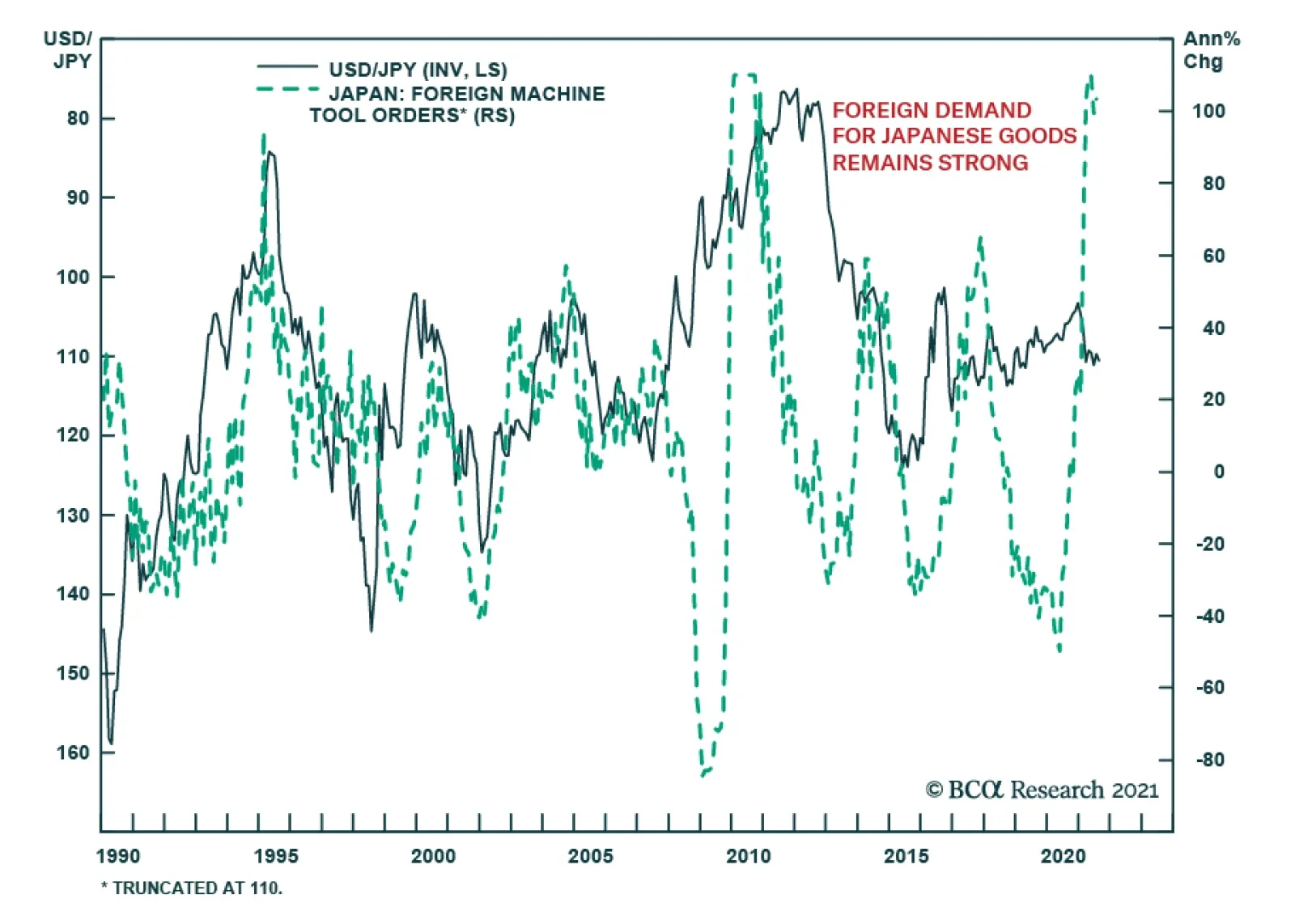

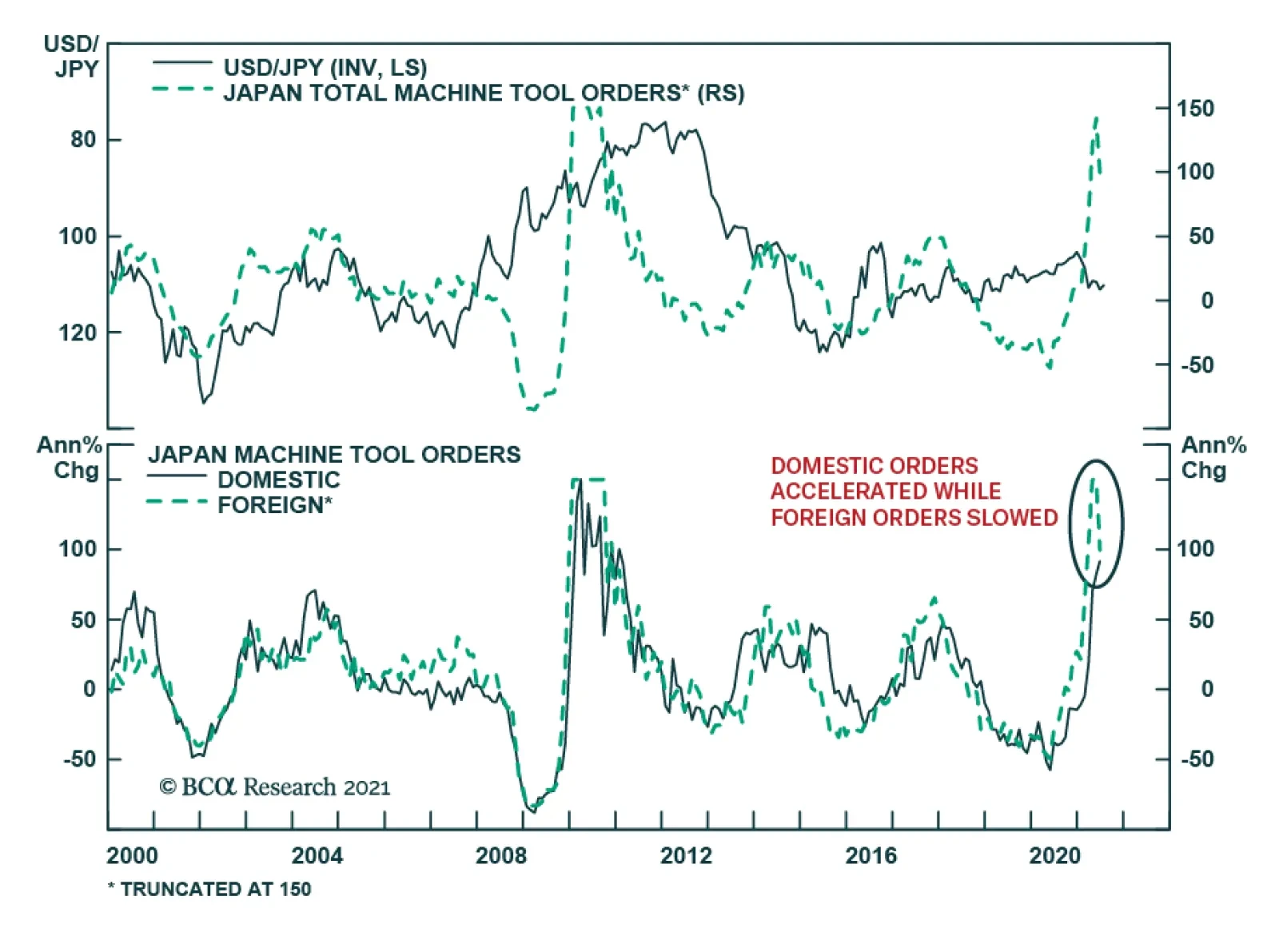

Japanese machine tool orders decelerated slightly to 93.4% y/y in July from June’s 96.6% y/y. Notably, foreign machine tool orders accelerated to 103.4% y/y from 99.5% y/y. Given that machine tool orders are one of the most…

Highlights China’s July Politburo meeting signaled that policy is unlikely to be overtightened. The Biden administration is likely to pass a bipartisan infrastructure deal – as well as a large spending bill by Christmas.…

