Our Global Fixed Income and FX strategists published their 2025 outlook, and provide five key views for the year ahead. Duration revival: After three years of underperformance versus cash, government bonds will…

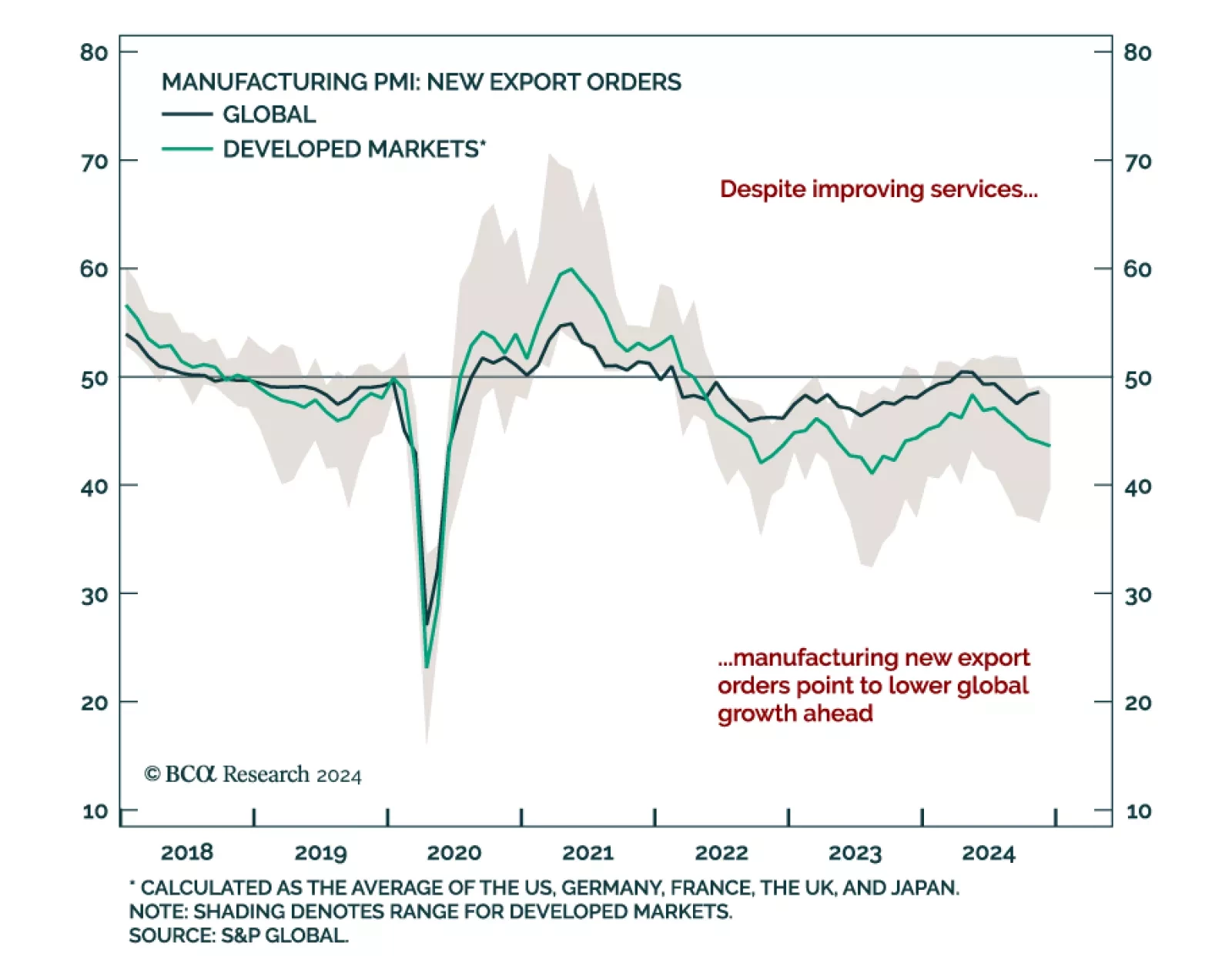

December flash PMIs for the core advanced economies showed service sector growth picking up. Manufacturing keeps contracting, and the US continues to outperform its DM peers. The US composite index beat expectations and…

