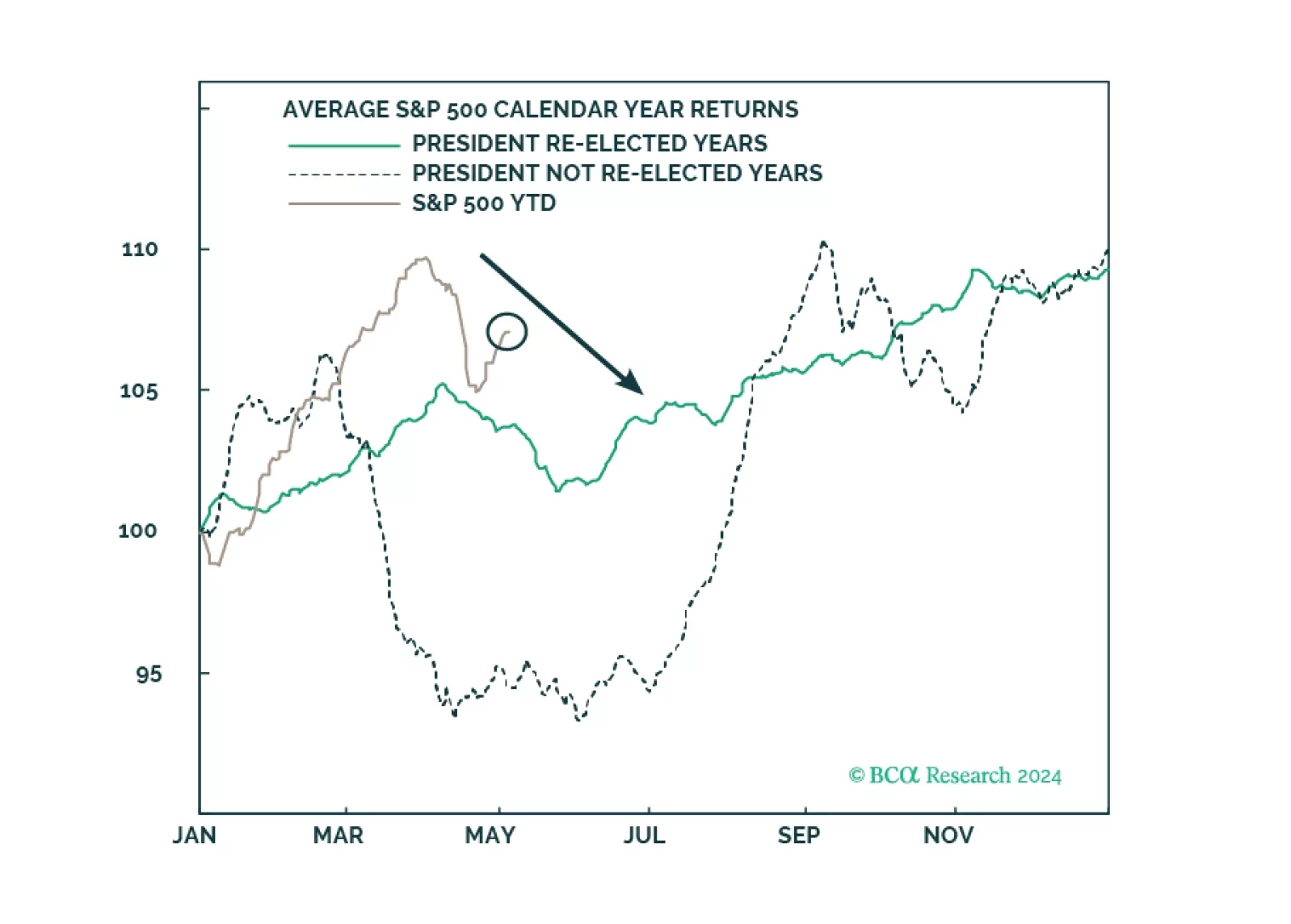

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

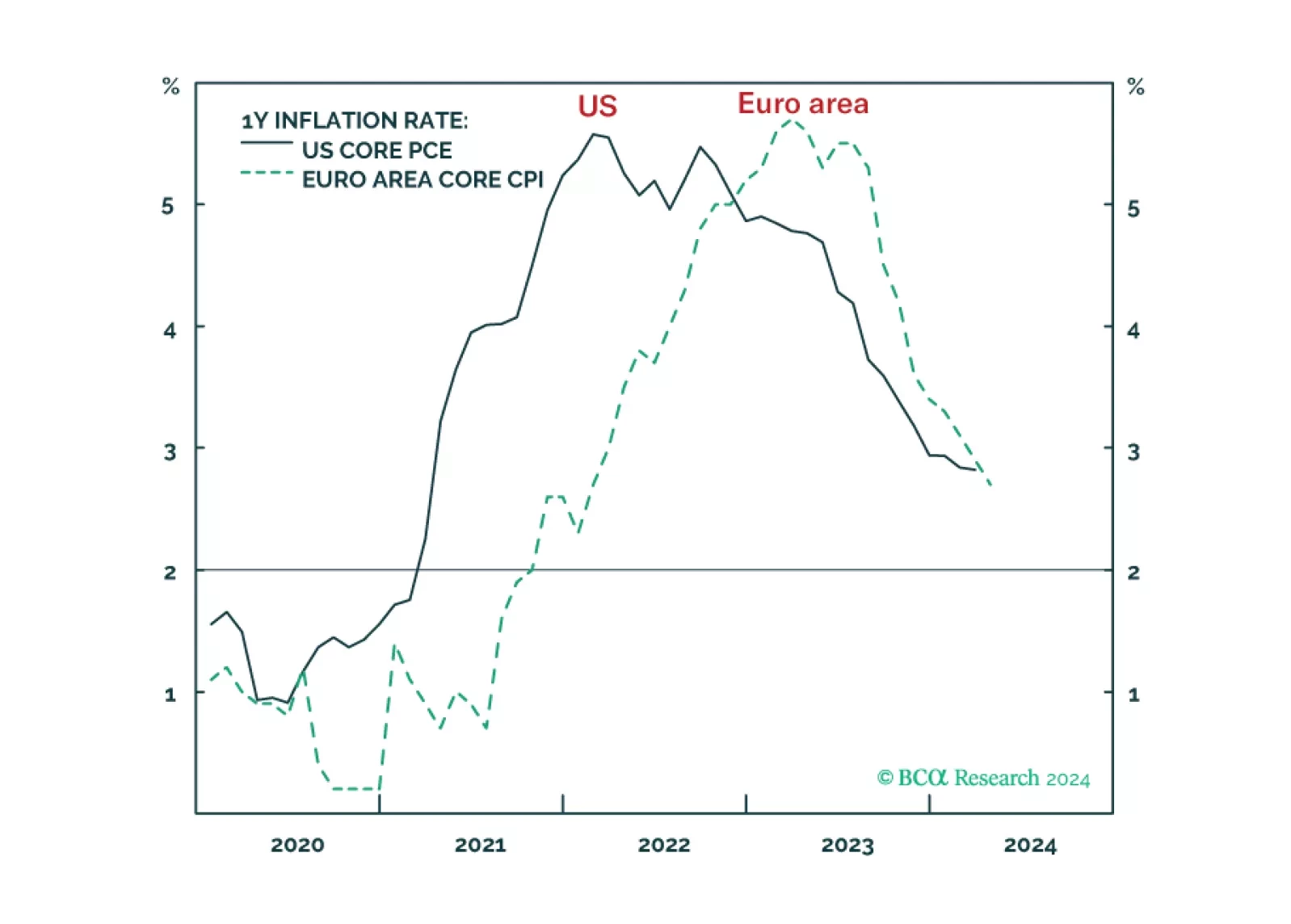

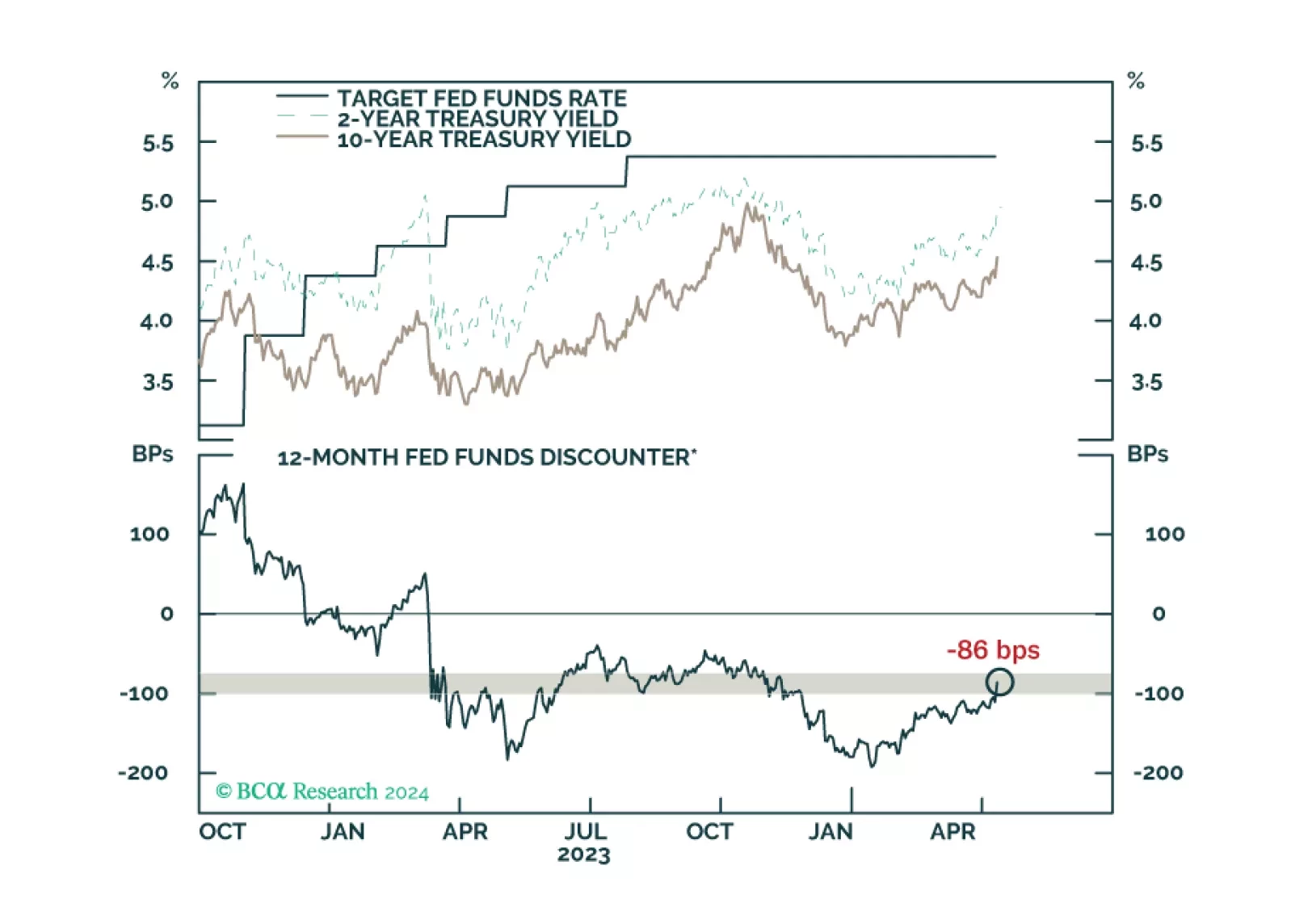

Wild hopes for US rate cuts got shattered, exactly as we predicted. But given the different incentives that the Fed and ECB now face, the relative pricing between the Fed and the ECB could widen further in the coming months. We…

