Banks have had an amazing run, and while such strong performance is unlikely to repeat, there is still oomph left in the trade thanks to a more favorable regulatory environment, stronger demand for loans, a steeper yield curve, and a…

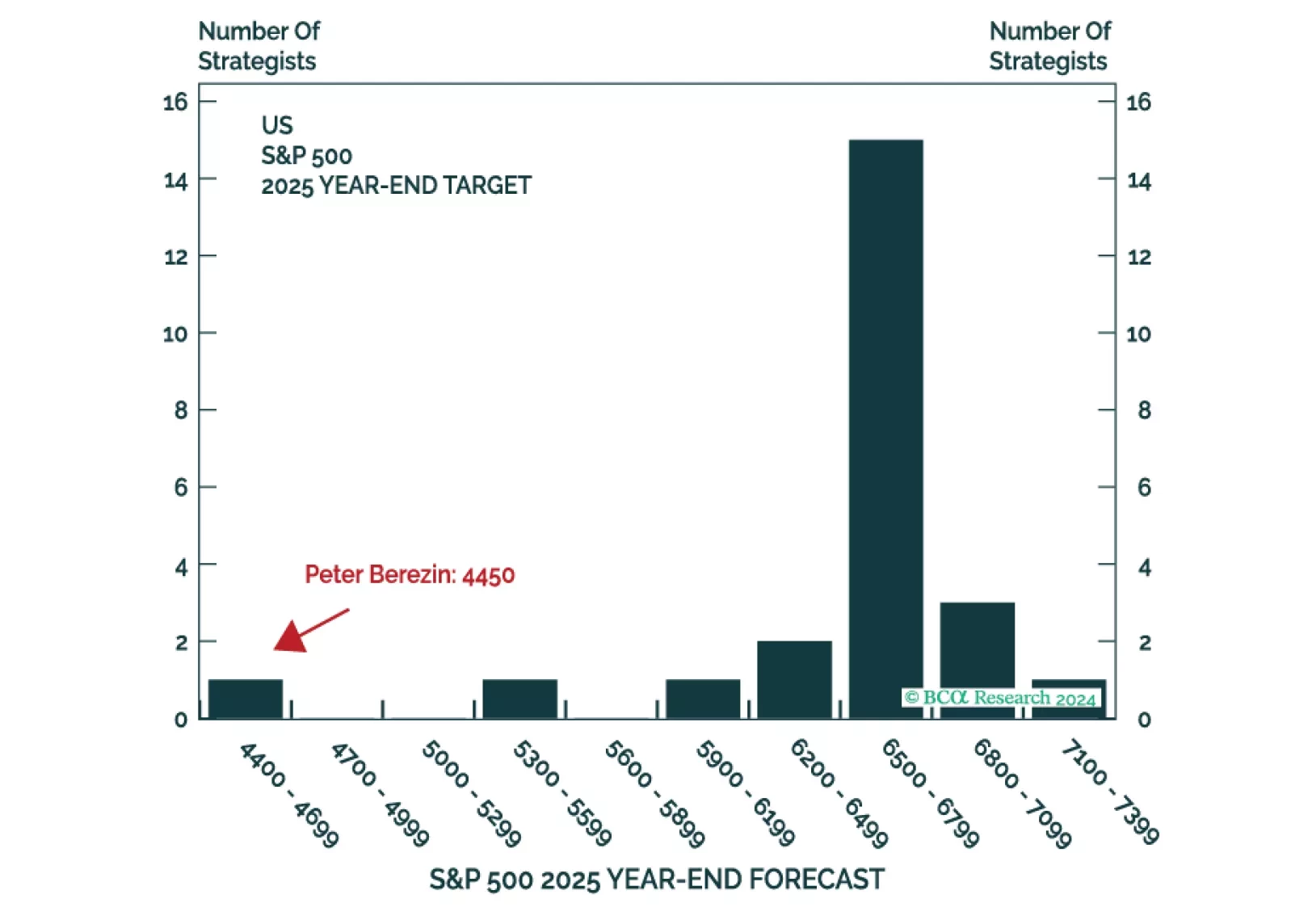

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

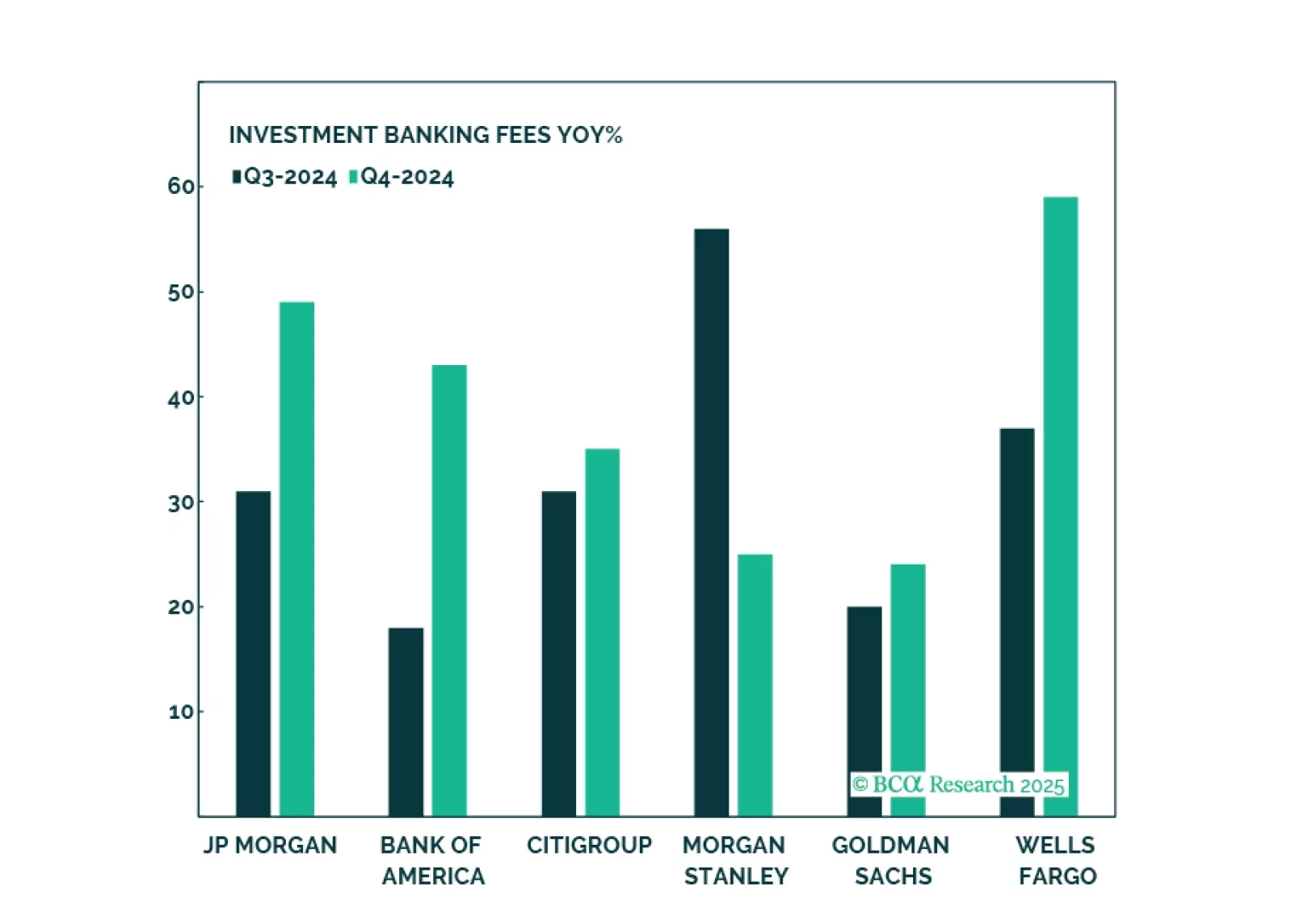

Following our recent downgrade in the S&P banks index, we were also compelled to downgrade the S&P investment banks & brokerage (IBB) index to a benchmark allocation as it has a similar investment profile. The…

Dear Client, There will be no US Equity Insights from July 1-3 inclusive, as the US Equity team will be on vacation for the week. Our regular publication schedule will resume on Monday July 13, 2020 with our Weekly Report. Happy…

We are compelled to downgrade banks and investment banks to neutral in advance of the release of the Fed’s stress tests this Thursday. This downgrade also pushes the financials sector overweighting to neutral. Our worry…

Overweight The recent global move away from risk assets has been a headwind for the high-beta S&P investment bank and brokers index that thrives when risk appetites are healthy. Still, the return of volatility should be a boon to…

Overweight The S&P investment bank and brokers index has been an excellent performer through the early days of the Q2 reporting season as results have generally been besting estimates and the outlook remains solid. Our…

Overweight We have recently been highlighting the burgeoning capex upcycle as the key investment theme driving our sector rotation into cyclical stocks over defensives. The investment bank & brokers index in particular thrives…

Highlights Portfolio Strategy Upgrade capital markets stocks to overweight and put them on the high-conviction list. Capital formation is poised to accelerate in the second half of the year. Our Indicators suggest that demand for…

Highlights Portfolio Strategy Retail food stocks are deep into the buy zone. Deflating food costs augur well for profit margins in the coming quarters. Lift the financial sector to neutral, via the asset manager and investment bank…