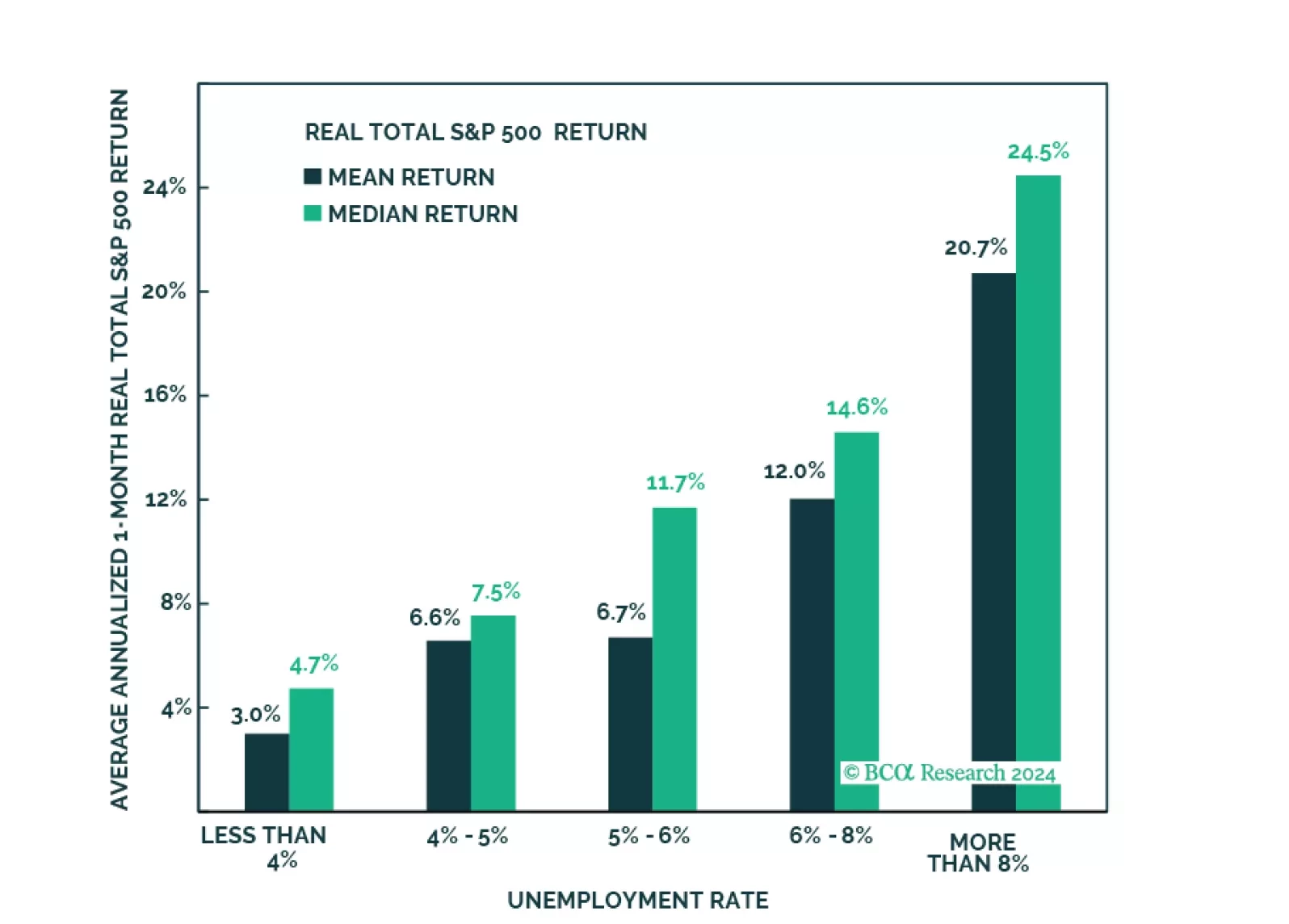

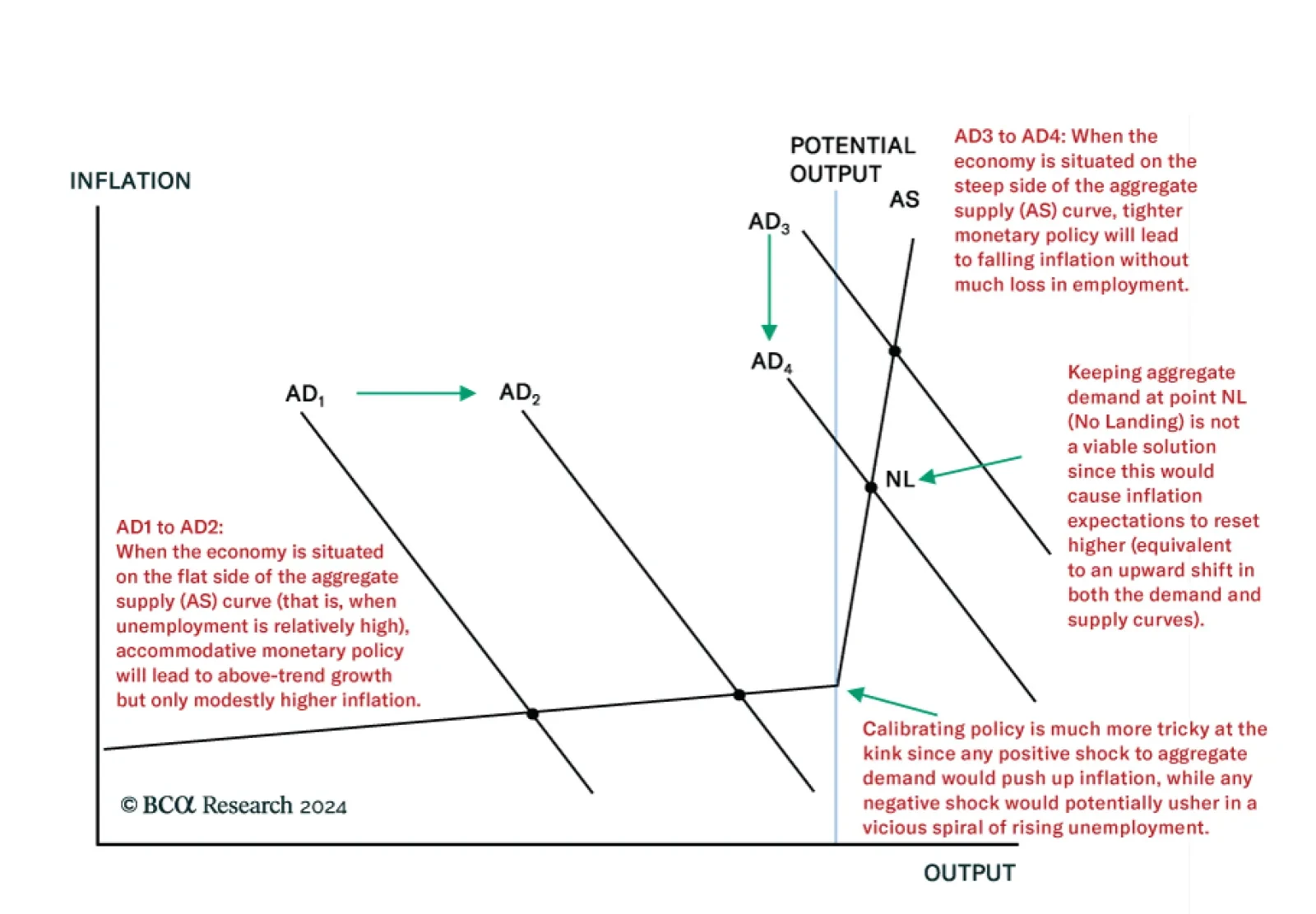

According to BCA Research’s Global Investment Strategy service, the wave of inflation that the US experienced over the past three years cannot be safely repeated. The unemployment rate is a highly mean-reverting series:…

