Feature For a decade, mainstream economics has prescribed remedies for sluggish growth in the euro area on the basis of three articles of blind faith. First, that the ailment arises from structural impediments to growth; second, that in…

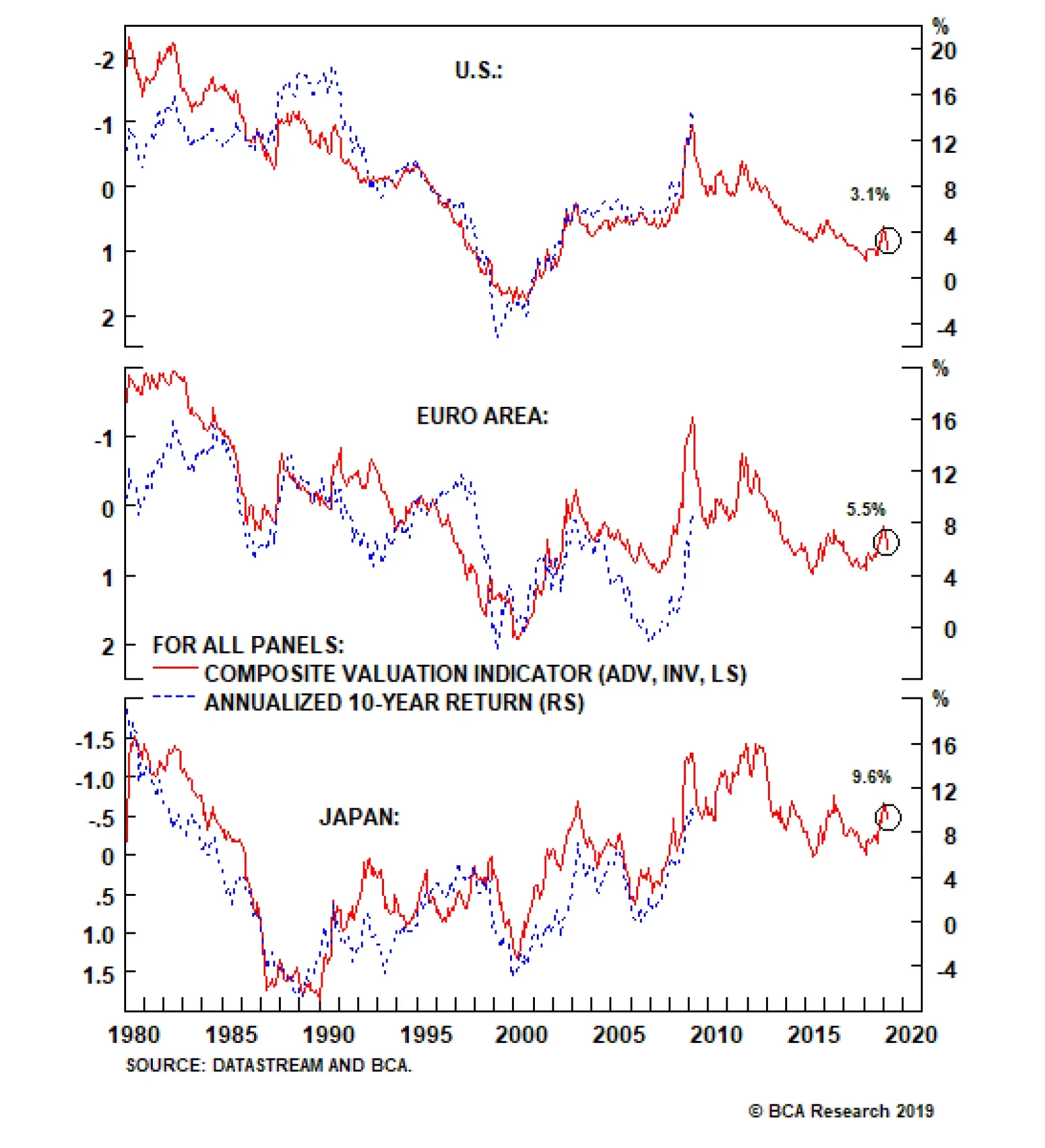

Private capital will begin stampeding toward the exits when the return on invested capital (ROIC) for U.S. assets falls below their cost of capital. For investors with a long horizon, this may already be happening. During bull…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of our country Monitors are now forecasting monetary policy on hold, apart from Australia and New Zealand where looser policy is…

