The latest edition of our Big Bank Beige Book suggests the expansion remains intact, though weakness in C’s private-label credit card portfolio could be a harbinger of distress among lower-income consumers. We remain tactically…

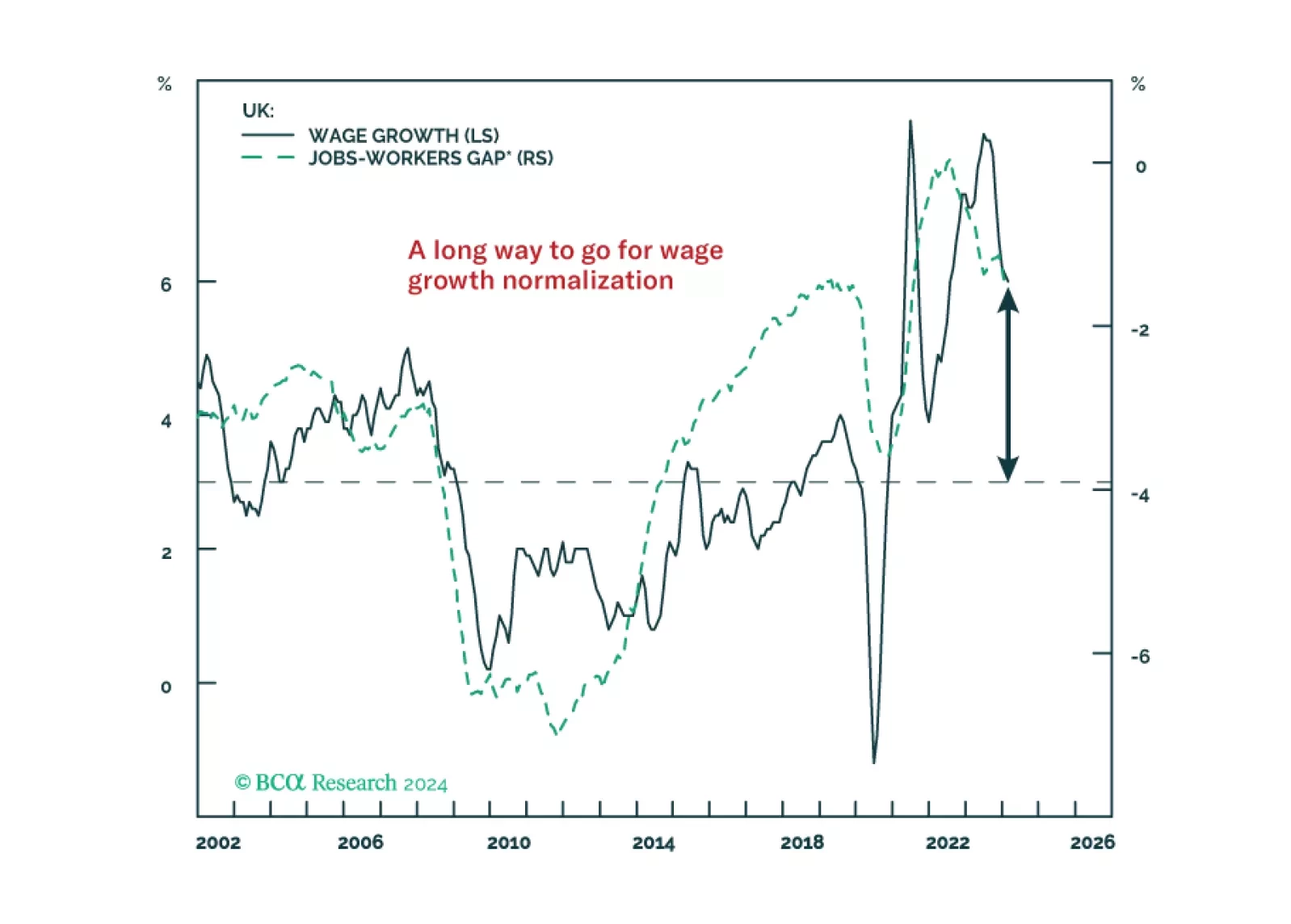

