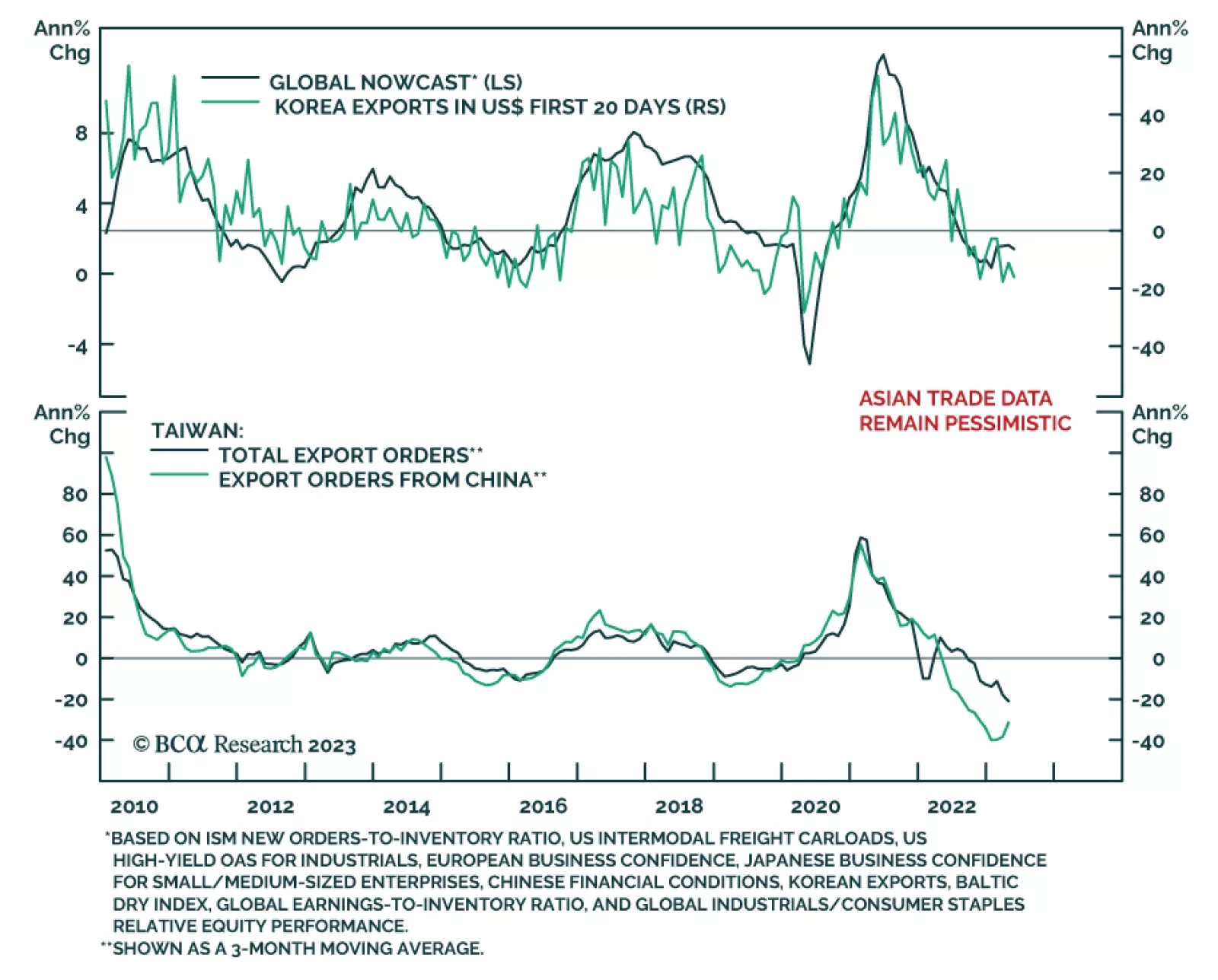

Recent Asian trade data do not provide any optimism that the global manufacturing slump is nearing its end. South Korean exports collapsed by 16.1% y/y in the first 20 days of May. While the decline was broad-based, sales to…

