Japan

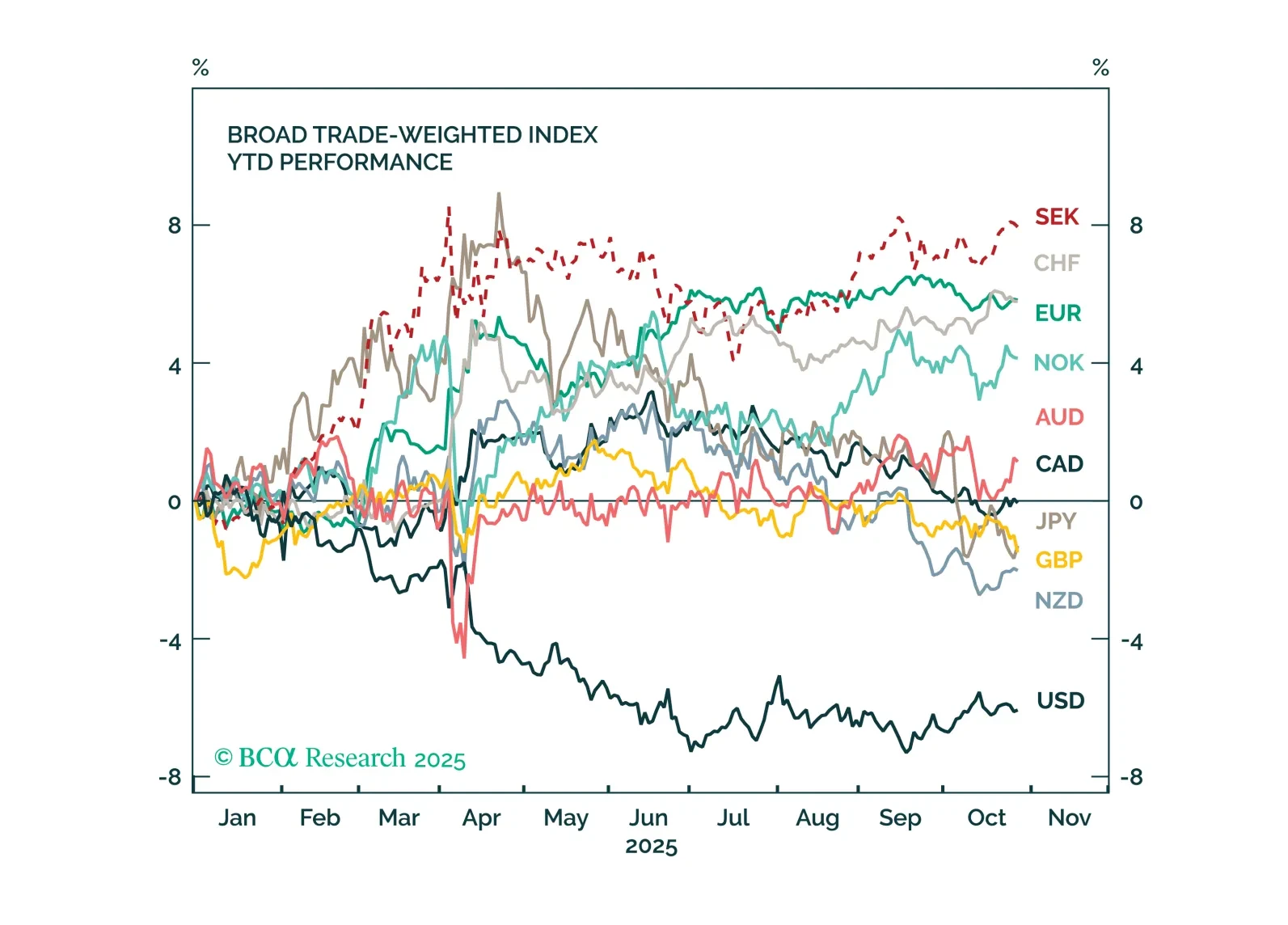

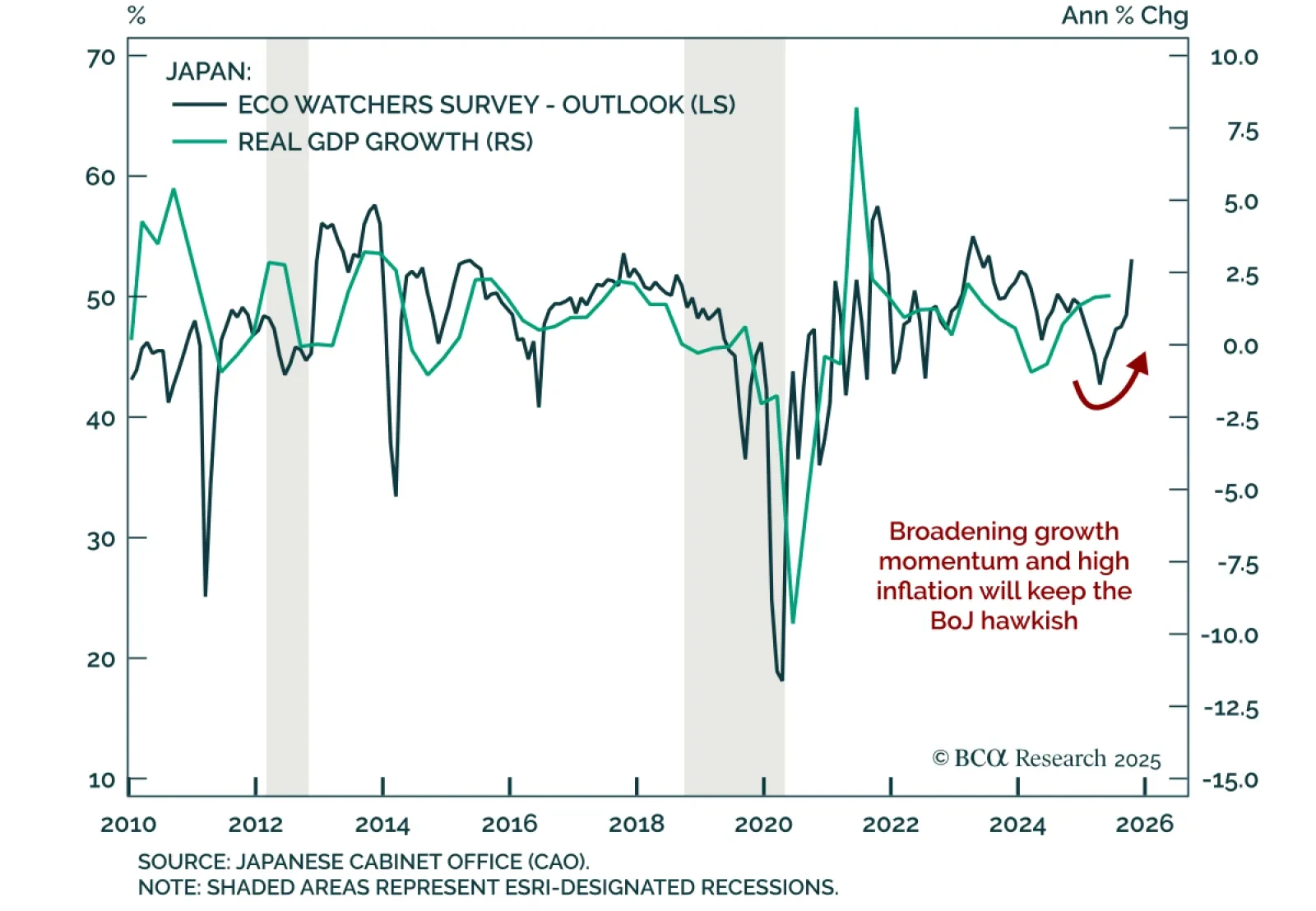

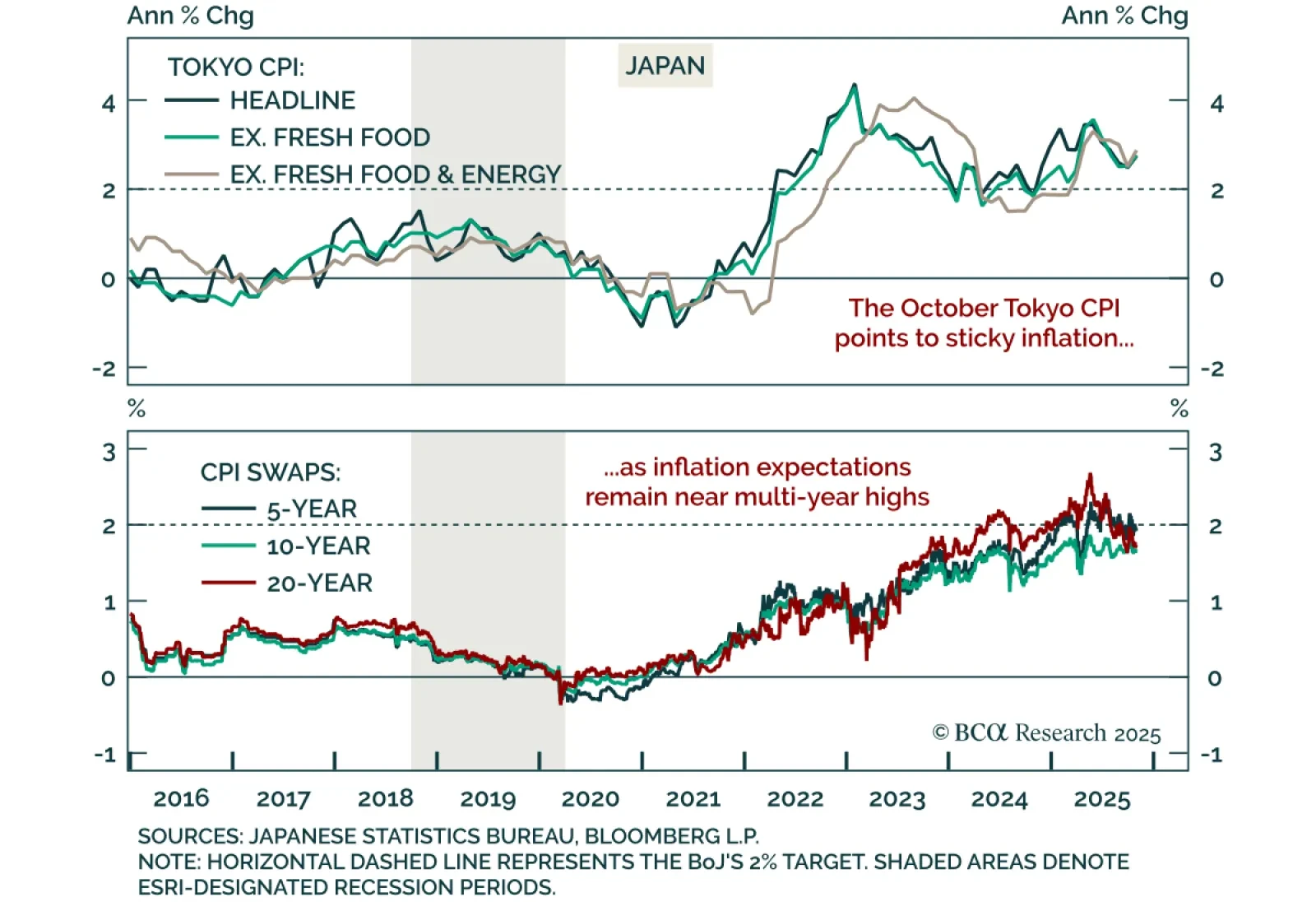