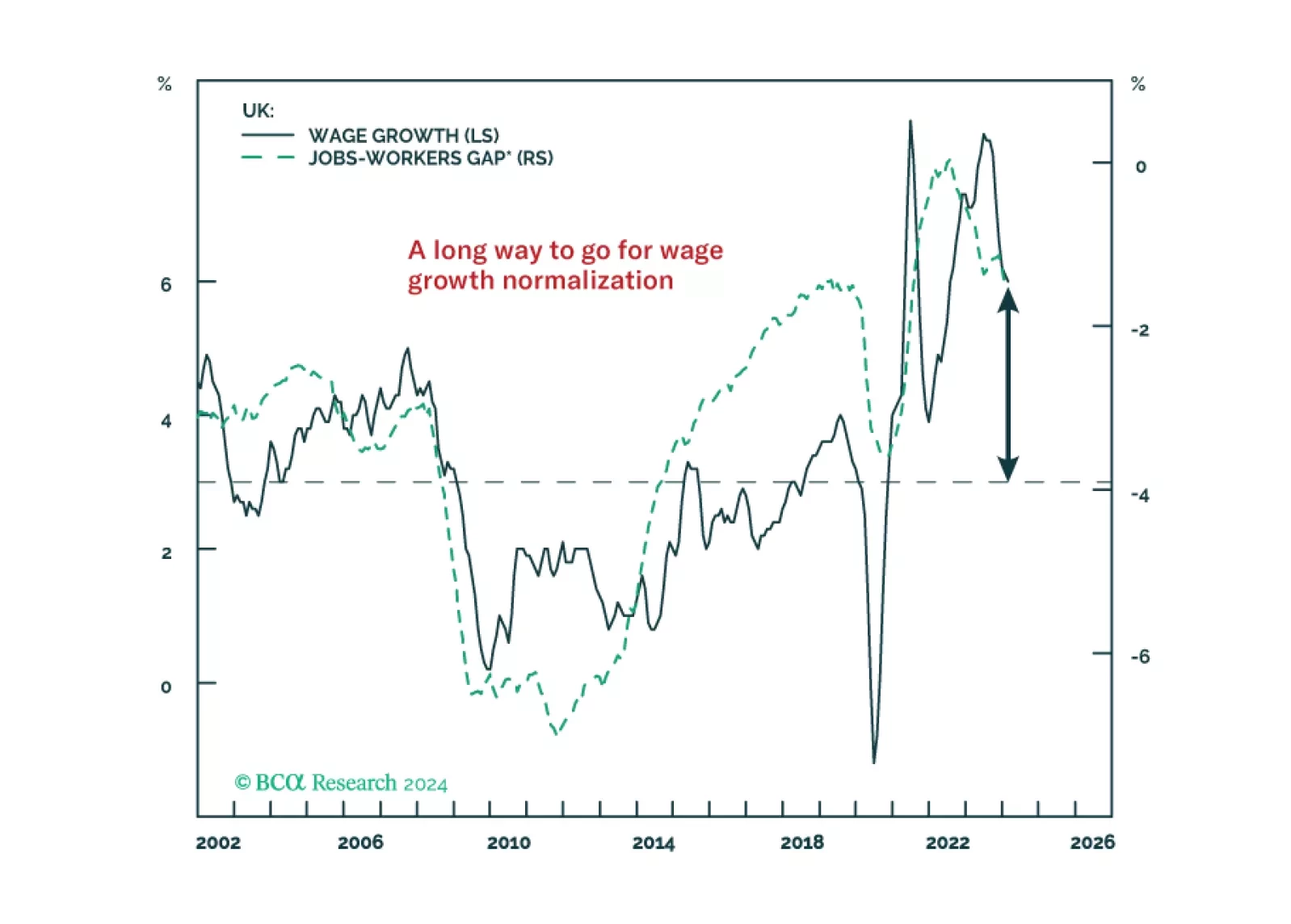

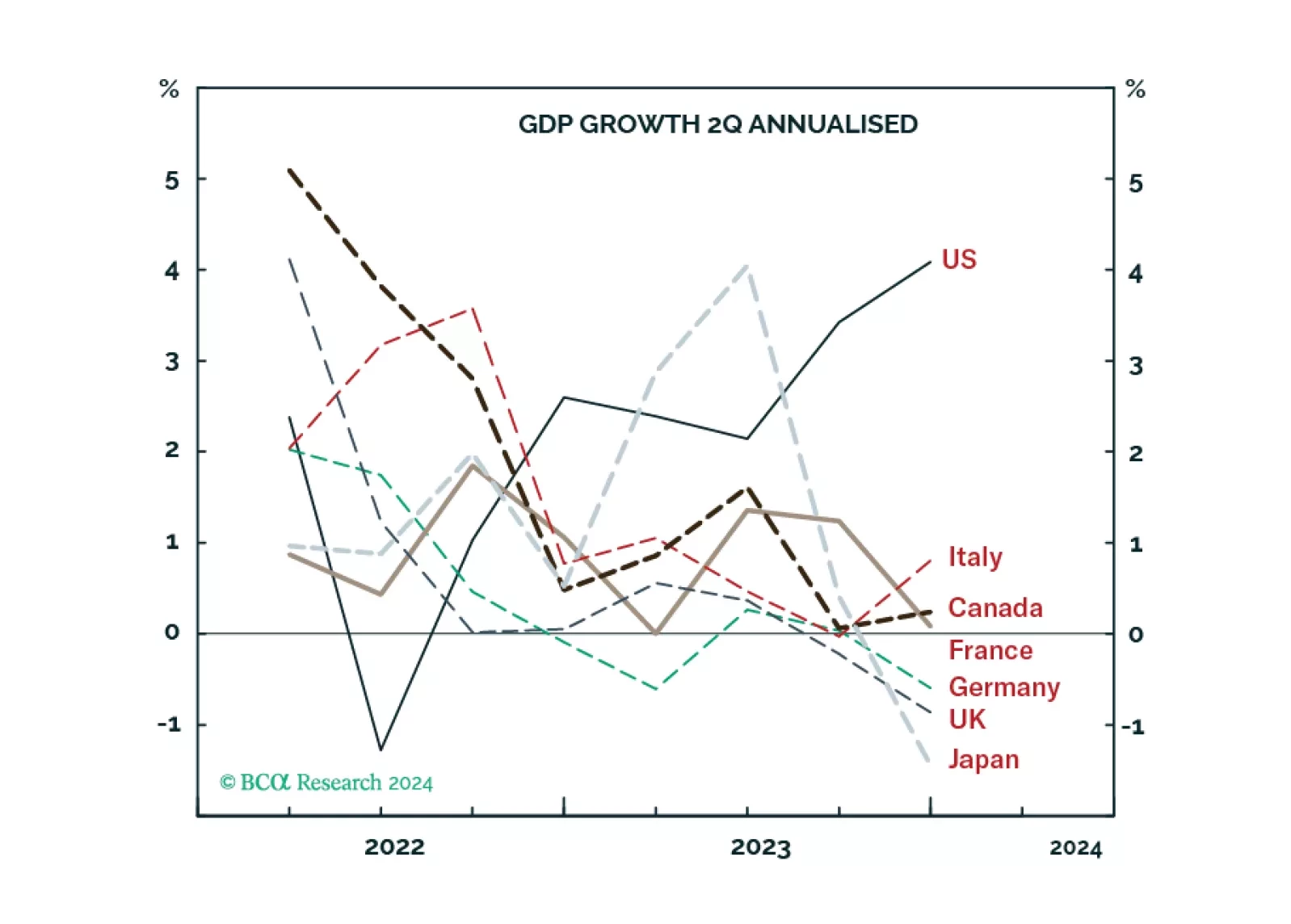

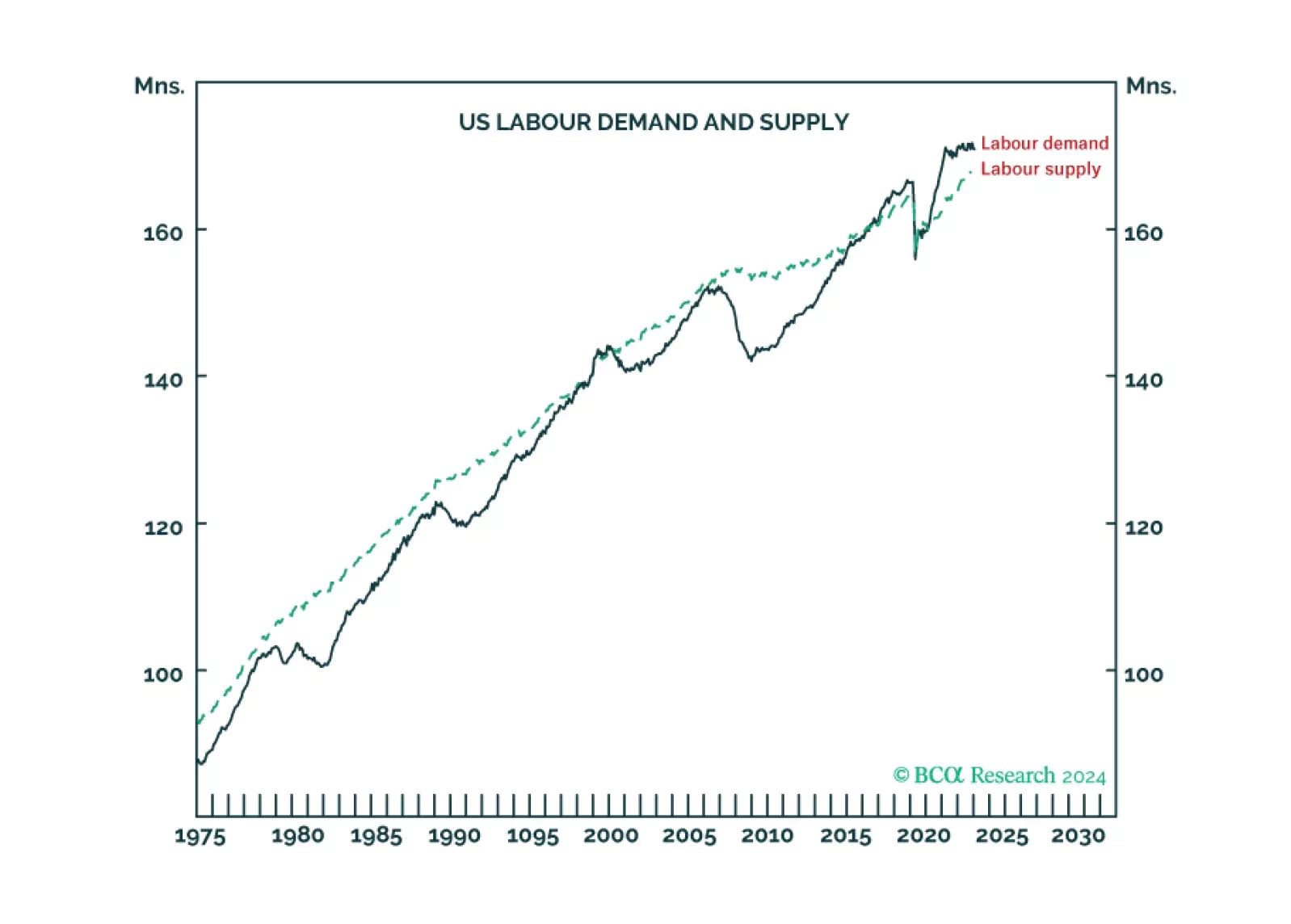

Unlike most advanced economies that are flirting with recession due to weak demand, the ‘inverted’ US economy is motoring along due to strong supply, from a combination of surging labour participation and surging immigration. We go…

