Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating the need for continued easy global monetary policy to help mitigate the…

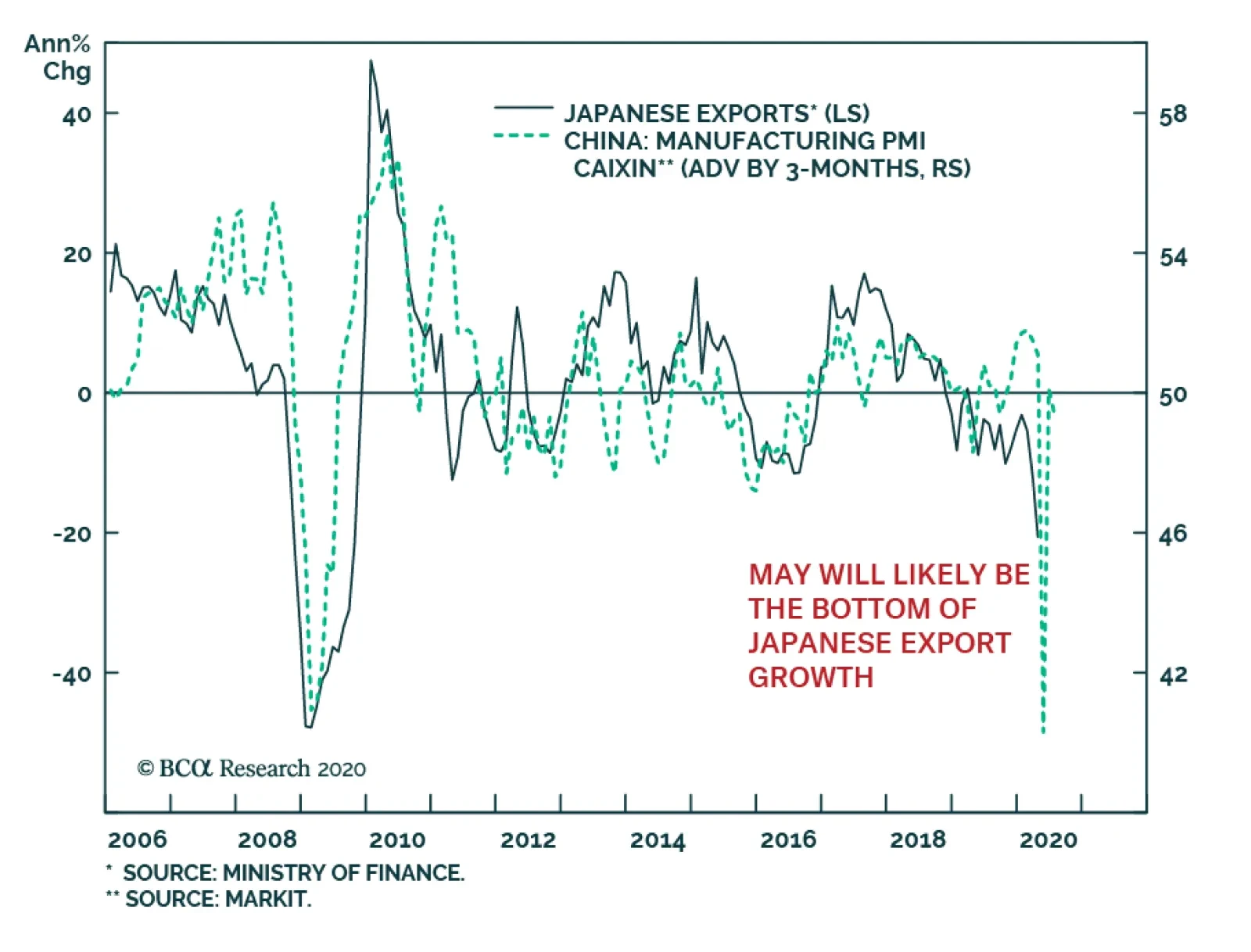

In April, Japanese exports contracted nearly 22% year-on-year. This was the poorest reading since the Great Financial Crisis, and it was also worse than the August 1986 number that followed a 71% appreciation in the yen. Clearly…

