Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

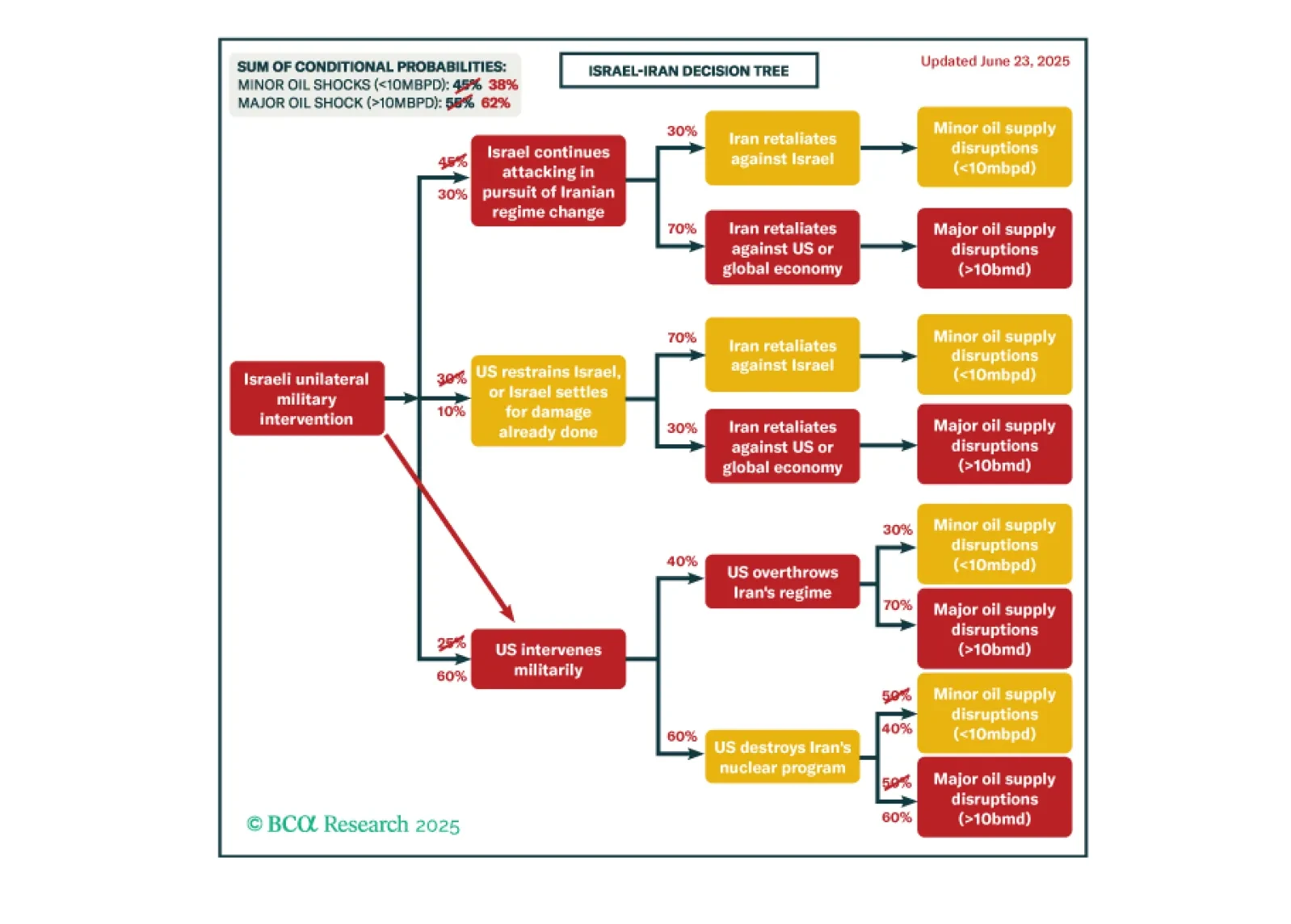

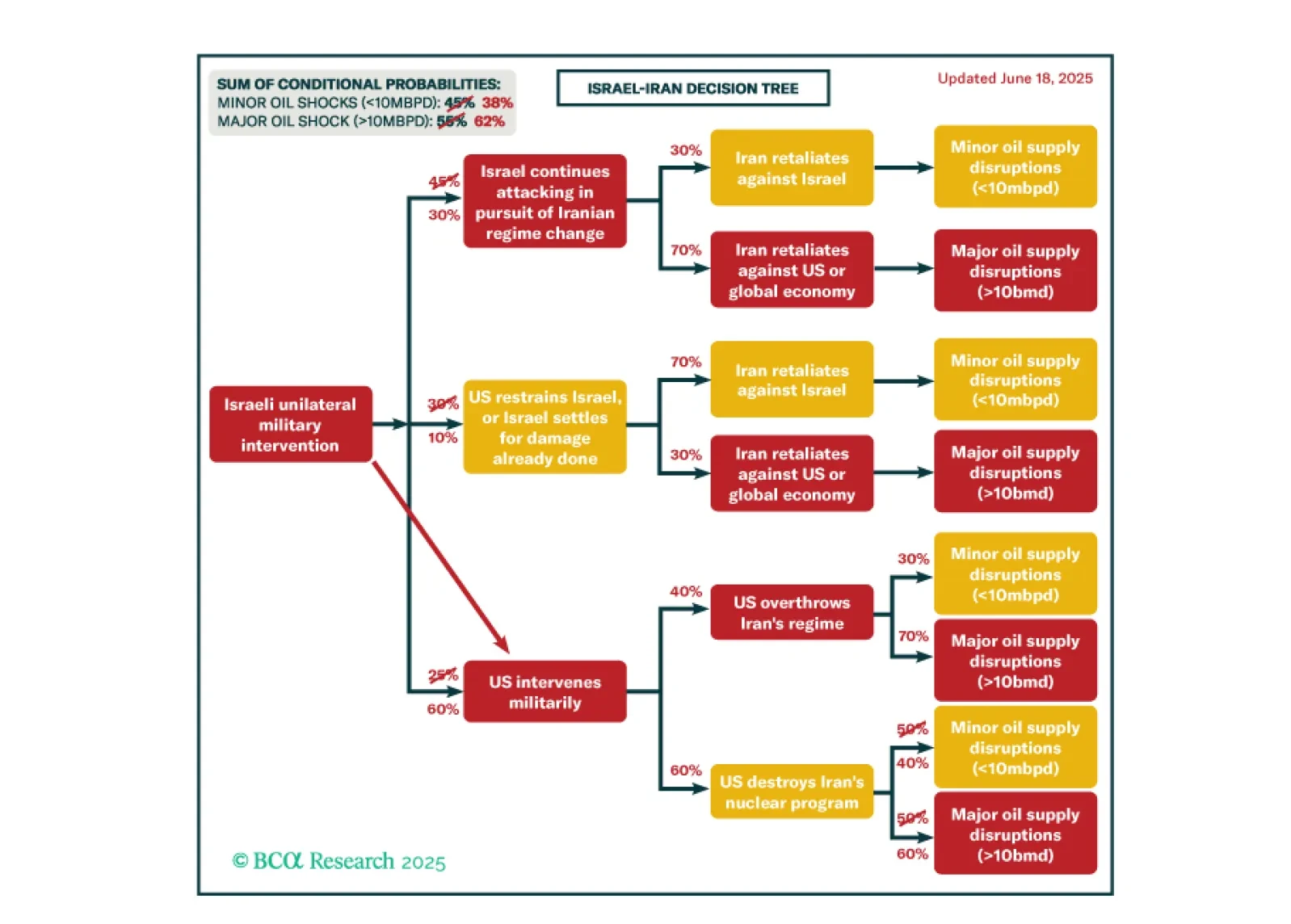

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…

Even if Iran tries to revive talks, the US has an irresistible opportunity to dismantle its nuclear program. Tactically, investors should favor Treasuries over the S&P, defensive sectors over cyclicals, energy stocks over…