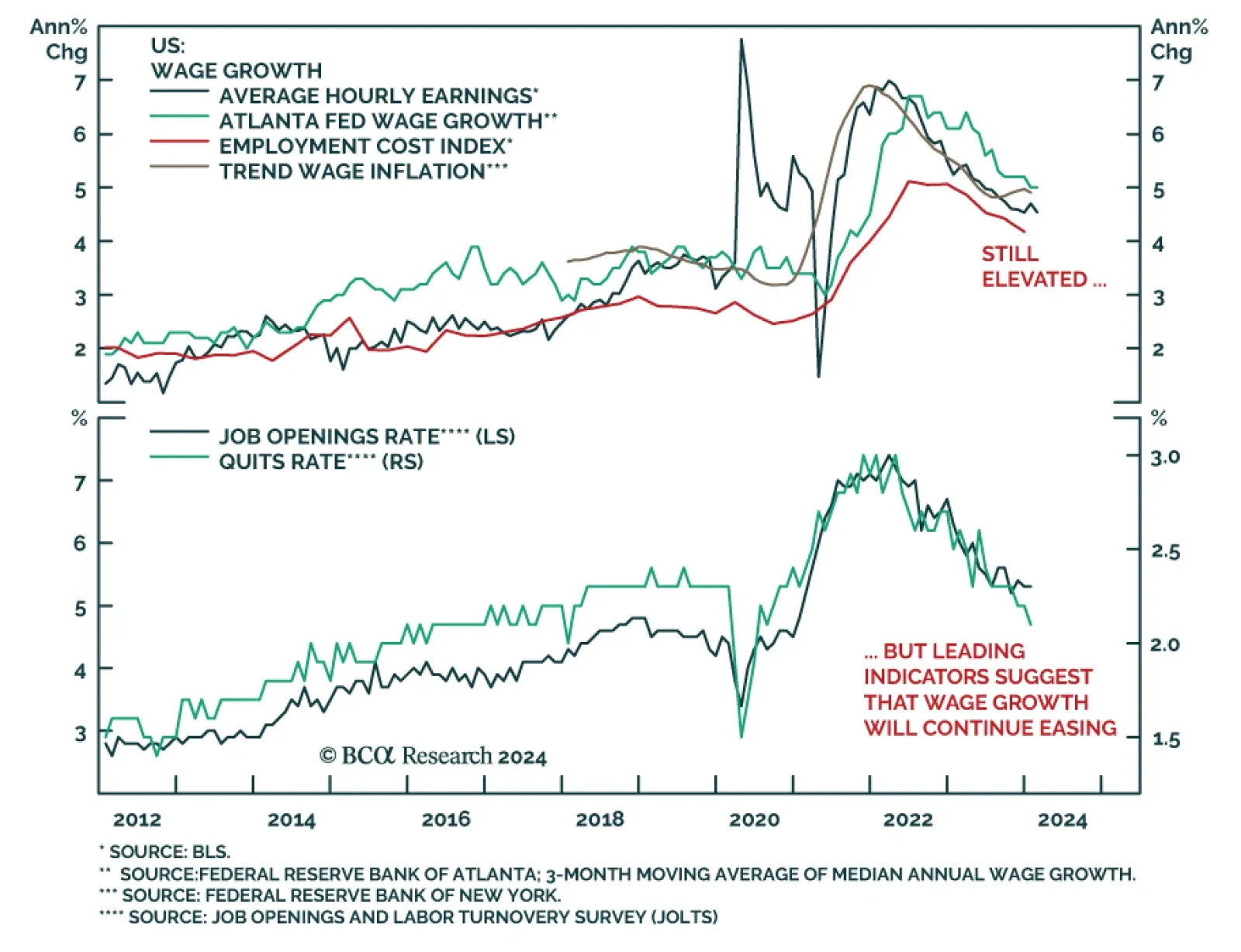

In Fed chair Jay Powell’s opening remarks at last week’s press conference, he noted that wage growth has been moderating and that FOMC participants expect a continued rebalancing of the labor market to help ease price…

