High rates have hurt real estate and, now, banks. The next shoes to drop: Loan growth, profits, and employment. Stay defensive. Recession is probable, but risk assets have not priced it in.

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

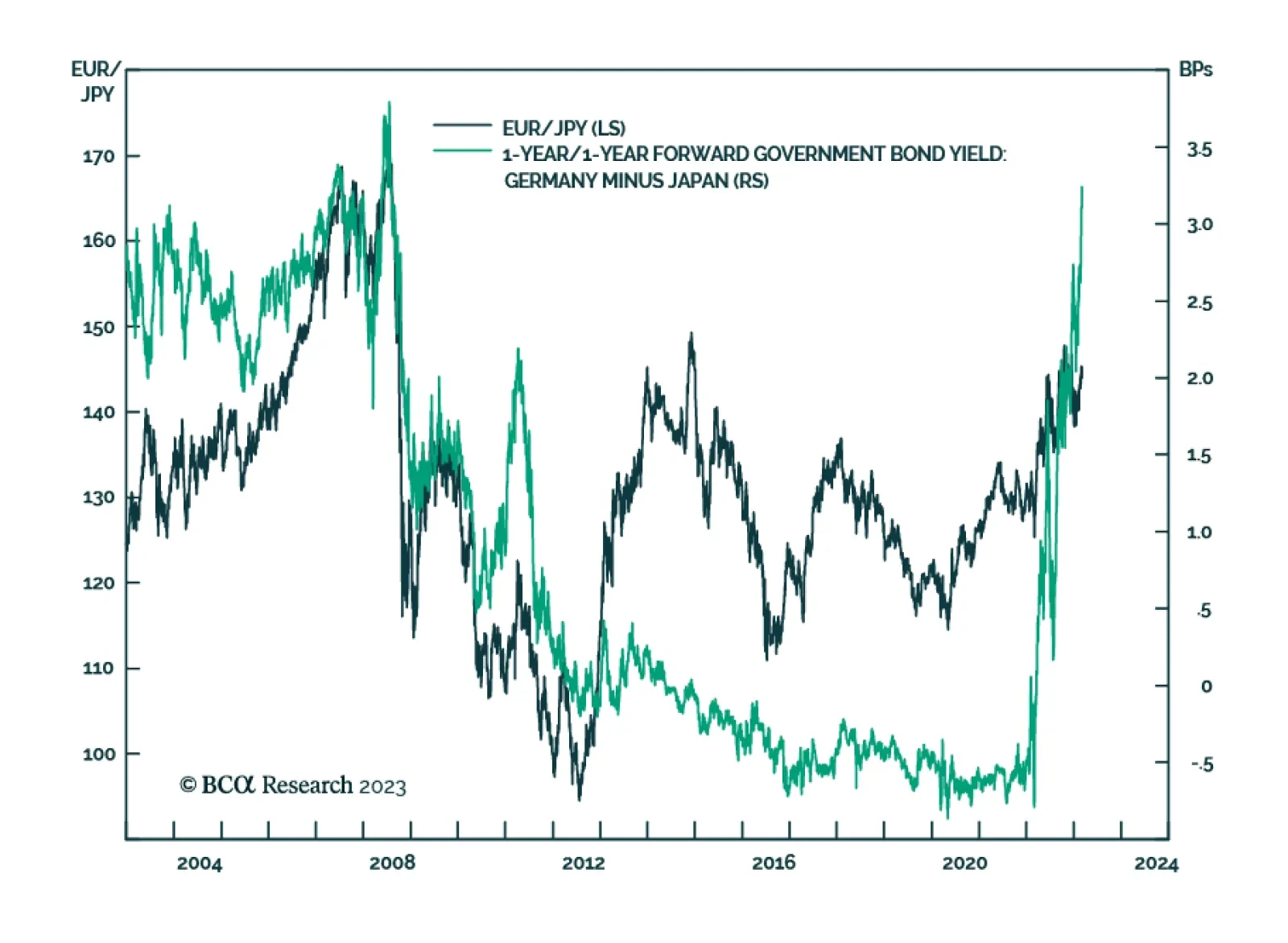

According to BCA Research’s Foreign Exchange Strategy & Global Fixed Income Strategy services, there are a few shifts that could be immediately expected with an end to the BoJ’s Yield Curve Control (YCC) program…