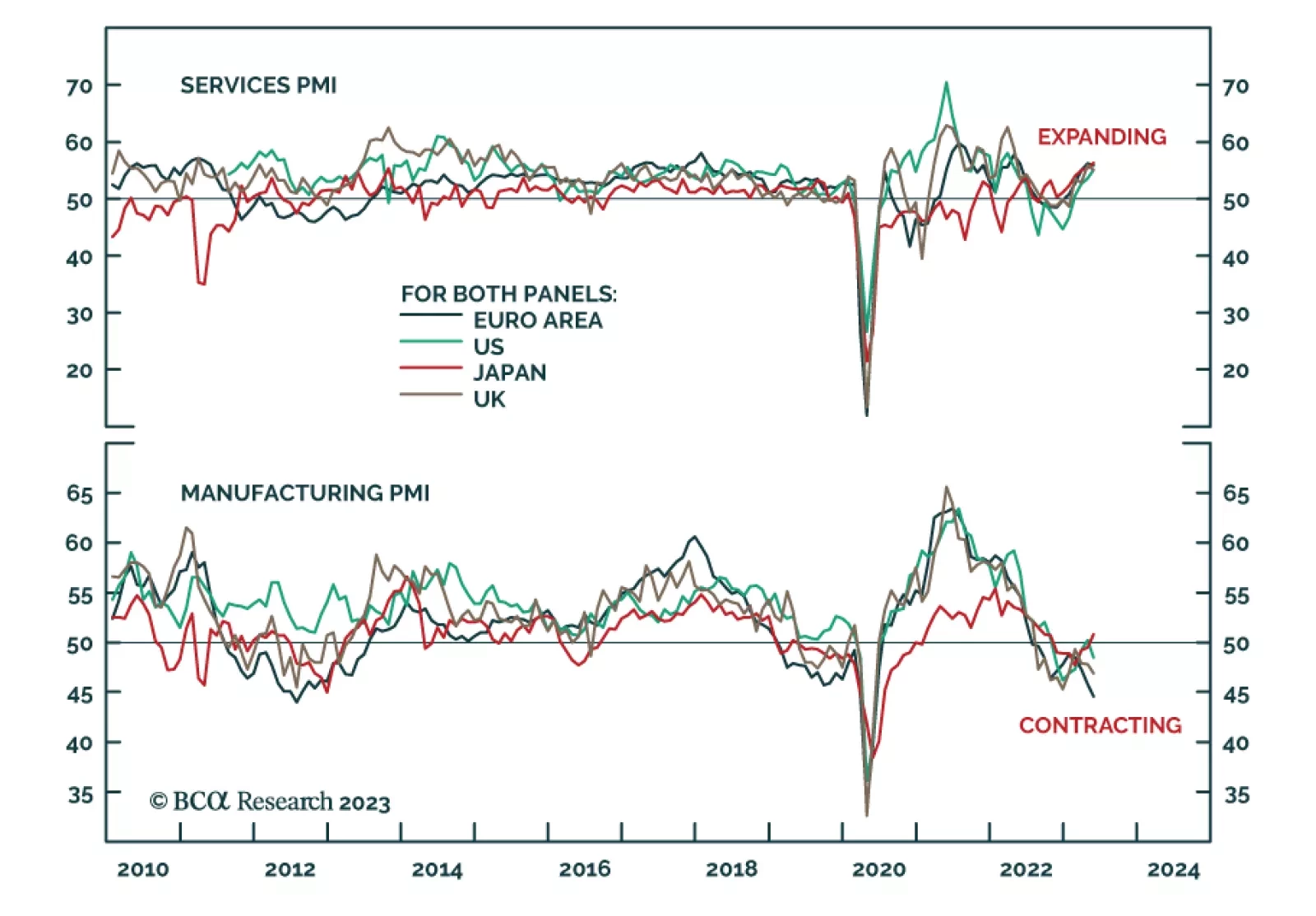

Preliminary PMI releases for May continue to show a divergence in activity across DM economies. On the one hand, the pace of expansion of service sector activity accelerated. The US Services PMI rose from 53.6 to 55.1 –…