Highlights German bunds and Swiss bonds are no longer haven assets. The haven assets are the Swiss franc, Japanese yen, and US T-bonds. Gold is less effective as a haven asset. During this year’s coronavirus crash, the gold…

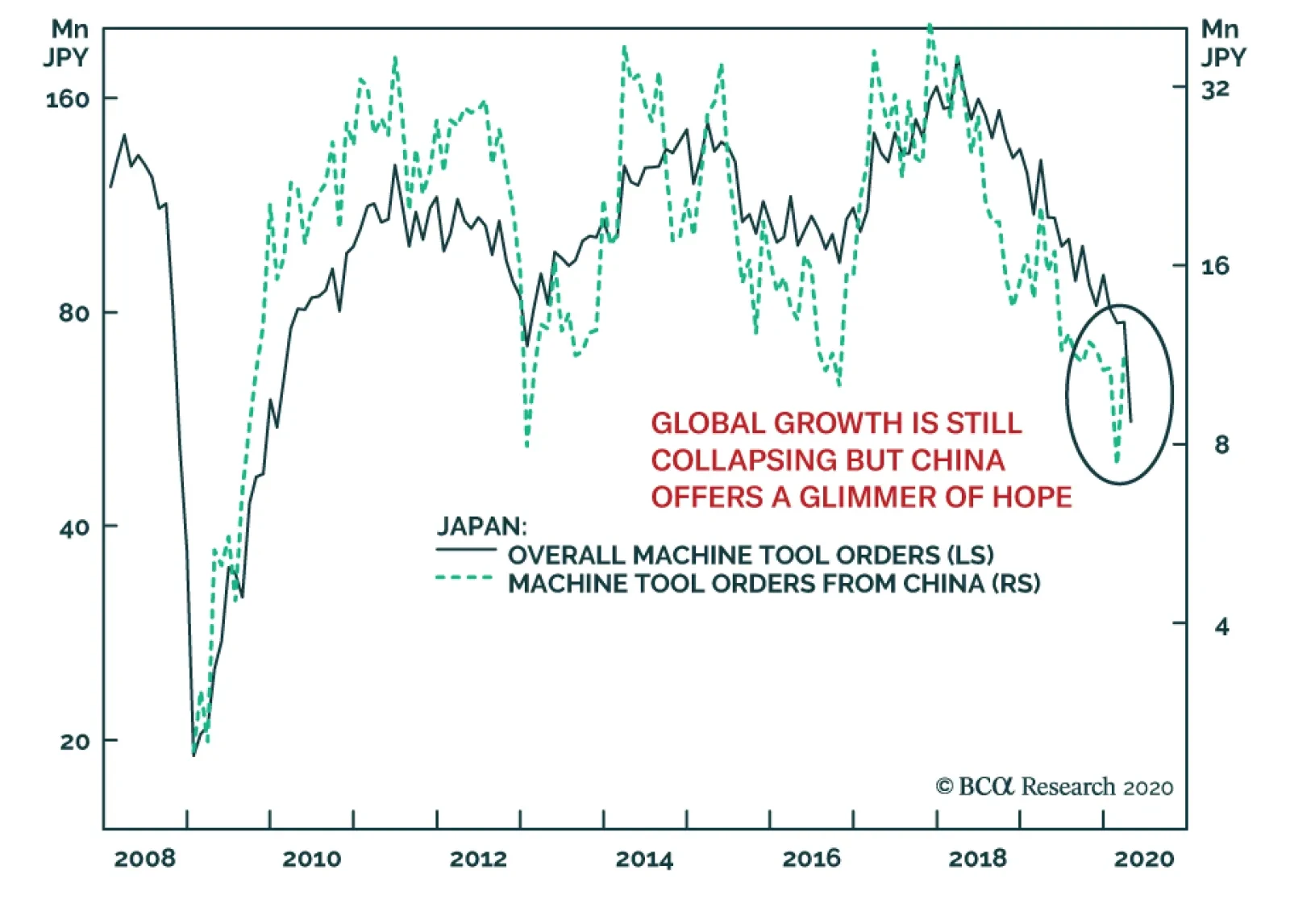

Japanese machine tool orders are an excellent gauge of the state of the global manufacturing and trade cycle. Unsurprisingly, they continue to contract at an accelerating pace, hitting -48% year-on-year in April. Despite this…

