Highlights China's high-profile jawboning draws attention to tightness in metals markets, and raises the odds the State Reserve Board (SRB) will release some of its massive copper and aluminum stockpiles in the near future. Over…

Highlights Global oil markets will remain balanced this year with OPEC 2.0's production-management strategy geared toward maintaining the level of supply just below demand. This will keep inventories on a downward trajectory,…

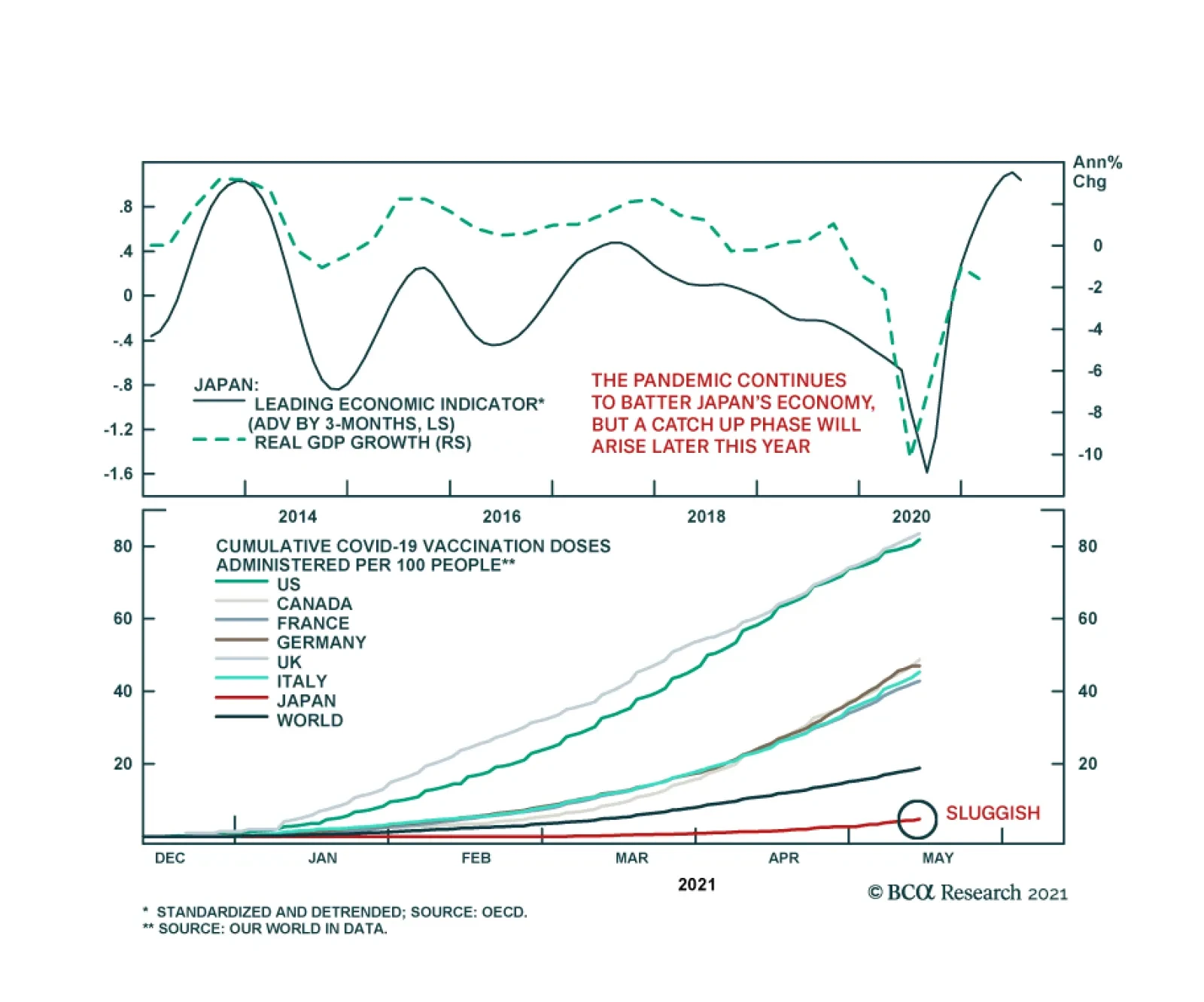

Japan’s economy was exceptionally weak in Q1. GDP shrank an annualized 5.1% q/q following an 11.6% boom in the prior quarter, disappointing expectations of a more muted 4.5% q/q contraction. The economy’s performance…

