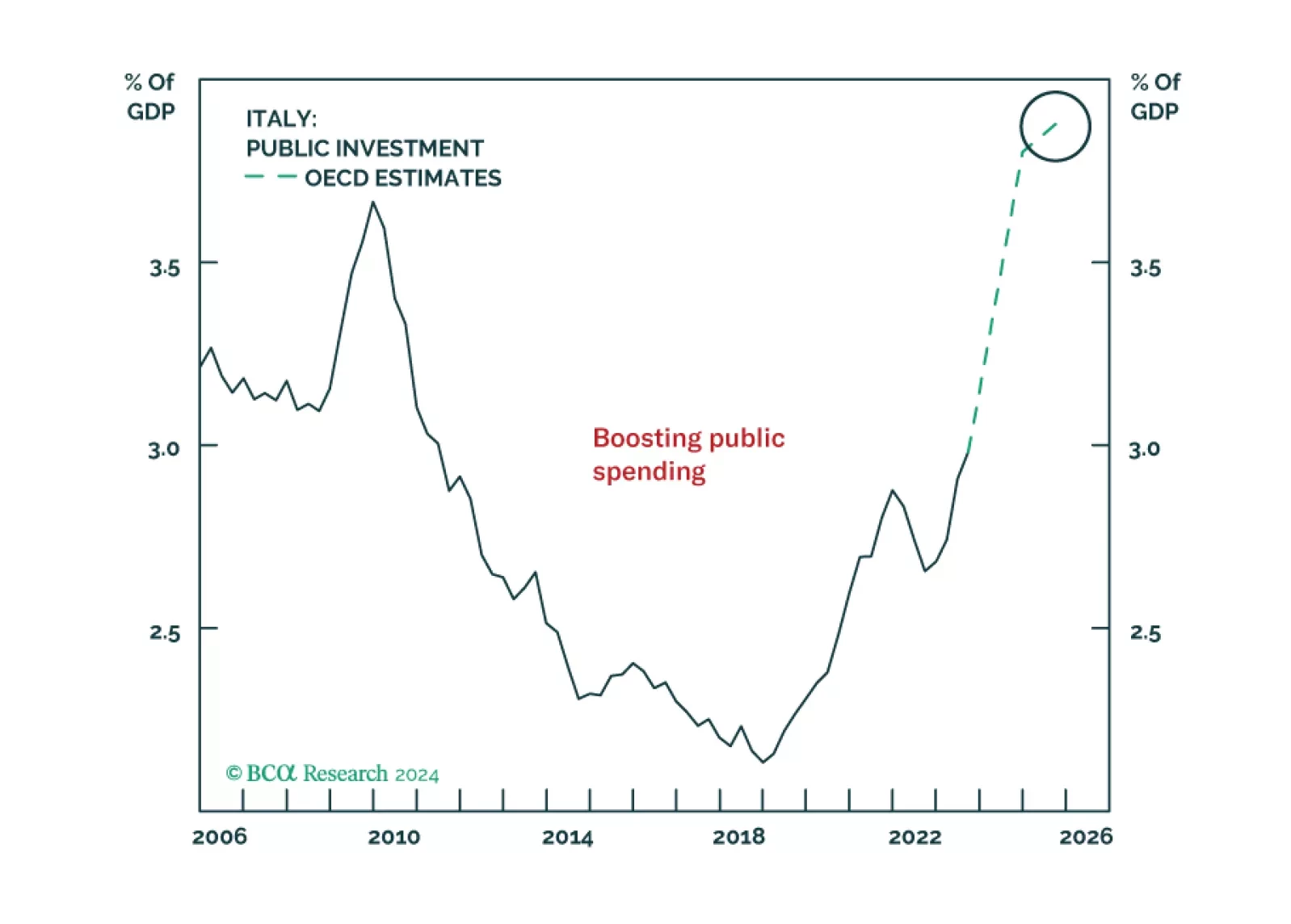

Italy and Spain have a poor reputation when it comes to their economies. The European debt crisis affected them more than other Euro Area countries. Their housing markets collapsed and debt cost soared. France and Germany, while…

