Euro area and Chinese interest rates must fall much further to prevent monetary policy from becoming ultra-restrictive. But Trump’s attempts to force unwarranted rate cuts from the Fed risks a vicious backlash from the bond…

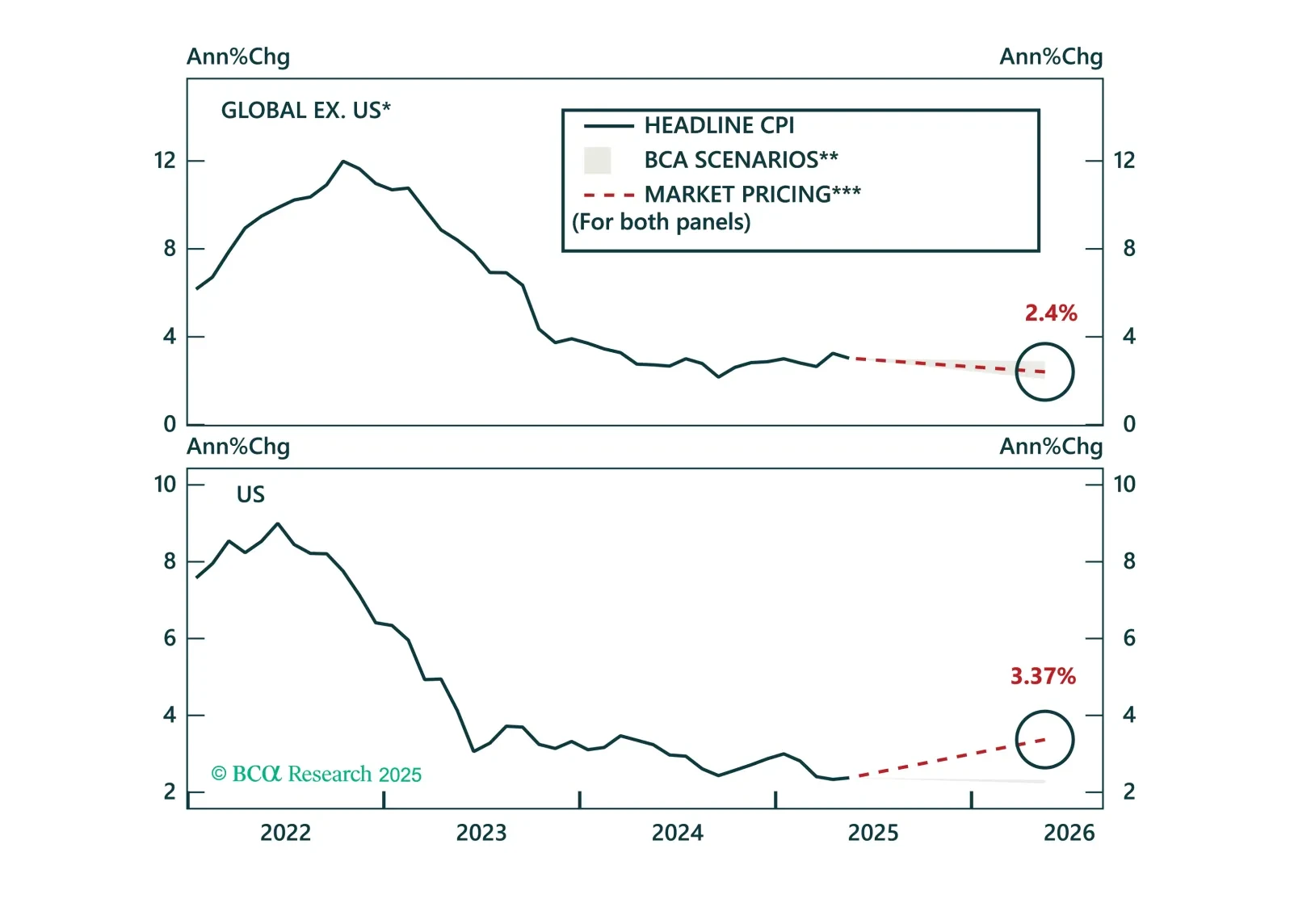

Disinflation continues to unfold globally, and markets are finally catching up. Inflation expectations have broadly realigned with fundamentals, prompting us to shift our global ILB allocation to neutral. While tariff risks are…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

