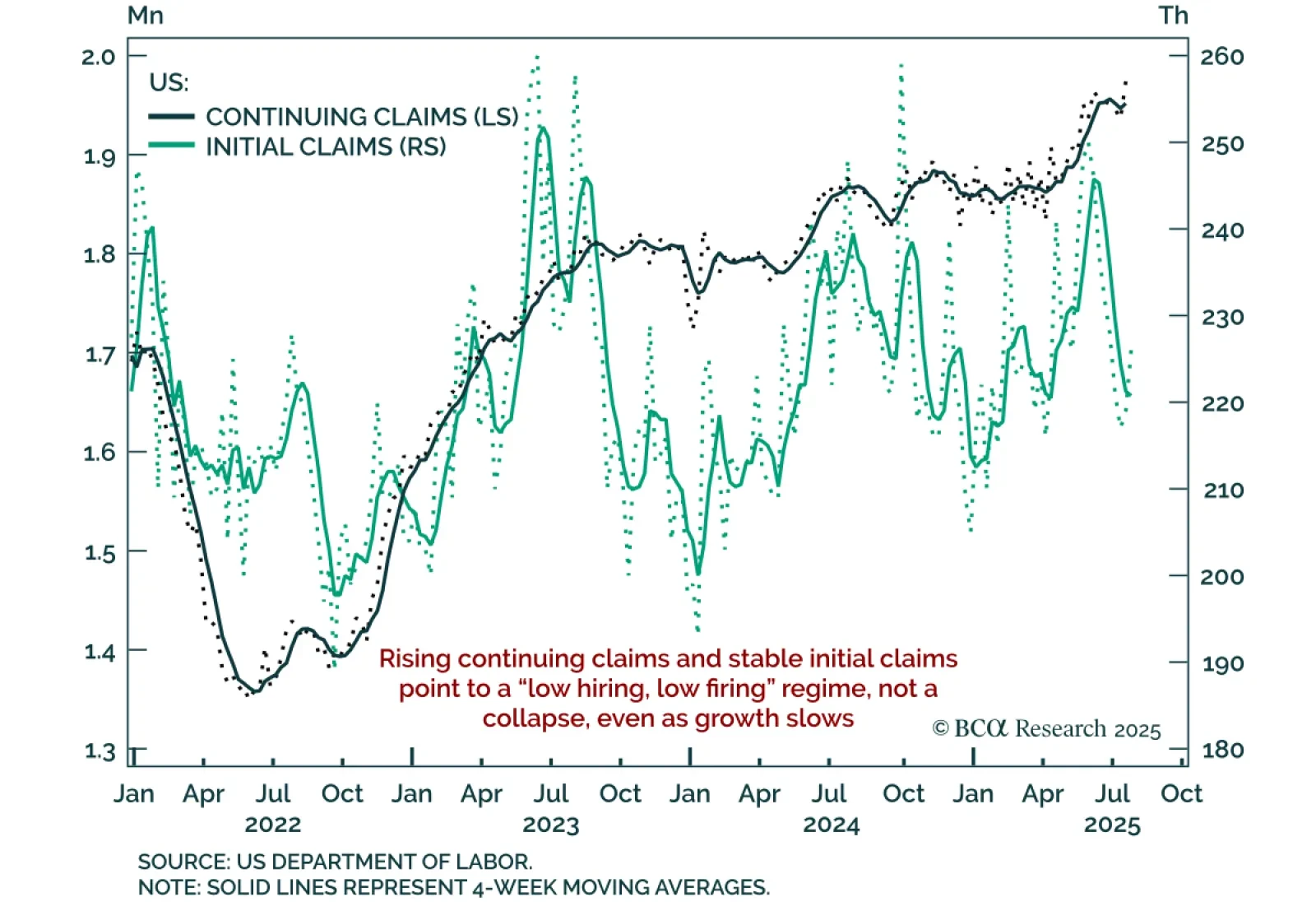

Rising continuing claims and slower job creation reinforce labor market softening, supporting a defensive stance. Continuing claims climbed to a post-COVID high of 1.974m, while initial claims held steady at 226k. Weekly claims…

