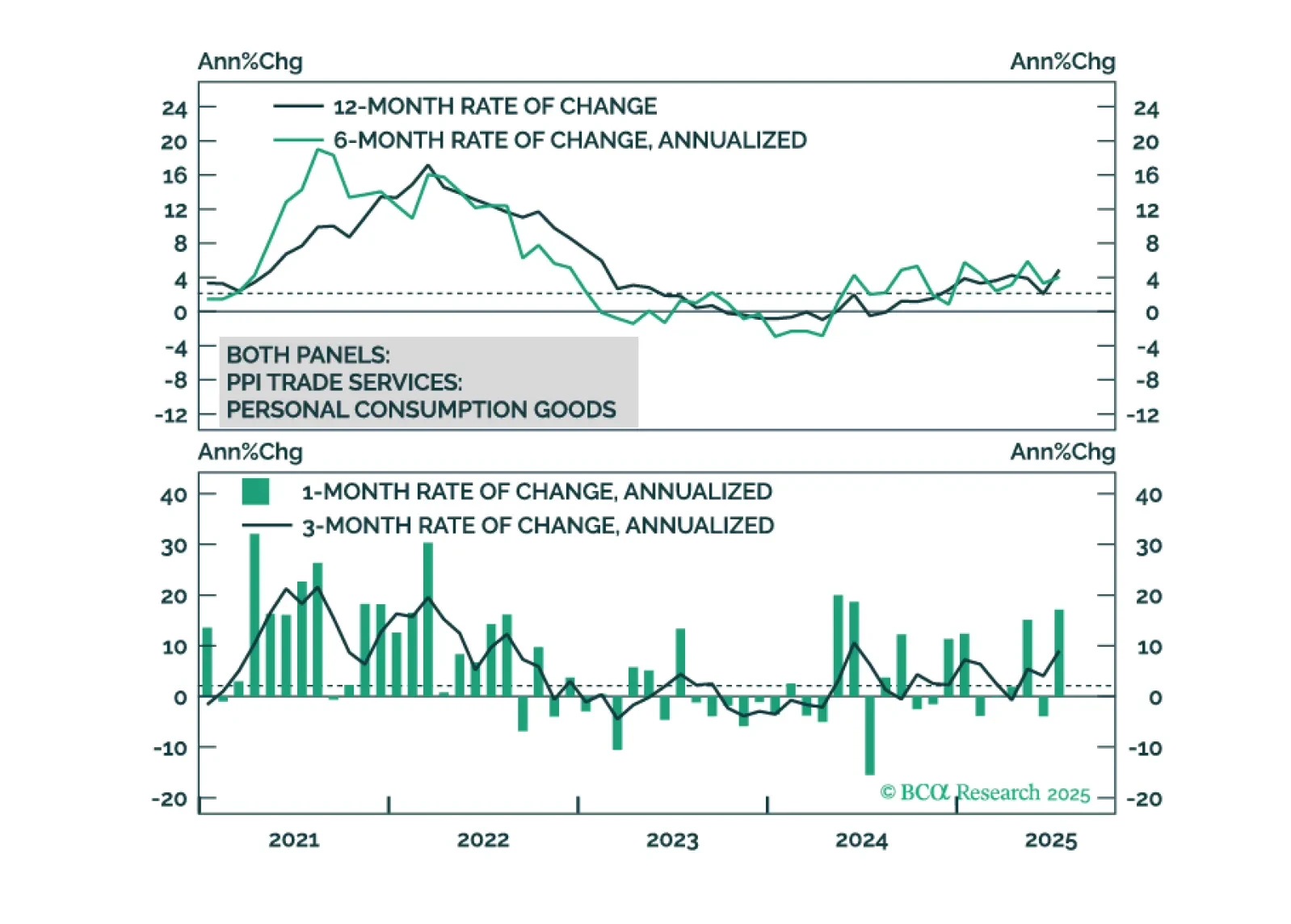

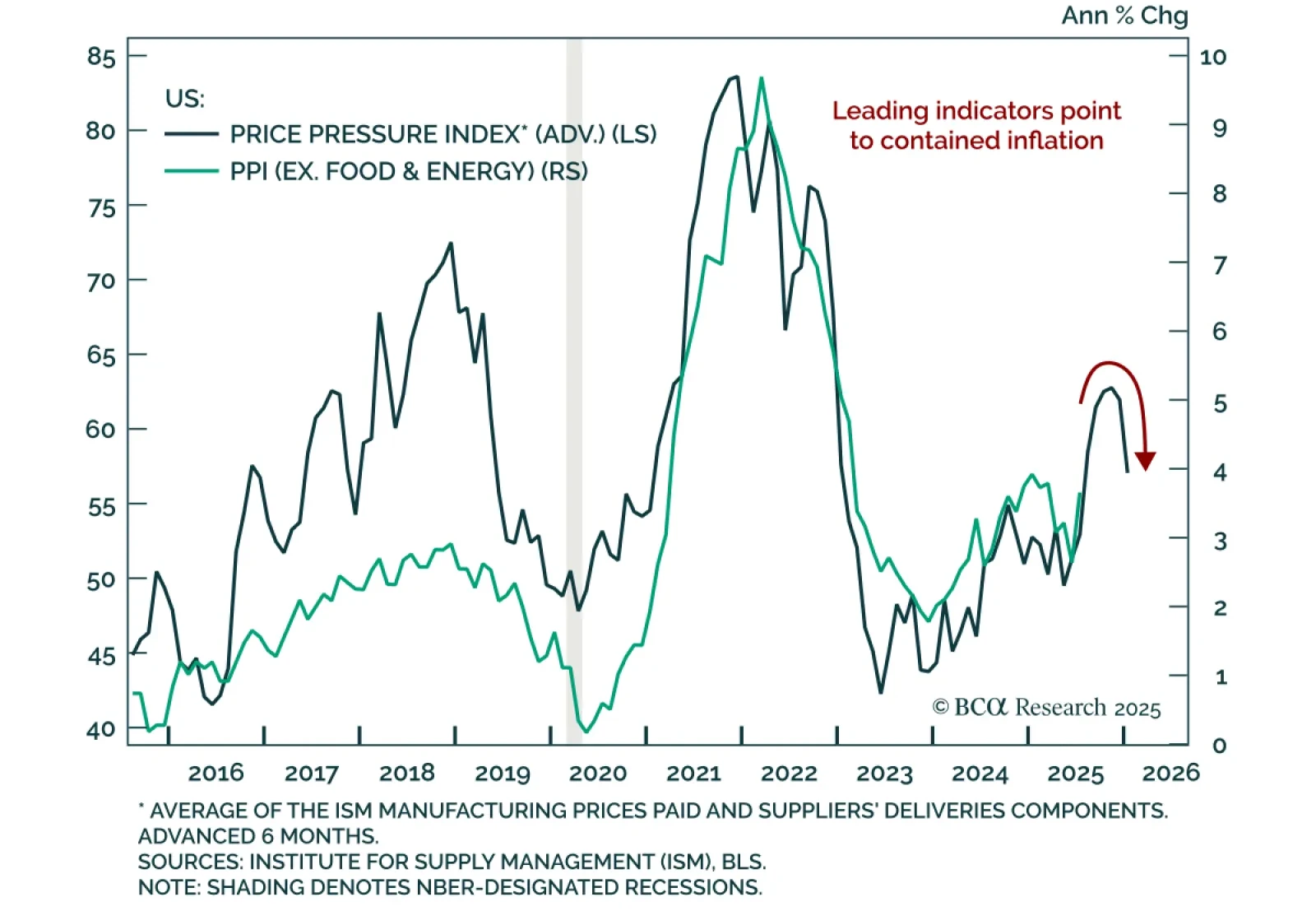

Inflation/Deflation