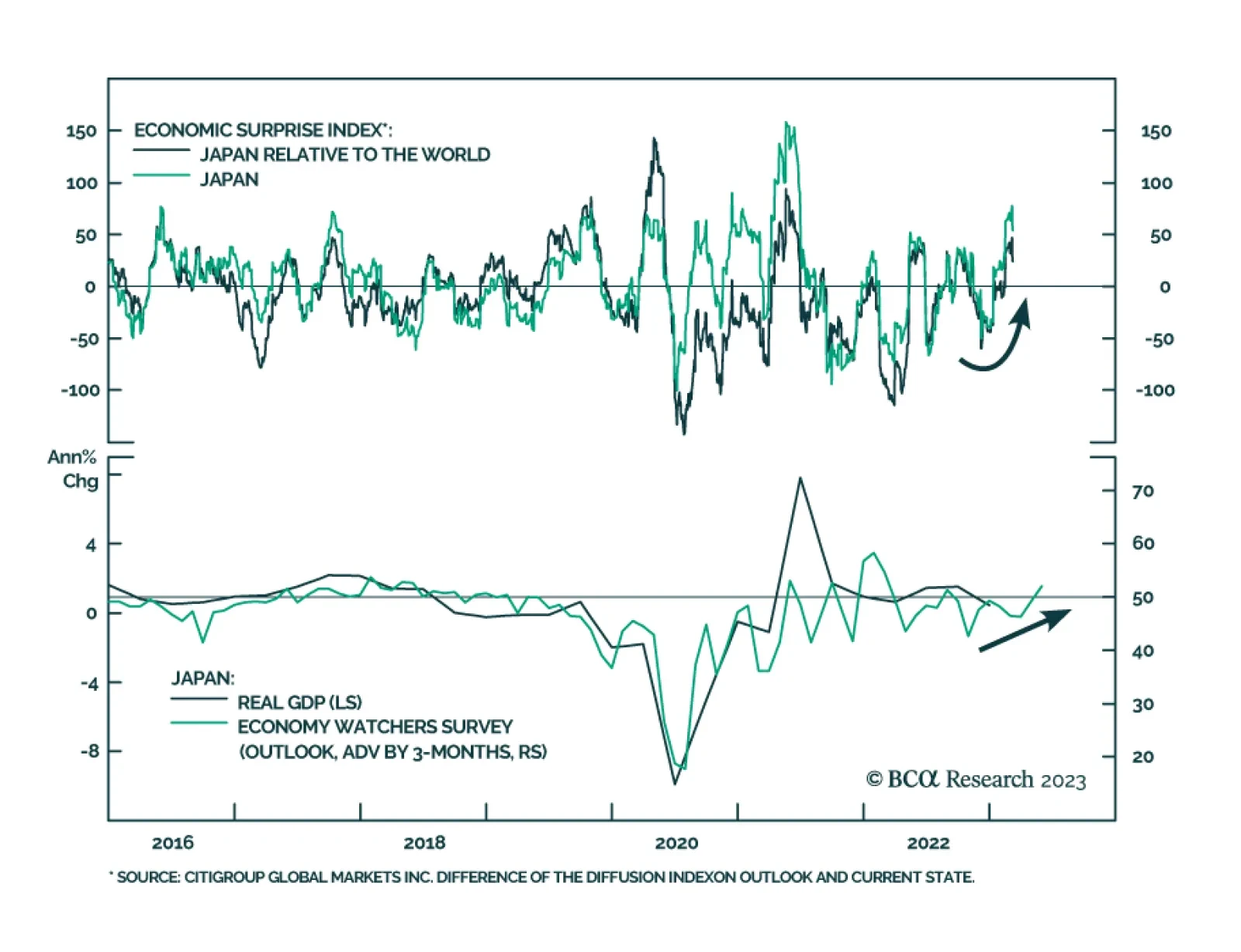

As expected, the BoJ maintained its dovish policy stance at Governor Haruhiko Kuroda’s last monetary policy meeting ahead of his April 8 departure. The post-meeting statement noted that the recovery in economic activity is…