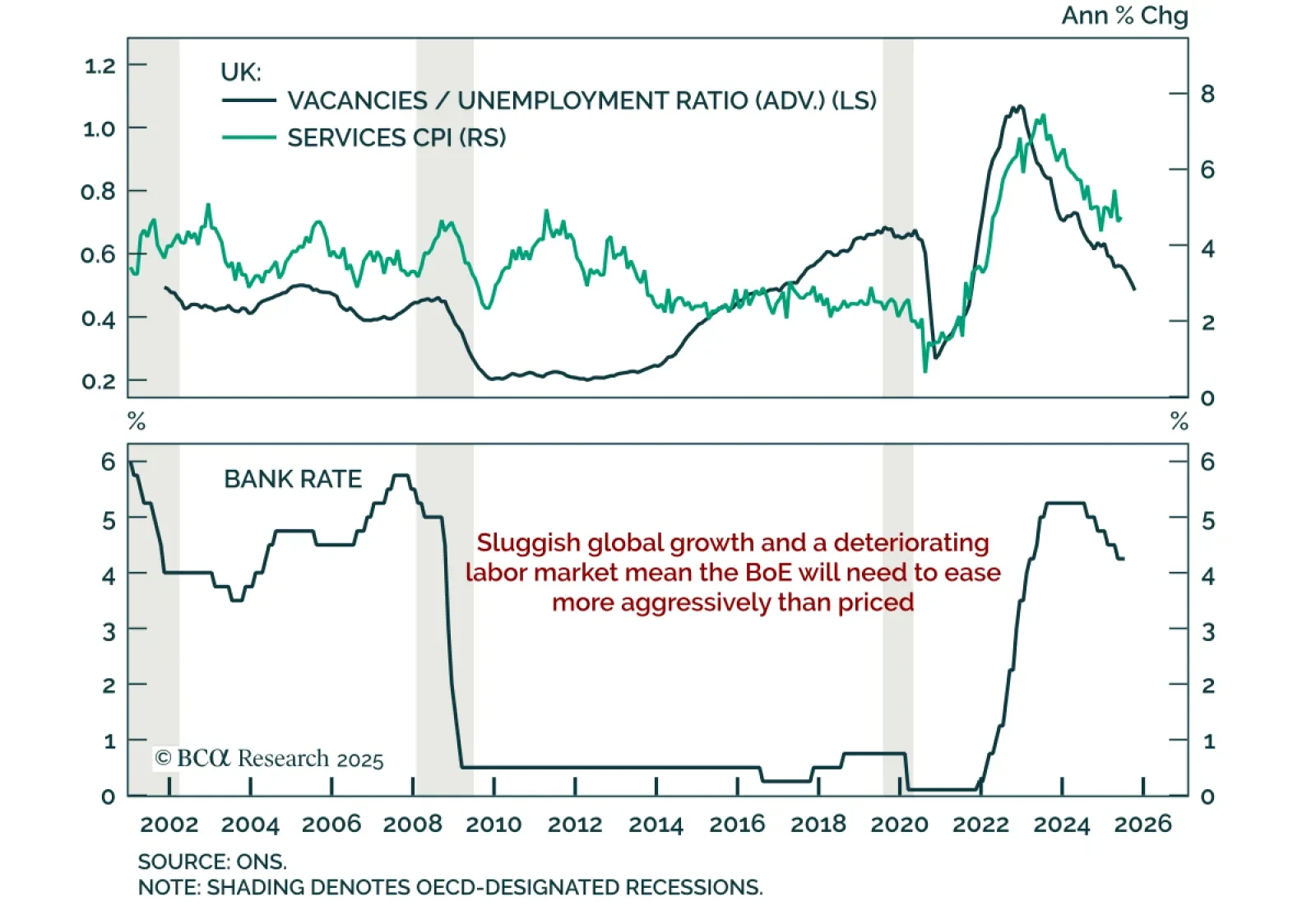

The BoE delivered a narrow rate cut to 4%, but a divided vote and fading growth momentum suggest markets are underpricing further easing. Stay overweight UK Gilts. The 5-4 split reflected concerns among dissenters about a…