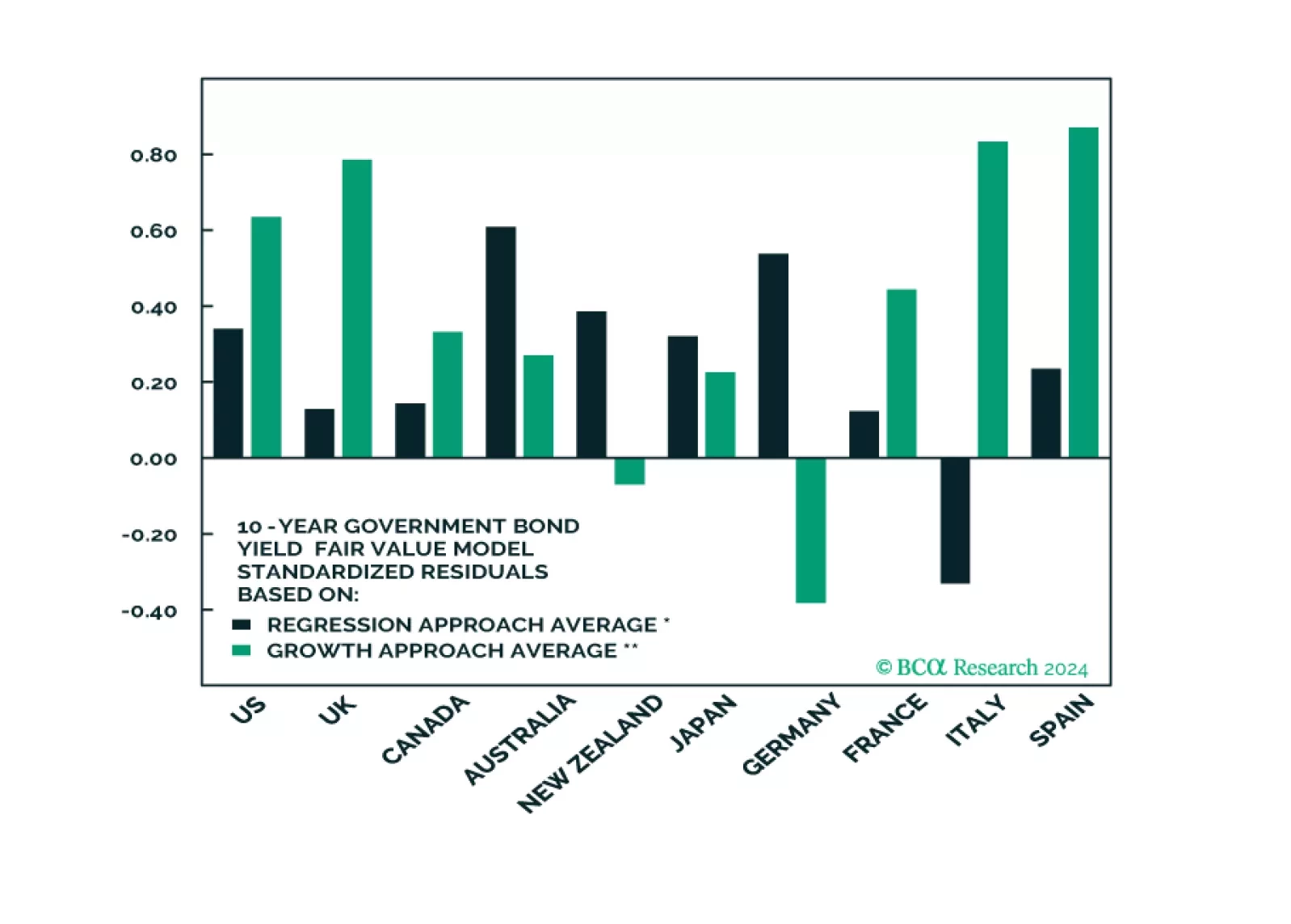

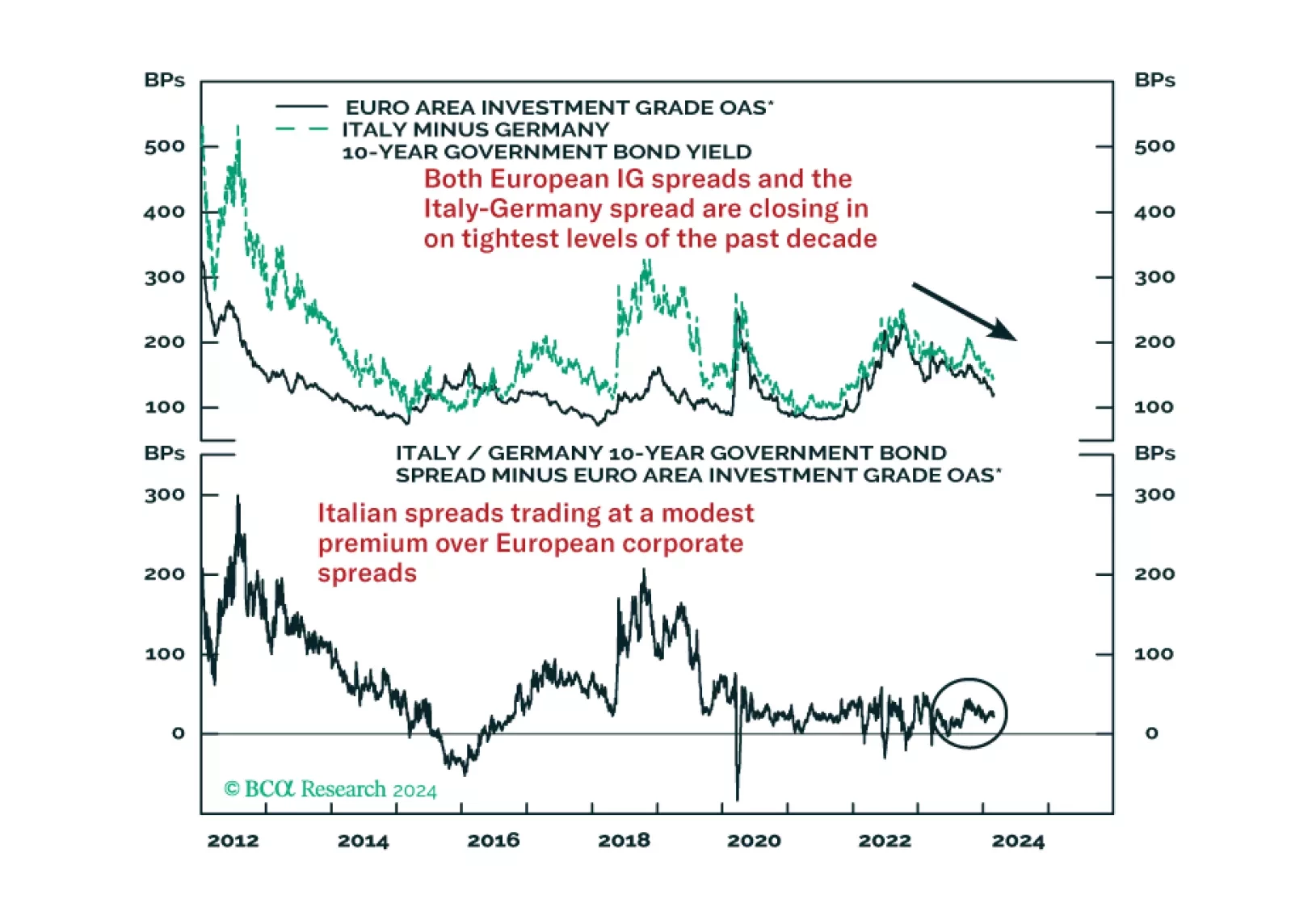

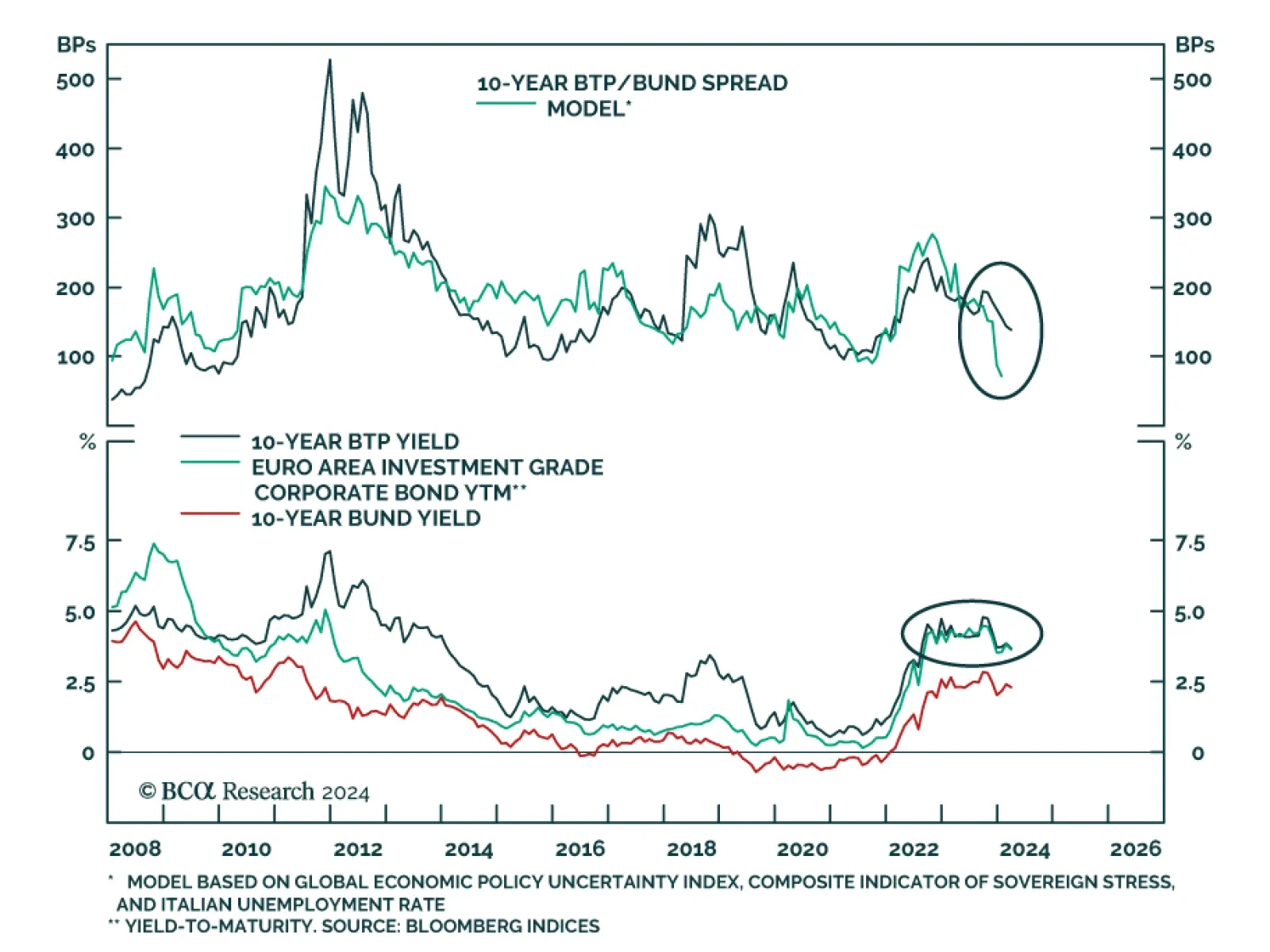

According to BCA Research’s European Investment Strategy service, investors should favor Italian BTPs over Euro Area IG until there is a better entry point to add exposure to BTP-bund spreads. The team’s latest…

In this Strategy Insight, we take a comparative look at two of the largest spread product sectors in Europe – Italian government bonds and investment grade corporates. We make the case for favoring Italy over investment grade in the…

