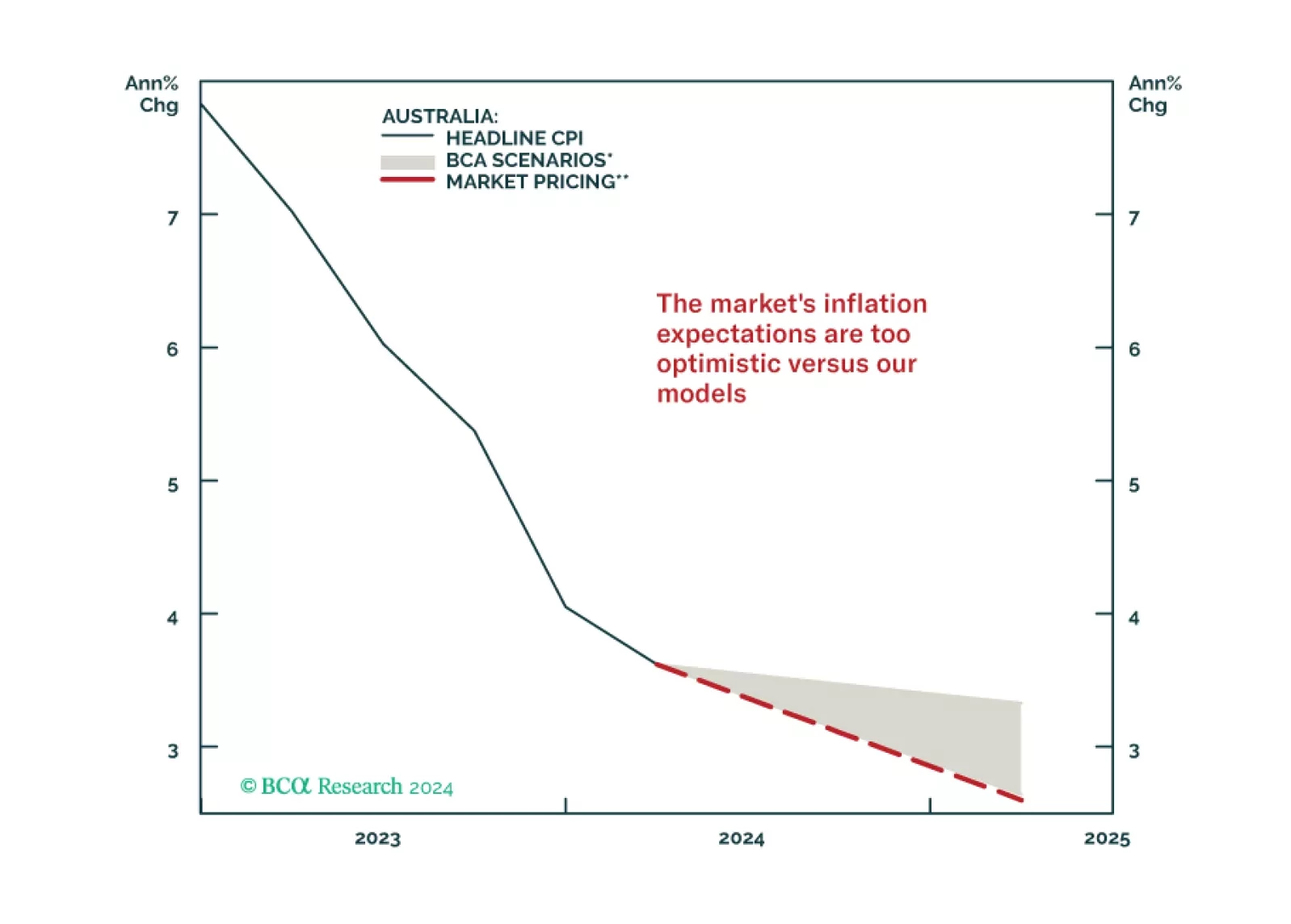

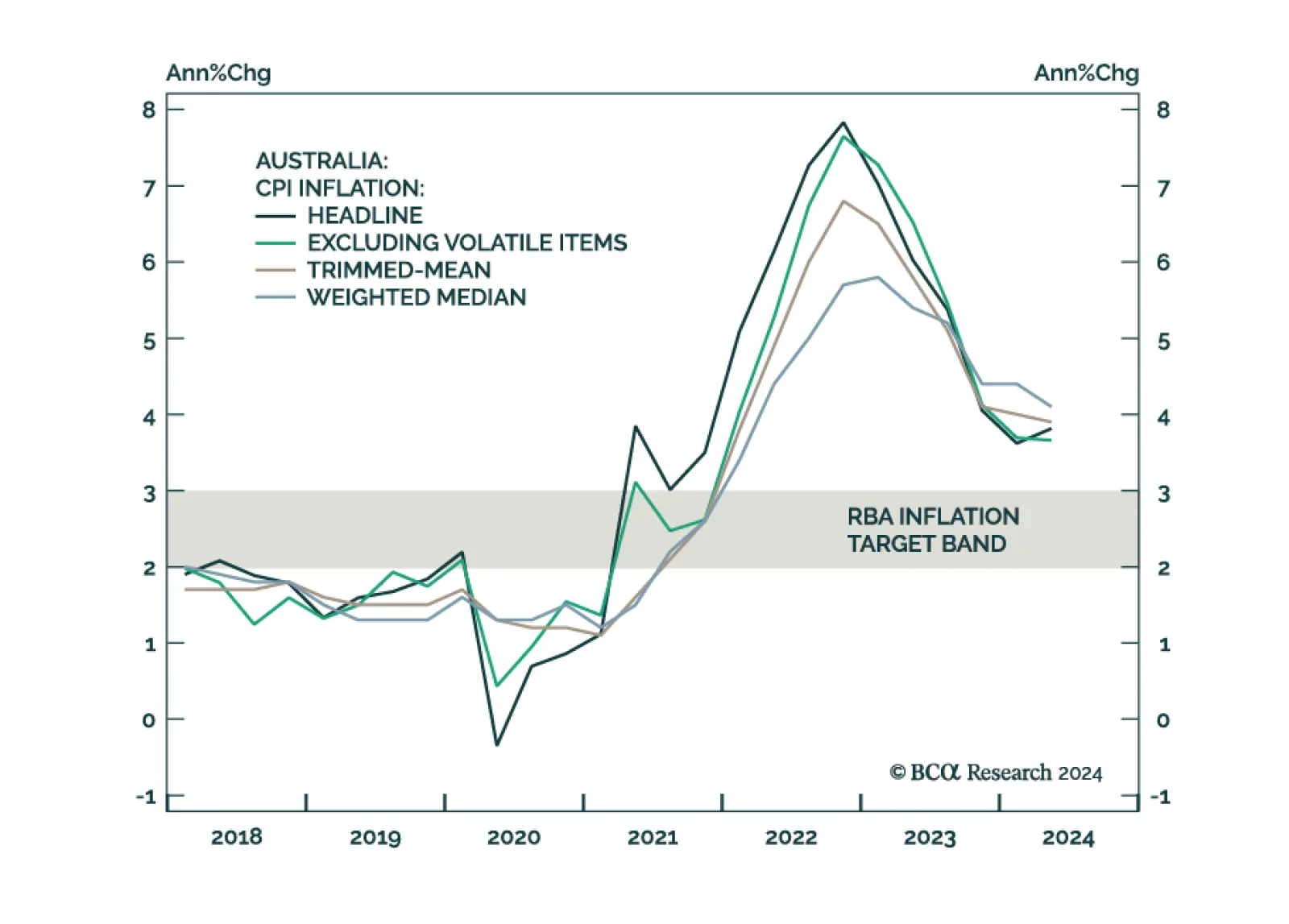

The Australian CPI release for Q2 came in broadly within expectations. Headline CPI reaccelerated to 3.8%y/y from 3.6%y/y the previous quarter. Some of the narrower measures of inflation — trimmed-mean and weighted…