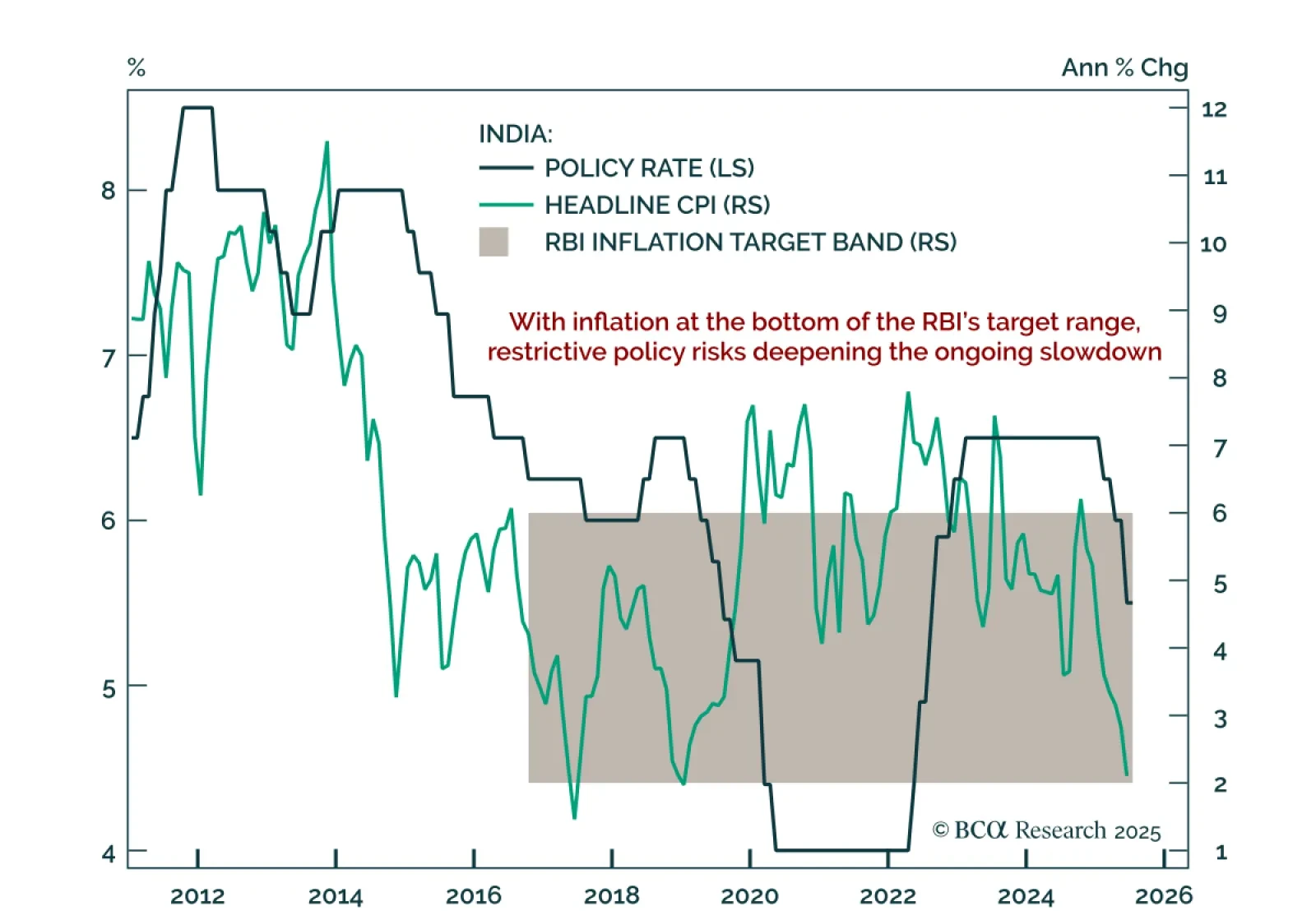

India’s central bank held rates at 5.5%, but restrictive policy, weak credit impulse, and rising external risks support further easing and a long bond position. Real lending rates remain near decade highs, and the negative…

Our Portfolio Allocation Summary for August 2025.