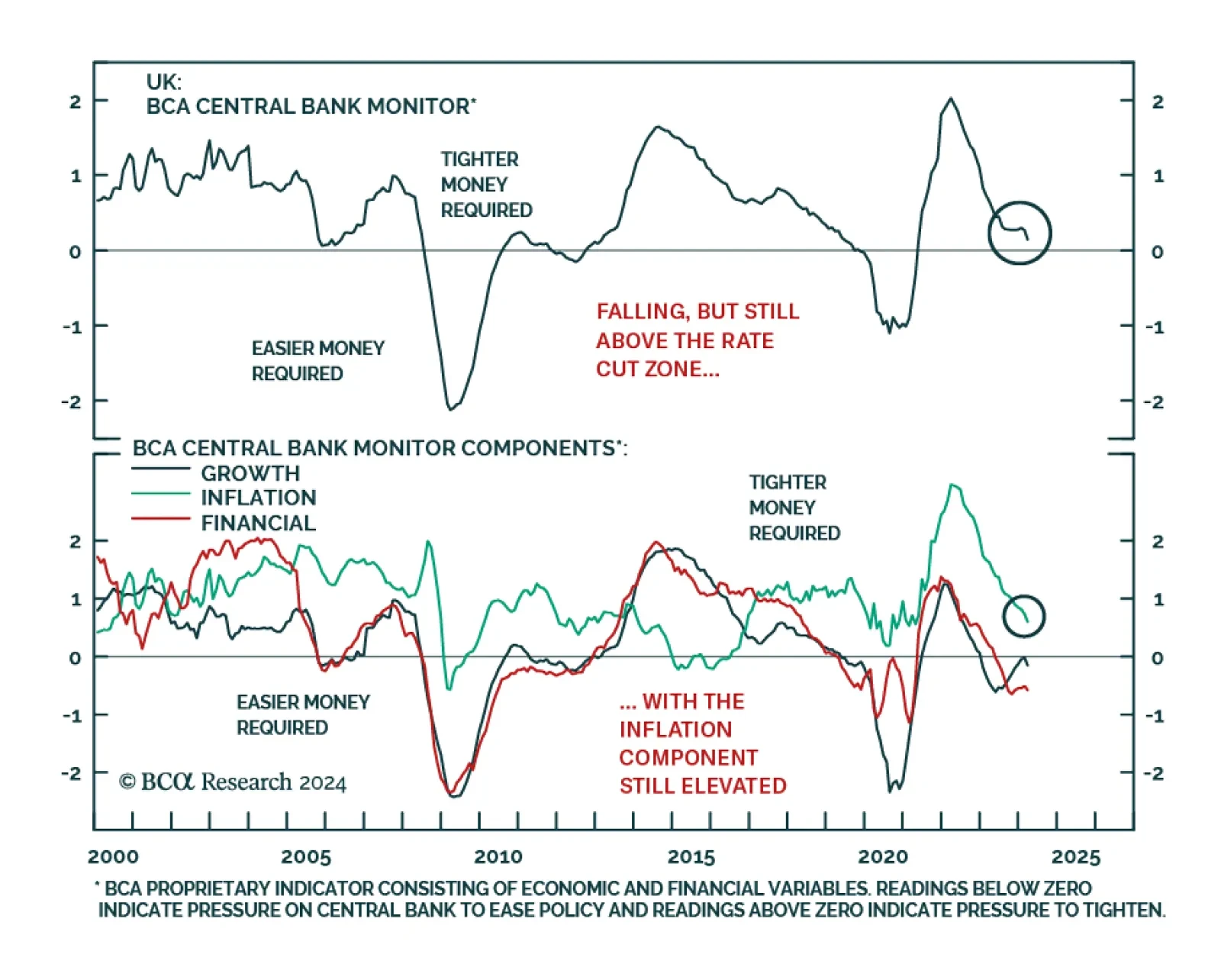

According to BCA Research’s Global Fixed Income Strategy service, a hard landing is the only way to solve the UK inflation problem. Sticky inflation and lingering inflation pressures have made the BoE’s job much…