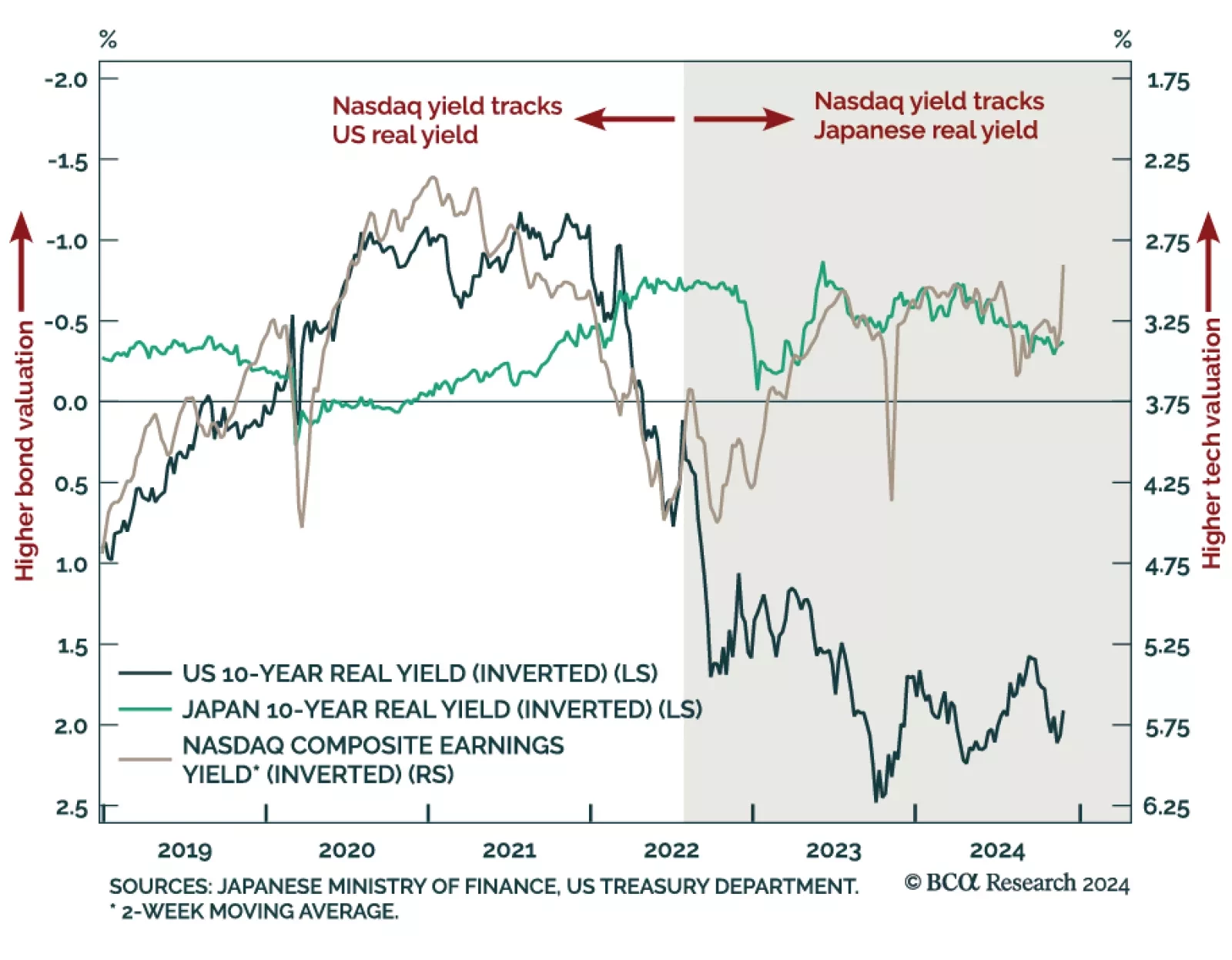

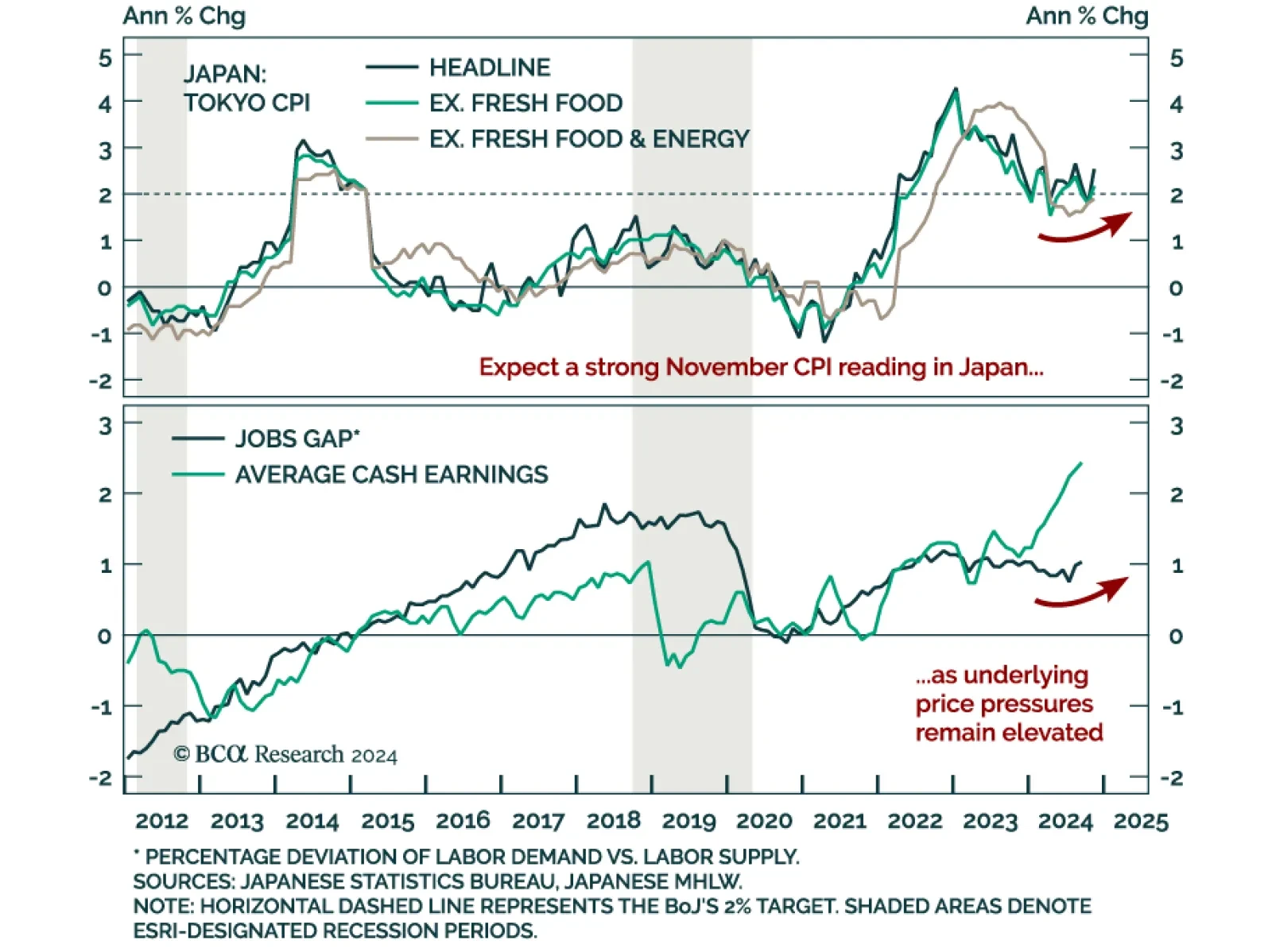

Our Counterpoint strategists published their 2025 outlook; they see major market movements for the year ahead hinging on Japan. Japan remains the cornerstone of global liquidity, with rising Japanese real yields posing a key…

