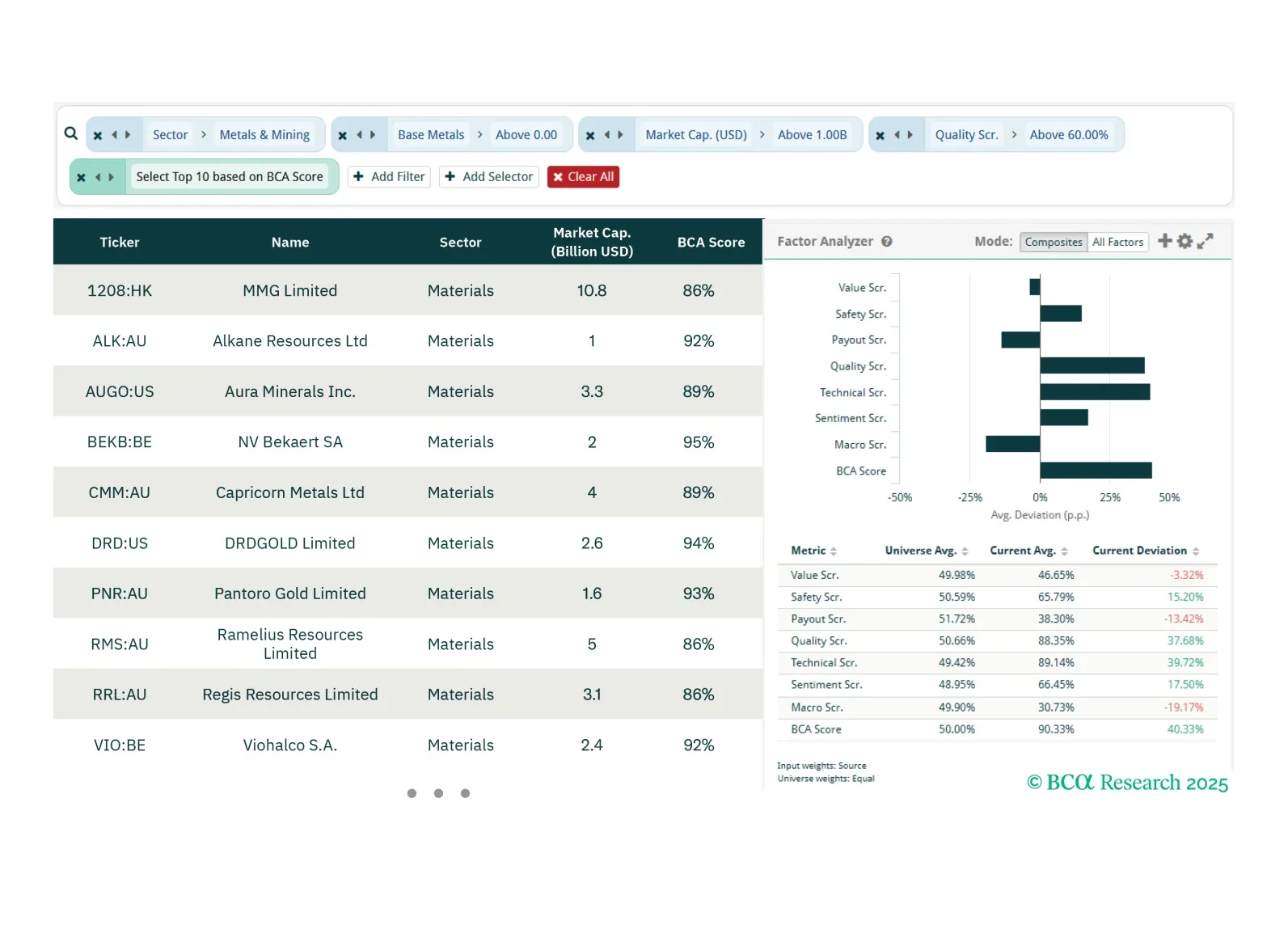

This week, our screeners explore ways to play a long-term bullish metals view, sub-sector REITS opportunities as well as Japanese Value stocks.

