Highlights Global growth is still slowing. Having rallied since the start of the year, global stocks will likely enter a “dead zone” over the next six-to-eight weeks as investors nervously await the proverbial…

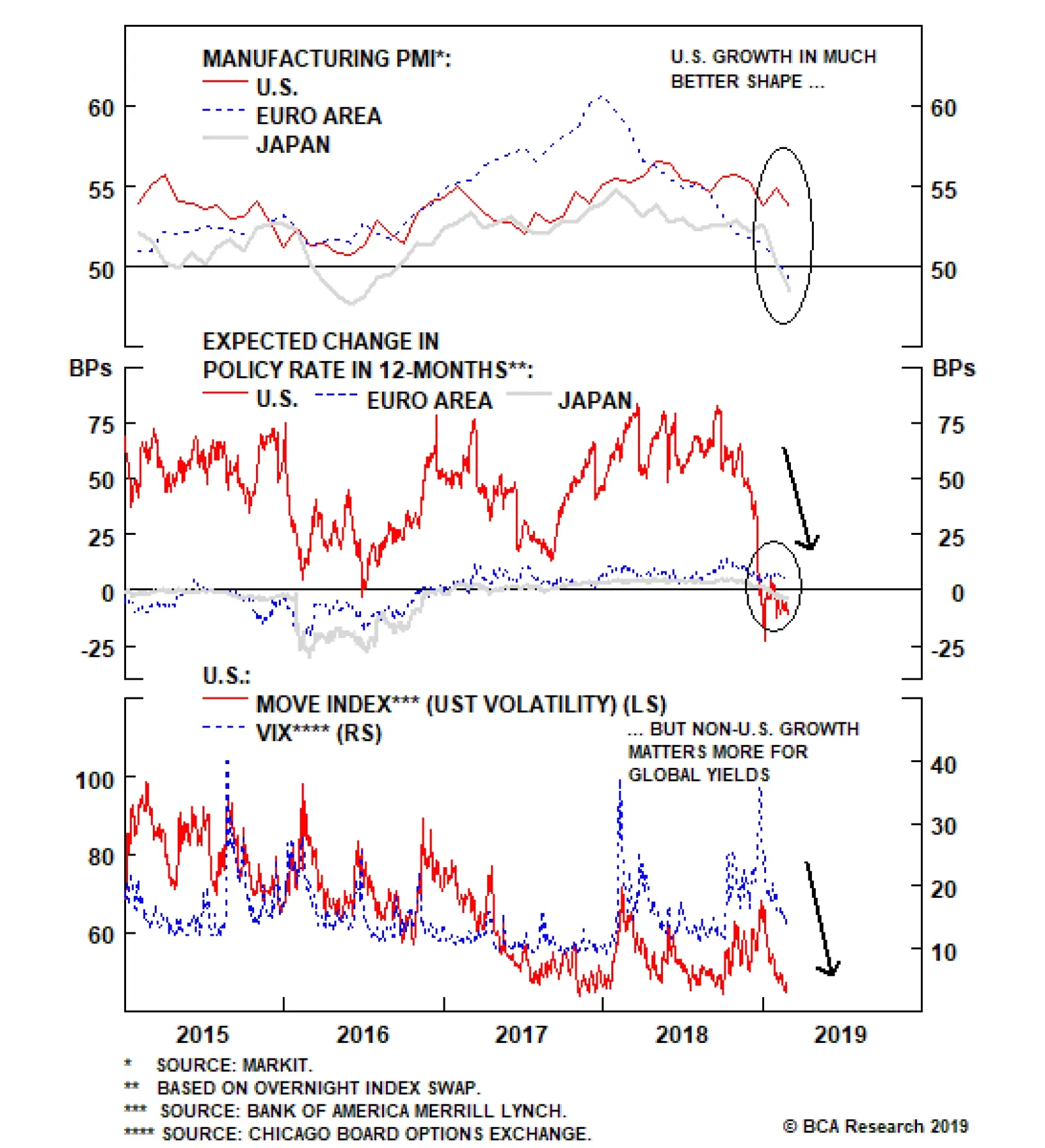

Investors have priced out any possibility of a Fed rate hike over the next year, and now even discount a modest rate cut, according to the U.S. Overnight Index Swap (OIS) curve. Yet, while most of the attention of bond investors…

If those expectations continue to rise, likely in the context of stickier realized U.S. inflation alongside solid U.S. growth, then the Fed will return to a hawkish bias. That ultimately means higher U.S. real yields and, most…