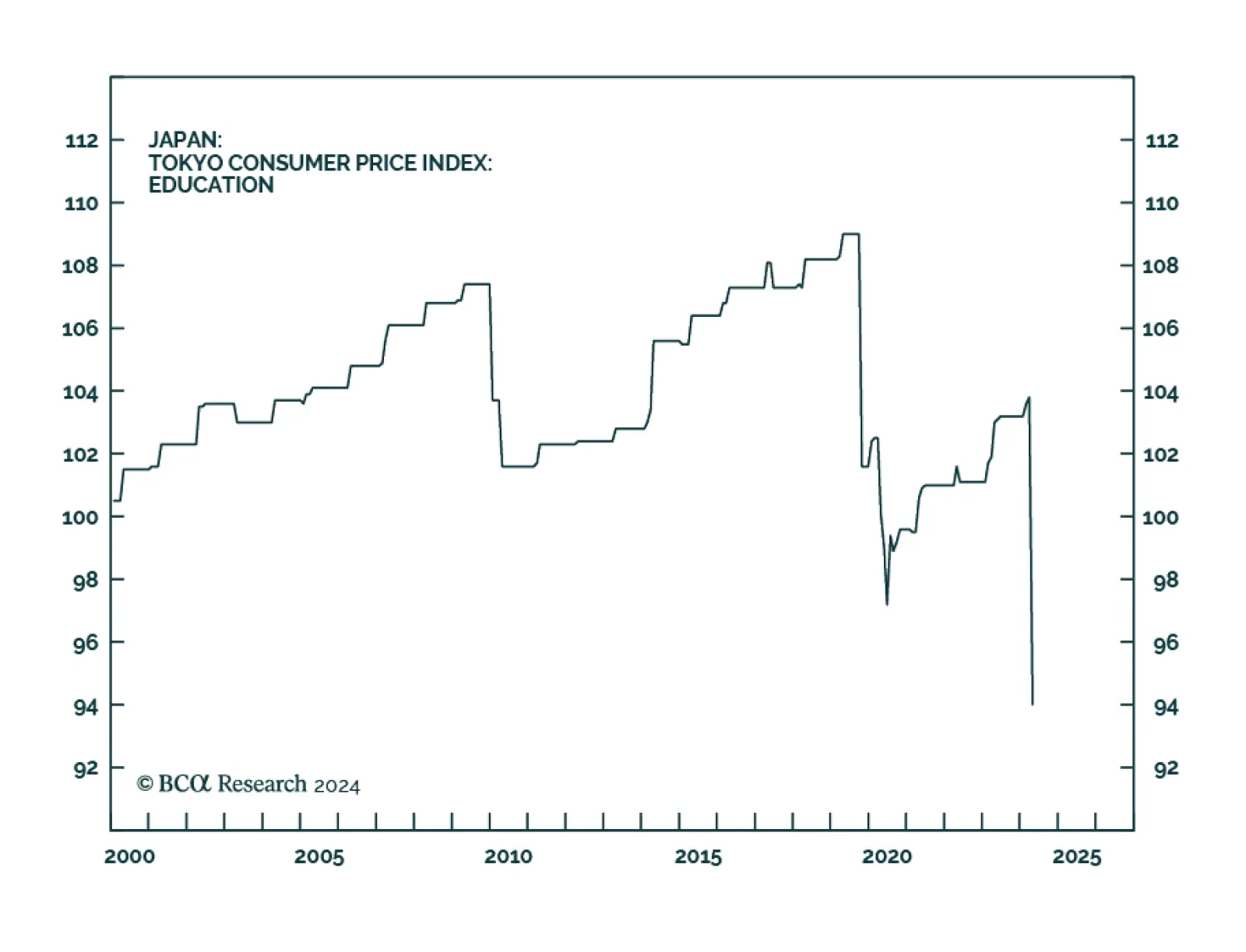

The Tokyo inflation release for April came in on the soft side on Friday, with every single metric coming in below expectations. Tokyo headline inflation declined from 2.6% y/y to 1.8% y/y, versus expectations of a much more…