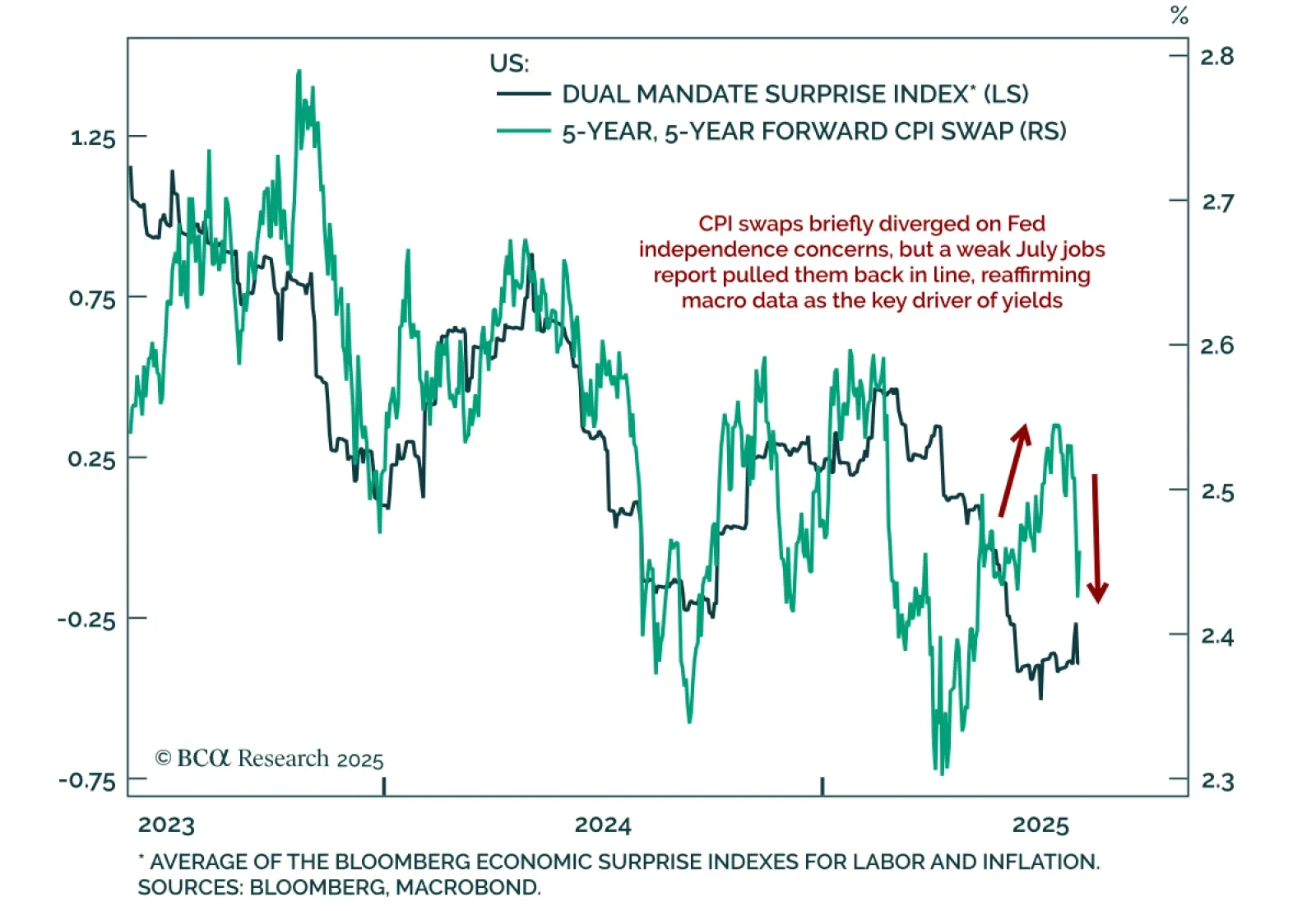

While the early resignation of Fed Gov. Kugler opened the door for a politically aligned nominee, yields will ultimately be determined by the economic outlook. Her departure triggered a further intraday DXY drop, as markets reacted…

