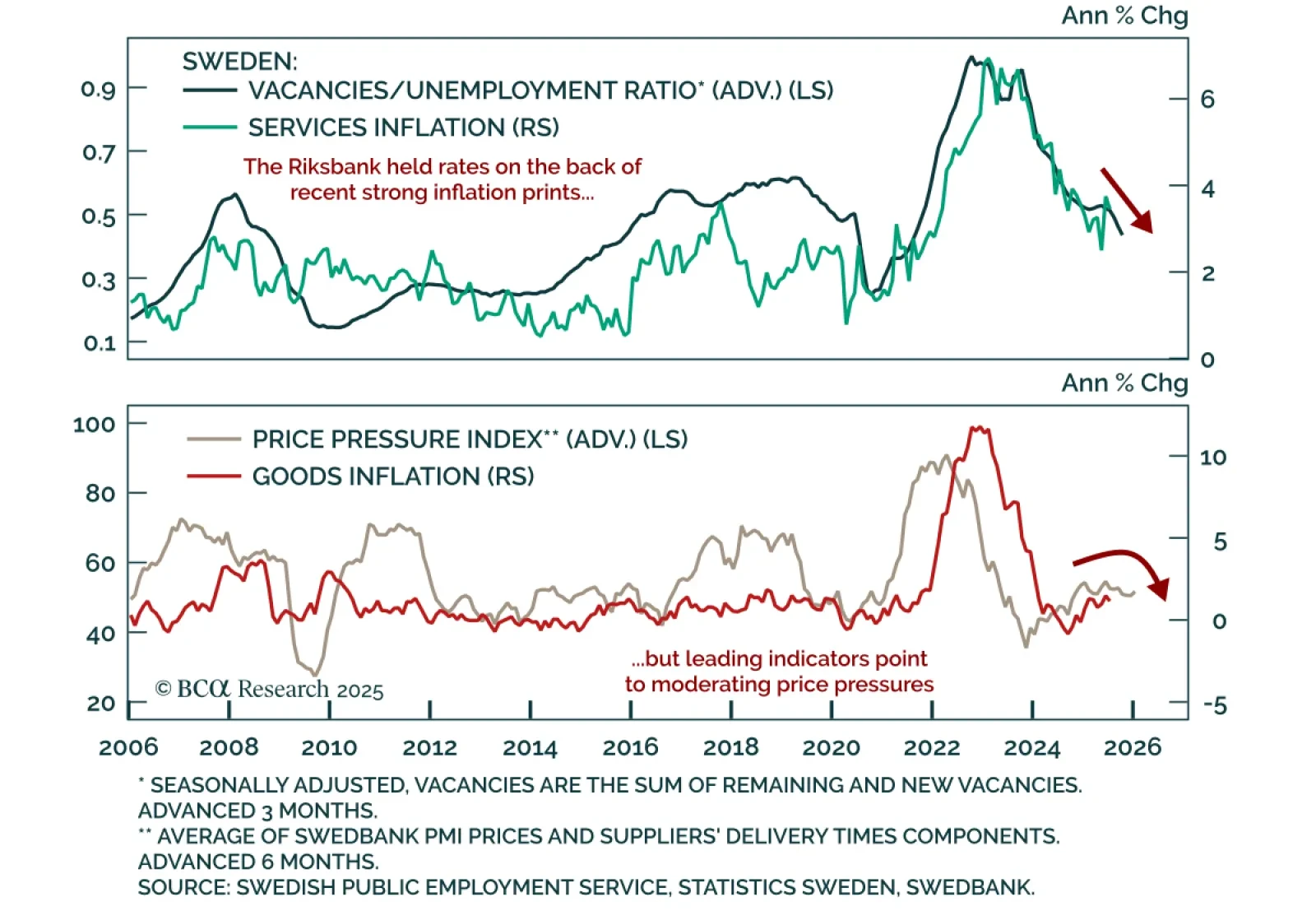

The Riksbank held at 2.0% as core inflation remains above target, though easing pressures are building. July headline inflation had slightly cooled, but core remains above both the bank’s forecast and the 1-3% target band. Inflation…