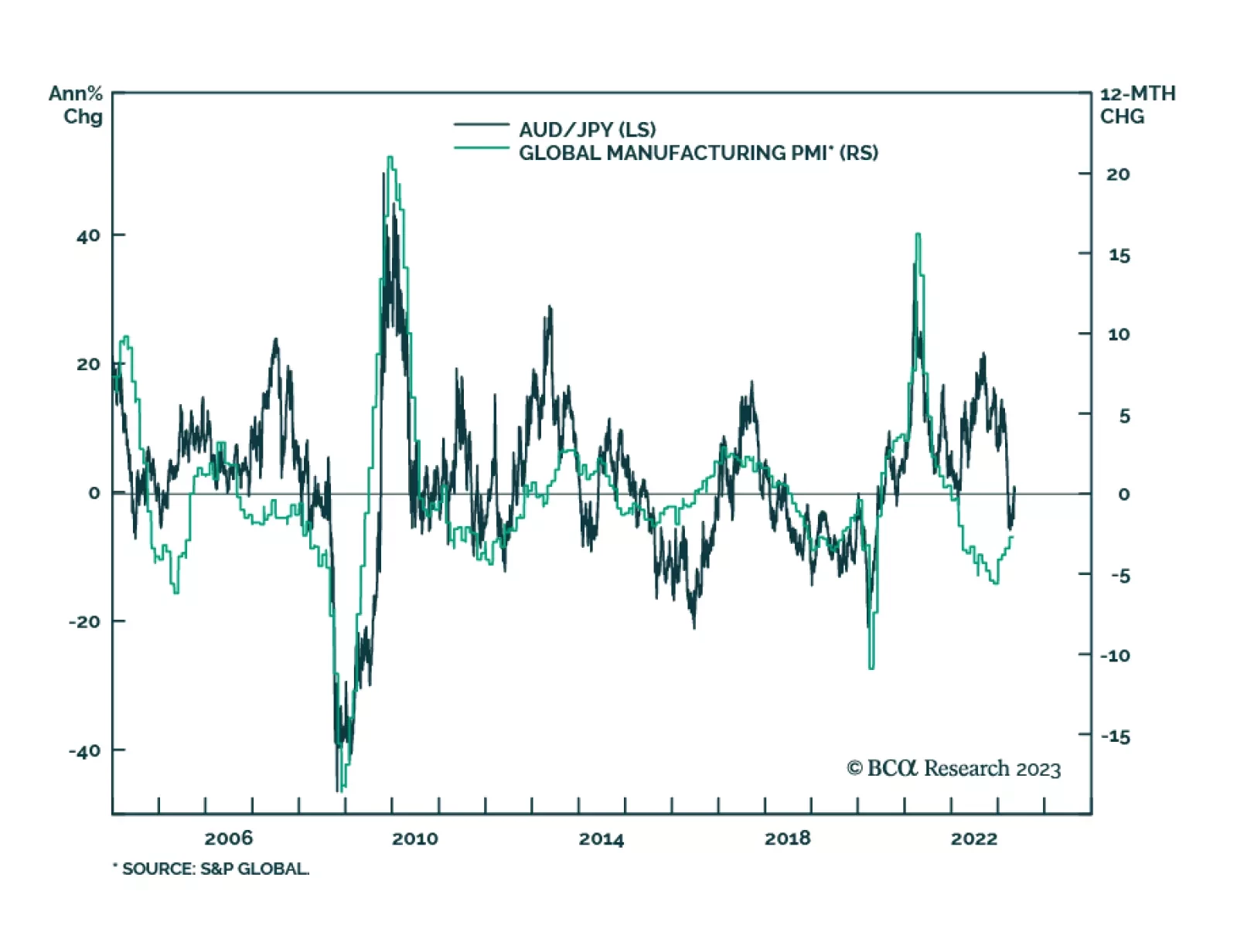

After a powerful 40% rally from the March 2020 lows, AUD/JPY peaked in September 2022 and has been consolidating those gains in bearish trading pattern of lower highs and lower lows. Although the cross is up 4.5% from the March…

According to BCA Research’s Counterpoint service, on a timeframe of two years, investors should shock-proof their portfolios by holding some combination of cheap insurance assets. All shocks end up with both deflationary…