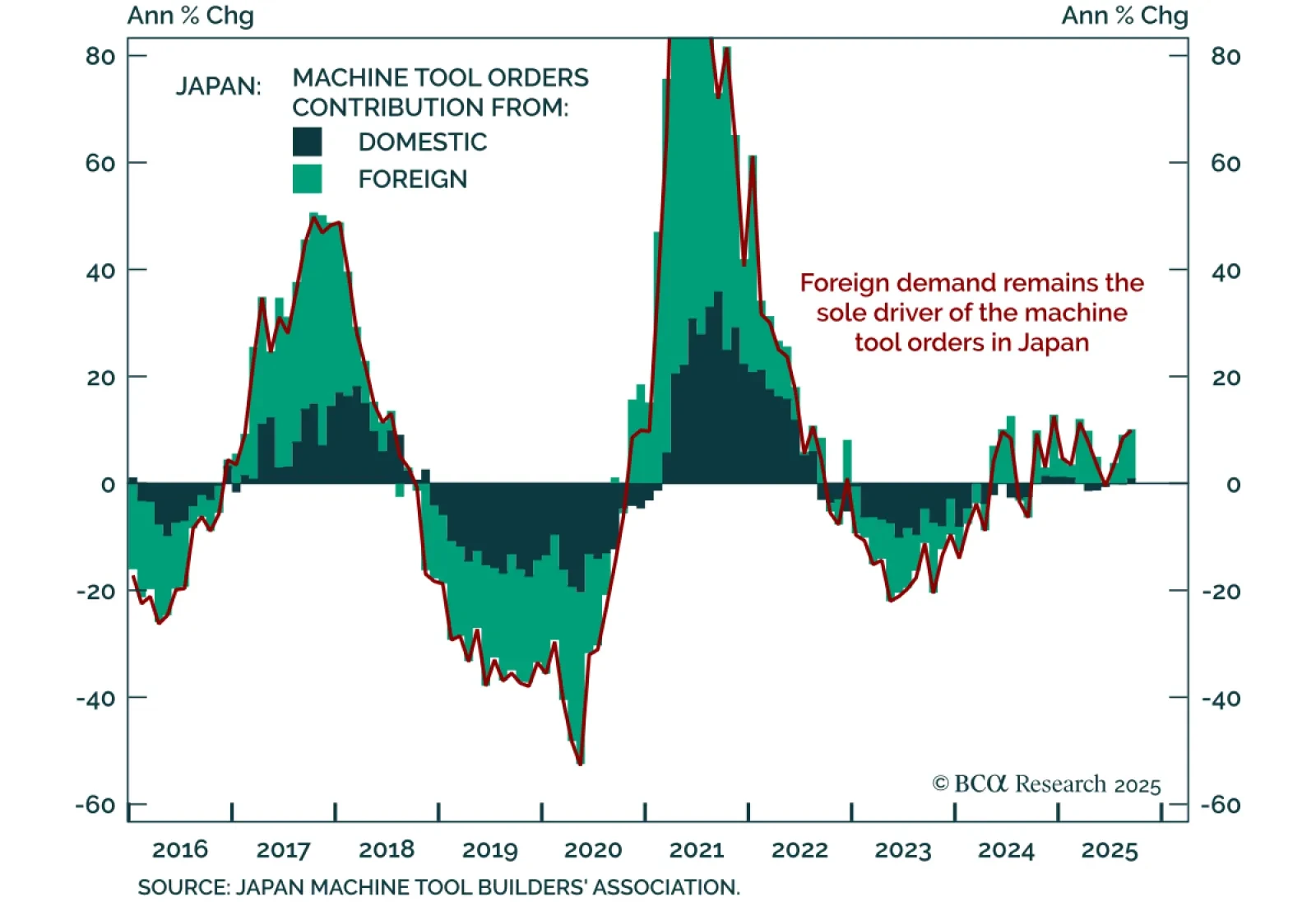

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down the current drivers behind G10 central bank policies, and how to position for the next moves across FX and fixed income.

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down the current drivers behind G10 central bank policies, and how to position for the next moves across FX and fixed income.

