Europe has a more dire demographic profile than the U.S. It needs to purge capital stock and invigorate its economy through reforms, a smaller public sector, and more diversified financing channels. But can the euro area fare…

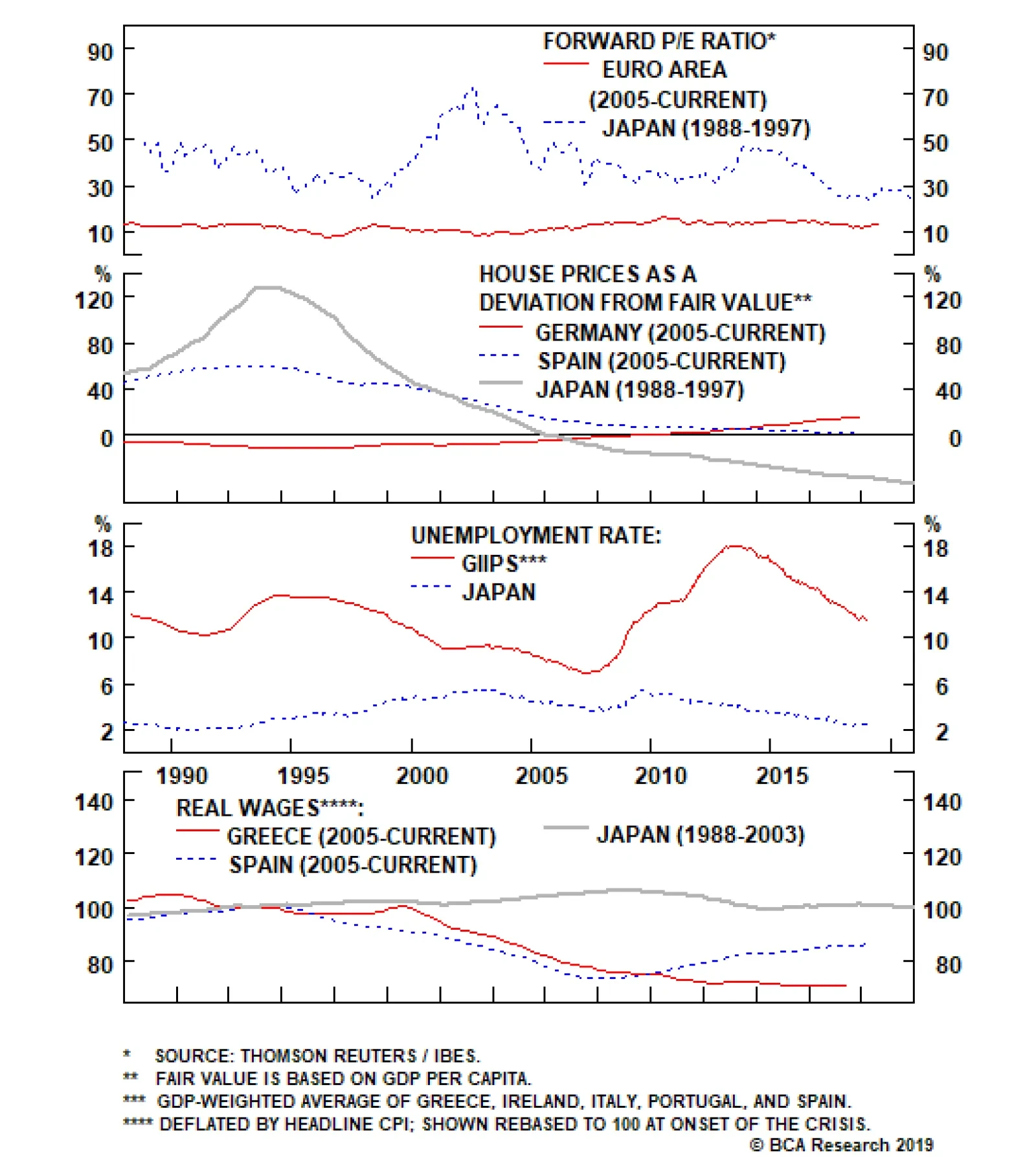

First, up until the last decade, Japan benefited from a robust global economy where trade grew strongly. Europe is entering its second decade of low growth in an environment of much weaker global economic activity. Second,…