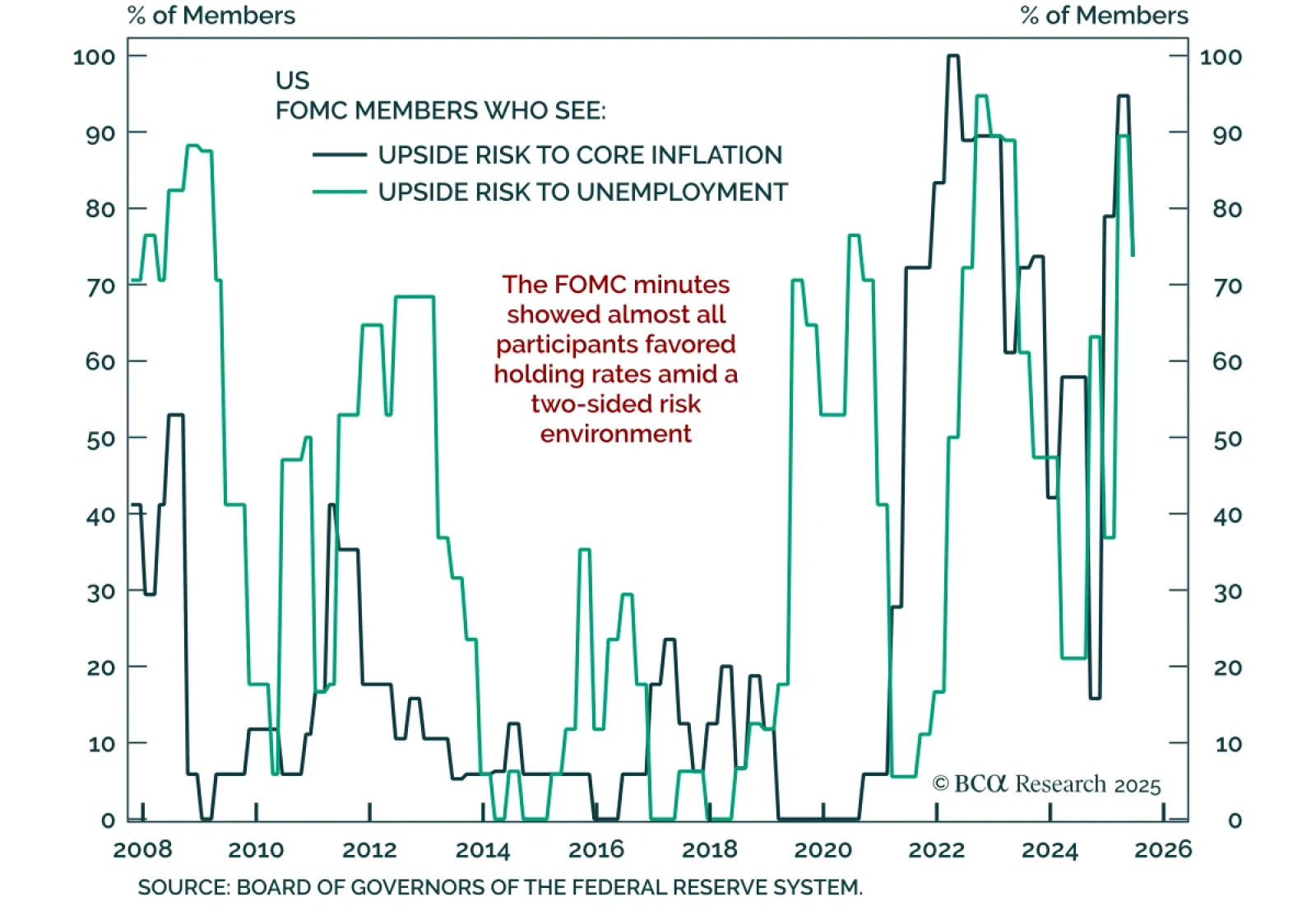

FOMC Minutes Showed Broad Consensus To Hold Despite High-Profile Dissents…

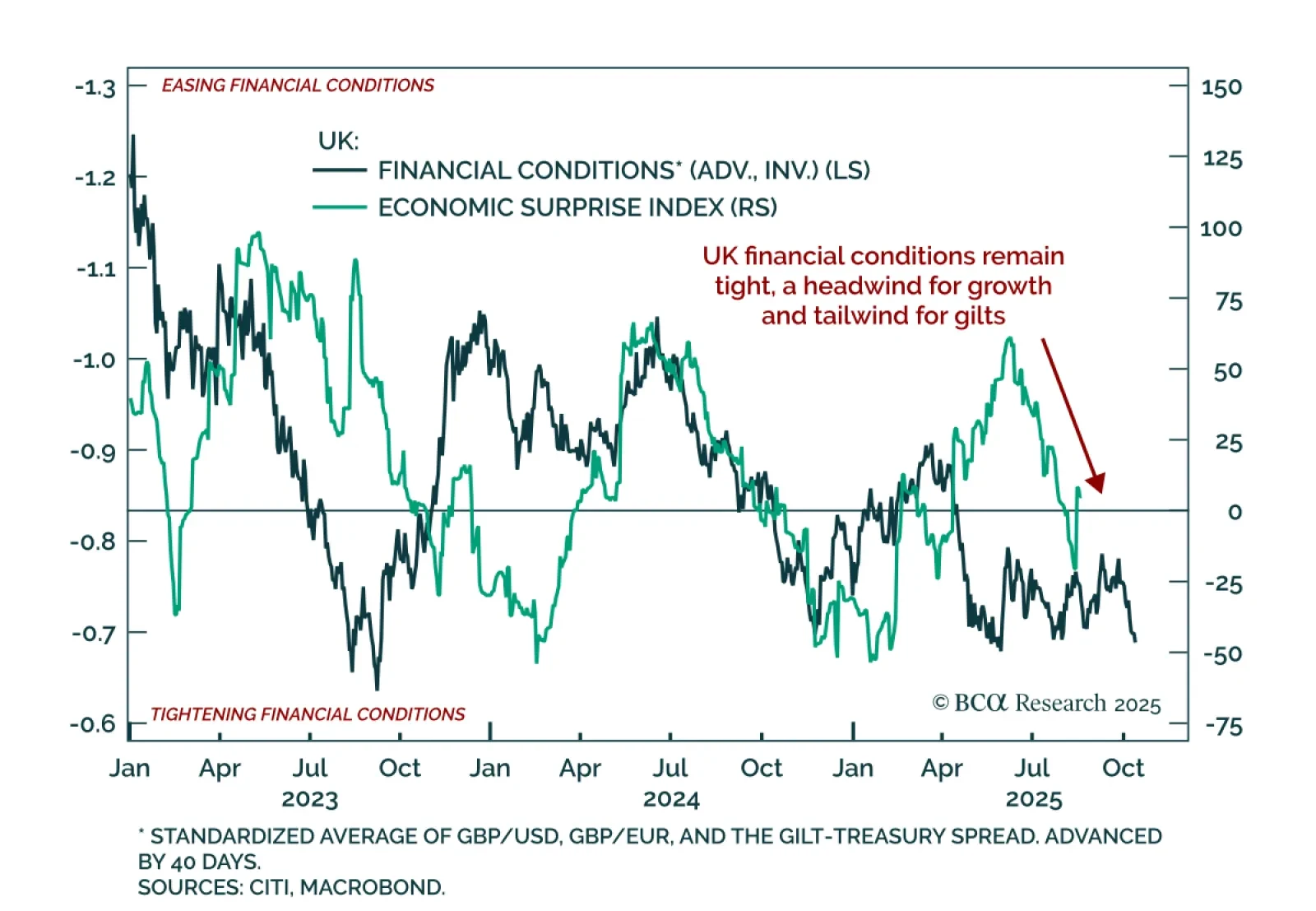

