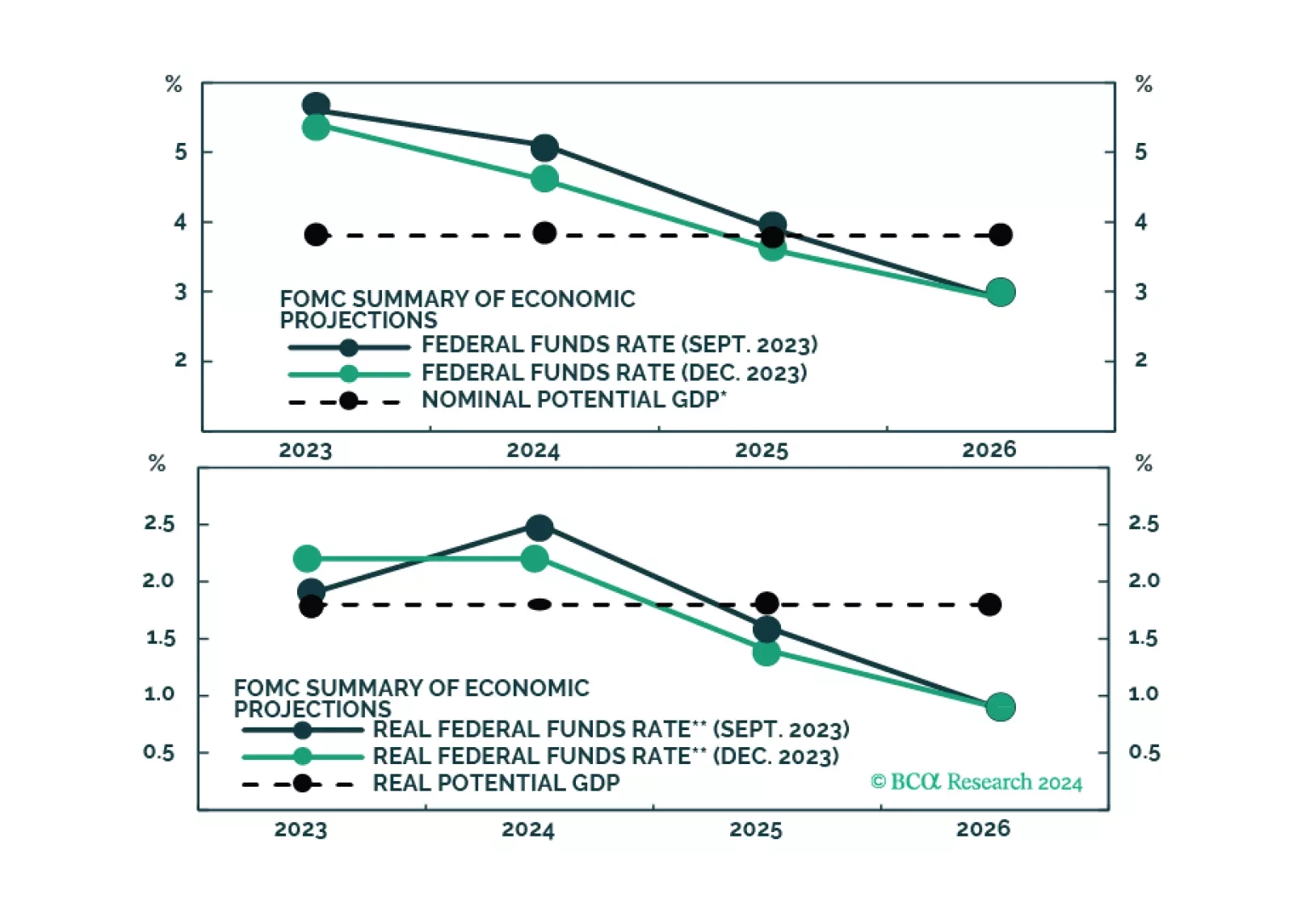

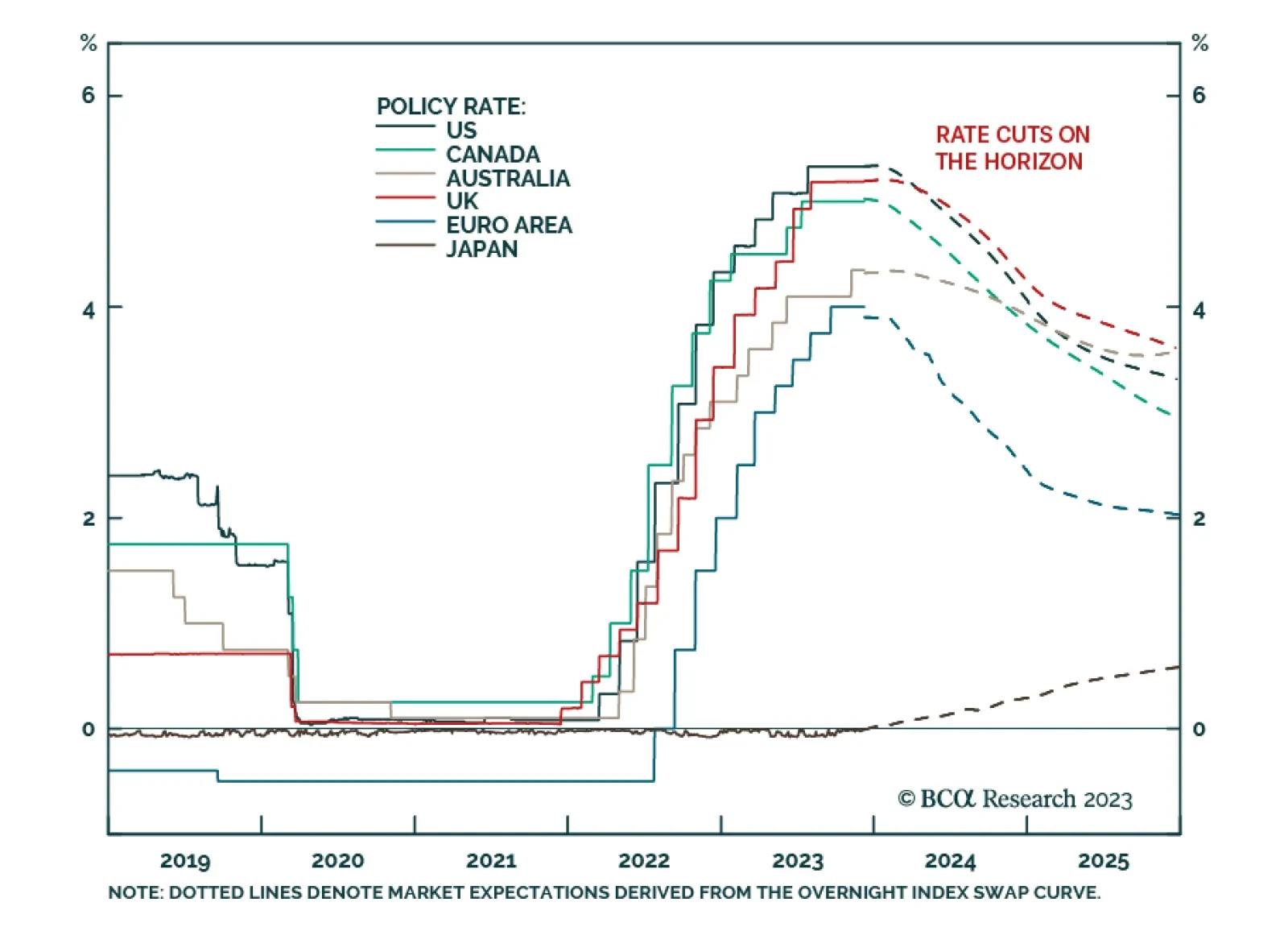

The market is excited by the idea that the Fed will cut rates early this year, even without a recession. But is that likely, with inflation still set to be around 2.8% mid-year?