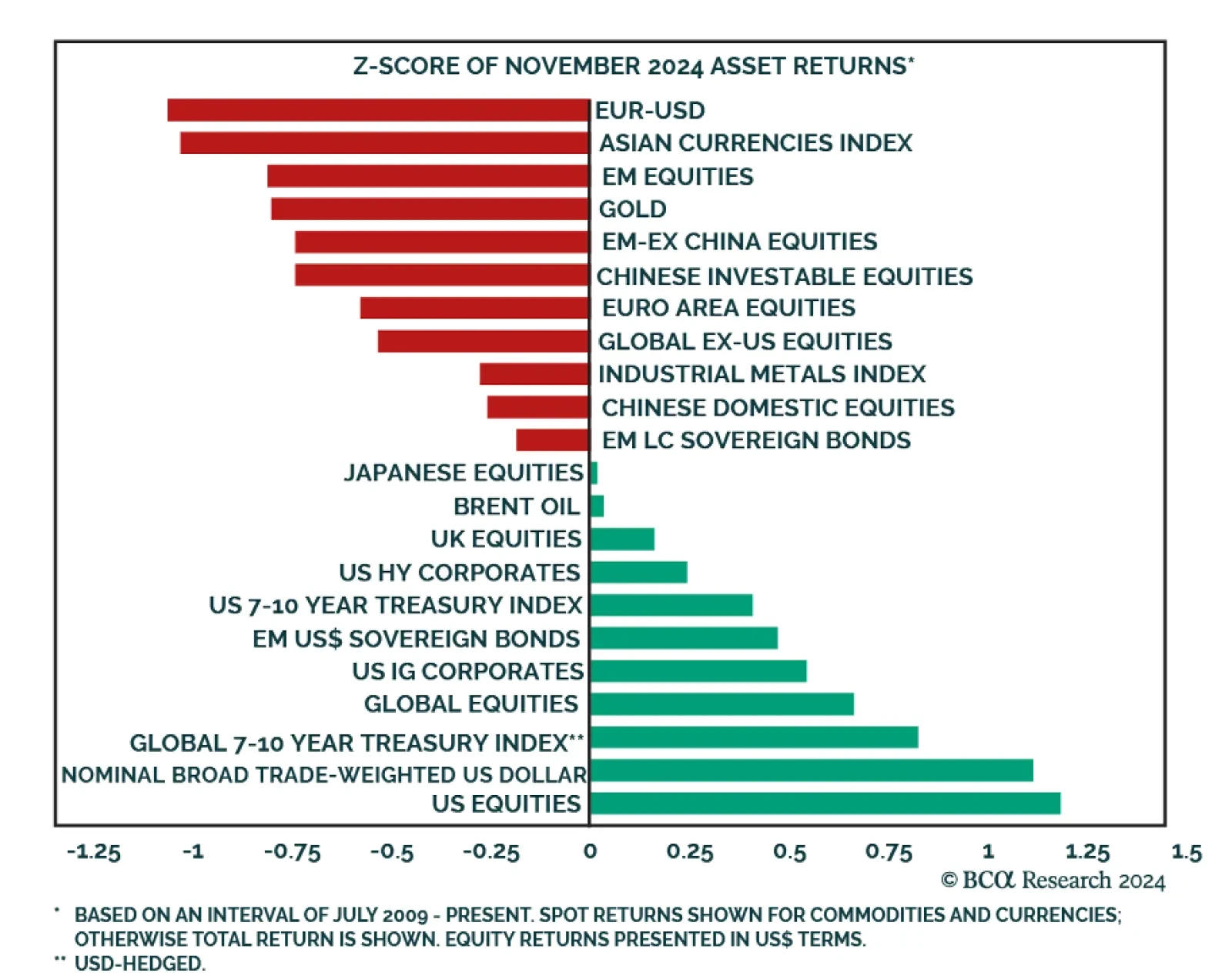

November trading was centered around the US election and its aftermath. US assets led the way, with US equities significantly outperforming their global counterparts. The US dollar strengthened considerably against both DM and EM…

The November Tokyo CPI beat expectations, with headline inflation accelerating to 2.6% y/y from 1.8%. The core (ex. fresh food) and “core core” (ex. fresh food and energy) measures also reaccelerated to 2.2% and 1.9…

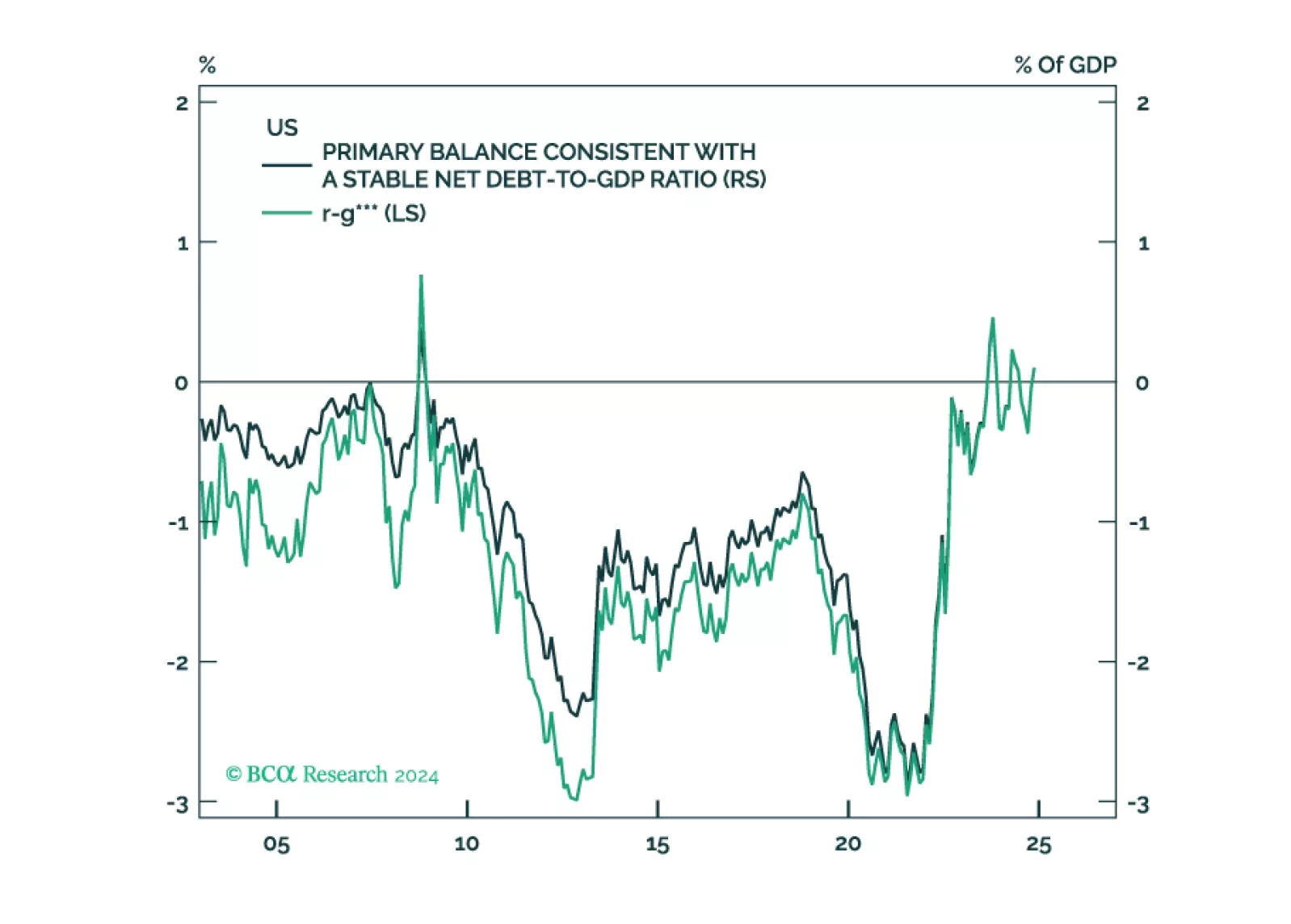

Executive Summary The US Needs To Reduce Its Primary Budget Deficit By Nearly 4% Of GDP To Stabilize Debt Rising government debt in the US has heightened the risk of a fiscal crisis. If interest rates stay where they are, the US primary…

