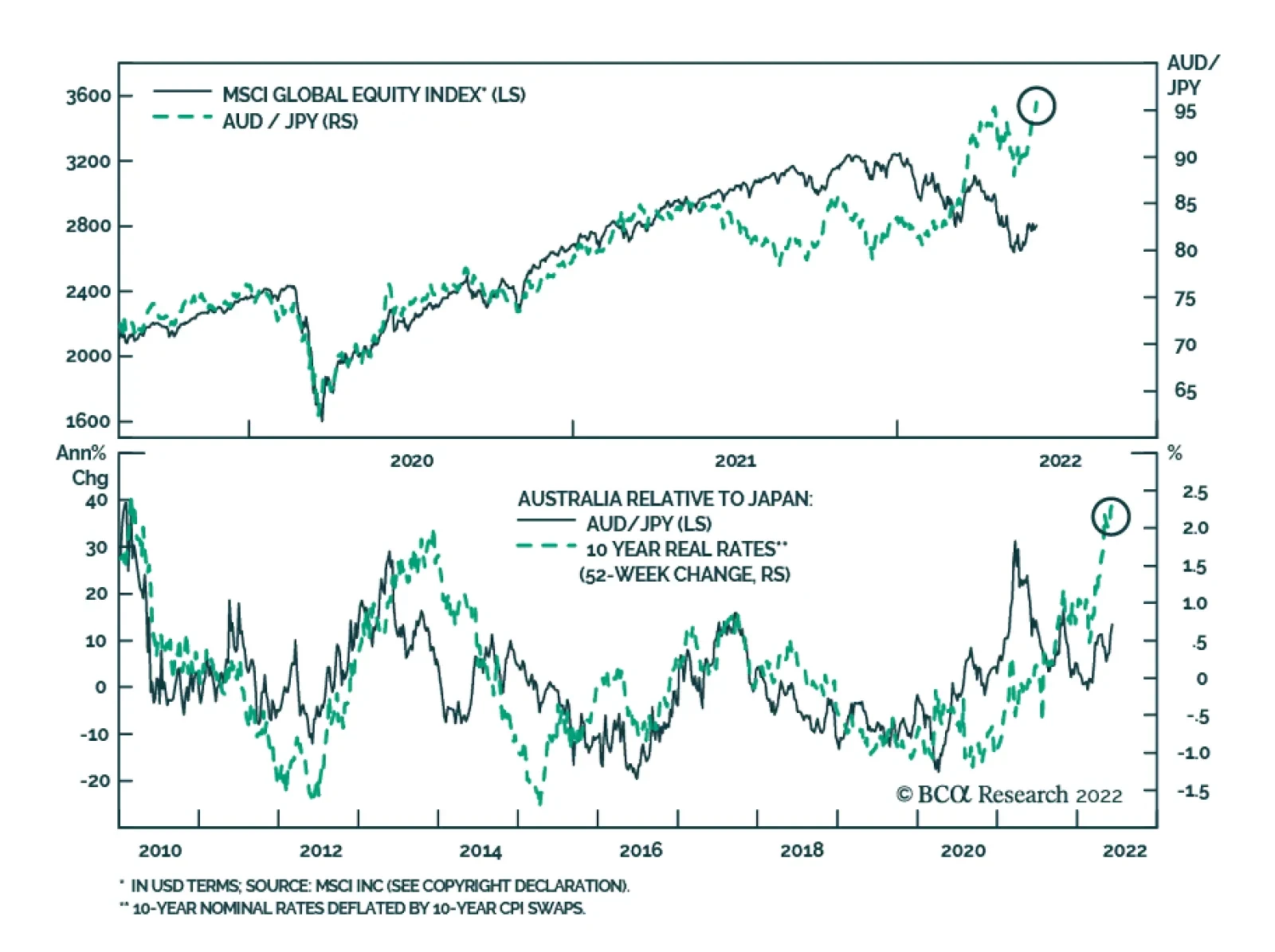

AUD/JPY has strengthened to a fresh multi-year high. As a key commodity producer, the Australian economy is extremely sensitive to the global economic cycle – particularly Chinese economic conditions. Meanwhile, the JPY is…

Listen to a short summary of this report. Executive Summary US Financial Conditions Have Tightened Significantly This Year US financial conditions have tightened by enough that the Fed no…

