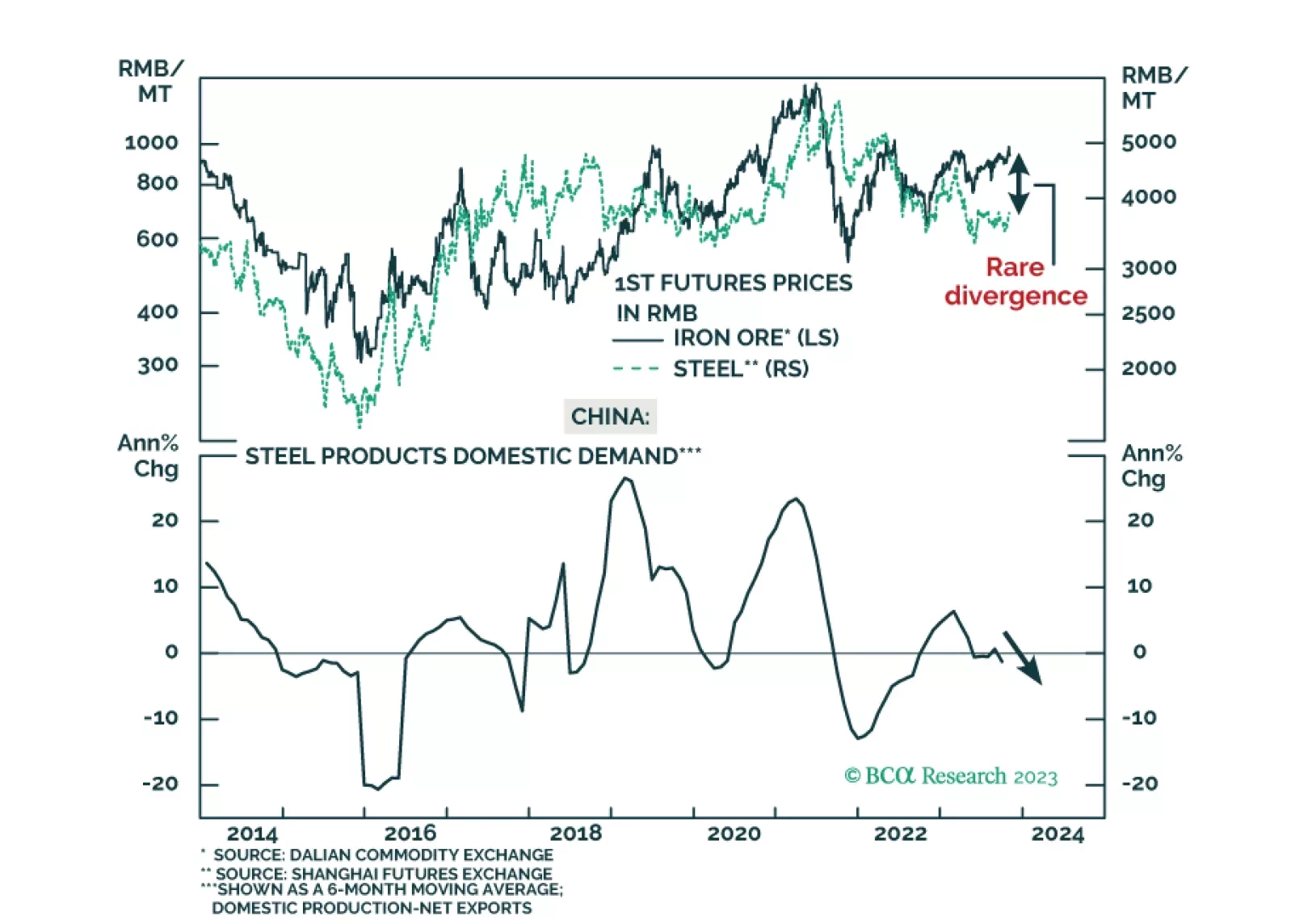

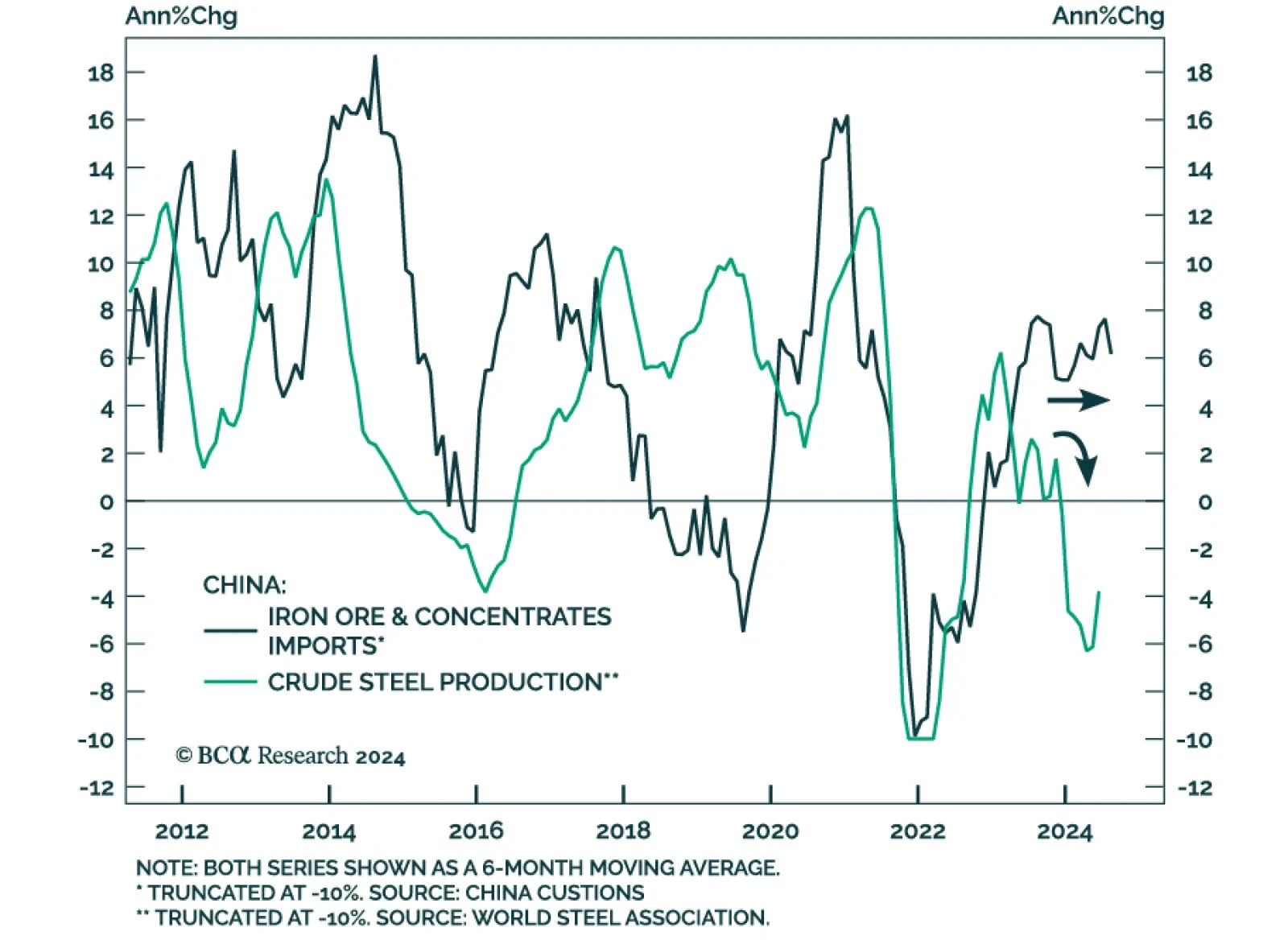

According to BCA Research’s Commodity & Energy Strategy service, robust iron ore imports are sending a false signal about steel demand. Instead, these supplies are being used to restock inventories. By the end of…