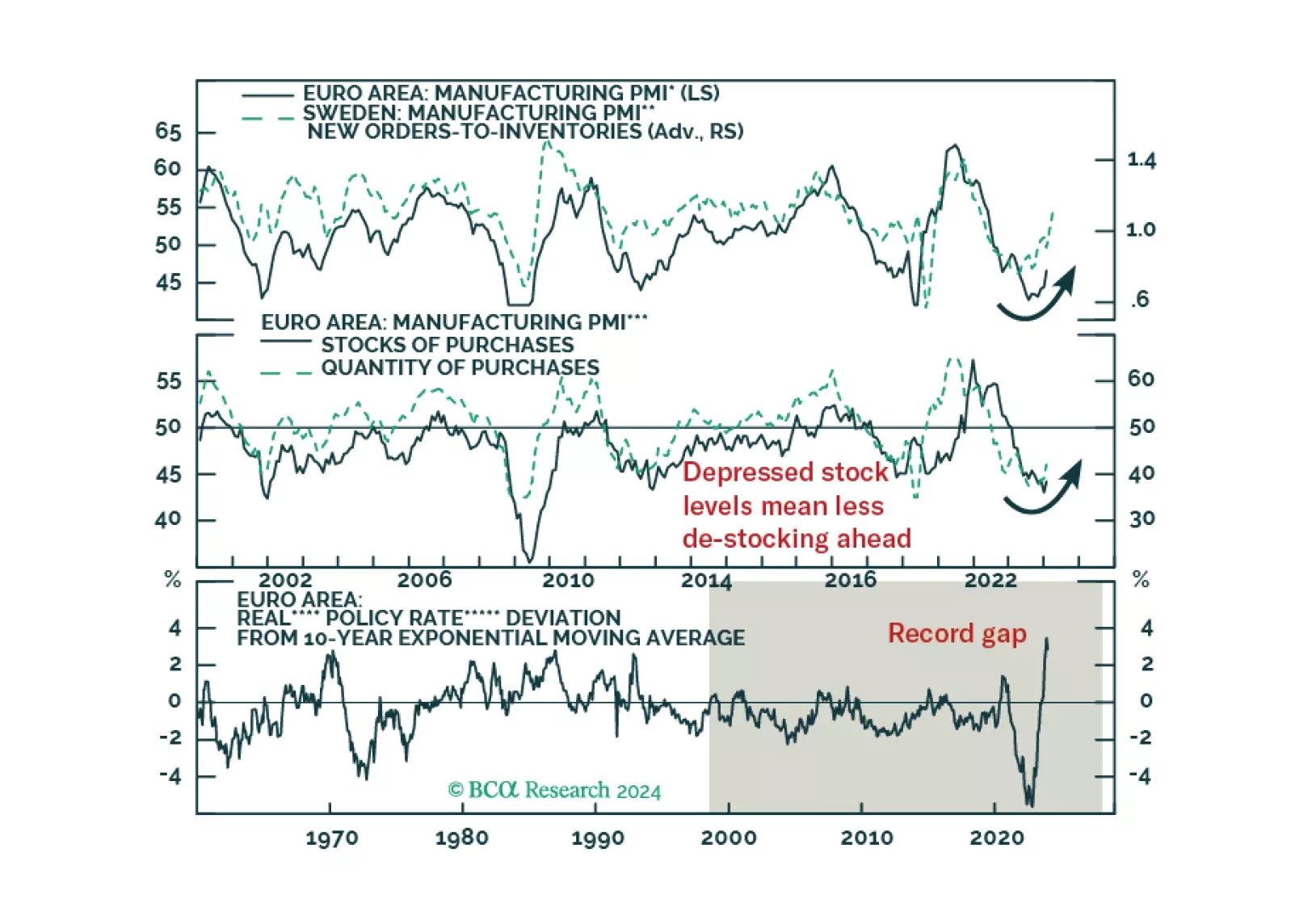

Is the rebound in European PMIs enough to boost the appeal of European risk assets?