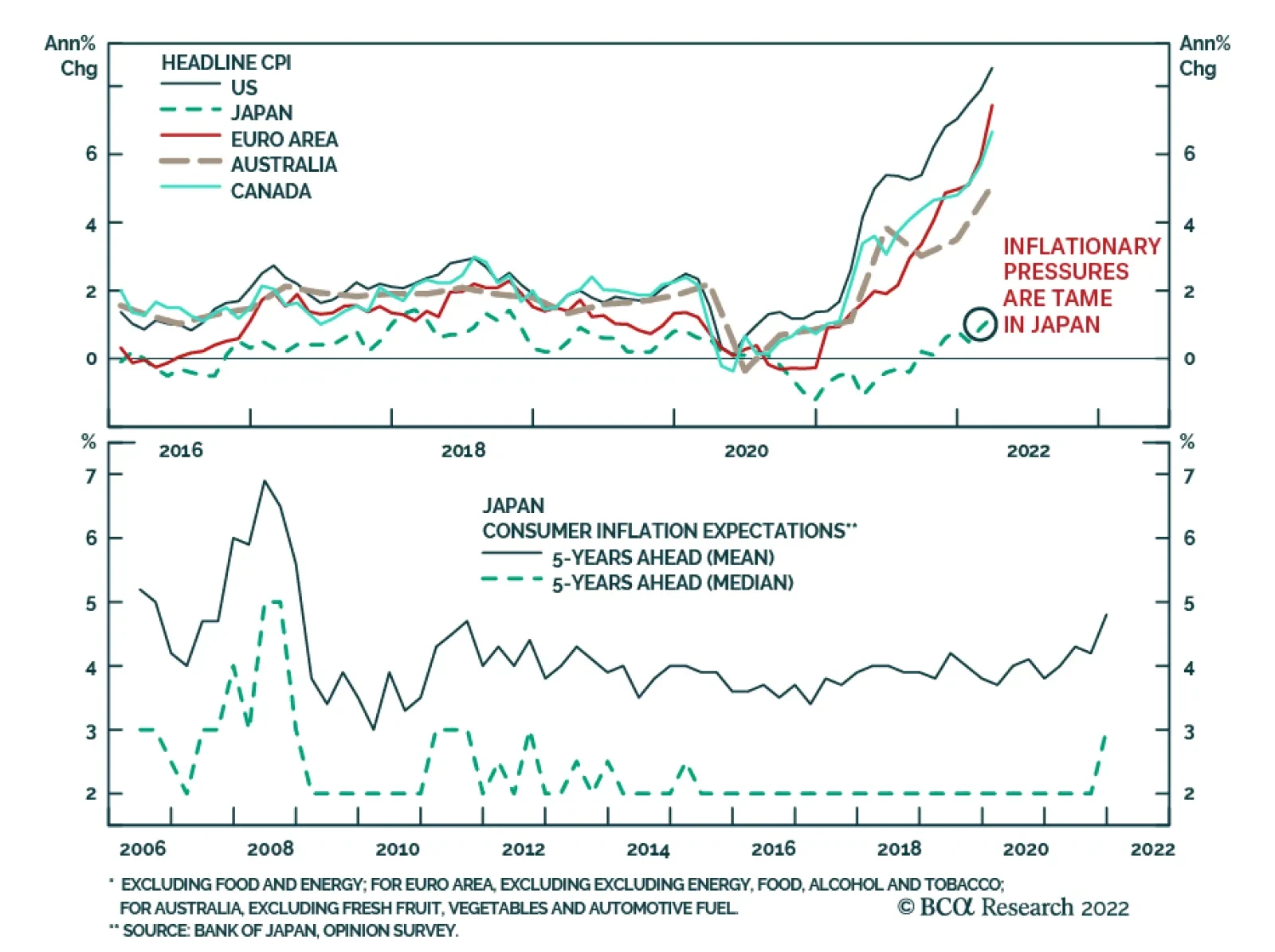

Japanese headline inflation increased from 1.2% y/y to 2.5% y/y in April. Similarly, core CPI inflation jumped from 0.8% y/y to 2.1% y/y. The April acceleration in consumer prices mostly reflects the fading effect of cheaper…

