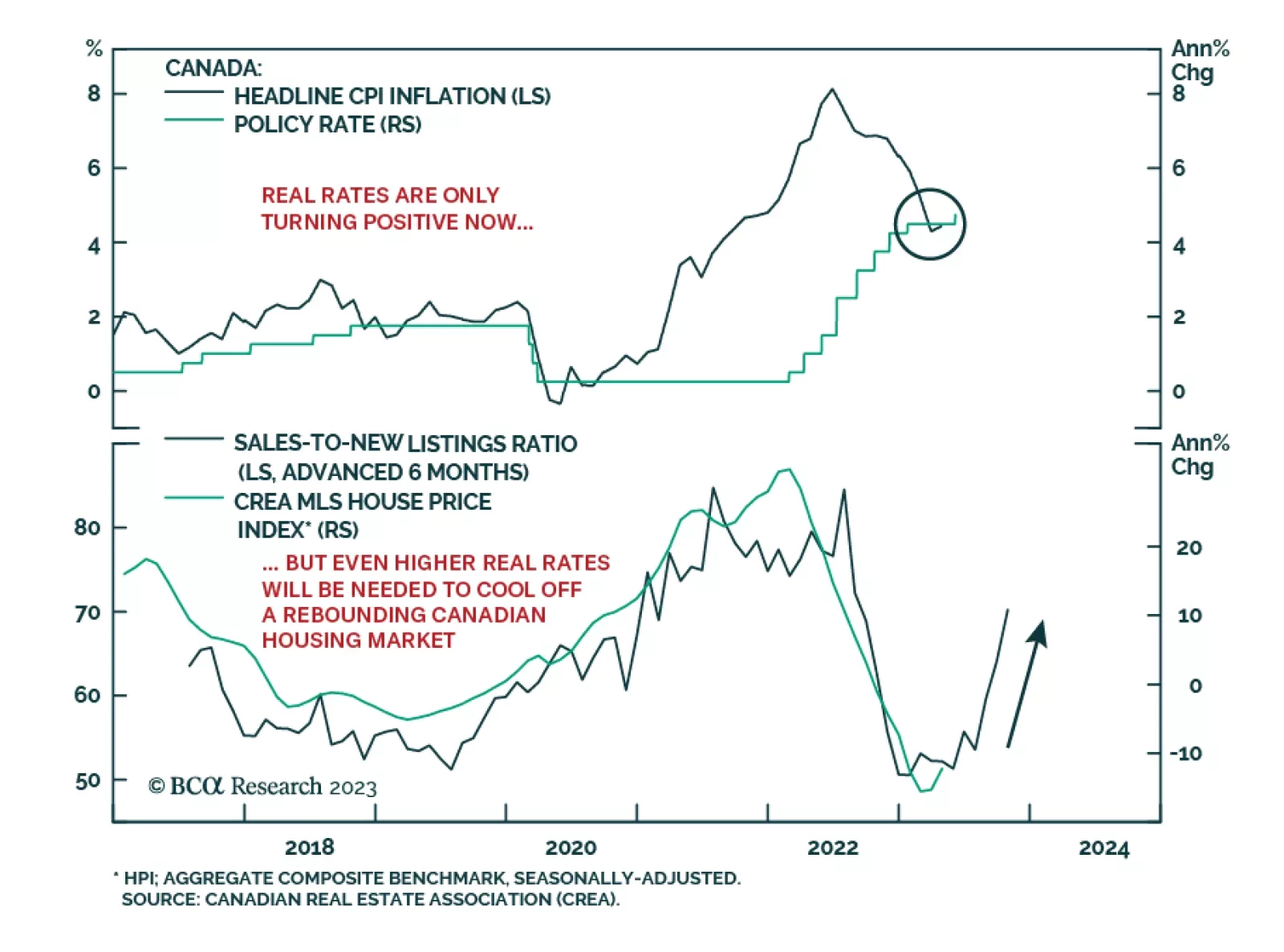

The Bank of Canada (BoC) surprised markets with a 25bp hike yesterday, bringing the policy rate up to a 22-year high of 4.75%. This ended the pause on rate hikes announced back in March, which only ended up lasting two meetings.…

