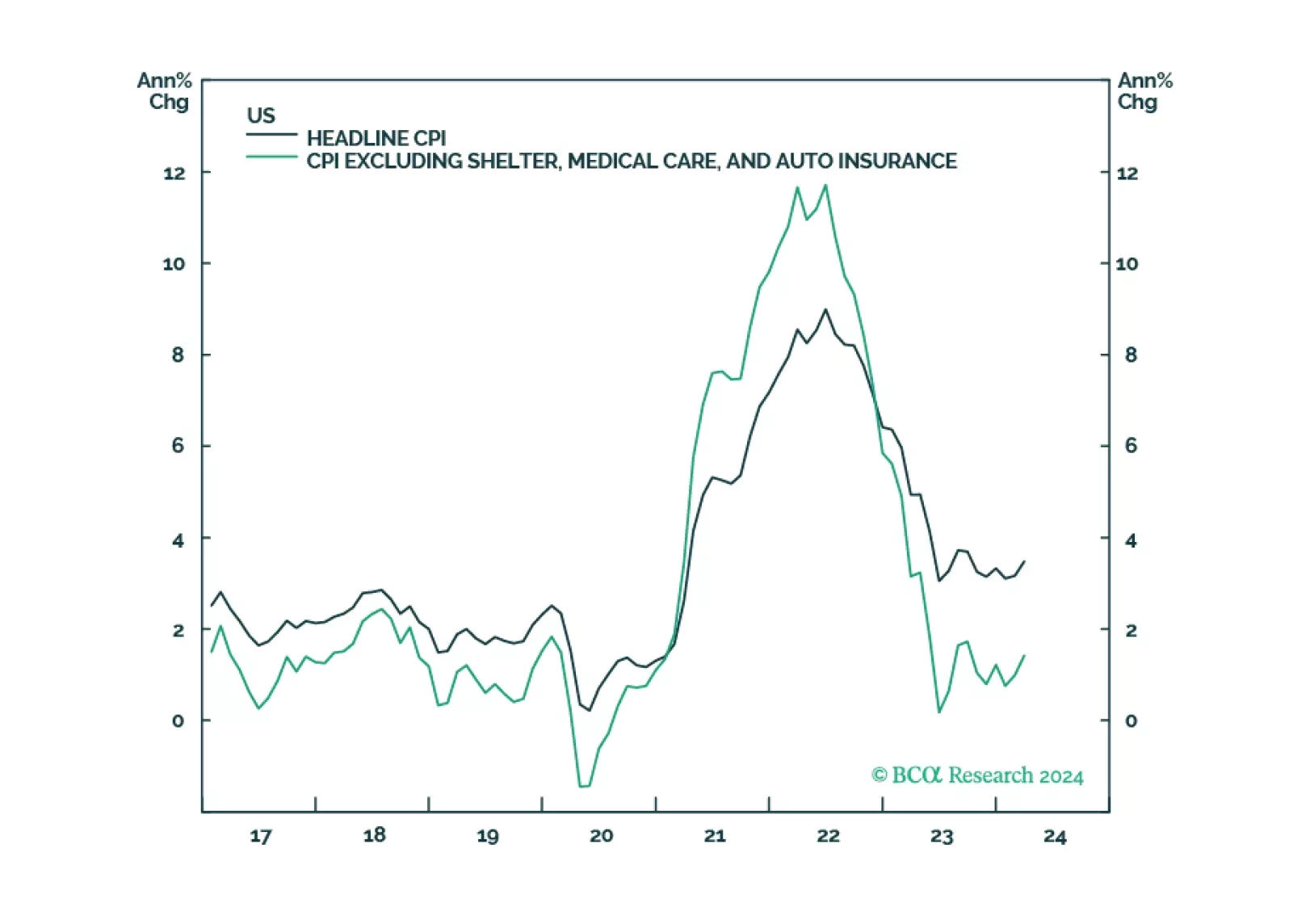

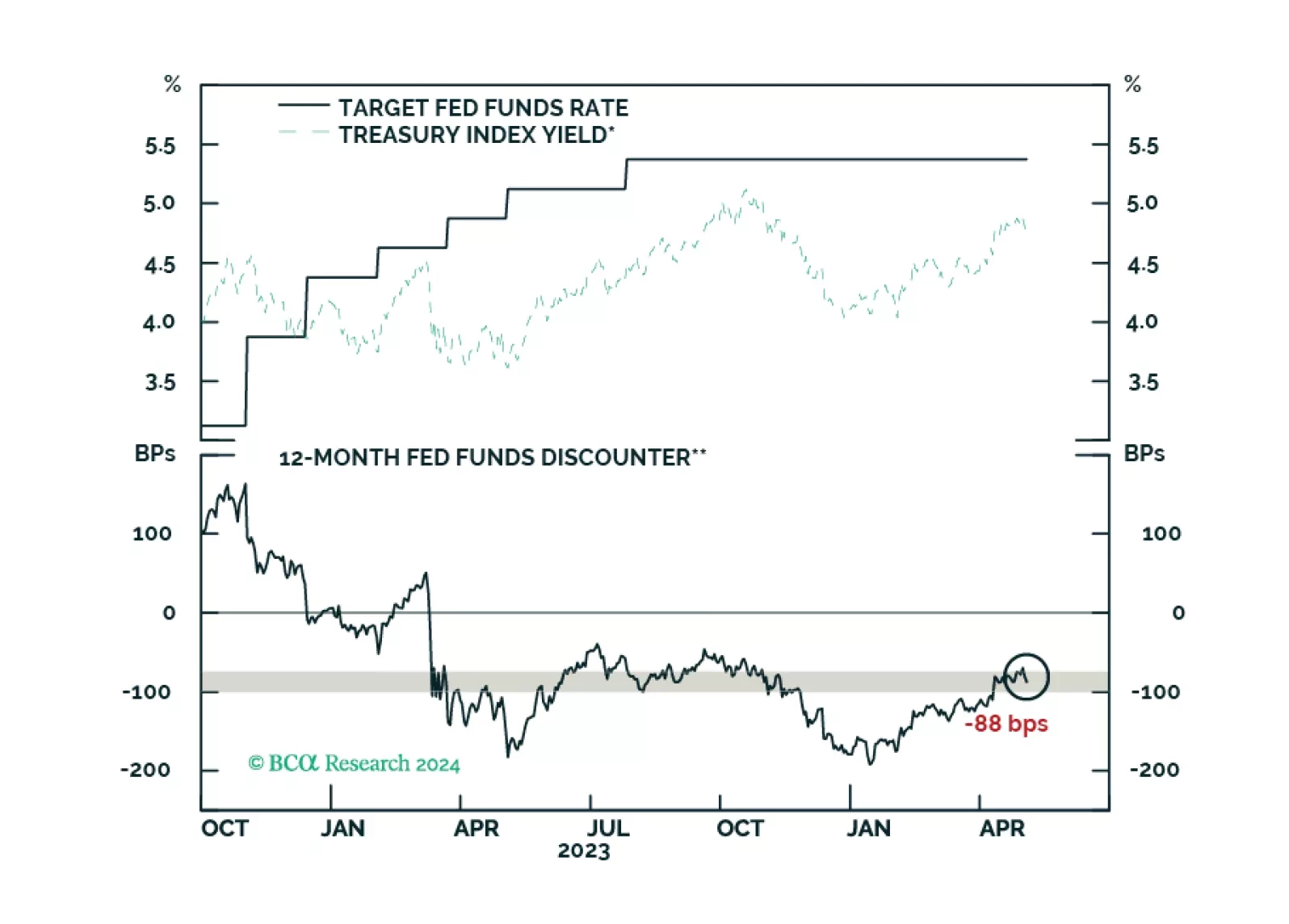

In this week’s report, we defend four out-of-consensus claims. Claim #1: Underlying inflation in the US is not