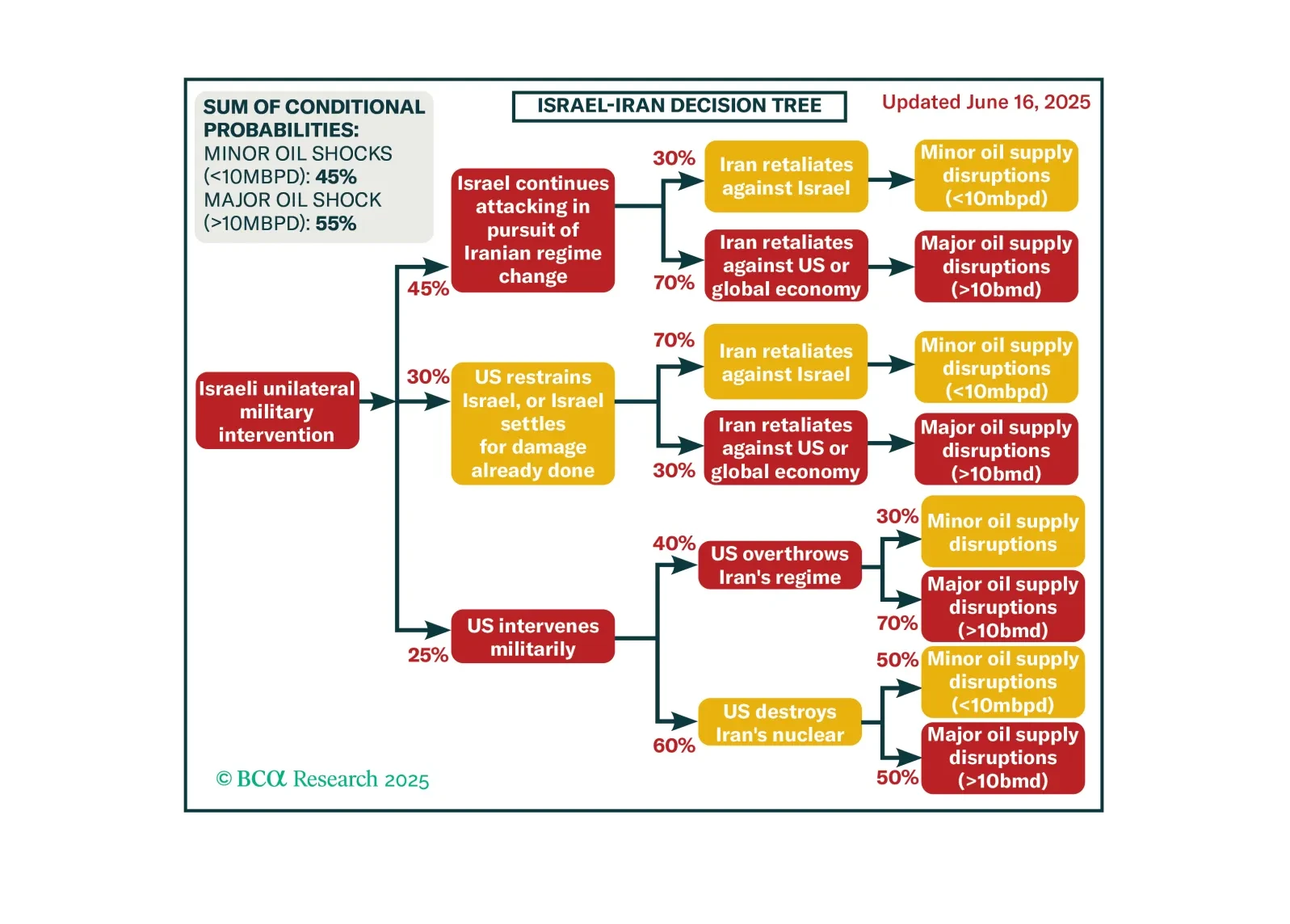