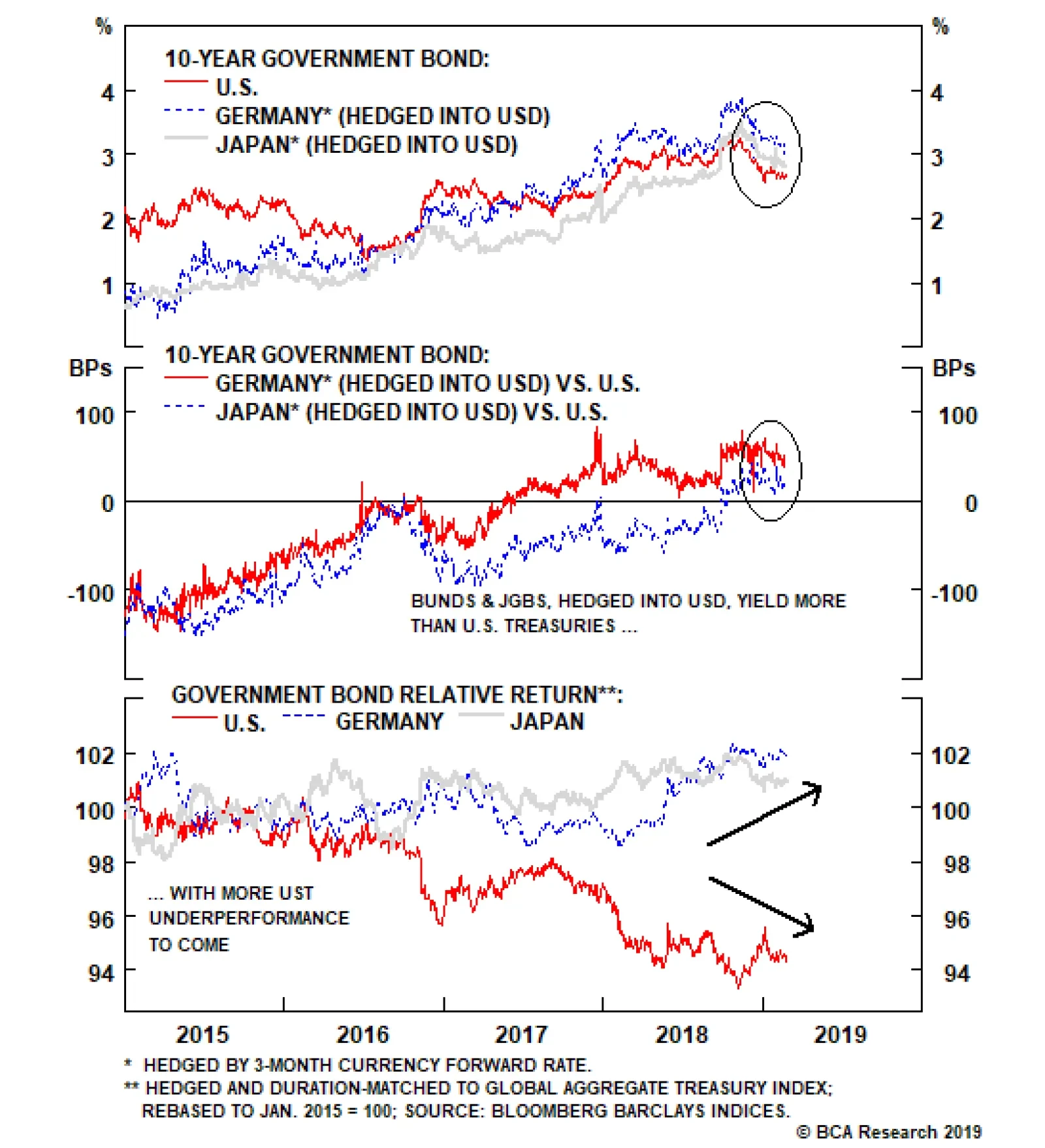

Highlights Low Bond Volatility: Weakening non-U.S. growth and a more dovish Fed have crushed global government bond volatility, especially in Europe and Japan where yields are struggling to stay above 0%. Treasury-Bund and Treasury-JGB…

Highlights It may seem self-evident that most governments are overly indebted, but both theory and evidence suggest otherwise. Higher debt today does not require higher taxes tomorrow if the growth rate of the economy exceeds the…

Highlights Global Growth: Early leading indicators (credit impulses, our global LEI diffusion index) are signaling that the worst of the global economic downturn should soon end. Okun’s Law: In the developed economies, the…

Highlights We would fade fears of an “earnings recession.” EPS growth should increase during the remainder of this year. While high debt burdens around the world may exacerbate deflationary pressures by restraining spending…

Highlights We always strive to develop new analytical methods to complement our focus on judging currencies based on global liquidity conditions and the business cycle. This week, we introduce a ranking method based strictly on…

Highlights Global equity markets have managed to recoup some of last year’s plunge since we upgraded stocks to overweight in late December. The equity rally has been tentative, however, and so far feels more like a technical…