The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

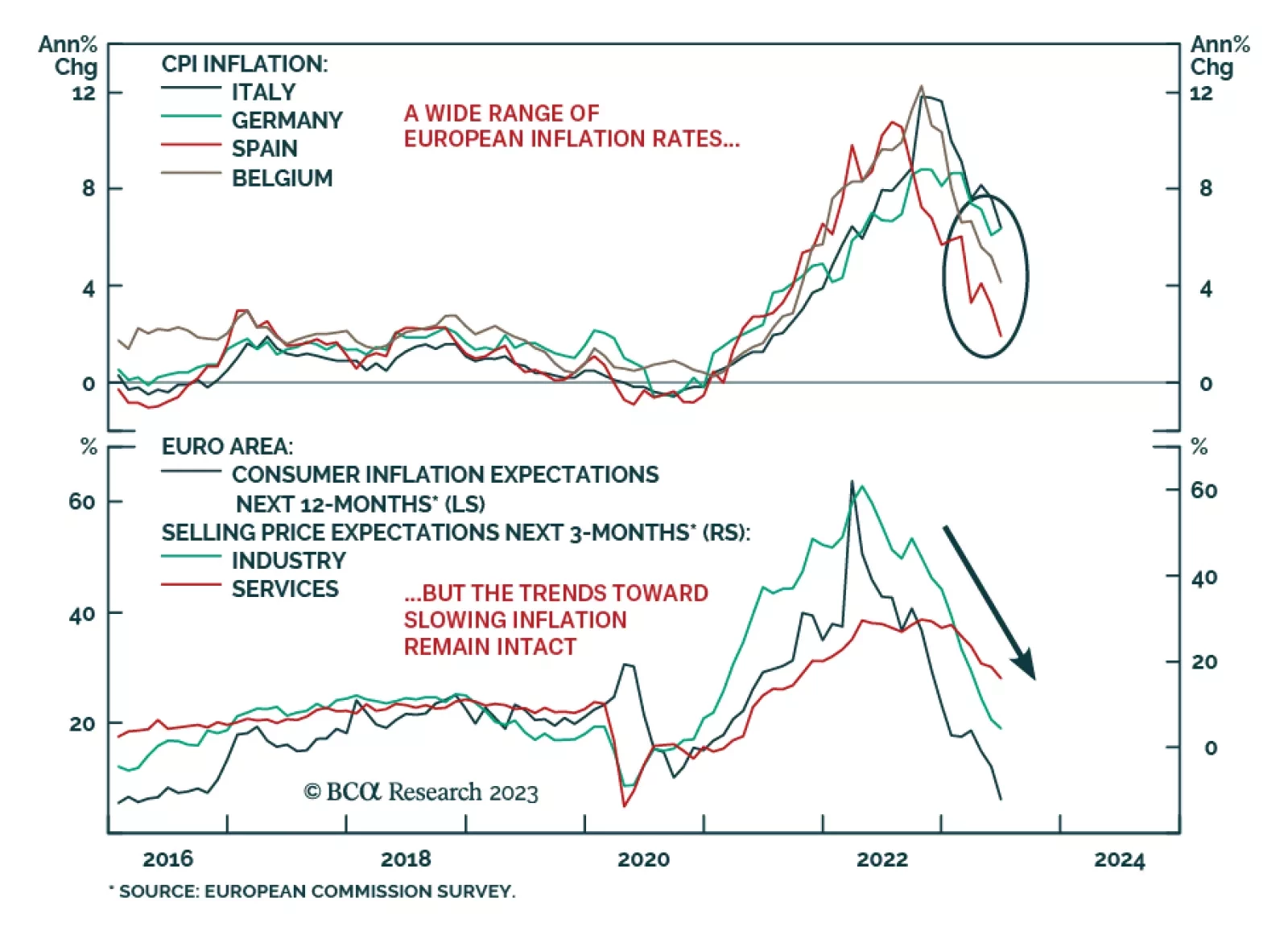

The preliminary inflation prints for June in the major euro area economies highlight a growing divergence in inflation outcomes. There was good news: headline CPI inflation in Italy fell to 6.7% in June from 8.0% in May, while…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

The Chinese government will repress social unrest, then relax Covid-19 social restrictions to try to stabilize the economy. Russia will be aggressive in the short term but will pursue a ceasefire before March 2024. European and…

Stay short Greater China assets. Stay long Japanese yen. Hold back on Brazil for now but look forward to opportunities in future.

