Highlights 1. How will the pandemic resolve? 2. Will services spending recover to its pre-pandemic trend? 3. Will we spend our excess savings? 4. How will central banks react to inflation? 5. Will cryptocurrencies continue to eat gold…

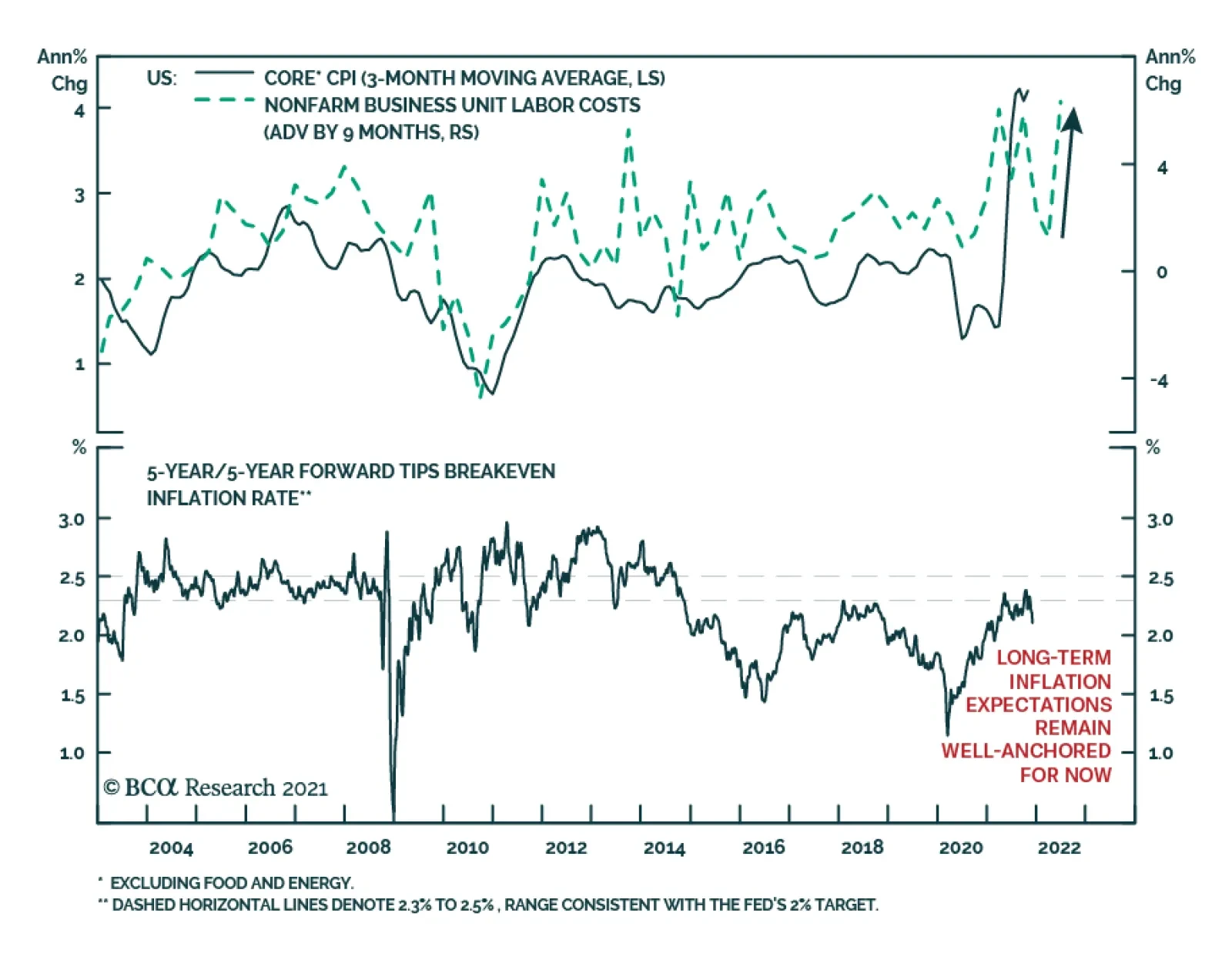

The US Bureau of Labor Statistics revised down its estimate for Q3 nonfarm labor productivity which fell by 5.2% on an annualized basis in Q3 from its earlier estimate of -5.0%. This translated into an upwards revision in unit…

Dear Client, We are sending you our Strategy Outlook today where we outline our thoughts on the global economy and the direction of financial markets for 2022 and beyond. Next week, please join me for a webcast on Friday, December 10th…

Highlights Long-term investors should place up to 5 percent of their assets in cryptocurrencies. As the drawdown risk of owning cryptocurrencies converges with that of owning gold, the cryptocurrency asset-class can reasonably…

Dear Client, There will be no report next week as we will be working on our Quarterly Strategy Outlook, which will be published the following week. In the meantime, please keep an eye out for BCA Research’s Annual Outlook,…

Highlights There is a high risk of a global demand shortfall in 2022. This is because consumer demand for services will remain well below its pre-pandemic trend… …while the recent booming demand for goods is crashing…

Highlights The circumstances of the pandemic improved in October, but data highlighting the economic consequences of the Delta wave grew more severe. US economic activity slowed meaningfully in the third quarter, driven by lower car…

In lieu of next week’s report, I will be presenting the quarterly Counterpoint webcast titled ‘Where Is The Groupthink Wrong? (Part 2)’. I do hope you can join. Highlights If a continued surge in the oil price…