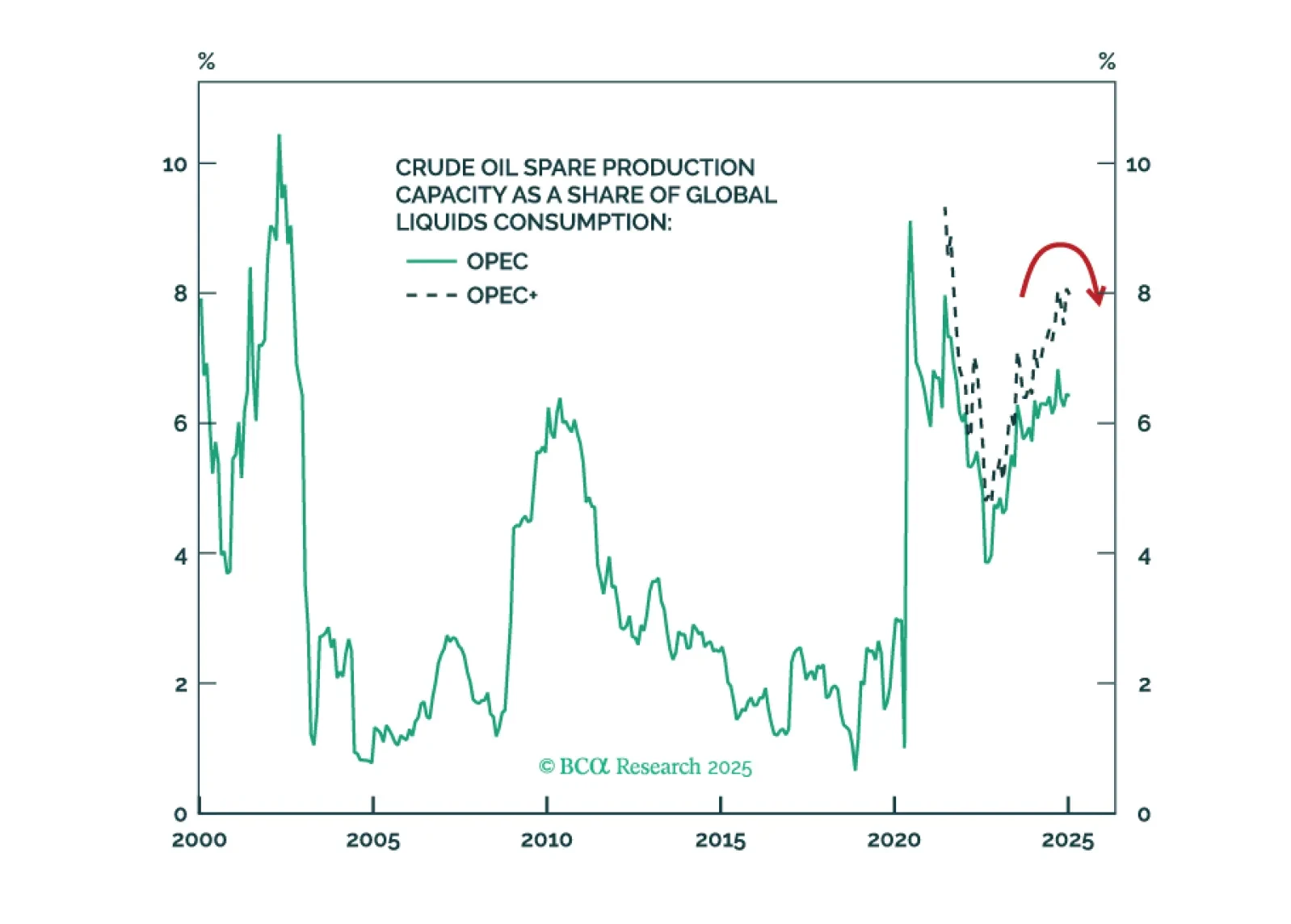

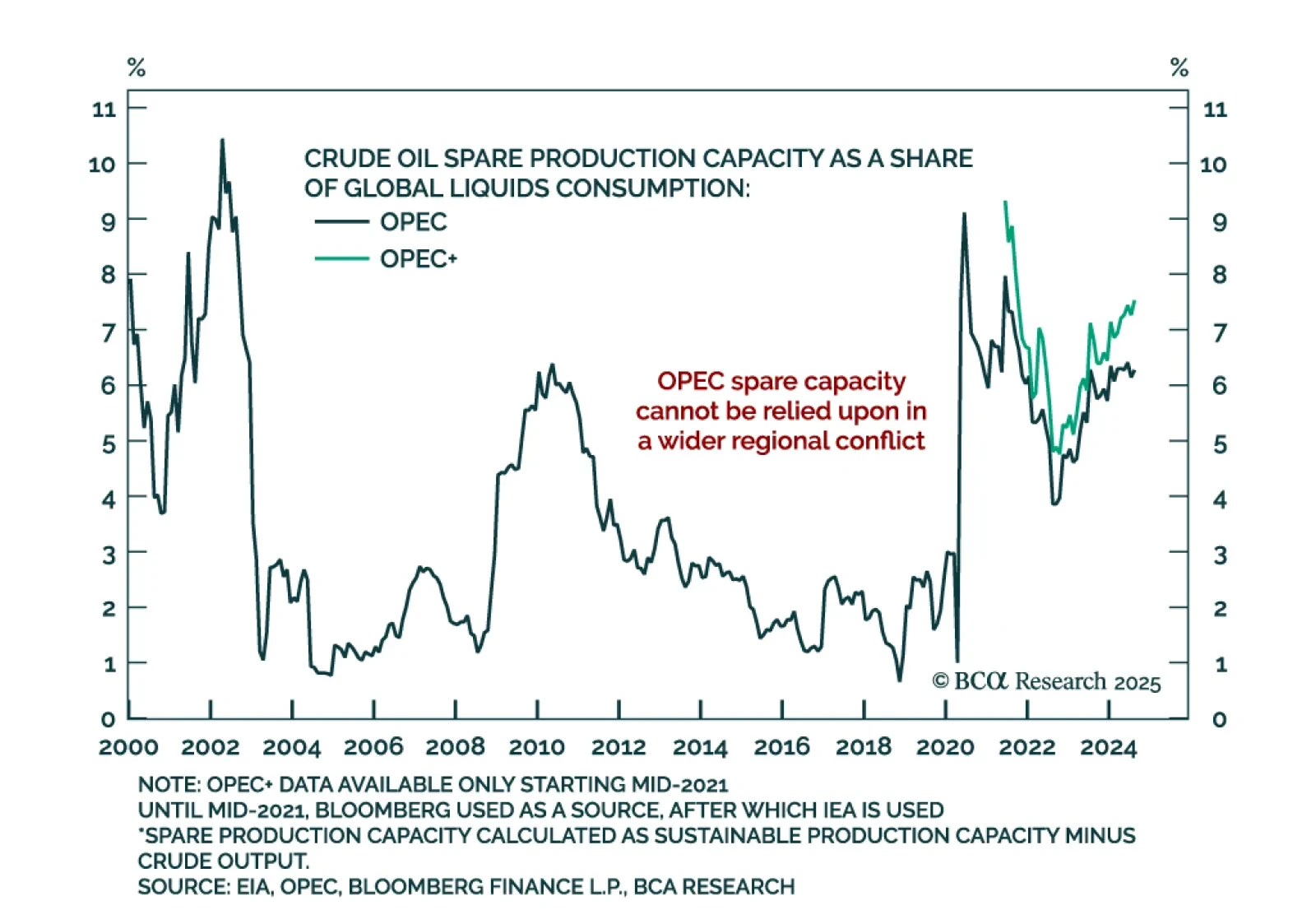

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.

