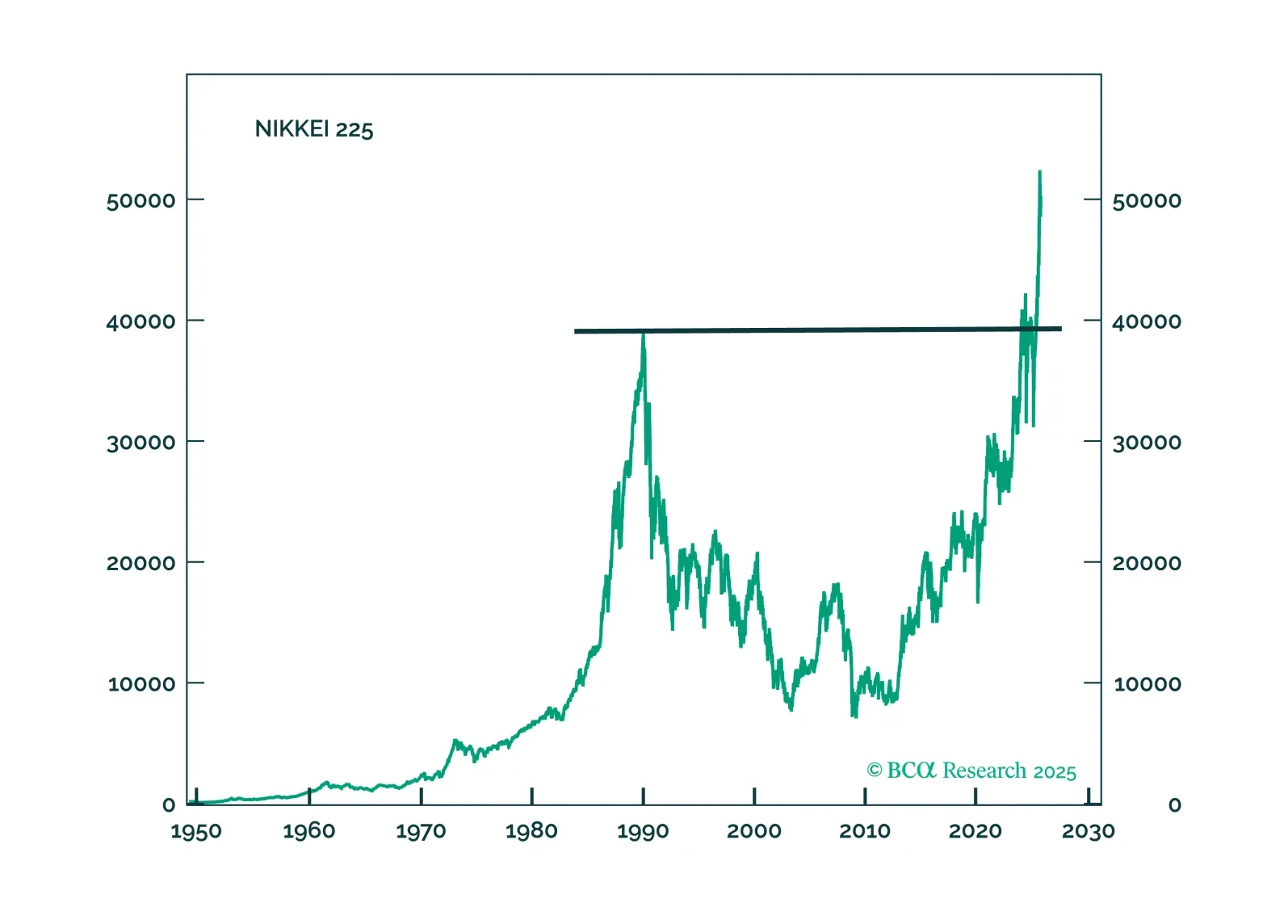

Japanese financial assets will finally have unfettered access to outsized returns. This performance will come in fits and starts, but we are comfortable laying our cards down on buying the yen, and Japanese industrial stocks.