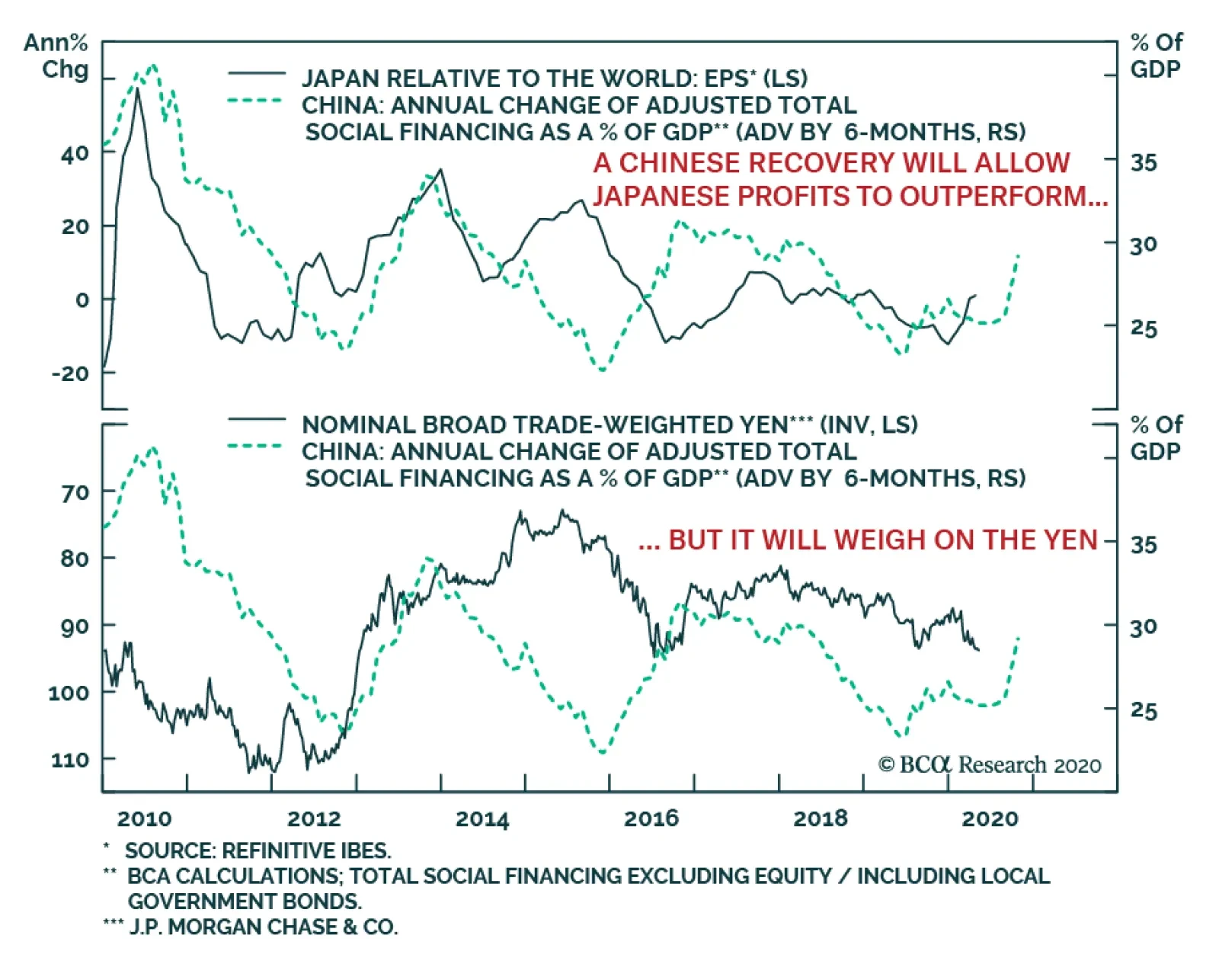

We previously highlighted that based on valuations alone, Japanese stocks were attractive for long-term portfolio allocators, but that the timing was not appropriate for investors with a 1-year investment horizon. Today,…