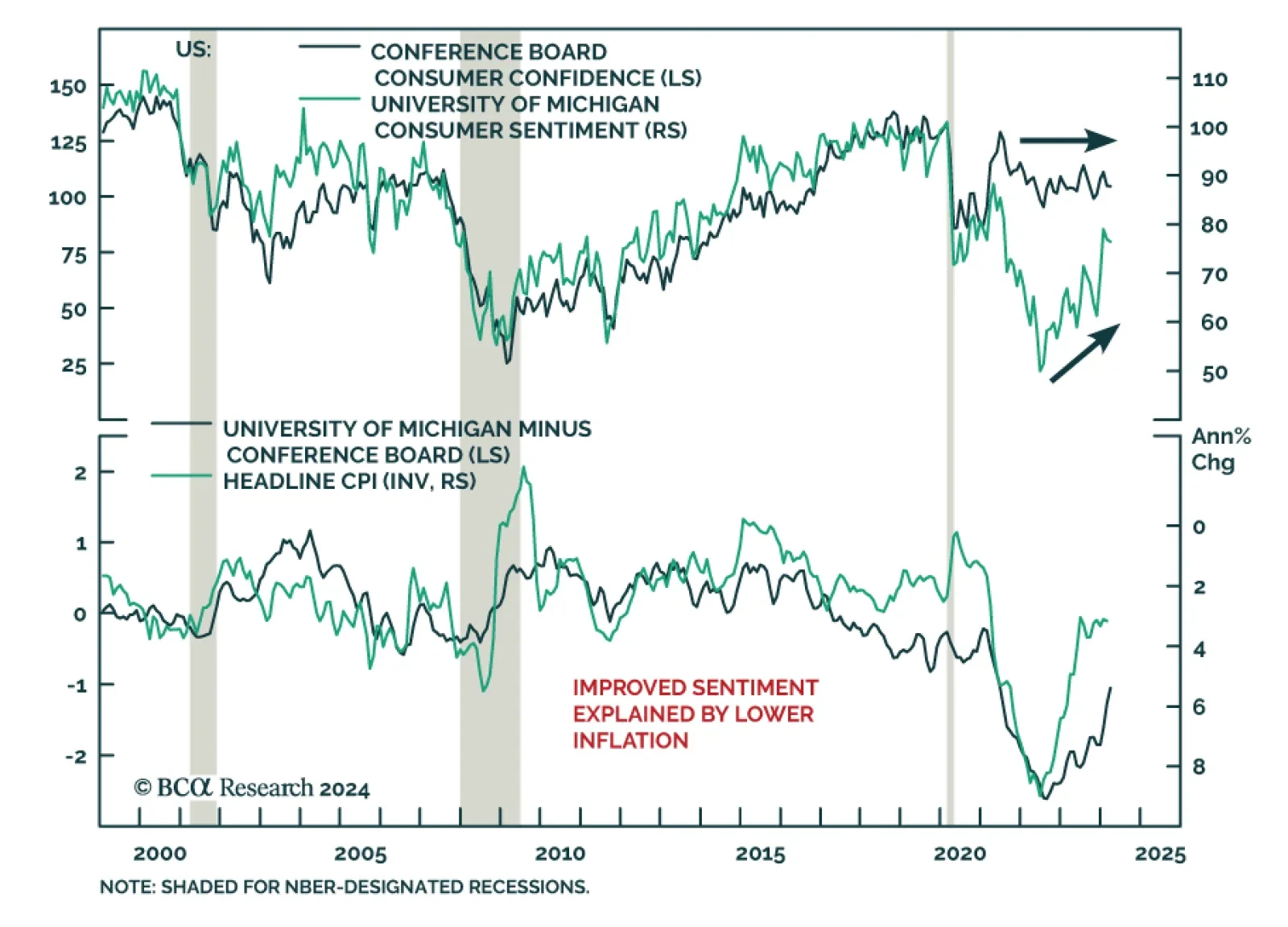

The Conference Board’s gauge of US consumer confidence came in at 104.7 in March – broadly unchanged from a downwardly revised 104.8 in February and below expectations of an improvement to 107. The Expectations Index…

In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.