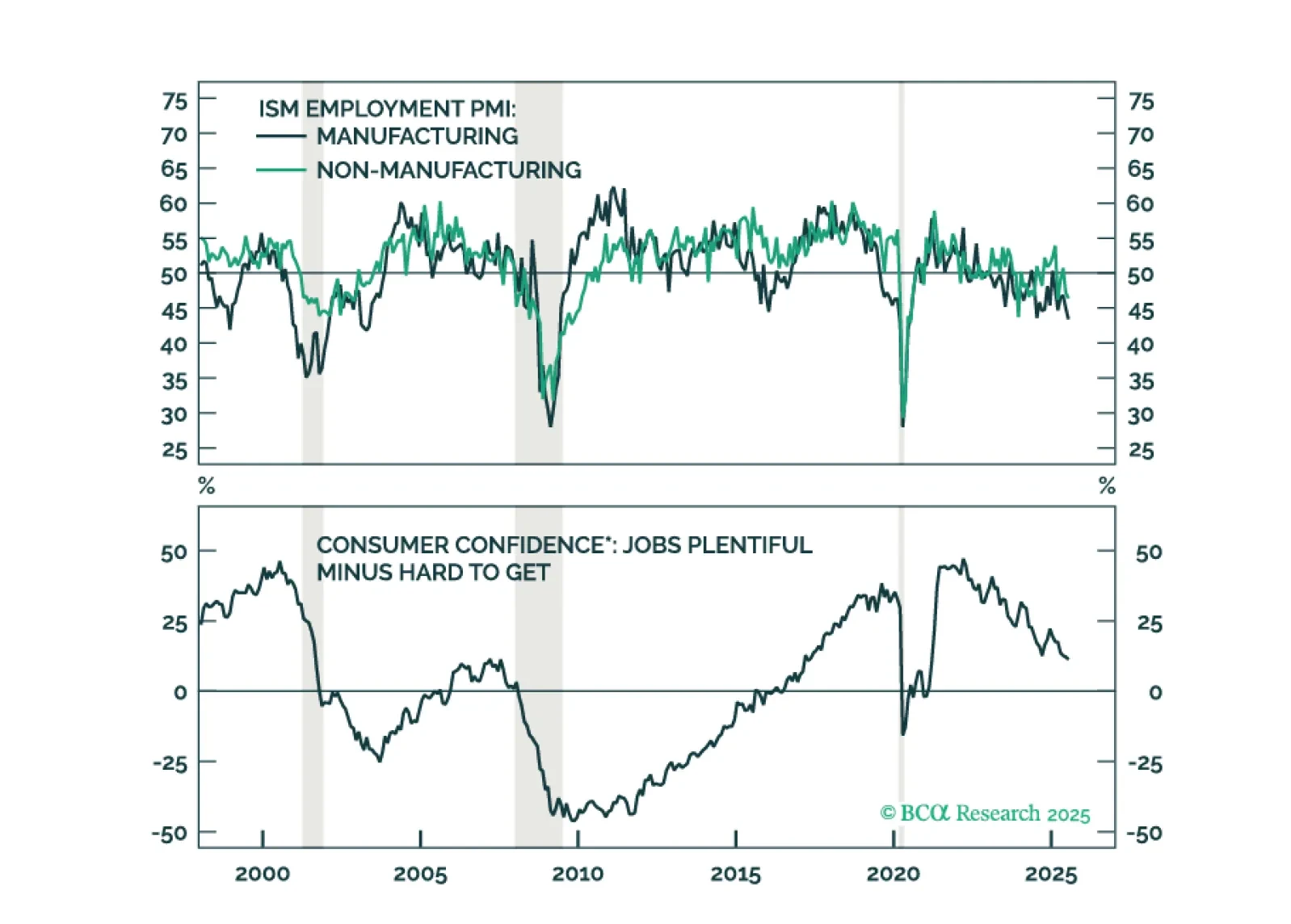

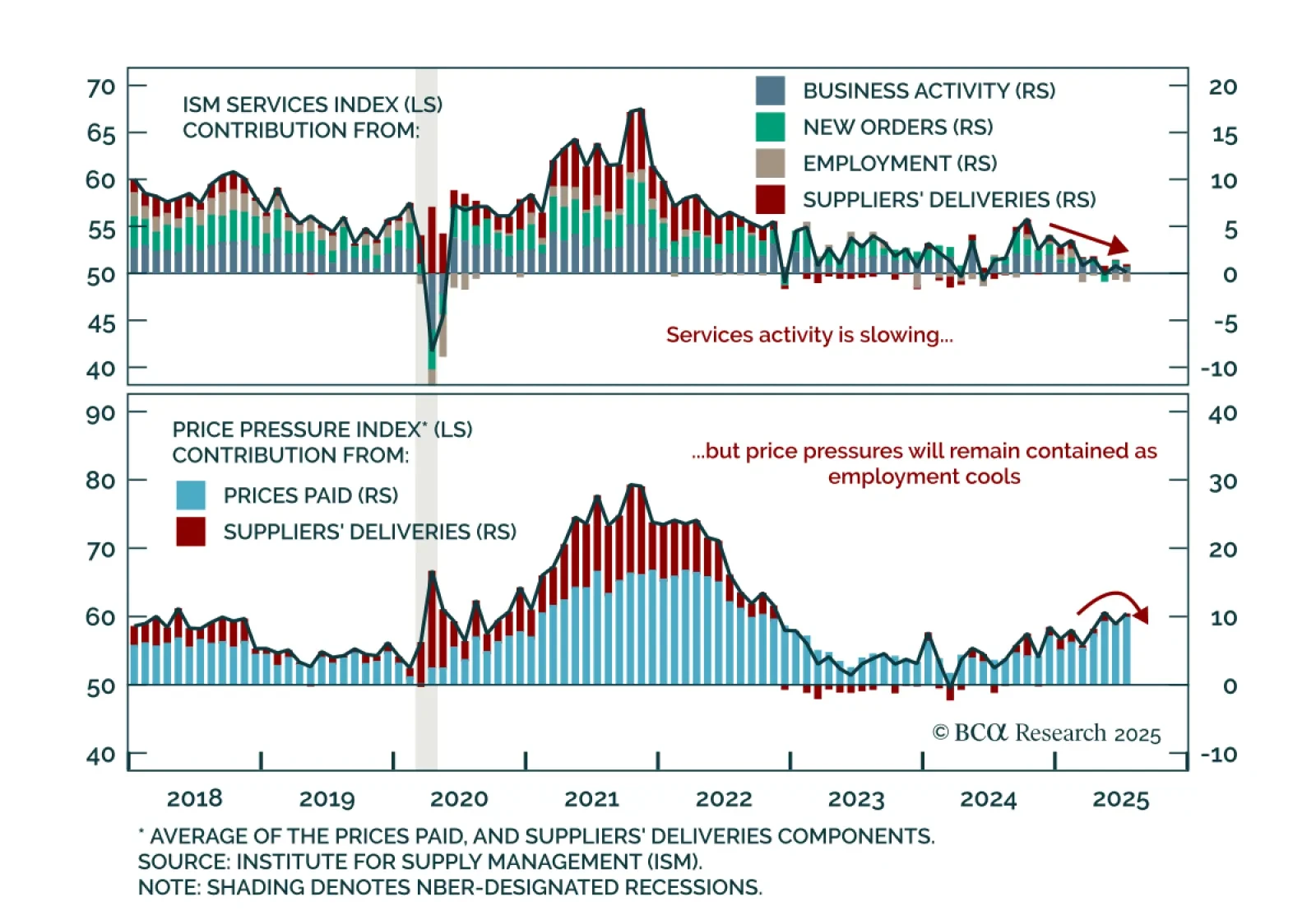

The July ISM Services report showed a stagflationary impulse, but soft labor momentum reinforces the view that price pressures remain contained. The headline index fell to 50.1 from 50.8, missing expectations. New orders softened to…