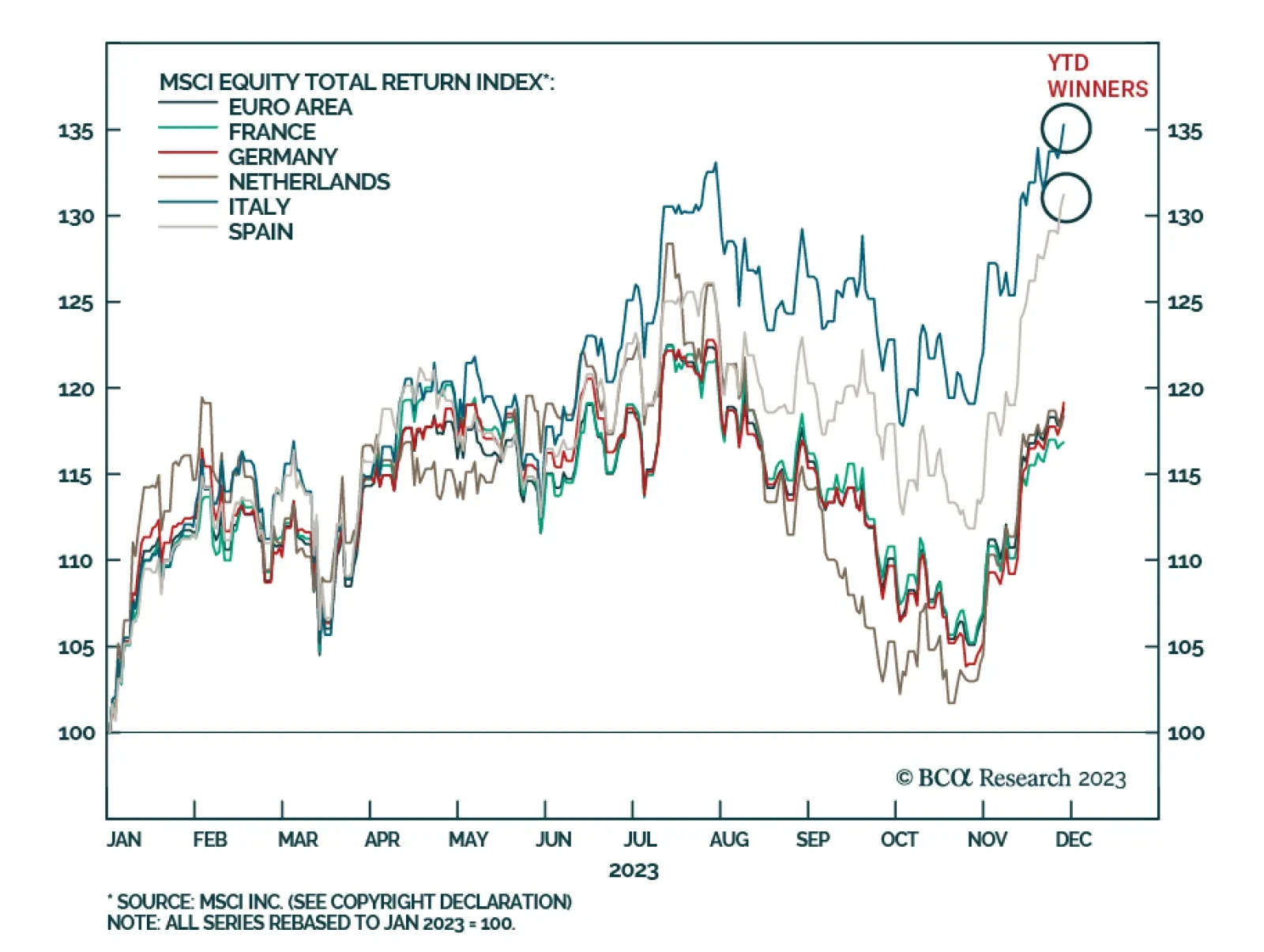

Euro Area stocks have had a strong 2023, rising by 18.8% year-to-date, only slightly behind the 19.1% gain captured by US equities, and outperforming the ACWI’s 14.3% increase. In particular, the Italian index’s 35…