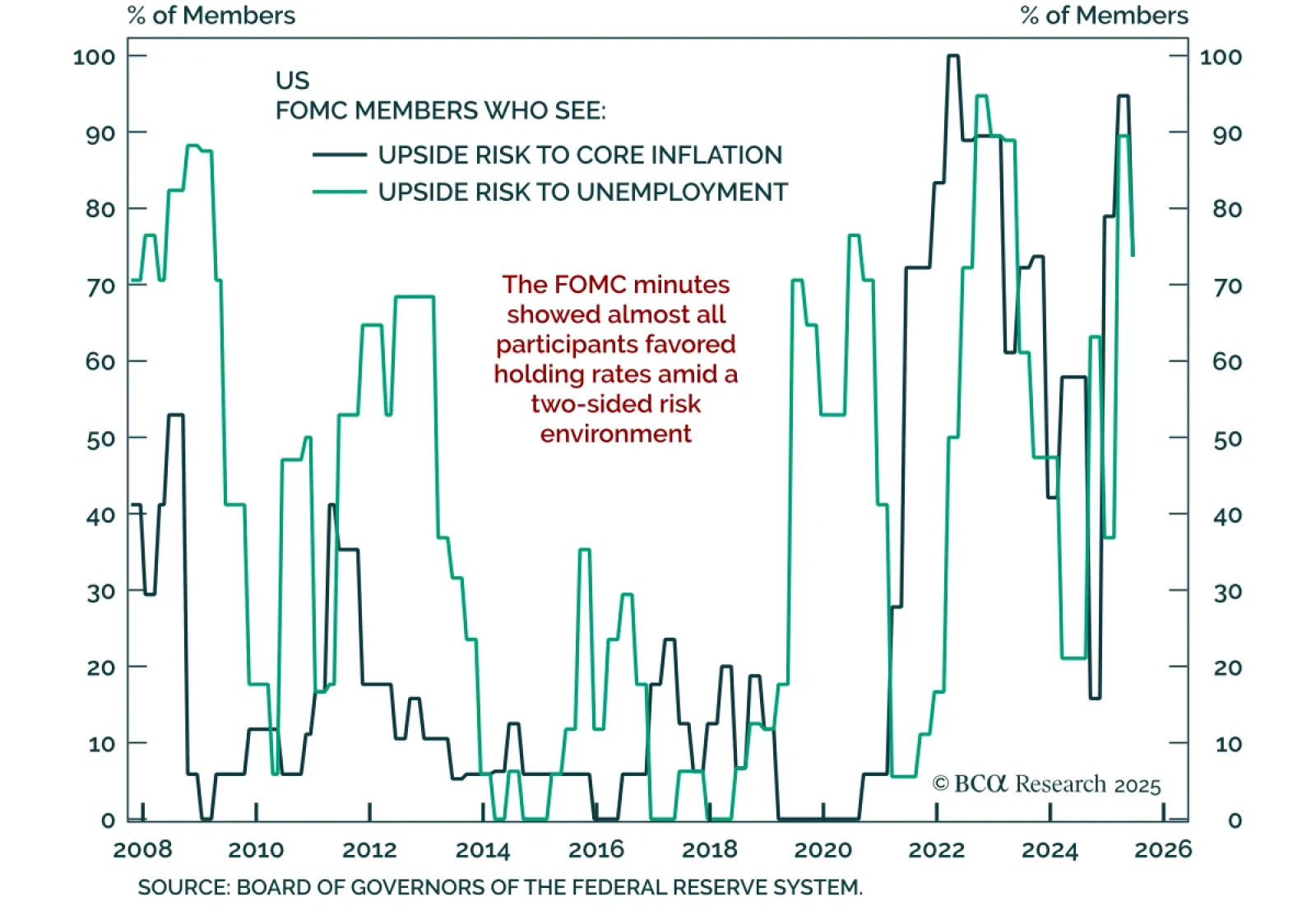

FOMC minutes showed broad support to hold in July, but the committee remains divided between proactive doves and reactive hawks. “Almost all members” favored leaving the funds rate unchanged, though two dissented for an…