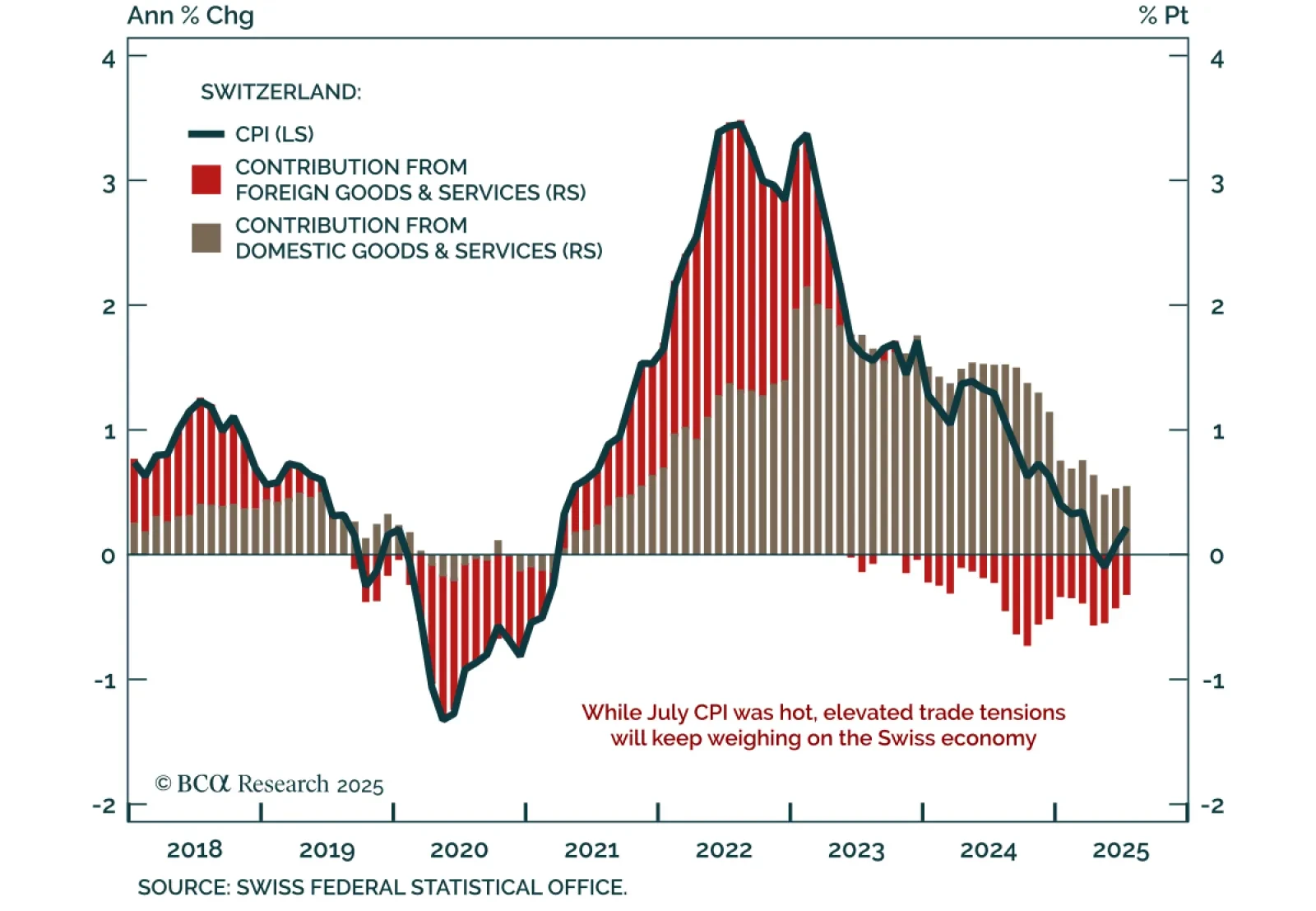

Hot July inflation does little to alter Switzerland’s near-term deflationary outlook, as soft data and trade risks support a defensive stance and preference for bonds over equities. CPI ticked up to 0.2% y/y from 0.1%, with core…