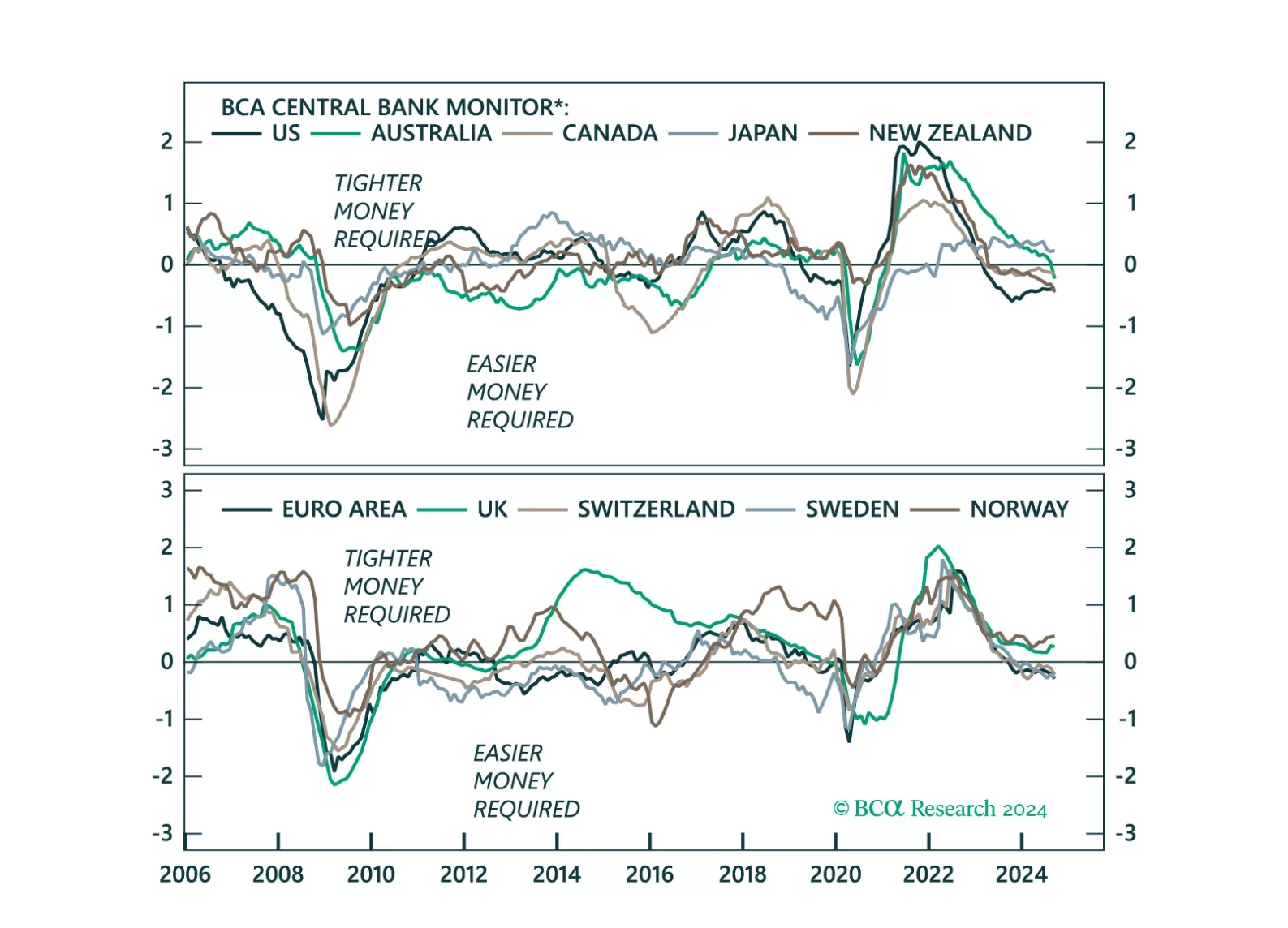

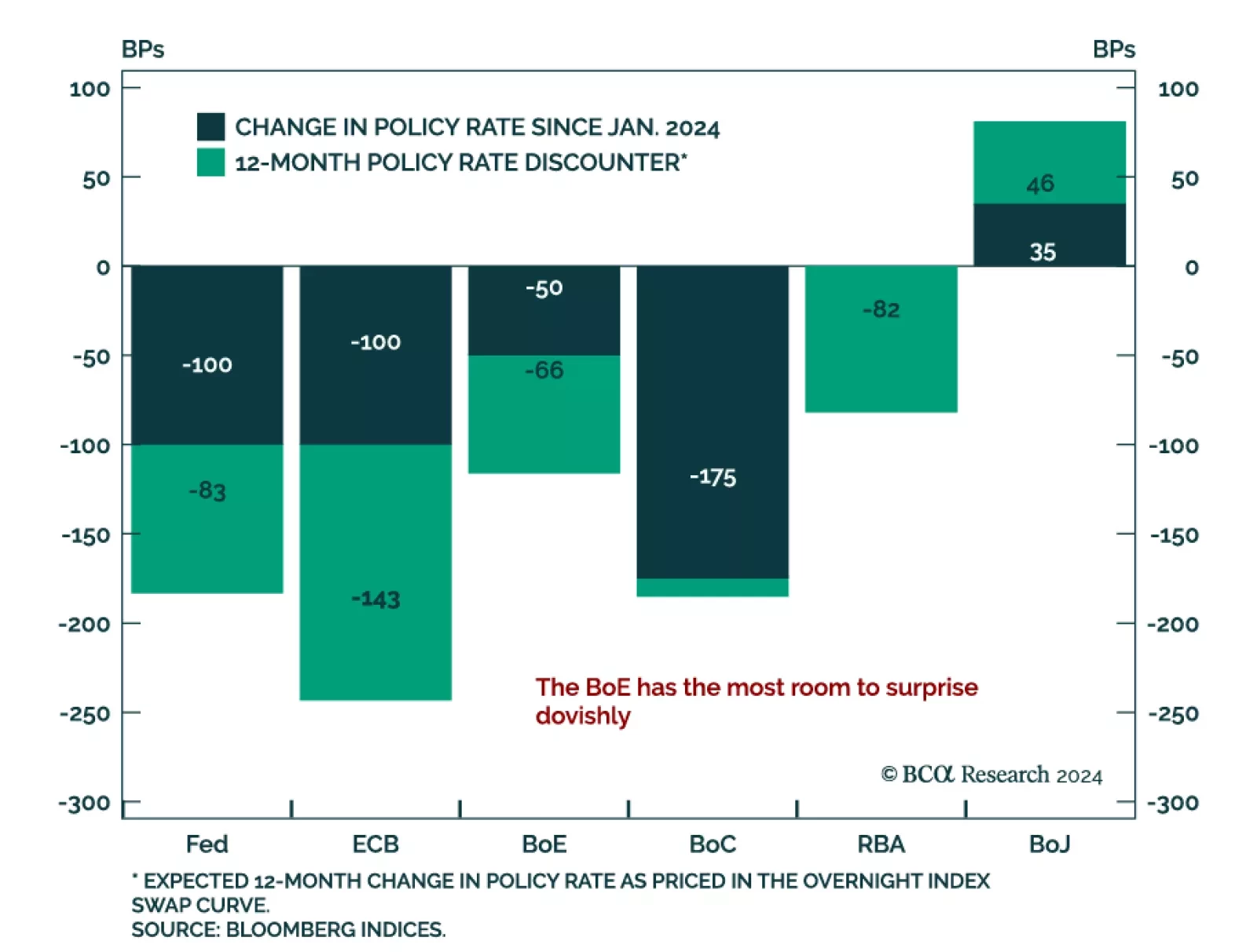

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

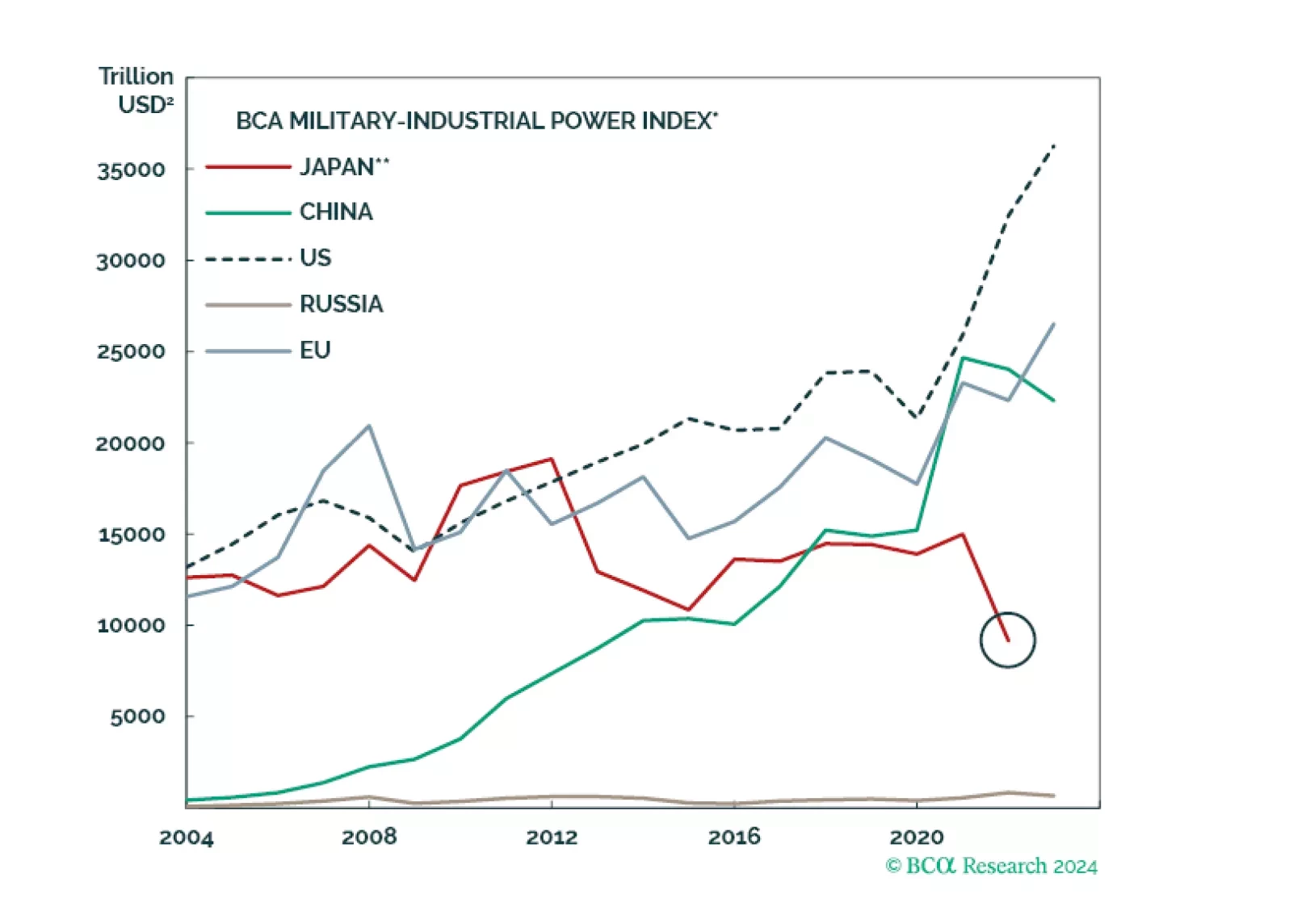

