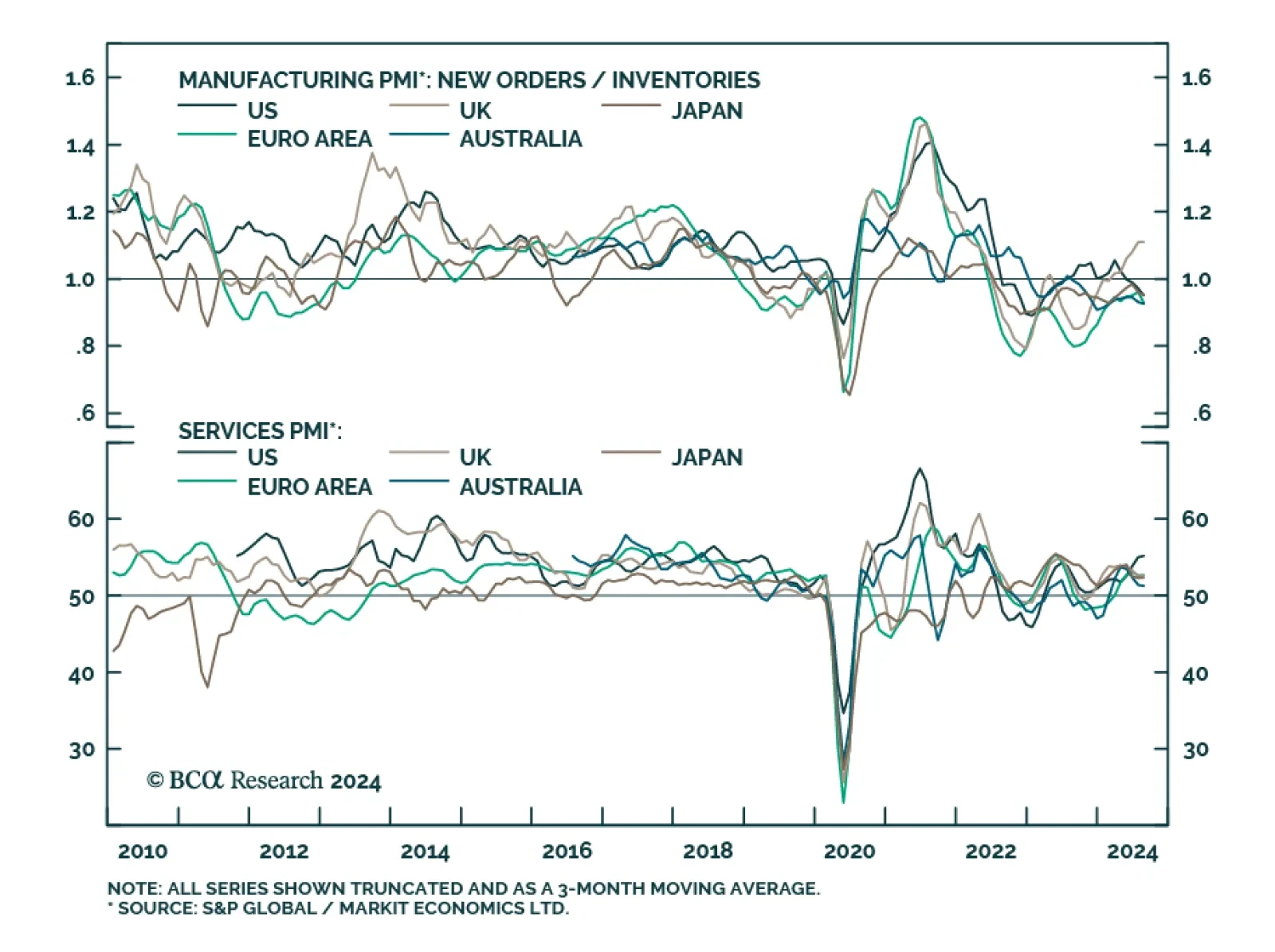

Preliminary estimates suggest that with the exception of the UK (see Country Focus), manufacturing activity remains lackluster in DM economies. Manufacturing declined at a slower pace in Japan and Australia but the contractions…