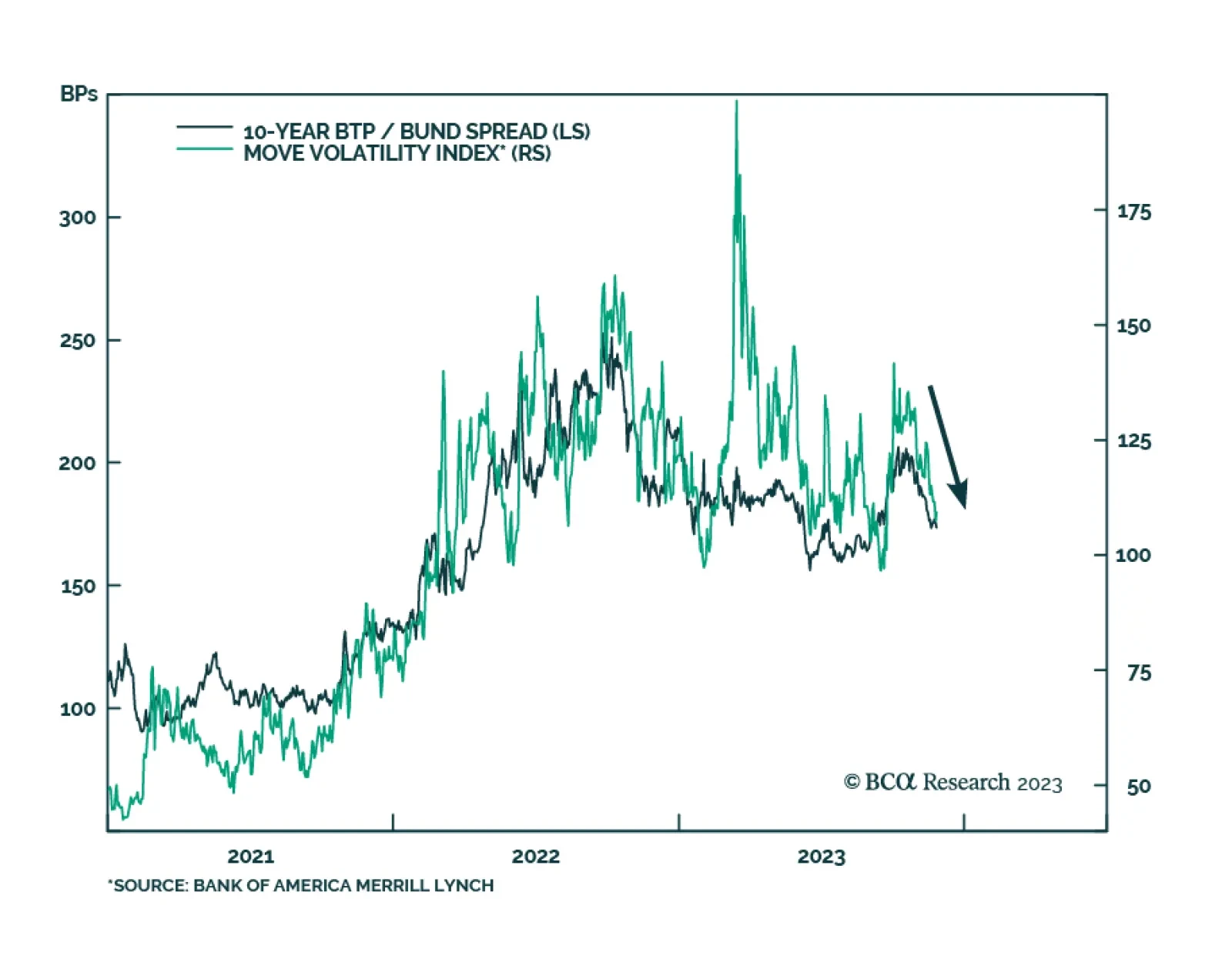

After widening since mid-year, the spread between German bunds and Italian BTPs has been narrowing over the past month. What is driving this move? Our Chief Global Fixed Income Strategist highlighted in Tuesday's BCA Live…