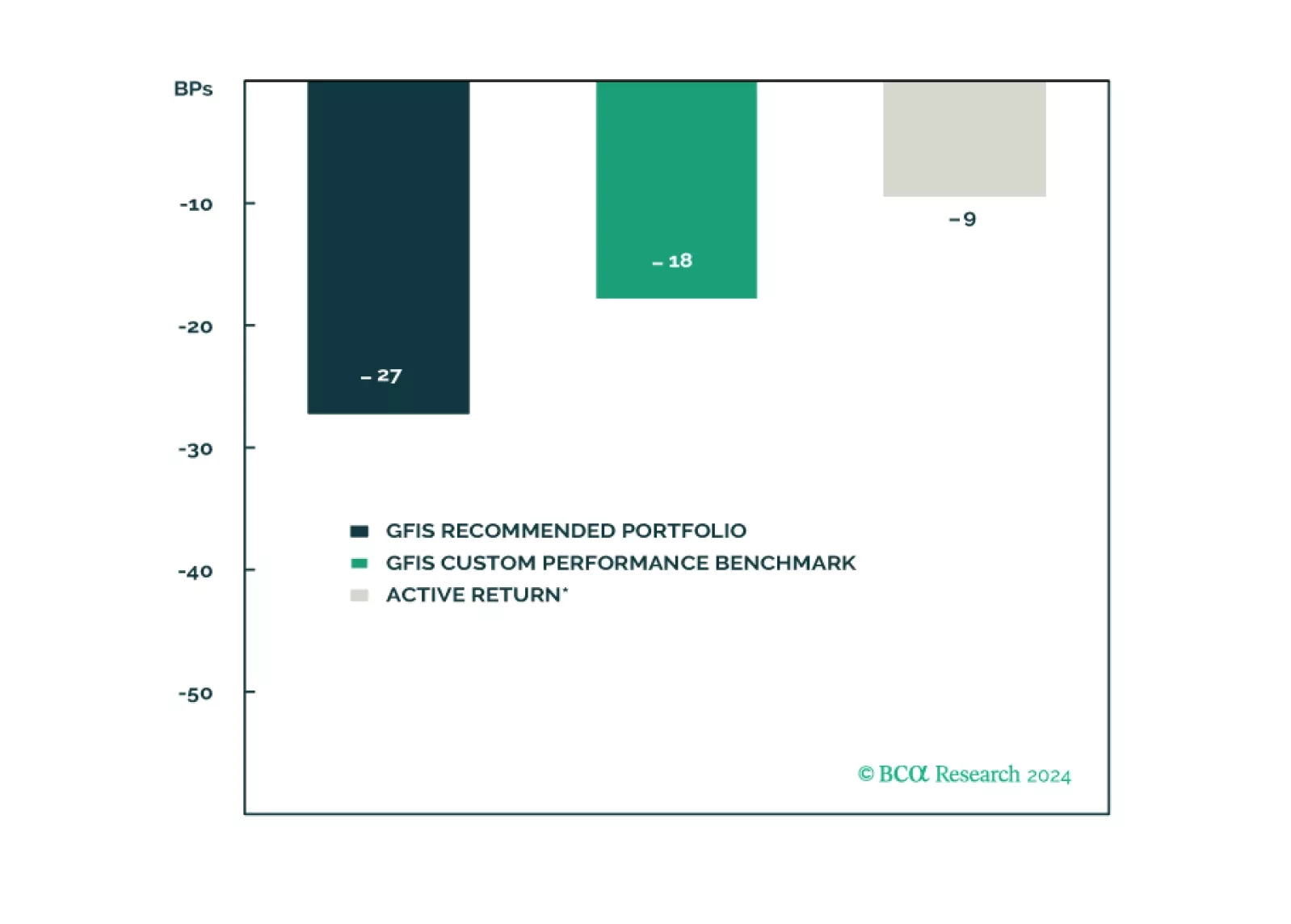

In this report, we present the quarterly review of our Model Bond Portfolio. Rebounding growth and political instability led to slightly negative portfolio performance in Q2/2024. As global growth starts to moderate, we continue to…

Our Portfolio Allocation Summary for July 2024.

