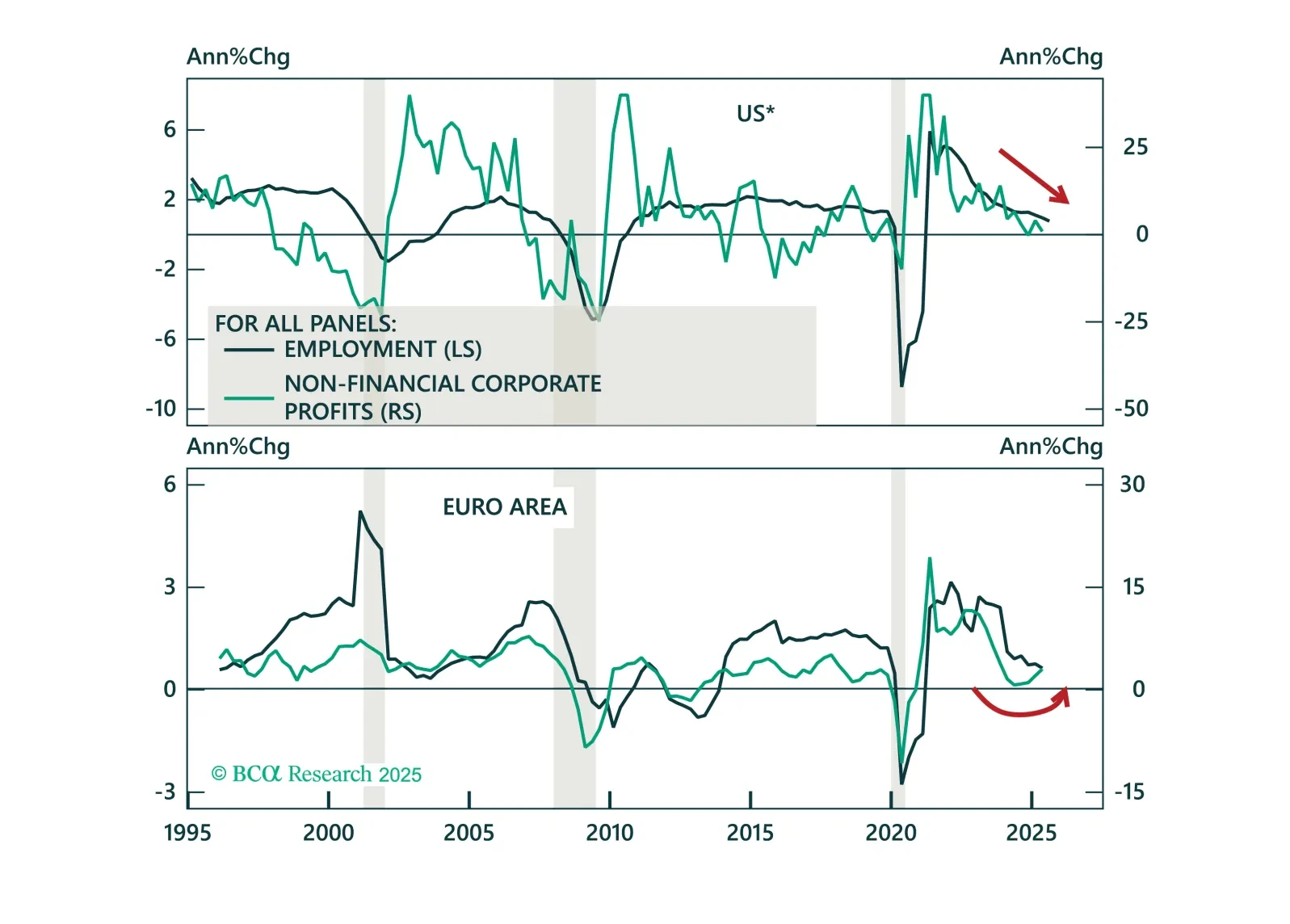

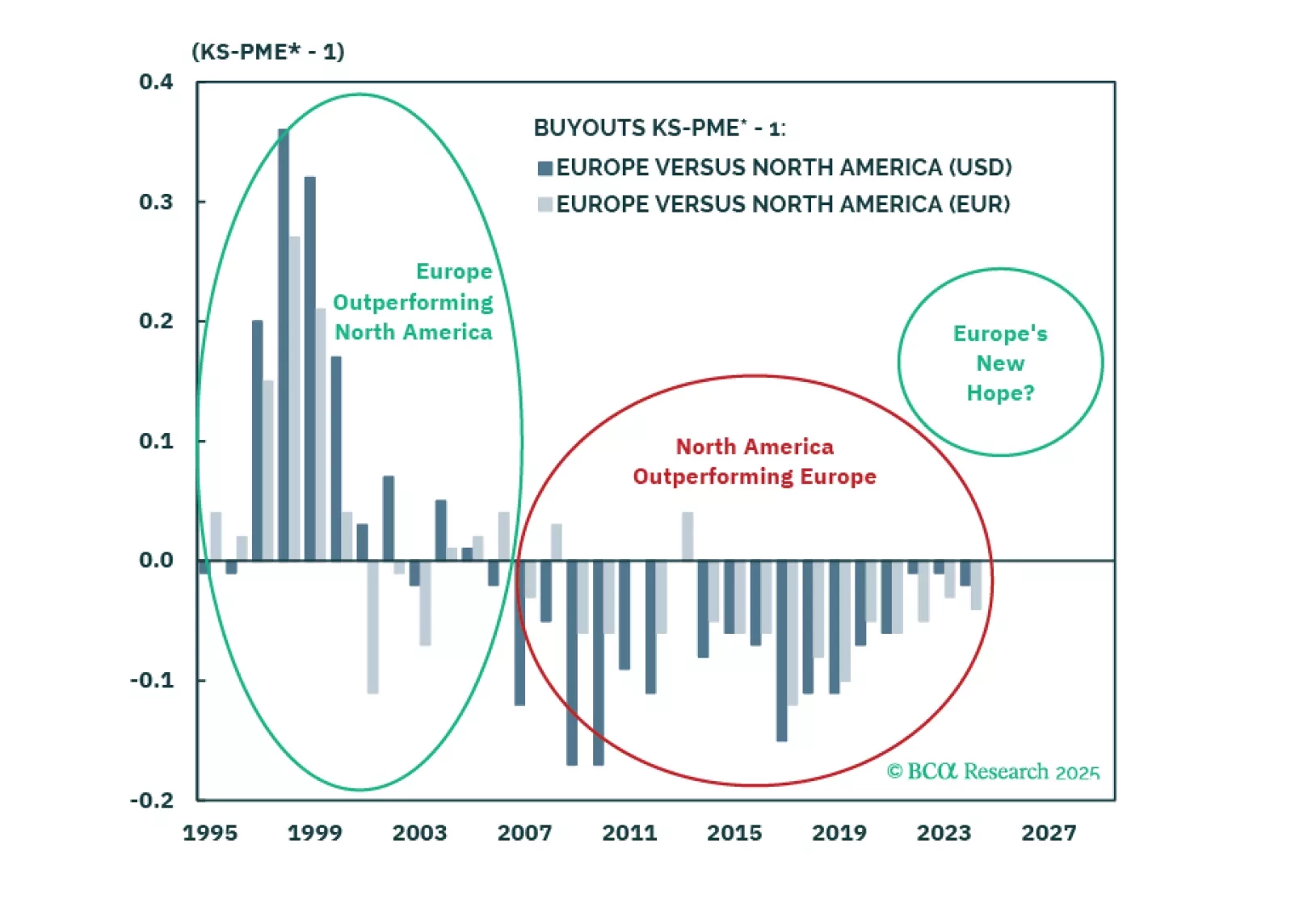

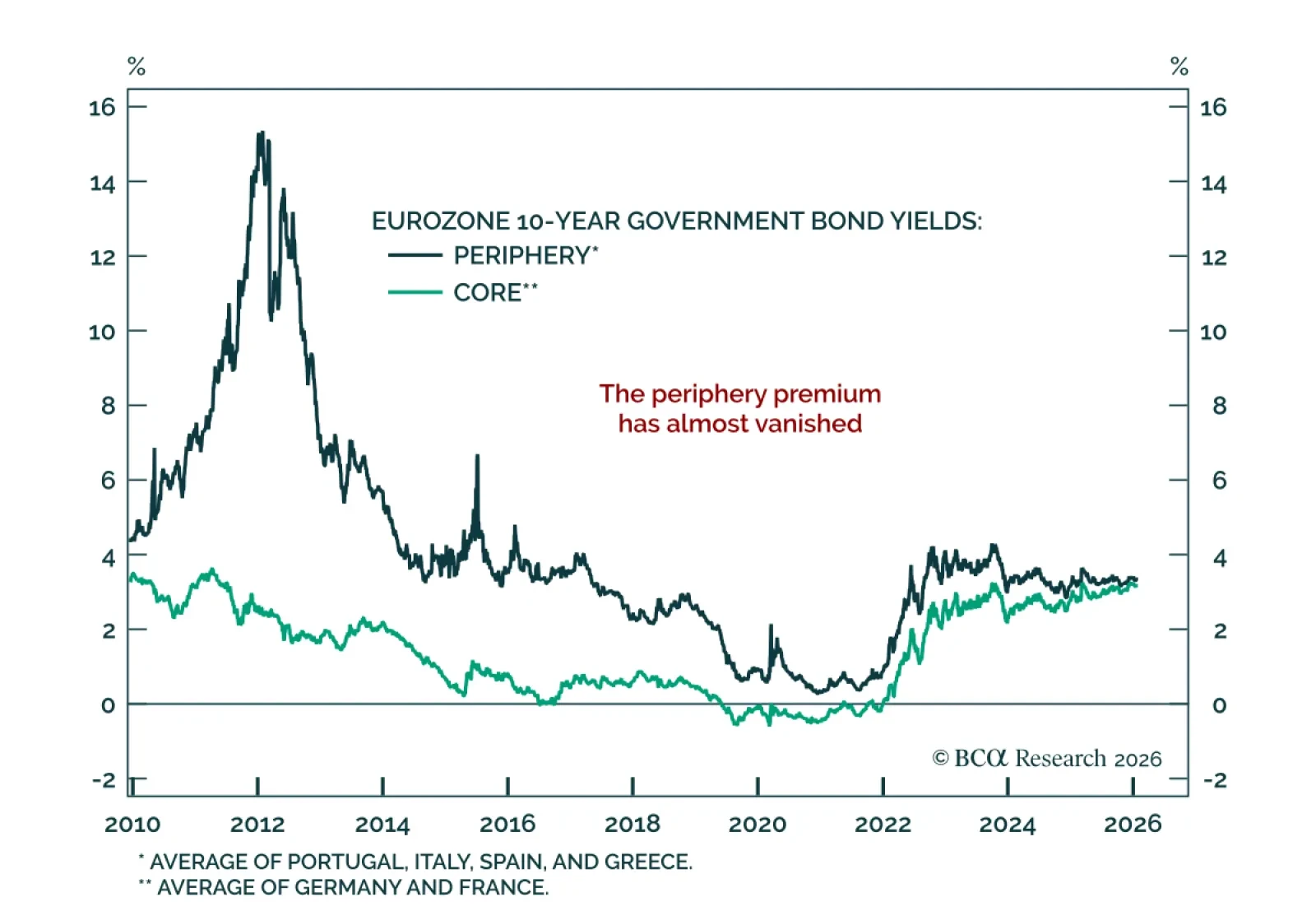

Peripheral Europe is driving the region’s resilience, and finally closing the gap with the core. Our Chart Of The Week comes from Jeremie Peloso, Chief European Investment Strategist. The resilience of the European economy and strong…