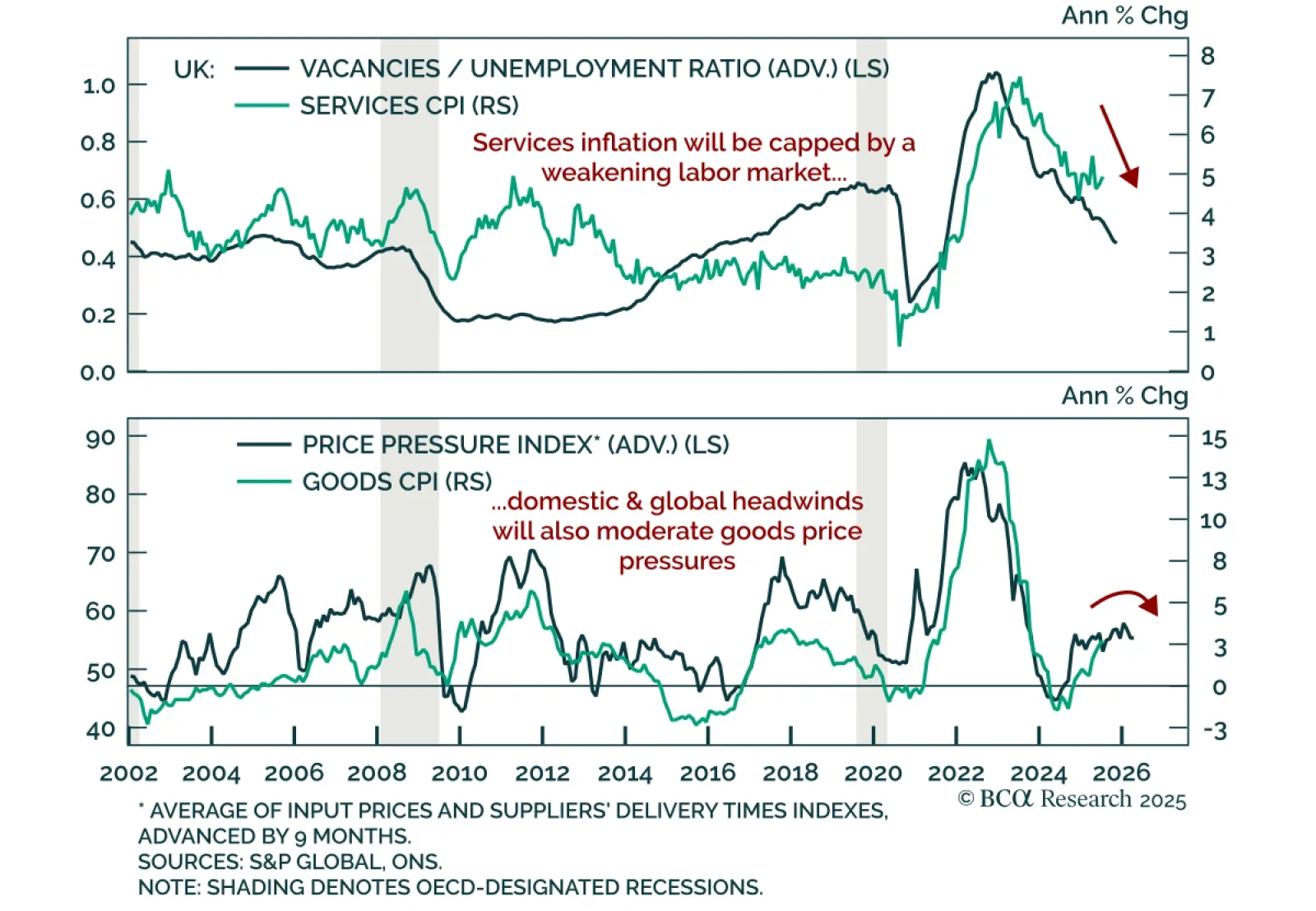

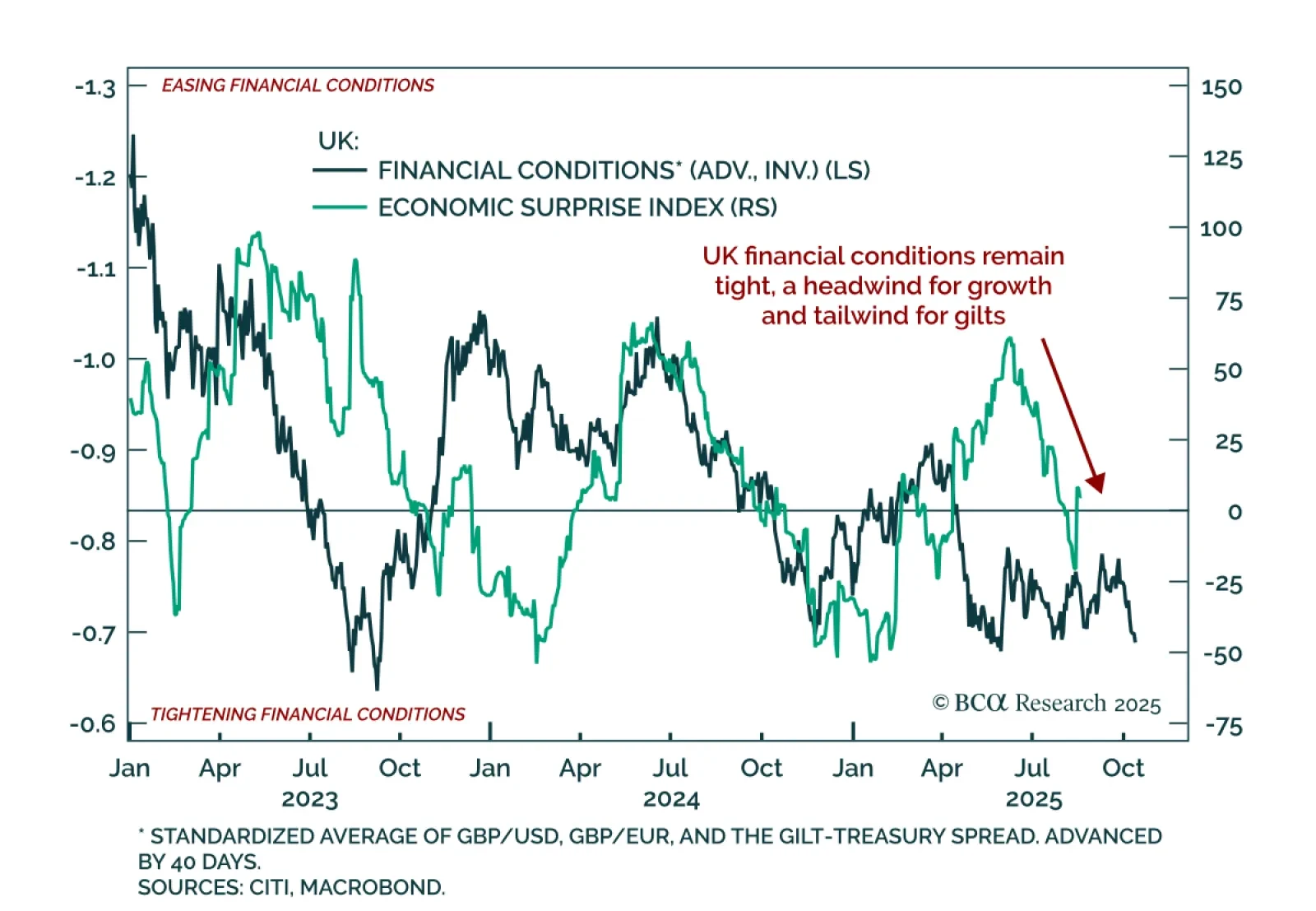

Hot July inflation does not alter the weakening UK backdrop, keeping Gilts attractive and GBP vulnerable. Headline CPI rose 0.1% m/m, lifting y/y inflation to 3.8% from 3.6%, while core ticked up to 3.8% from 3.7%. Services…

UK data momentum is fading, keeping Gilts attractive and GBP vulnerable. At 5.60%, 30-year Gilts trade at their highest yields since the late 1990s, reflecting persistent pressure on the long end across DMs. The Bank of England…

US housing data remain weak, reinforcing a fragile growth backdrop and the need for equity downside protection. July housing starts rose 5.2% m/m (annualized), but building permits fell 2.8% following a small June decline. The…

