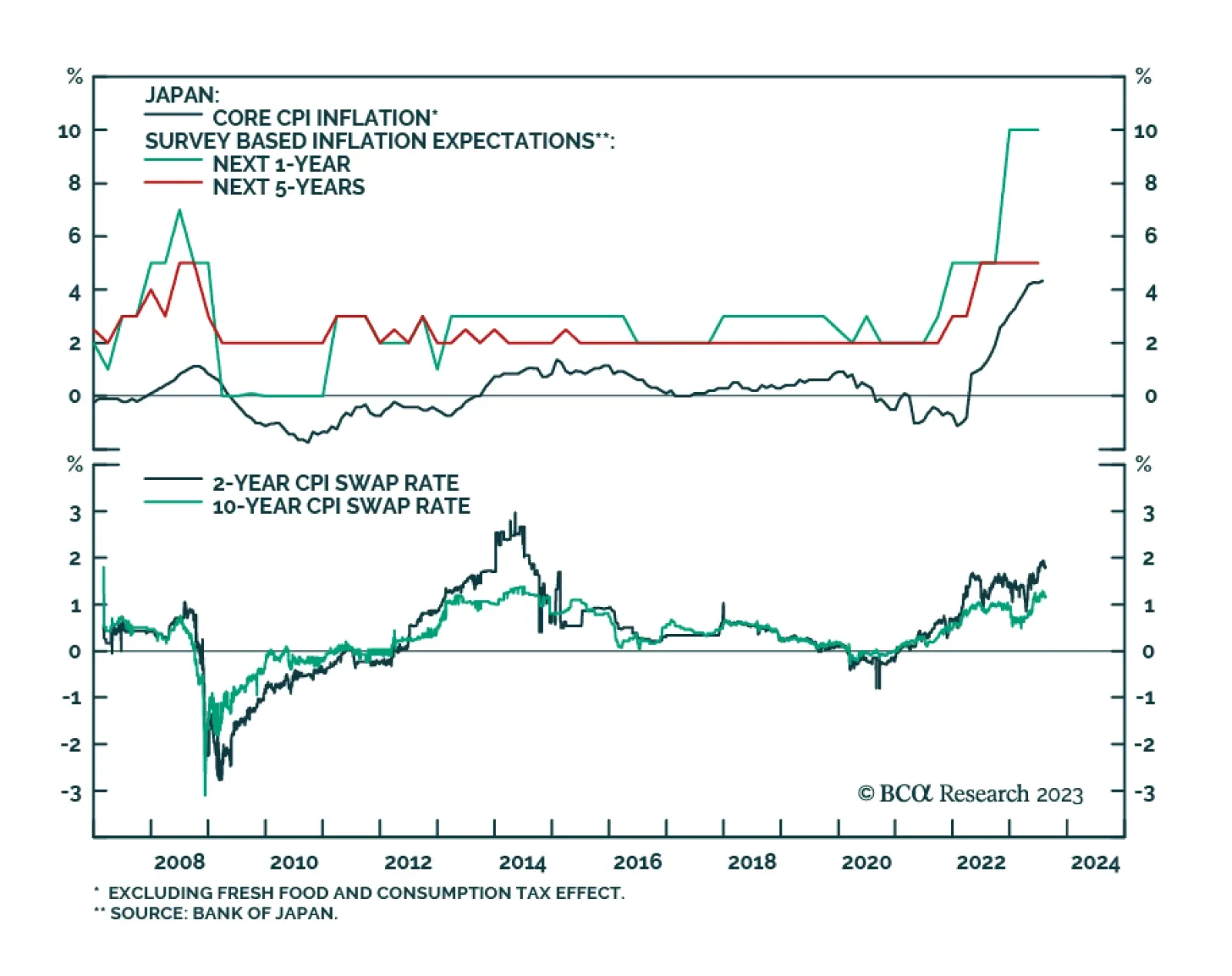

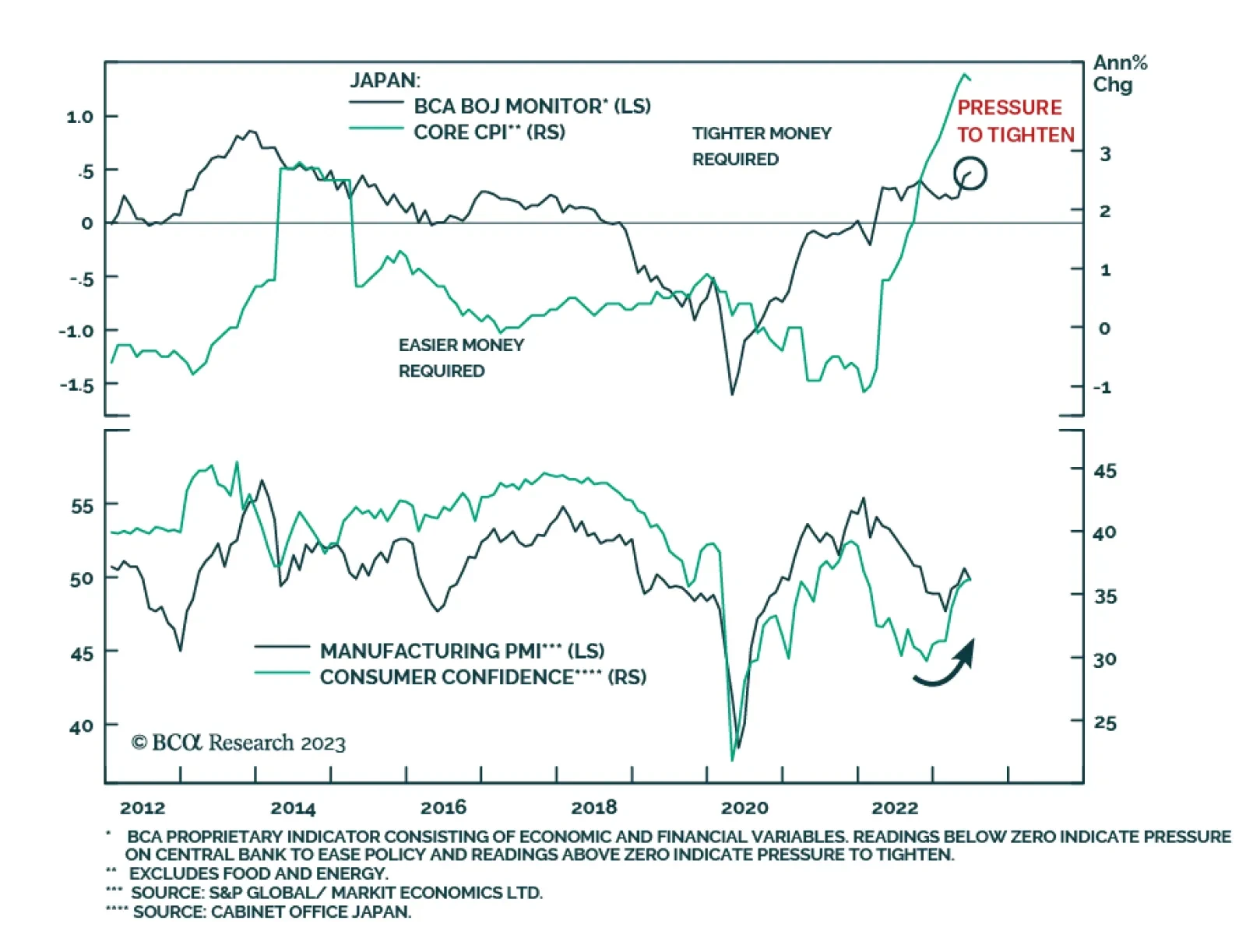

According to BCA Research’s Foreign Exchange Strategy and Global Investment Strategy services, most indications of Japanese inflation are pointing to upside surprises. This will boost interest-rate differentials in…

In this special report, we discuss whether the economic conditions necessary for a stronger yen (and higher JGB yields) will materialize over the next 12-to-18 months.