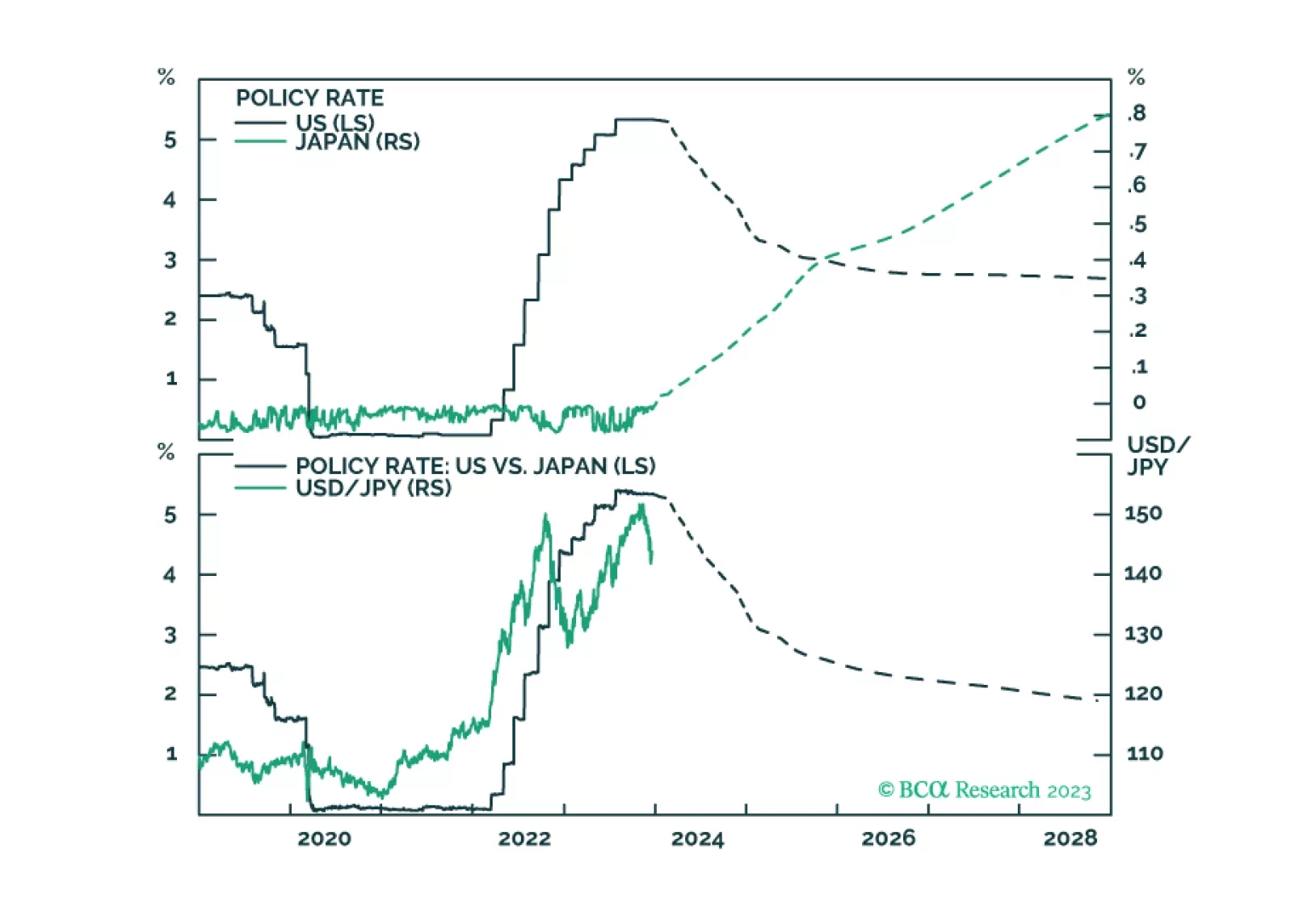

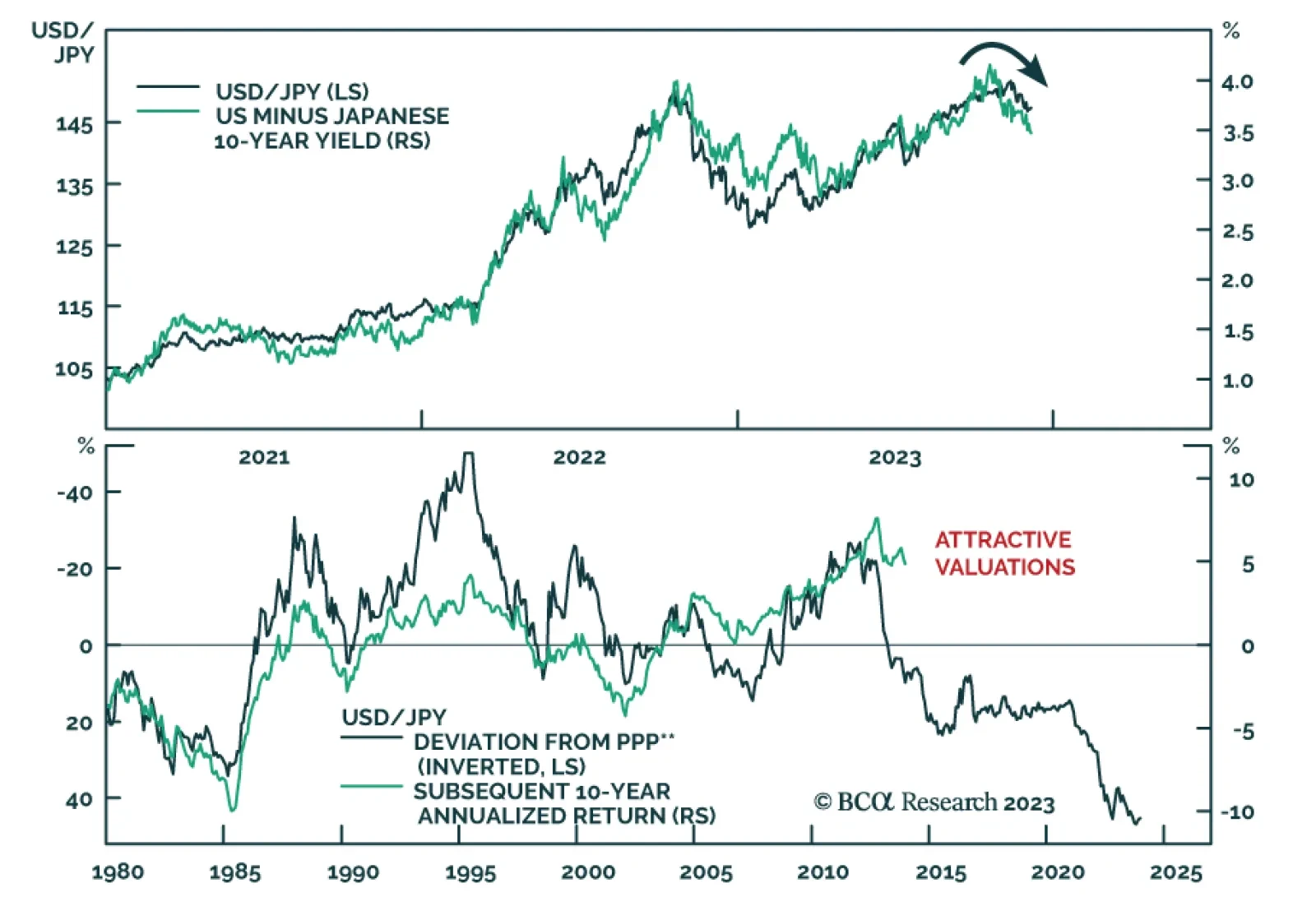

A post-mortem of our trades for the year, and also comments on future yen and sterling moves from the recent BoJ meeting, and the UK inflation report.