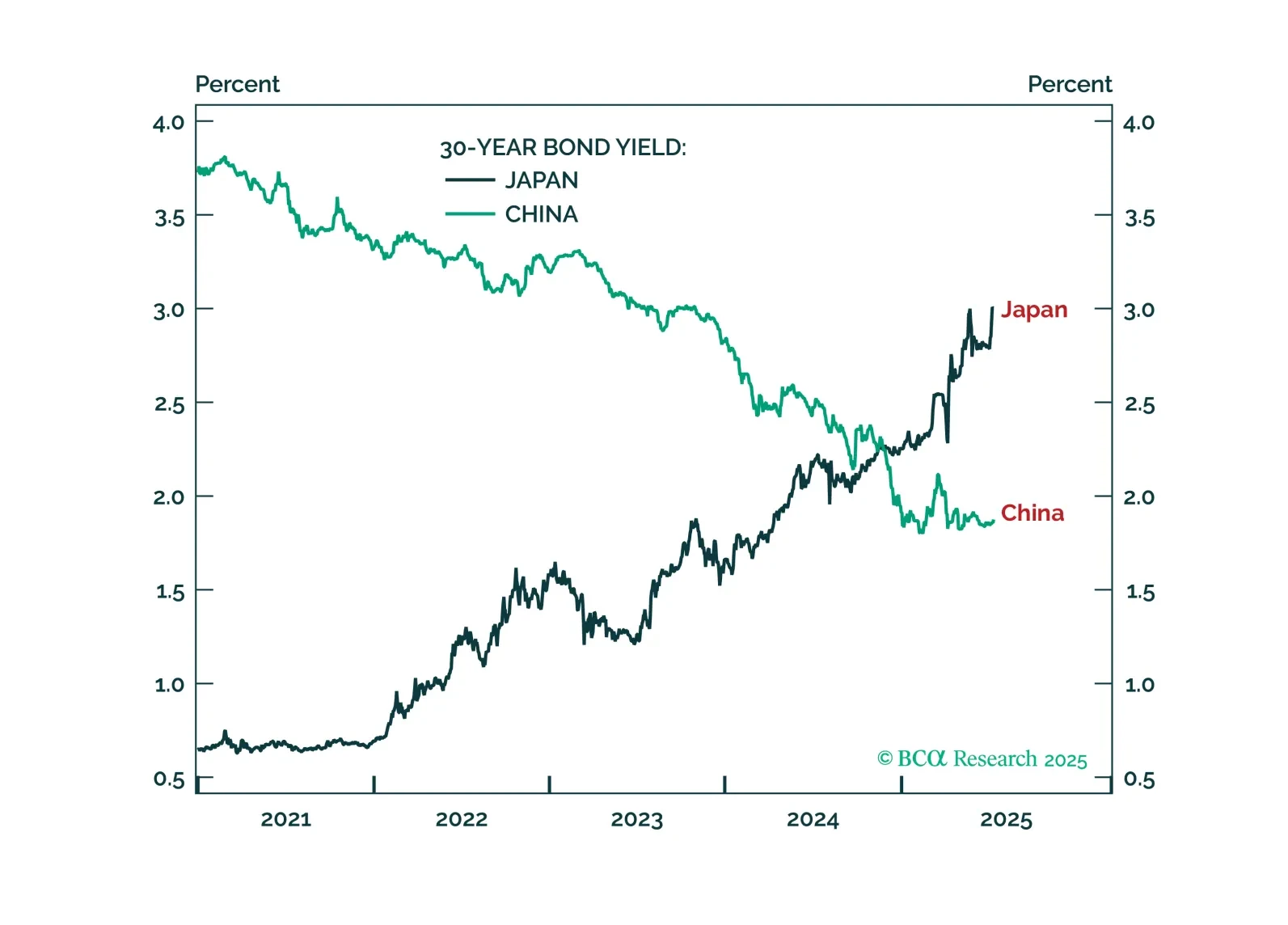

Upward pressure on Japan’s real bond yield justifies overweighting the yen and underweighting overvalued tech. Plus: two new tactical trades are long JPY/EUR and short platinum.