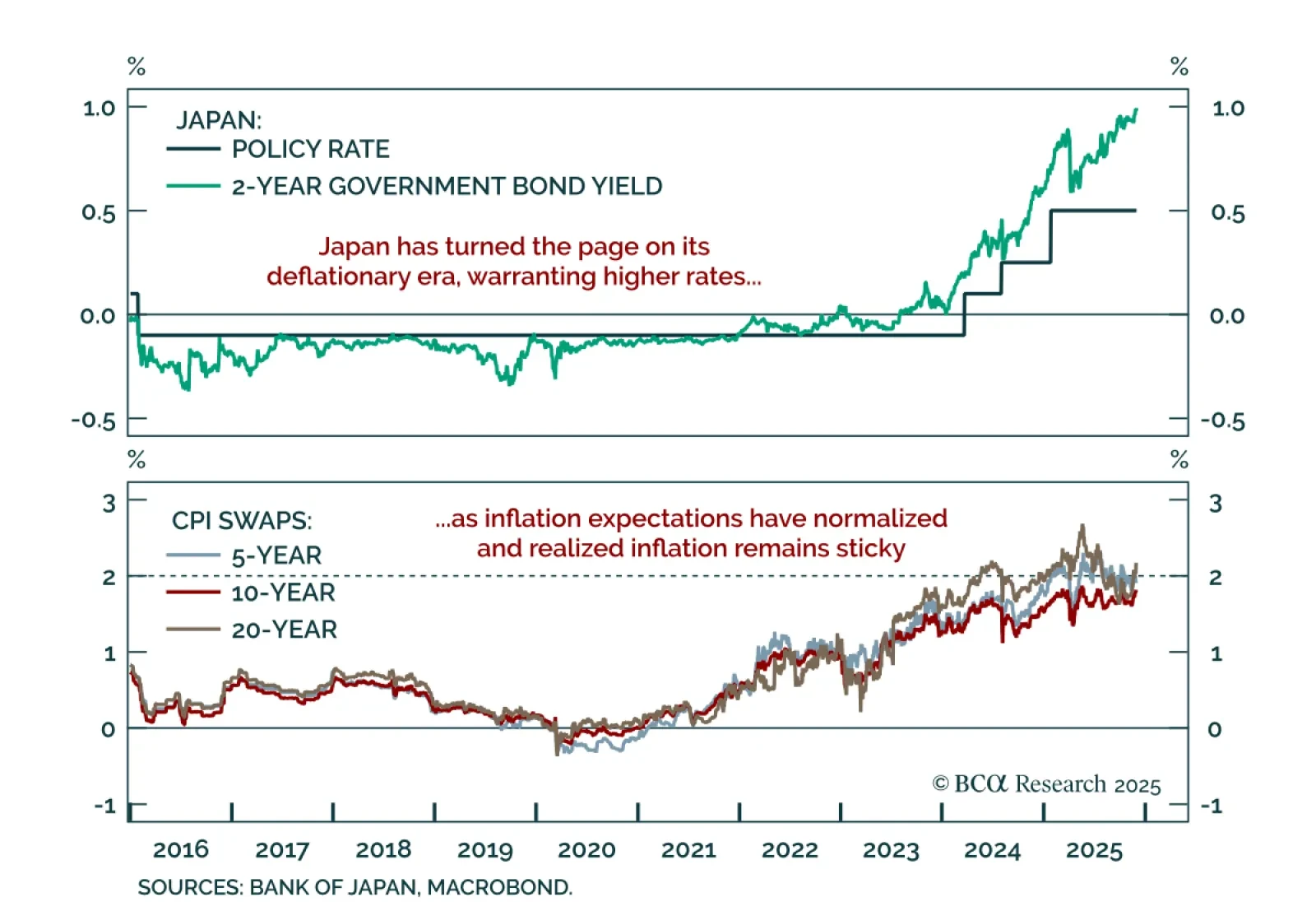

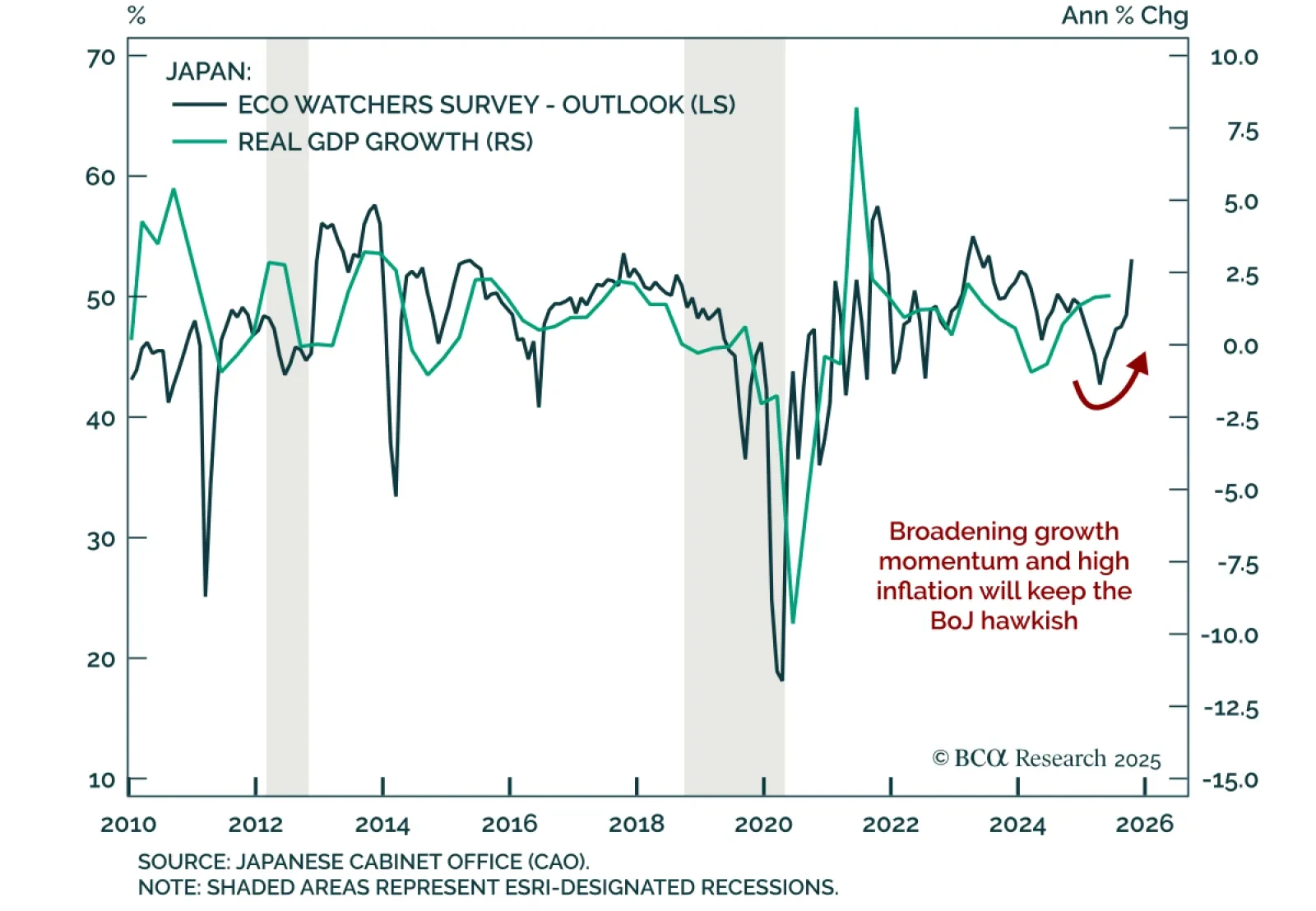

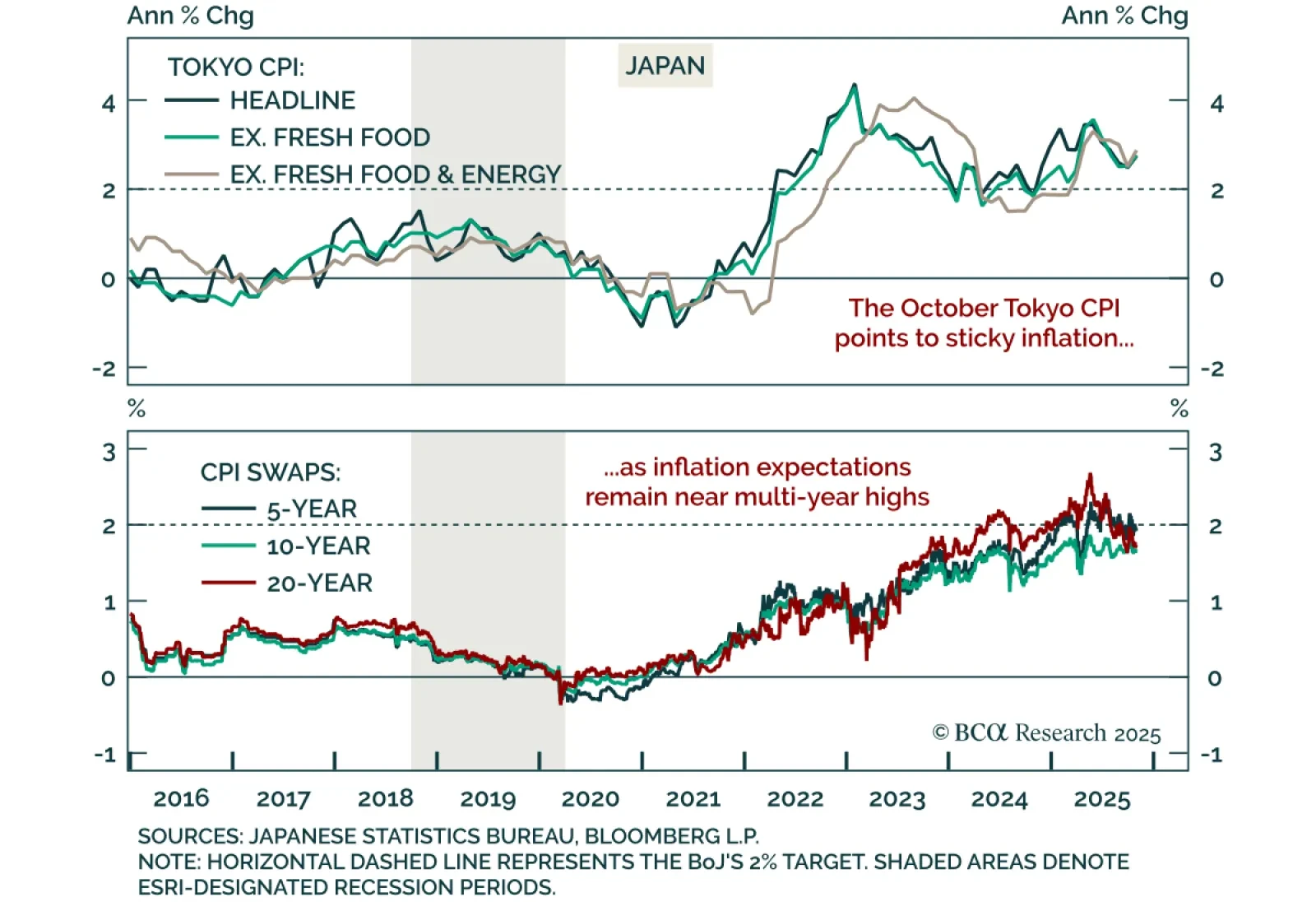

Stay underweight JGBs crosses as sticky inflation and improving growth momentum point to a higher terminal rate than markets expect. Japanese 2-year JGB yields have breached 1%, the highest since June 2008. BoJ Governor Ueda has…

