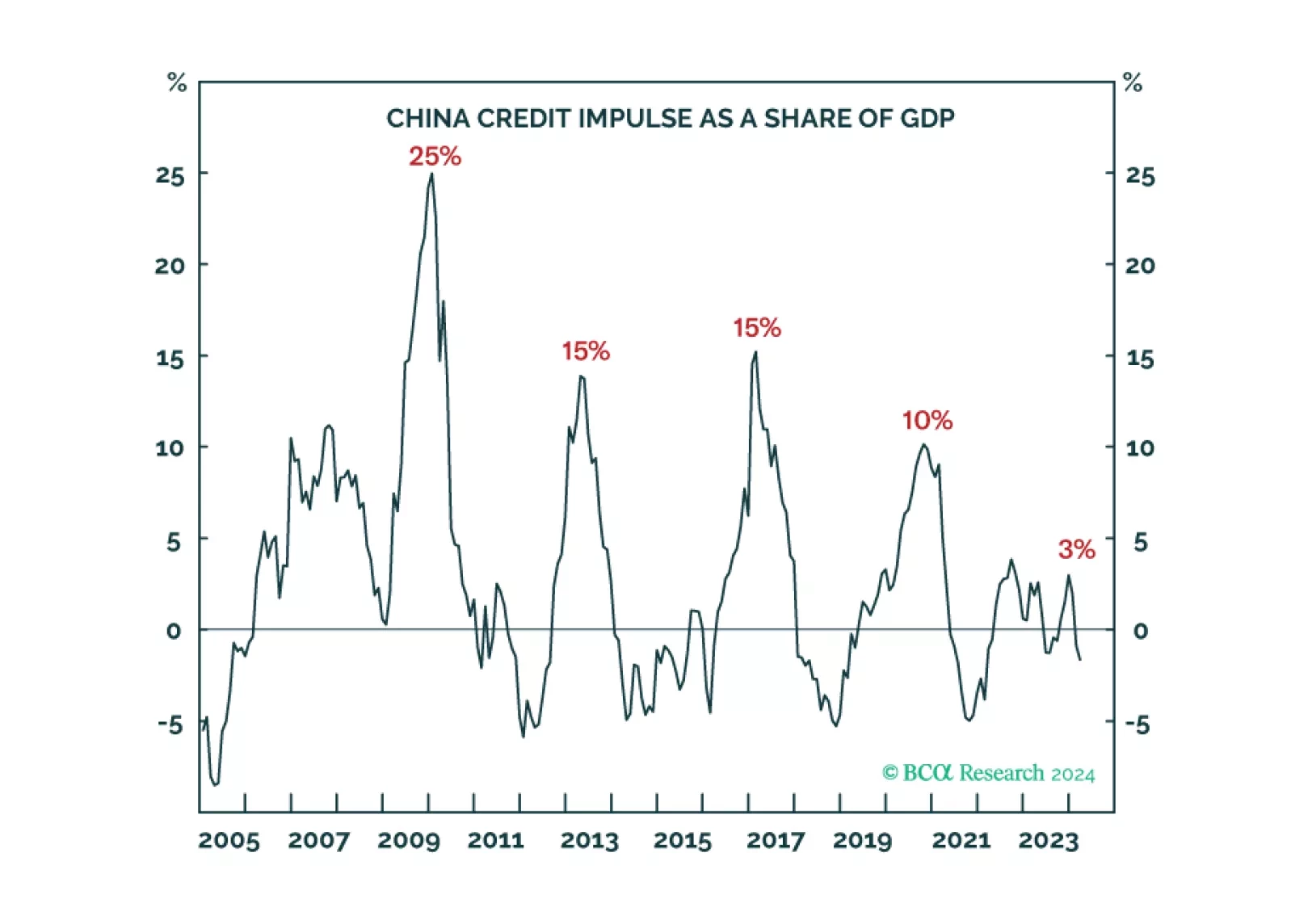

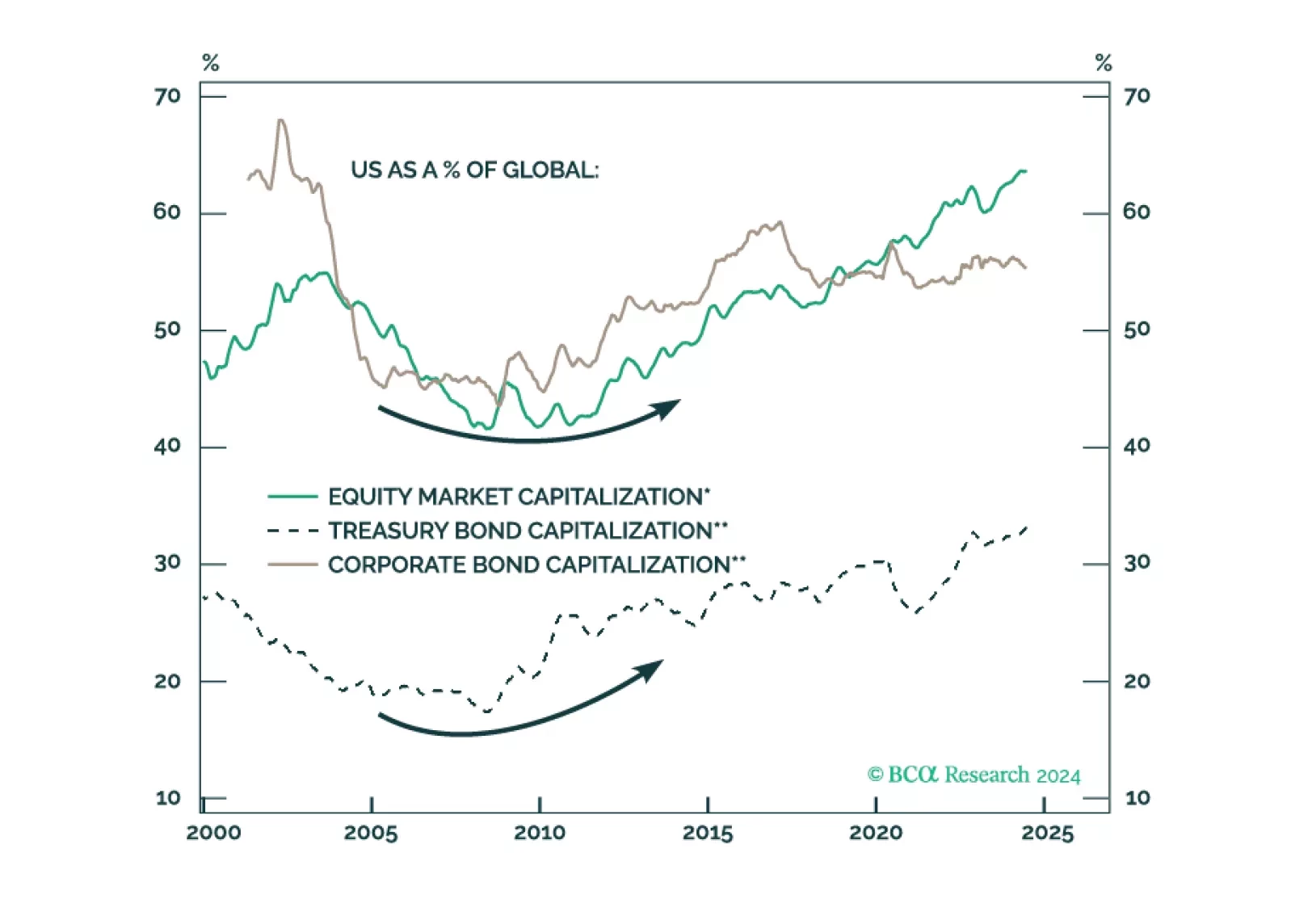

The end of China’s exponential credit growth will impede structural rallies in Chinese stocks and commodities, but US superstar stocks’ bubble-like valuations will impede them too. Leaving European stocks as the likely structural…