UK: Tight Financial Conditions, Weak Data Support Gilt Overweight…

Weak Housing Underscores Vulnerable US Growth Outlook…

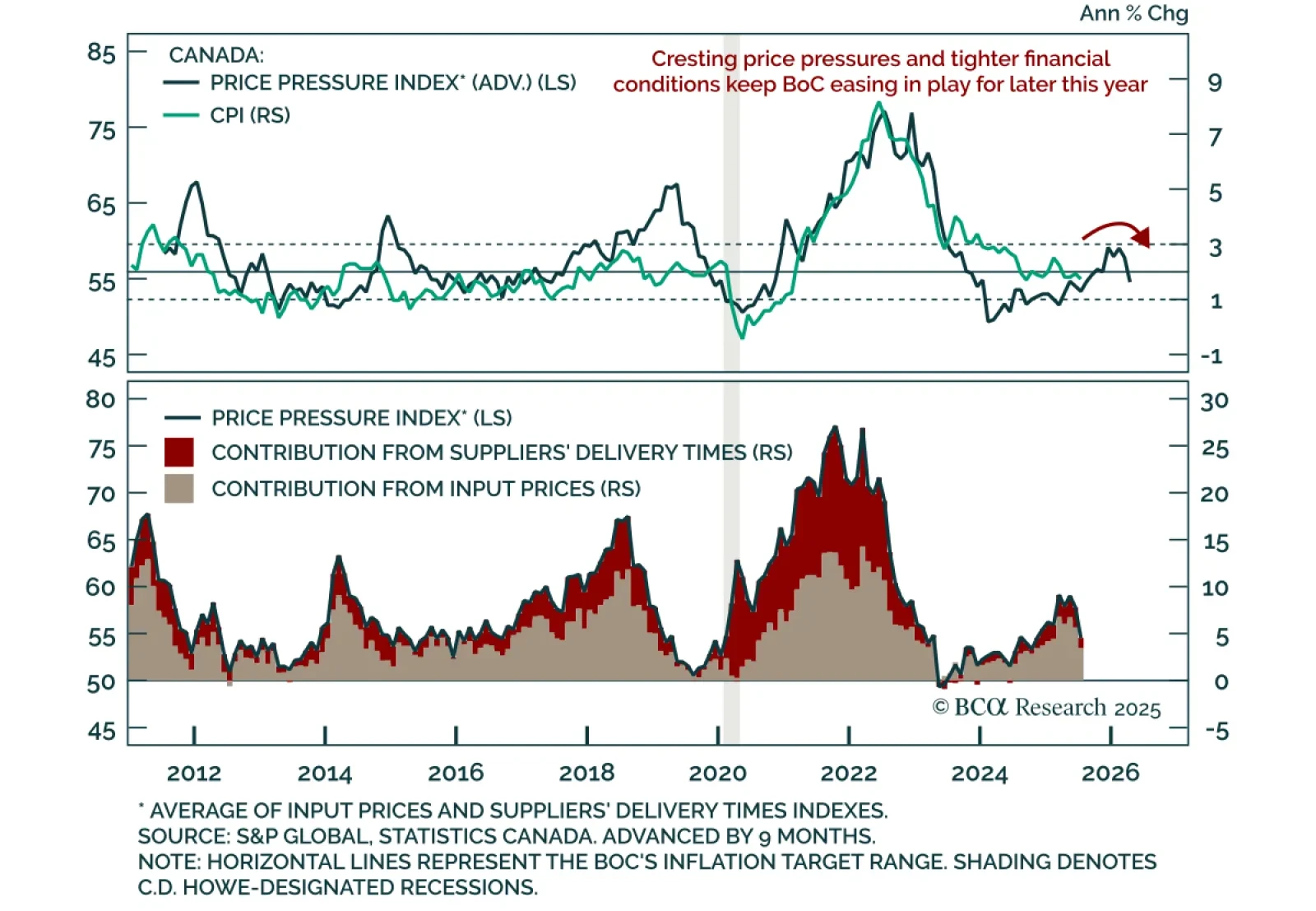

Canadian Macro Fragility Points To Deeper Easing Path…