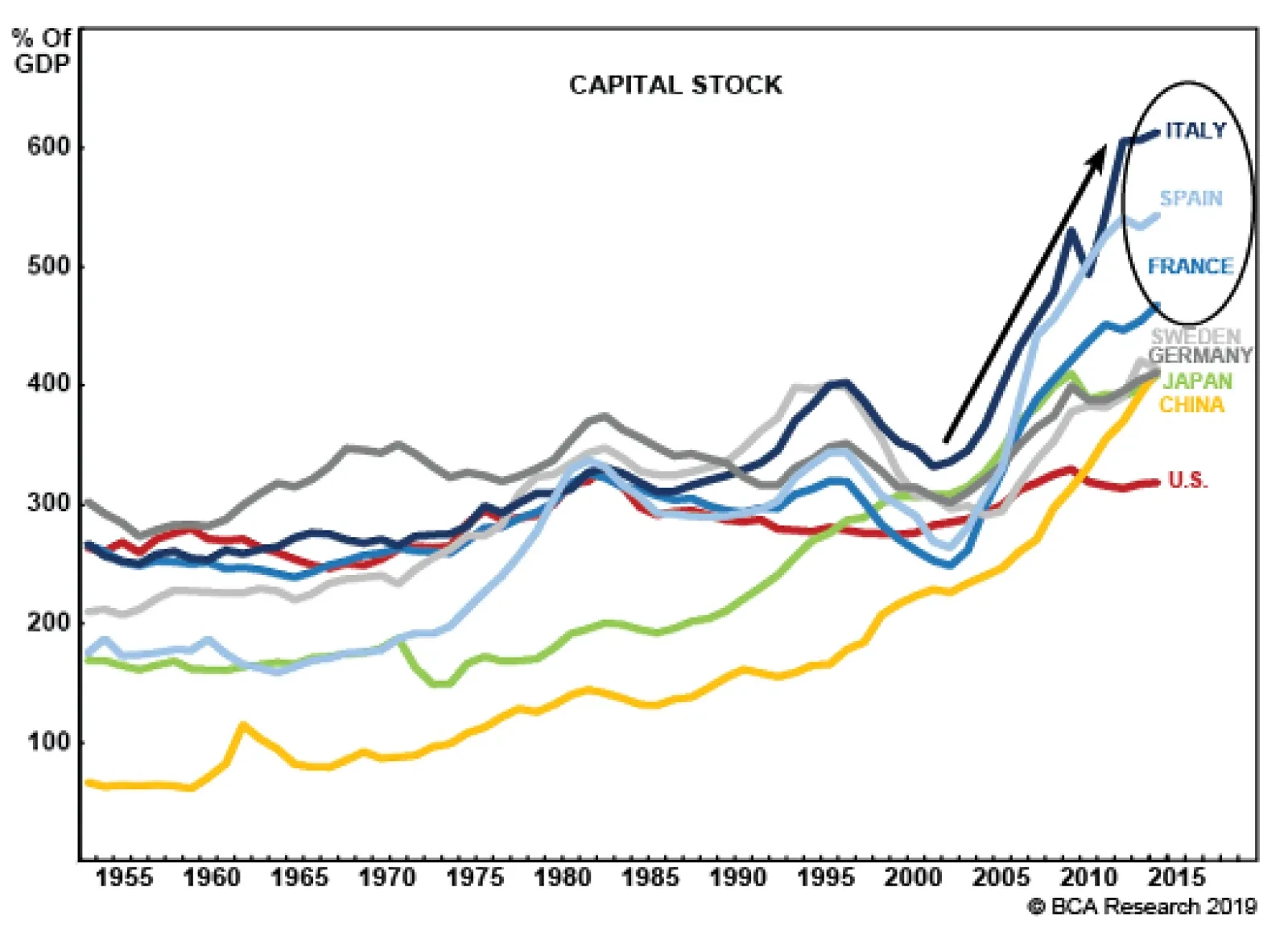

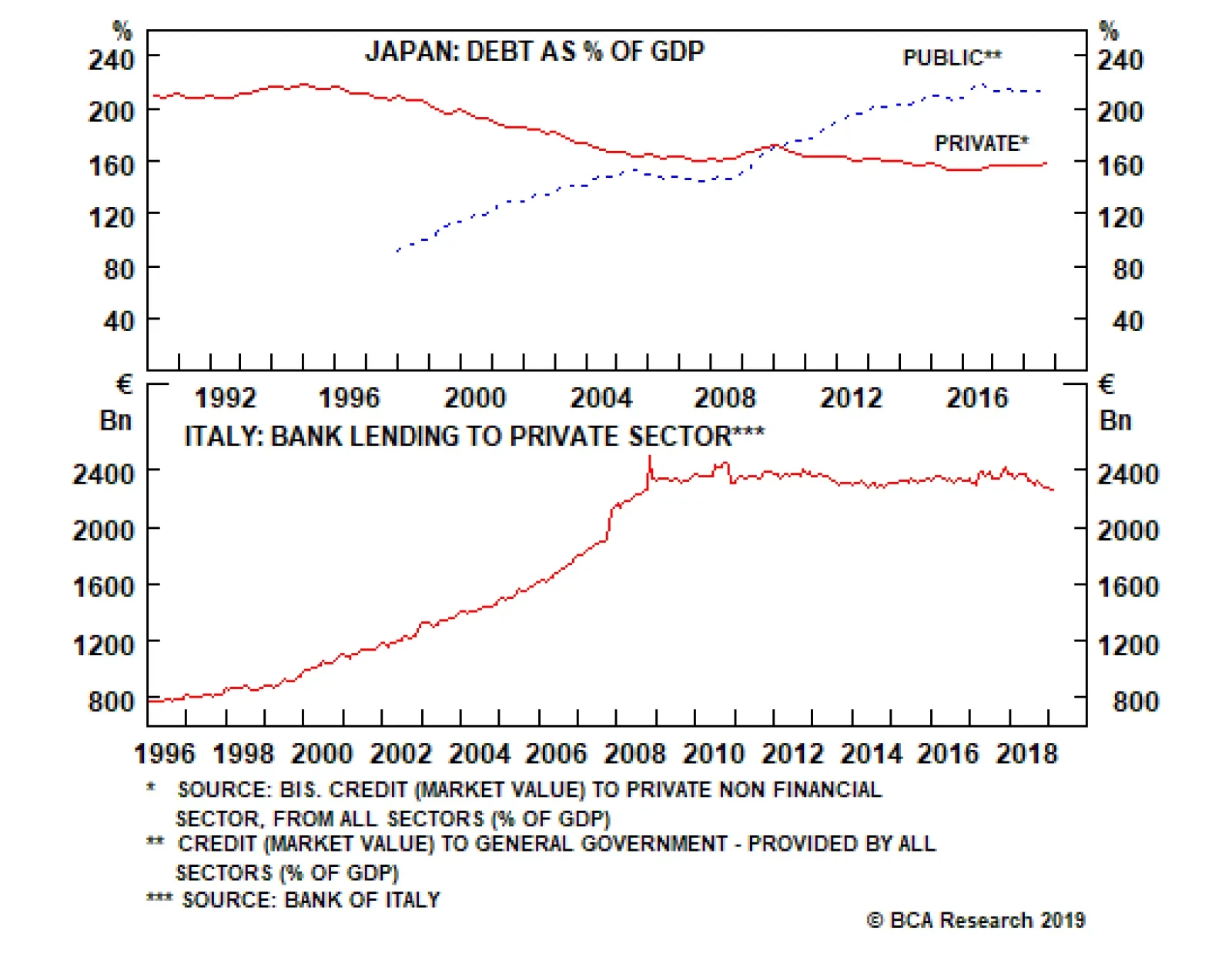

Like Japanese businesses 30 years ago, European firms have large debt loads. Another problem is the lack of capex opportunities in Europe. Why does our Bank Credit Analyst service make this assertion? The return on assets in…