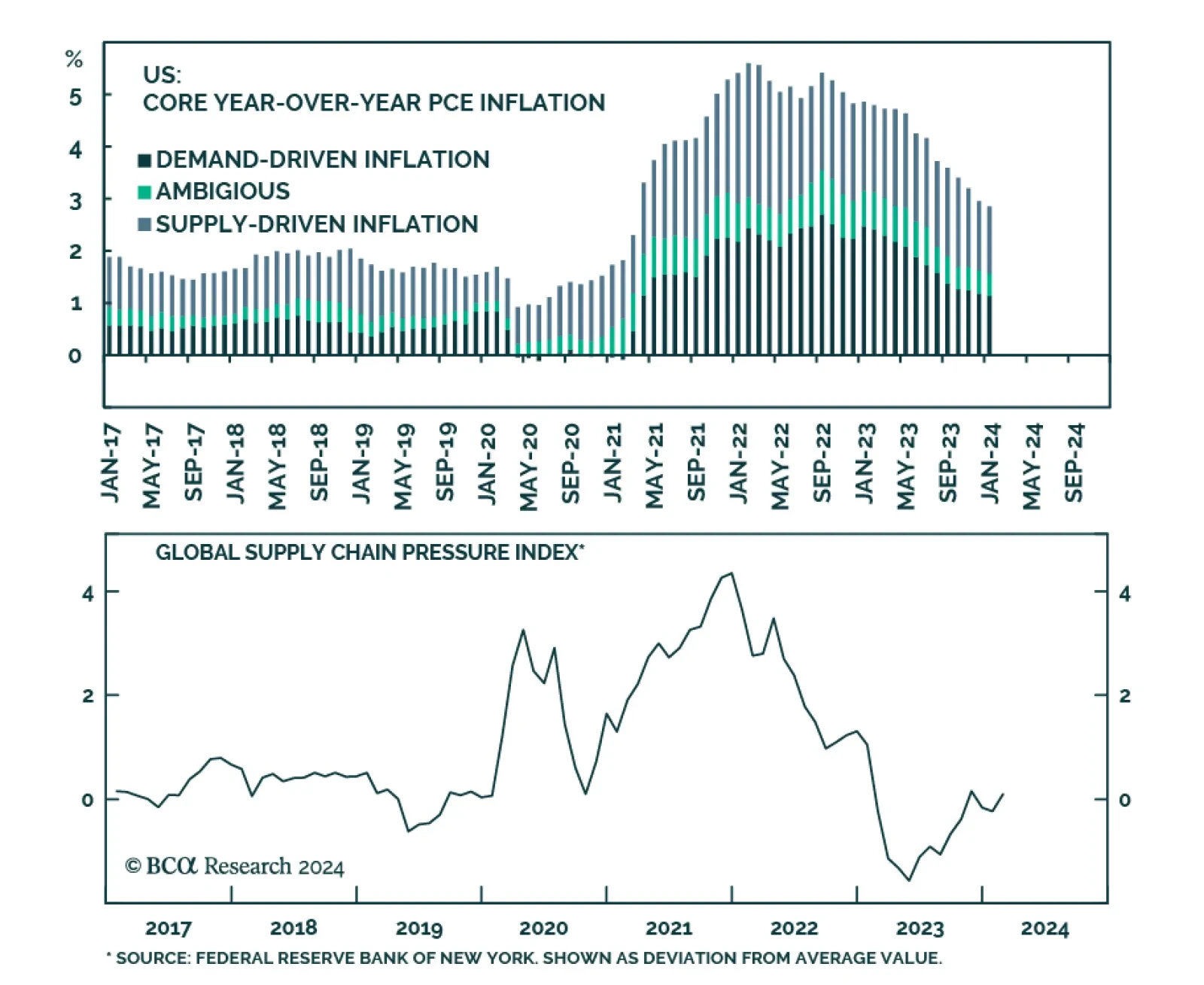

Both supply- and demand-side forces contributed to the inflation surge in 2021/2022. According to the San Francisco Fed’s estimates, the contribution of demand-side forces to annual core PCE inflation jumped from -0.09…