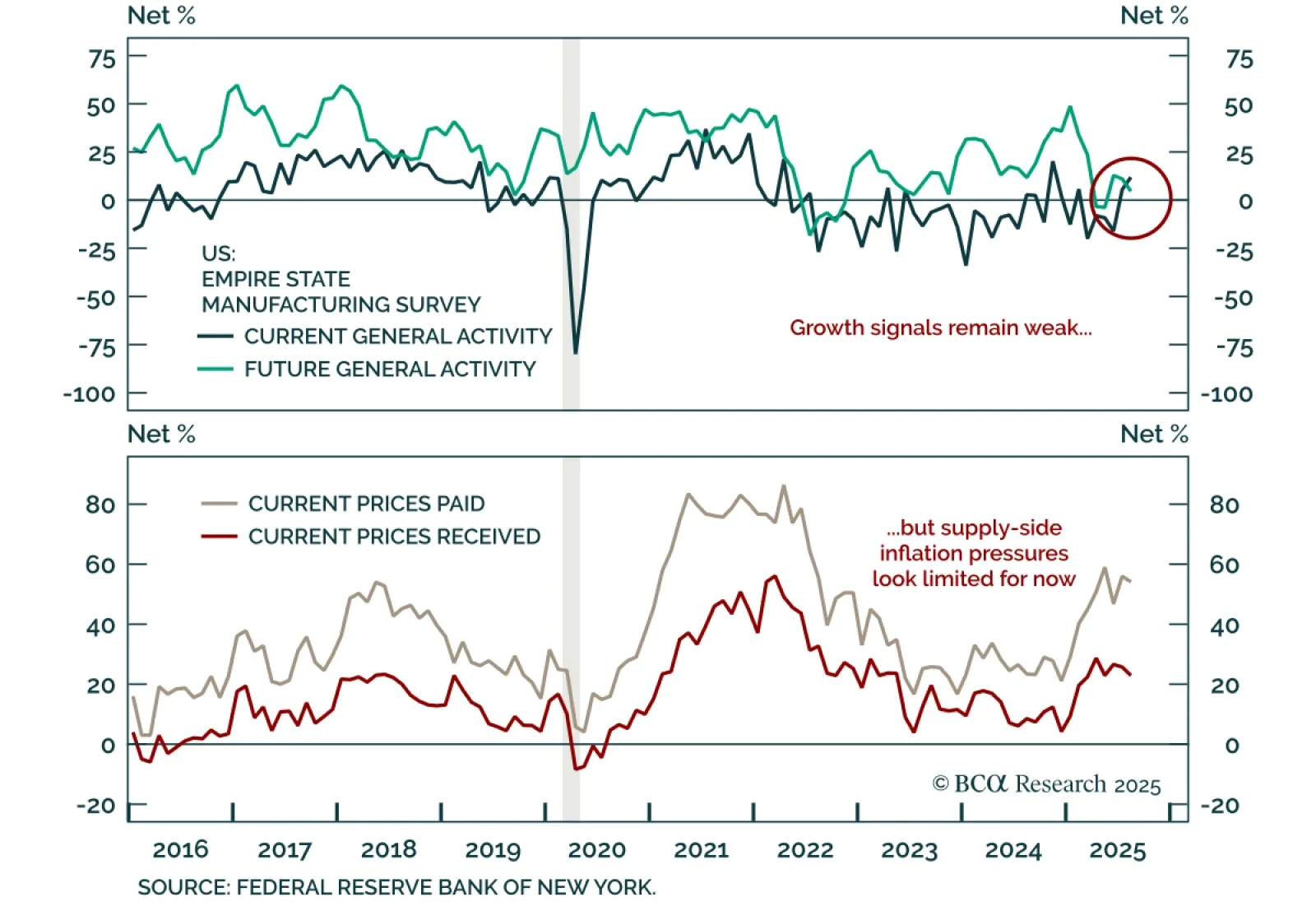

Empire Beat Masks Weak Growth and Pricing Power…

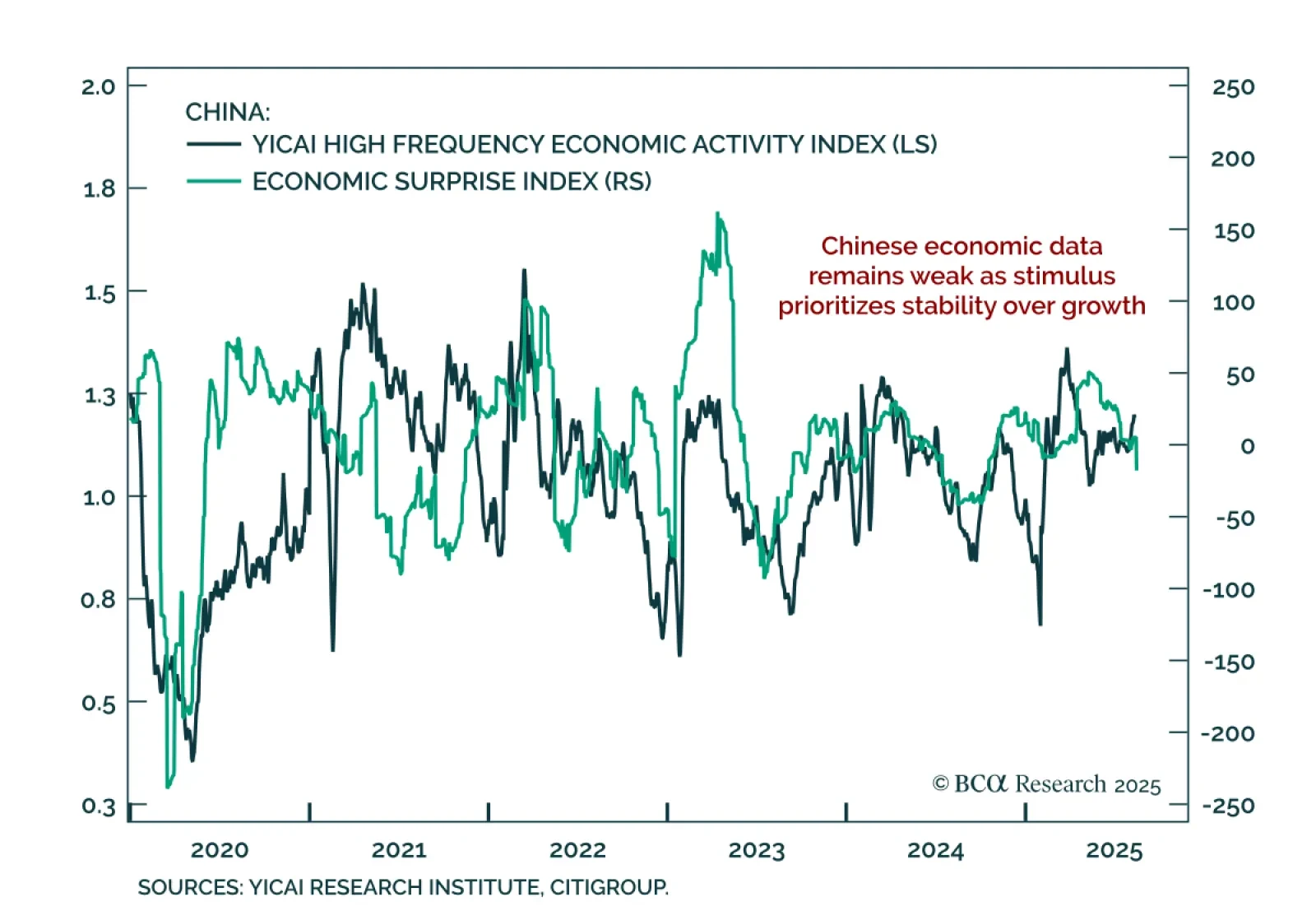