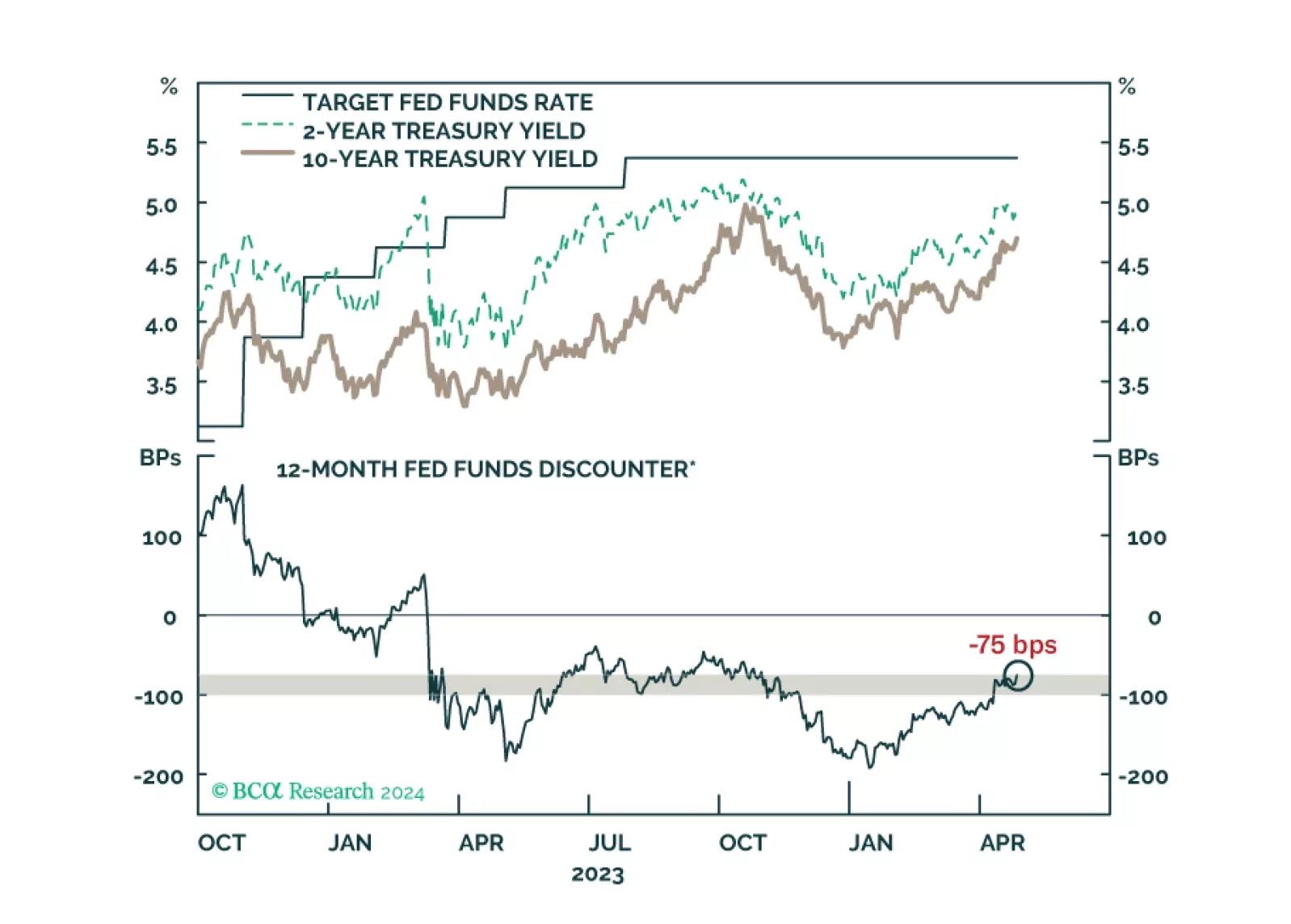

Our latest views on the recent increase in Treasury yields and some key things to watch at next week’s FOMC meeting.