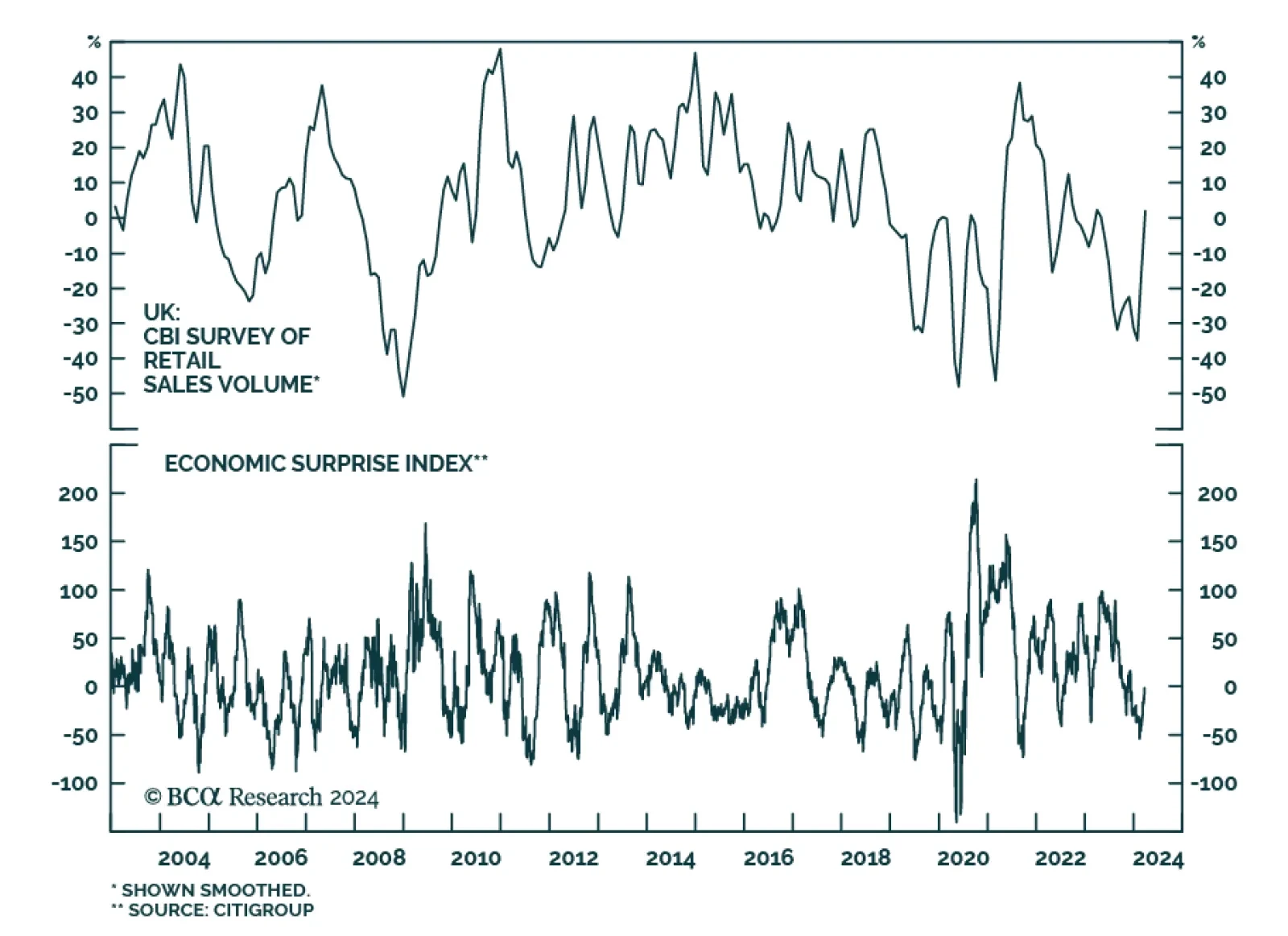

The latest batch of economic data out of the UK suggests that economic conditions have recently stabilized. The flash Manufacturing PMI rose by a stronger-than-anticipated 2.4 points to a 20-month high of 49.9 in March –…