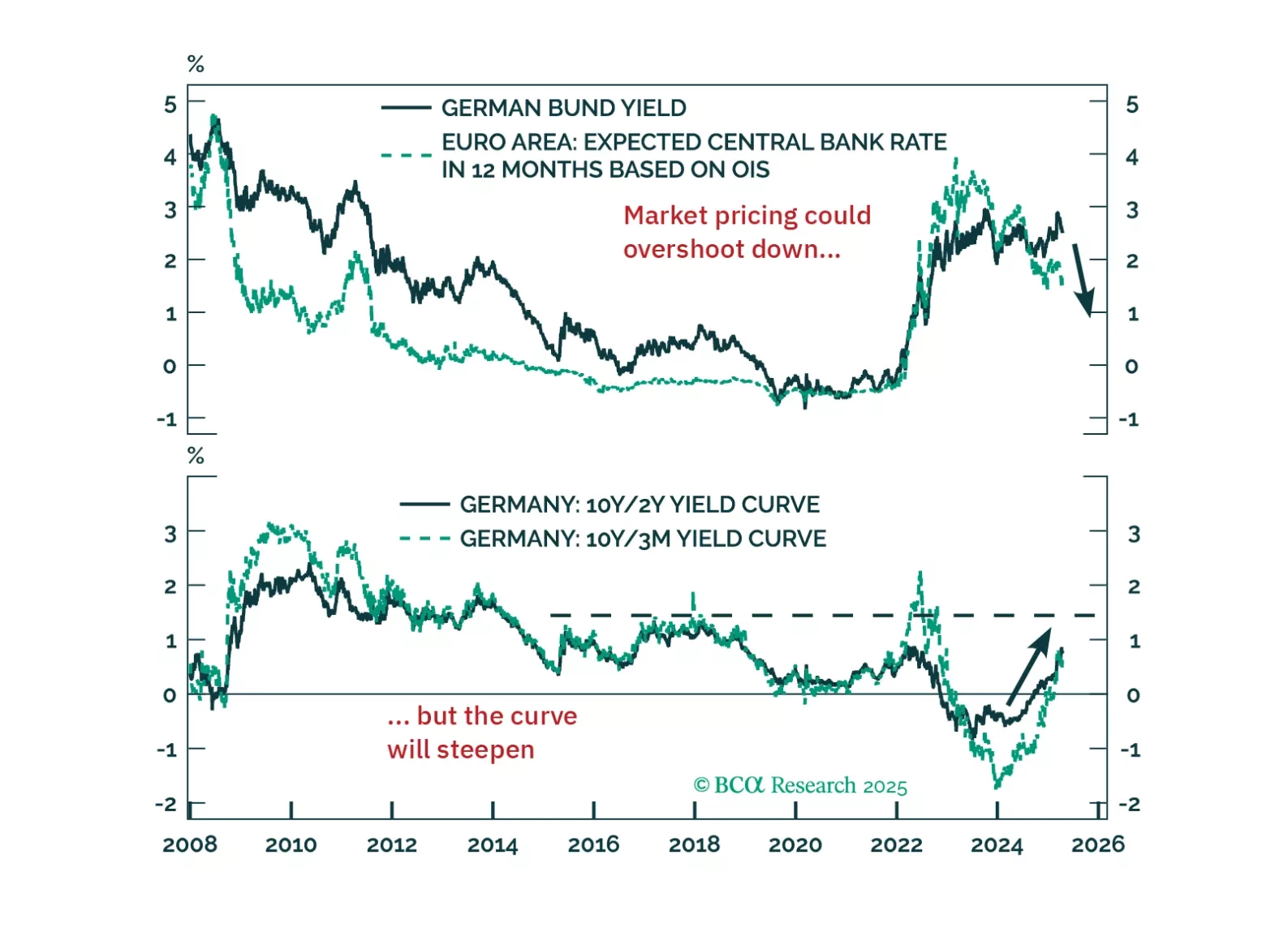

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

The European bond market is pricing in a more optimistic outlook. The BTP-Bund spreads have narrowed 30bps since April 9 and are now within reach of their pre-Ukraine war level. BCA’s European strategists do not share this…