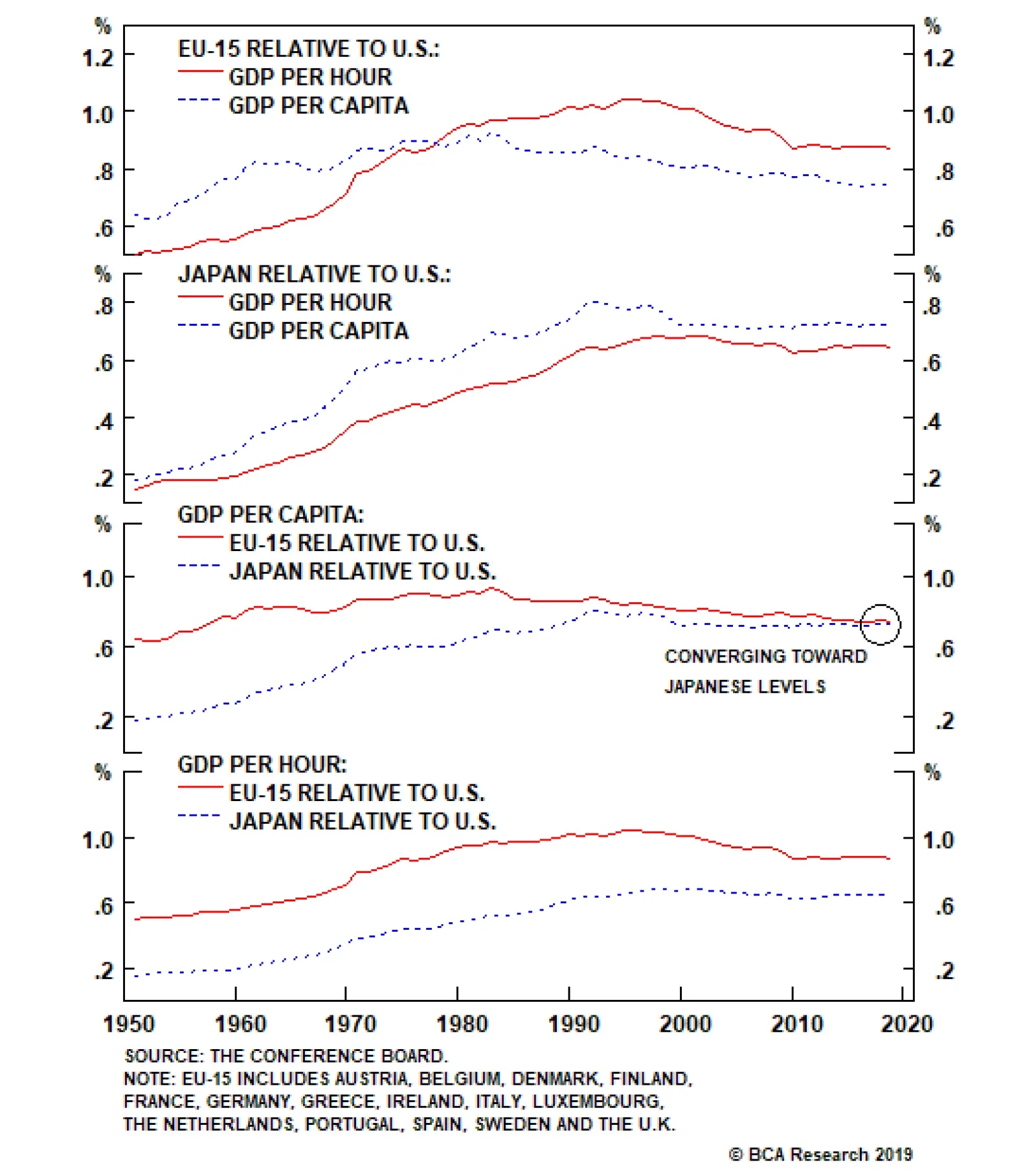

The second factor weighing on European asset utilization and returns is the poorer level of labor productivity. From the 1950s to the early 1980s, European GDP per worker rose relative to the U.S., albeit peaking at 92% of the…