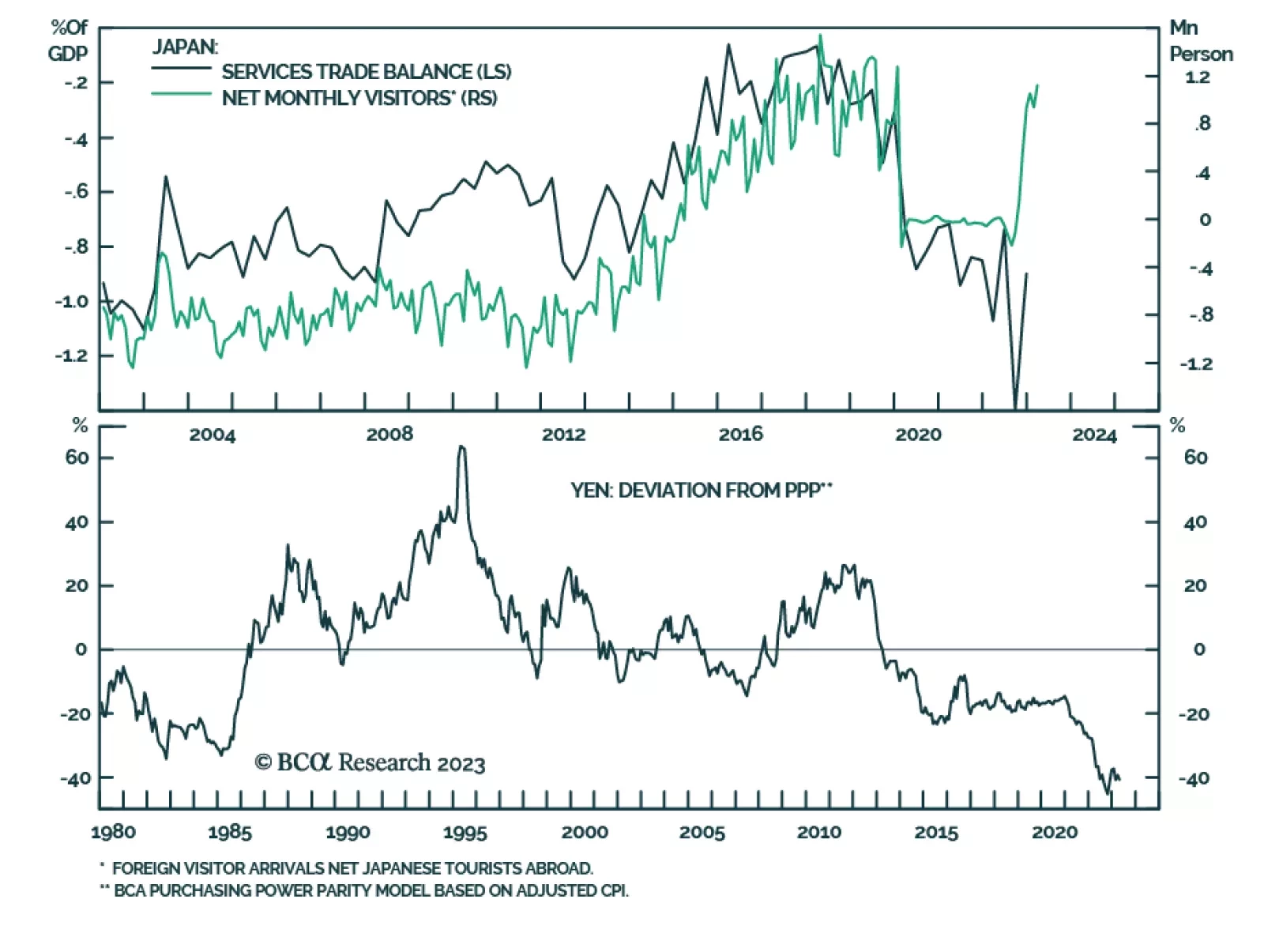

BCA Research’s Foreign Exchange Strategy service remains bullish on the yen’s longer-term outlook. The yen is at capitulation levels. Long positions versus the dollar can be established at USD/JPY 138. The team…

Yen bulls need patience. The near-term narrative remains bearish on the back of interest-rate differentials. Longer term, it is the most attractive currency the G10, on valuation grounds.

Yen bulls need patience. The near-term narrative remains bearish on the back of interest-rate differentials. Longer term, it is the most attractive currency the G10, on valuation grounds.

