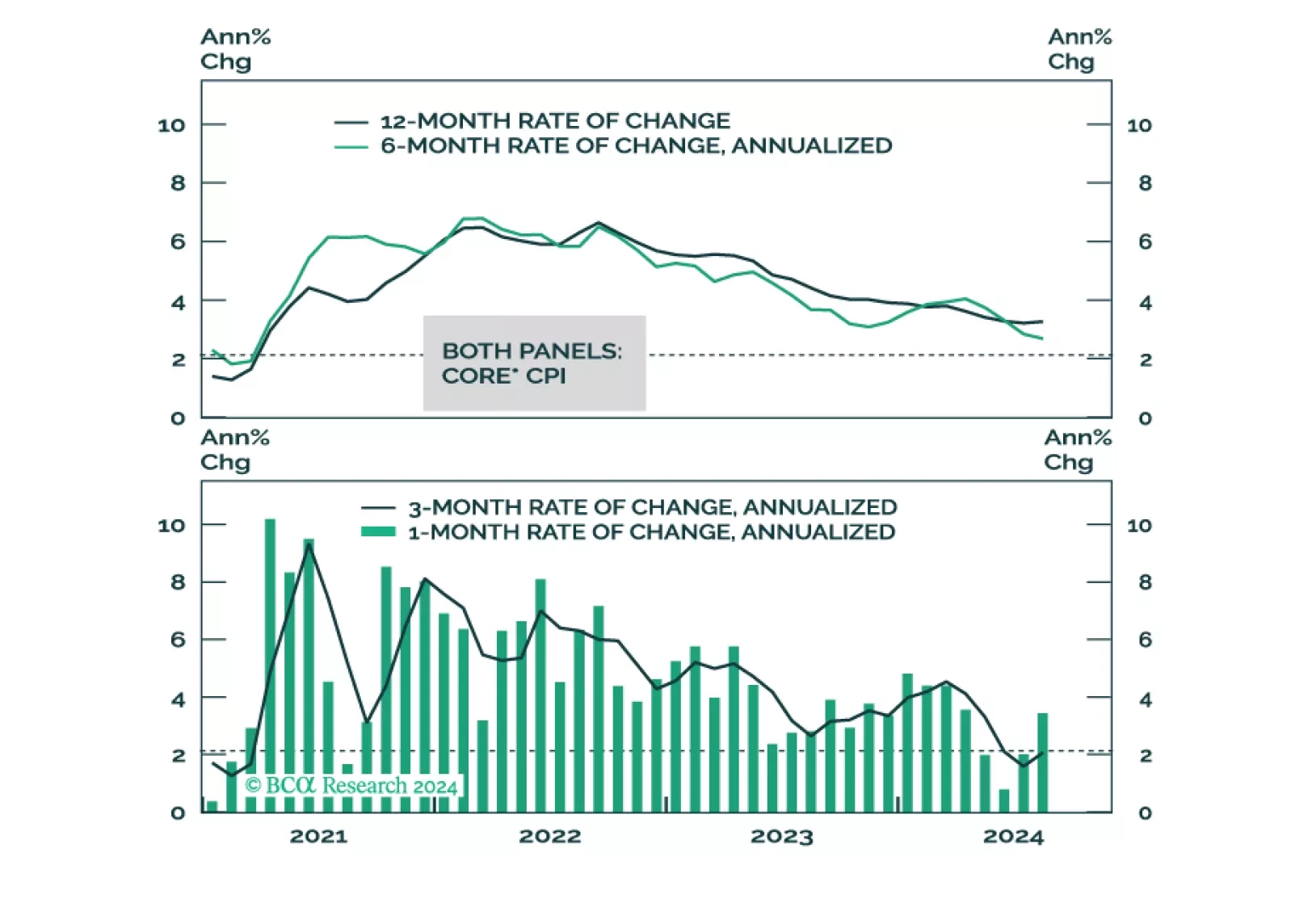

We give our thoughts on this morning’s CPI release and (lack of) market reaction. We also close our short position in January 2025 fed funds futures.