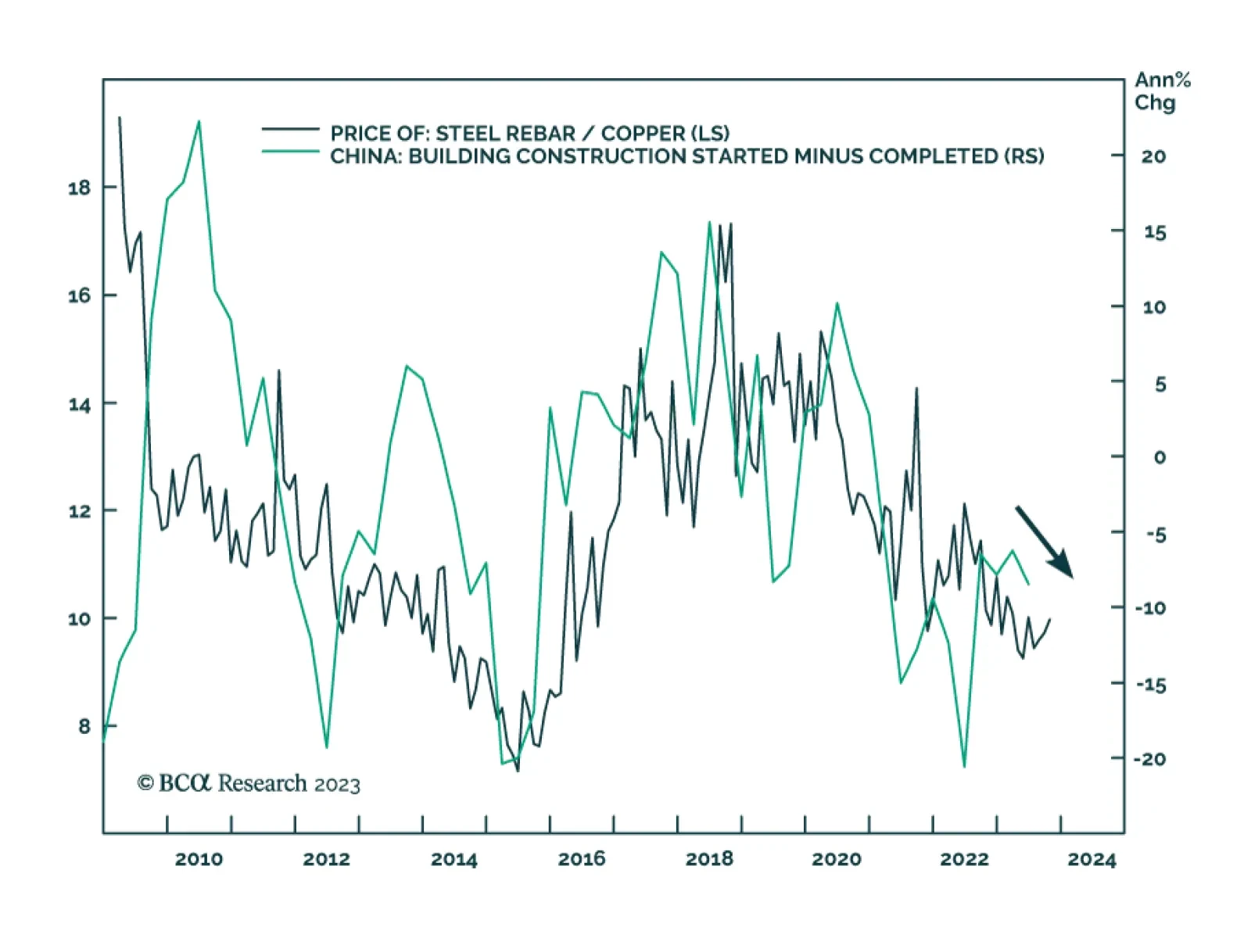

Earlier this year we highlighted that China's property market dynamics pose a greater risk to the price of steel vis-à-vis copper. This view was based on the expectation that Chinese policymakers will direct financing…