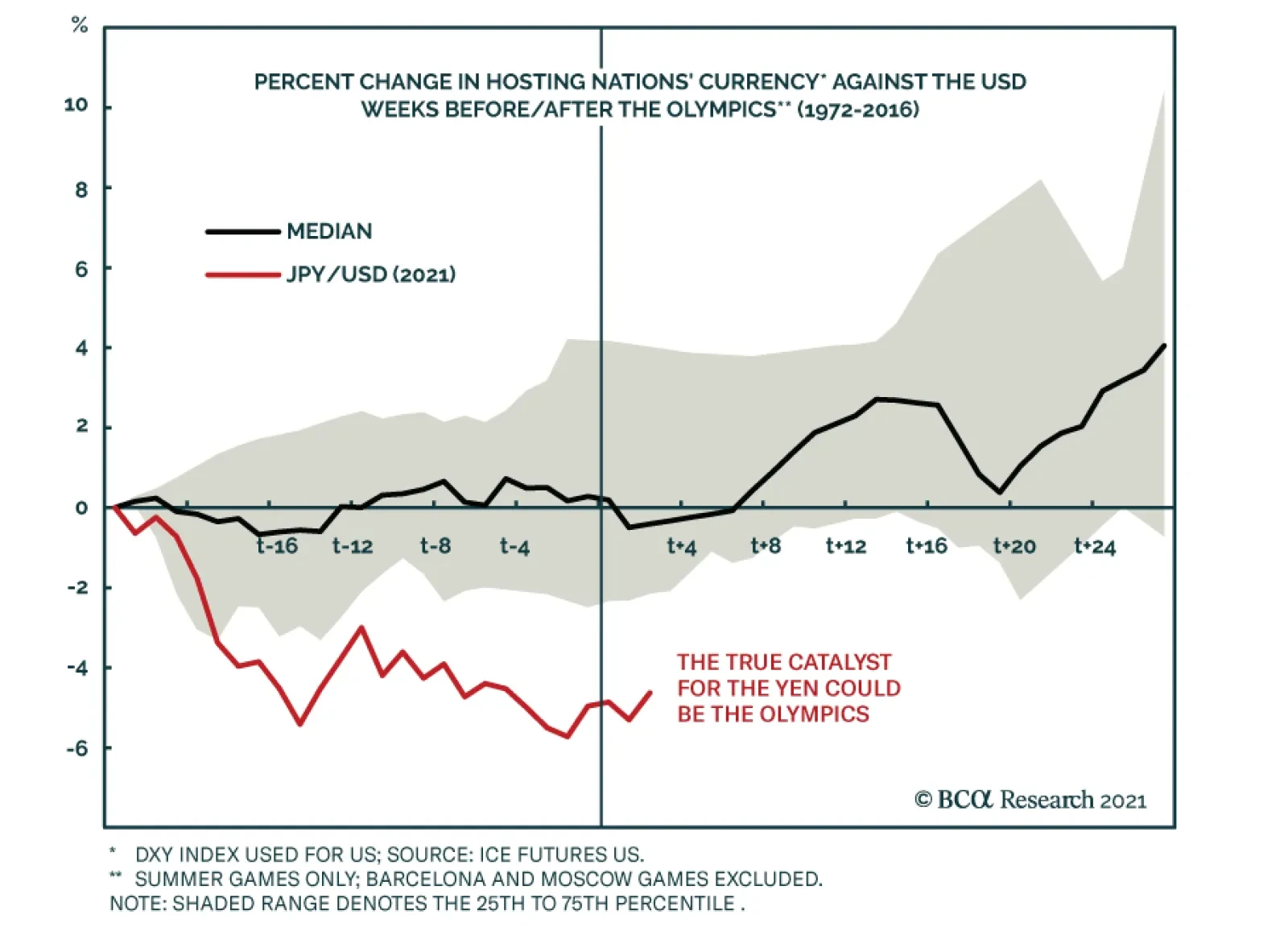

Since the 1970s, the median performance of a currency hosting the Olympics is 4% over a year. This year’s games have obviously been unique given the pandemic. However, the performance of the yen today already falls well…

Highlights The dollar is fighting a tug of war between two diverging forces: an economic slowdown around the world but plunging real interest rates in the US. The litmus test for determining which force will gain the upper hand is if…