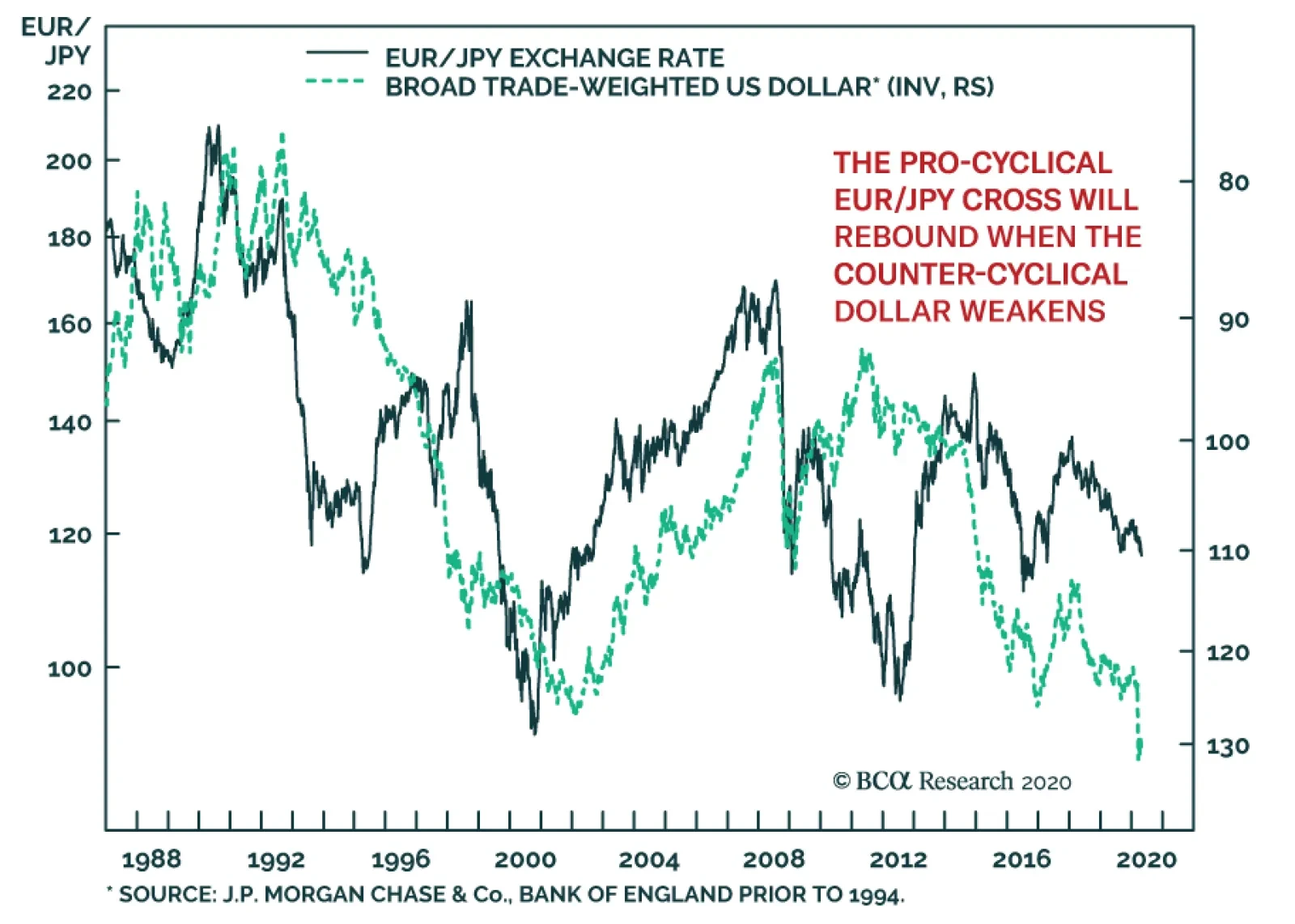

The EUR/JPY cross’s incapacity to break down below 115 when global markets seized up last march caught our attention. Now that the BoJ and the ECB have a similar level of interest rates and that the yield spread between…

