Inflation Protected

Our Portfolio Allocation Summary for March 2026.

Our Portfolio Allocation Summary for February 2026.

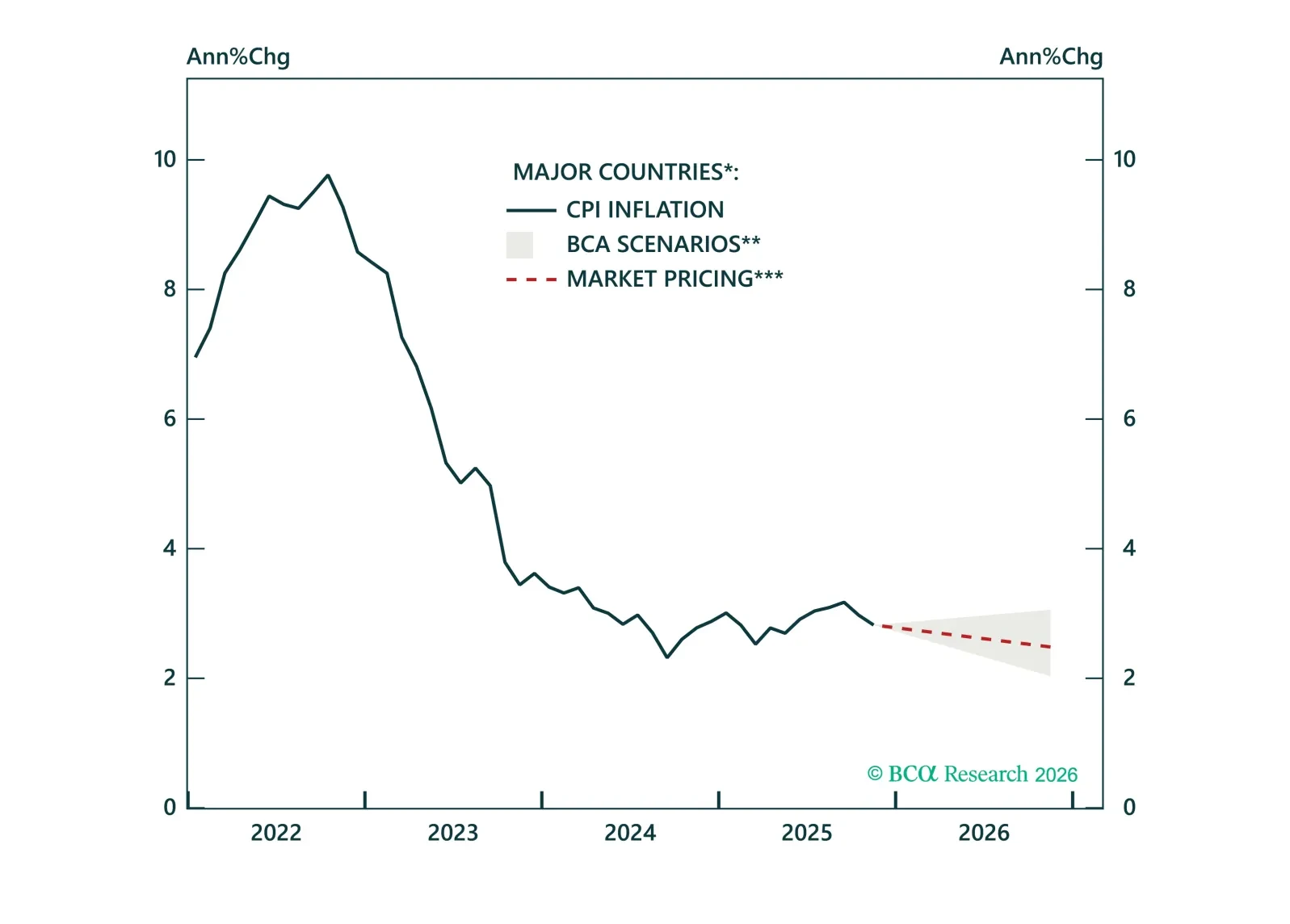

In our 2026 inflation outlook, we explain why 2026 will bring more disinflation, upside risks remain contained, and how to position in ILBs across major markets.