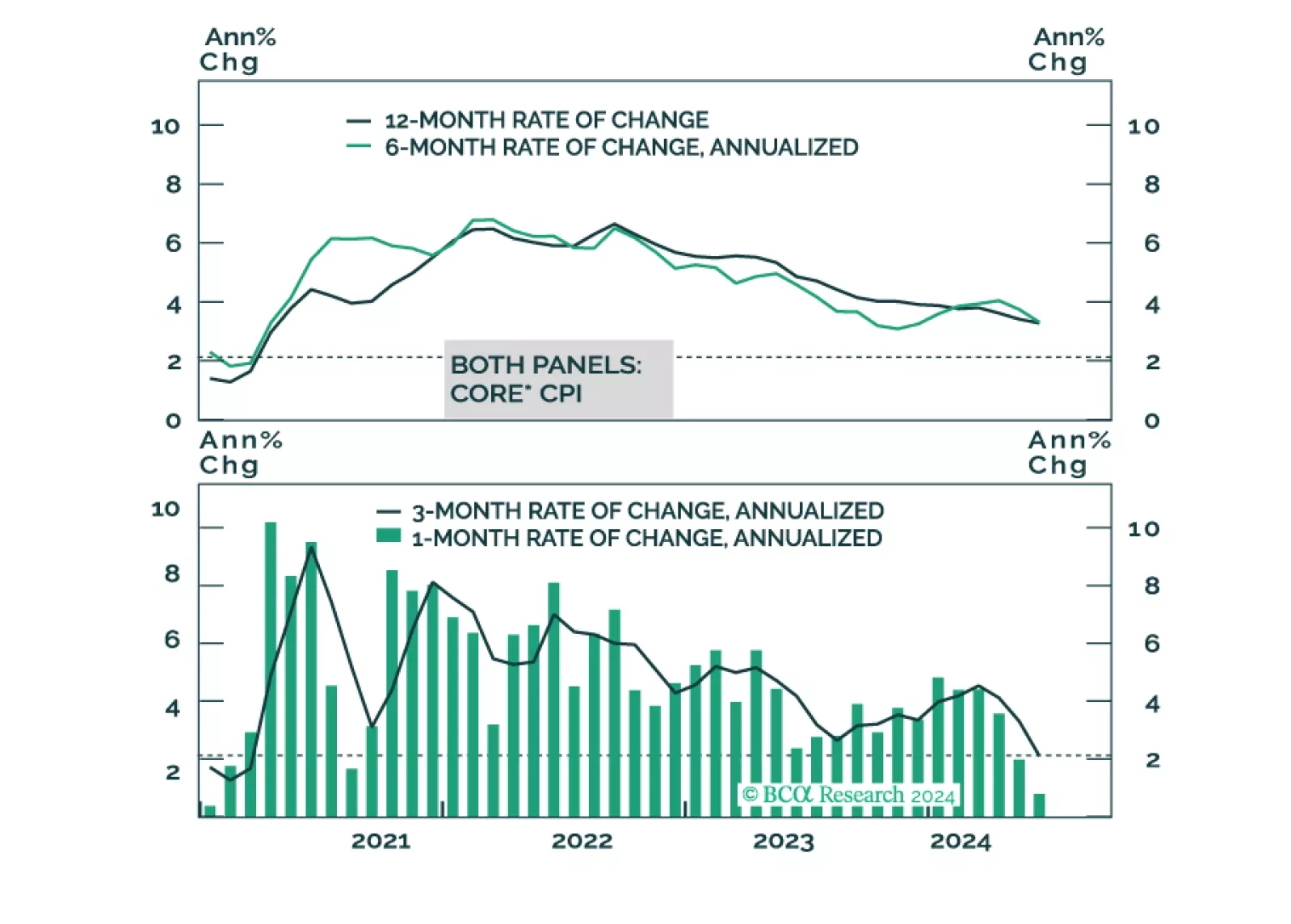

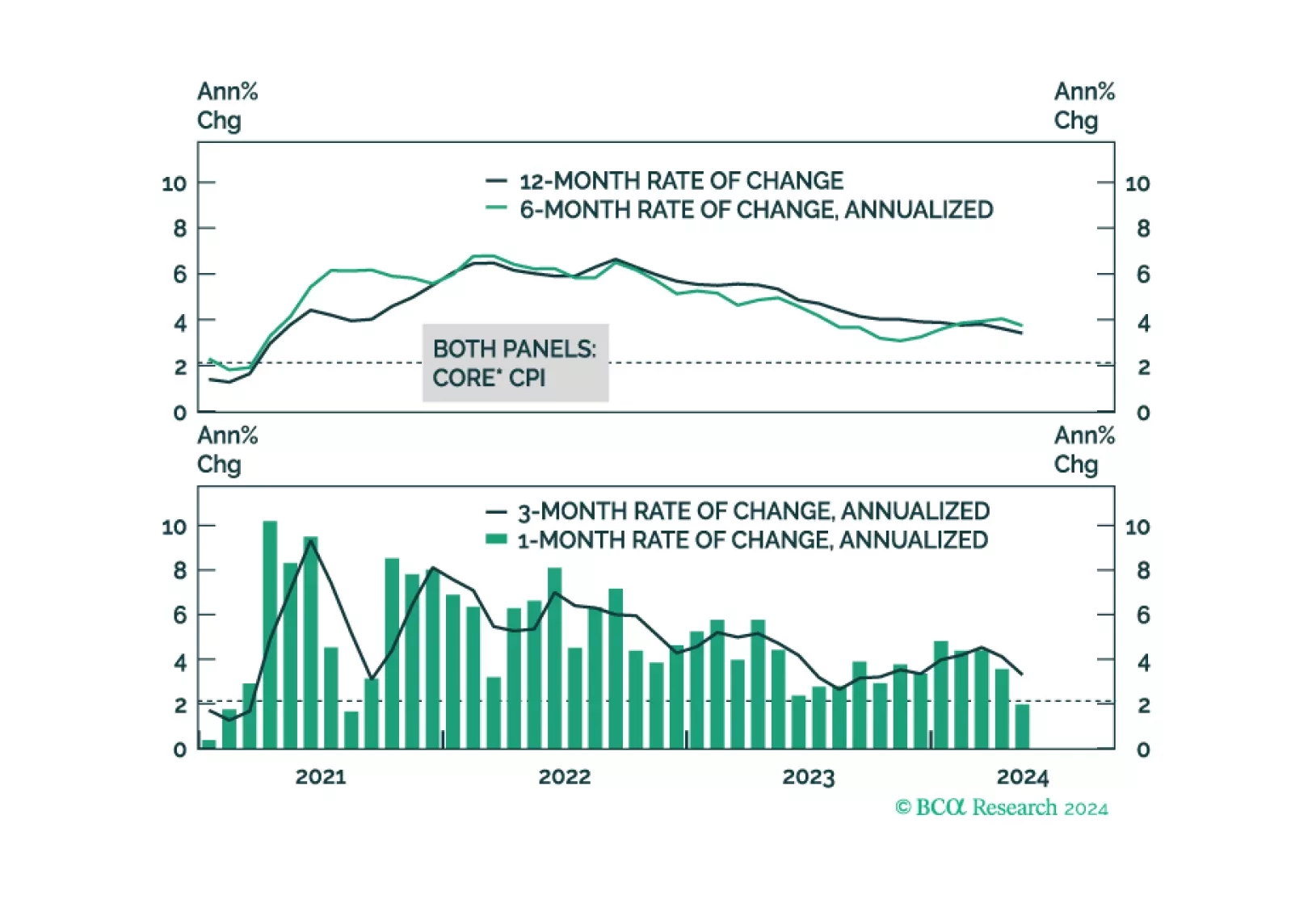

Our reaction to this morning’s CPI report and what it means for Fed policy.