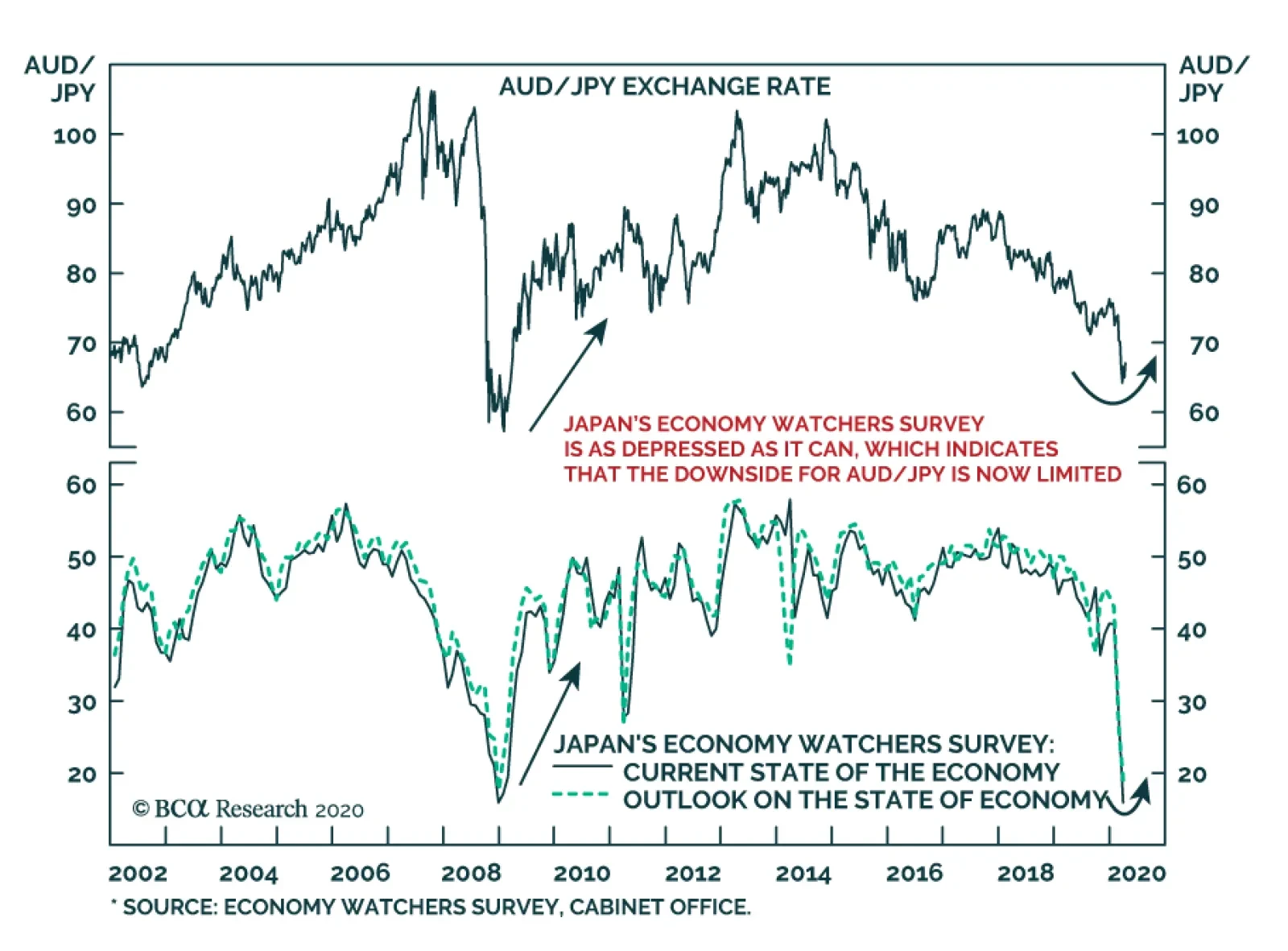

The Japanese economy is in freefall. Yesterday’s release of the Economy Watchers survey confirmed that Japan is likely to suffer a shock comparable to the Great Financial Crisis, as both the Current Conditions and the…

Highlights Recommended Allocation The outlook for markets over the next few months is highly uncertain. On the optimistic side, new COVID-19 cases are probably close to peaking (for now), and so equities could continue to…