Our Portfolio Allocation Summary for January 2026.

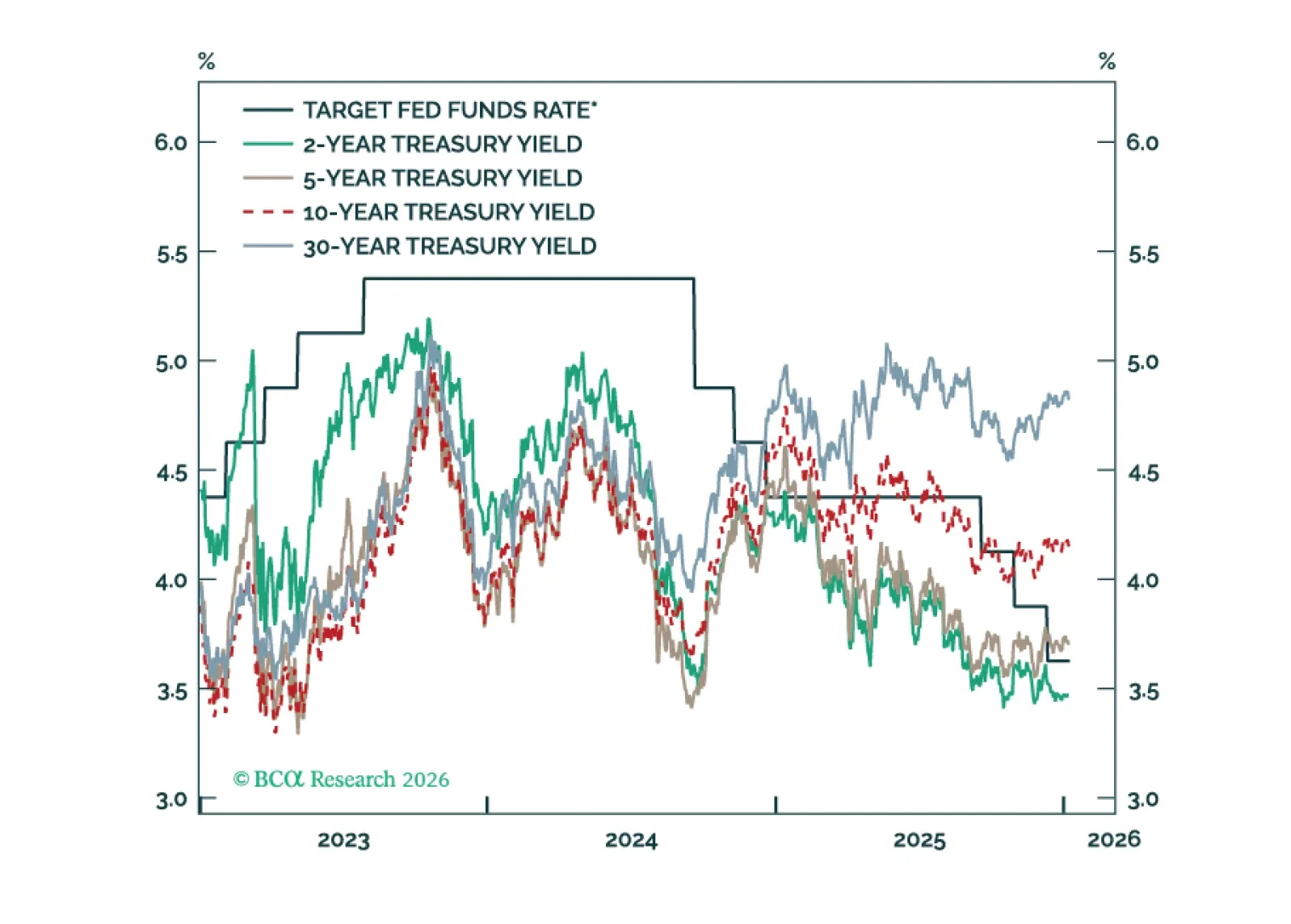

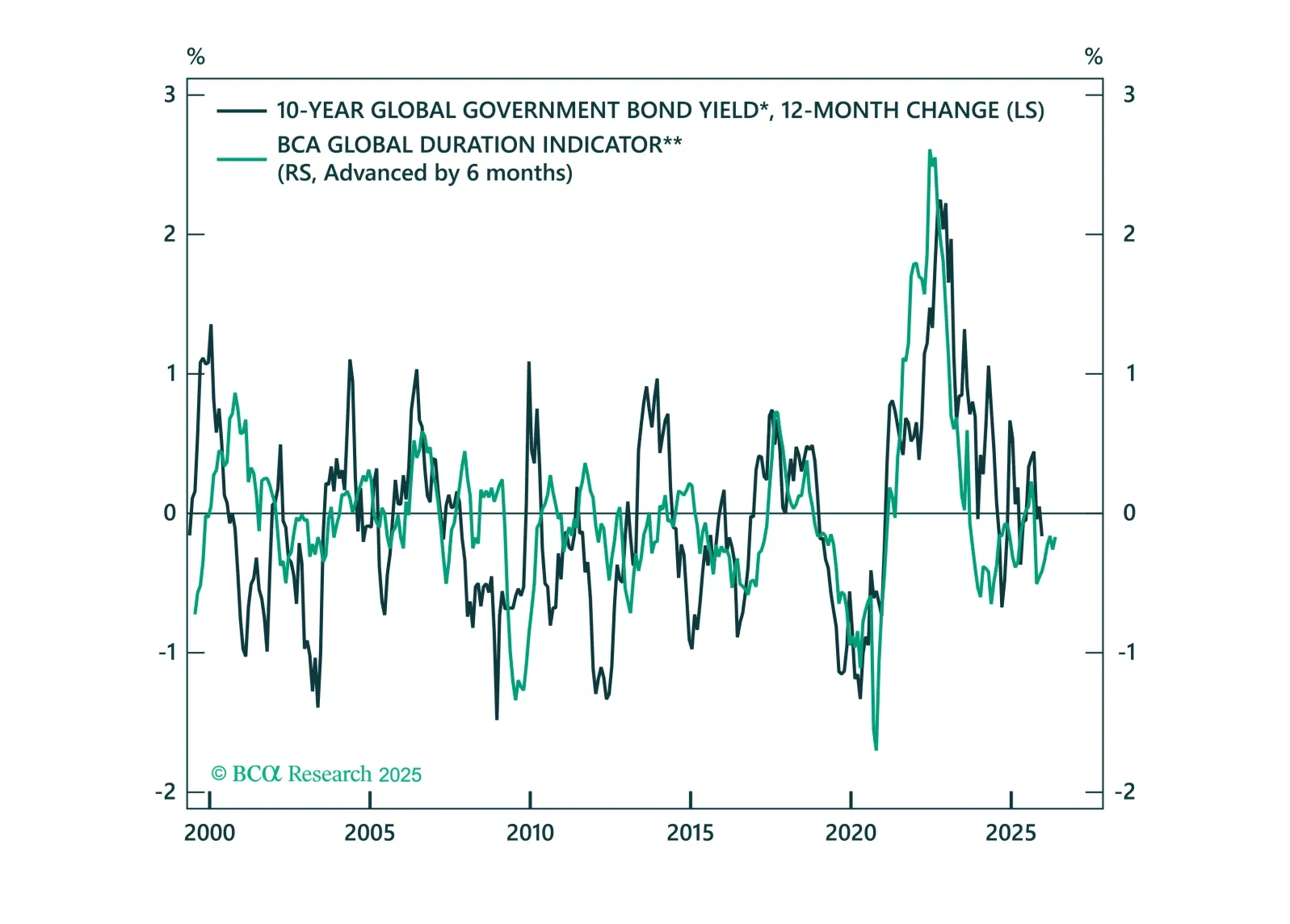

We present our five key views for global fixed income markets in 2026. A year that will see the global easing cycle come to an end.