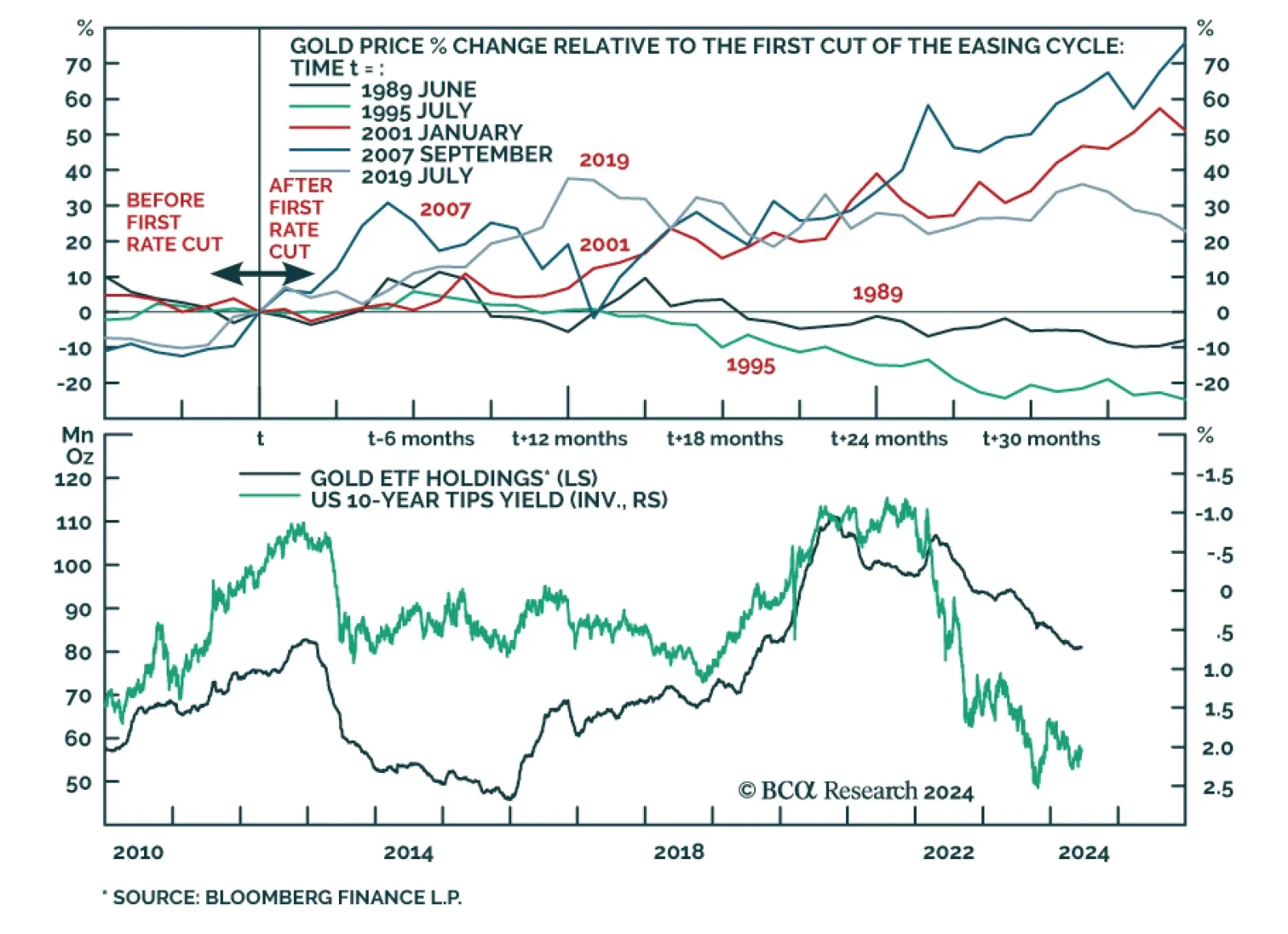

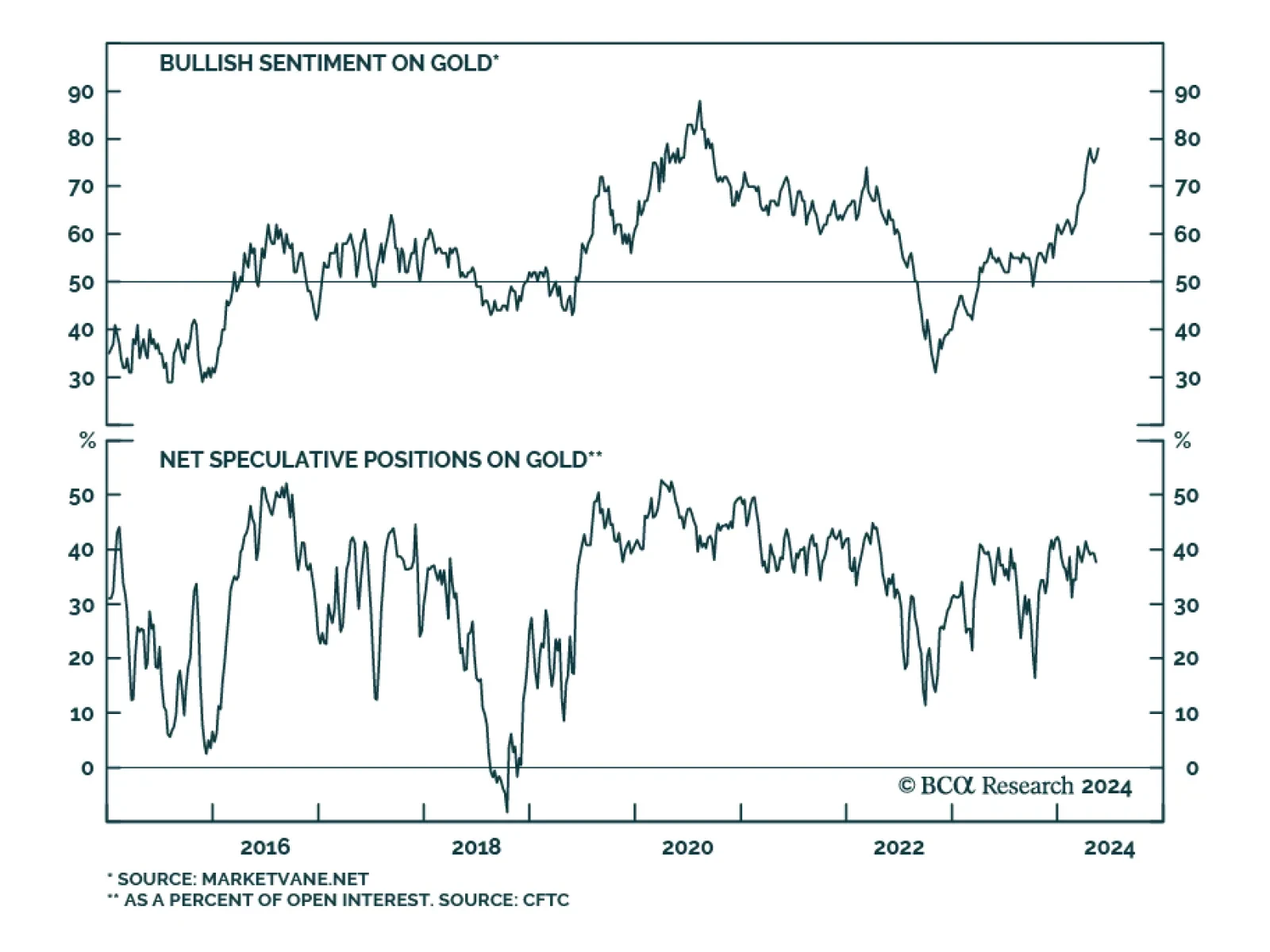

According to BCA Research’s Commodity & Energy Strategy service, a Fed pivot to rate cuts will provide gold prices with a tailwind. At first blush, the historical evidence is mixed. While gold rallied in the three…

In light of this week’s RBA decision to keep policy on hold, we look at the best possible trades in fixed income markets. In our view, inflation-linked bonds, relative to nominals remain a good bet.

Our Portfolio Allocation Summary for June 2024.