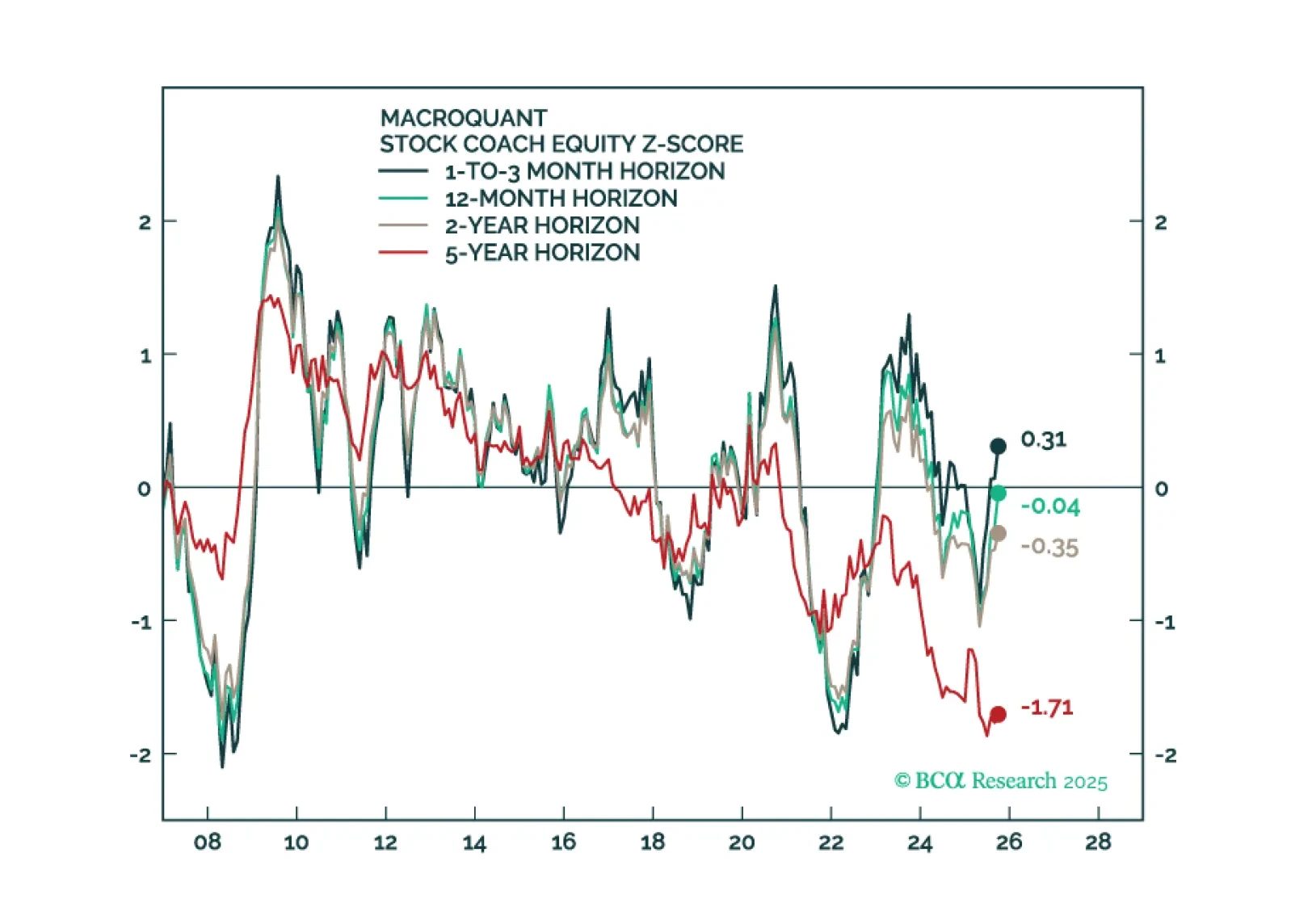

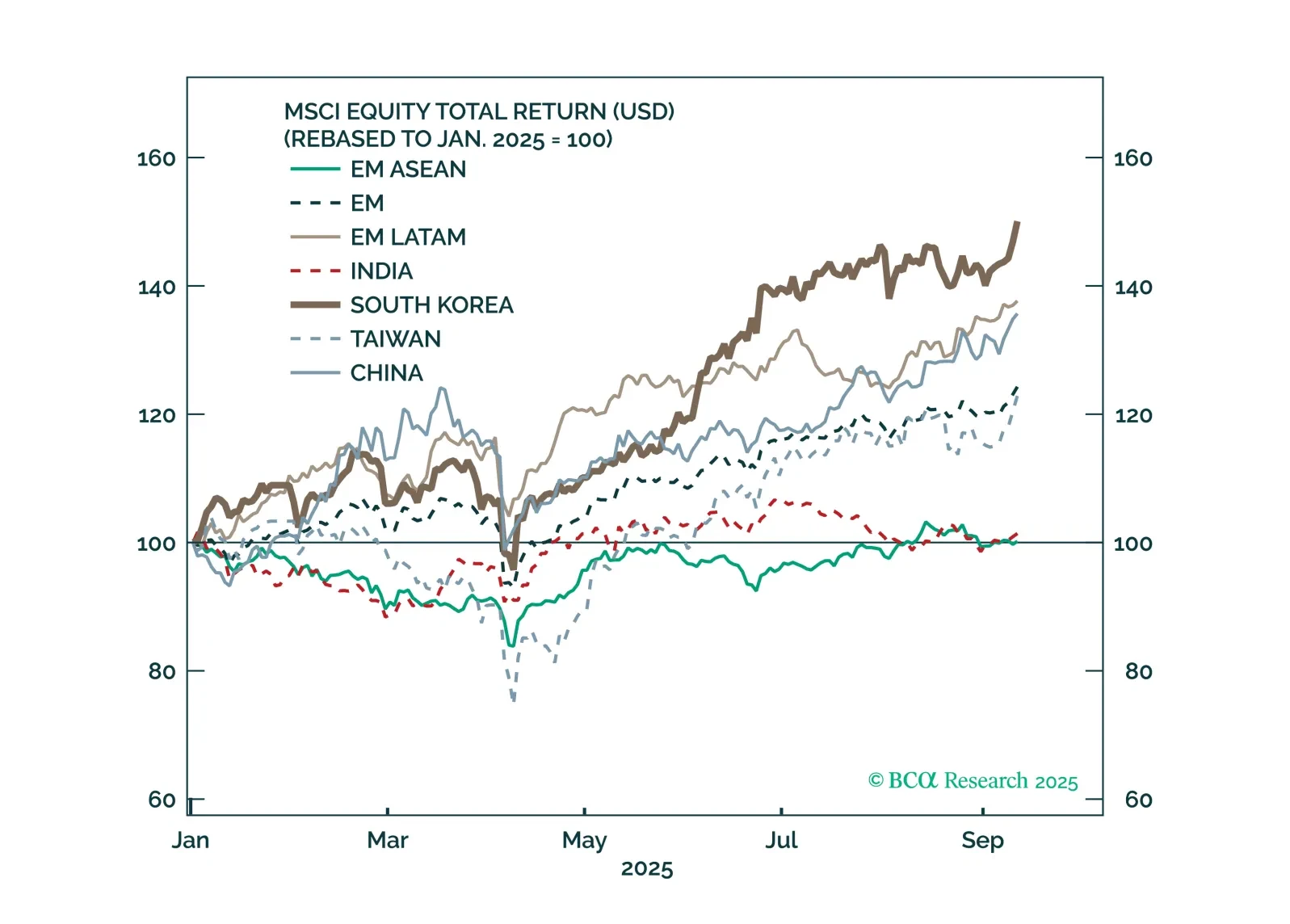

A world of political churn favors safe havens — buy yen, stay overweight US stocks, and avoid chasing the fragile rally in China.