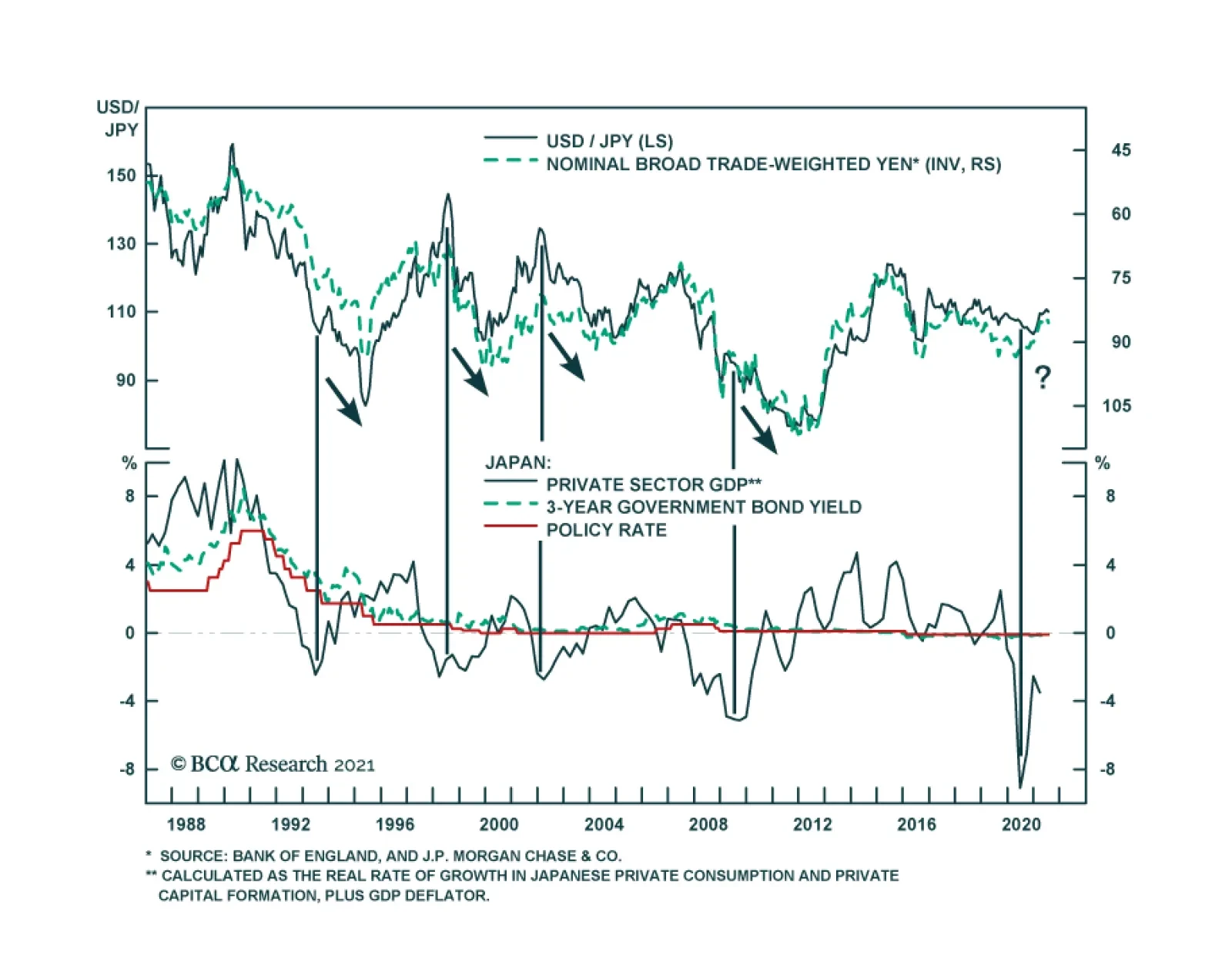

As expected, the Bank of Japan did not make any changes to monetary policy at its Friday meeting. Instead, the central bank downgraded the growth outlook and now expects the economy to expand 3.8% in the current fiscal year, down…

Recent data releases suggest that Japan’s domestic recovery is progressing. Japanese machine tool orders are up 96.6% y/y in June. Although this marks a sharp deceleration from May’s 141.9%, the pace remains…