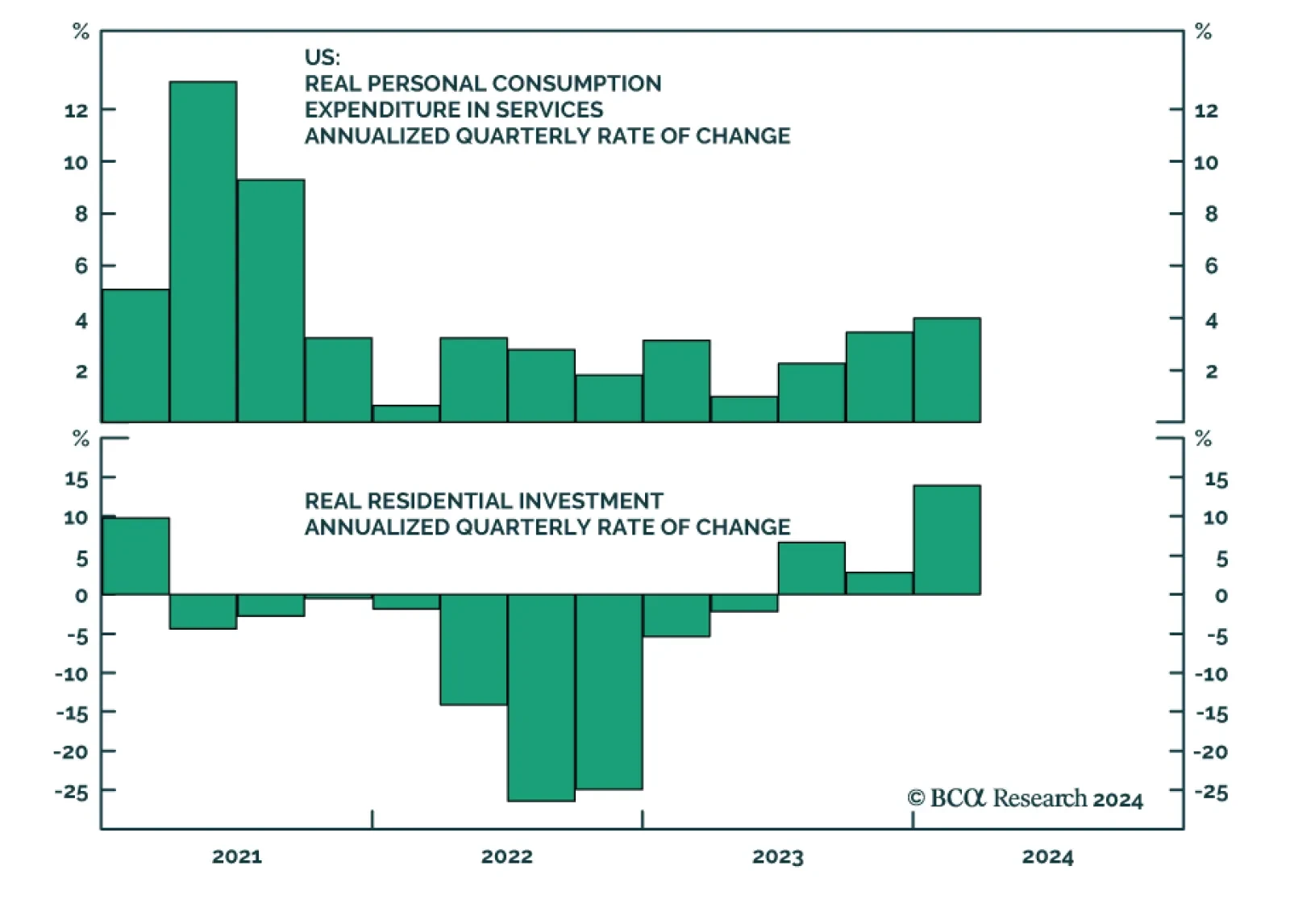

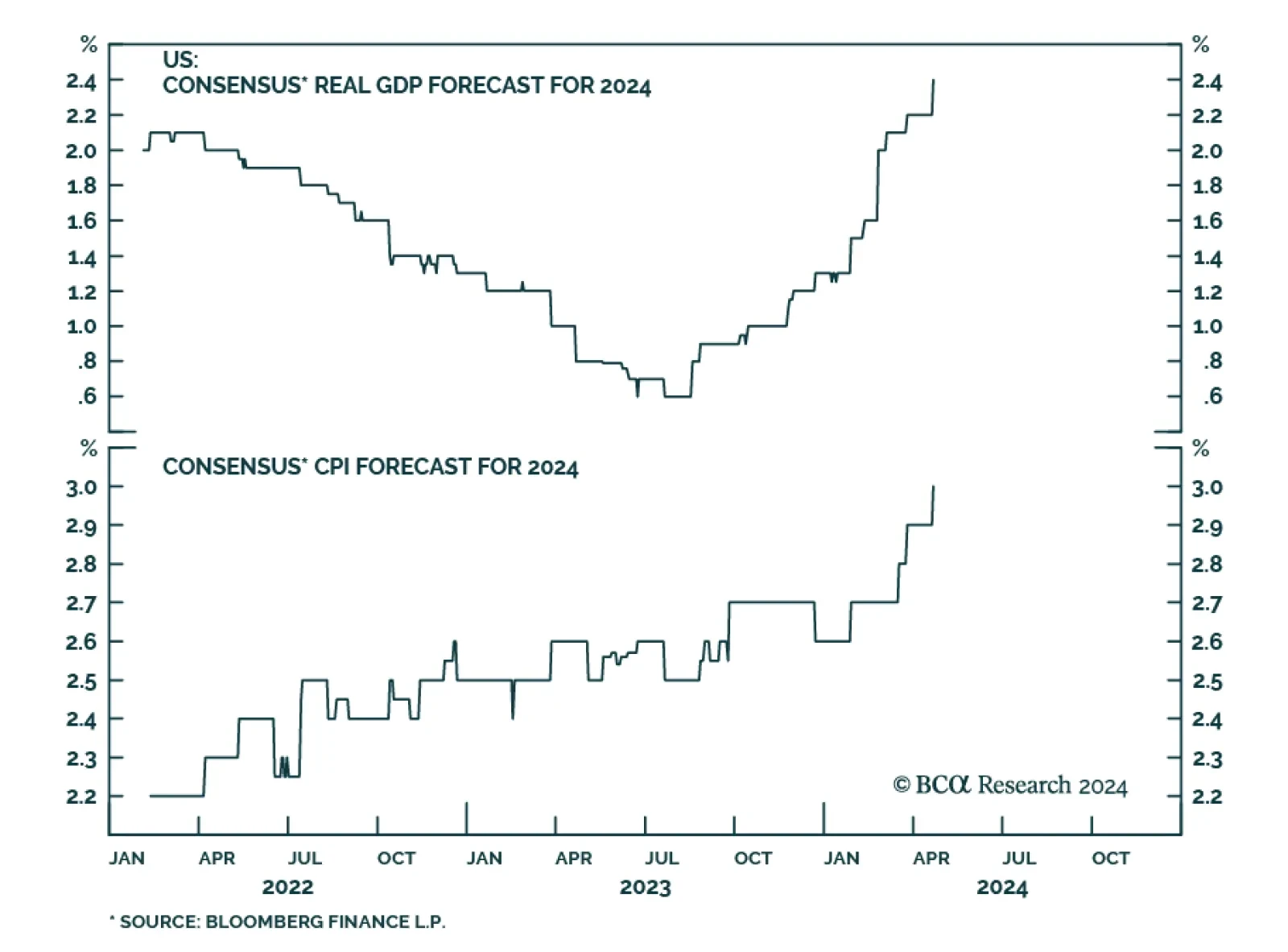

The advanced estimates for US real GDP suggest that economic growth slowed meaningfully from 3.4% in Q4 2023 to 1.6% in Q1 2024 on an annualized basis, significantly below expectations of 2.5%. That said, the details of the…