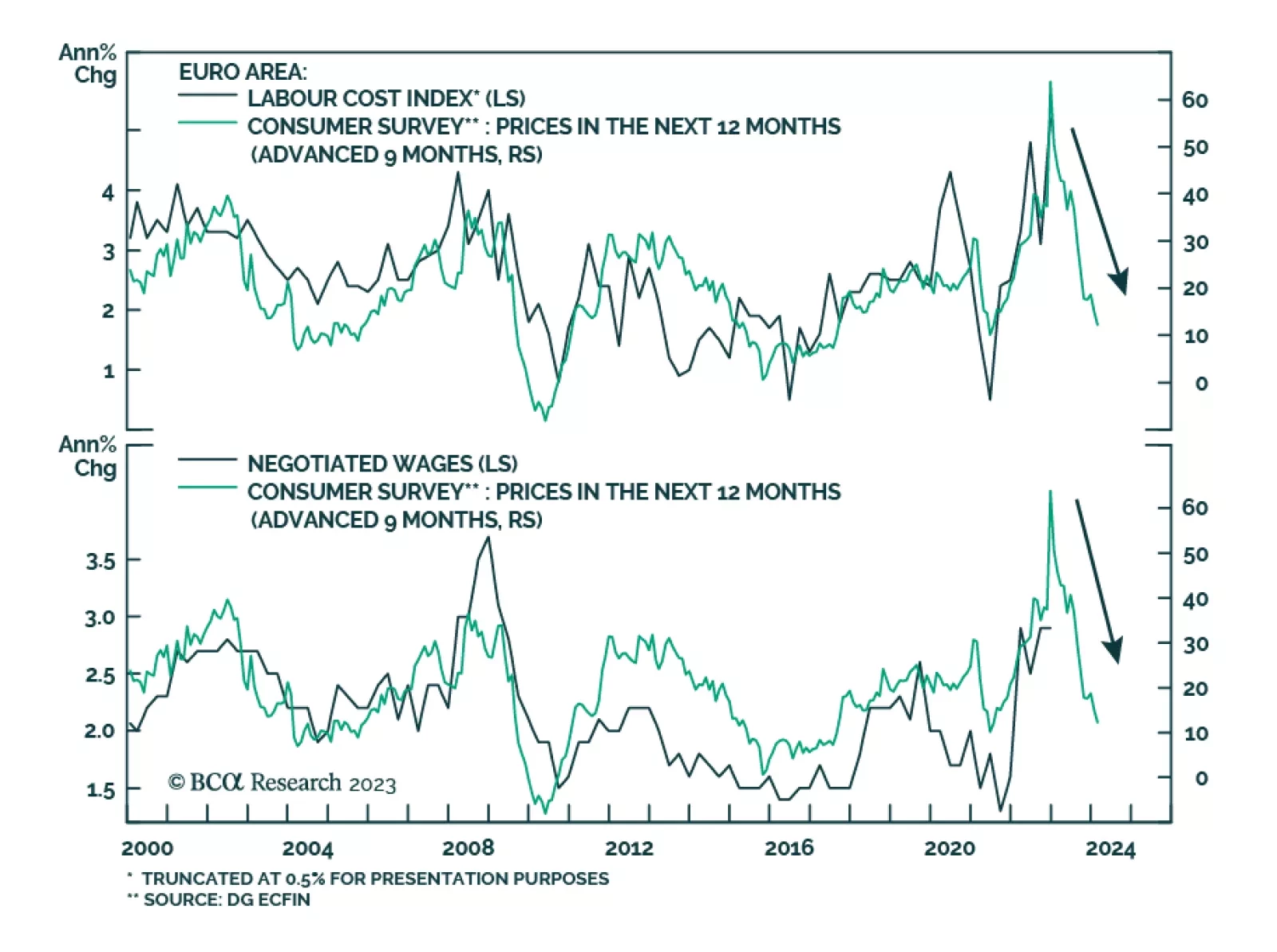

Eurozone households are becoming less concerned about the near-term outlook for inflation. The results of the latest ECB Consumer Expectations survey show a significant drop in median 12-month inflation expectations from 5.0% in…

What’s going on? The market-weighted stock market is up. But the equally-weighted stock market is not up. Neither is credit. Neither are industrial metal prices. Neither is the oil price, despite two waves of OPEC output cuts. We…