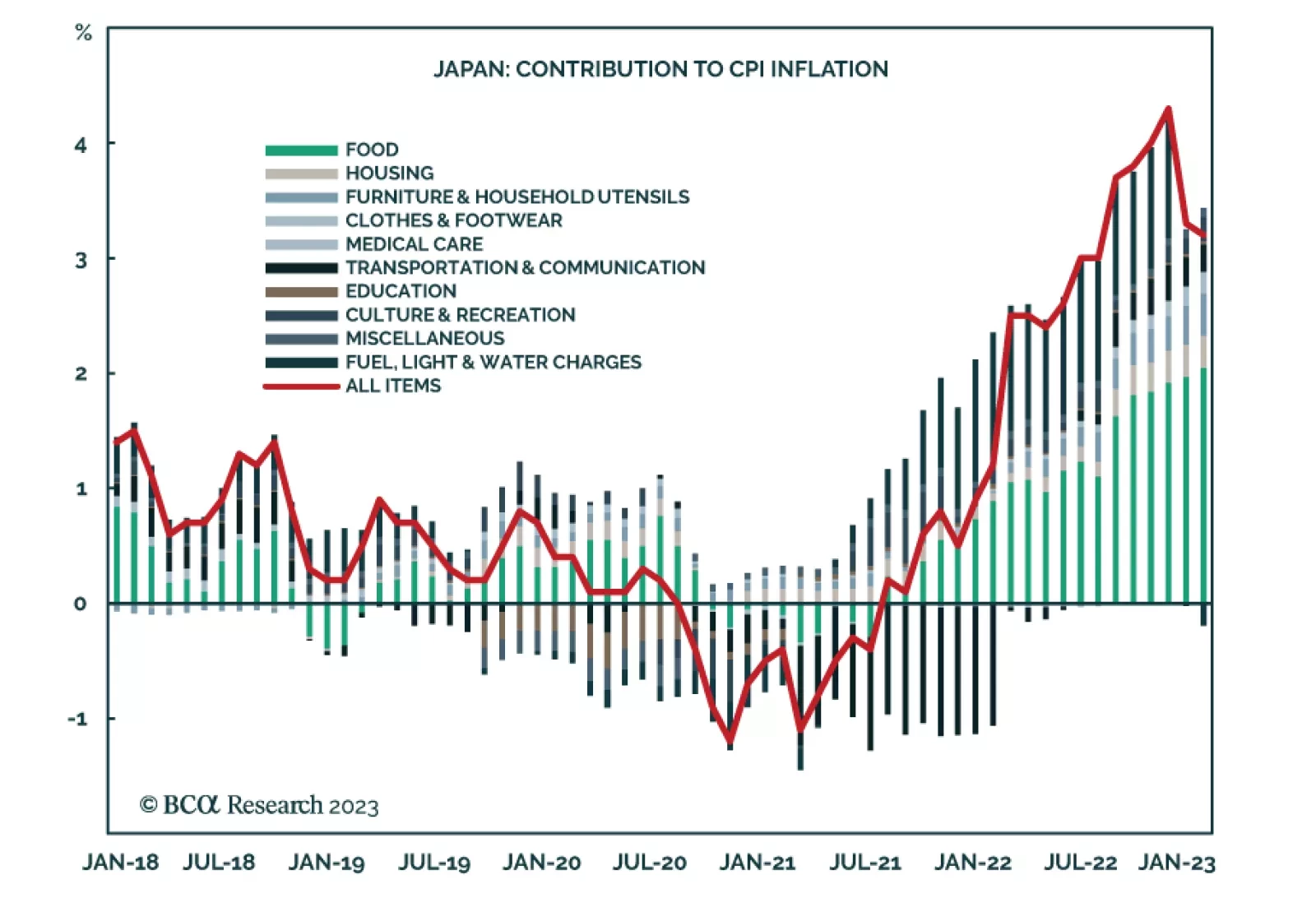

Japanese inflation was perky in March. Headline CPI came in at 3.2%, a slight deceleration from the previous month on a year-on-year basis, but still astronomical by Japanese standards. The real surprise was the acceleration in…

No, the secular rise in geopolitical risk has not peaked. EU-China trade ties underscore the multipolar context, but this multipolarity is unbalanced, as the US has not reached a new equilibrium with its rivals. While the second…