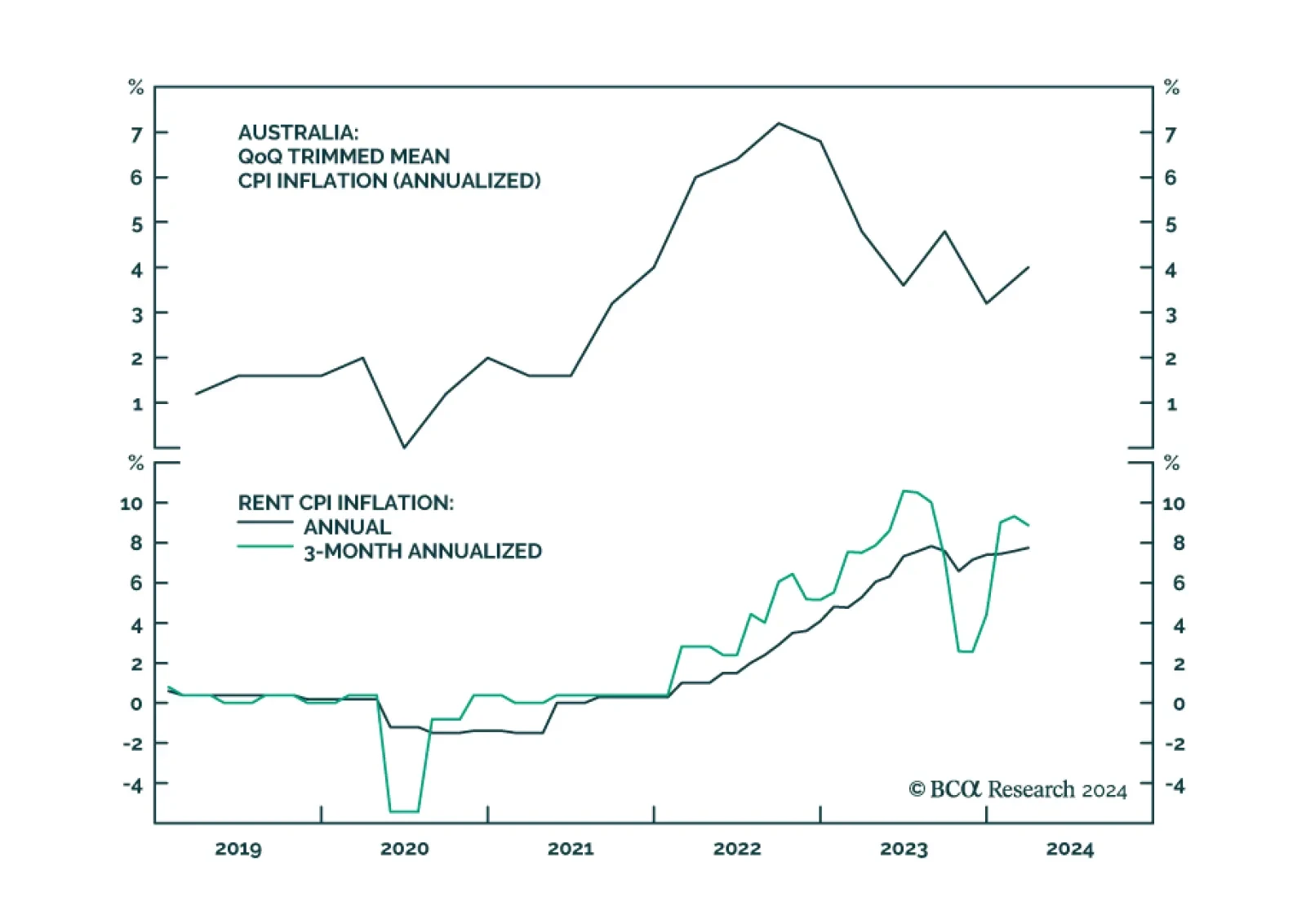

Tuesday’s Australian inflation release came in hotter than anticipated. Quarter-on-quarter headline inflation increased from 0.6% in Q4 2023 to 1% in the first quarter of this year, above expectations of 0.8%. Although…