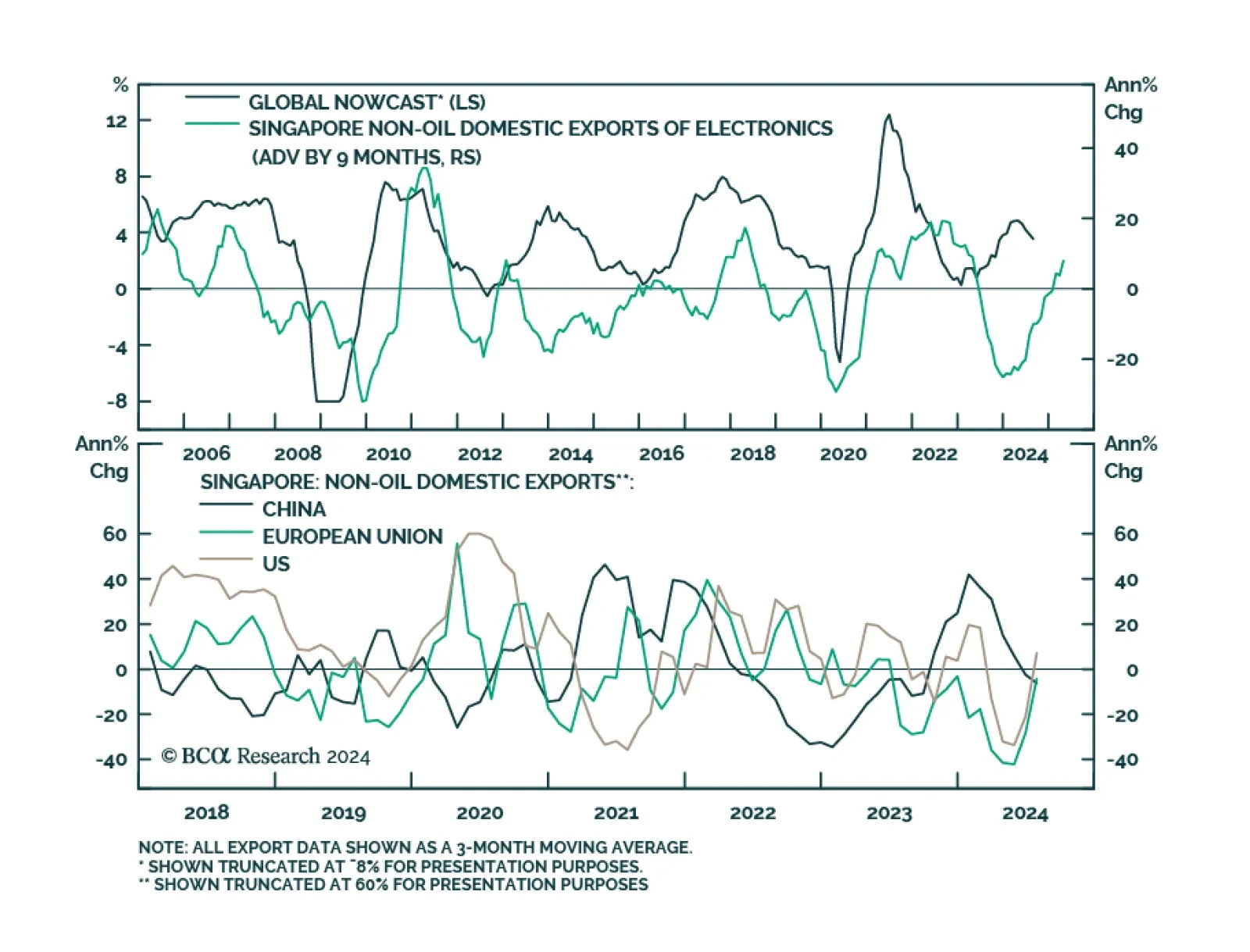

Singapore is a small open economy sensitive to global trade dynamics. Its non-oil exports (NODX) are thus a good bellwether for global growth conditions. They rebounded sharply in July from a previous contraction, largely…