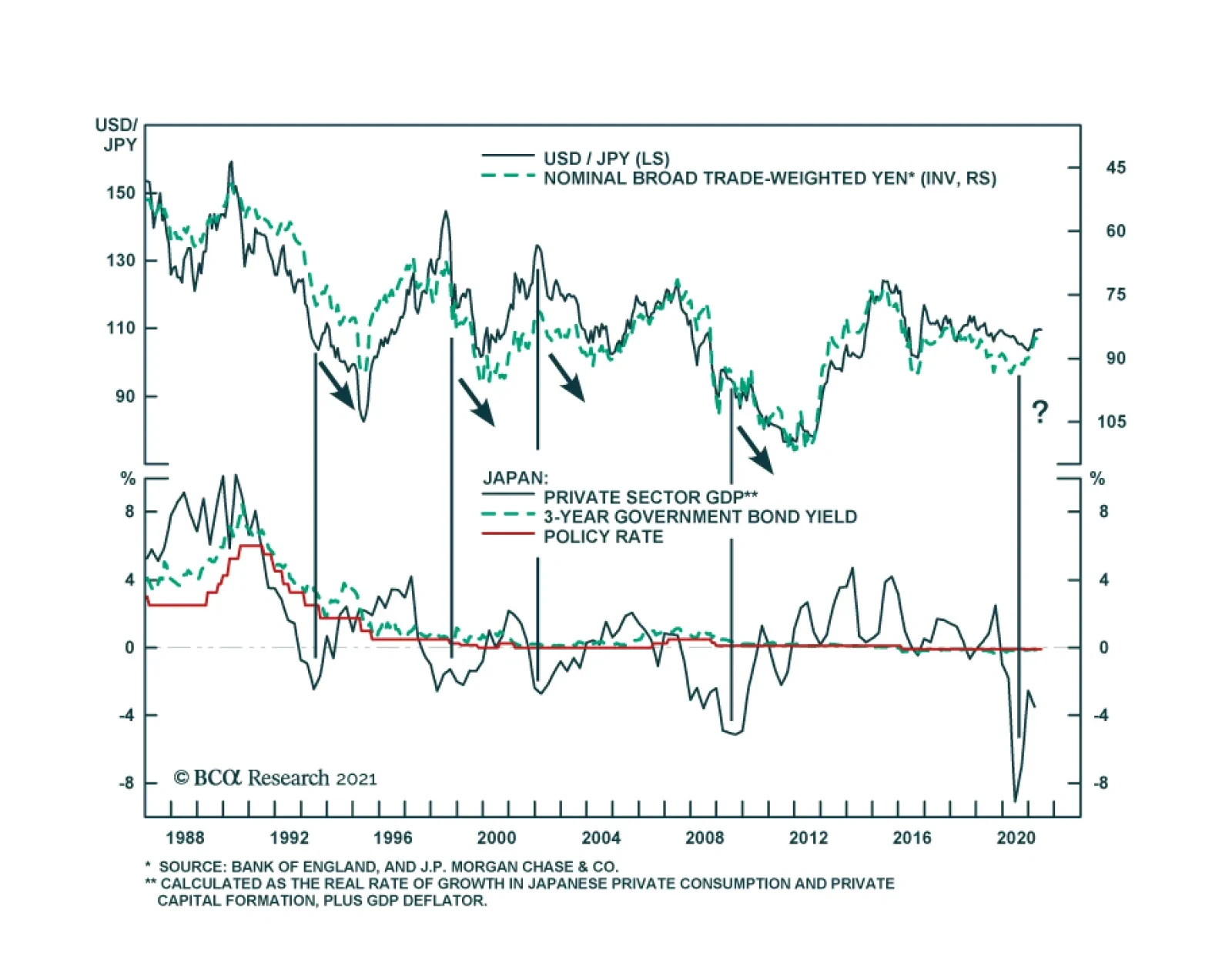

The yen has been the worst-performing currency in the developed FX space this year. Unlike the euro area or the US, the Japanese economy remains under siege from the pandemic. The number of new COVID-19 cases is at the highest…

Highlights Oil demand expectations remain high. Realized demand continues to disappoint. This means OPEC 2.0's production-management strategy – i.e., keeping the level of supply below demand – will continue to dictate…