Weak Chinese Data Not Yet Forcing A Policy Shift…

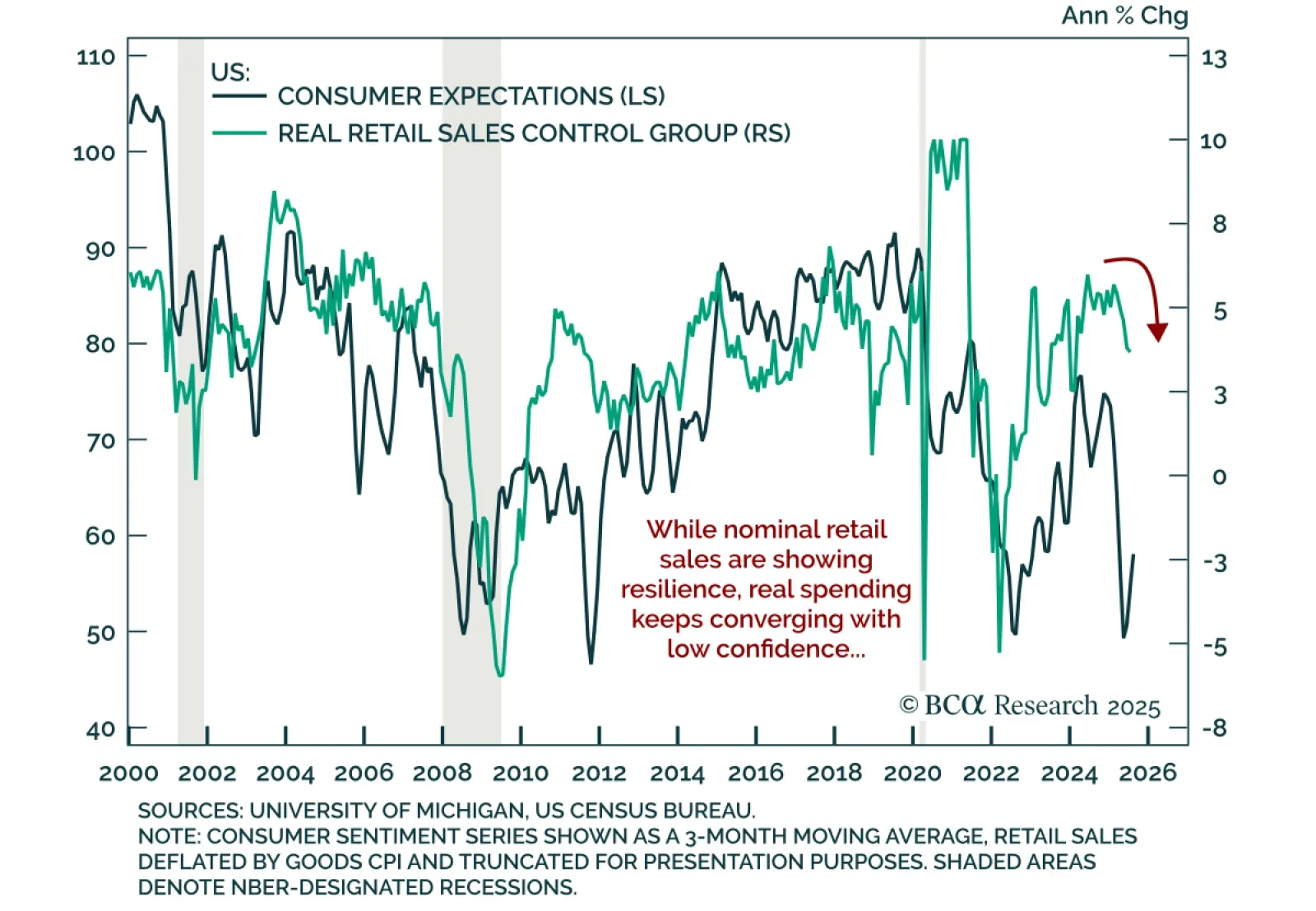

Softening US Consumption and Sentiment Support Long Duration…

The cost of tariffs is falling on the US consumer, not foreign exporters or US firms.