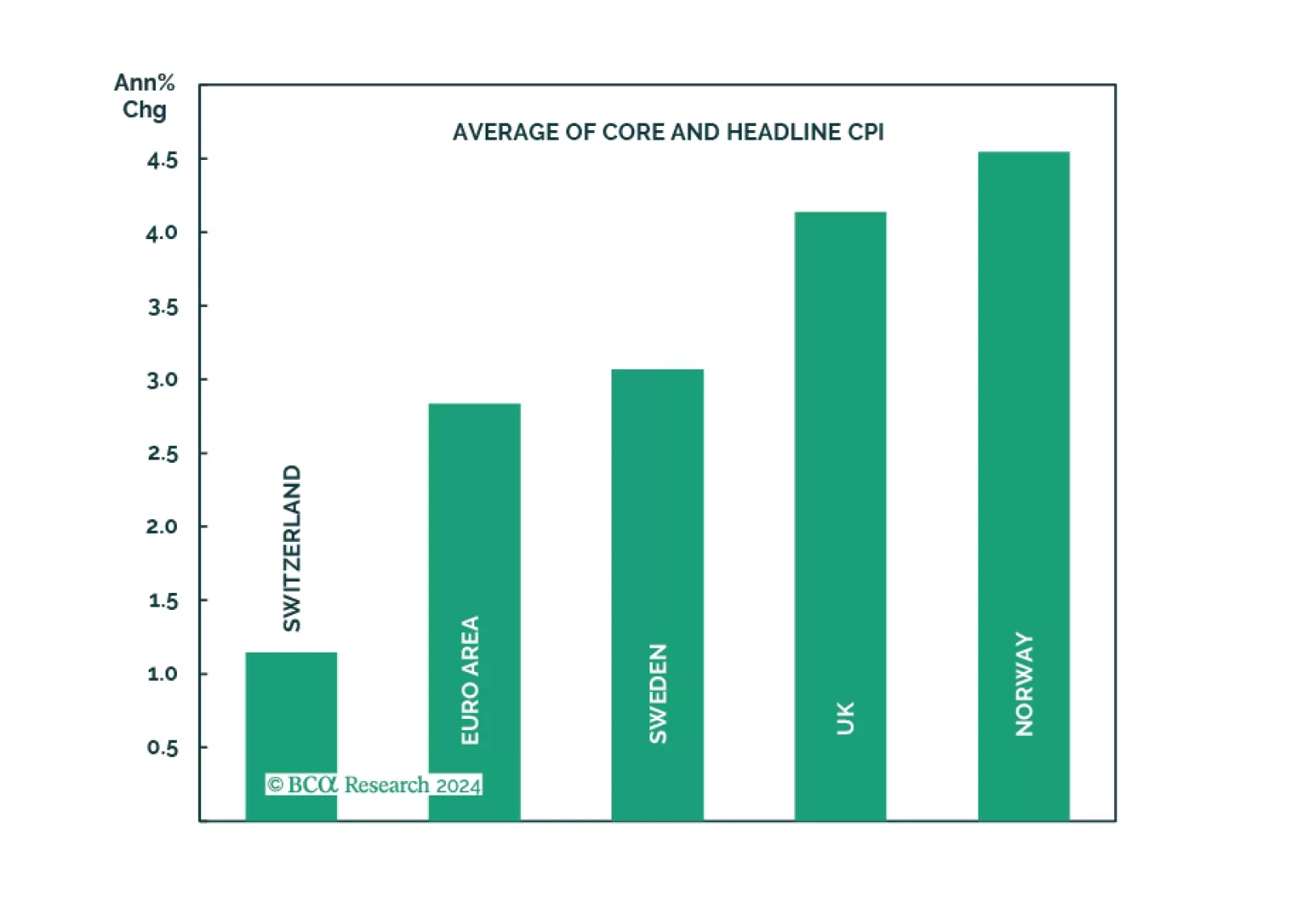

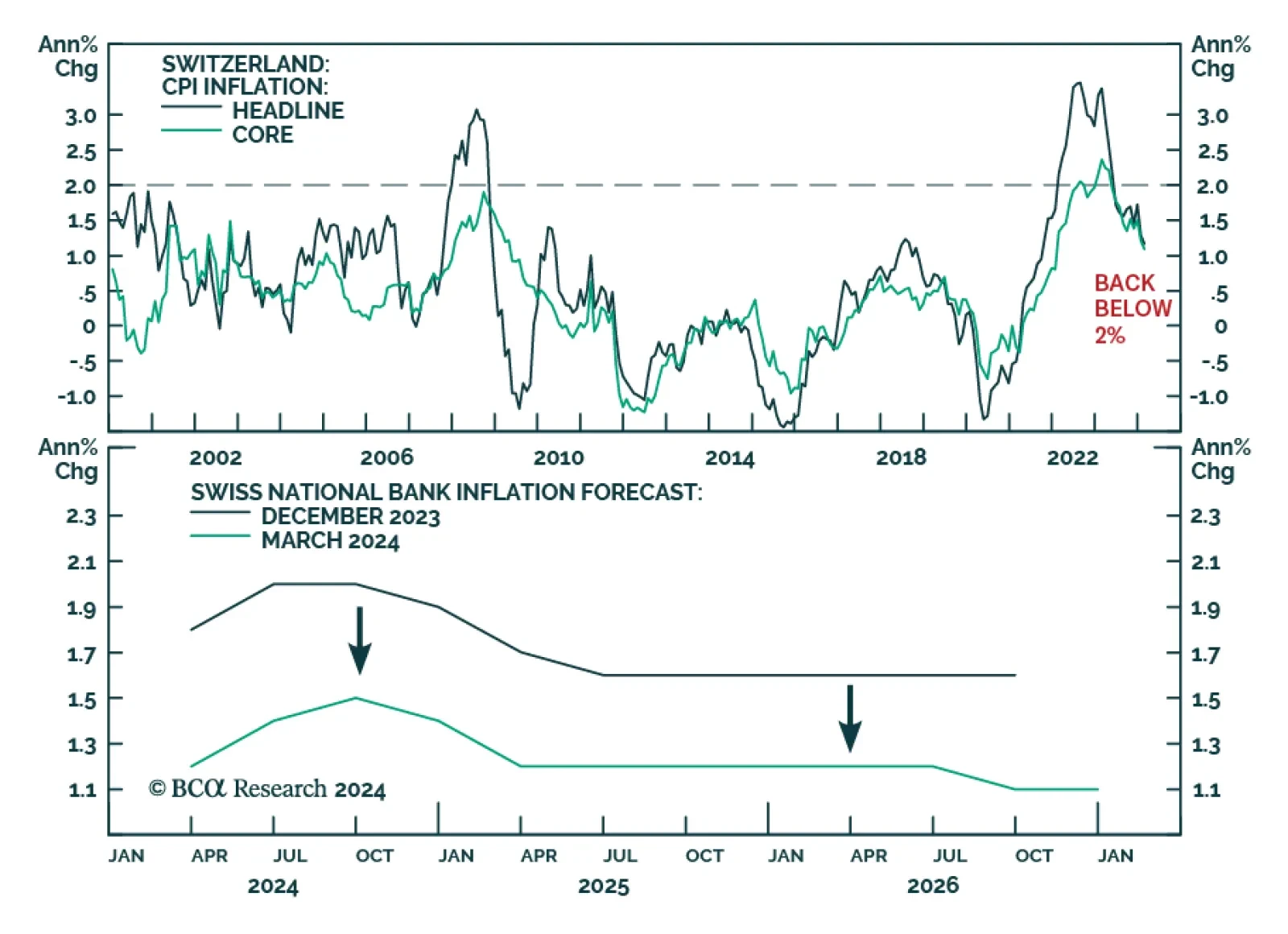

Does the recent surprise rate cut by the Swiss National Bank augur other dovish surprises among major central banks in Europe?

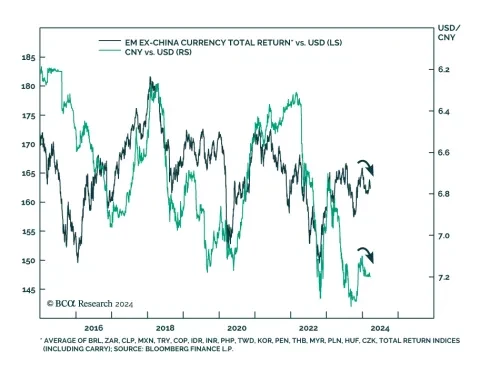

The Chinese yuan slide sharply against the US dollar on Friday, breaching the 7.2 level. The weakness comes after the PBOC loosened its hold on the currency by setting a weaker-than-anticipated daily fixing. The move…

The Swiss National Bank’s 25 basis point rate cut on Thursday came as a dovish surprise to market participants anticipating it would hold the policy rate unchanged. The rate cut, which brought the policy rate down to 1.5%…