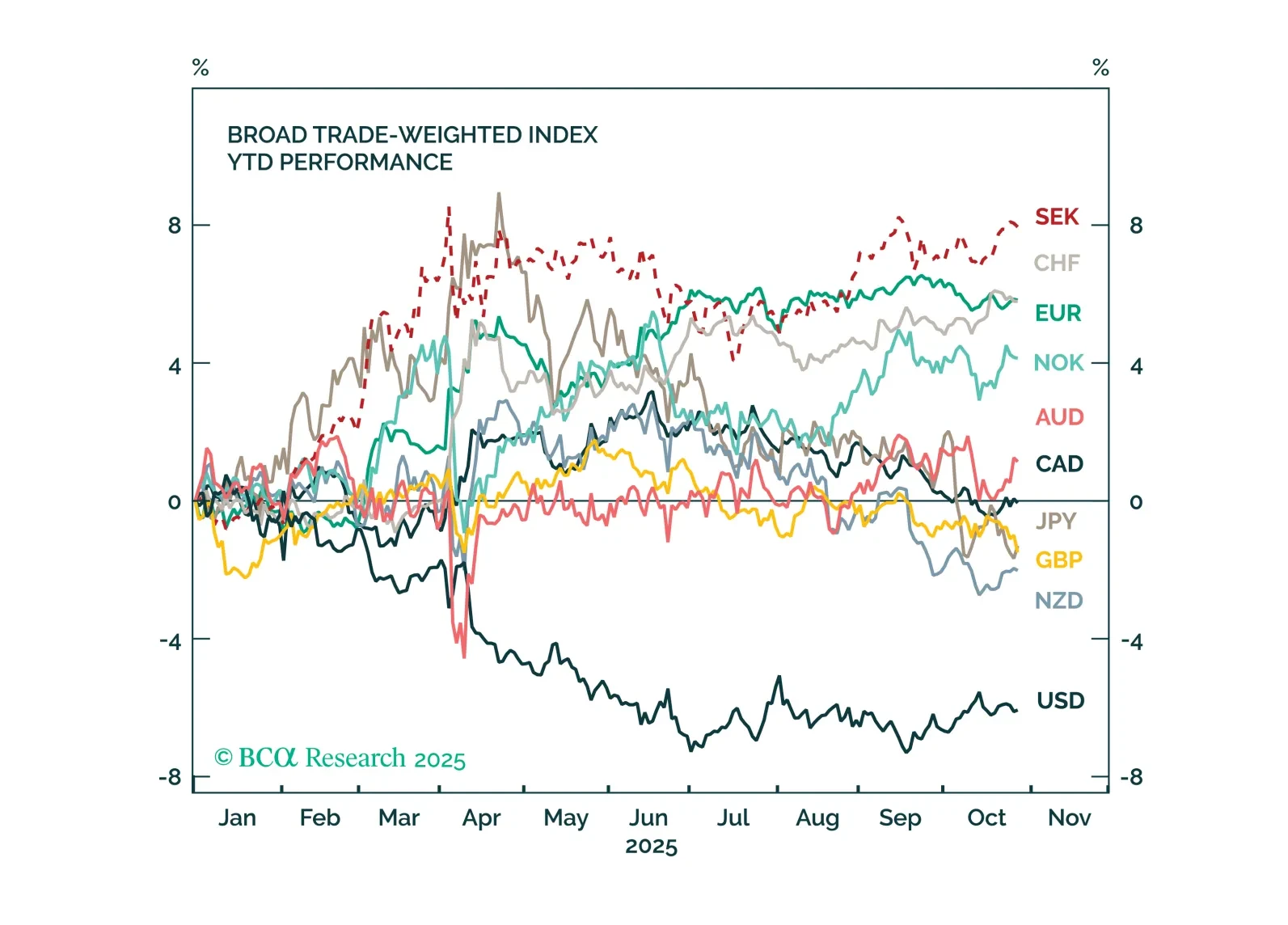

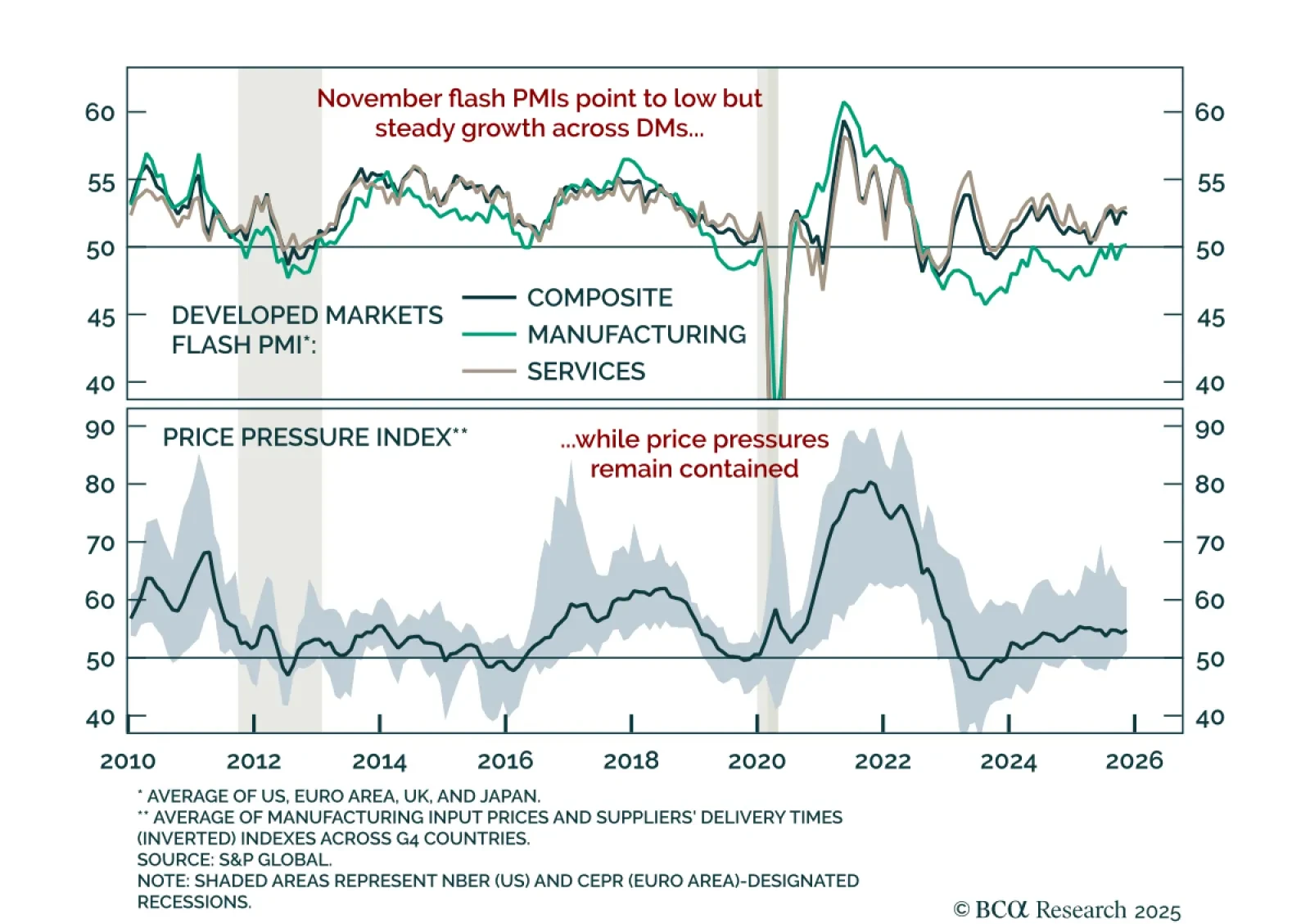

November flash PMIs confirmed sluggish global momentum, reinforcing a defensive stance with tactical support for the USD. The US composite PMI rose to 54.8, driven by stronger services but weaker manufacturing. The Euro area showed a…