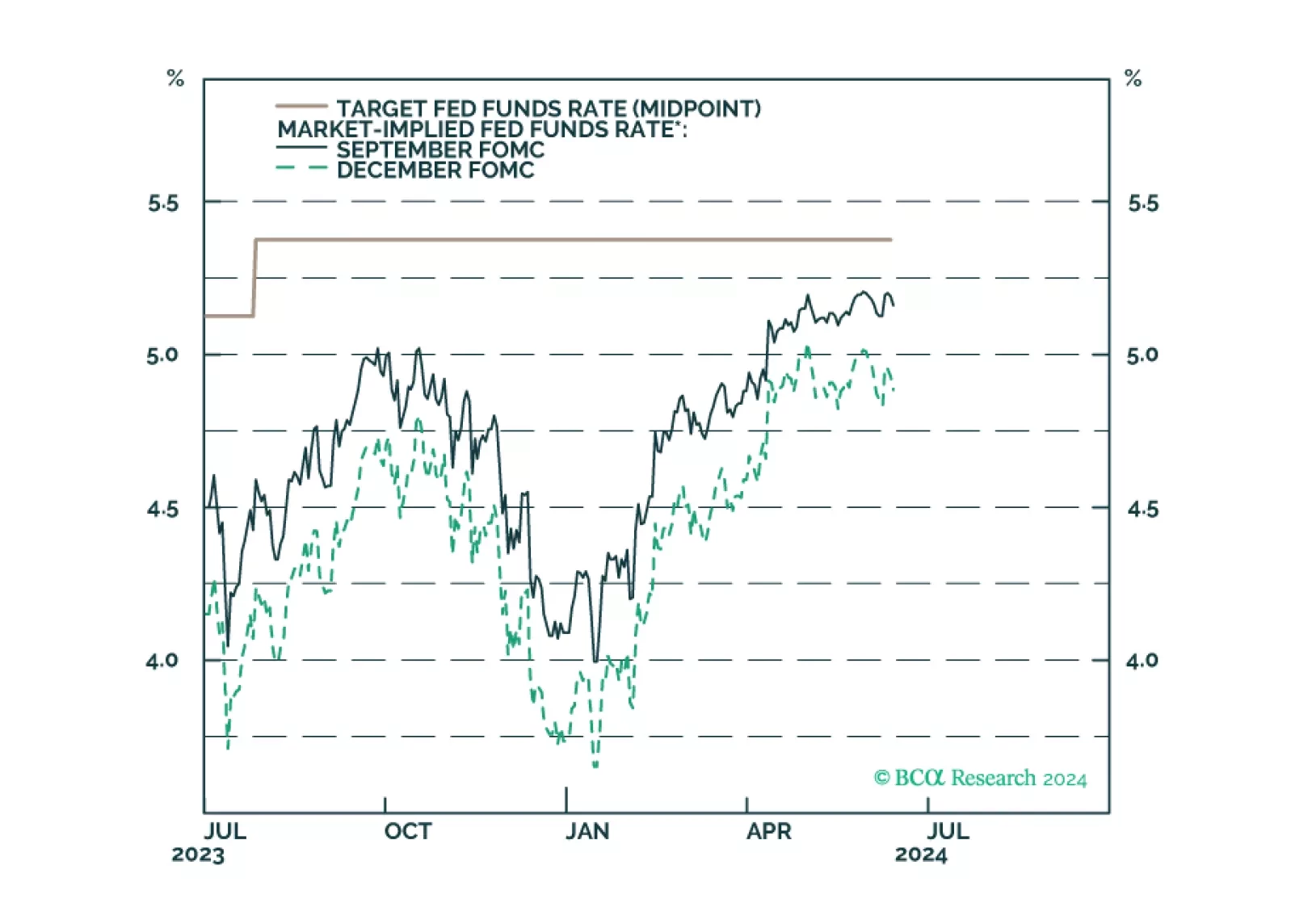

Our reaction to this morning’s CPI report and this afternoon’s FOMC meeting.