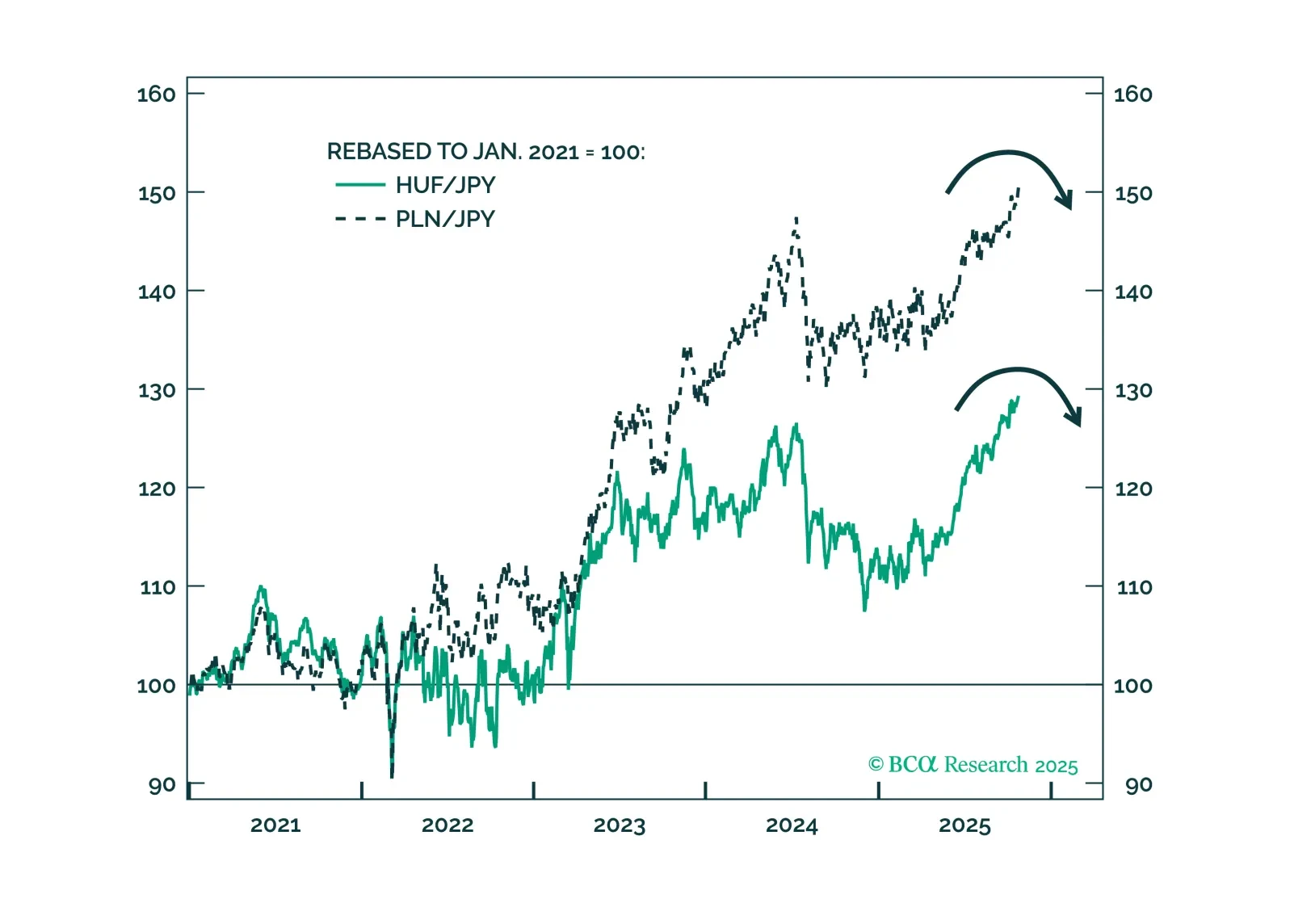

Japan's first woman prime minister, Sanae Takaichi, will underperform on economic stimulus but outperform on defense spending and strategic diplomacy. Stay long Japanese yen.