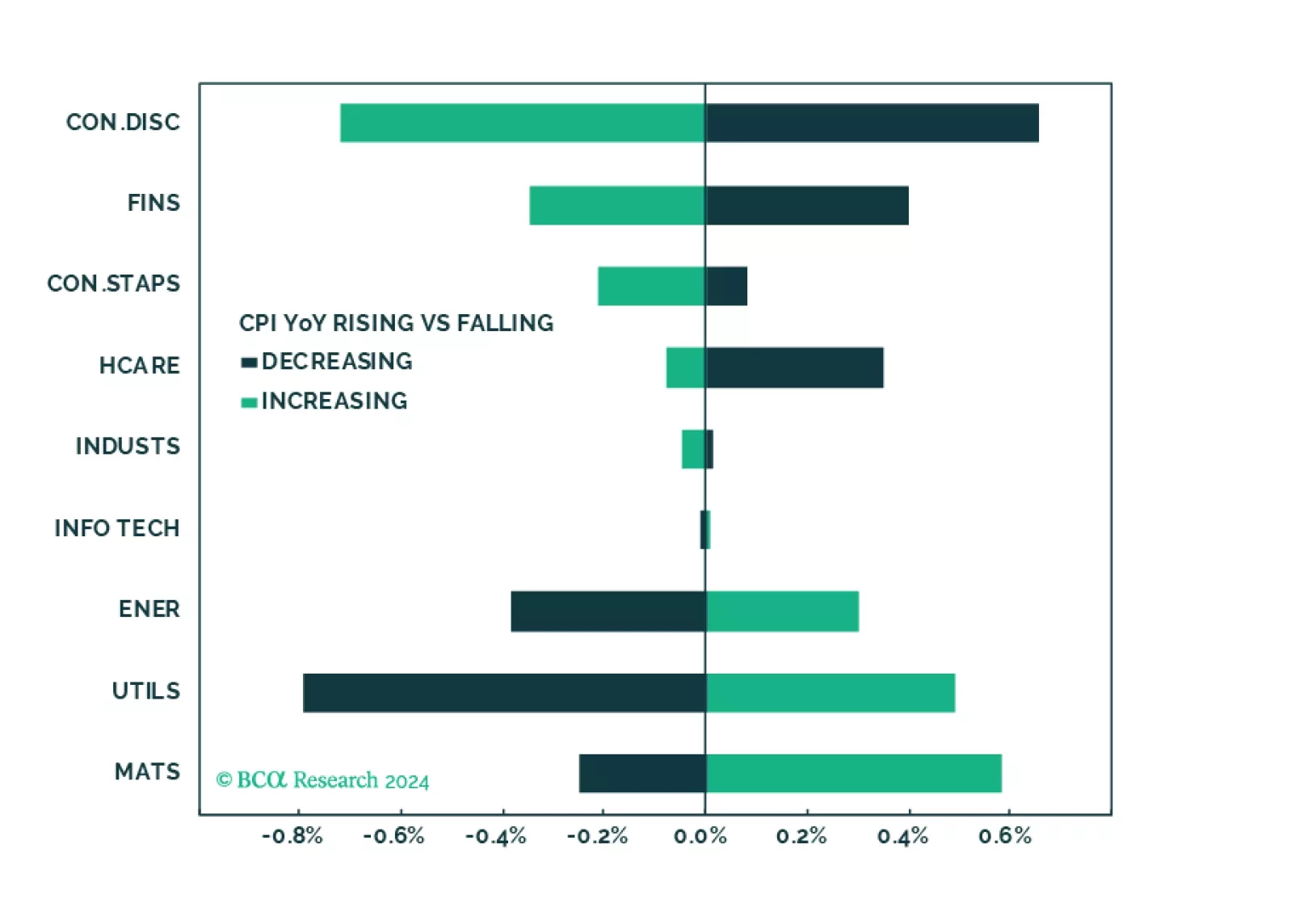

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

Our reaction to this morning’s CPI report and bond market moves.