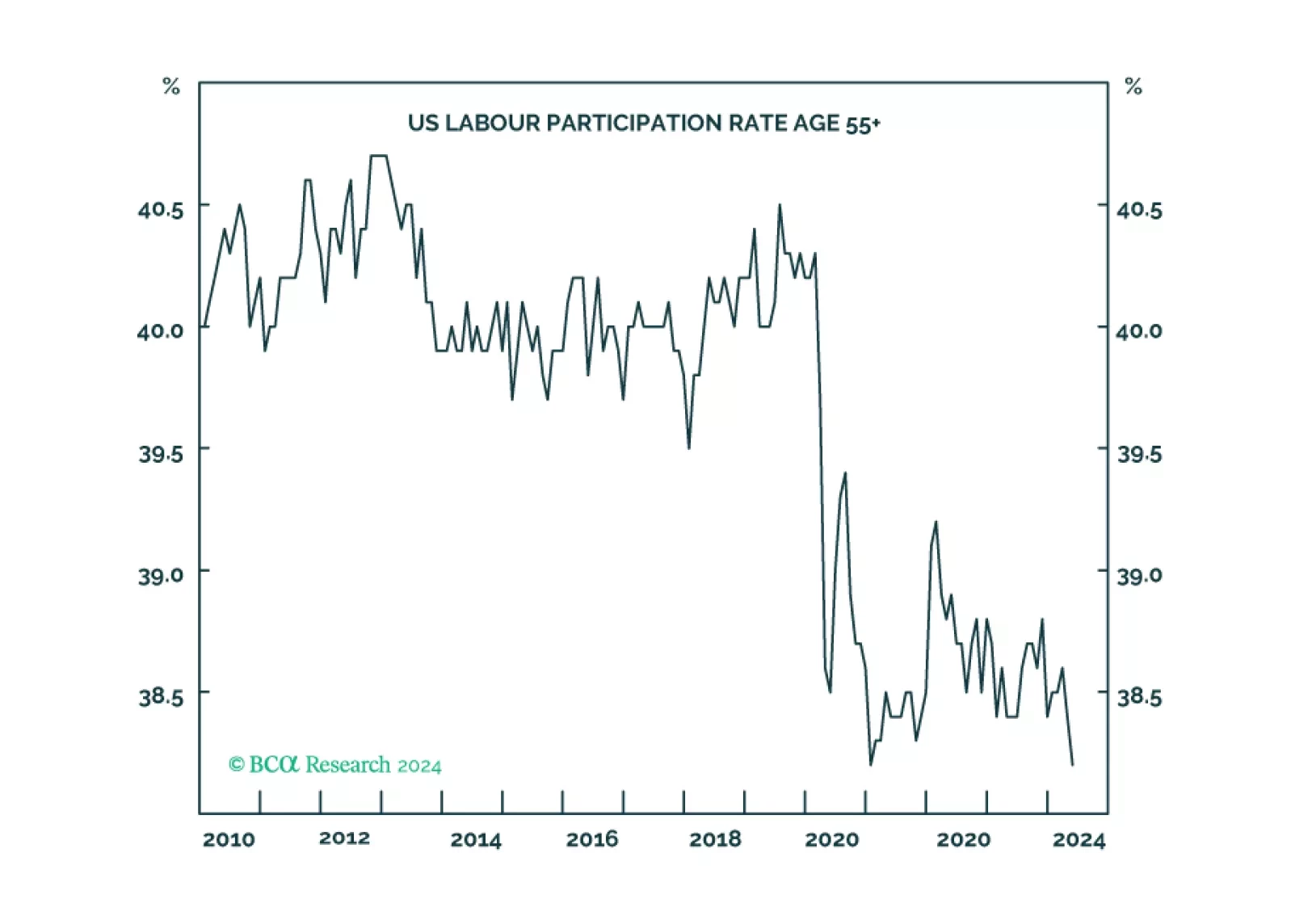

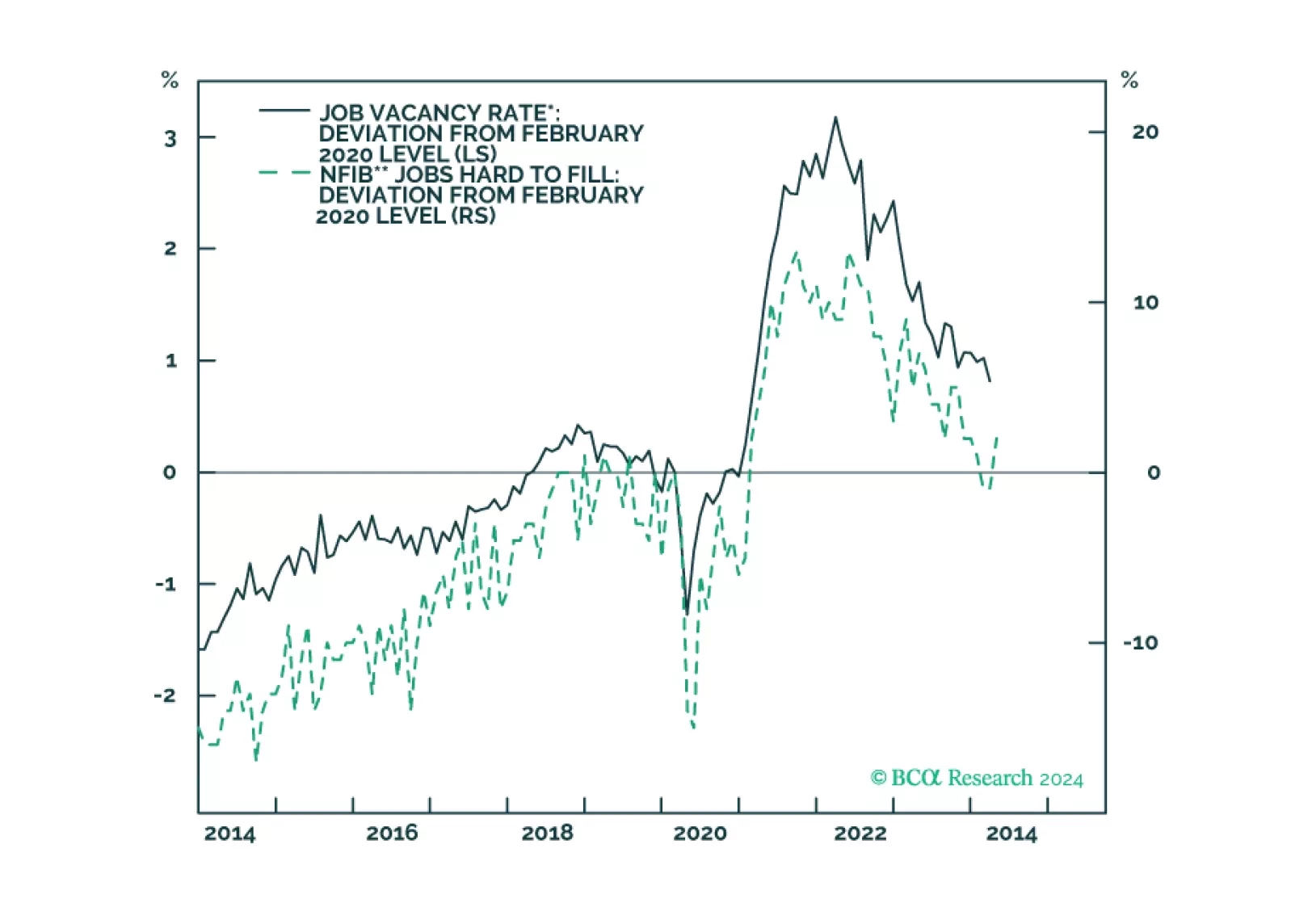

1 in 17 older Americans workers have gone missing either through ‘excess retirements’ or ‘excess mortality’. The consequent dislocation of the labour market means that the Fed’s work is not yet done. We go through some investment…