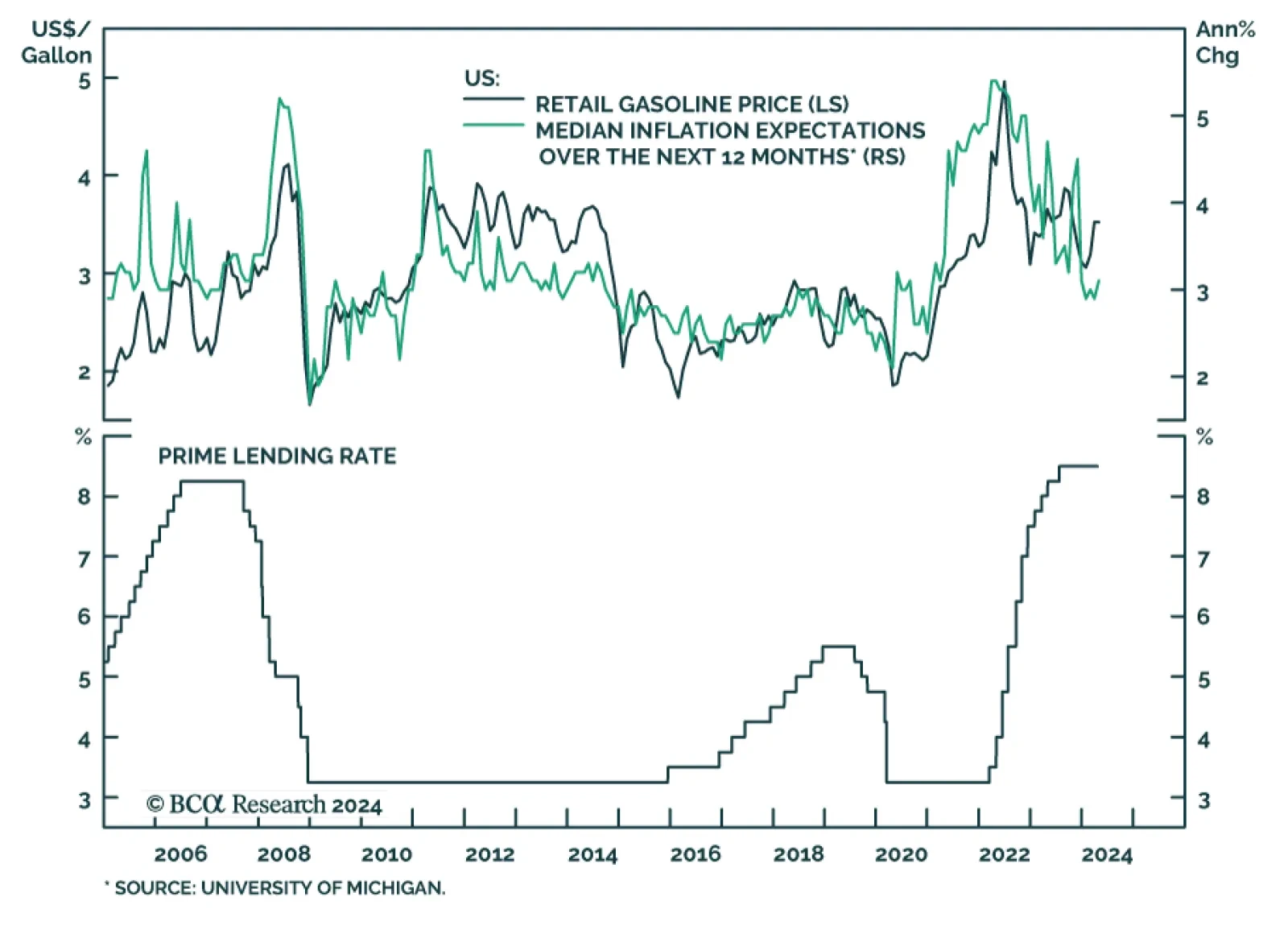

Retail gasoline prices have surged 13% since the beginning of the year, boosted by resilient global demand and geopolitical tensions. A key question for investors pertains to the ability of US consumption to sustain further…