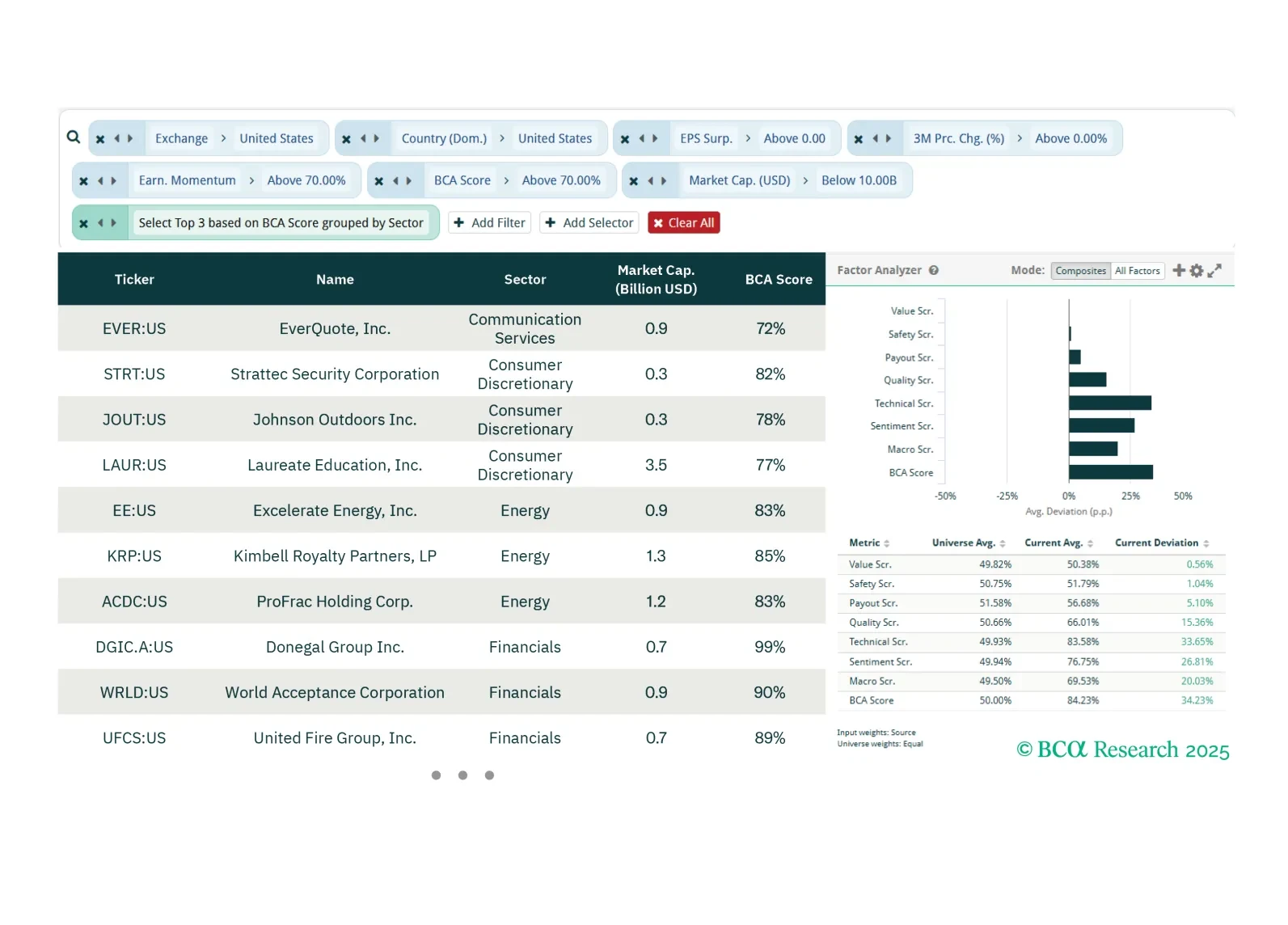

This week our three screeners identify stocks that are likely to keep delivering deliver earnings surprises in the US, European small caps that are high quality and mean reverting, and Japanese large caps picks across GICS 1 sectors…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