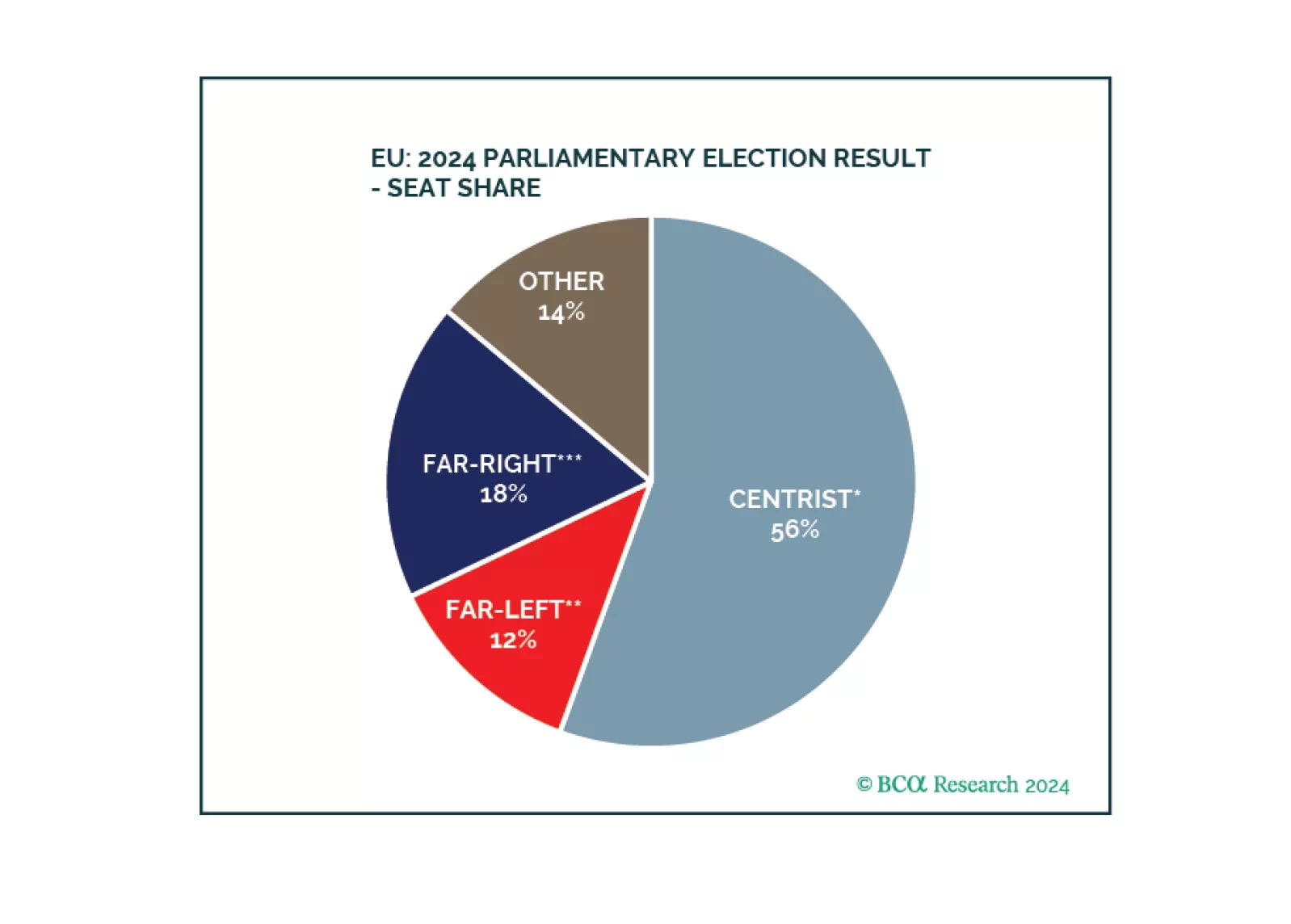

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

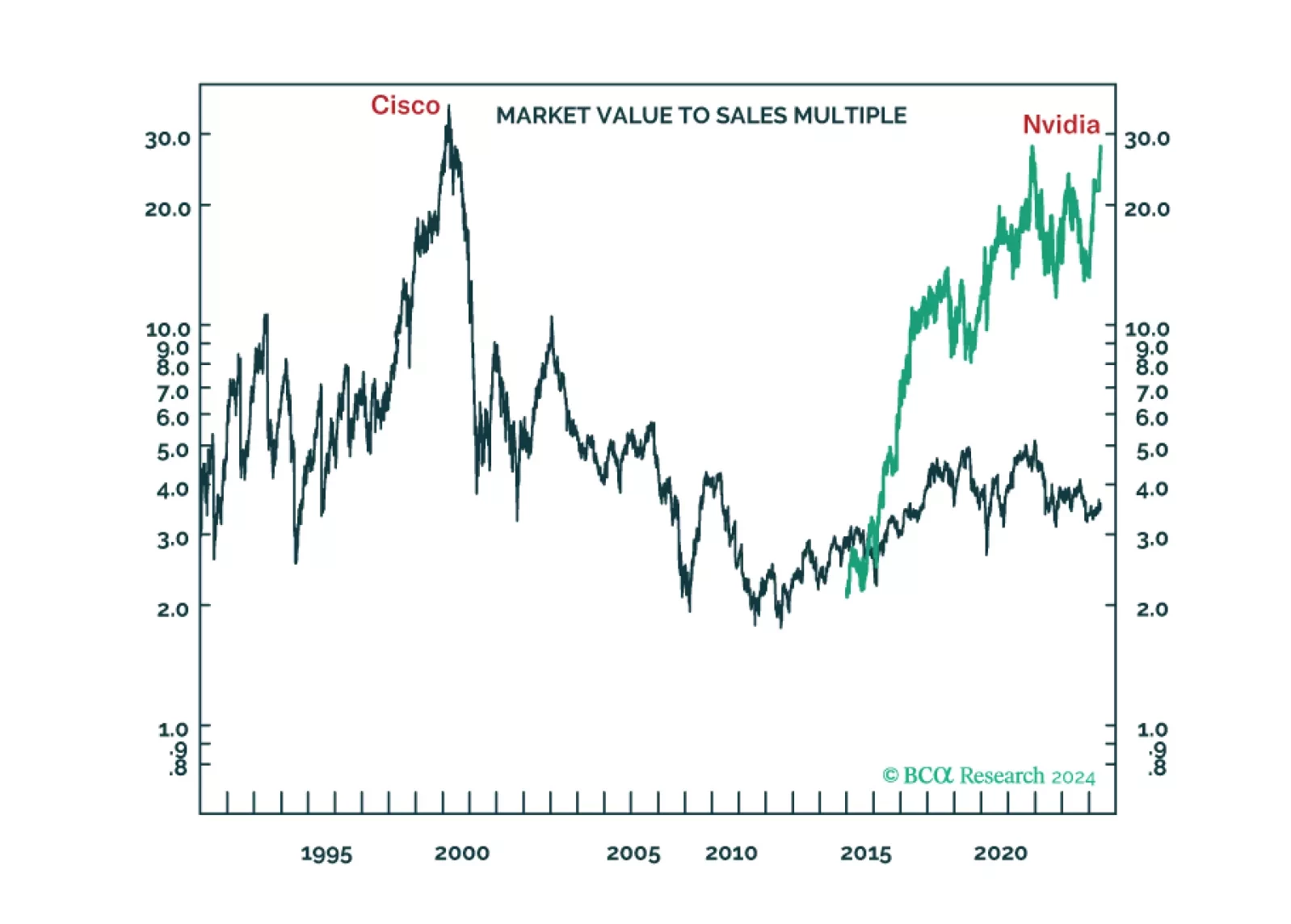

The long-term winners from the generative-AI gold rush are unlikely to be the ‘picks and shovels’ stock Nvidia or the overvalued US superstars of Web 2.0. We discuss the structural investment implications. Plus: time to go tactically…