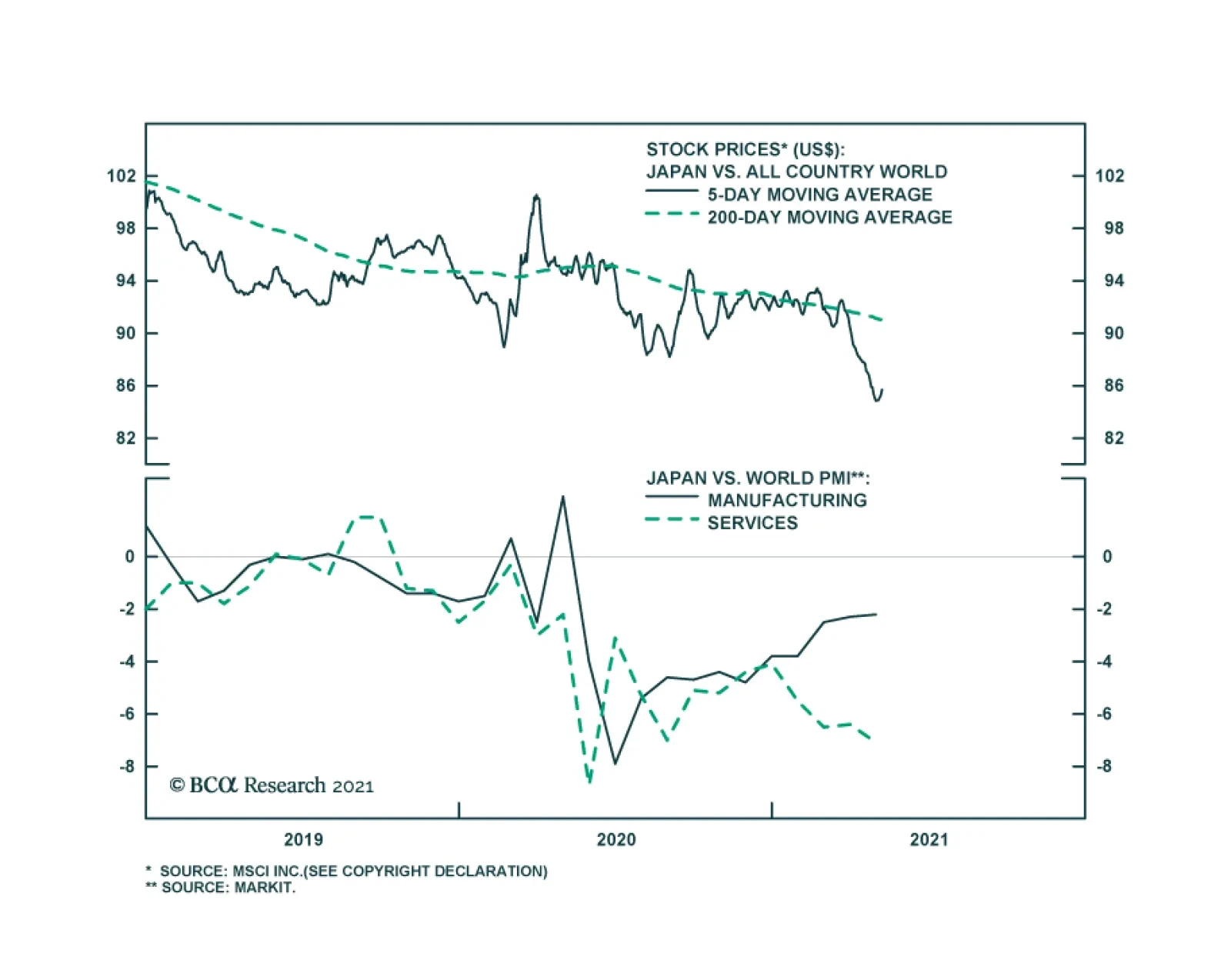

Since the beginning of the calendar year, global stock prices have risen roughly 10% in US$ terms. The Japanese equity market, by contrast, has barely risen, resulting in a whopping 8.5% underperformance. Most of this…

Highlights Global Tapering: The Bank of England has joined the Bank of Canada as central banks tapering the pace of bond buying. Markets are now trying to sort out who is next and concluding that it will not be the Federal Reserve,…