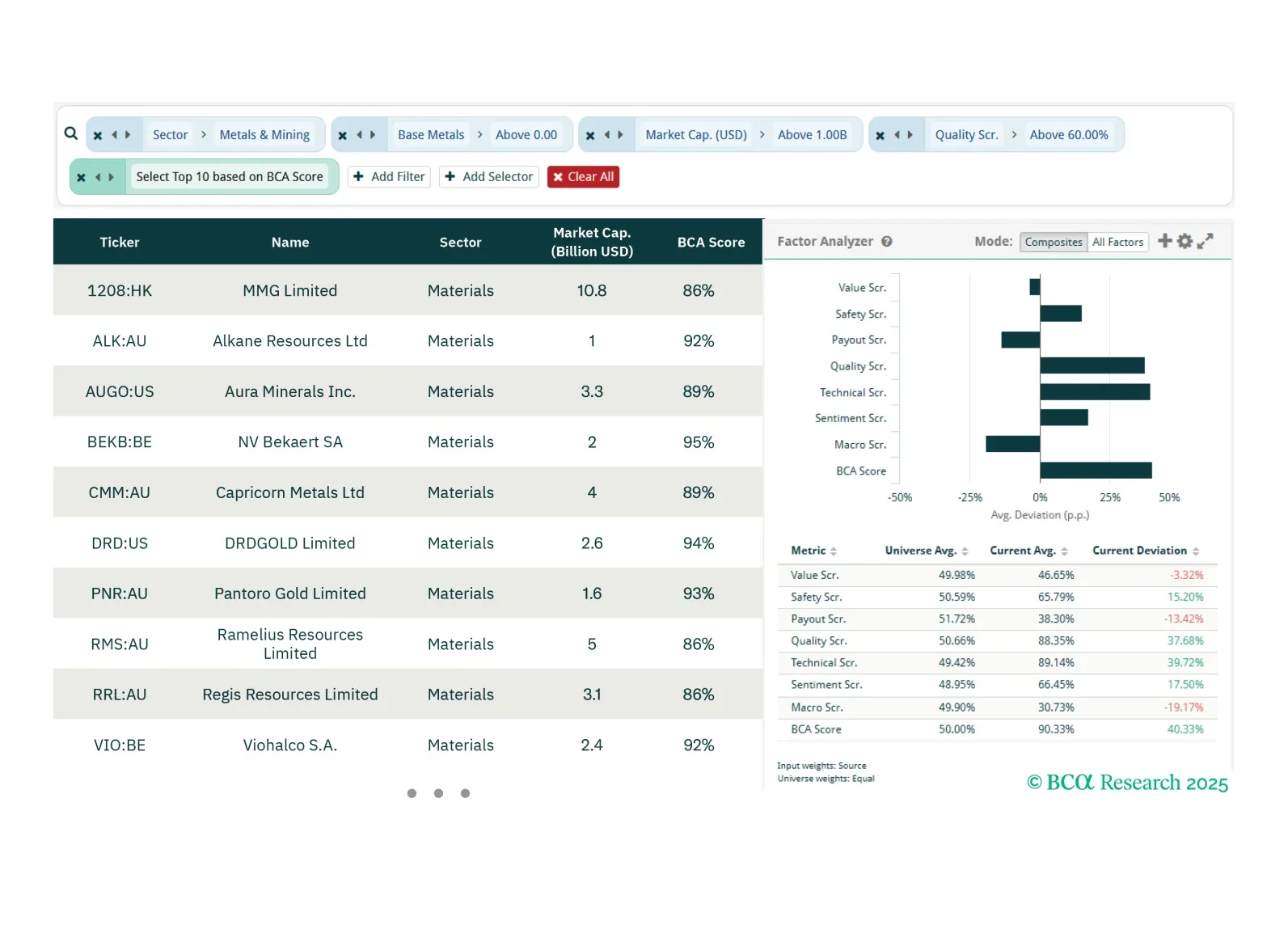

This week, our screeners explore ways to play a long-term bullish metals view, sub-sector REITS opportunities as well as Japanese Value stocks.