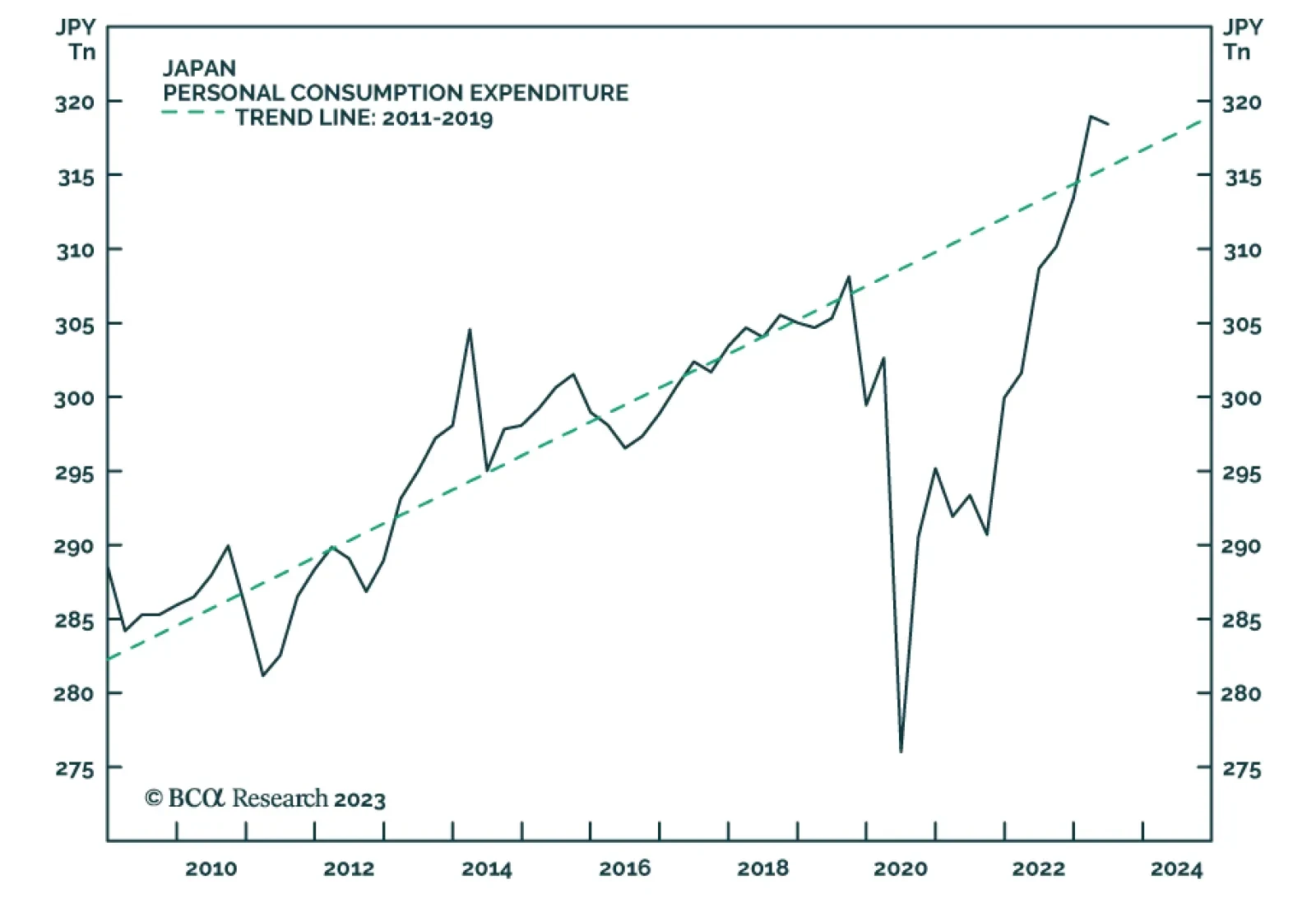

Japanese real GDP grew at an annualized pace of 6% year-on-year in Q2. Reading the tea leaves from the release, public investment rose by 5% quarter-on-quarter annualized, while residential investment jumped by a whopping 7.7%.…

