This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

Neutral In mid-April we moved the S&P consumer discretionary sector to the overweight column via upgrading the internet and home improvement retail sub-sectors. While the home improvement retailers hit our stop earlier…

In mid-April we boosted the S&P internet retail index to overweight as it was poised to benefit from the shifting consumer spending habits due to the COVID-19 outbreak. True, the “amazonification” of the…

Overweight In our April 14 Weekly Report we executed our upgrade alert and boosted the S&P internet retail index to overweight – a call that has since produced handsome relative gains of 14%. The most recent Advance Monthly…

Overweight In the most recent Weekly Report, we boosted the S&P consumer discretionary index to overweight via upgrading its heavy-weight internet retail sub-index to an above benchmark allocation. E-commerce has been…

Highlights Portfolio Strategy The Fed’s QE and ZIRP, the collapse in gasoline prices and extremely depressed breadth readings that are contrarily positive, all signal that it no longer pays to be bearish consumer discretionary…

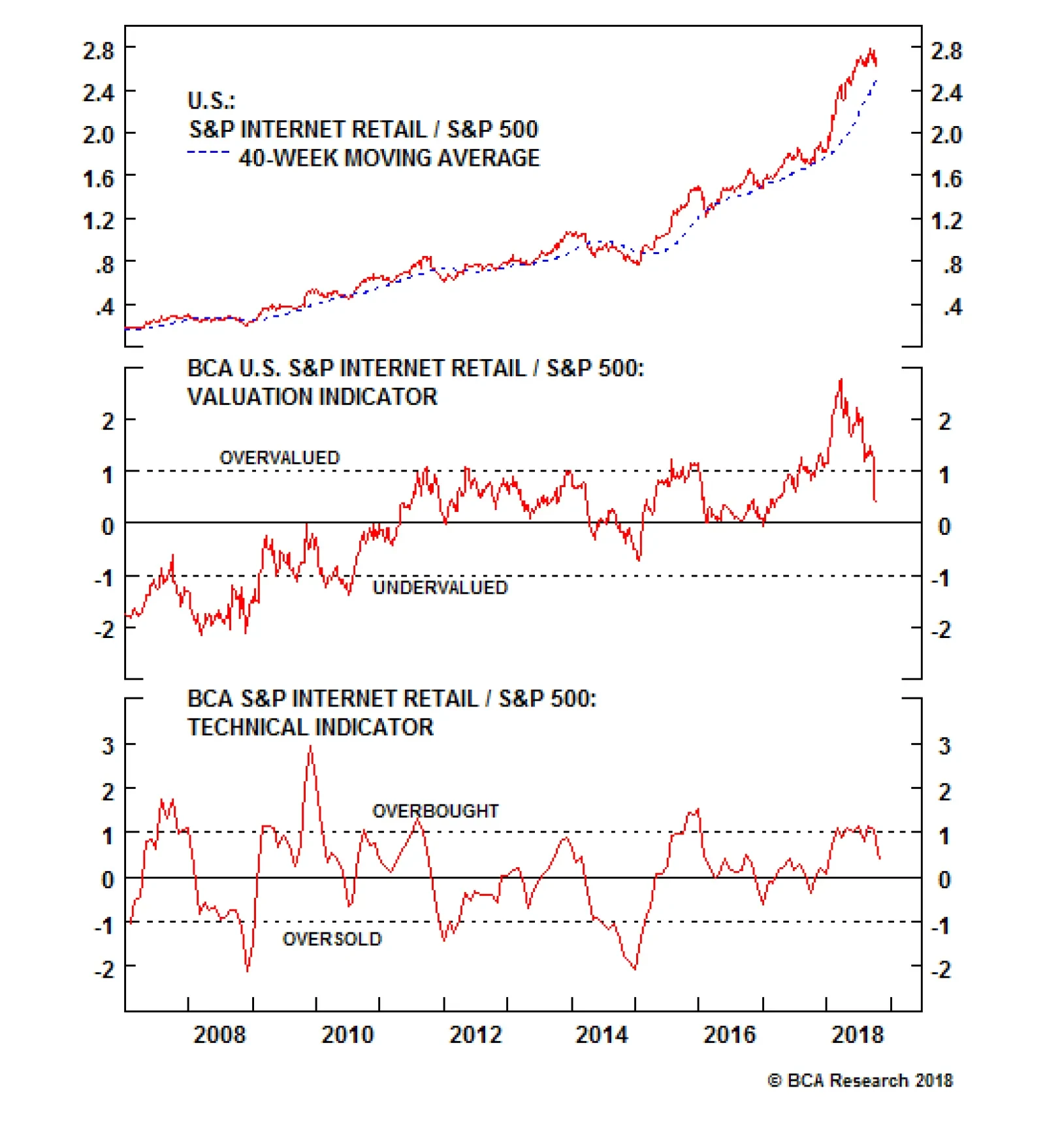

In a recent Insight Report ,1 we highlighted the collapse in valuations that were making us grow more constructive on the S&P internet retail index. In fact, sky high valuations were what kept us on the sidelines in the first place…

Neutral In our recent initiation of coverage on the newly minted Communication Services sector, we examined the impact of a variety of technology and consumer discretionary stocks being pulled together to form a new GICS1…

One sector that saw some important changes was the S&P internet retail index, a sub-sector of consumer discretionary, with Netflix and TripAdvisor moving out and eBay moving in. Our thesis of continued elevated profit…