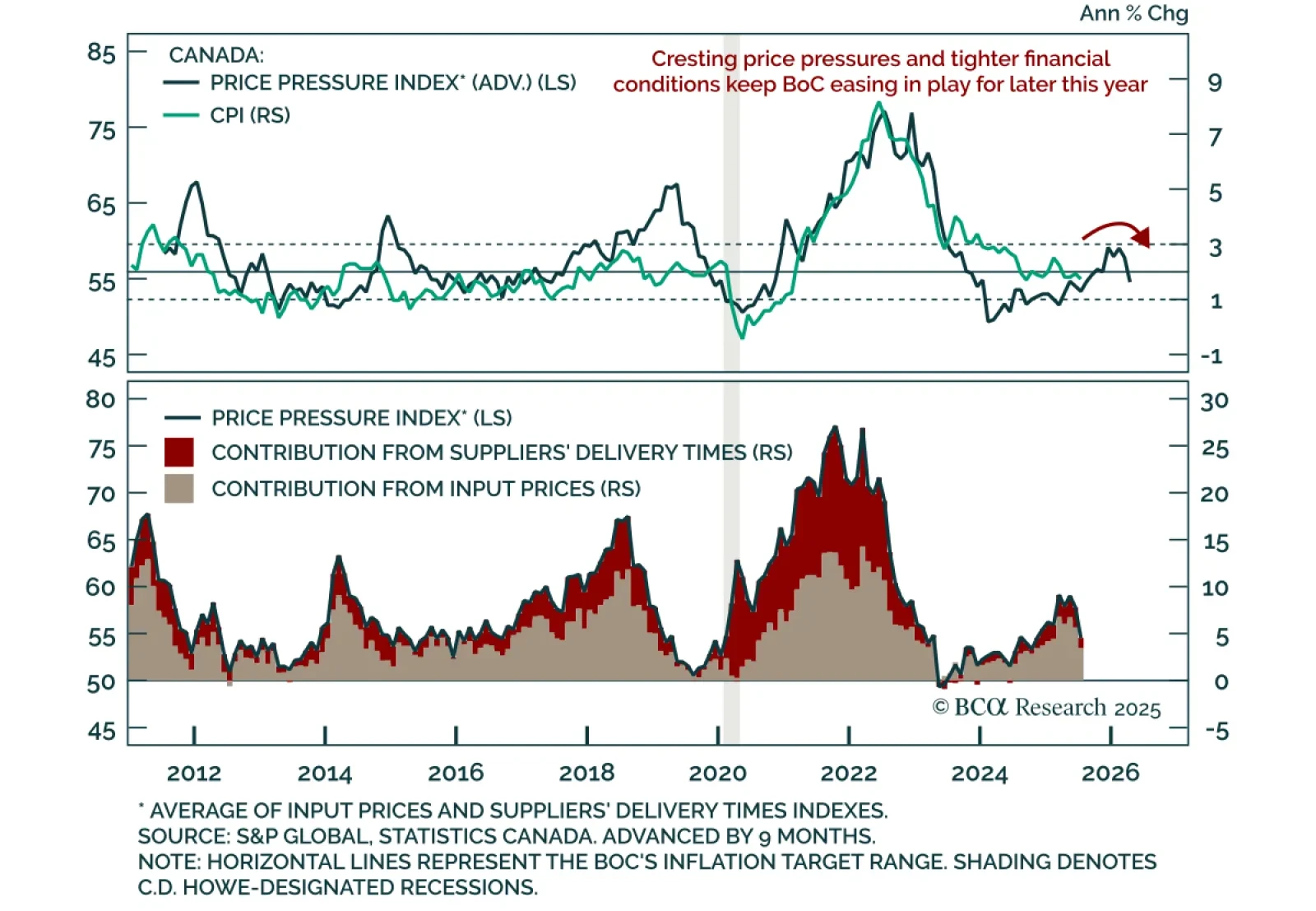

July’s softer Canadian inflation, set against lingering macro weakness, reinforces the case for more BoC easing than markets are currently pricing. Headline CPI slowed to 1.7% y/y from 1.9%, below expectations, driven by lower…