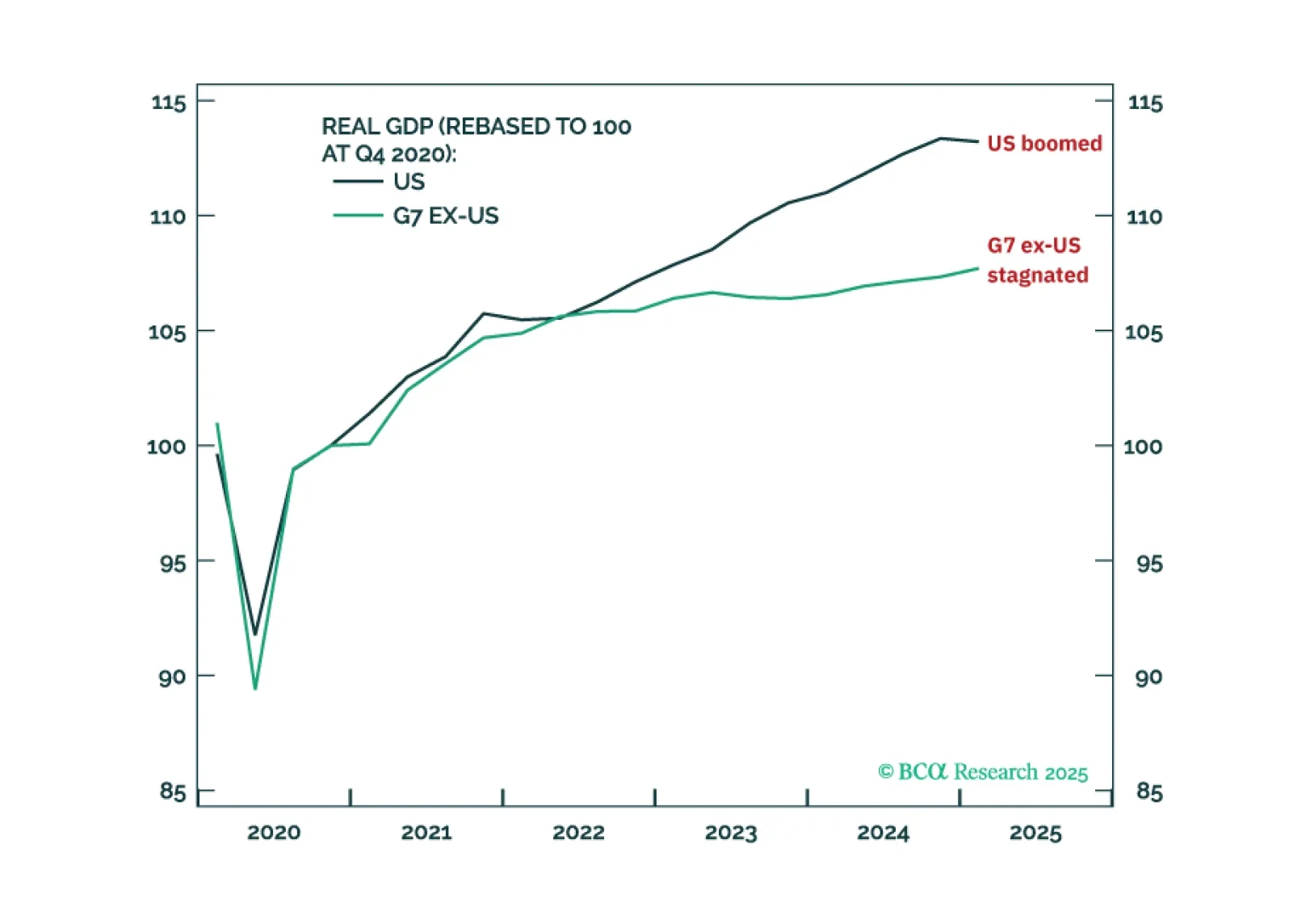

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

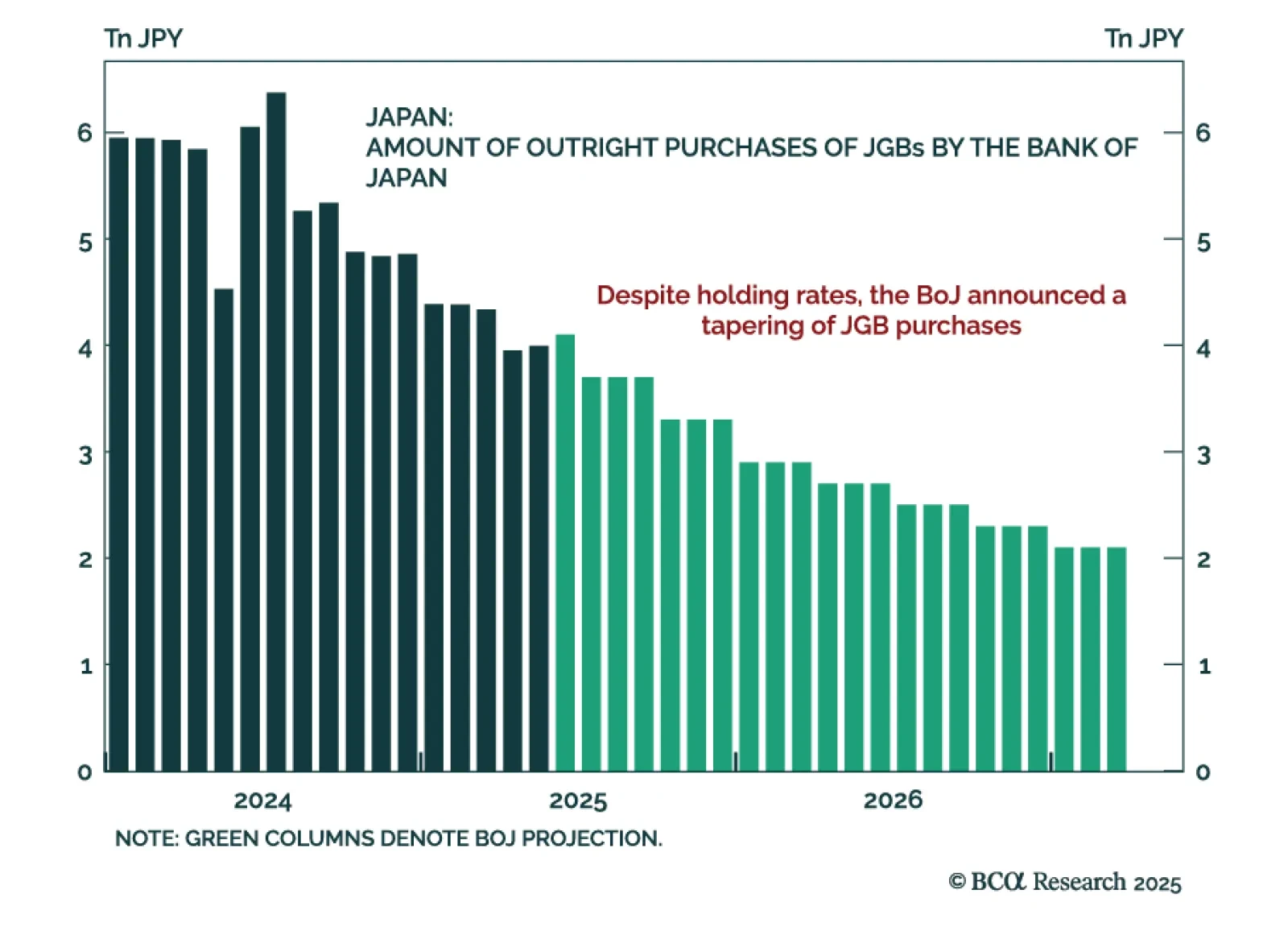

In this note, we reaffirm our underweight position in JGBs and long yen positions given the BoJ’s meeting overnight.