Our Portfolio Allocation Summary for December 2025.

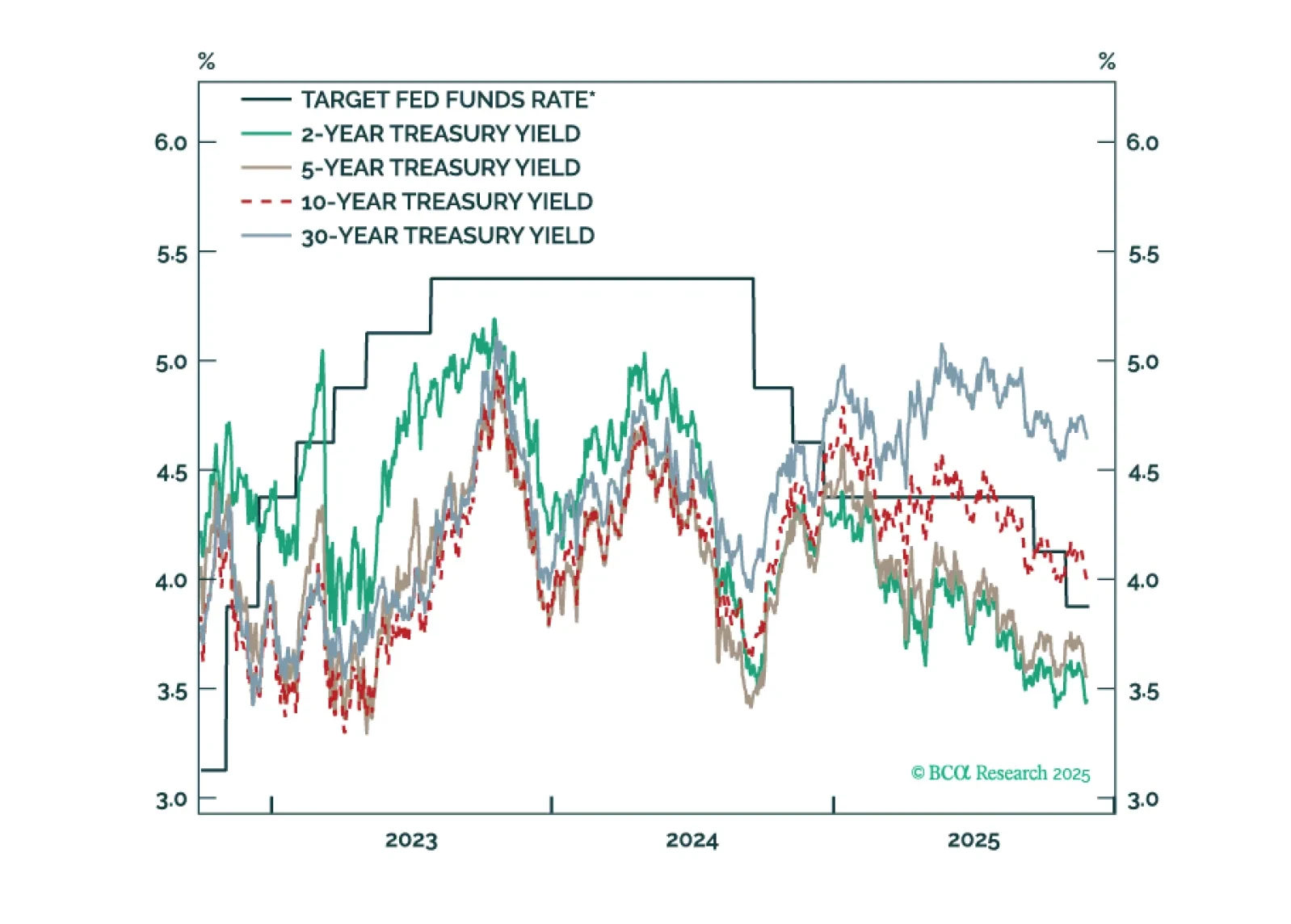

Our key US fixed income views for 2026.

Our Portfolio Allocation Summary for November 2025.