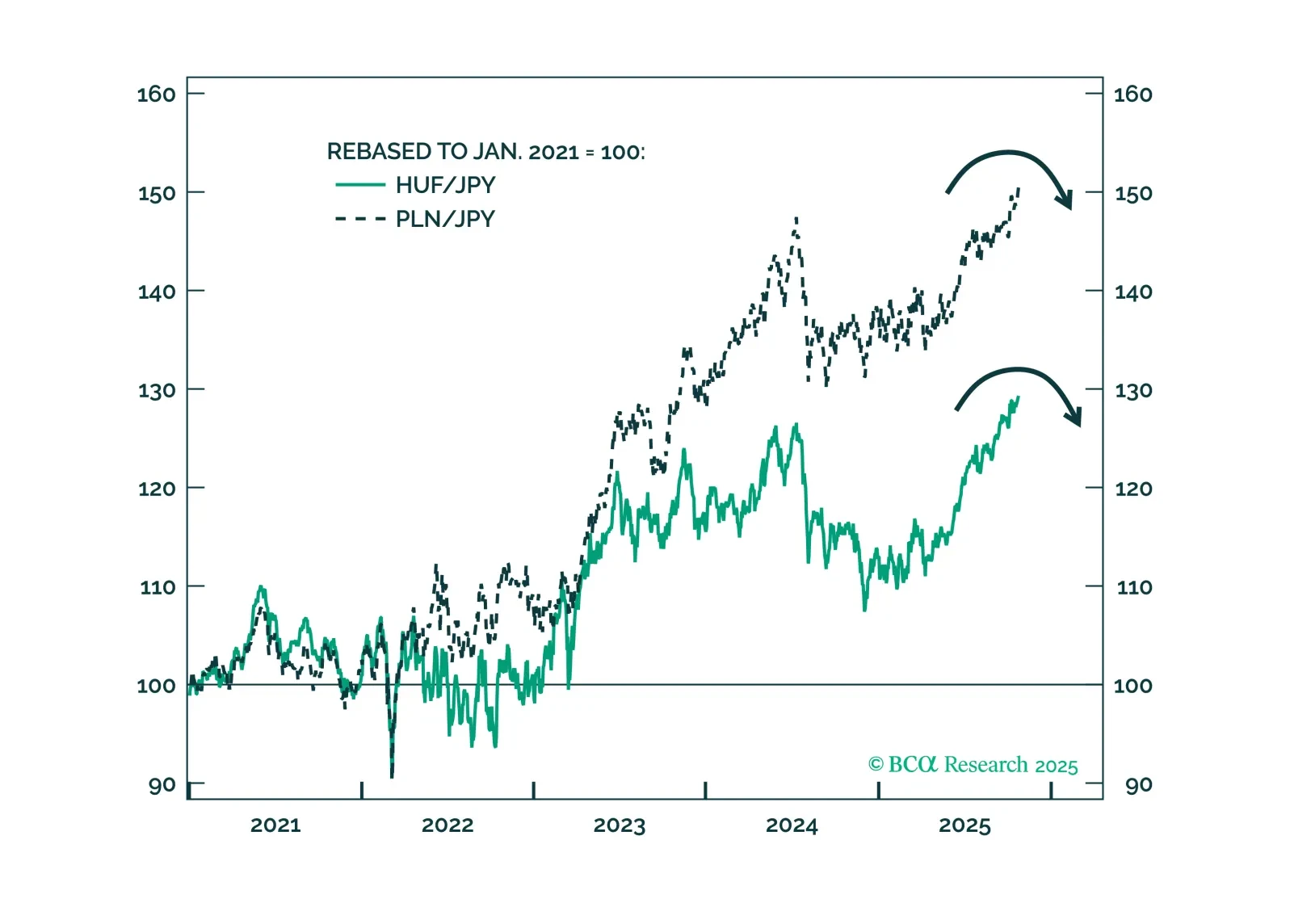

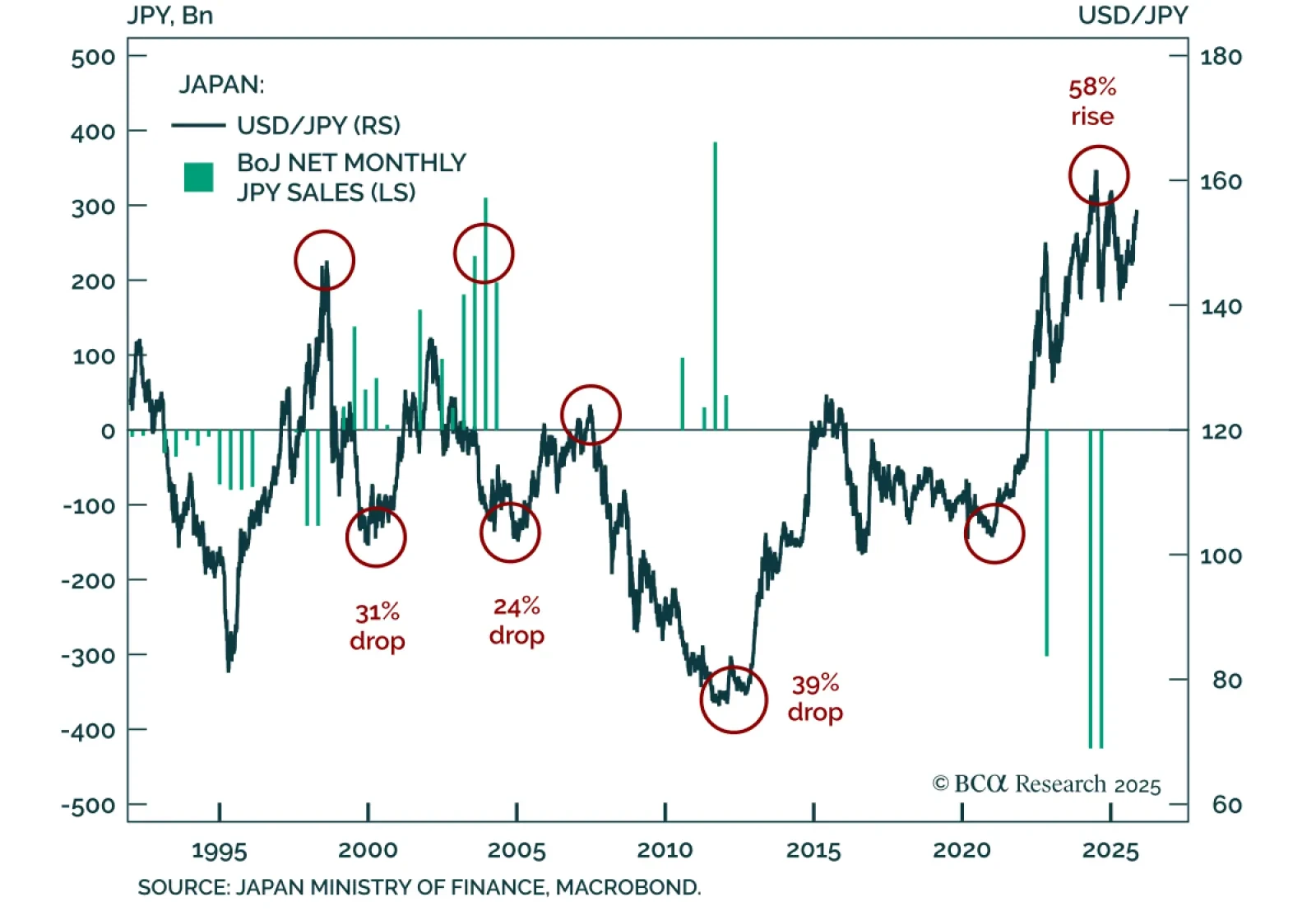

A third Japanese intervention to support the yen may be near, creating a tactical FX opportunity. Since 2022, Japan’s Ministry of Finance and the Bank of Japan have stepped into currency markets twice to curb yen weakness, first in…

Japan’s Q3 GDP beat expectations but still contracted, highlighting weak overall growth amid improving momentum. Output fell 1.8% annualized, though capex expanded and consumption stabilized. The decline was largely due to weaker net…