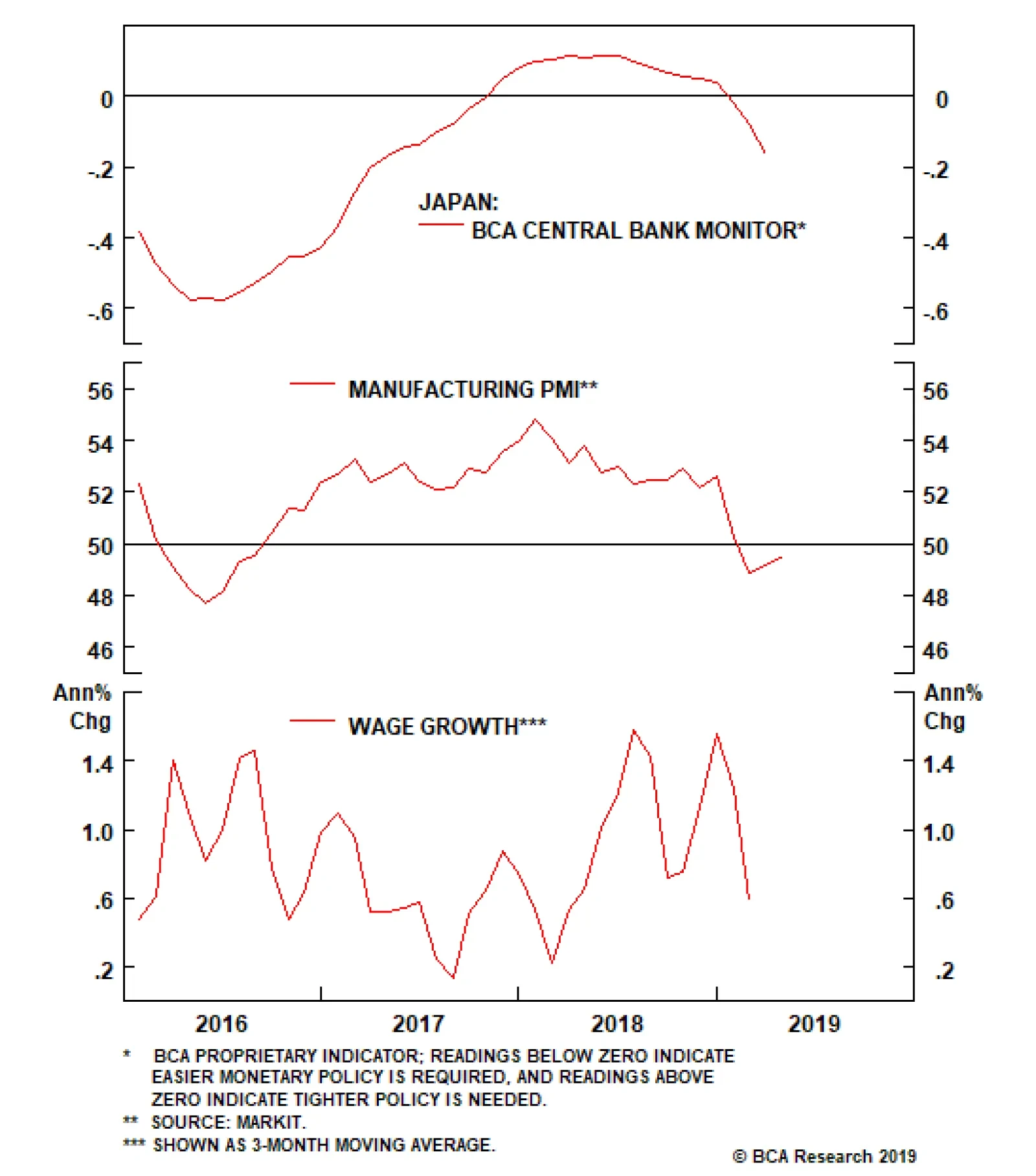

The central bank tweaked some of its lending facilities to further loosen financial conditions. It also “clarified” its forward guidance by promising to keep both short- and long-term interest rates extremely low…

Highlights The recent dovish shift in tone from central banks around the world is here to stay this year, providing support for global growth. As a result, stock prices will benefit from a combination of easy policy and rebounding…

Highlights Solid credit growth numbers from China last week suggest an emerging window for pro-cylical currency trades. However, since 2009, these currency pairs have tended to work in real time rather than with a lag. Continued muted…