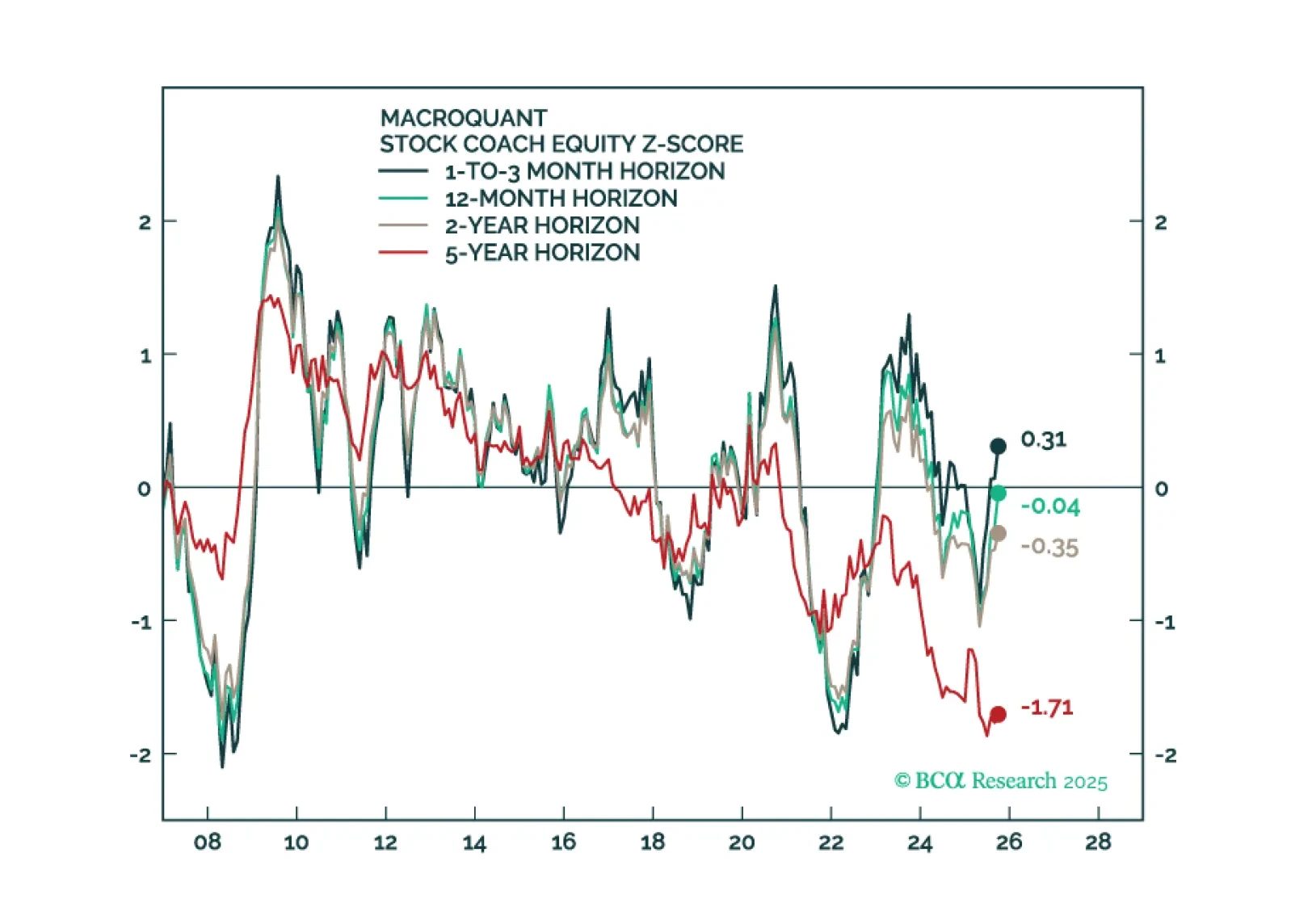

A world of political churn favors safe havens — buy yen, stay overweight US stocks, and avoid chasing the fragile rally in China.

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has entered a structural downtrend, our perspective on the yen, gold and other commodities, and much more.

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and identify opportunities in government bonds, short-term interest rate futures, global yield curves, inflation-linked bonds, and credit.