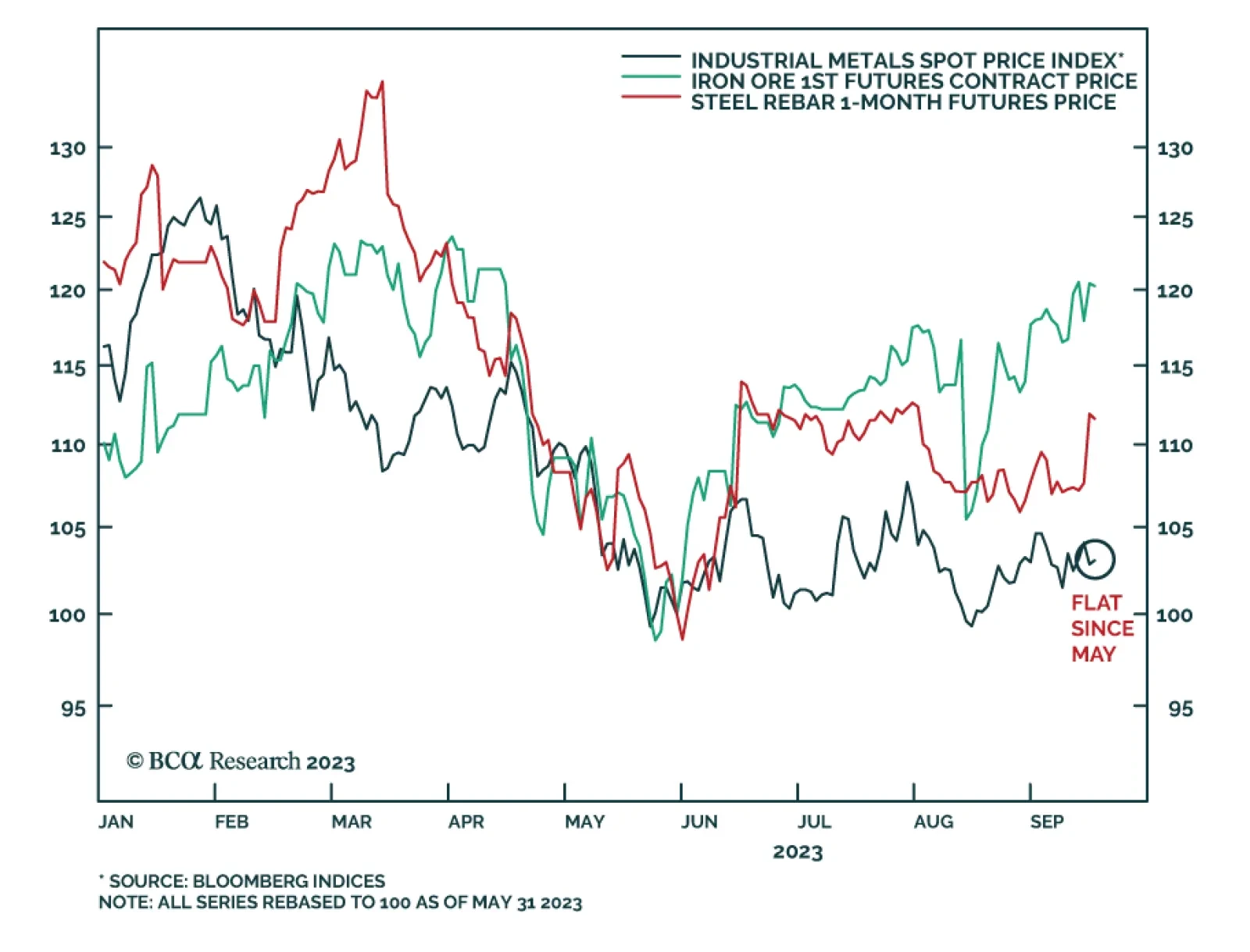

Over the past few months a schism has emerged in the industrial metals complex. On the one hand, the Bloomberg Industrial Metals Index – which is composed of futures contracts on copper, aluminum, zinc, nickel, and lead…

The risk-on rally is challenging our annual forecast so we are cutting some losses. But we still think central banks and geopolitics will combine to reverse the rally later this year.

Highlights Asian and European natural gas prices will remain well bid as the Northern Hemisphere winter approaches. An upgraded probability of a second La Niña event this winter will keep gas buyers scouring markets for supplies…

Highlights The odds of a stronger recovery in EM oil demand next year are rising, as vaccines using mRNA technology are manufactured locally and become widely available.1 This will reduce local lock-down risks in economies relying on…