Multiple major DM central banks are scheduled to decide on monetary policy this week. The US Fed will meet on Wednesday, followed by the ECB, BoE, and Norges Bank on Thursday. It comes after the BoC and RBA both opted to keep…

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

The Japanese yen strengthened considerably on Thursday after comments by Bank of Japan (BoJ) Governor Kazuo Ueda caused investors to bring forward their expectation of the timing of the end of negative rates. In particular, Ueda…

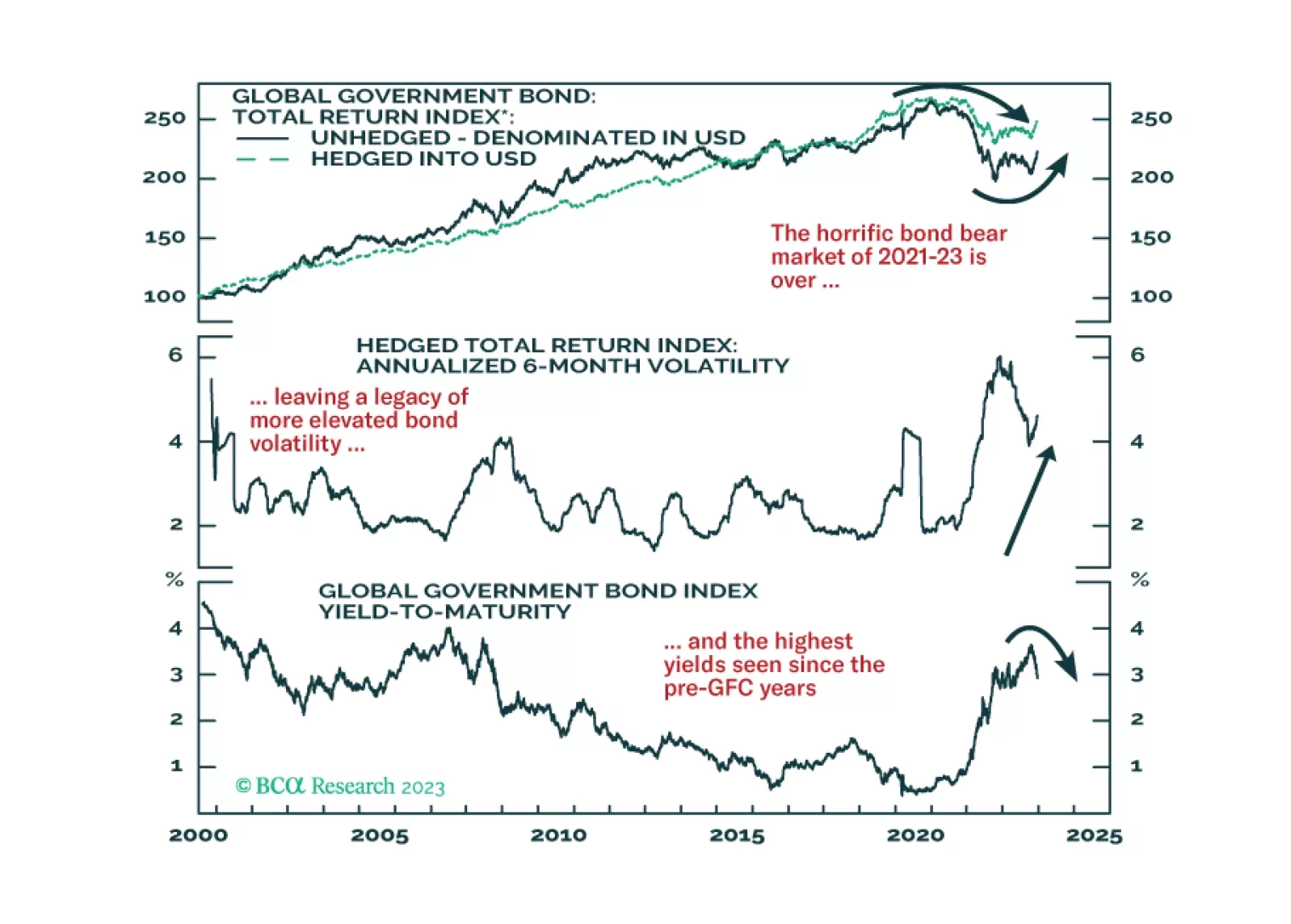

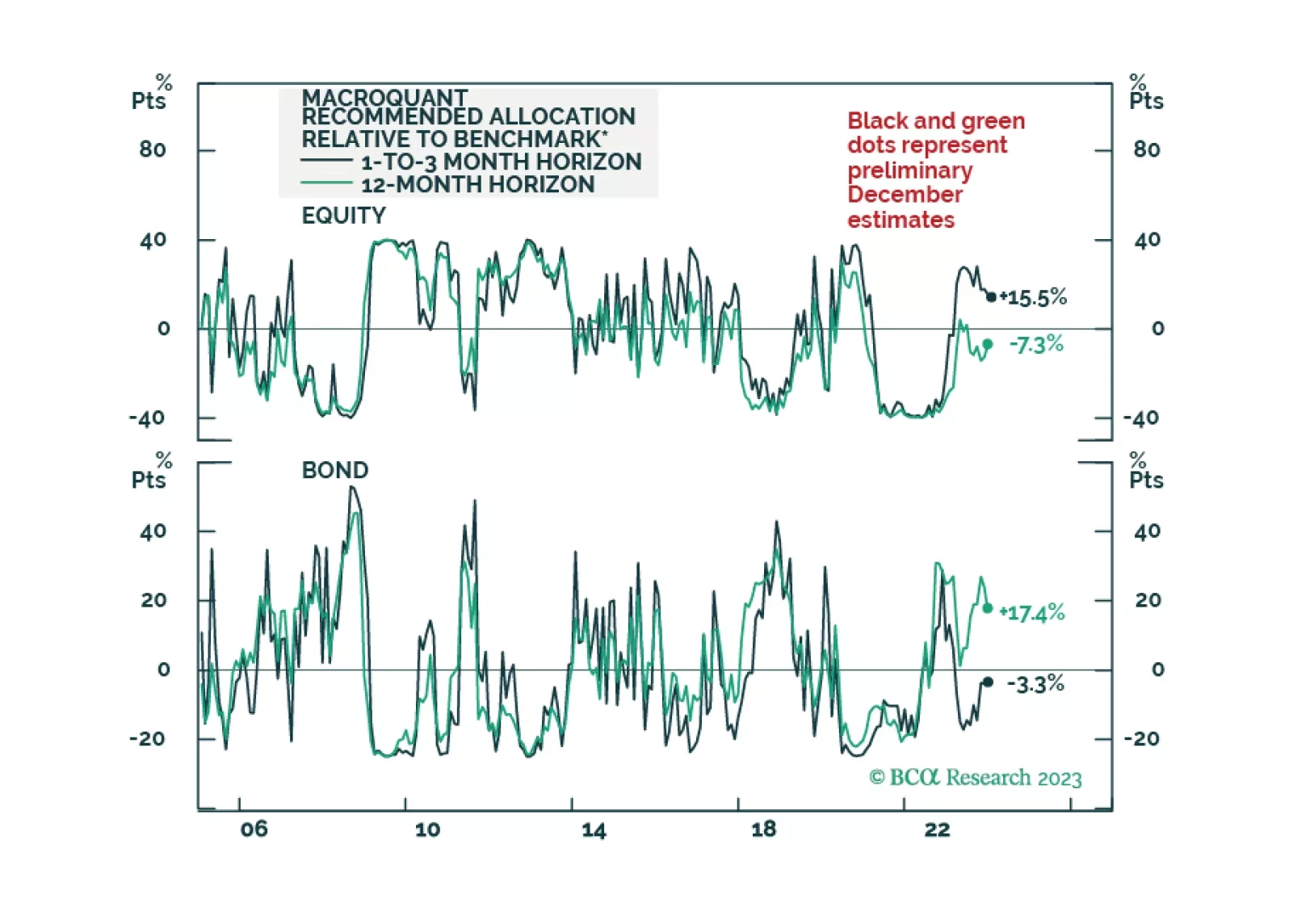

Inflation won’t fall fast enough for the Fed to cut rates preemptively before recession arrives. The risk/rewards balance is unfavorable for risk assets. Stay overweight bonds versus equities.