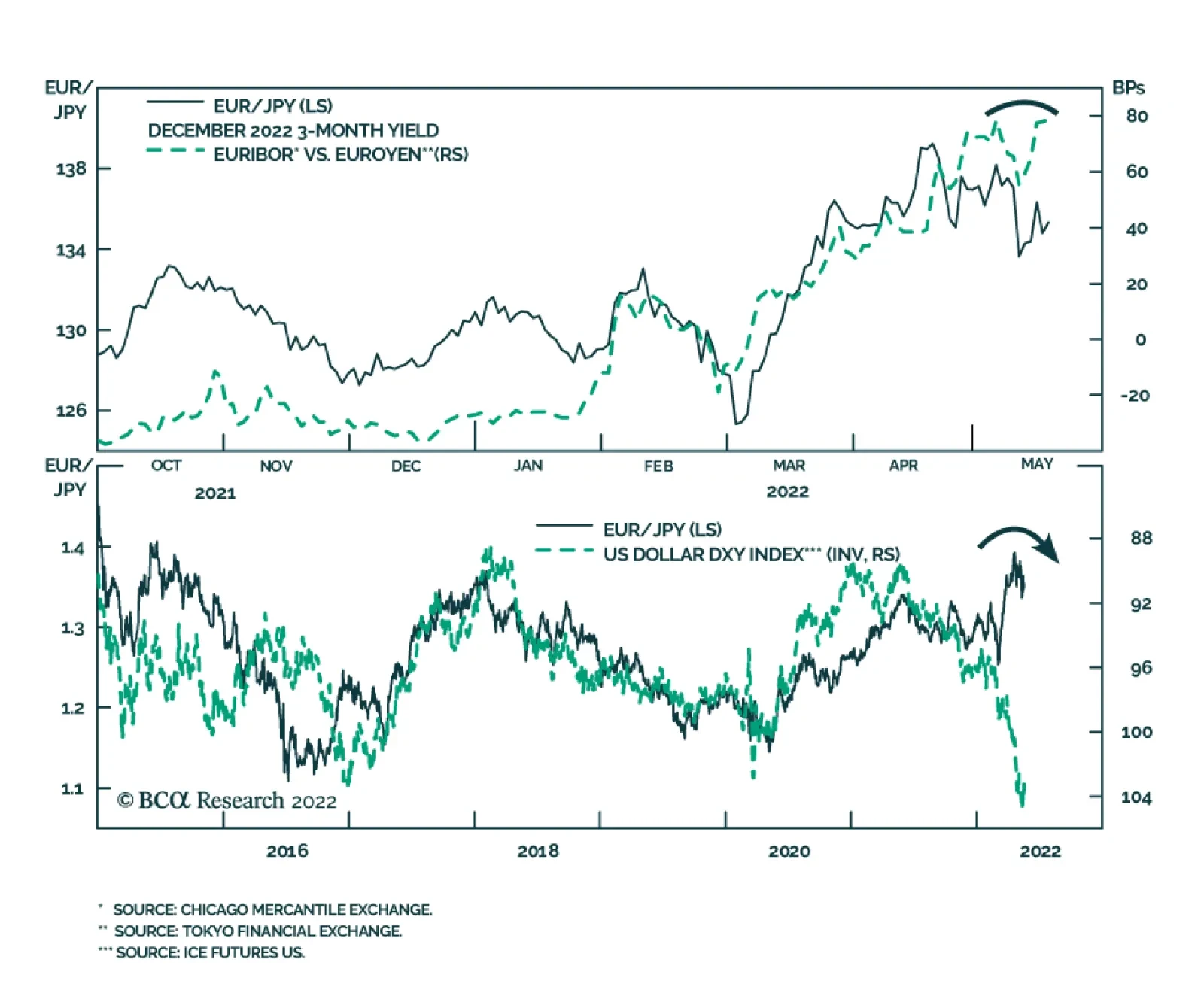

Listen to a short summary of this report. Executive Summary EUR/JPY And The DXY: Unsustainable Gap Three interrelated themes are likely to play out by the end of 2022 – peak Fed hawkishness,…

Executive Summary Global inflation will peak sometime in the next few months, a process that has likely already begun in the US. This will give policymakers some breathing room to turn less hawkish, a more credible stance given…