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

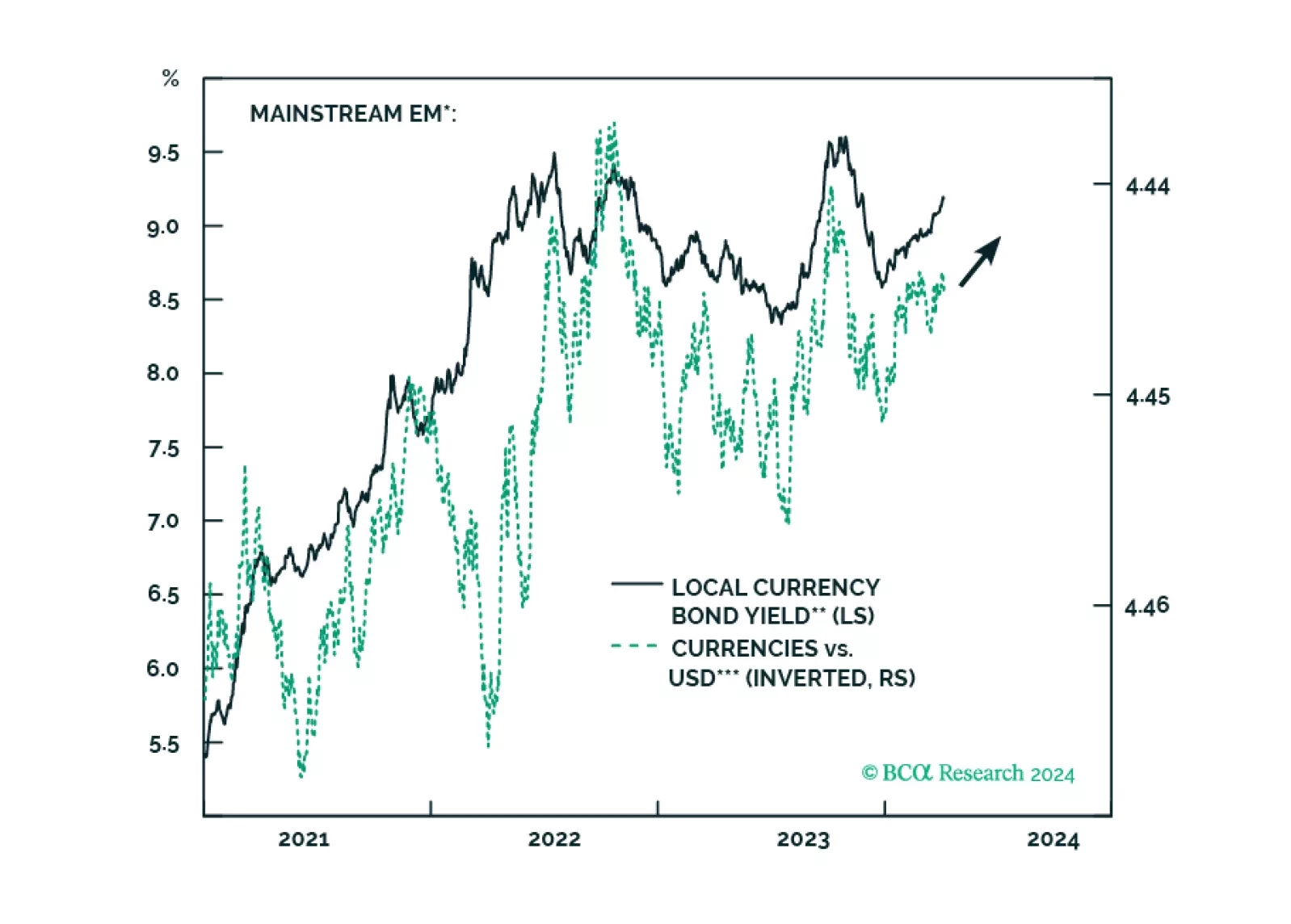

Climbing US bond yields, alongside higher oil prices, might spoil the party for global risk assets. There are budding cracks in EM domestic bonds, and even though we like this asset class in the long run, investors exposed to it…

