Highlights The failure of the dollar to break out amid one of the most bullish fundamental catalysts in months suggests that many opposing tectonic forces are at play. Our bias is that short-term and longer-term investors are caught…

Highlights So What? Tariffs and currency depreciation will likely lead to military saber-rattling in Asia Pacific. Why? President Trump is not immune to the market’s reaction to his trade war escalation. Yet China’s…

Highlights So What? Key geopolitical risks remain unresolved and most of the improvements are transitory. Maintain a cautious tactical stance toward risk assets. Why? U.S.-China relations remain the preeminent geopolitical risk to…

Highlights Central banks globally have turned dovish, with the Fed virtually promising to cut rates in July. But this will be an “insurance” cut, like 1995 and 1998, not the beginning of a pre-recessionary easing cycle.…

Highlights So What? Economic stimulus will encourage key nations to pursue their self-interest – keeping geopolitical risk high. Why? The U.S. is still experiencing extraordinary strategic tensions with China and Iran…

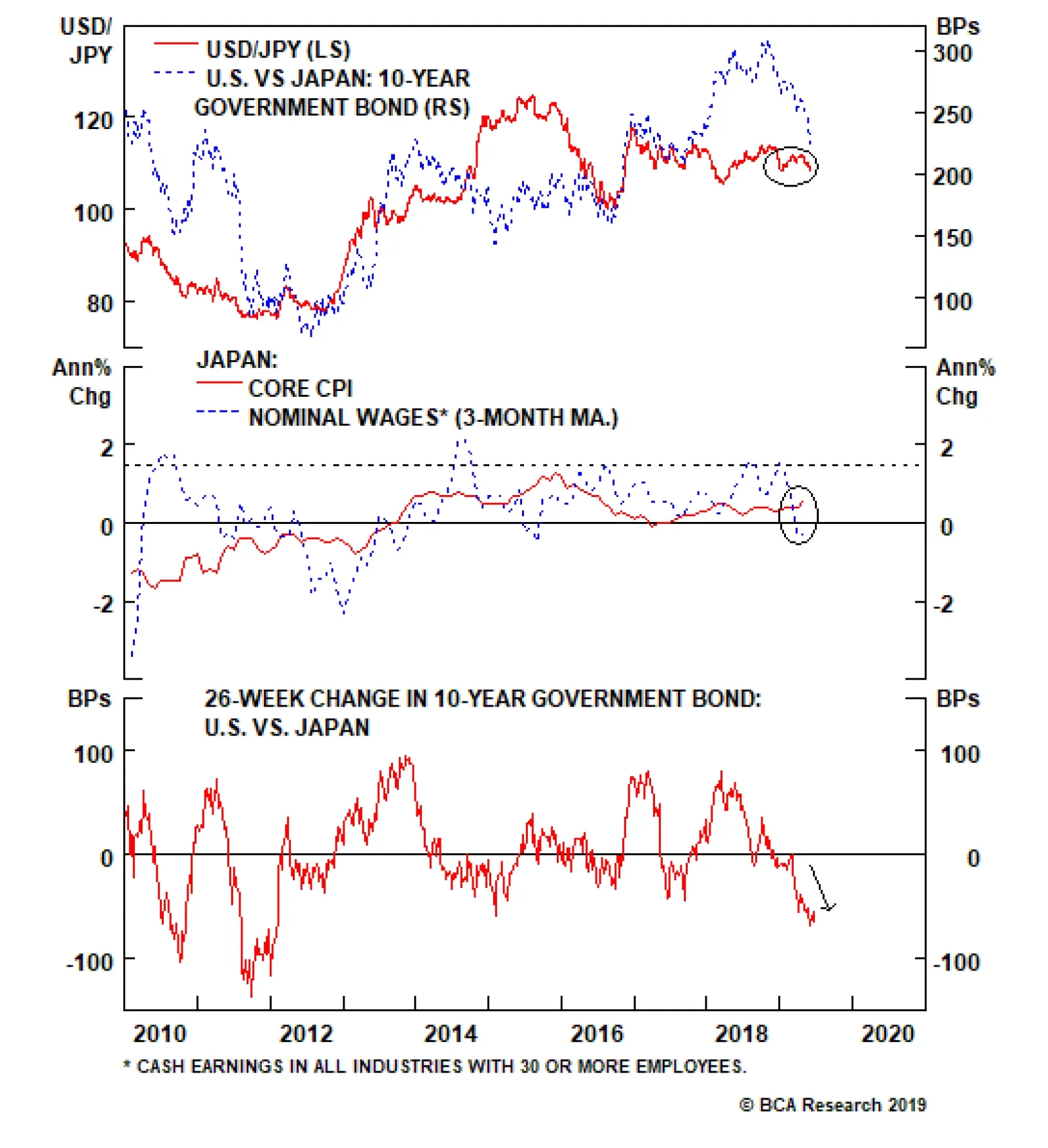

JGBs outperform their developed market peers when global yields rise, and underperform when global yields fall. In other words, JGBs are a low-beta sovereign bond market, making them a useful way to manage duration risk in a…