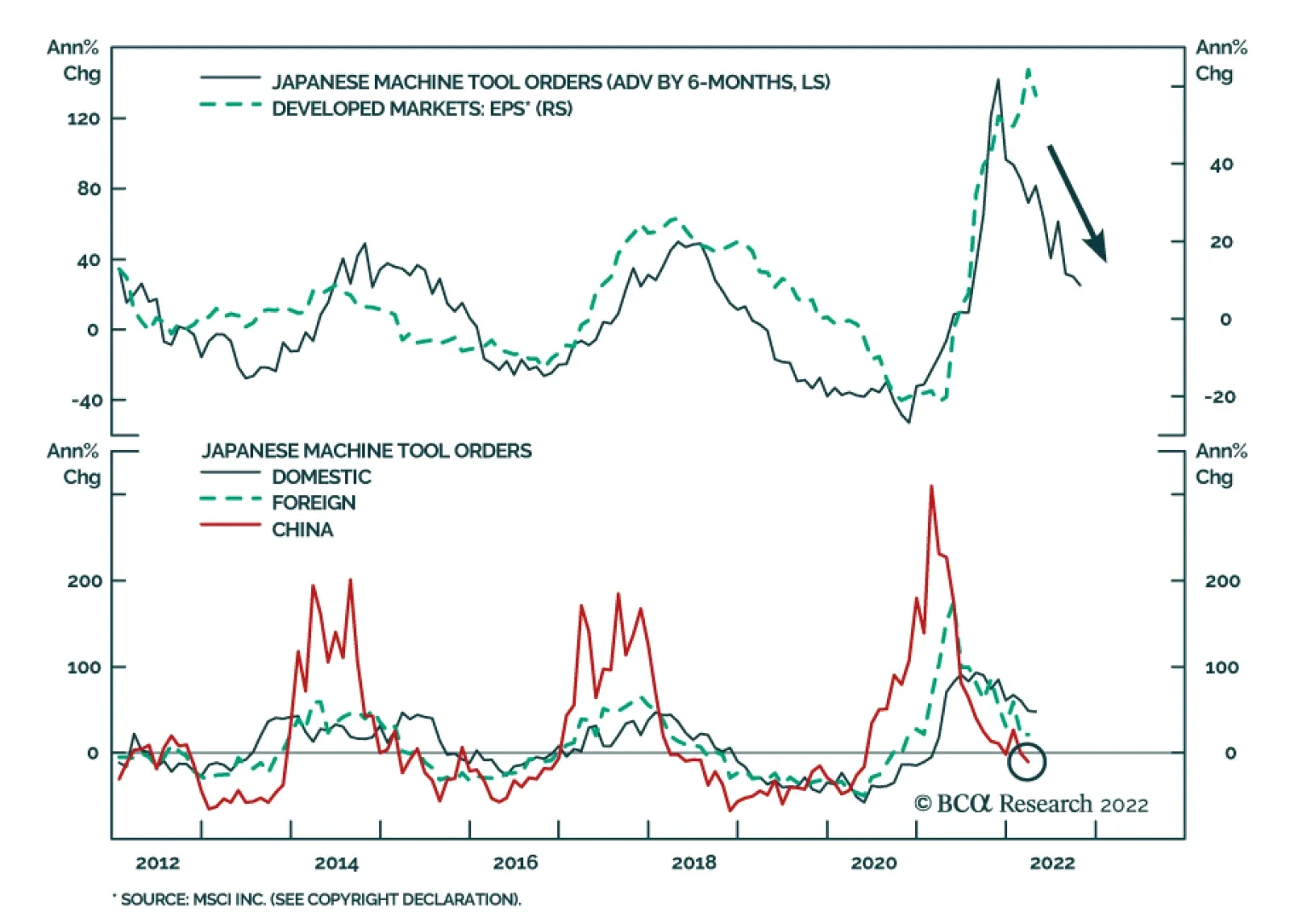

Japanese machine tool orders are an excellent gauge of the state of the global manufacturing and trade cycle. On the surface, the double-digit year-on-year pace of expansion in April suggests that underlying macroeconomic…

Listen to a short summary of this report. Executive Summary The Dollar Likes Volatility Uncertainty about Fed policy has supercharged volatility in bond markets, and correspondingly, USD demand (Feature…

Executive Summary A True Bond Bear Market, USD-Hedged Or Unhedged The US dollar has appreciated in 2022, most notably against the euro and Japanese yen. The rally has been more muted against the currencies of major US…

The Japanese yen dropped nearly 2% versus the USD on Thursday on the reaffirmation of the BoJ’s commitment to ultra-easy policy. The BoJ pledged to purchase an unlimited amount of bonds daily in order to maintain its 10-…

Executive Summary Summarizing Our Main Investment Themes In One Chart Our current strategic recommendations are centered around four key themes: global inflation will slow over the rest of 2022, Europe remains too weak to…