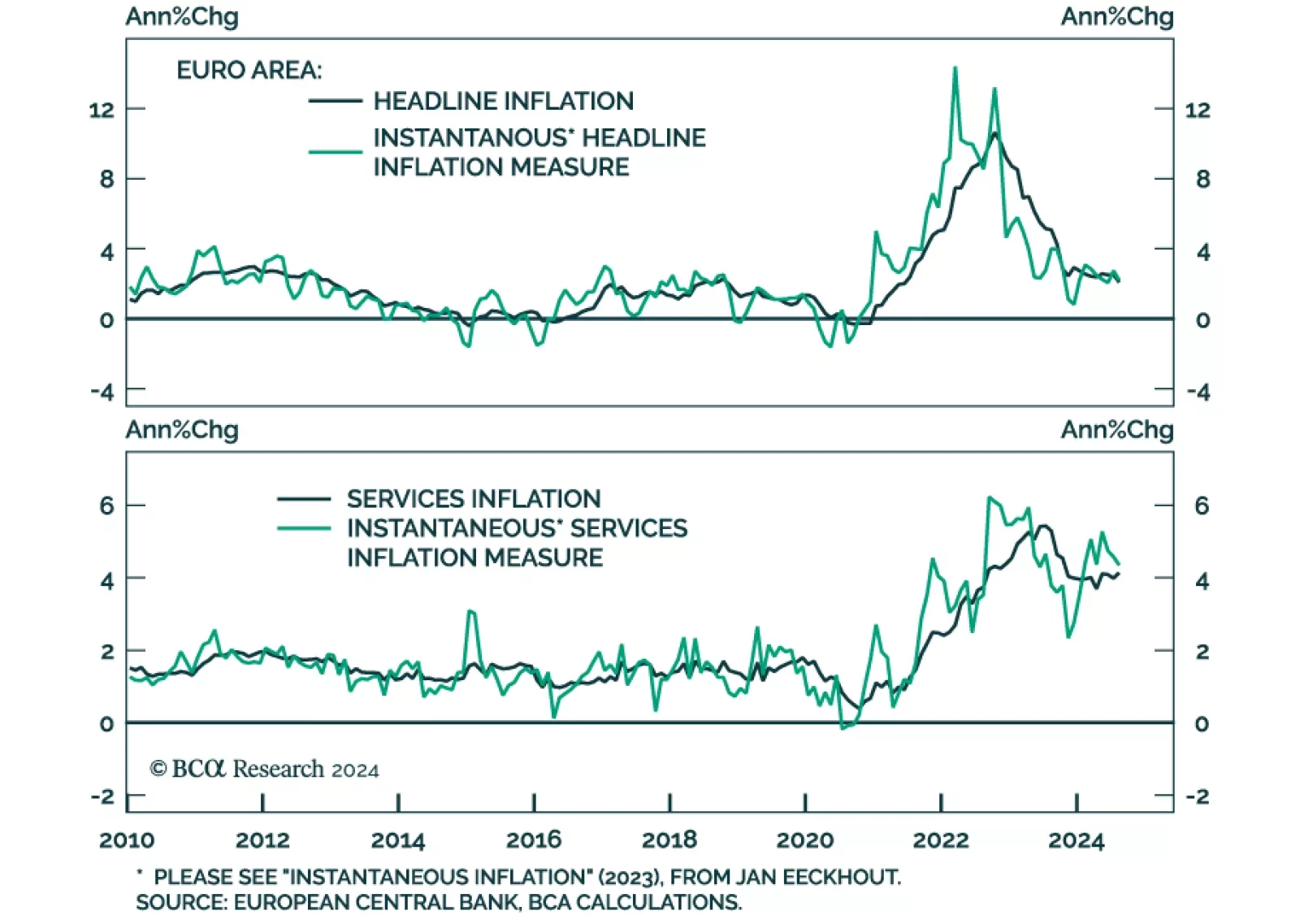

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

A nascent theme in the latest data is the broad improvement in European sentiment. The February Sentix and ZEW surveys both improved, and flash estimates for European consumer confidence beat estimates, ticking up to -13.6%.…