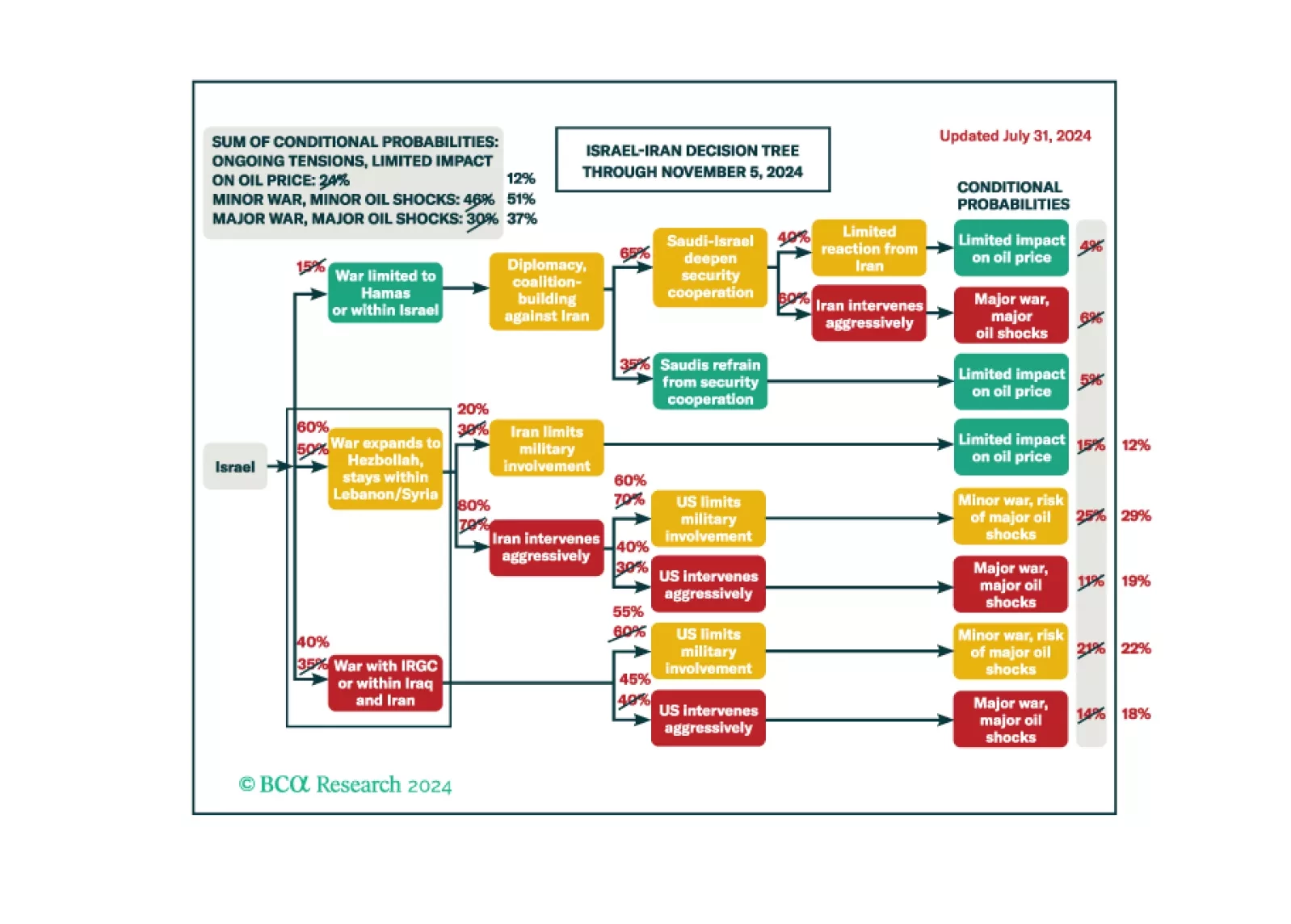

The Israel-Iran conflict is escalating, raising the odds of a major oil supply shock and reinforcing the case for cash, US equity overweight, and tactical energy exposure. Our Chart Of The Week comes from Matt Gertken, Chief…

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

We maintain 37% odds of a major recessionary oil shock, 51% odds of minor shocks, and 12% odds of no shocks.