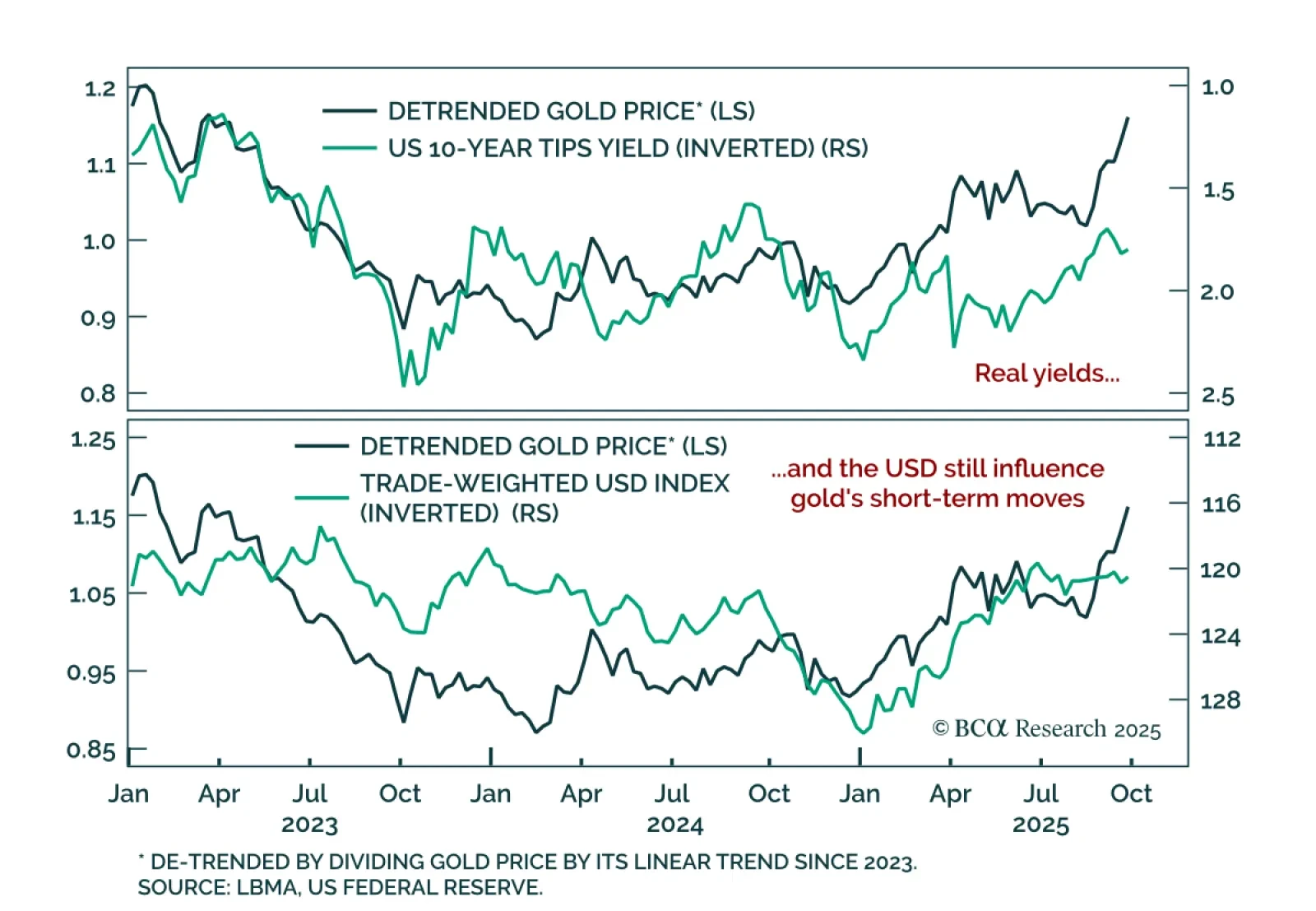

Gold Is Still Exposed to Traditional Macro Drivers…

Our Portfolio Allocation Summary for October 2025.