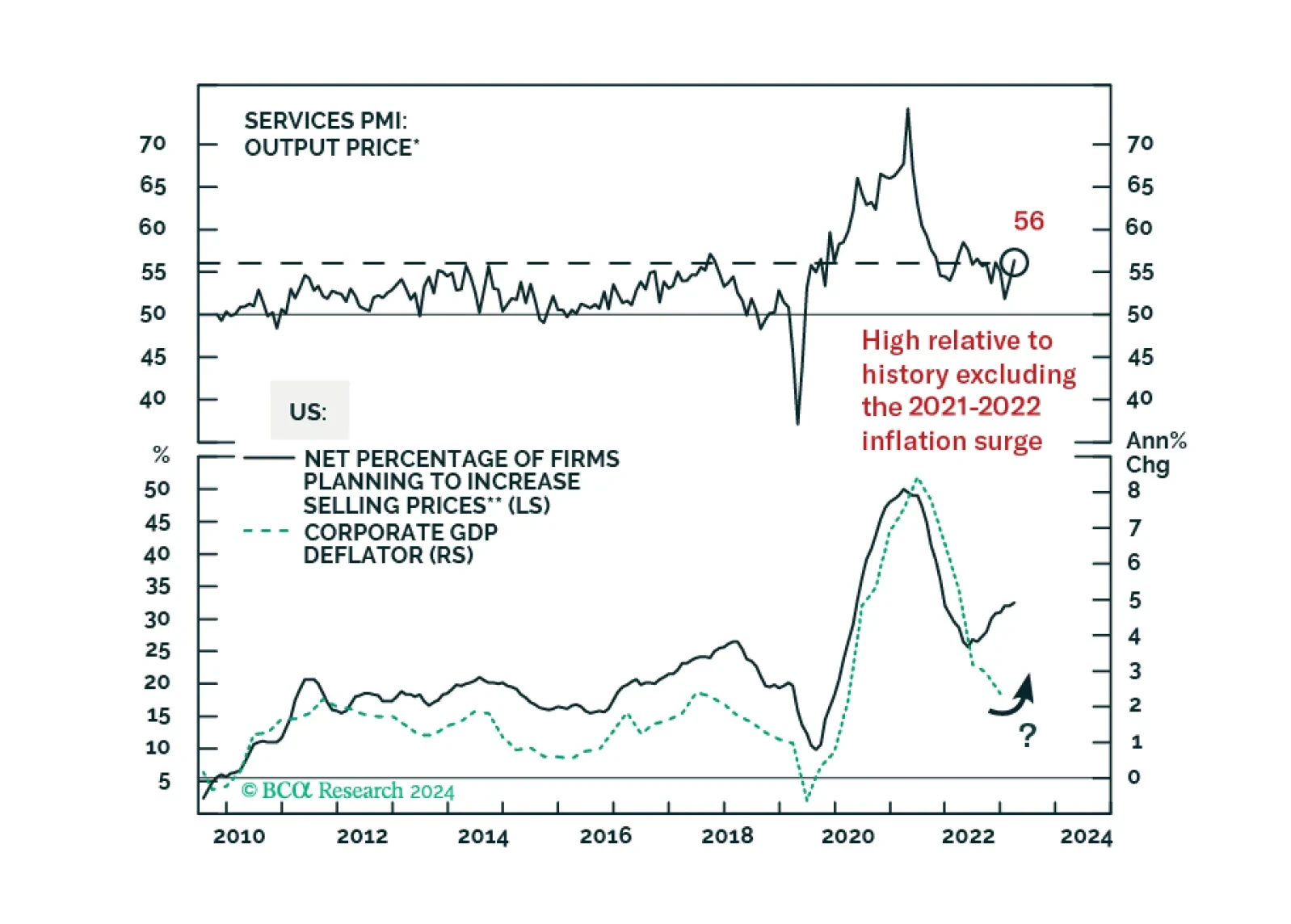

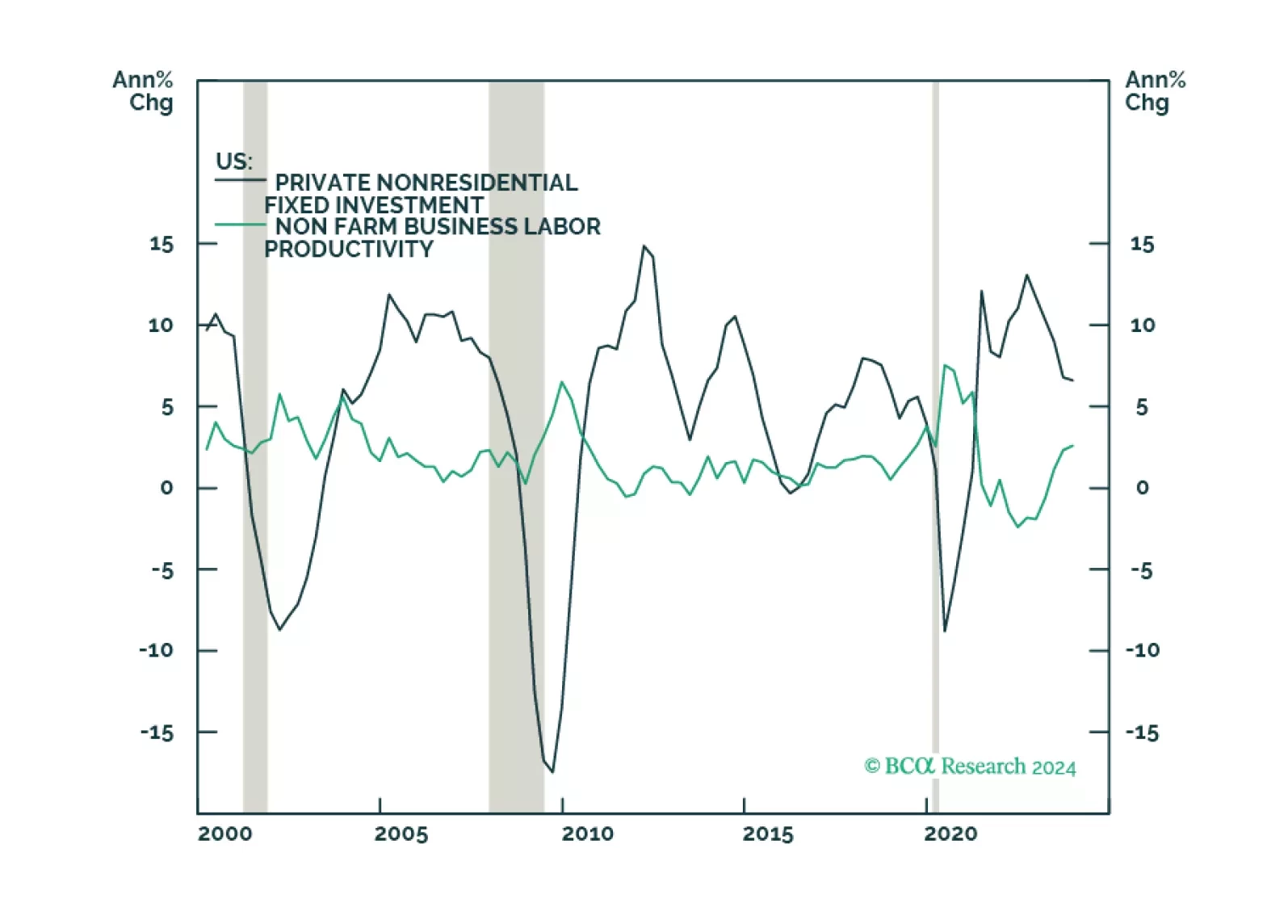

Inflationary pressures this year will remain subdued as labor-productivity growth – driven by strong capex and R+D spending – continues. This will make the Fed more confident in beginning its policy-rate-cutting cycle in June, and…

For the first time in at least fifty years, US labour supply is running well below labour demand, meaning the US economy is ‘inverted’. We discuss how and why the economy inverted, and what it means for recession, inflation, and…