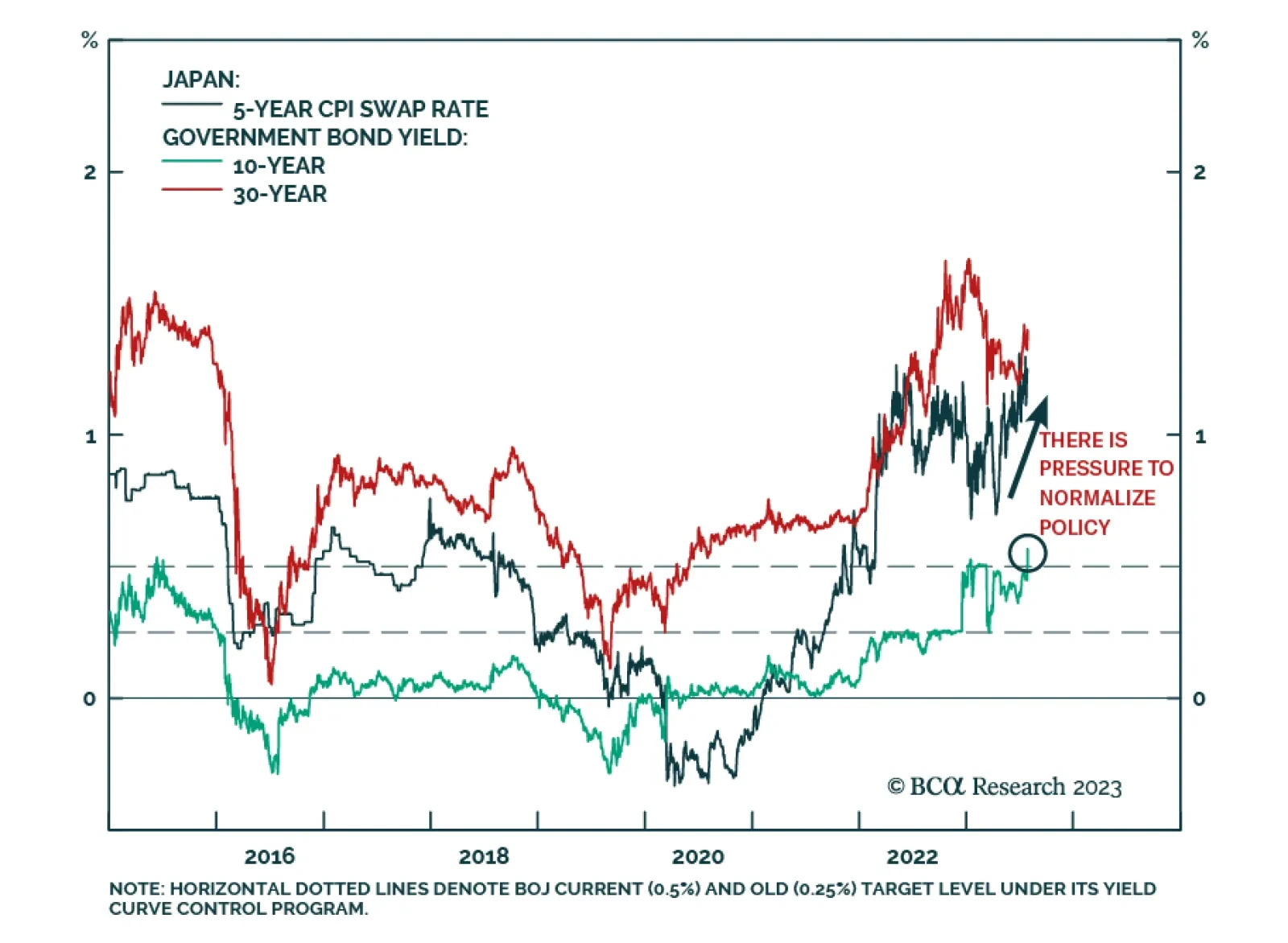

On Friday, the Bank of Japan announced an important tweak to its yield curve control (YCC) program. Although it maintained the 0.5% cap on 10-year bond yields, it indicated that it will manage the program with “greater…