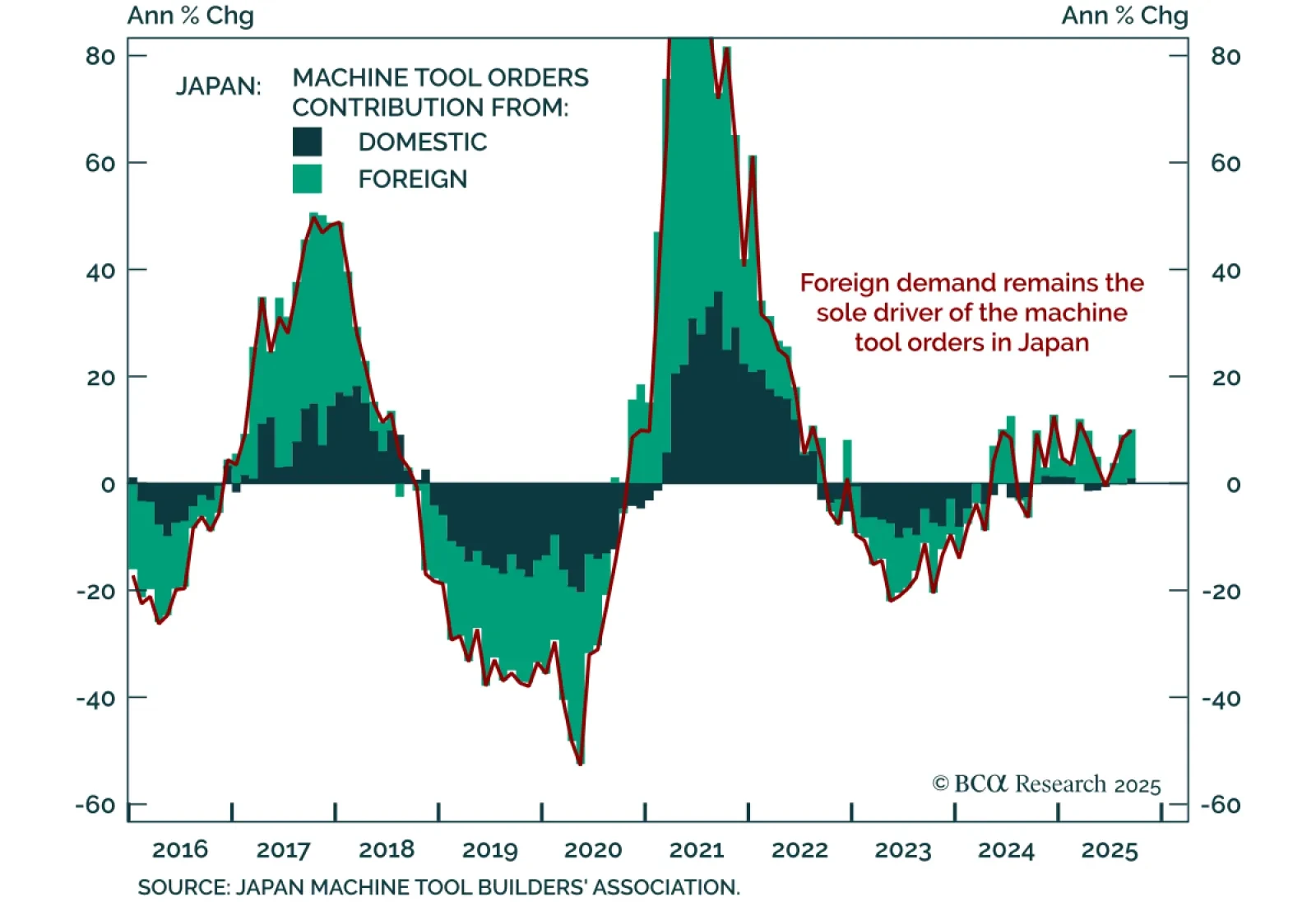

Japan’s September machine tool orders rose 9.9% year-on-year to a six-month high, led by a 13% jump in foreign exports, reinforcing the growing tailwind for Japan’s industrial sector and supporting a structural overweight yen…