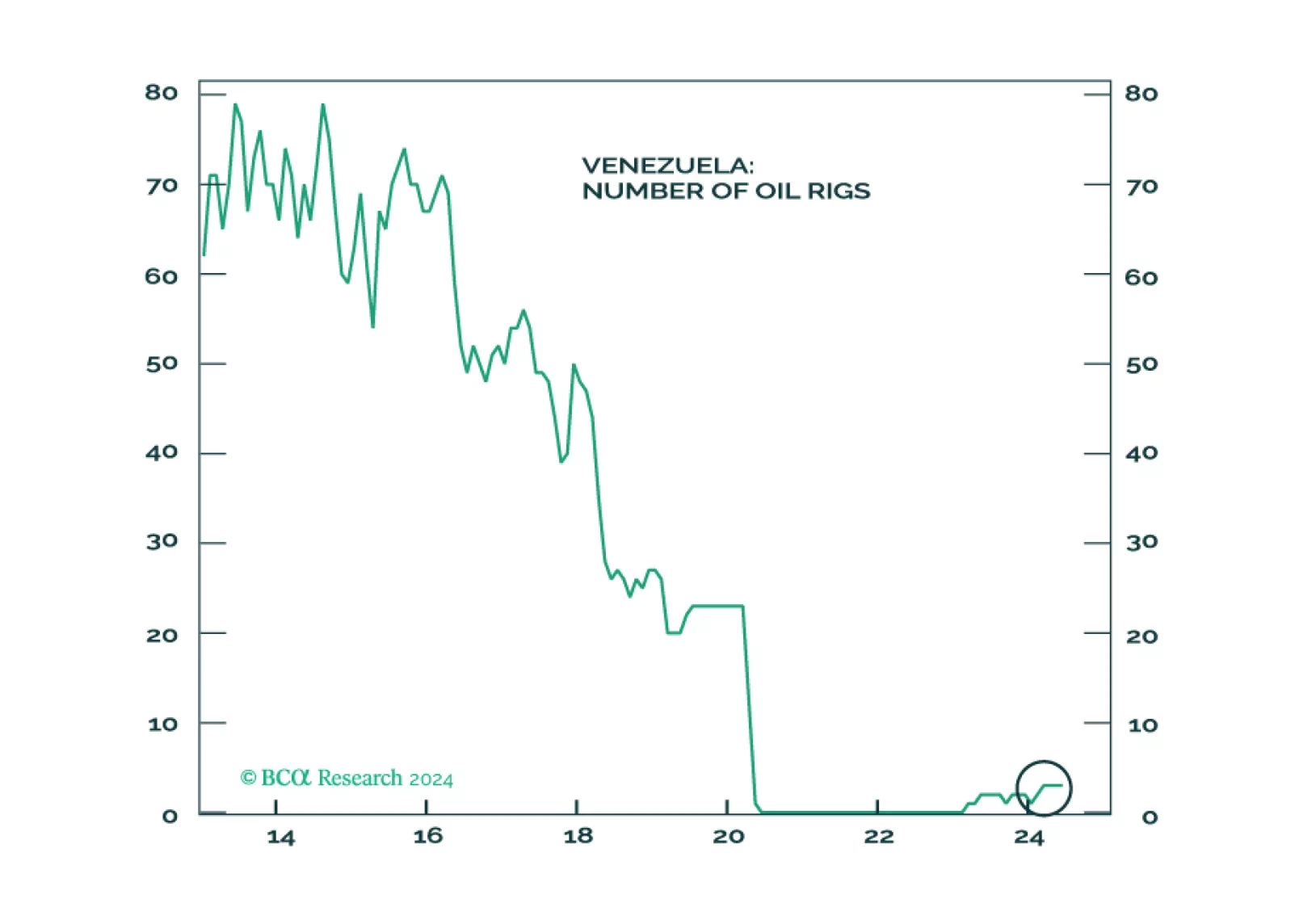

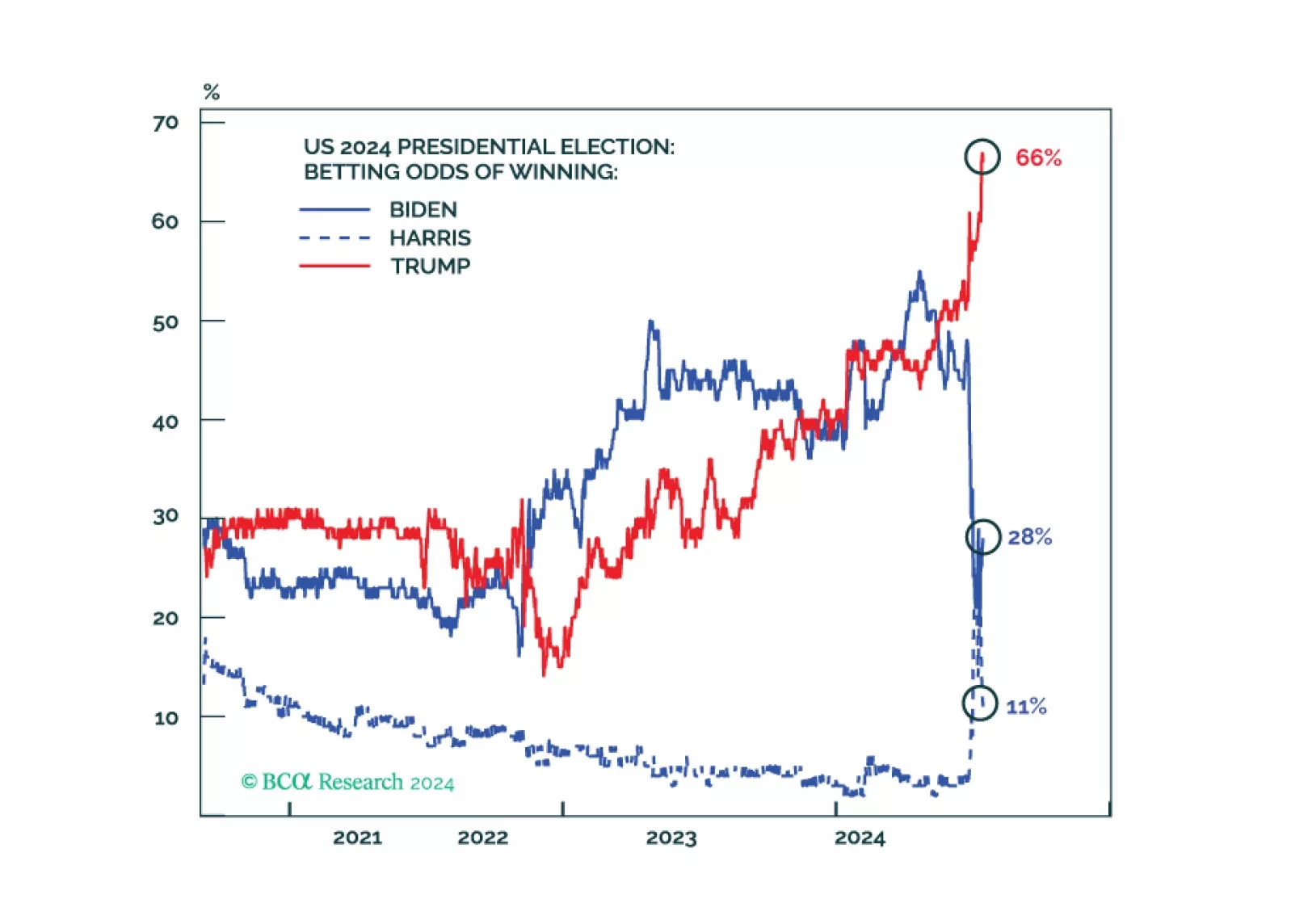