Highlights Rising CO2 emissions on the back of stronger global energy growth this year will keep energy markets focused on expanding ESG risks in the buildout of renewable generation via metals mining (Chart of the Week). …

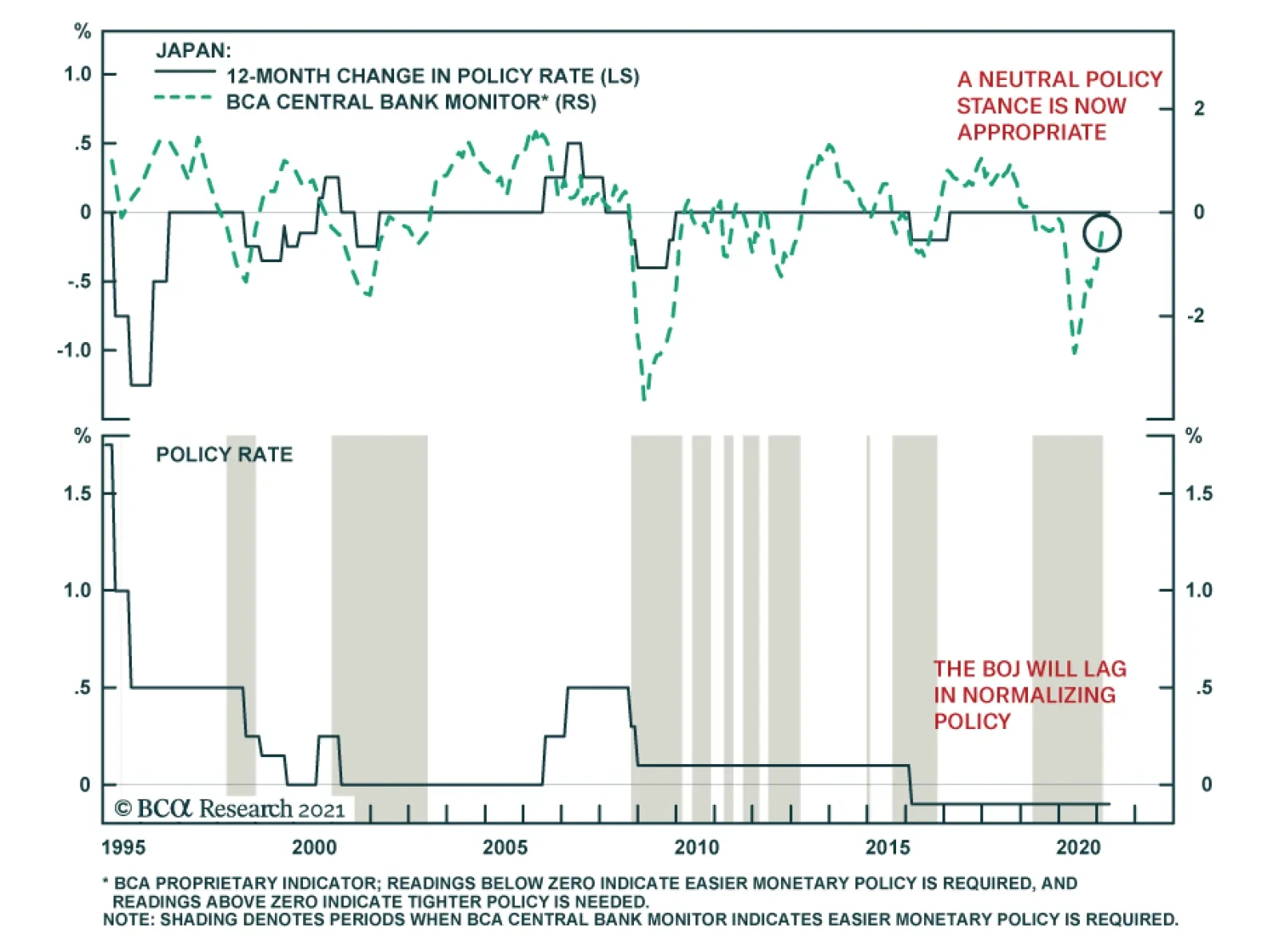

As expected, the Bank of Japan did not change monetary policy on Tuesday. It maintained the policy rate at -0.1% and kept the current pace of asset purchases. However, the central bank upgraded the economic growth outlook by 0.…