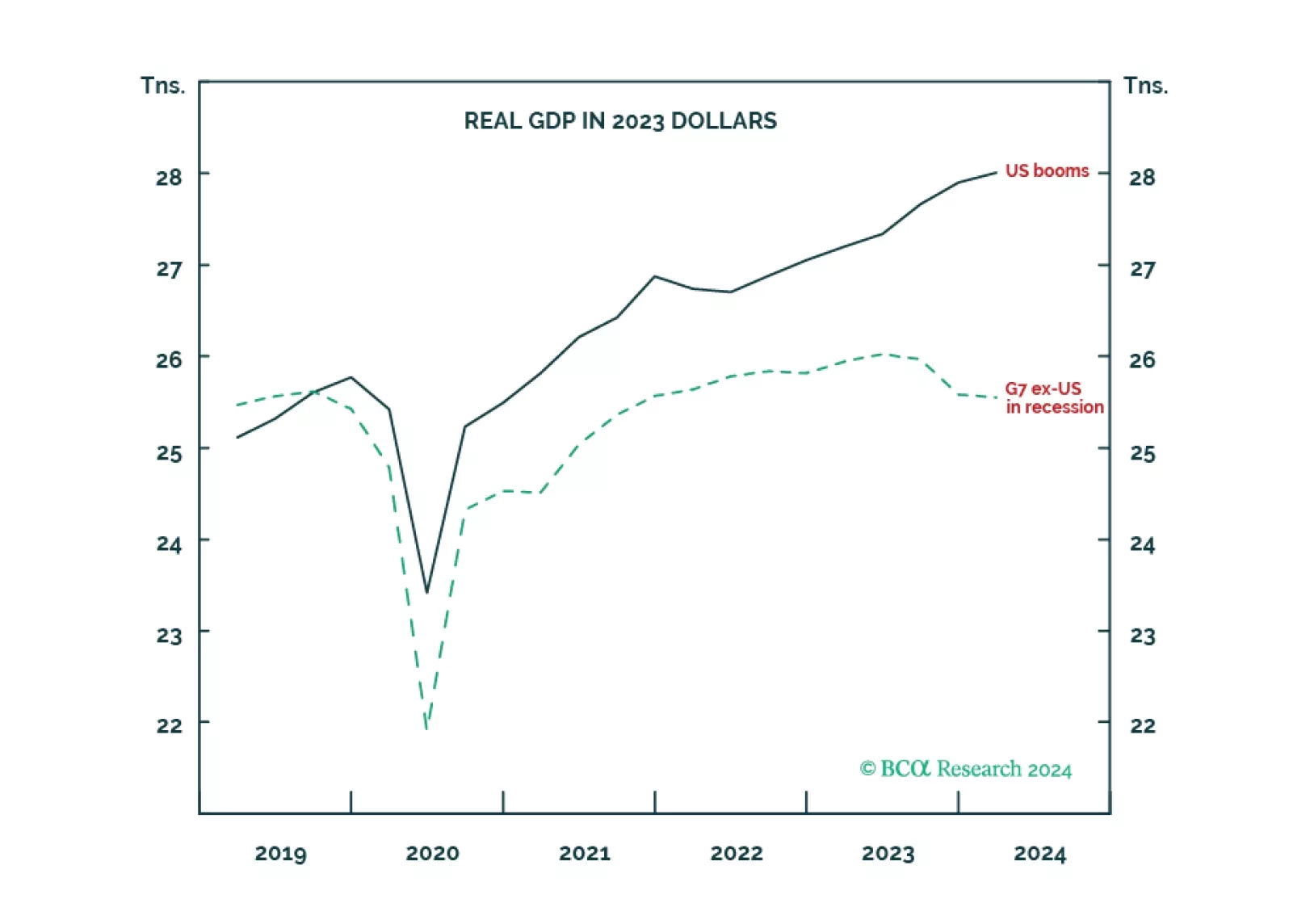

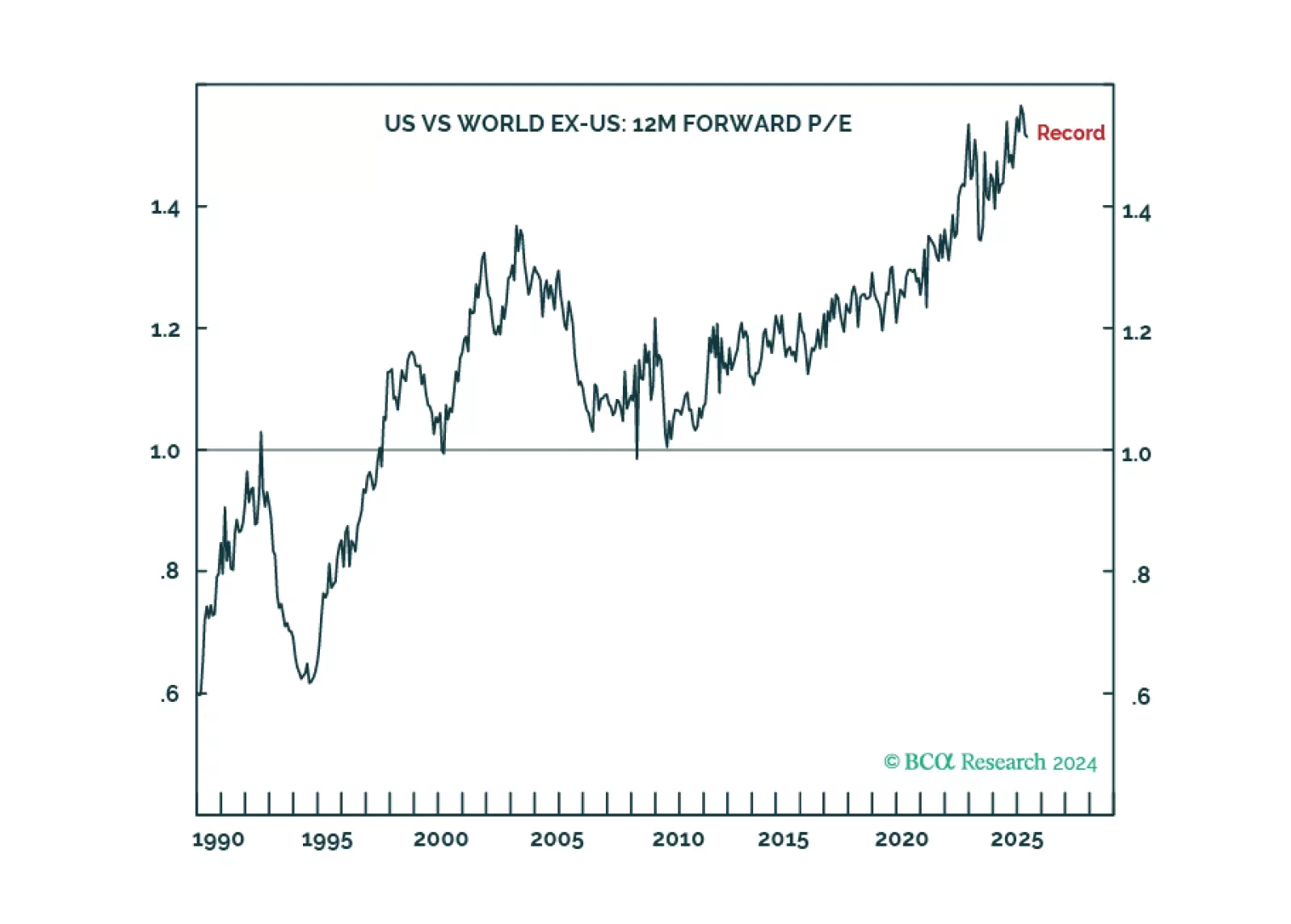

The economic schism in the world economy, between the non-US developed economy in recession and the US in strong growth, is unprecedented during our lifetimes. Now the schism will continue in reverse, as the non-US developed economy…

