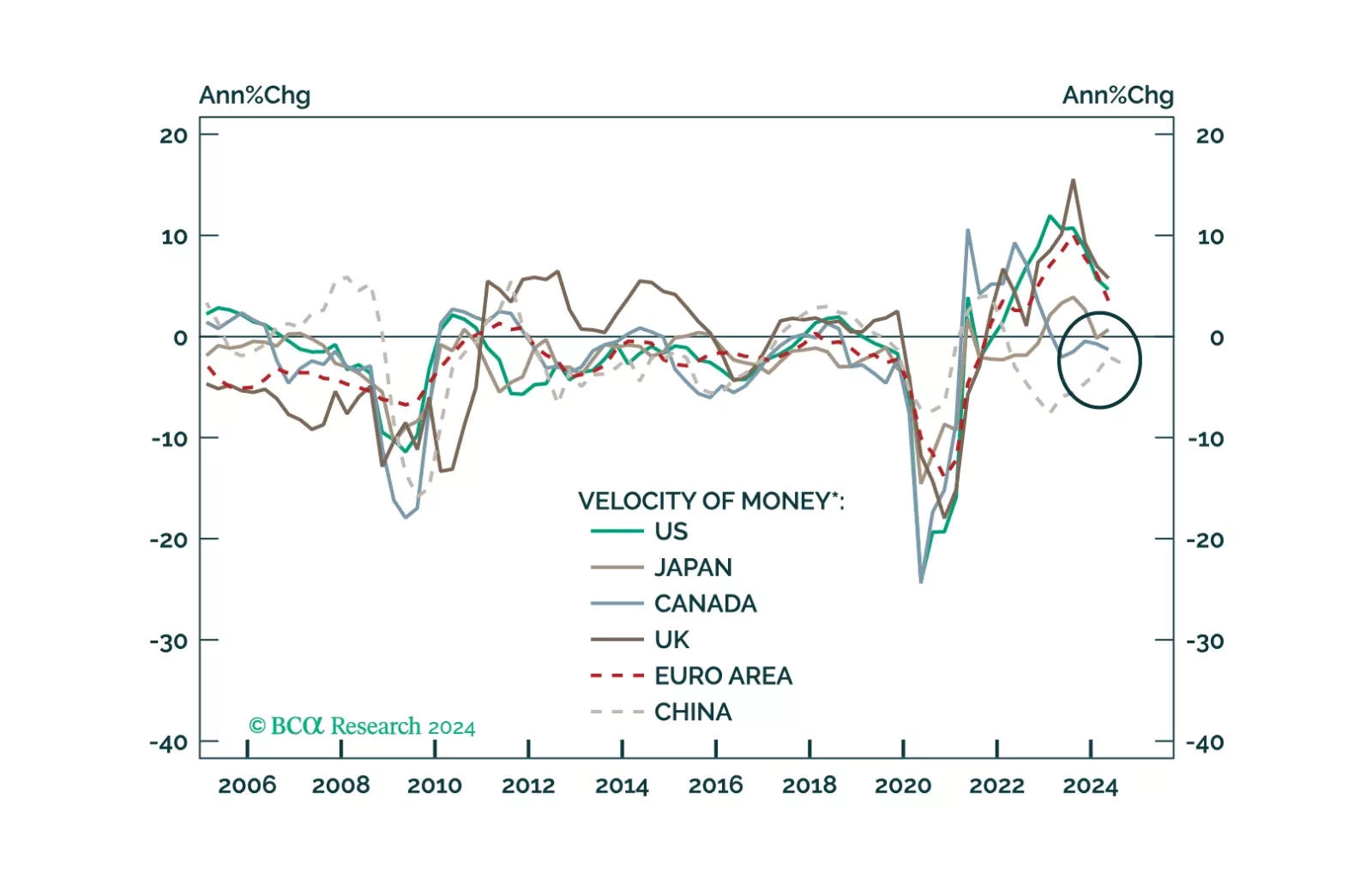

This Insight looks at the likely direction of bond yields and the dollar, from the lens of money velocity.