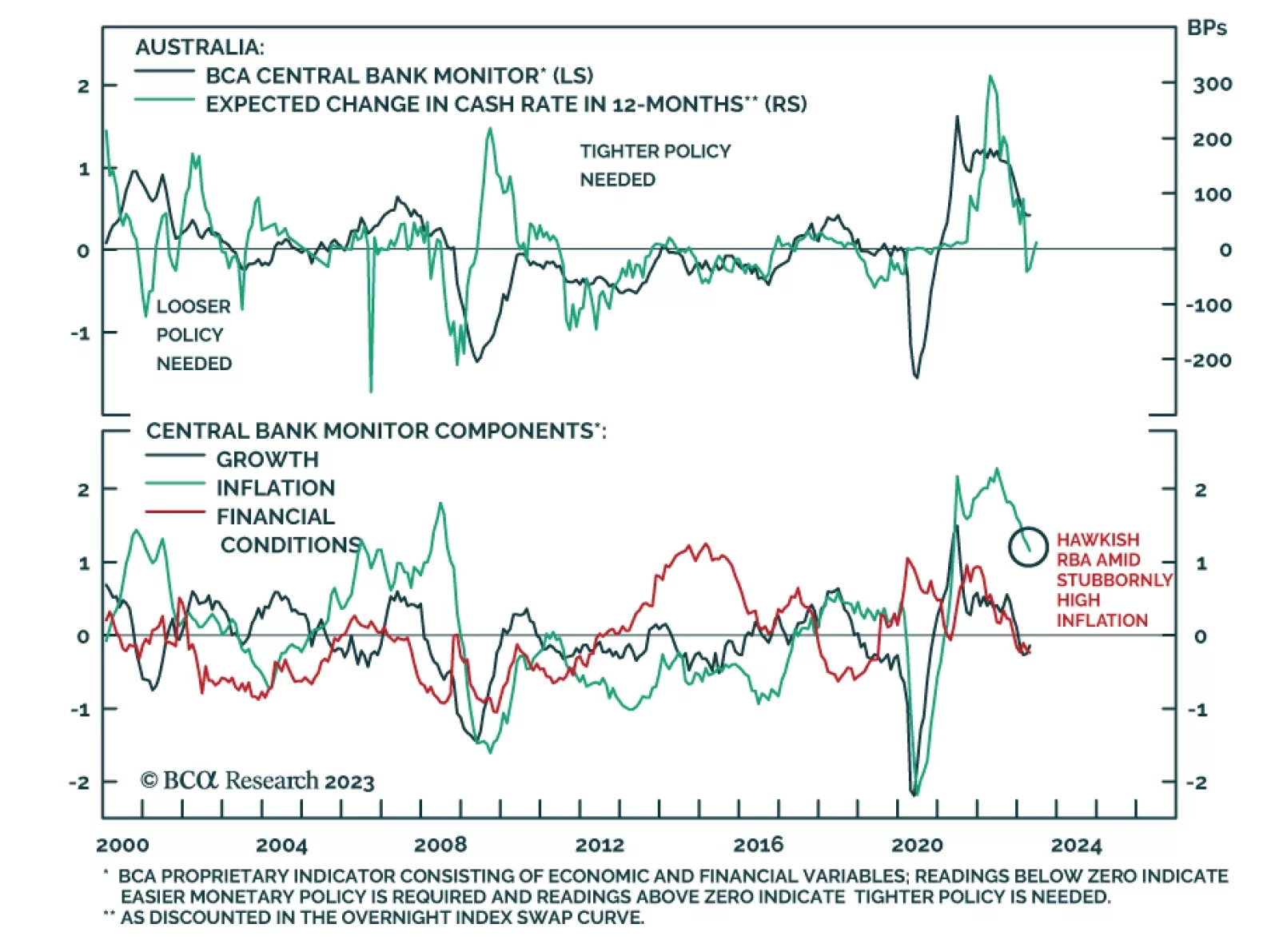

The Reserve Bank of Australia surprised markets with a 25 basis point rate hike on Tuesday, bringing the Cash Rate up to 4.1%. This marks the second consecutive rate increase following a pause in April. The post-meeting…