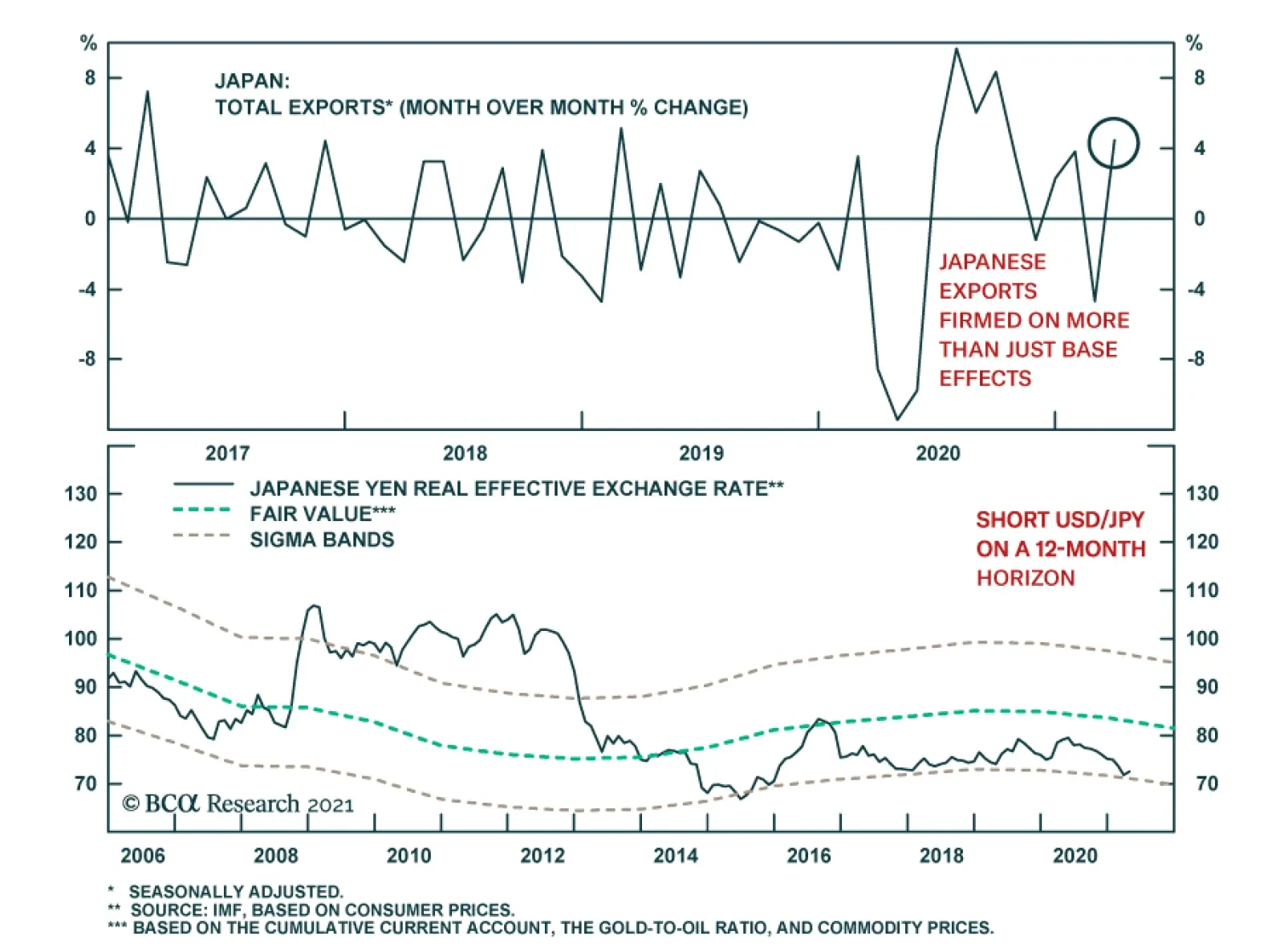

Japan’s trade balance surprised to the upside in March and revealed better-than-expected domestic and global fundamentals. Exports jumped 16.1% y/y following a 4.5% y/y decline in February, beating the anticipated 11.4%.…

Highlights Global Inflation: The case for maintaining a strategic overall allocation to inflation-linked bonds (ILBs) versus nominal government debt in dedicated global fixed income portfolios remains intact. Global growth expectations…