The BoJ’s decision to keep rates unchanged while announcing a tapering of bond purchases reinforces our underweight stance on JGBs and long bias on the yen. While the decision was broadly neutral, the reduction in asset purchases…

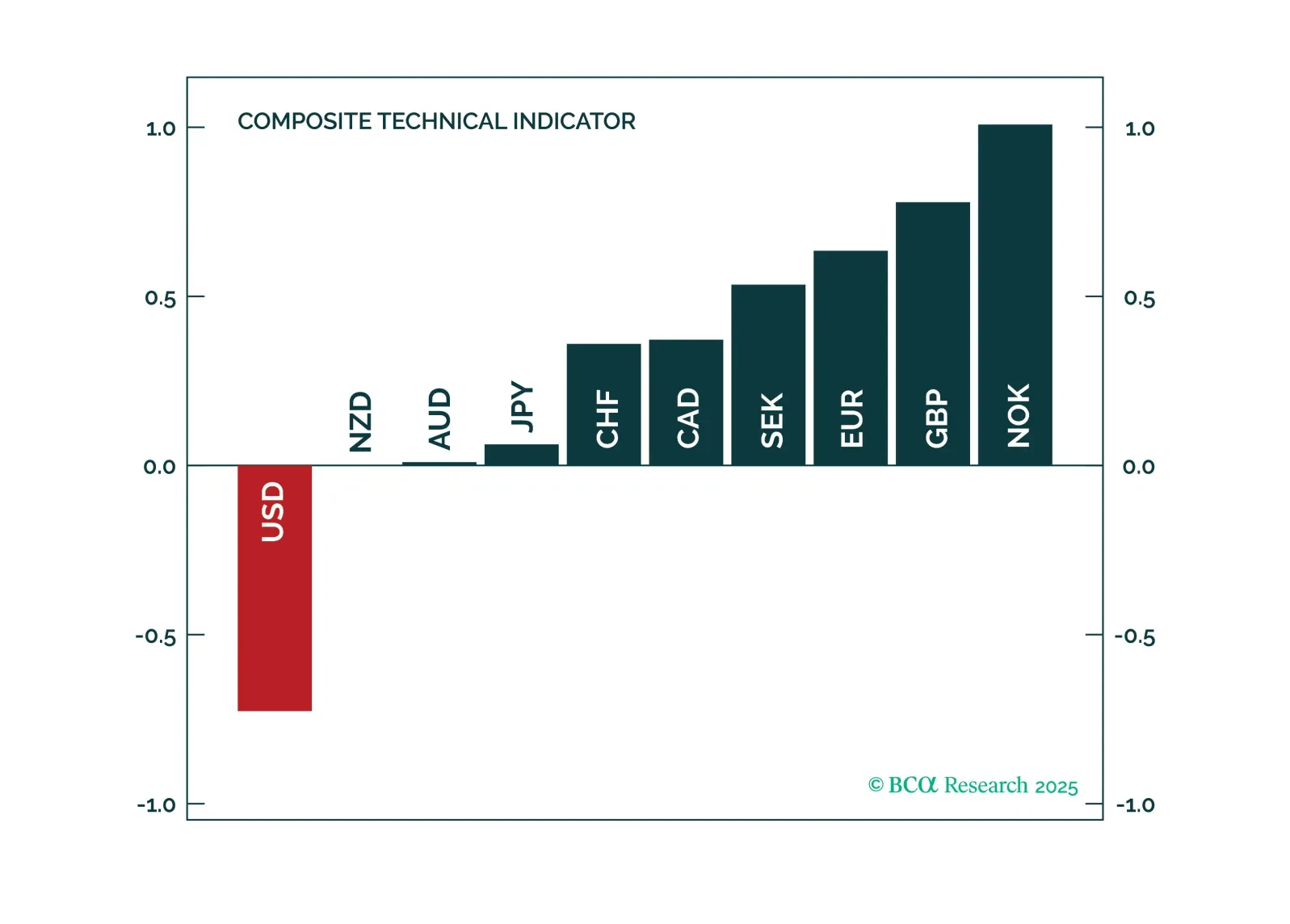

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…