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

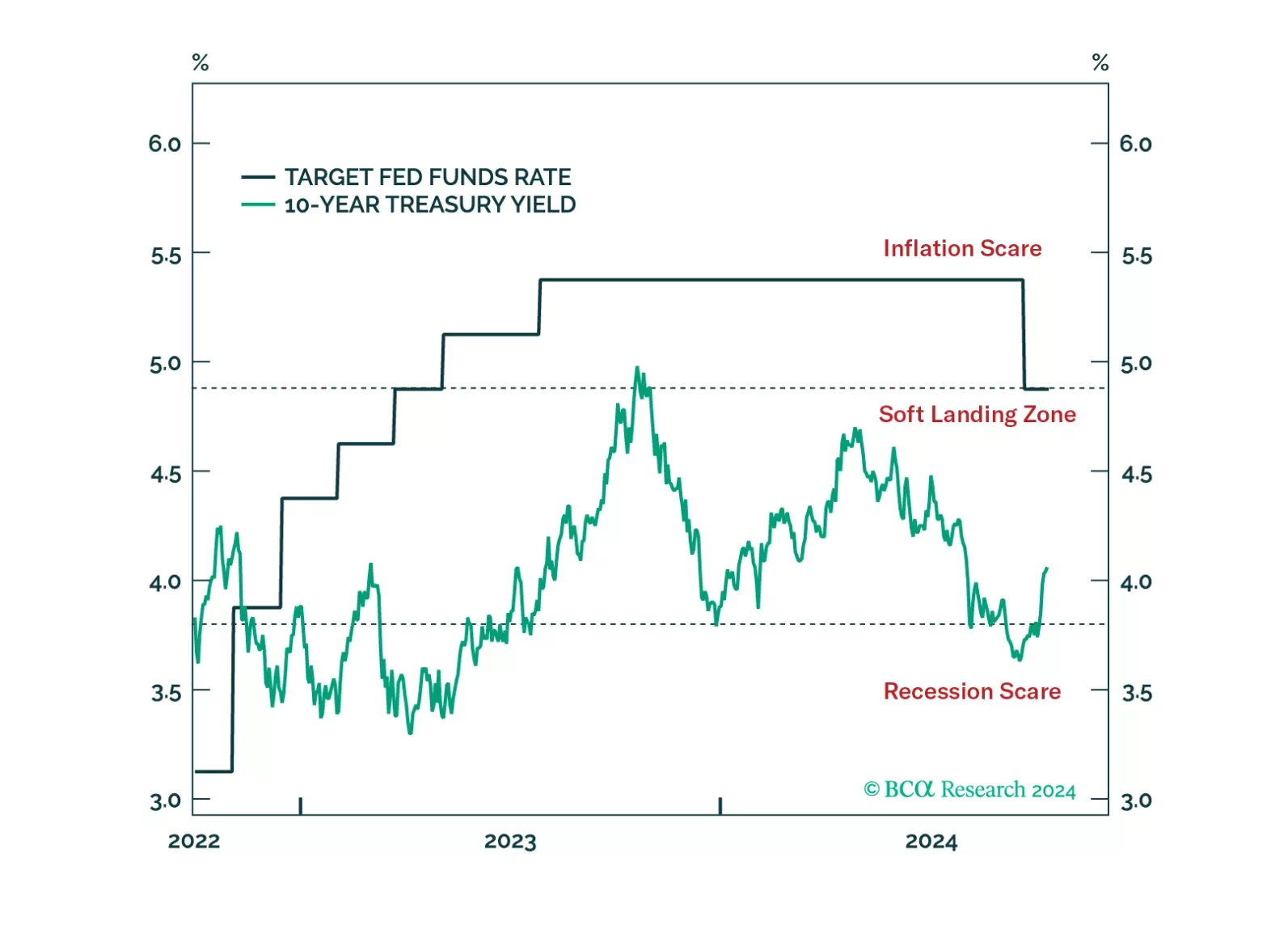

In light of last week’s employment report and this morning’s CPI, it’s time for the Federal Reserve to cut rates.