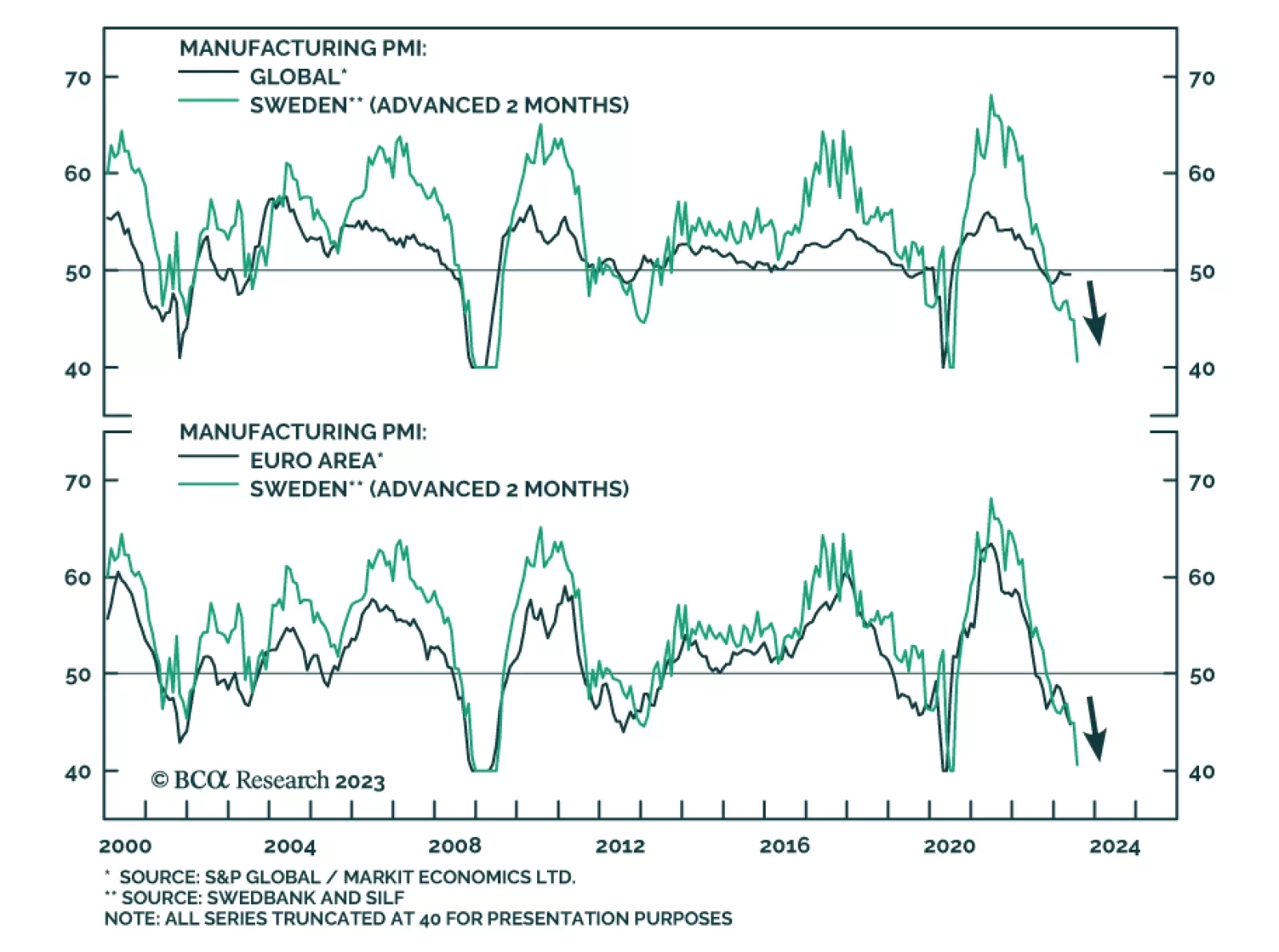

The Swedish manufacturing PMI declined to 40.6 in May, the lowest level since June 2020. This deterioration in Sweden’s manufacturing activity not only reflects the domestic economy, but it also highlights weaknesses in the…

In this report, we follow up on the upgrade to our US duration stance from last week with a review of our rates views and government bond allocations outside the US. We conclude that while we now find US Treasuries to be more…

Expectations for oil demand growth through 2023-24 are way too optimistic. Until these expectations fall to -0.5-1 percent, the oil price has further downside. Plus: collapsed complexity confirms that AI is in a mania, while basic…

The Reserve Bank of New Zealand hiked rates this week to 5.5%. There are many reasons to expect that to be the last rate hike for this cycle – a development that is positive for New Zealand bonds but bearish for the New Zealand…

The Reserve Bank of New Zealand hiked rates this week to 5.5%. There are many reasons to expect that to be the last rate hike for this cycle – a development that is positive for New Zealand bonds but bearish for the New Zealand…

The debt ceiling game’s endpoint will avoid default only if it implies economic pain. For the Republicans, the best strategy is not to lift the debt ceiling unless the Democrats cut spending a lot, or unless the economy starts to…