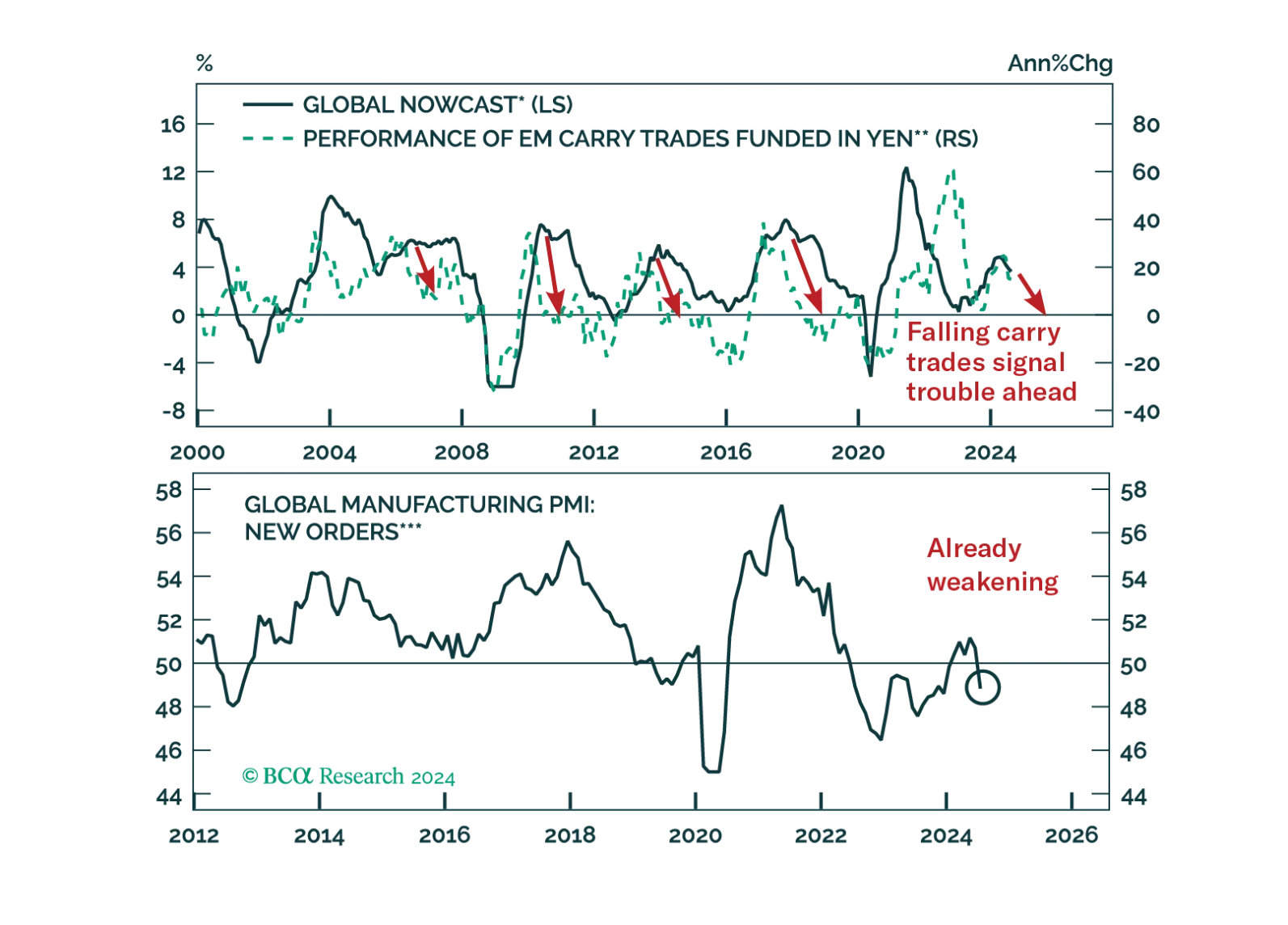

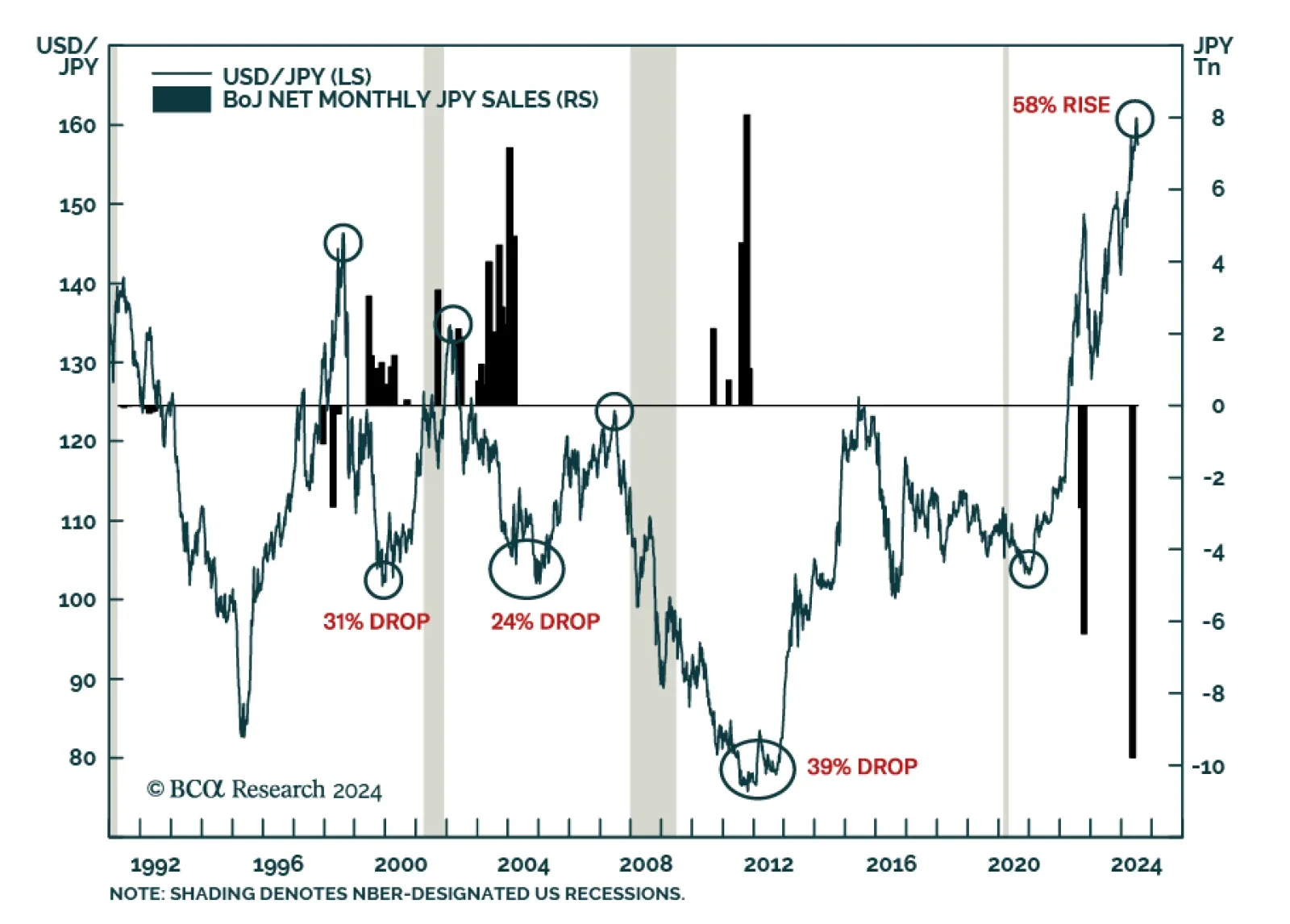

The unwind of yen carry trades caused violent tremors across the globe. Was this shock a one-off event or the prelude to more troubles?