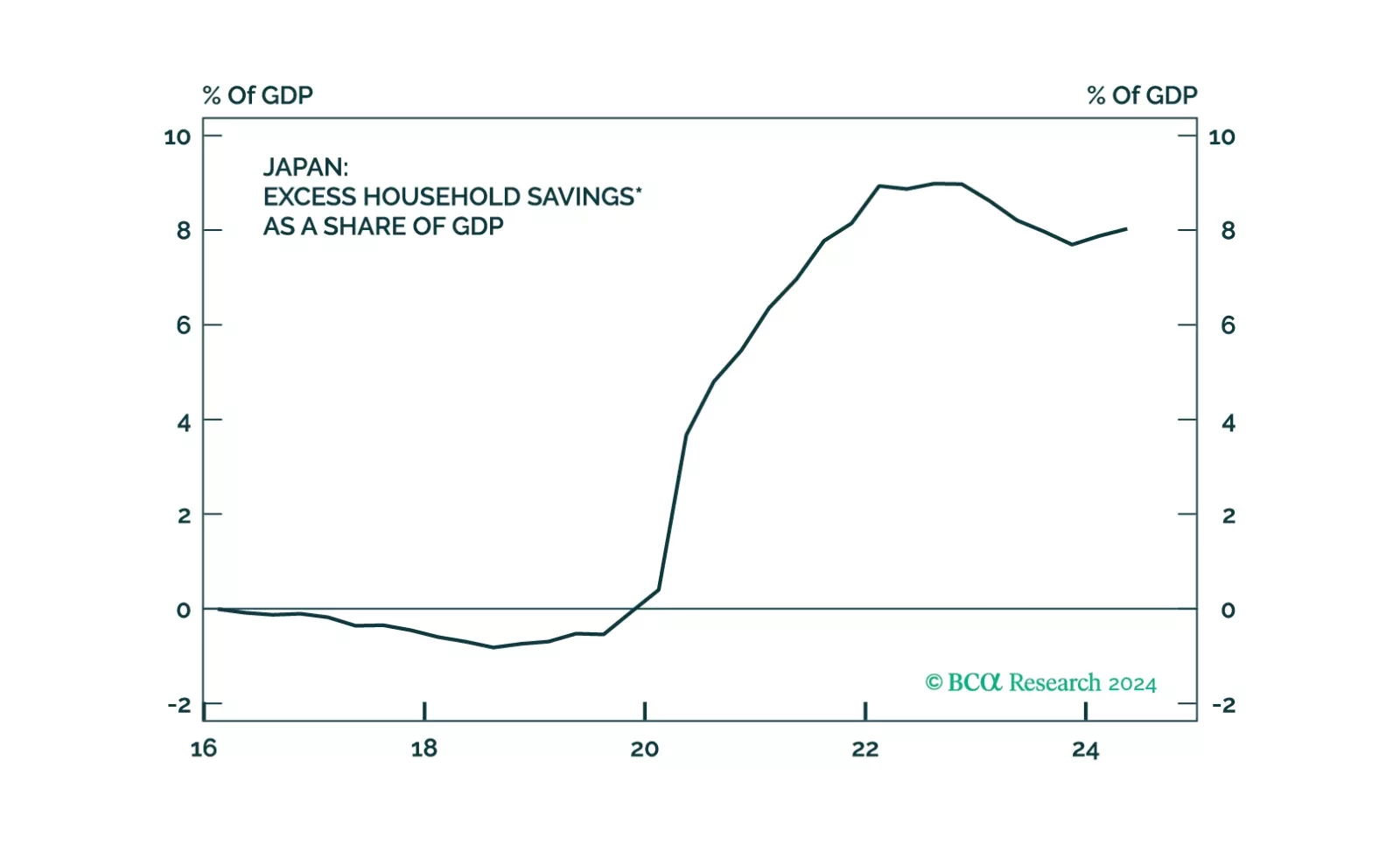

Over the next few months, Japan’s new government will ease fiscal policy, which will improve domestic demand on