Our updated views on Treasury yields and Fed policy following this morning’s CPI report.

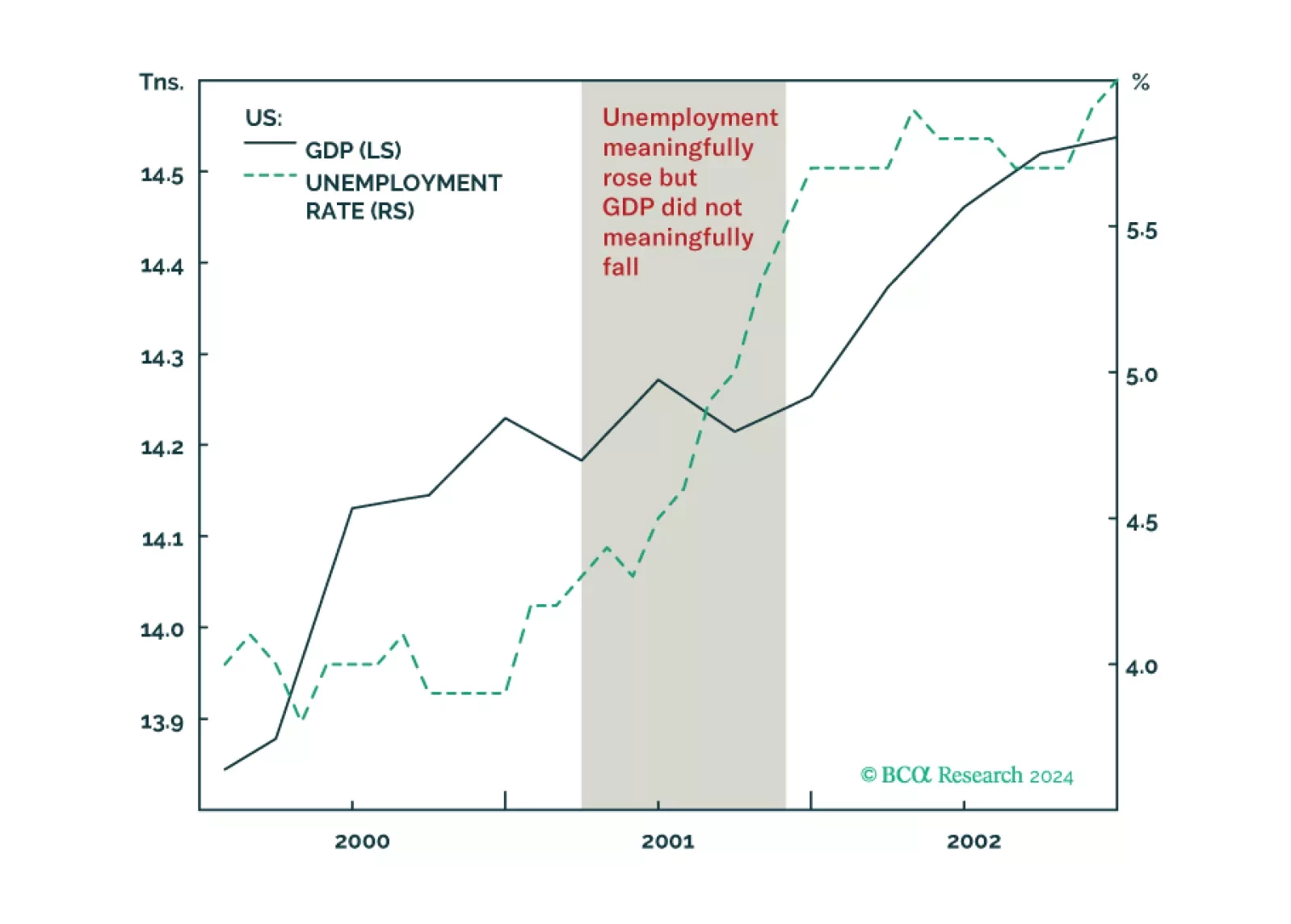

Why the US could get a jobs recession without a GDP recession, as happened in 2001, and what it means for stocks and bonds. Plus, an update on the Joshi rule.