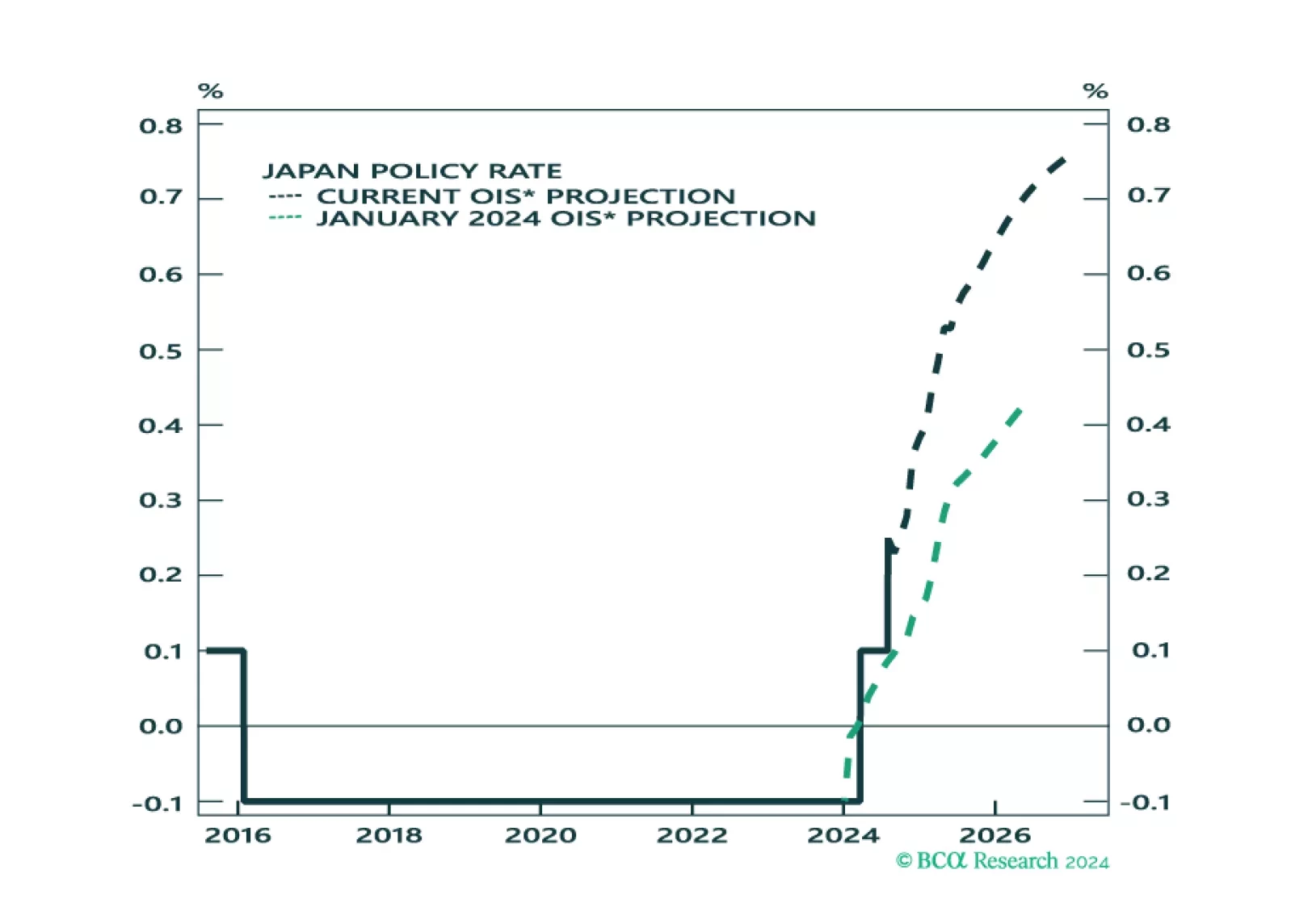

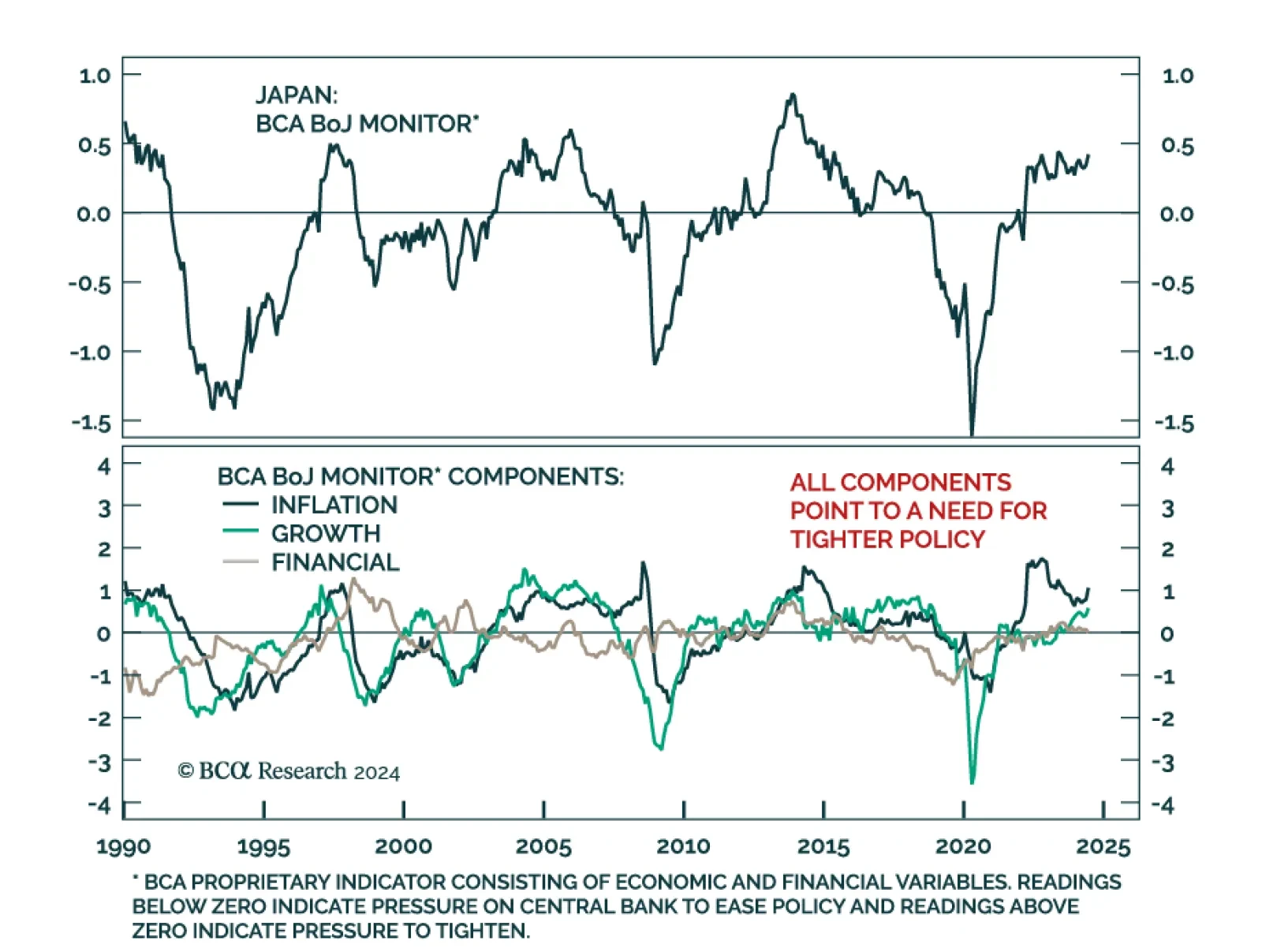

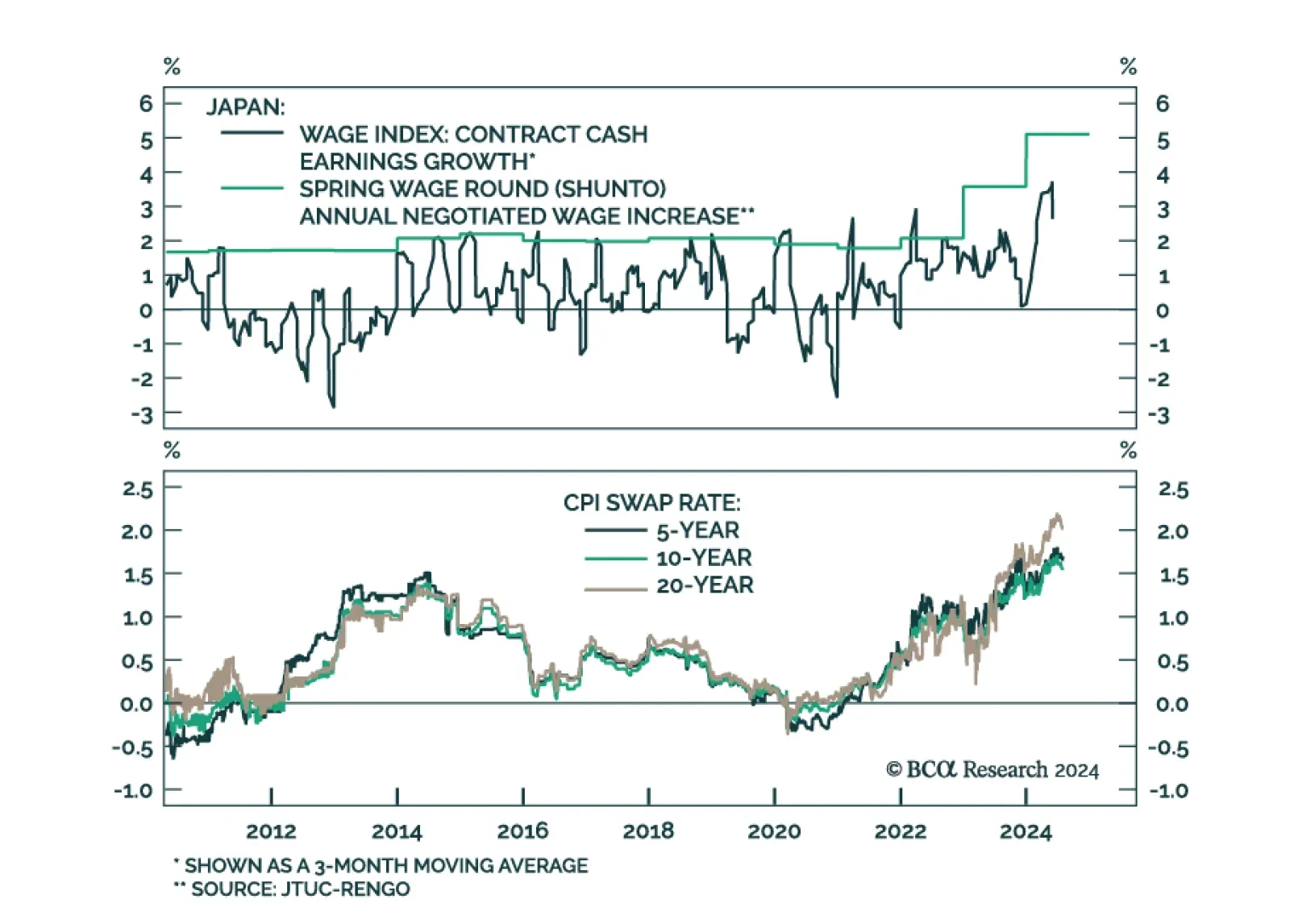

The BoJ delivered a surprise rate hike last week, then proceeded to sending a more dovish signal on Wednesday. Deputy Governor Shinichi Uchida strongly hinted at a central bank that would refrain from hiking further in times of…

The market is pricing in a soft landing, but we see growing signs that the global economy is faltering. Investors should be defensively positioned.

We assess the investment implications of the BoJ and Fed meetings, and give our take on the next policy moves. We also assess the impact on asset markets.