the margin. Monetary policy may tighten further in the short run but not too much over the long run. The geopolitical…

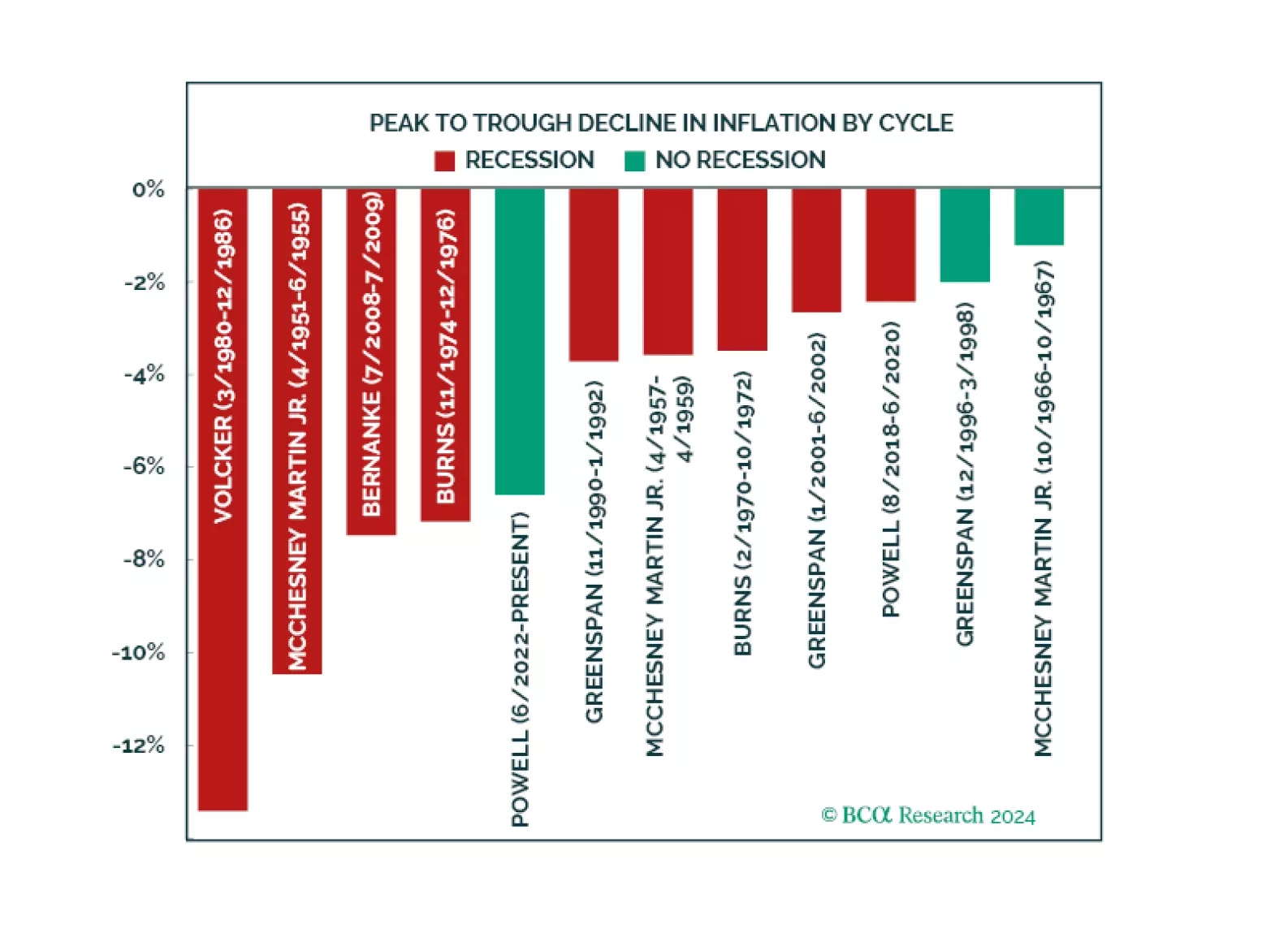

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

The latest Bank of Japan meeting did not alter our high-conviction views of being long the yen and underweight JGBs.