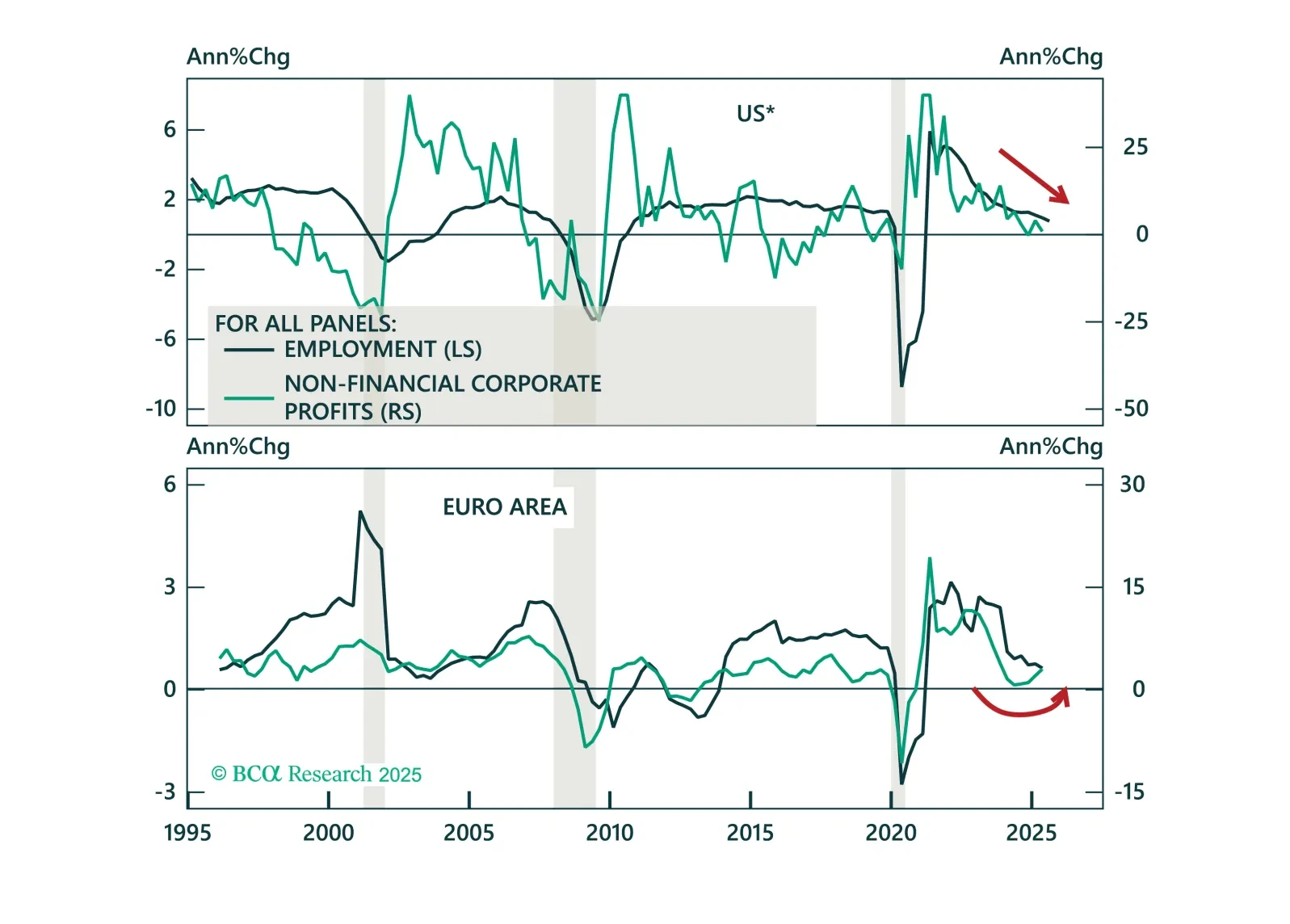

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

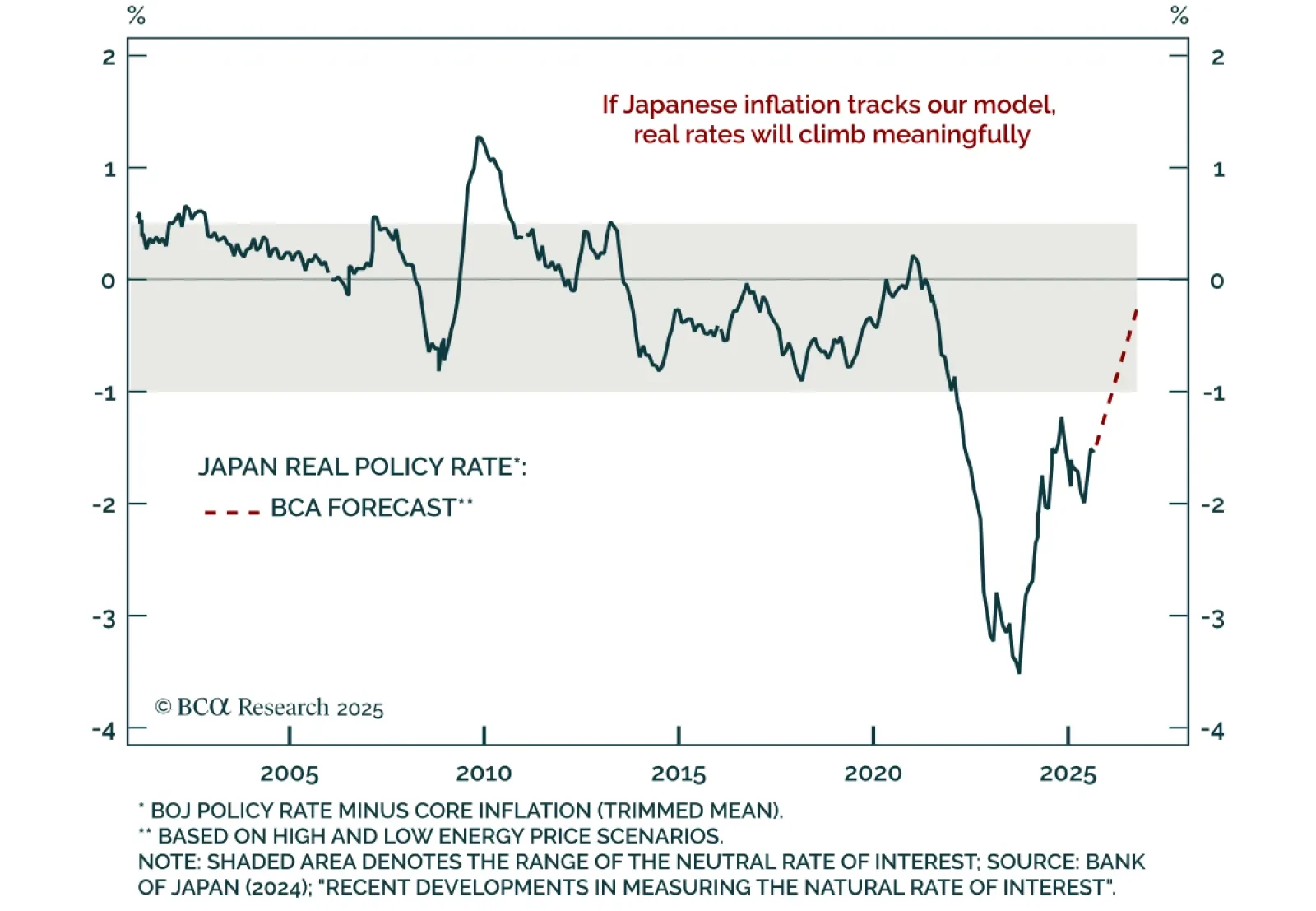

Japanese markets reacted sharply to Sanae Takaichi’s election as the leader of the ruling Liberal Democratic Party and the frontrunner to become Japan’s next Prime Minister. The Nikkei surged 4.8% and the yen plunged nearly 2% across…