Highlights U.S. growth remains robust, despite some temporary softness in recent months. Ex U.S., growth continues to fall but, with China probably now ramping up monetary stimulus, should bottom in the second half. Central banks…

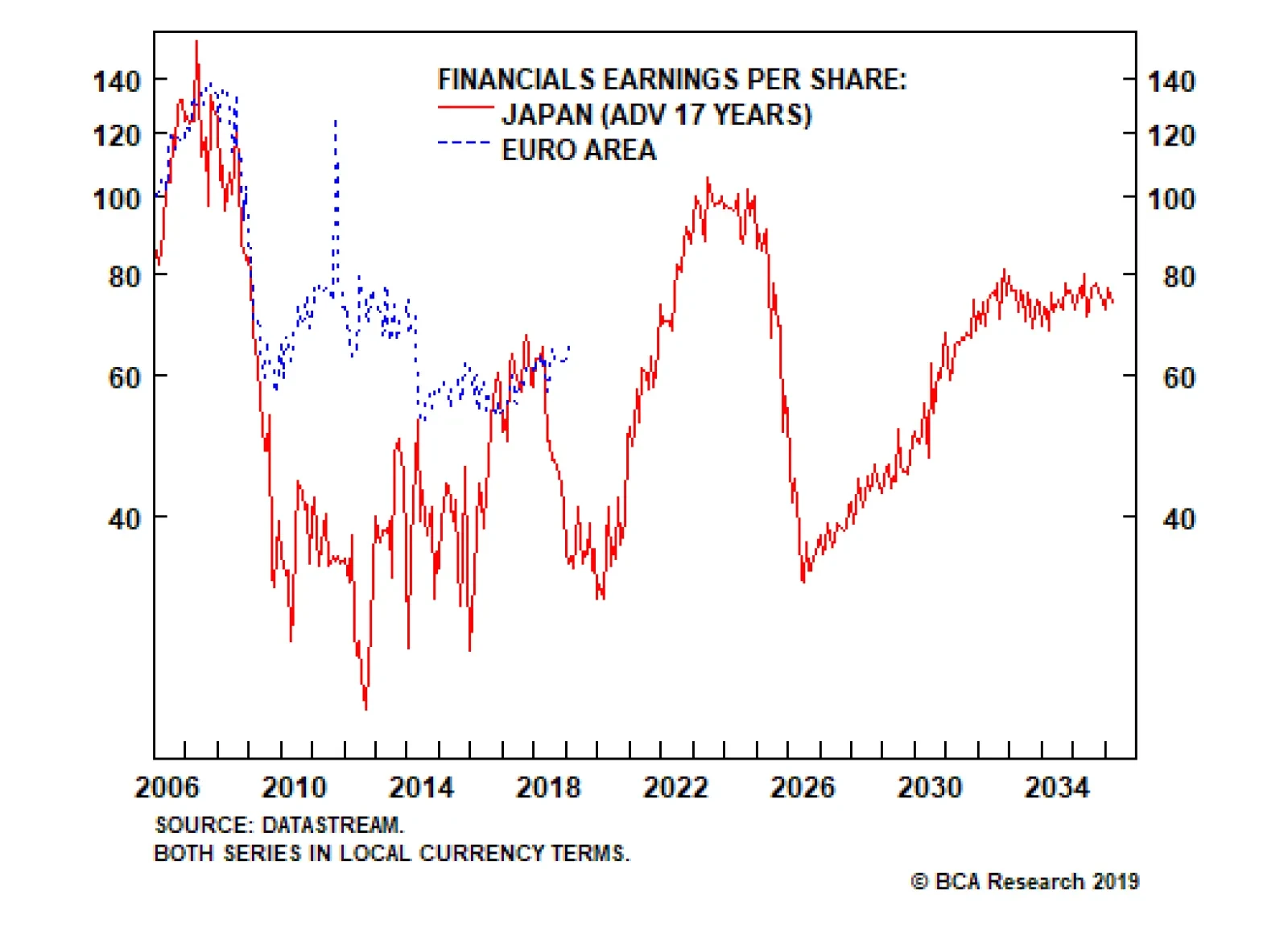

Japanese financial sector profits peaked in 1990 and stand at less than half that level today. Euro area financial sector profits peaked in 2007, and are tracking the Japanese experience with a 17-year lag. If euro area financial…