September numbers for East Asian trade disappointed across the board. Japanese exports dropped 1.7% year-on-year (YoY) after rising 5.5% in August, and Singapore’s non-oil domestic exports decelerated to 2.7%YoY after…

Japanese core machinery orders decreased by 1.9% in August and dropped 3.4% year-over-year, missing expectations for modest growth. This decline reversed July’s improvement, when machinery orders grew at an 8.7% annual pace…

The Bank of Japan’s Economy Watchers Survey – a gauge of sentiment among business owners – disappointed in September. The Current Conditions and the Outlook indices deteriorated from 49.0 to 47.8 and from…

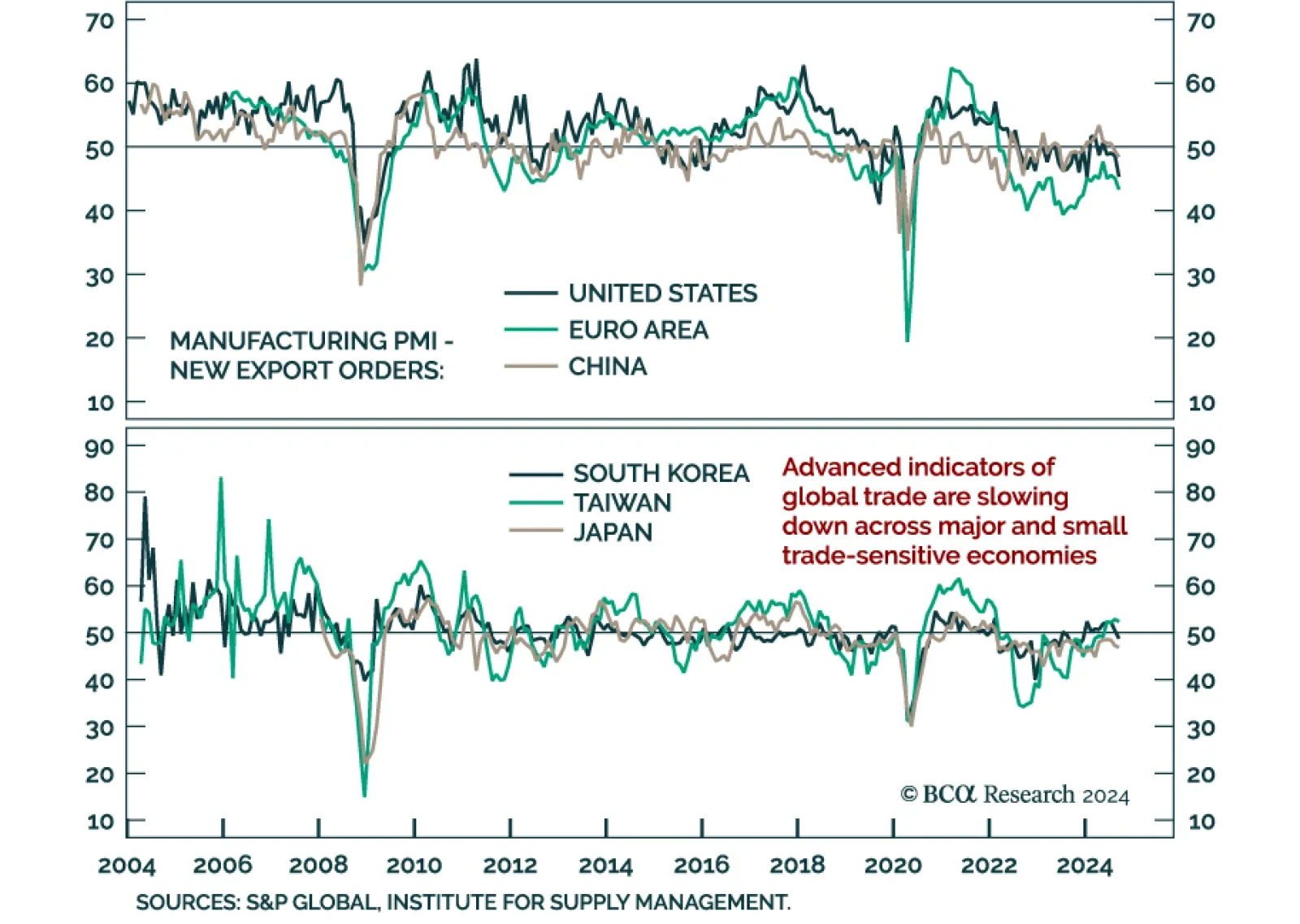

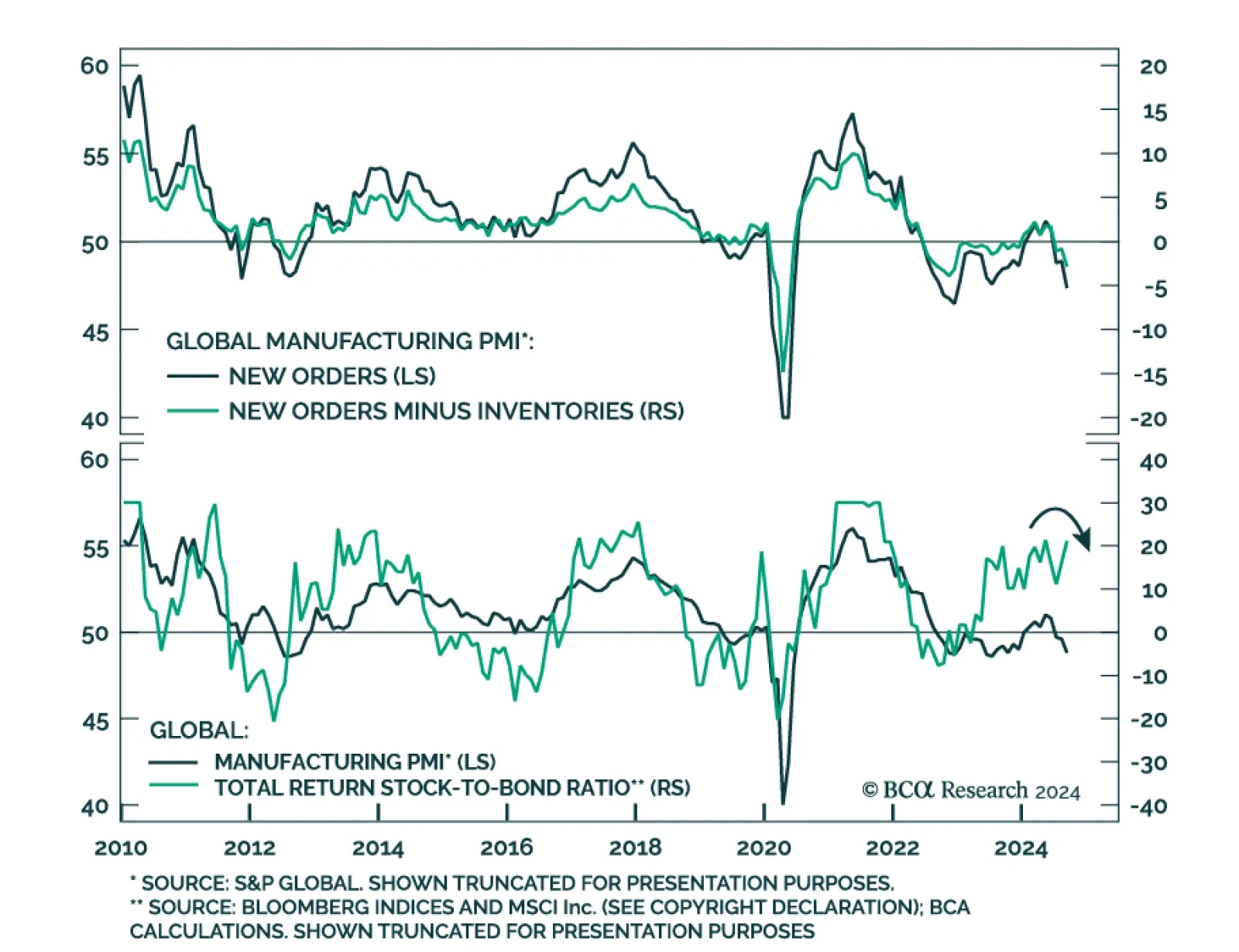

The JPM Global manufacturing PMI declined at an accelerating pace in September (49.6 to 48.8). Moreover, international trade flows deteriorated notably with the new export orders component falling from 48.4 to 47.5. A sector…