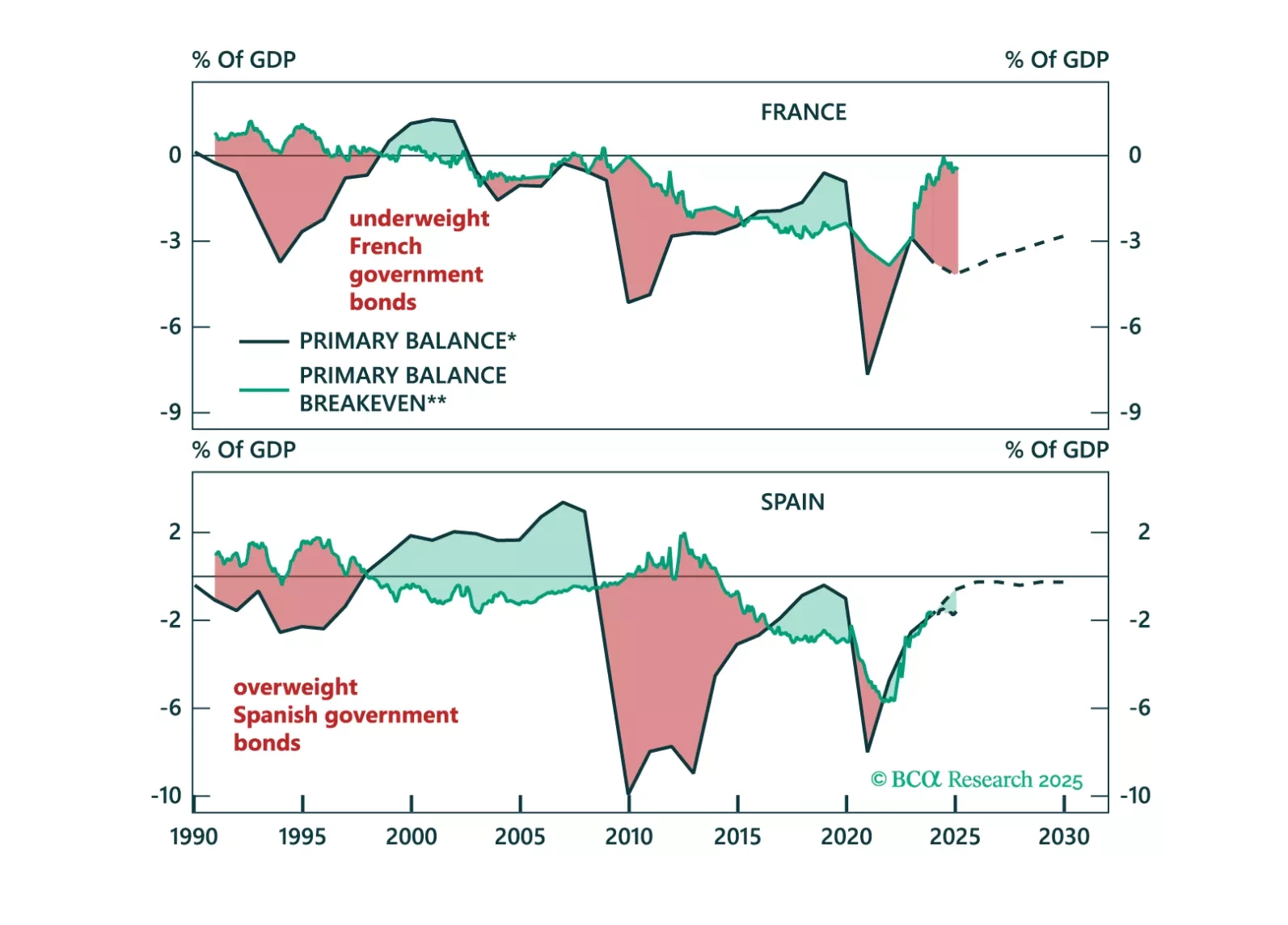

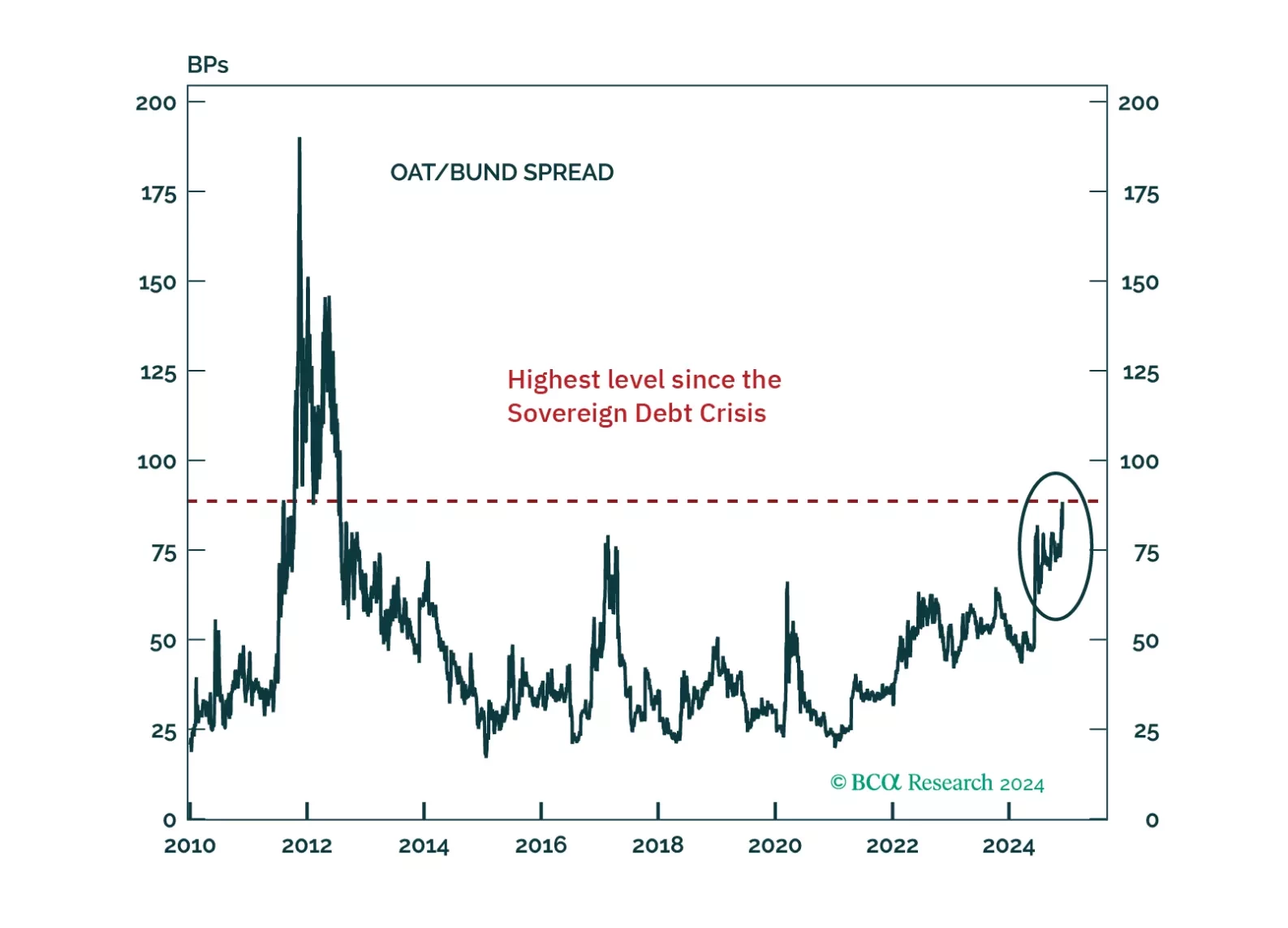

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

France’s and Spain’s preliminary September CPI readings declined on a month-on-month basis, clocking in at 1.5% and 1.7% y/y respectively, and undershooting consensus expectations. Germany’s and Italy’s…