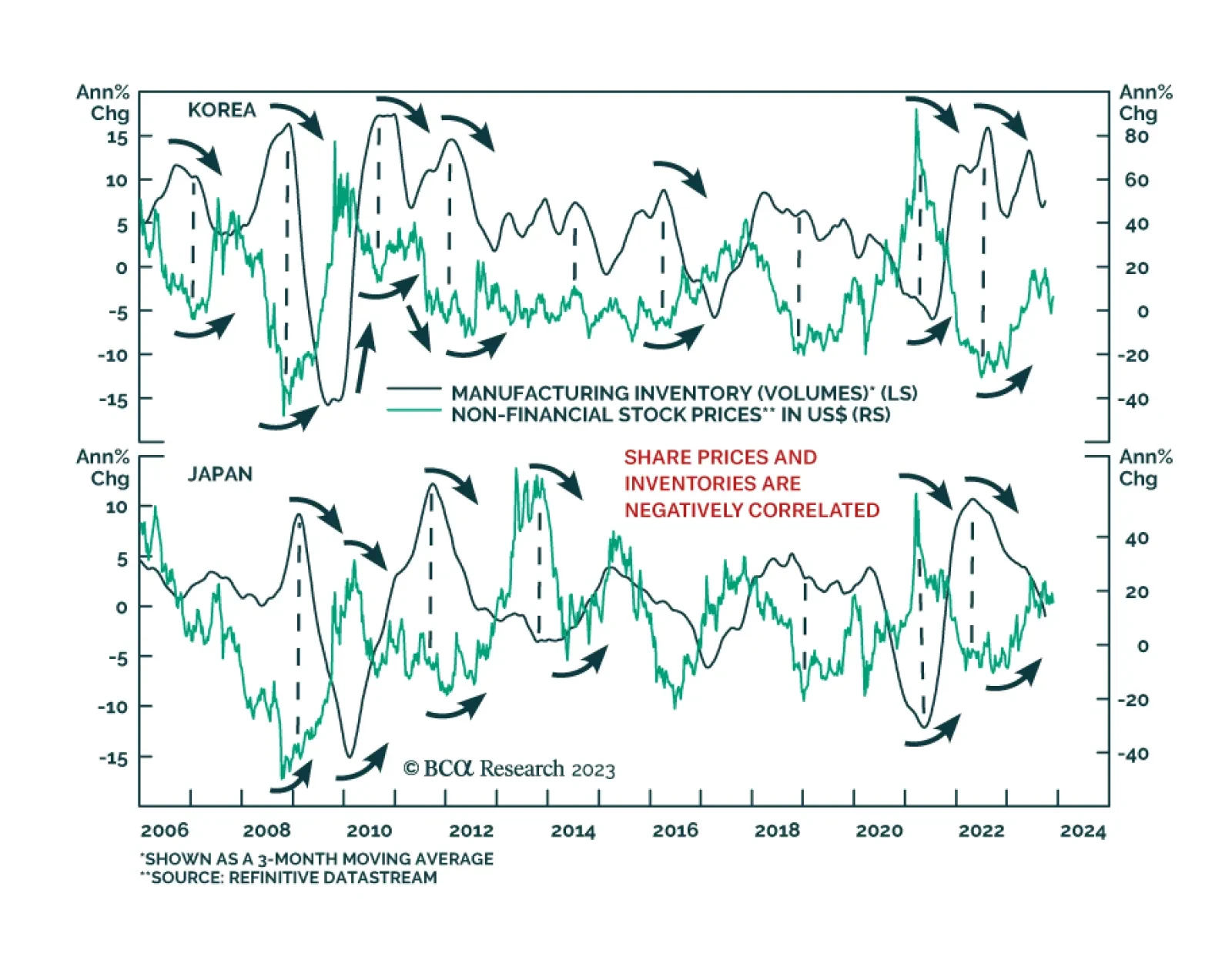

According to BCA Research's Emerging Markets Strategy service, investors should focus on fluctuations in final demand rather than inventories. A common narrative endorsed by many market participants is that inventory…