Russia’s conflict with the West will escalate and trigger more bad news for risky assets this fall. Beyond that, stalemate looms. Latin American equities present a potential opportunity once the macro and geopolitical backdrop…

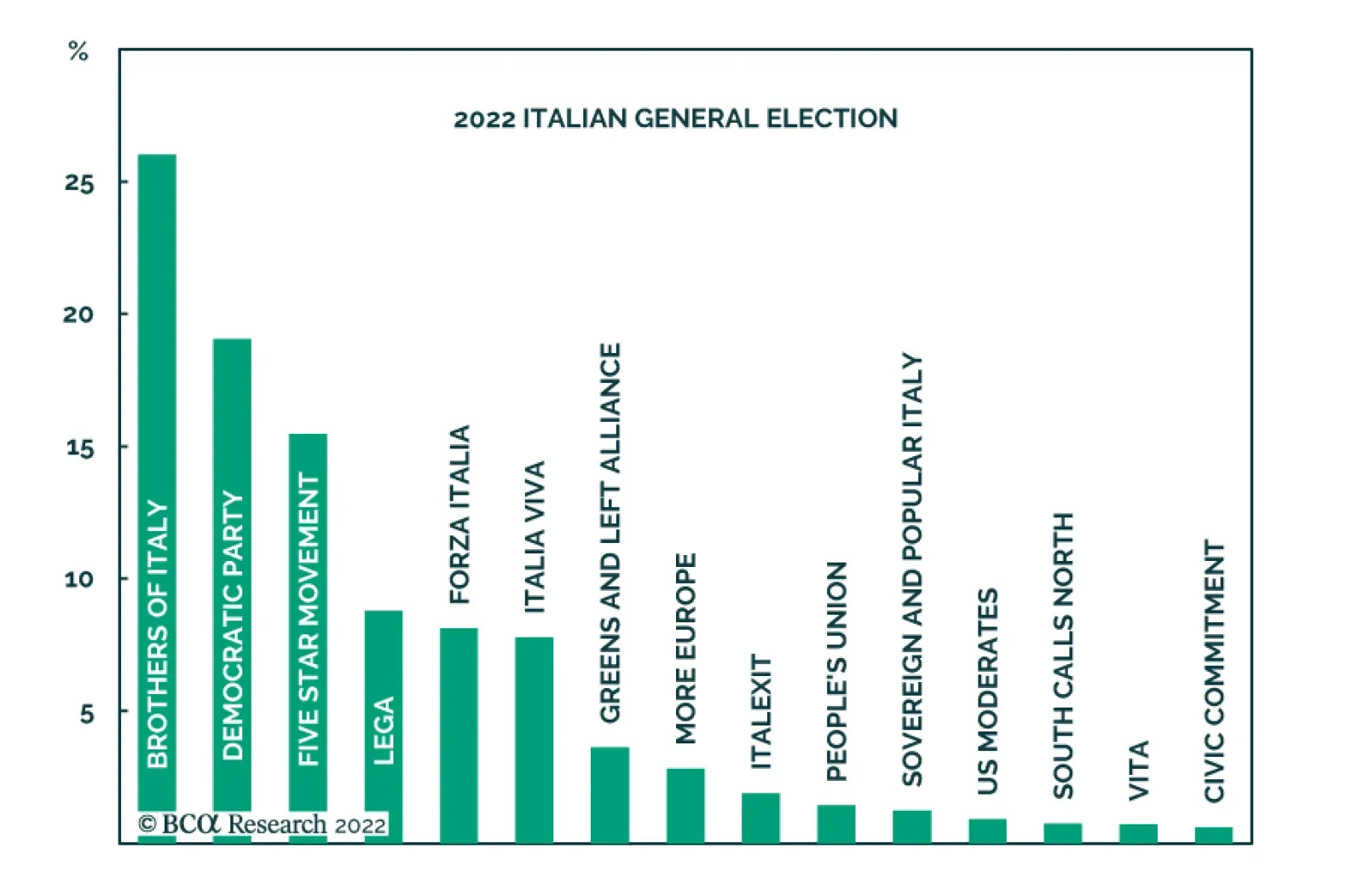

Italy’s right-wing coalition led by Giorgia Meloni of the far-right Brothers of Italy party –which also includes the League and Forza Italia – secured 44% of the vote in Sunday’s general election. Italian…

Executive Summary Our negative view on the summer rally is coming to fruition, with equities falling back on the negative geopolitical, macro, and monetary environment. China is easing policy ahead of its full return to autocratic…

Executive Summary Italy’s right-wing alliance, led by Brothers of Italy, will likely outperform in the upcoming election. The new government will prioritize the economy, posing a risk to the EU’s united front…