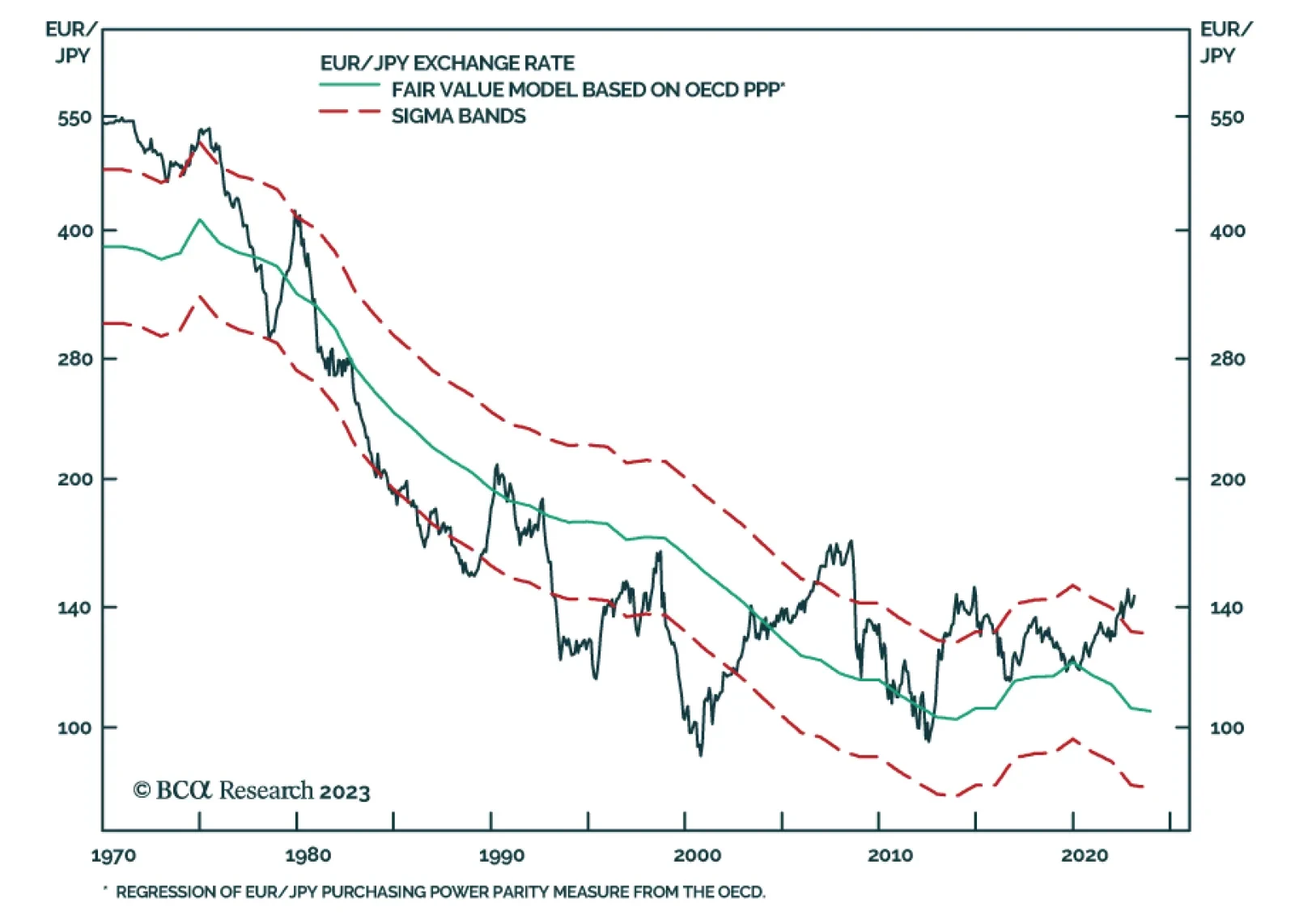

The strength in the euro versus the yen since May 2020 can be divided into two phases. During the first phase, from May 2020 to June 2021, the ebbing of the worst of the pandemic and the re-opening of the global economy boosted…