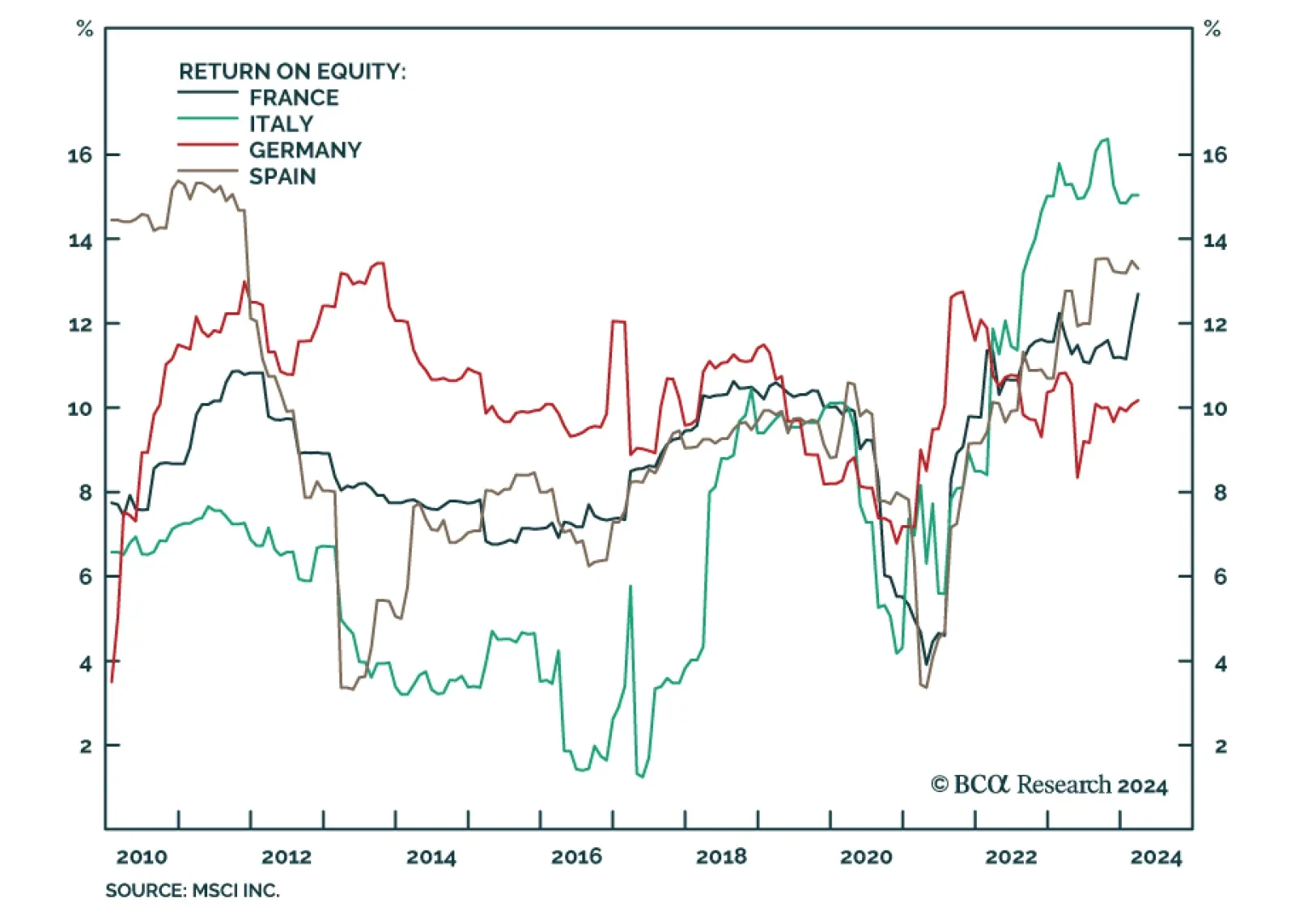

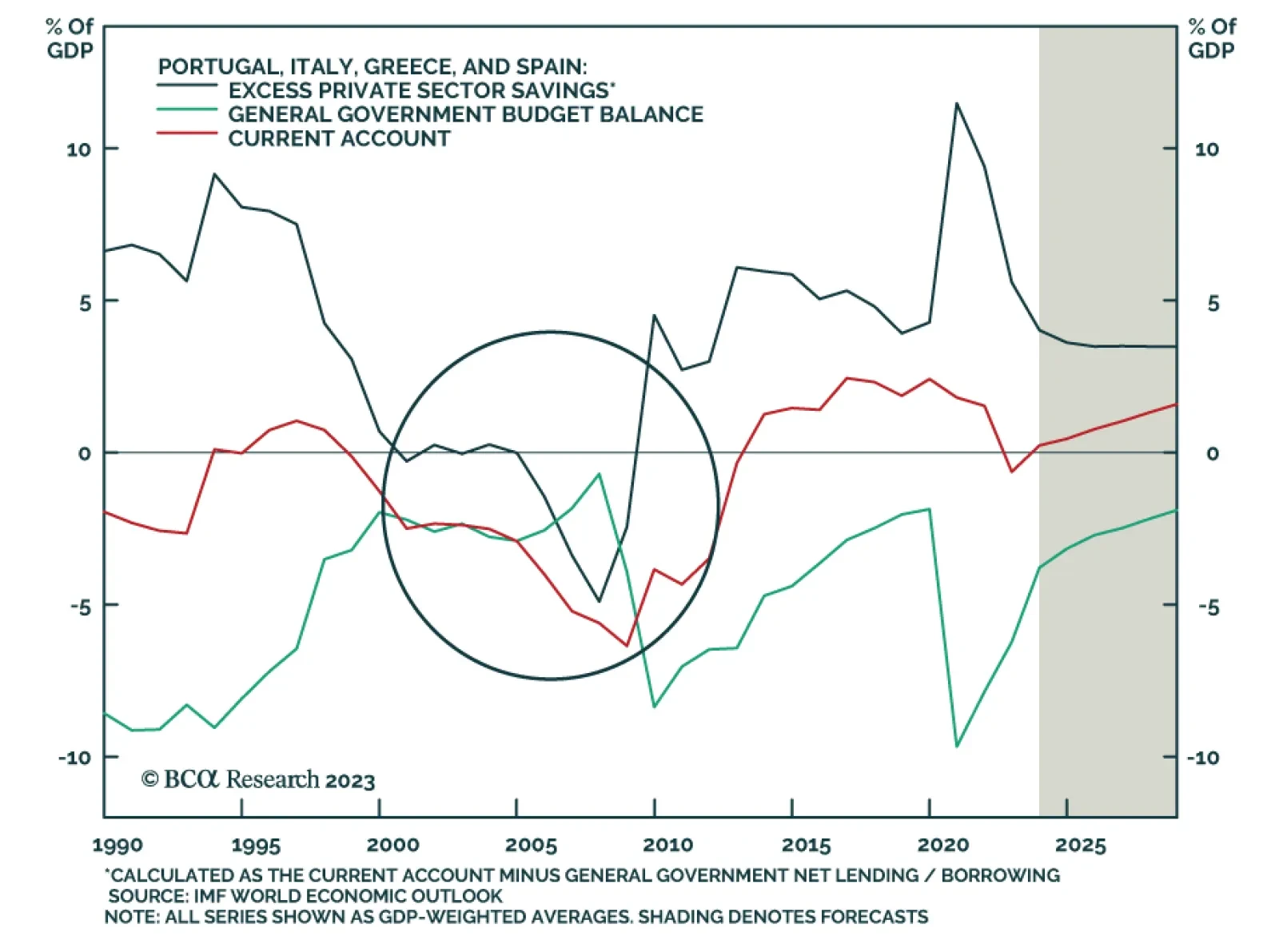

According to BCA Research’s European Investment Strategy service, the Mediterranean bloc’s move from current account deficit to current account surplus nations greatly limits the risk of a new sovereign debt crisis…