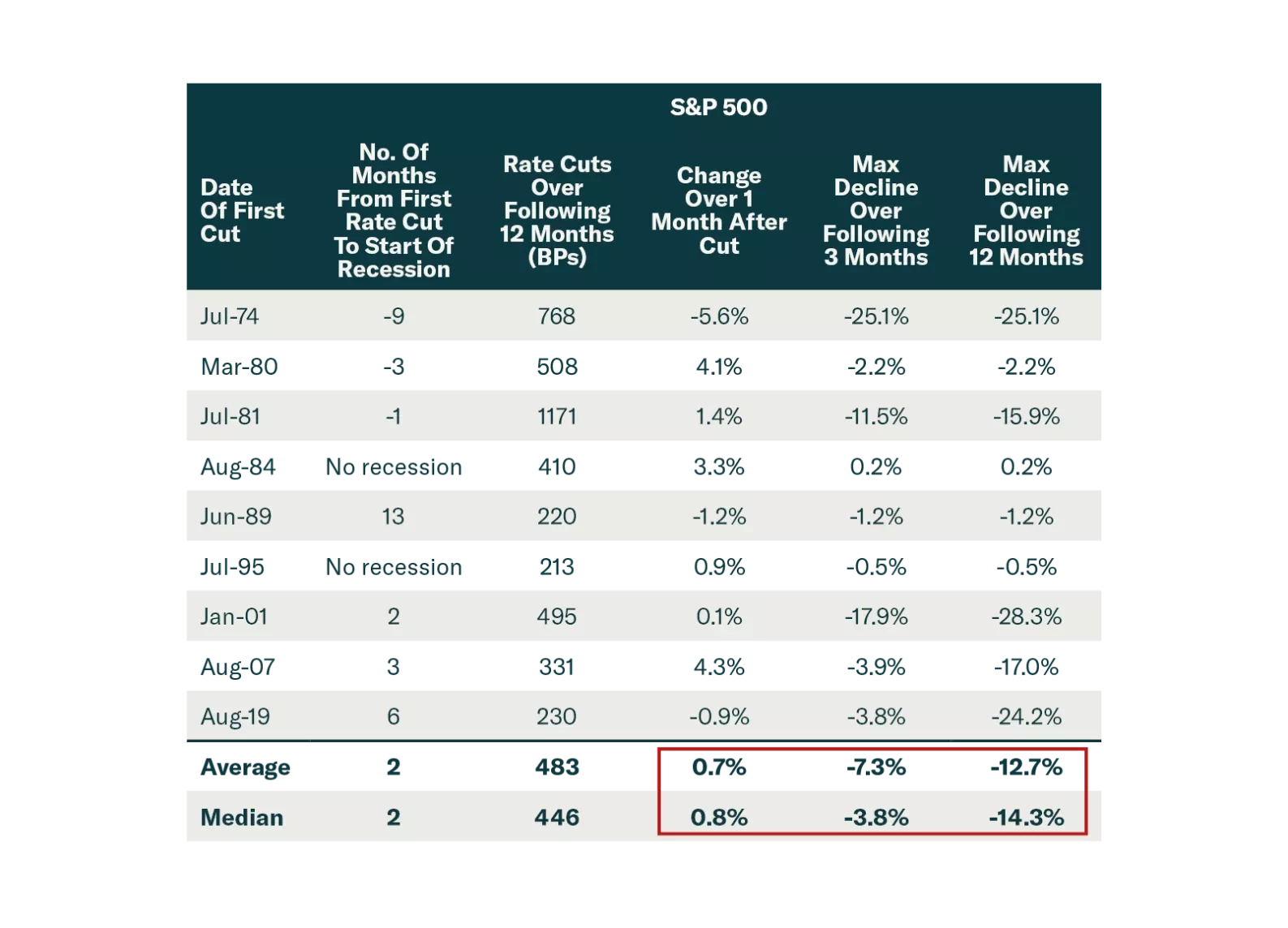

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…