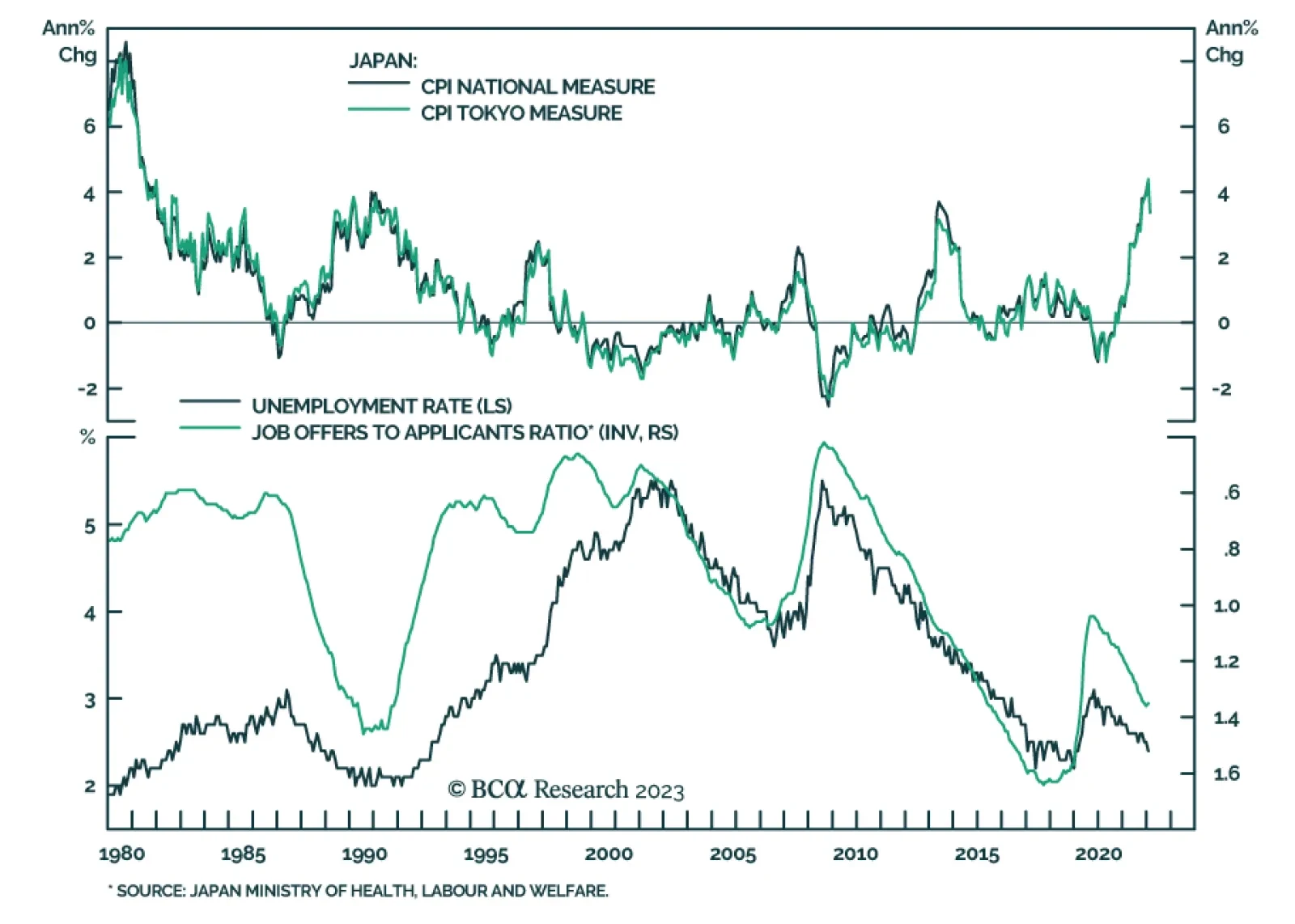

Last week’s Tokyo CPI release showed the first signs of modest disinflationary pressures in the Japanese economy. Headline inflation fell from 4.4% to 3.4%, in February. The ex-fresh food component also fell. That said, the…

The rebound in growth is pushing up inflation. More aggressive monetary policy is likely to trigger recession over the next 12 months or so. Investors should stay defensive.