The Bank of Japan hiked its policy rate by 15 bps from 0.10% to 0.25% on Wednesday, and announced further quantitative tightening, reducing its pace of monthly bond buying from JPY 6 trillion to JPY 3 trillion. While the central…

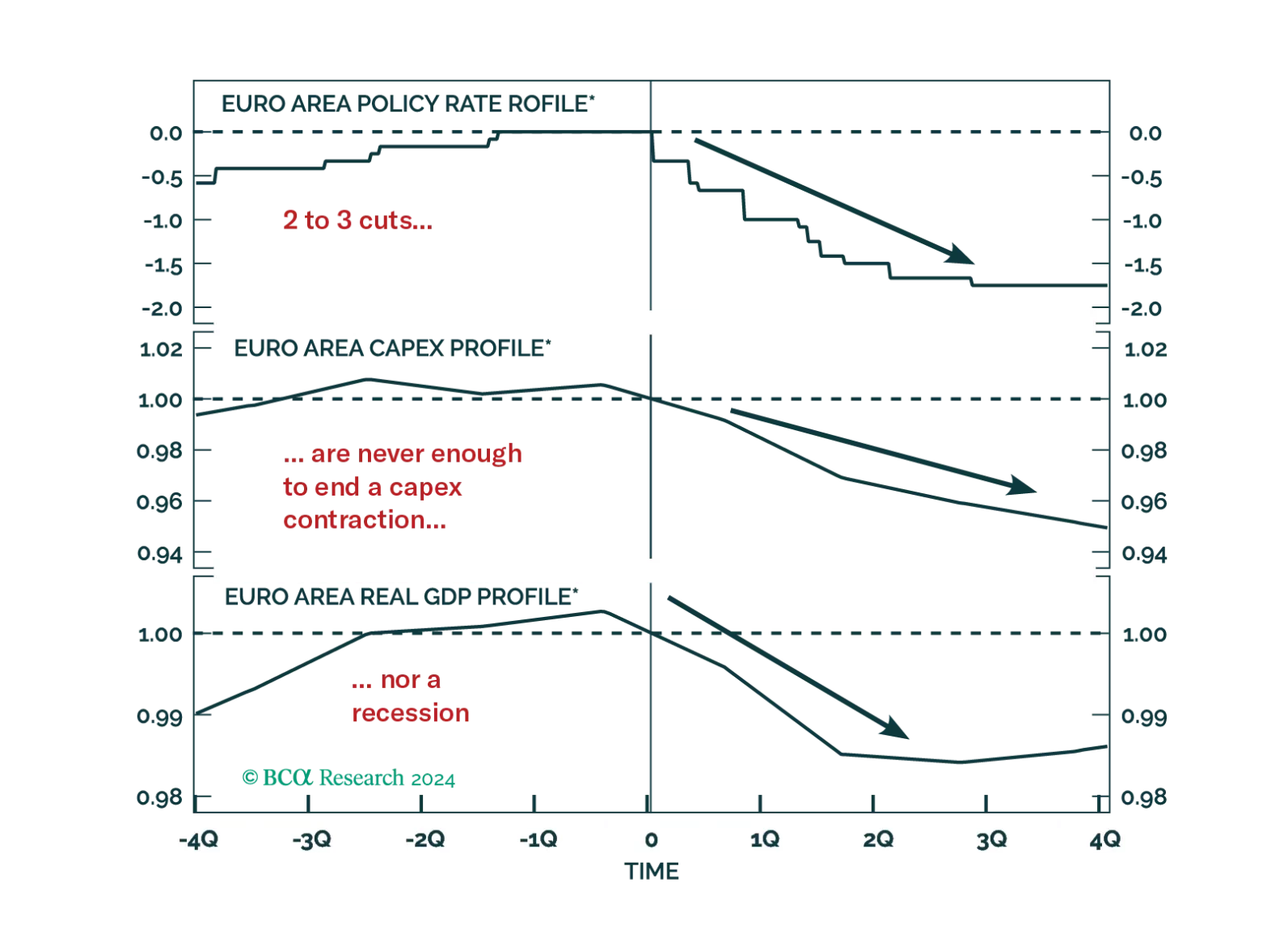

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

The yen rallied against most major currencies in July and has climbed close to 3.5% so far this month against the greenback. Resurfacing suspicion of central bank interventions to prop up the currency is one of the factors…

We review some of the key data releases this week that we find have an impact on our currency strategy. Long yen positions make sense today. Long sterling and the euro bets are more of a judgment call, and we will fade any strength…