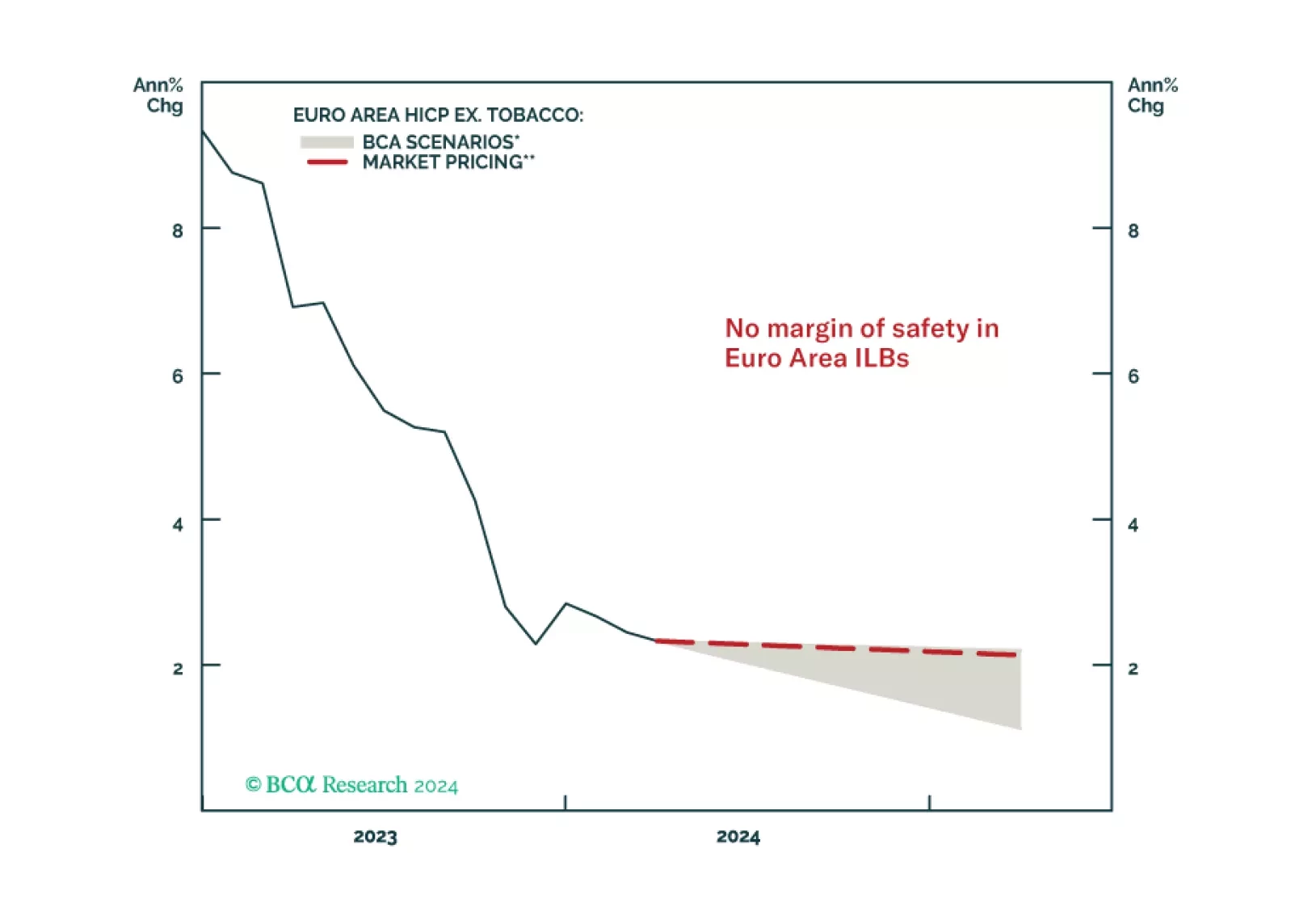

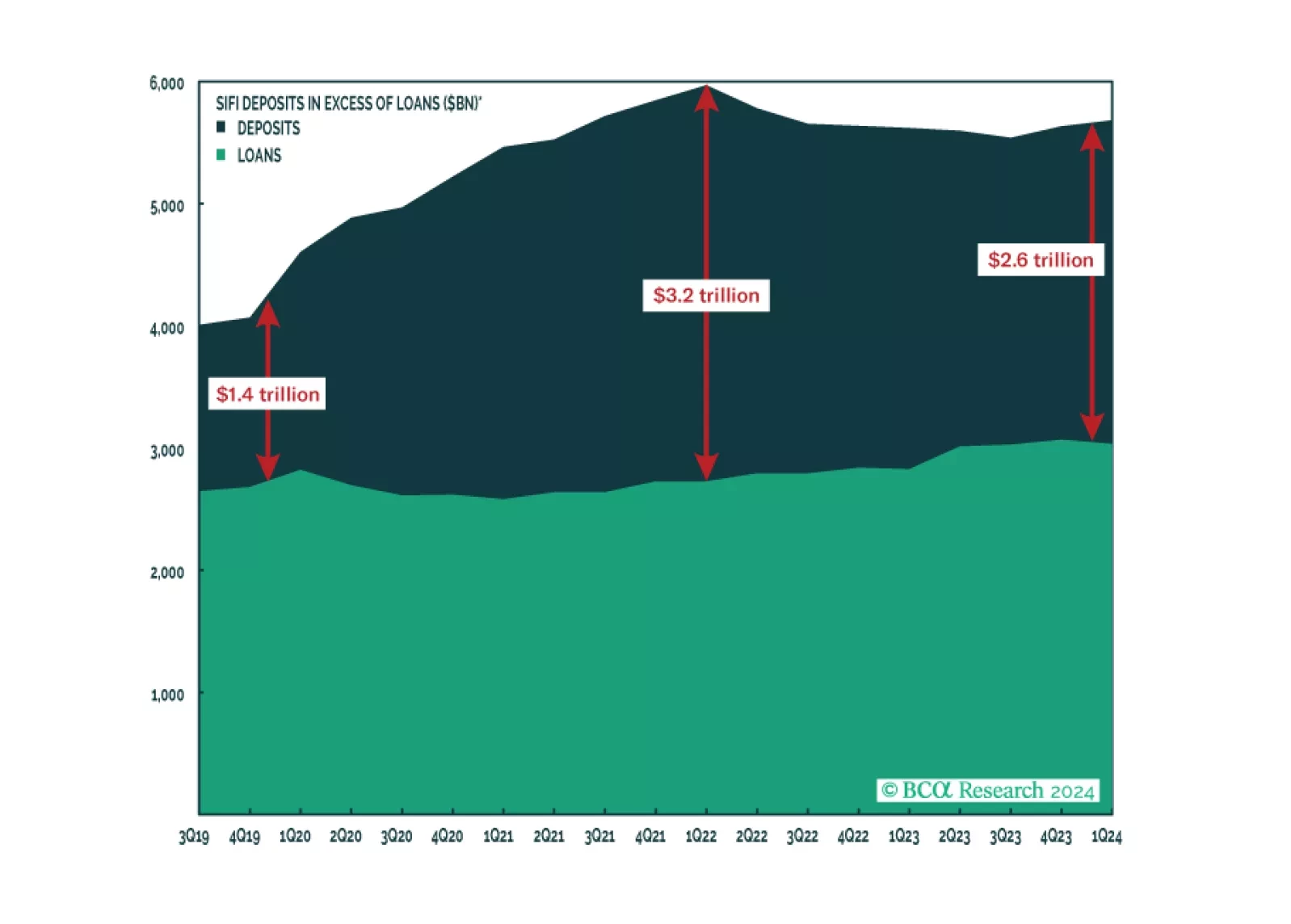

By the end of 2023, the “soft landing” scenario became the dominant narrative in financial markets. Following the regional banking scare in March of last year, market participants slowly came around to the view that…