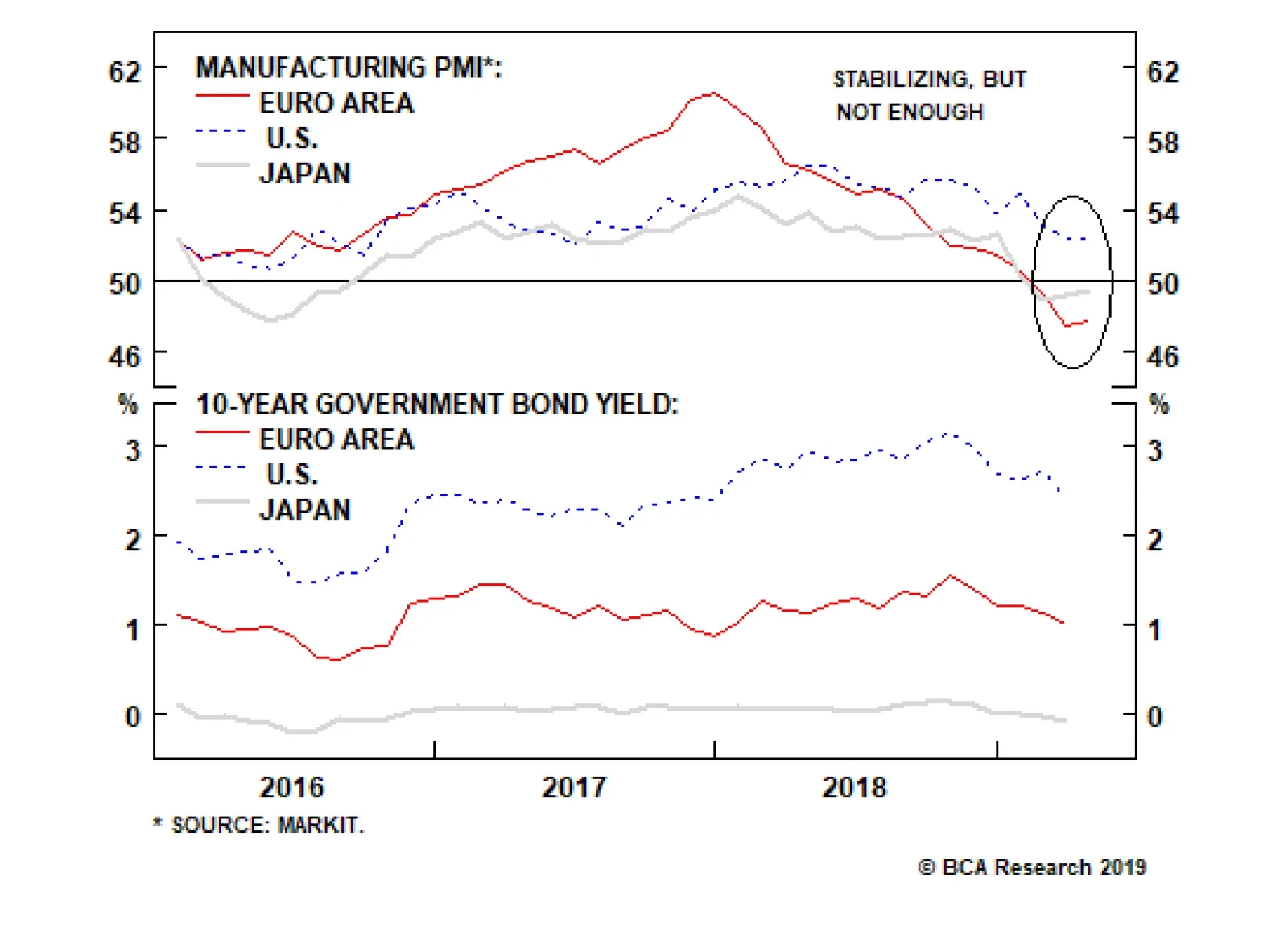

The flash estimates for the Eurozone manufacturing PMI moved up in April to 47.8 from 47.5. In Japan, they rose to 49.5 from 49.2. In the U.S, they were stable at 52.4. Despite this stabilization, bond yields weakened and the…

Welcome to Italy! After the 2008 global financial crisis, Italian banks’ balance sheets were left unrepaired and undercapitalized. For an individual bank whose solvency is impaired, the right thing to do is shrink its…