The rally in gold continues and spot prices flirted with their all-time highs last week. Interestingly, these gains have occurred despite the rise in real yields, with which they are usually strongly inversely correlated.…

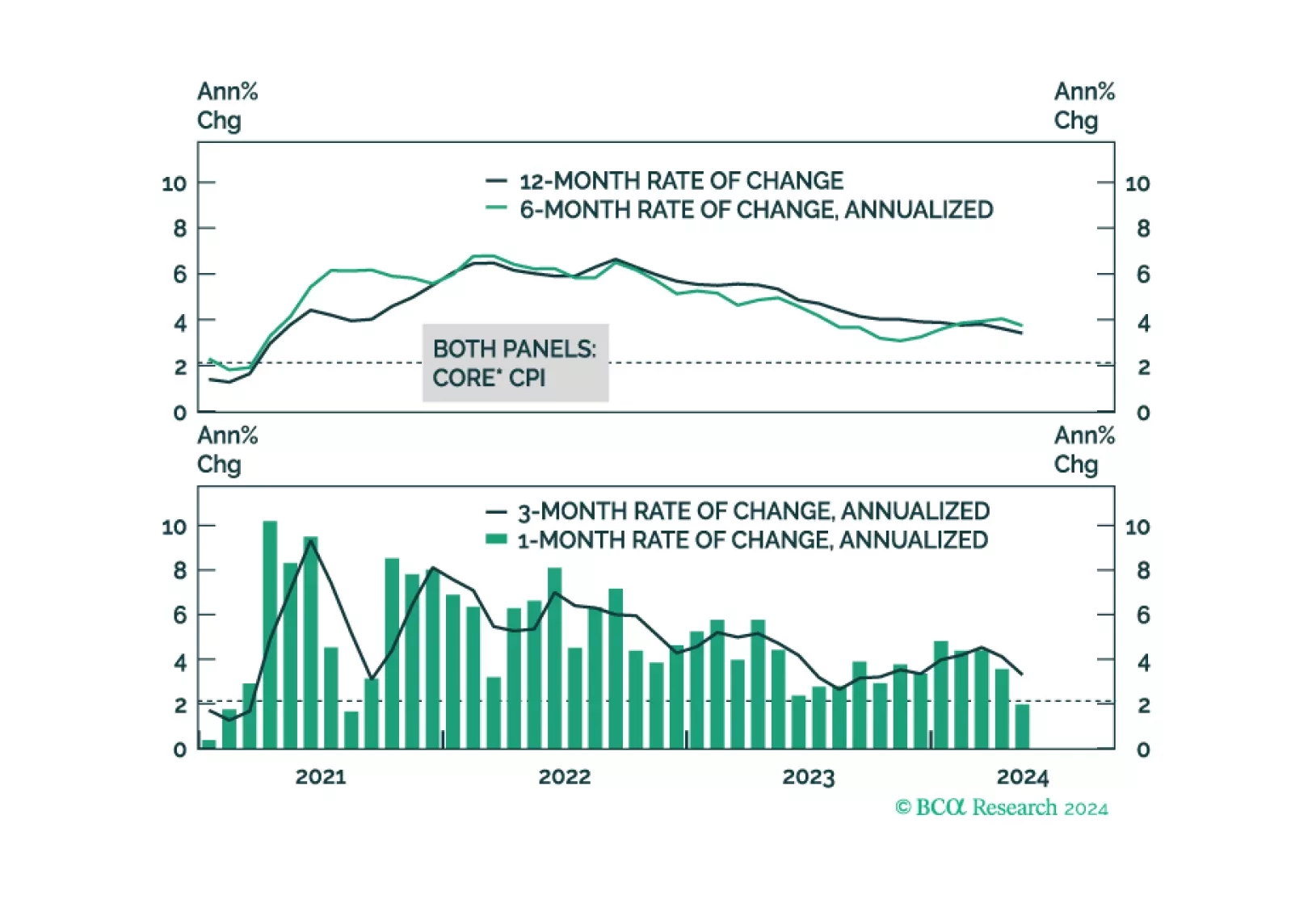

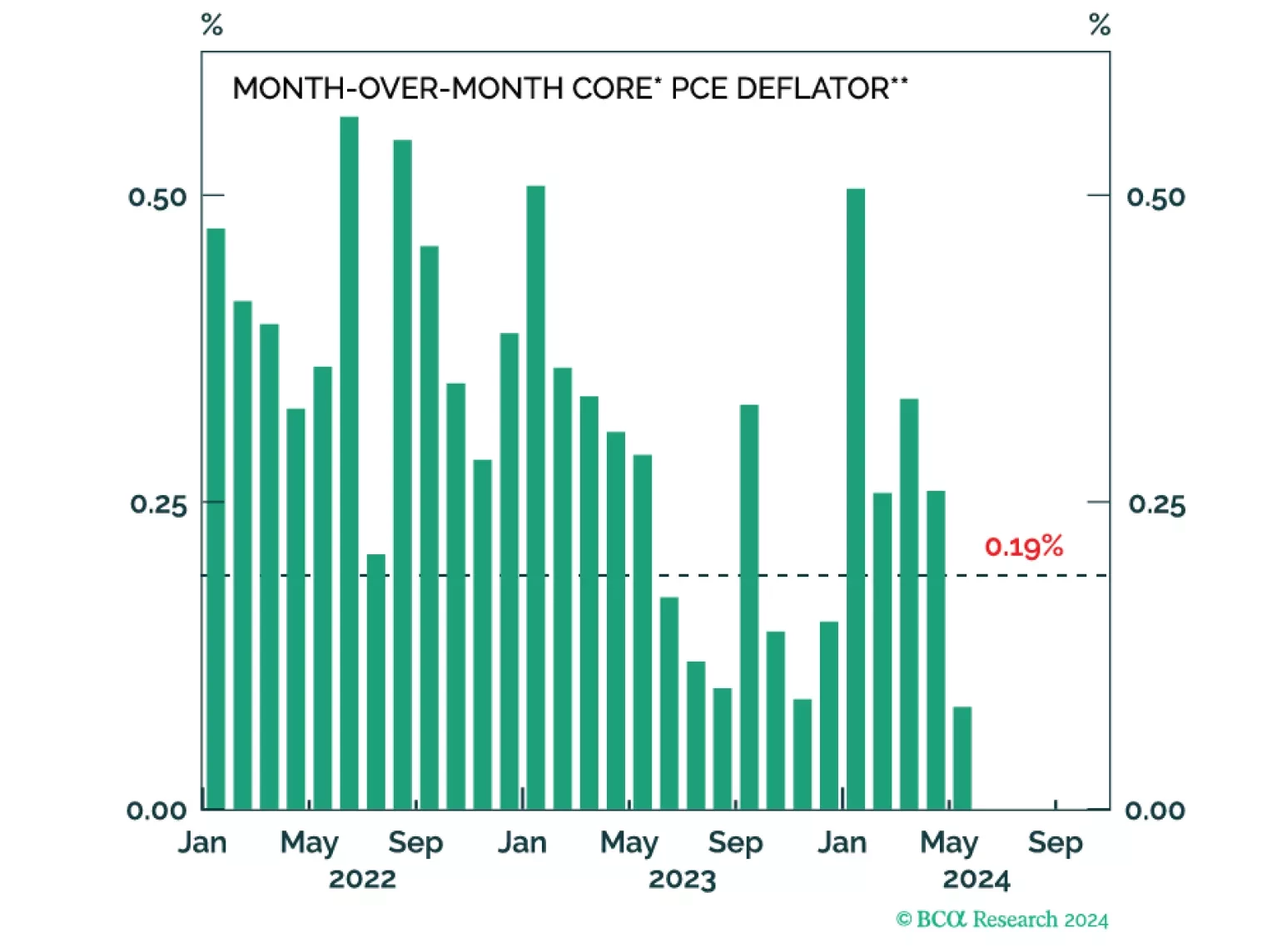

The US Citi Economic Surprise Index has recently dipped below zero, indicating that US economic data releases have been disappointing expectations. Most notably, the ISM Services PMI started contracting in April against…

Our Portfolio Allocation Summary for May 2024.