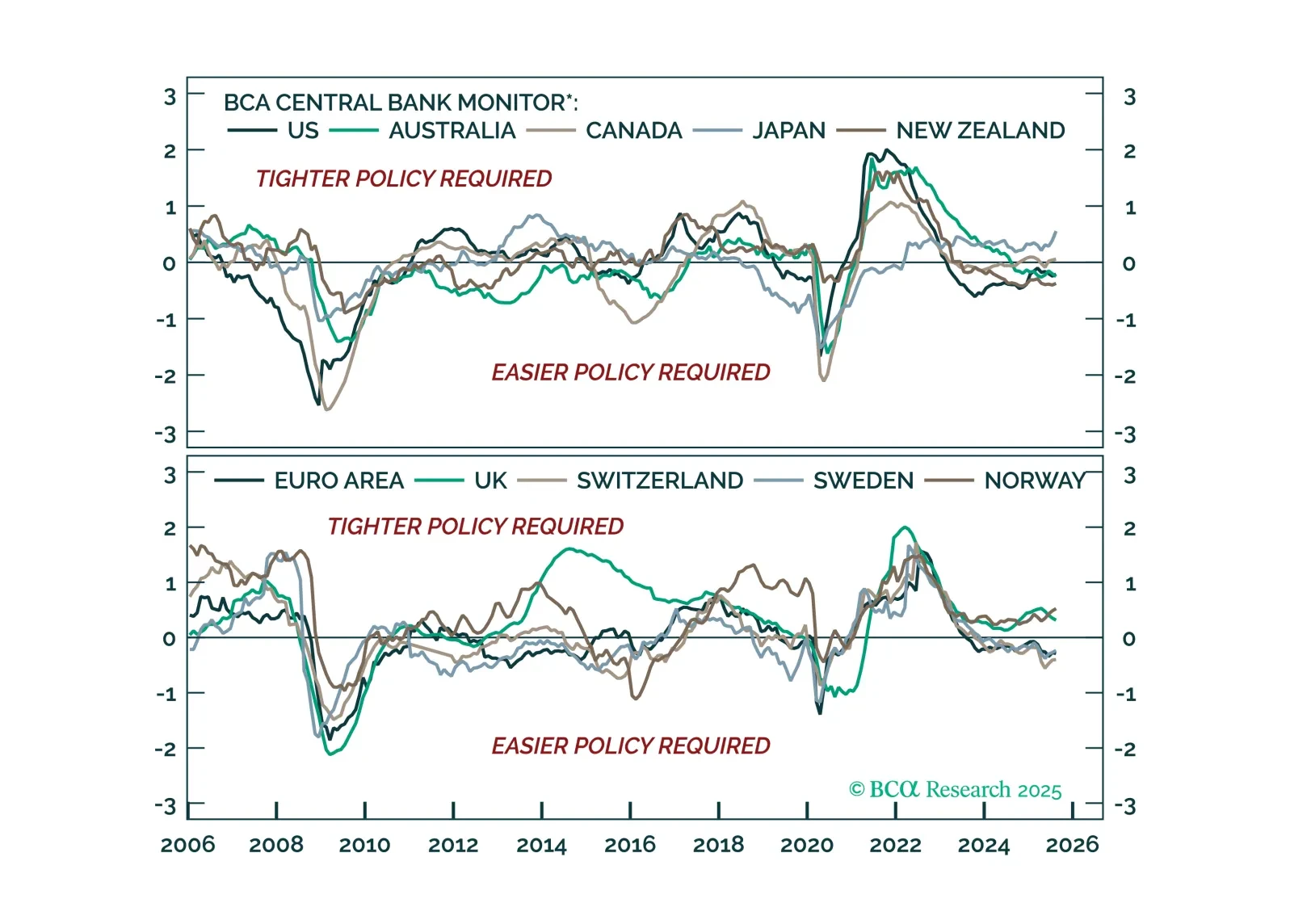

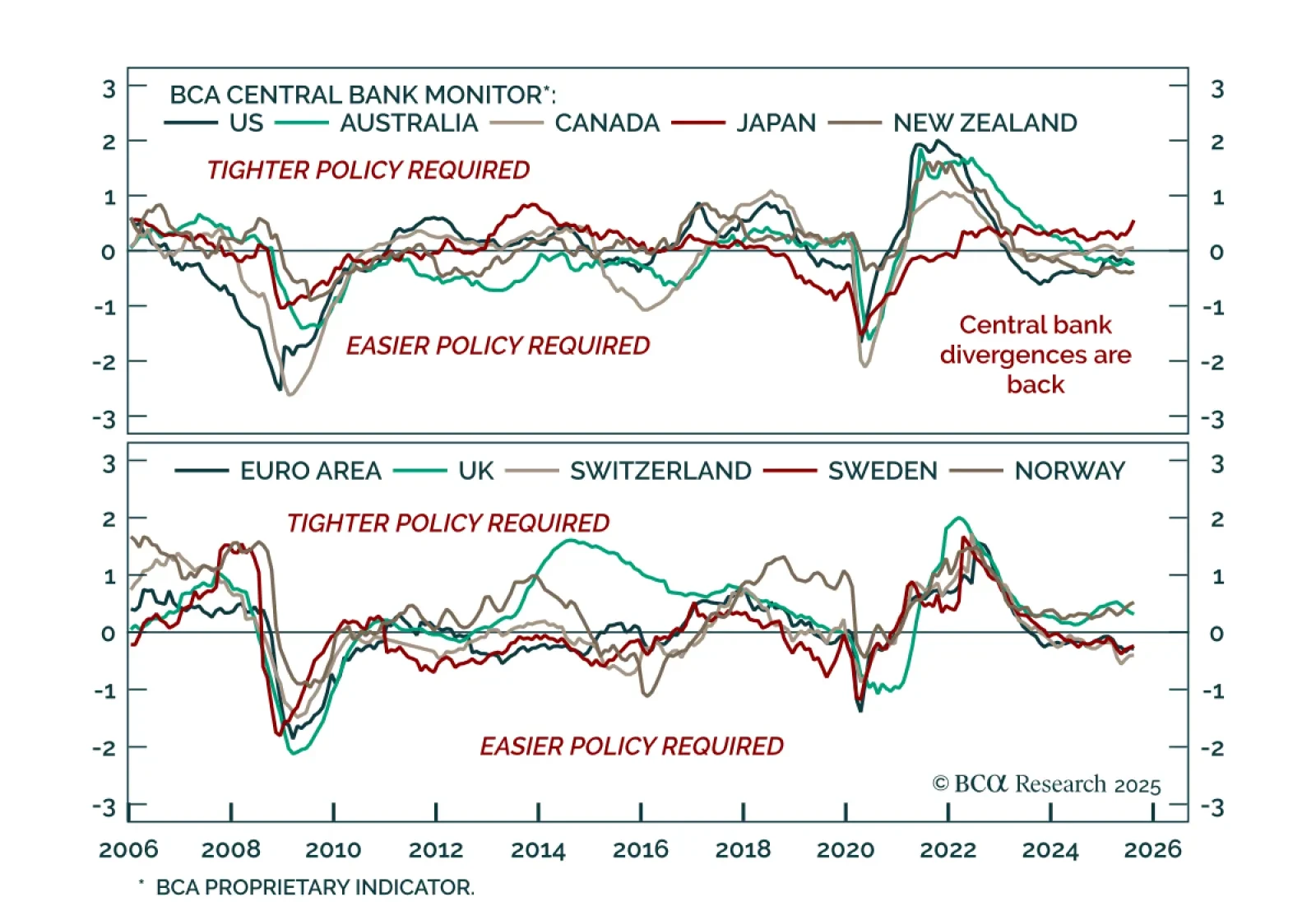

Our DM strategists recommend regional bond overweights in the UK, Canada, and Sweden, and express policy divergence through tactical FX trades: long USD, underweight GBP and SEK, and long JPY vs. EUR. Most G10 central banks are…

Monetary policy divergences are re-emerging. We rely on BCA’s Central Bank Monitor to assess the current policy stance of major central banks, and highlight the tactical opportunities across bond markets and currencies.