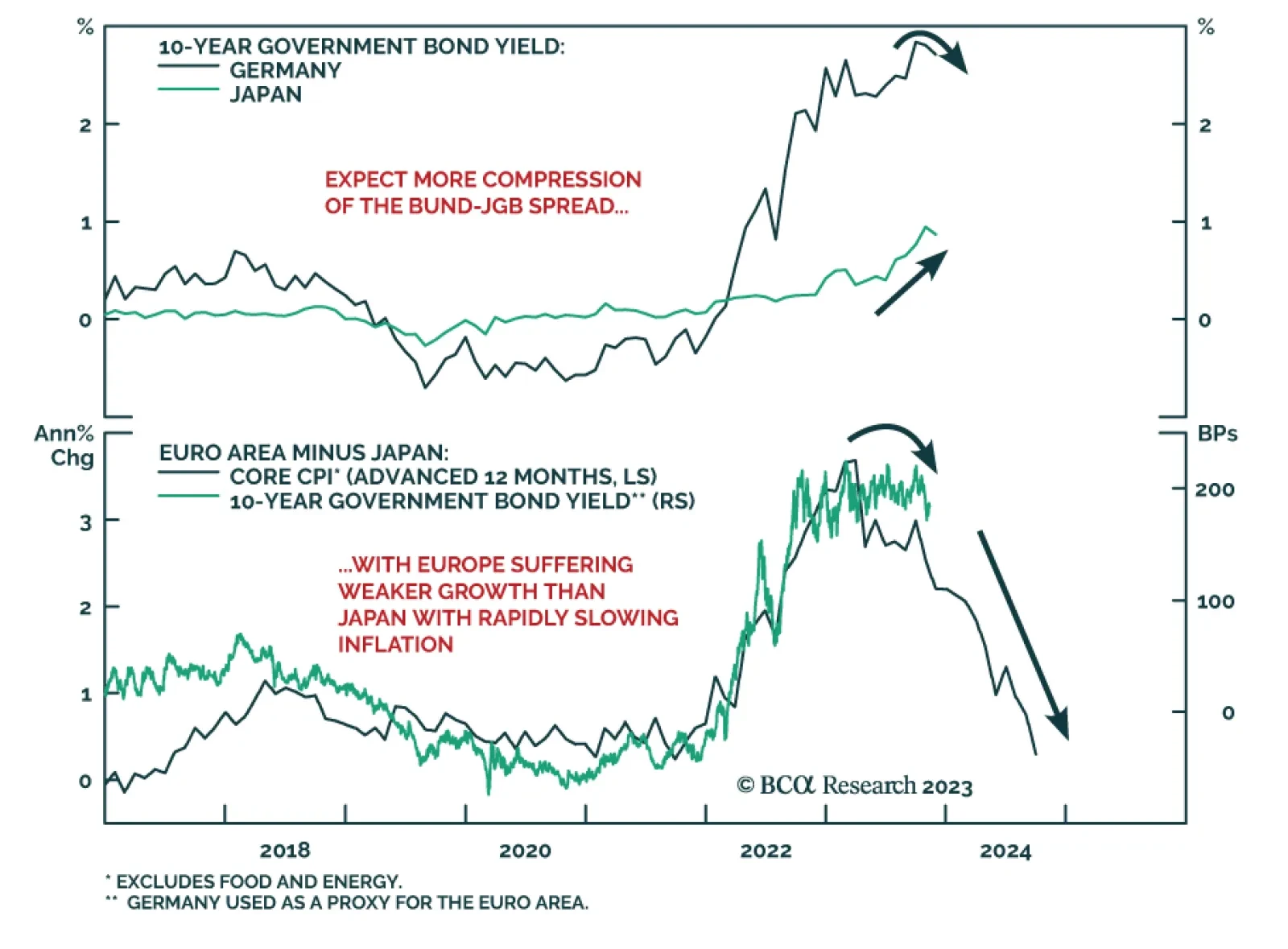

BCA Research’s Global Fixed Income Strategy service remains long 10-year German bunds vs short 10-year Japanese government bonds (JGBs) as a tactical trade. This trade mirrors the team's two highest conviction…