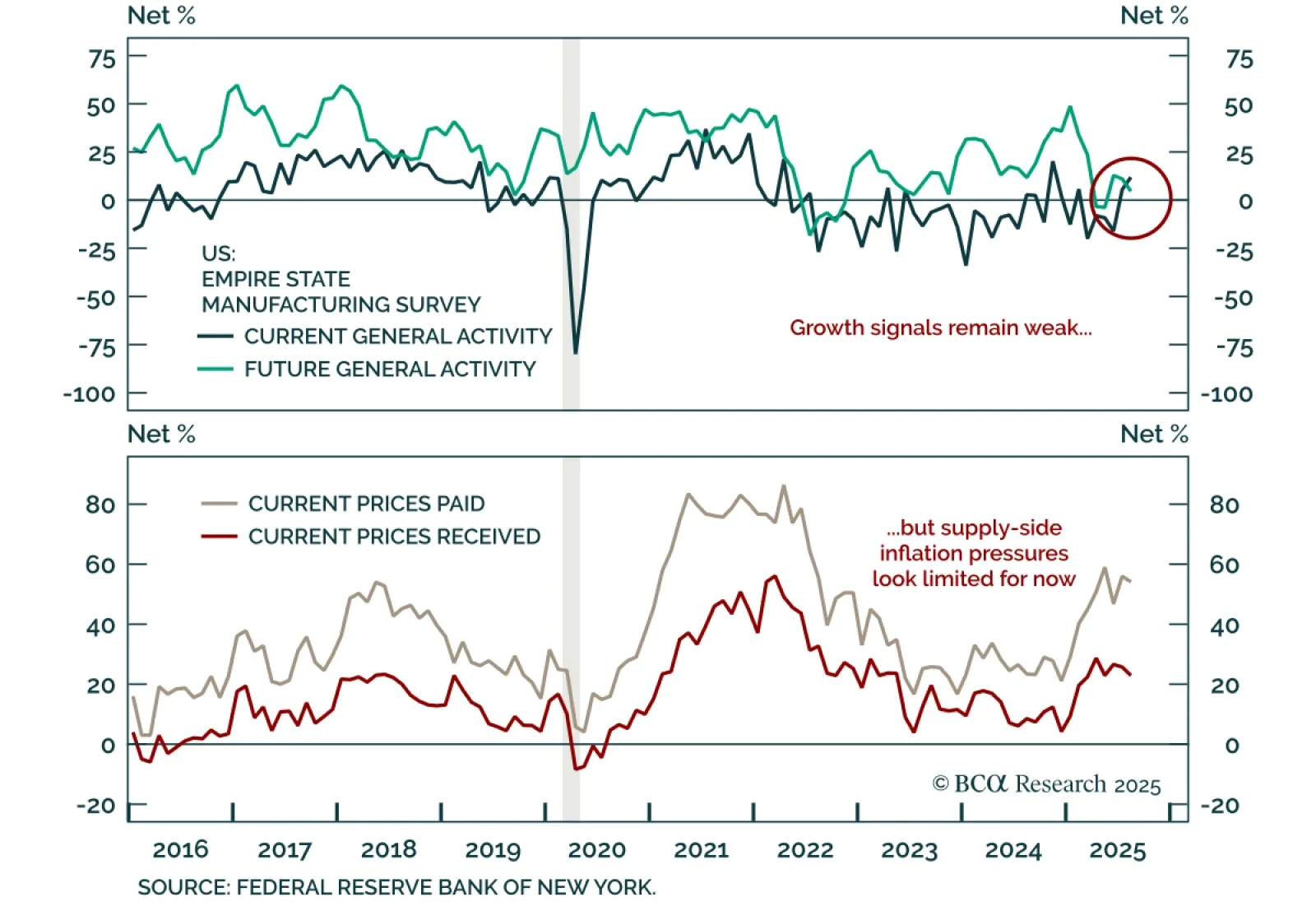

The surprisingly positive August Empire State Manufacturing survey conceals growth headwinds. The headline index rose to 11.9 in August from 5.5 in July, well above estimates. But the report showed a split between current…