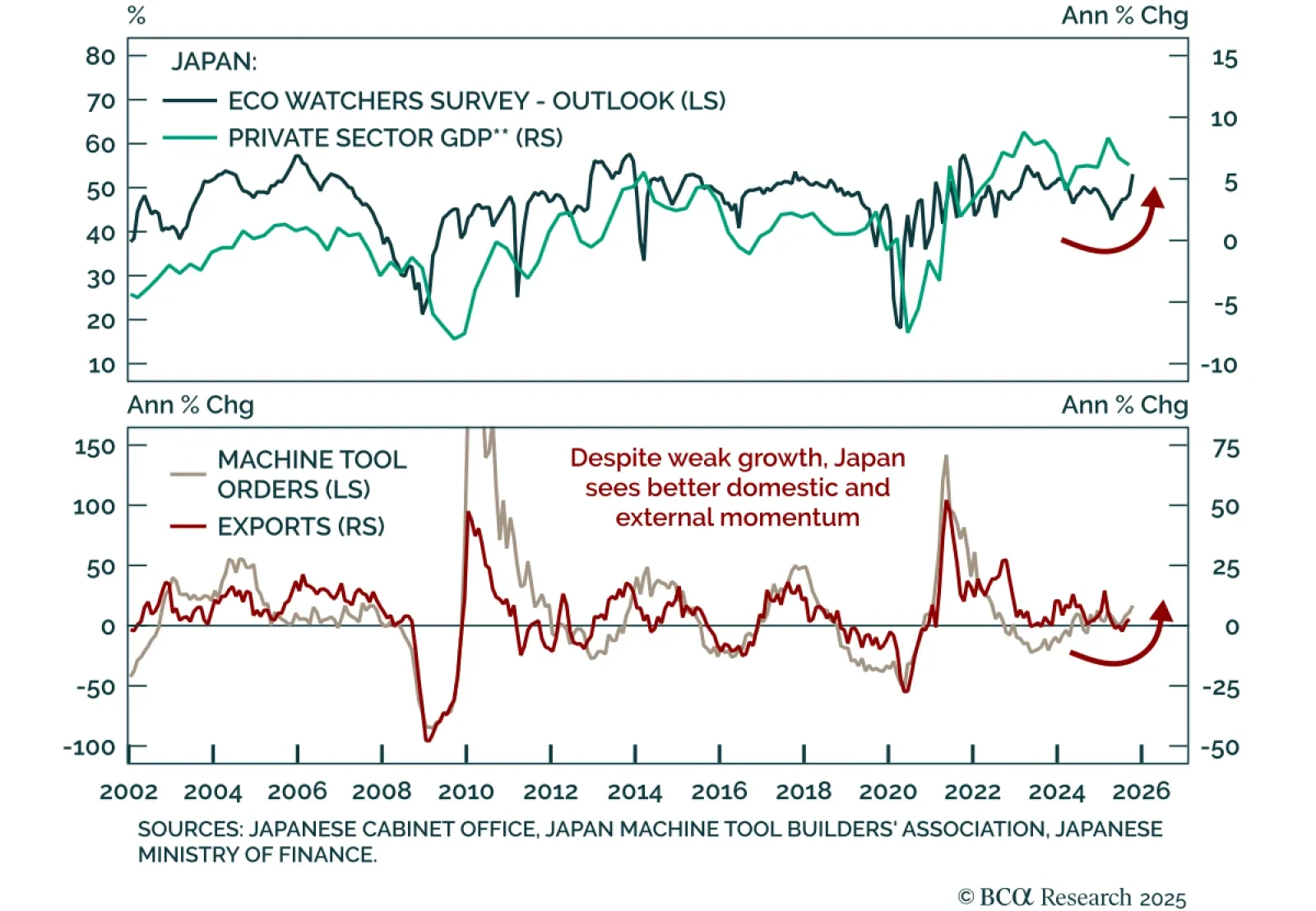

Japan’s October Eco Watchers Survey and machine tool orders both beat expectations, confirming improving growth momentum amid strong inflation. The current conditions component rose to 49.1 from 47.1, while expectations jumped to 53.…

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…

The October Tokyo CPI surprised to the upside, keeping pressure on the BoJ to resume rate hikes despite political pressures. Headline inflation rose to 2.8% from 2.5%, with both CPI ex-fresh food and “core core” (ex-fresh food and…

Markets are increasingly pricing an end to the global easing cycle, with many central banks expected to remain on hold. But uncertainty remains high, and policy surprises are likely going into 2026. This Strategy Report breaks down…

Japan's first woman prime minister, Sanae Takaichi, will underperform on economic stimulus but outperform on defense spending and strategic diplomacy. Stay long Japanese yen.