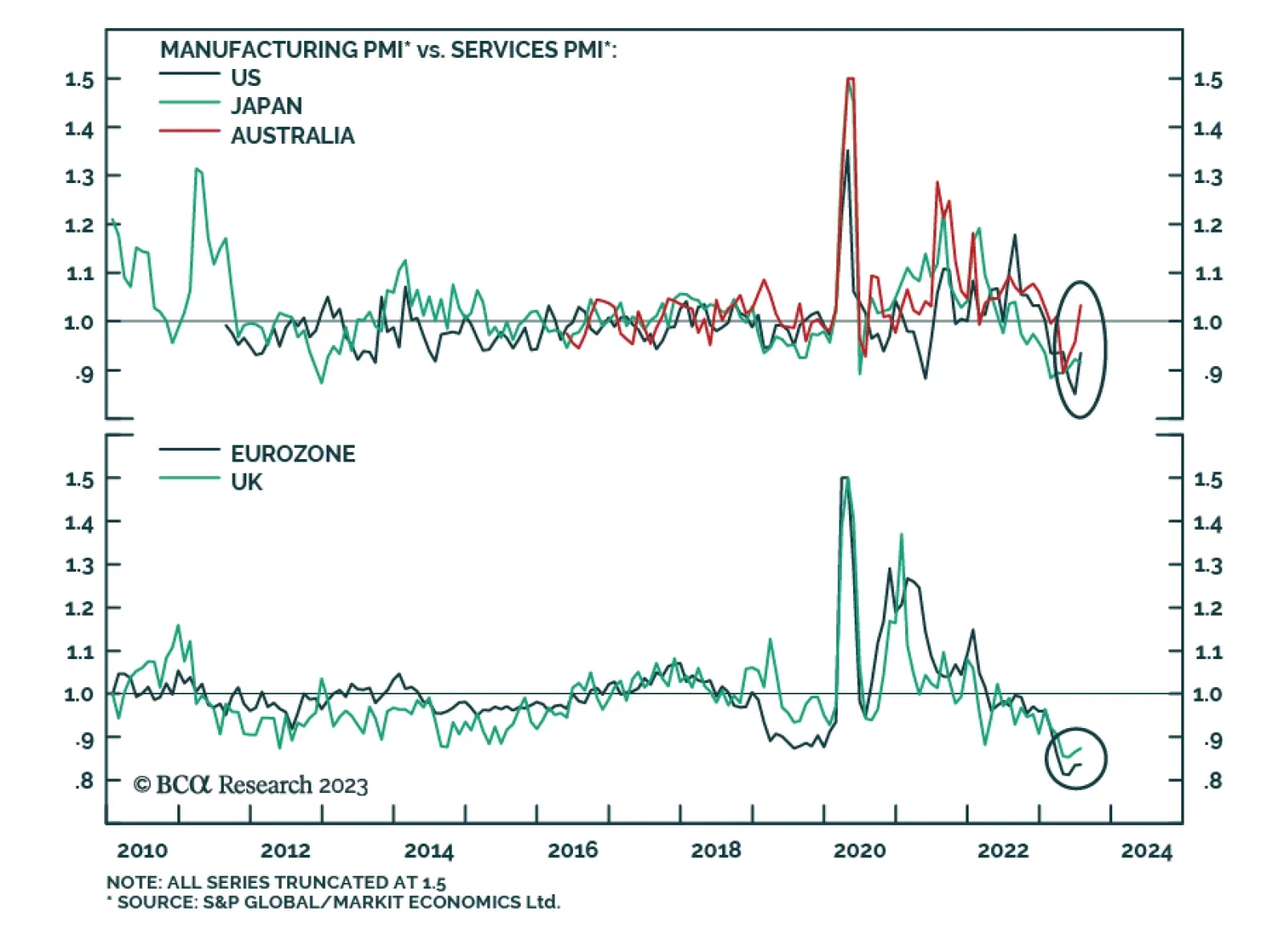

The DXY will continue to have near-term upside, as economic growth holds up in the US, while it deteriorates in other parts of the world. Remain constructive on the DXY at current levels, but pivot to a short position on evidence US…

The US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. Any further increase in inflation risk would prompt us to turn more cautious on stocks.

Flash PMIs sent a mixed signal about manufacturing and service sector conditions across DM economies in July. The Euro Area release was particularly weak. An unexpected 0.7-point decline in the Manufacturing PMI and a 0.9…

In this report, we present our performance review of the BCA Research Global Fixed Income Strategy (GFIS) model bond portfolio for the Q2/2023, and the outlook and scenario analysis for the next six months. The portfolio return…

The Japanese yen slid by 2.1% vis-à-vis the US dollar last week, reversing the prior week’s rally. This latest bout of weakness comes on the back of speculation that the Bank of Japan will keep policy unchanged at…