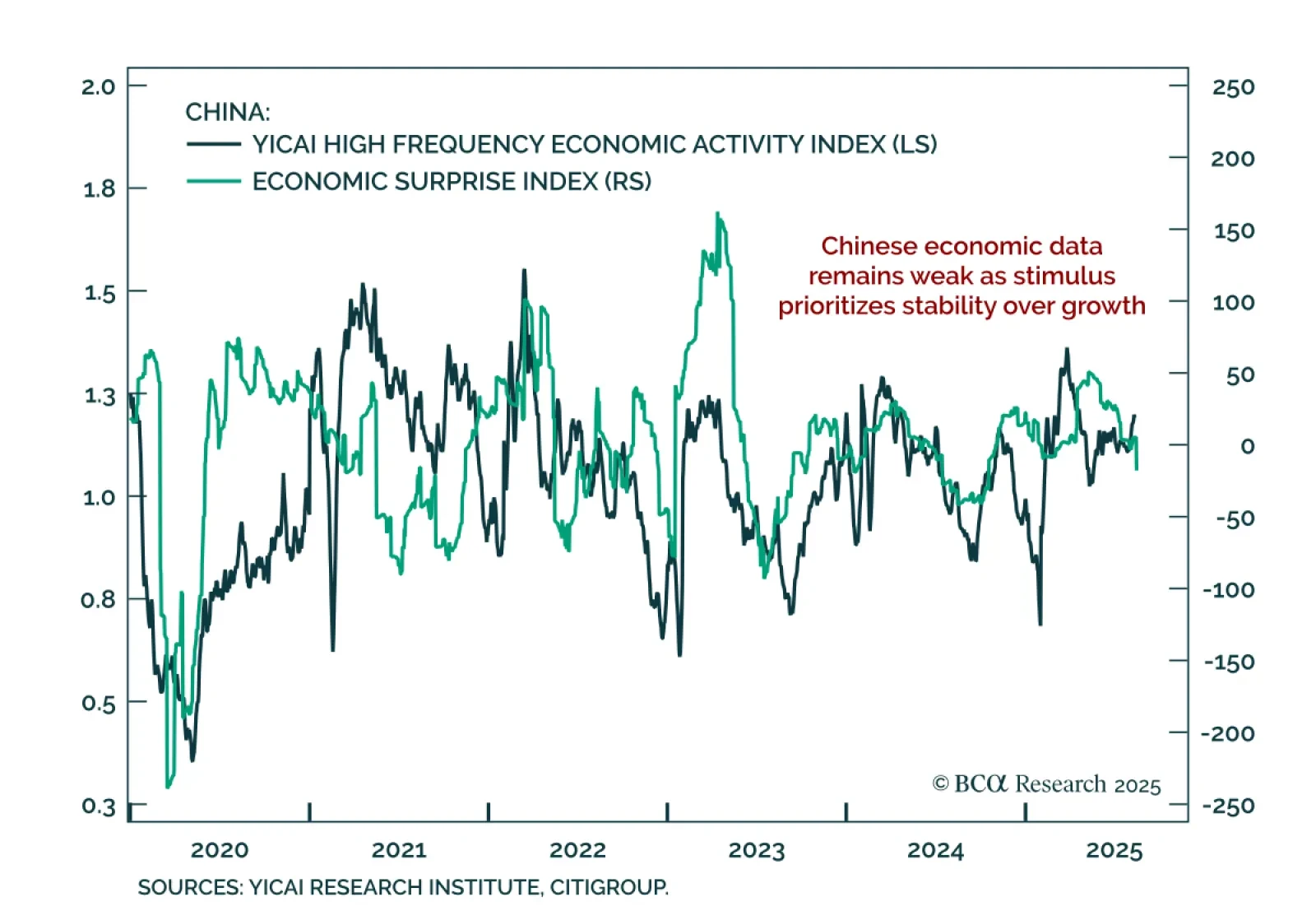

July data confirm China’s weak growth, with no near-term shift toward meaningful stimulus. New home prices fell 0.31% m/m, retail sales slowed to 3.7% y/y from 4.8%, and industrial production eased. Flooding in July disrupted…

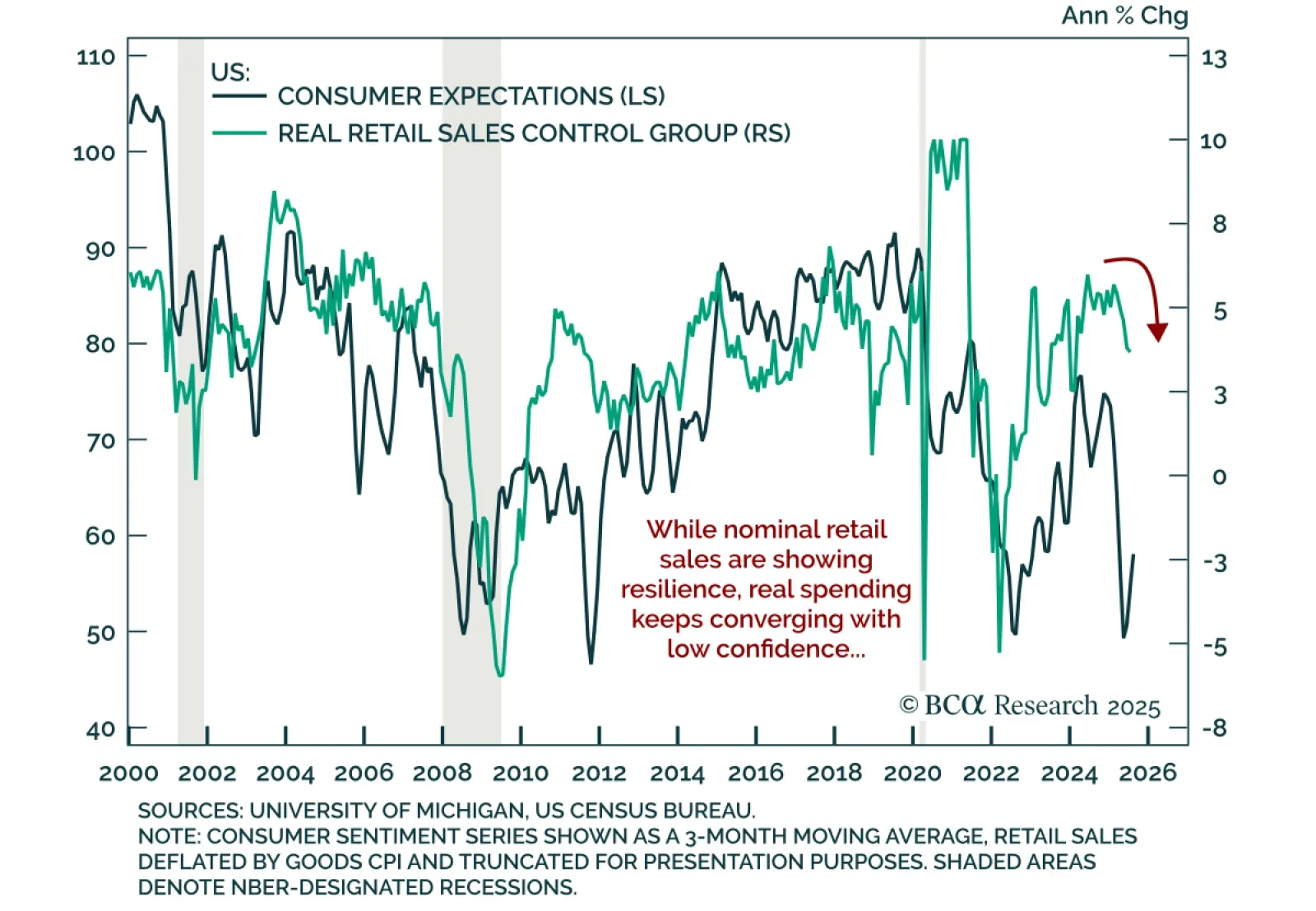

Retail sales and consumer sentiment data point to slowing underlying momentum despite headline resilience. Retail sales rose 0.5% m/m in July, below estimates and decelerating from 0.9% in June. The control group beat estimates…