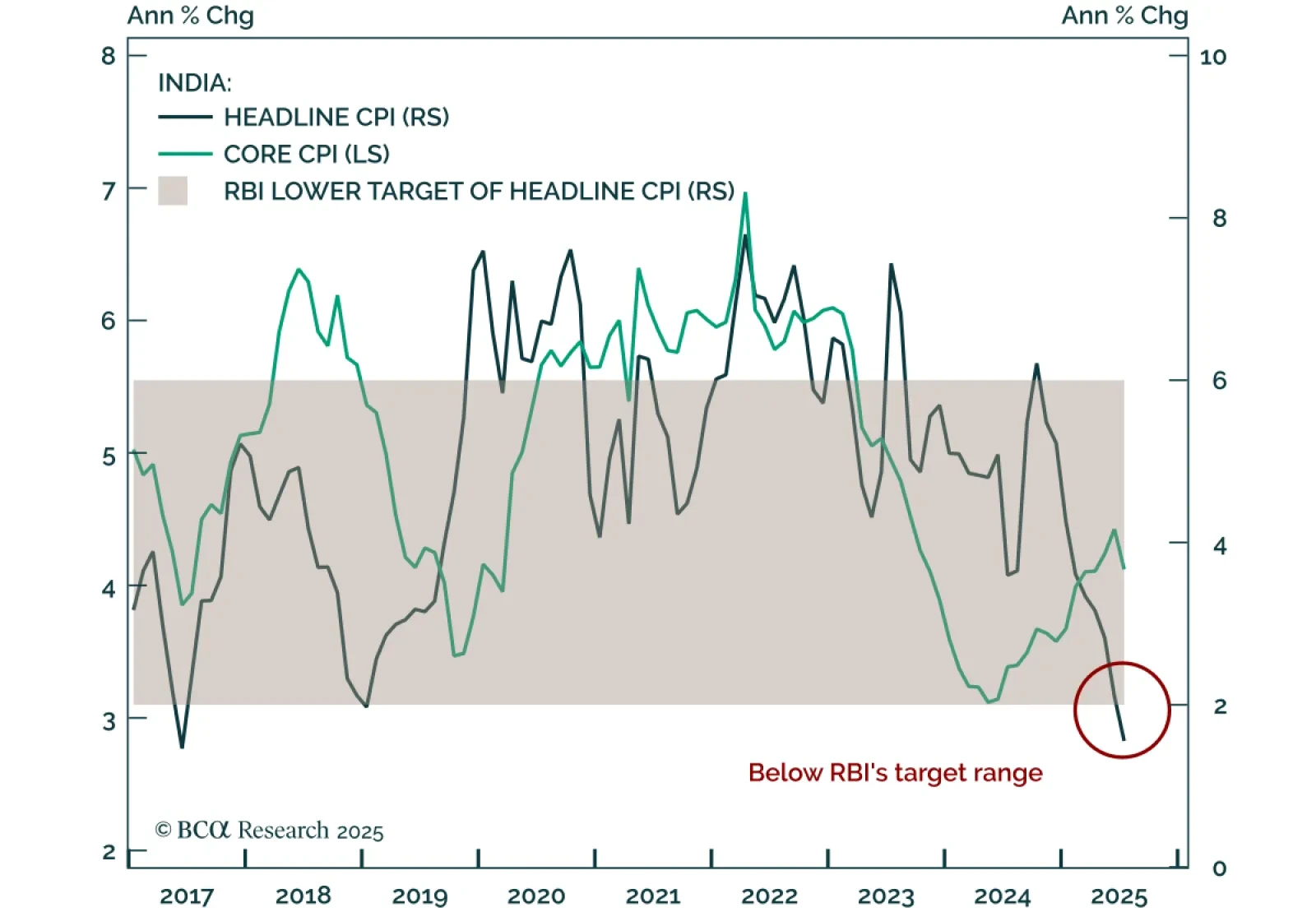

The RBI Will Cut Rates Substantially…