Highlights The mood among investors is shifting from the recessionary gloom of this past summer. Equities worldwide are rallying, buoyed by a combination of dovish monetary policies, tentative signs of bottoming global growth and…

Highlights An expansion in the Federal Reserve’s balance sheet will increase dollar liquidity. This should be negative for the greenback, barring a recession over the next six to 12 months. Interest rate differentials have…

Highlights Equities & Bonds: The accelerating upward momentum of global equities – the ultimate “leading economic indicator” – suggests that the current rise in global bond yields can continue. Maintain…

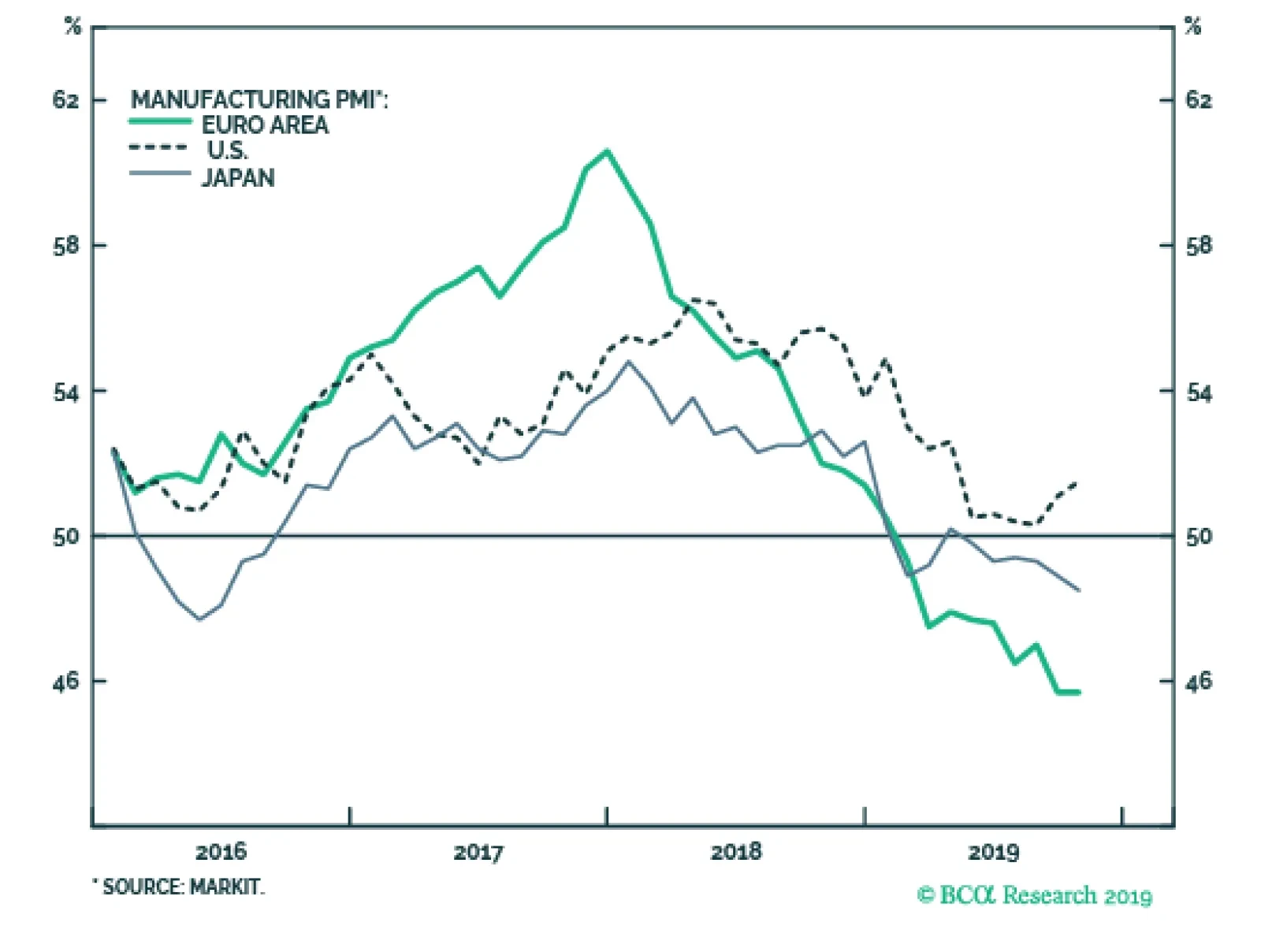

The October flash PMIs released this morning show a very modest stabilization. The Eurozone manufacturing gauge was stable at 45.7, as was Germany’s which increased slightly from 41.7 to 41.9. France’s manufacturing…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating a growing need to ease global monetary policy (Chart of the Week).…

Highlights Q3/2019 Performance Breakdown: Our recommended model bond portfolio underperformed the custom benchmark by -30bps during the third quarter of the year. Winners & Losers: The biggest underperformance came from…

Highlights MARKET FORECASTS Investment Strategy: Markets have entered a “show me” phase. Better economic data and meaningful progress on the trade negotiations will be necessary for stocks to move sustainably…

Highlights The global manufacturing cycle is likely to bottom soon, and consumption and services remain robust. The risk of recession over the next 12 months is low. This suggests that equities will continue to outperform bonds. But…

Highlights The world remains mired in a manufacturing recession. As such, it is still too early to put on fresh pro-cyclical trades. Focus on the crosses rather than outright U.S. dollar bets. Two new trade ideas: sell EUR/NOK and…