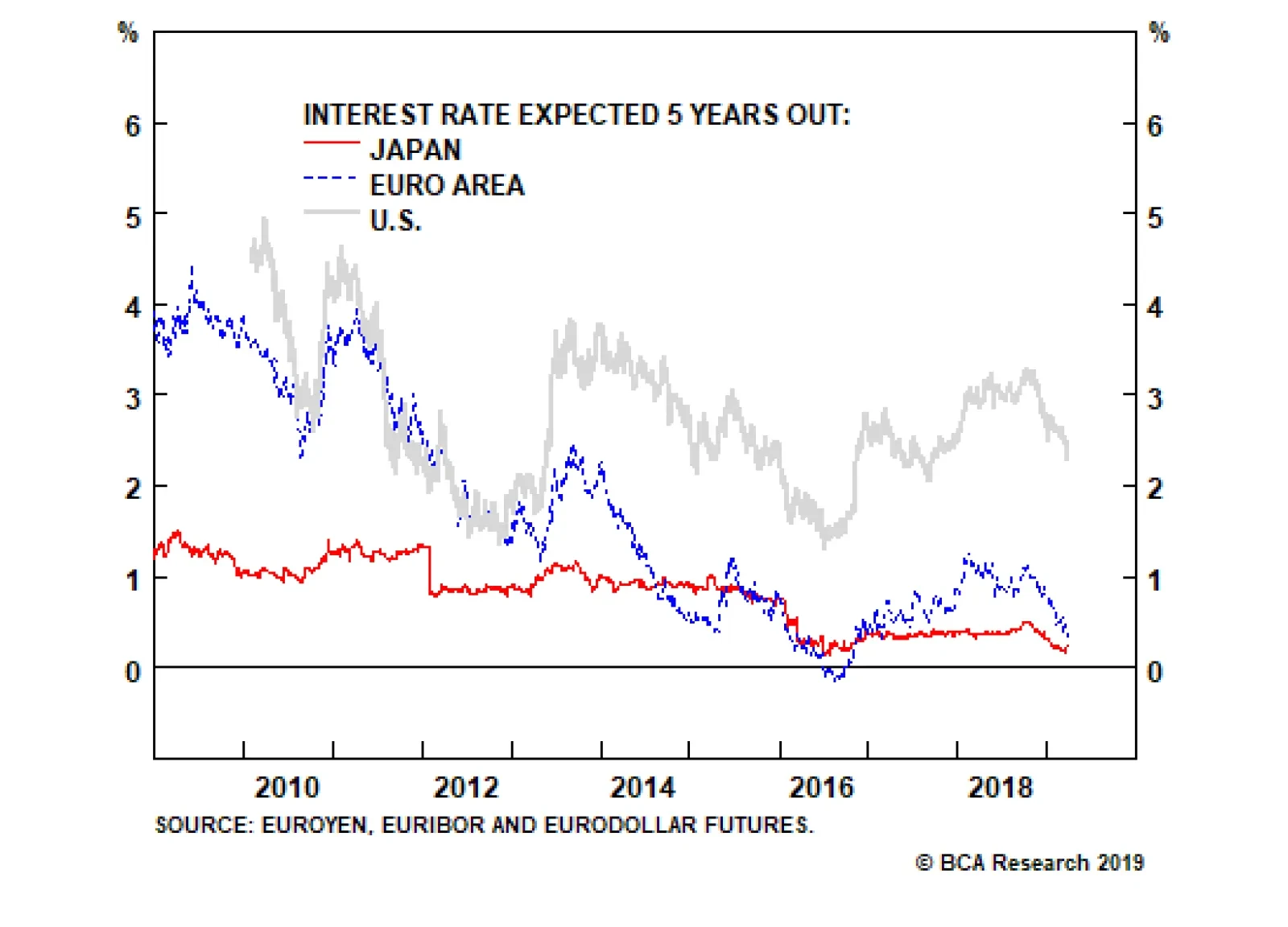

The twenty year life of the euro captures multiple manias and crises, some centered in Europe, some in the U.S. Through these twenty years, the euro area versus U.S. long bond yield spread has averaged -50 bps. Over this same…

Highlights Investors should use the following dynamic for tactical asset allocation: 1. Sum the 10-year yields on the T-bond, German bund, and JGB. 2. When the sum is near 4 percent, it is prudent to de-risk portfolios and sit aside,…