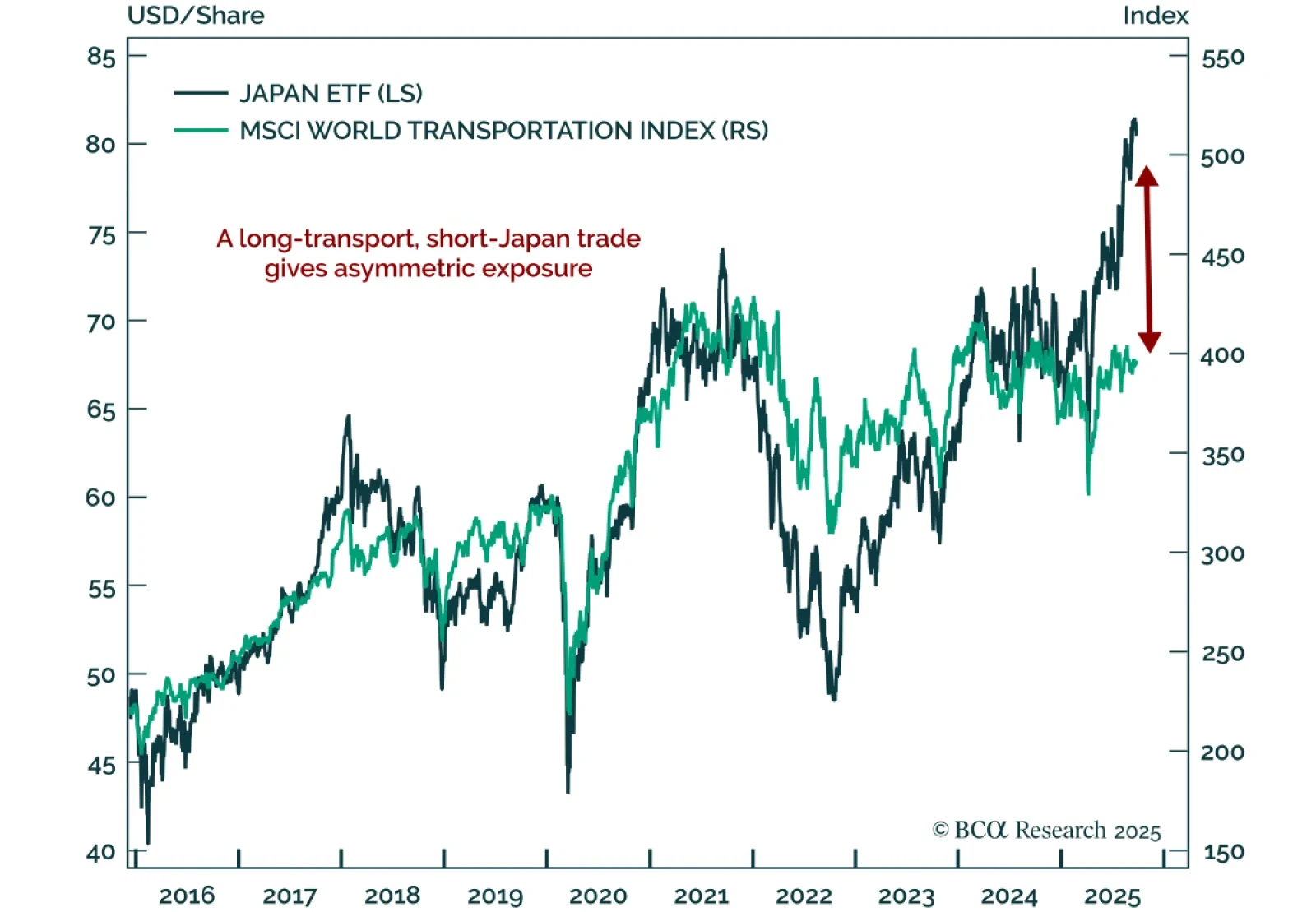

Sell Japanese equities and buy global transportation stocks to capture an overdue mean-reversion in trade-exposed assets. Our Chart Of The Week comes from Mathieu Savary, Chief DM ex. US Strategist. The post-Liberation Day…

Political instability across Asia is colliding with the trade war fallout, forcing Southeast Asian economies to ease monetary and fiscal policy, while pushing the Bank of Japan in the opposite direction.