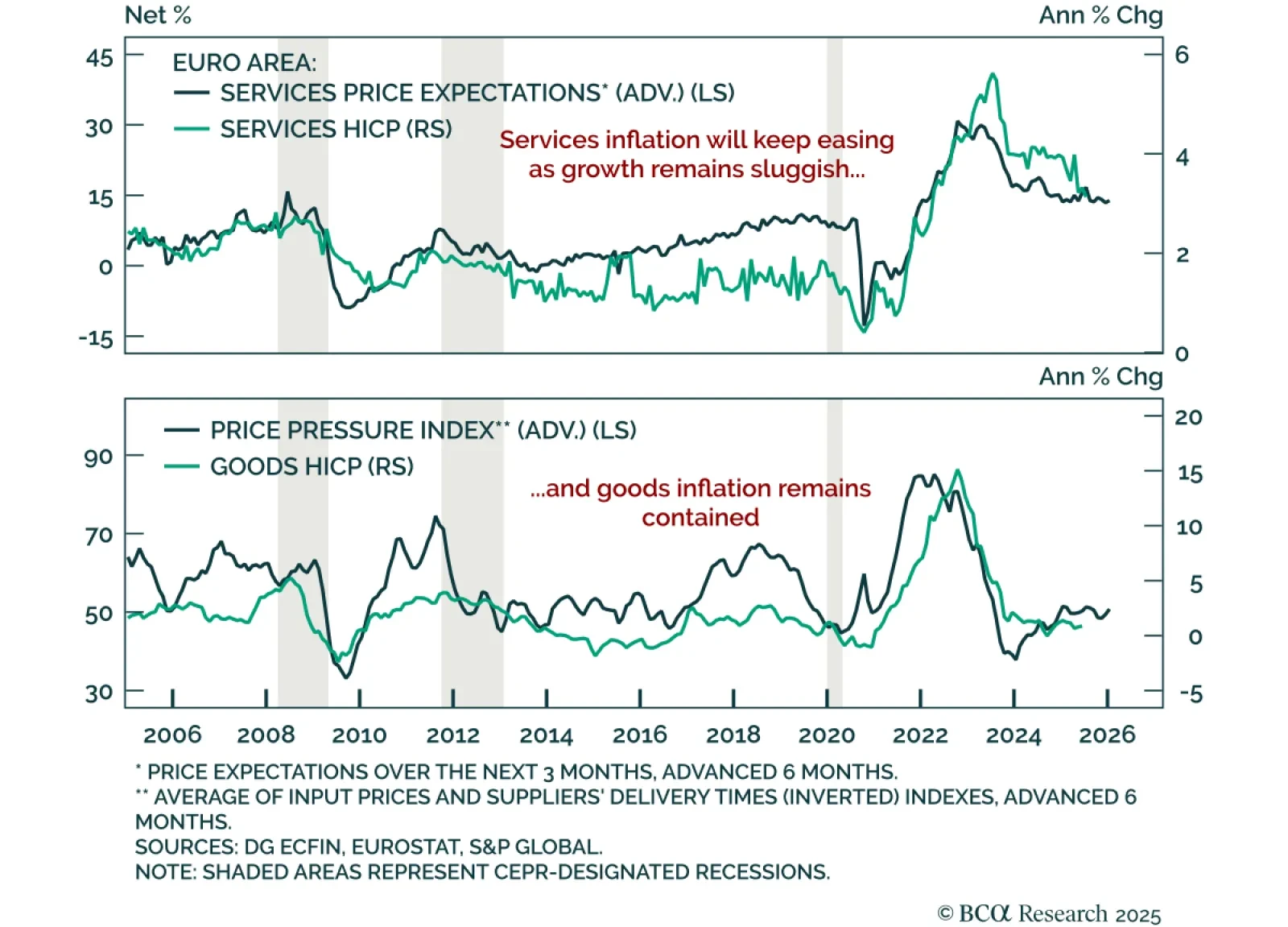

Euro area inflation held steady in July, but near-term risks remain. Long-term investors should buy on dips. Headline and core HICP came in at 2.0% and 2.3% y/y, roughly in line with expectations. The ECB held its deposit rate…