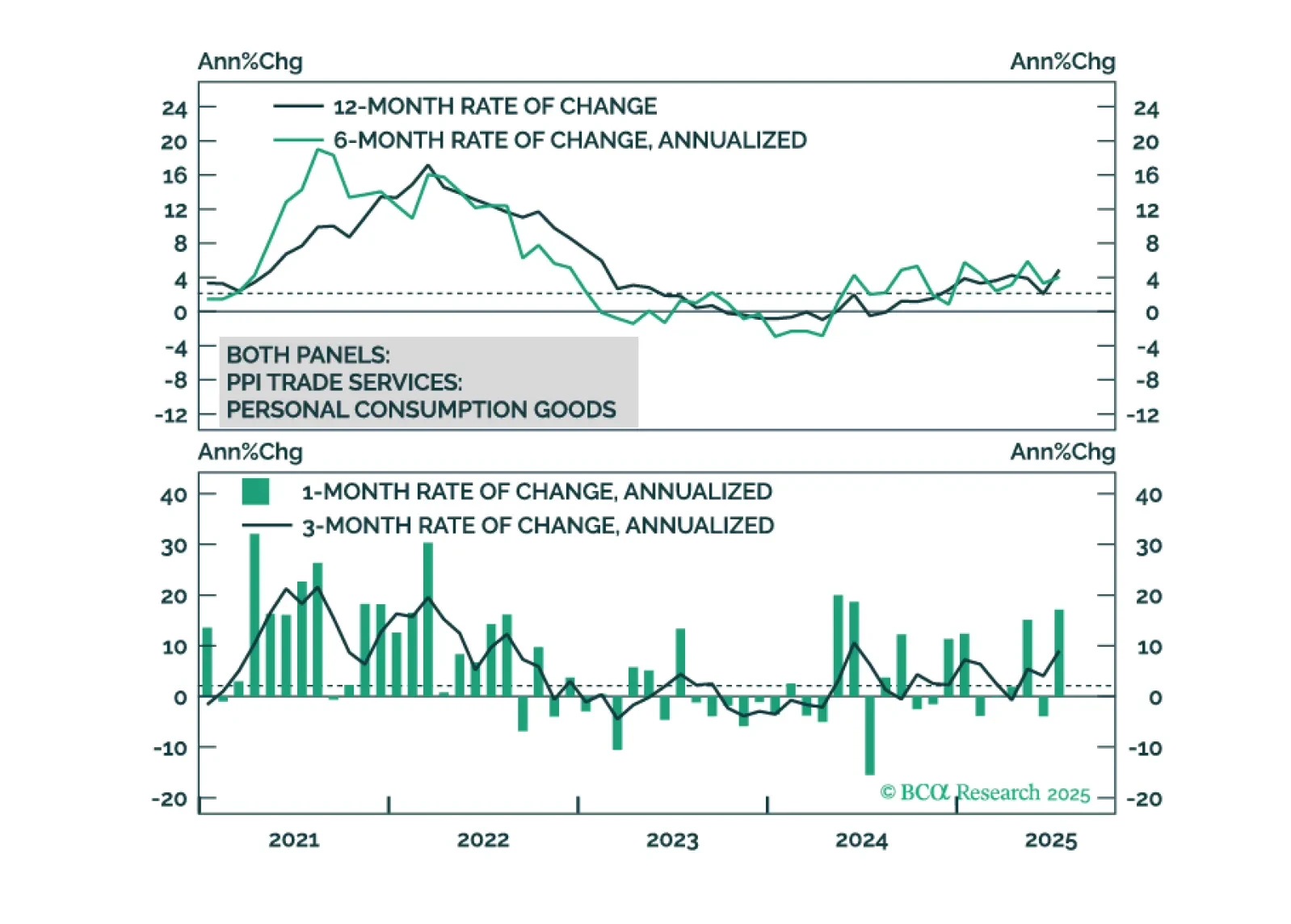

The cost of tariffs is falling on the US consumer, not foreign exporters or US firms.