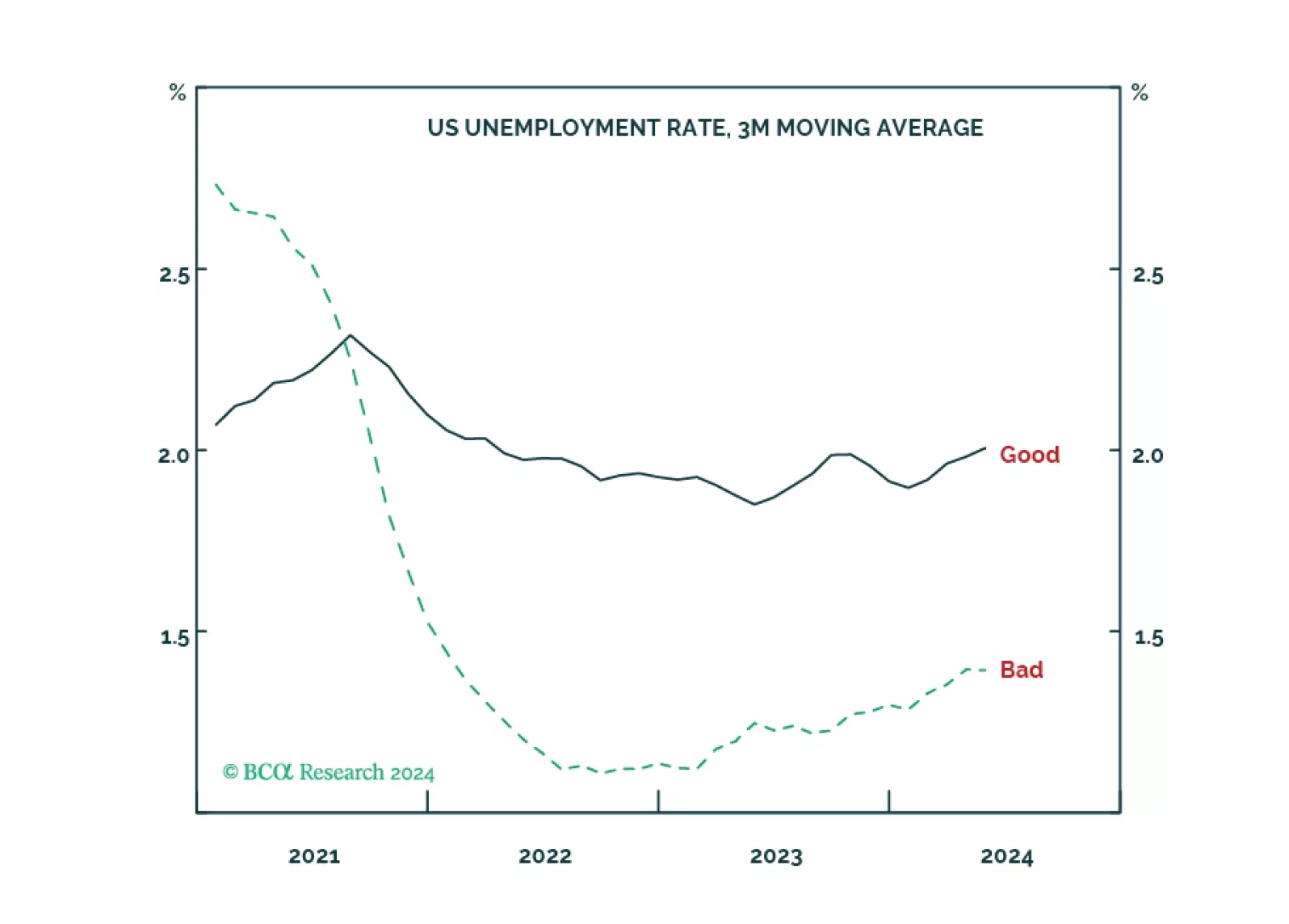

We explain how to distinguish between ‘good’, ‘bad’ and ‘ugly’ unemployment, why bad unemployment is a much better gauge of the jobs market than headline unemployment, and what this means for the tactical positioning in bonds and…

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…