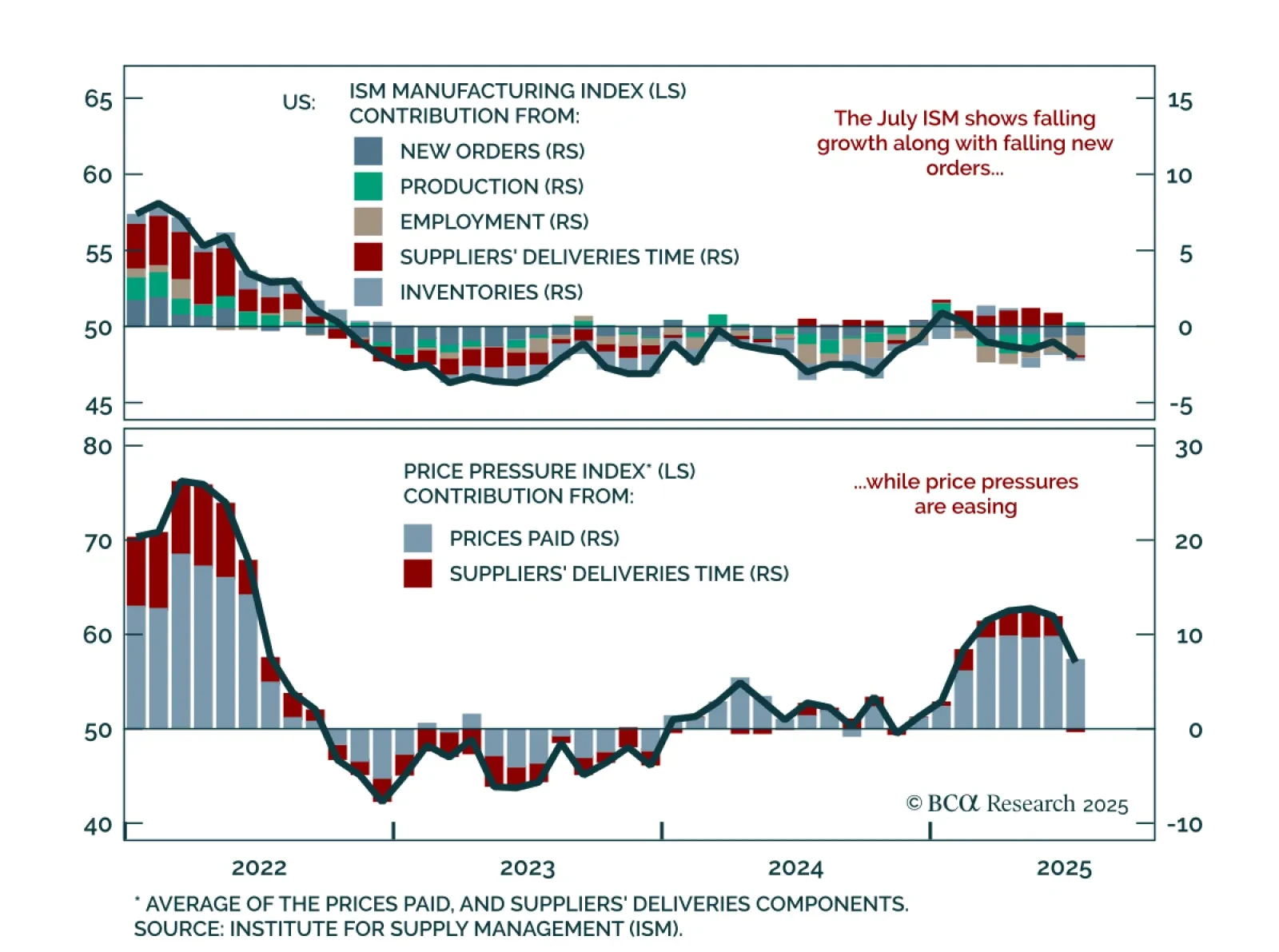

The July ISM Manufacturing miss shows weakening growth and decelerating inflation, reinforcing our long-duration stance. The index fell to 48.0 from 49.0, with only the production component contributing positively. New orders remain…

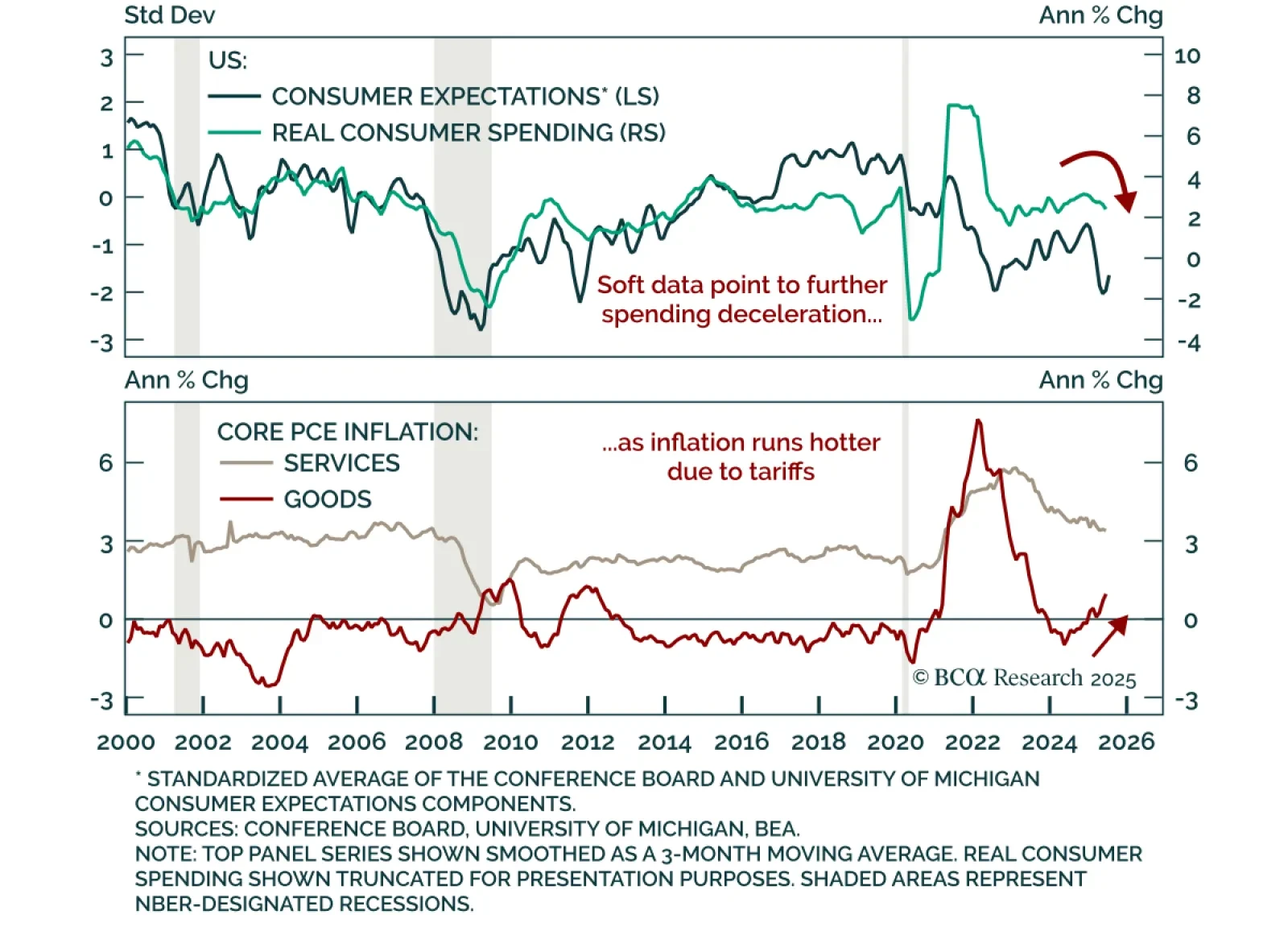

June US income and spending shows softening demand and rising goods inflation pressure, reinforcing our long-duration stance. Real personal spending only rose 0.1% m/m, in line with expectations. Personal income increased 0.3% m…