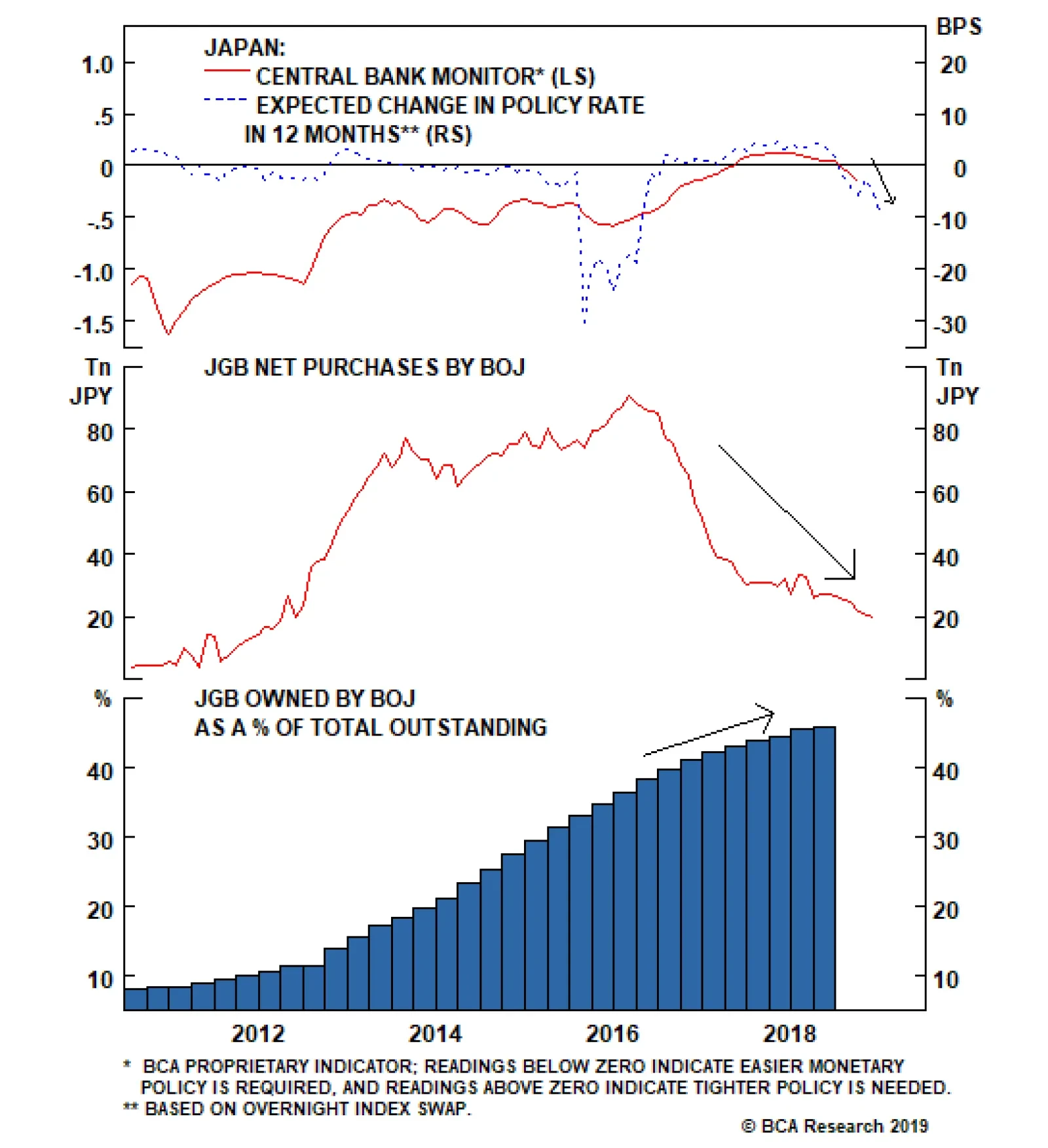

The Yield Curve Control (YCC) strategy is the only real remaining arrow in the BoJ’s quiver. Via YCC, the BoJ targets a 10-year JGB yield close to 0% and manages purchases to sustain the yield target. In our view, any…