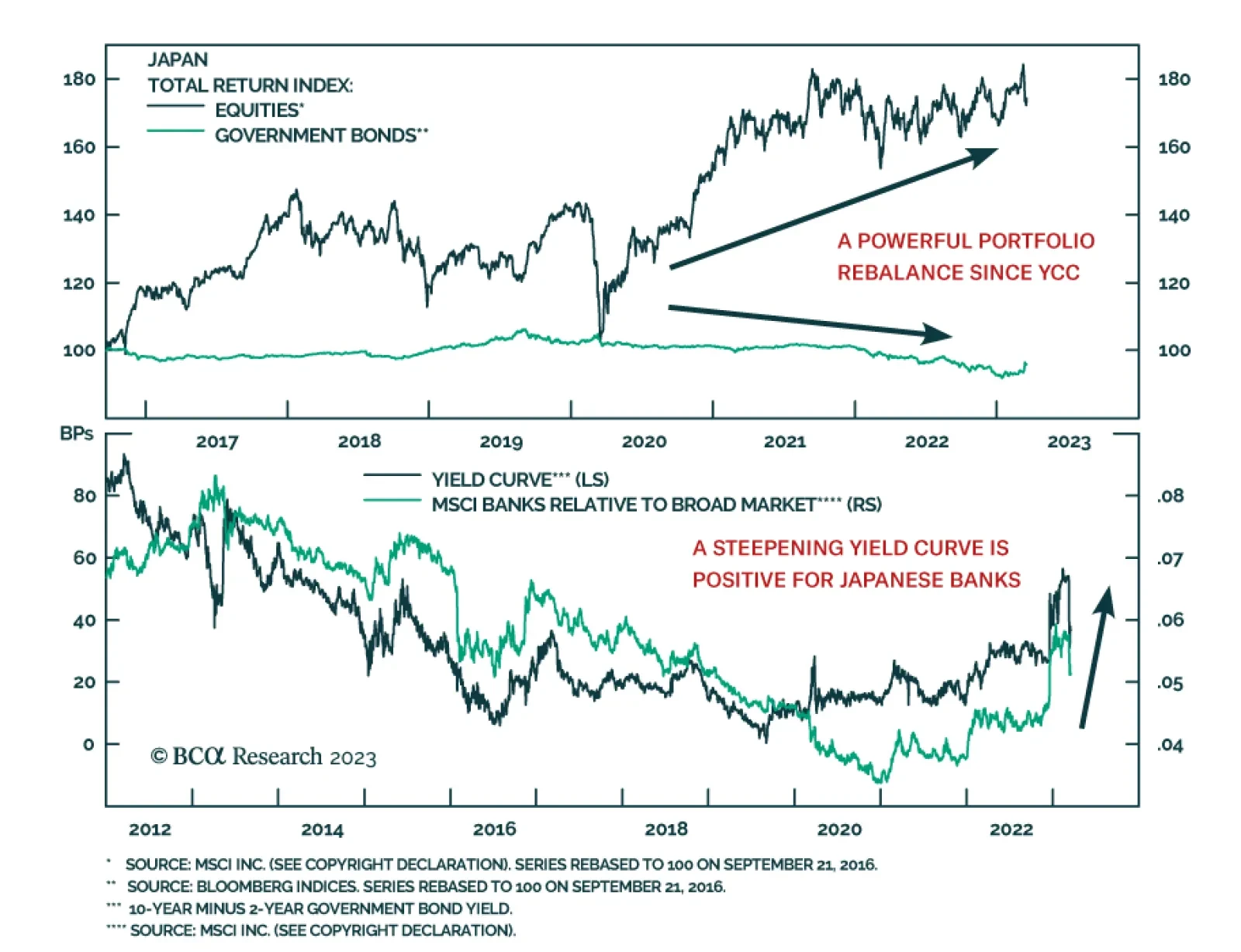

A lot of ink has been spilled of late on the Bank of Japan’s incoming governor and the impact this will have on the central’s bank Yield Curve Control (YCC) policy. Japanese inflation has been climbing steadily…