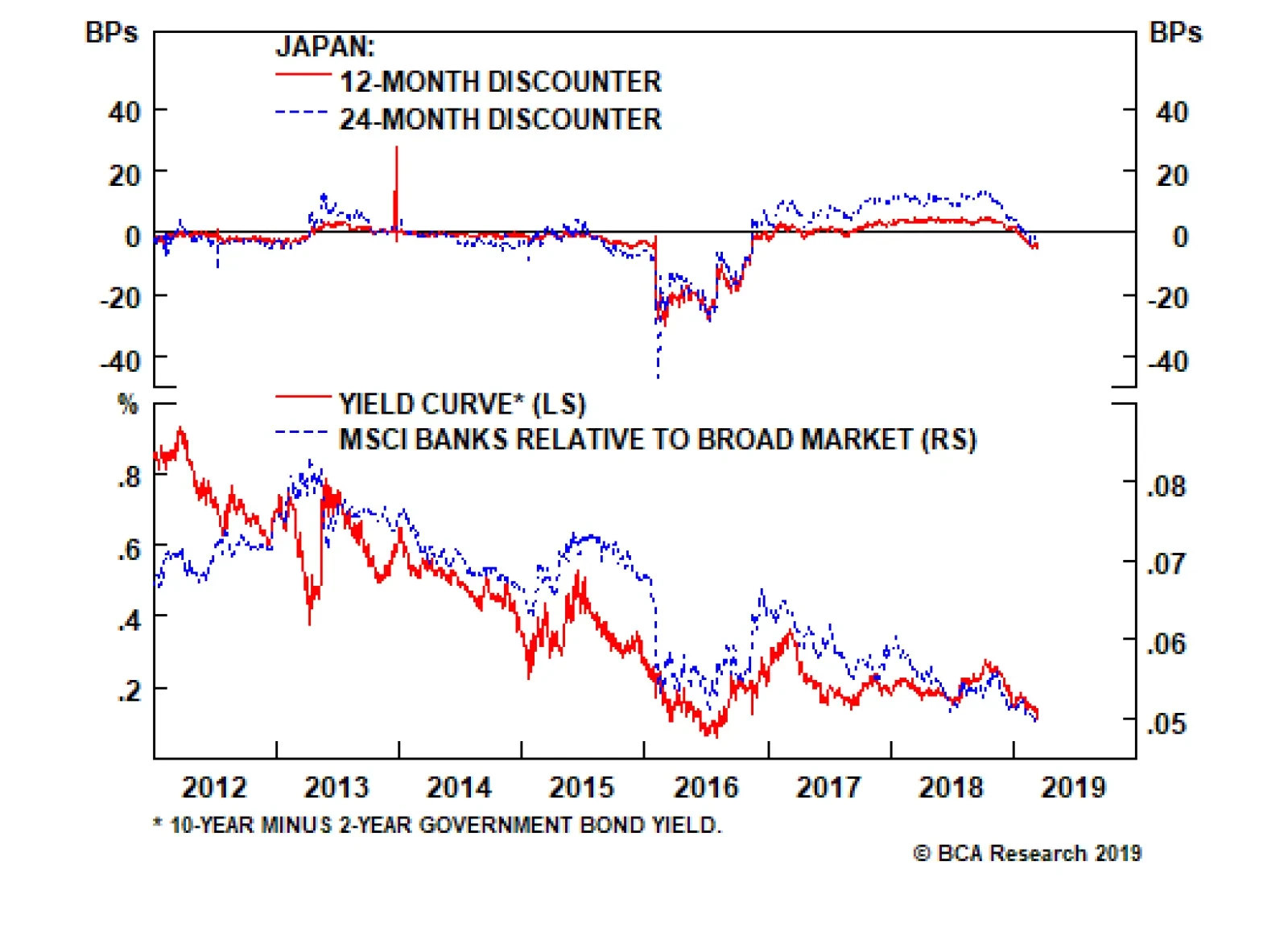

The Bank of Japan (BoJ) sounded dovish in its latest policy meeting, in a move that has been echoed by global central banks. For the BoJ, the starting point is that the consumption tax hike, scheduled for October this year, could…

Highlights Every diversified currency portfolio should hold the yen as insurance against rising market volatility. However, for tactical investors, the latest dovish shift by global central banks almost guarantees the Bank of Japan…

Highlights Global growth is still slowing. Having rallied since the start of the year, global stocks will likely enter a “dead zone” over the next six-to-eight weeks as investors nervously await the proverbial green shoots…