reaccelerating. Claim #2: The US labor market is set to weaken abruptly. Claim #3: The S&P 500 will drop to 3700 in…

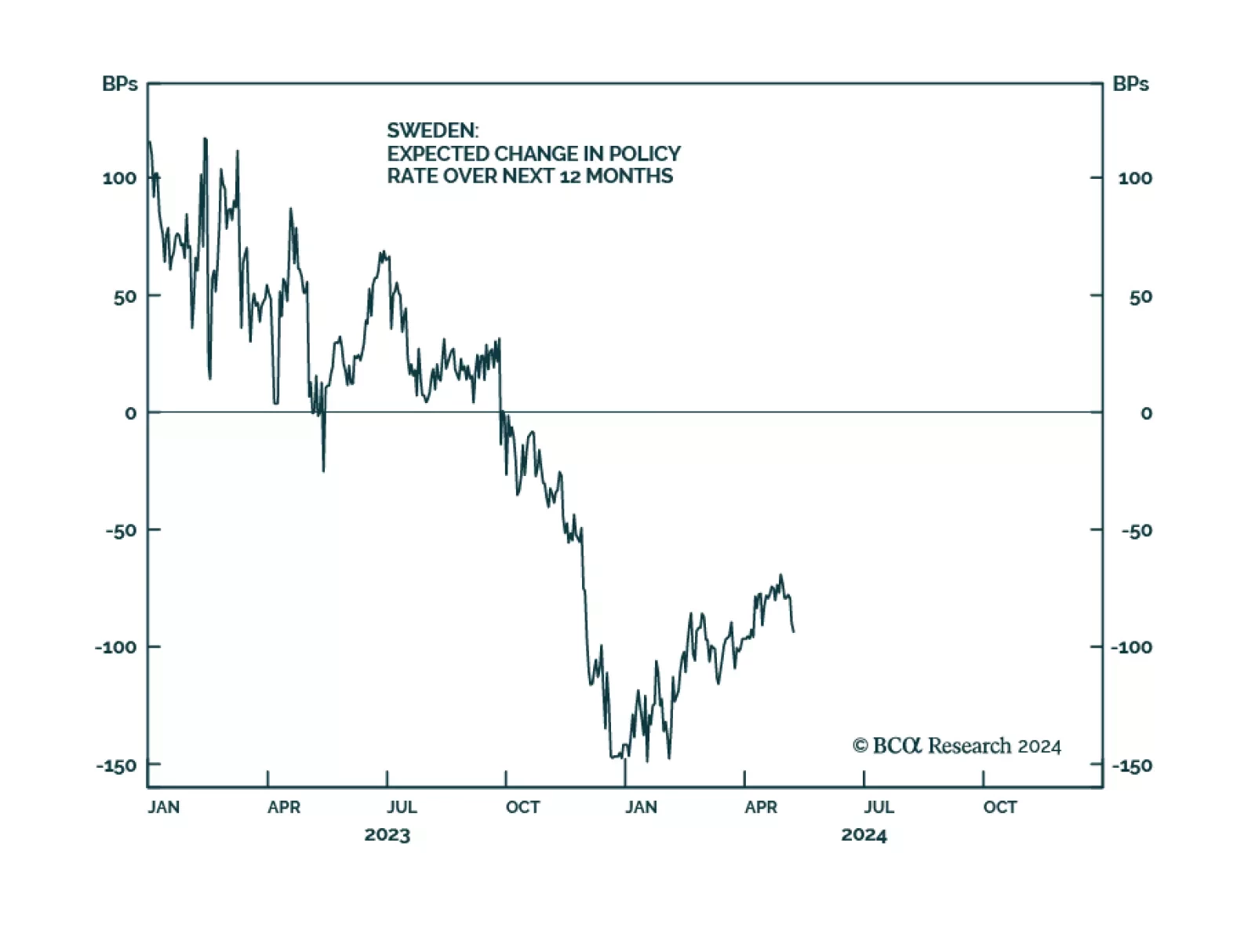

In a widely expected move, the Riksbank cut its policy rate by 25 basis points on Wednesday from 4% to 3.75%. The policy statement highlighted that inflation is approaching its 2% target, that leading indicators are pointing to…

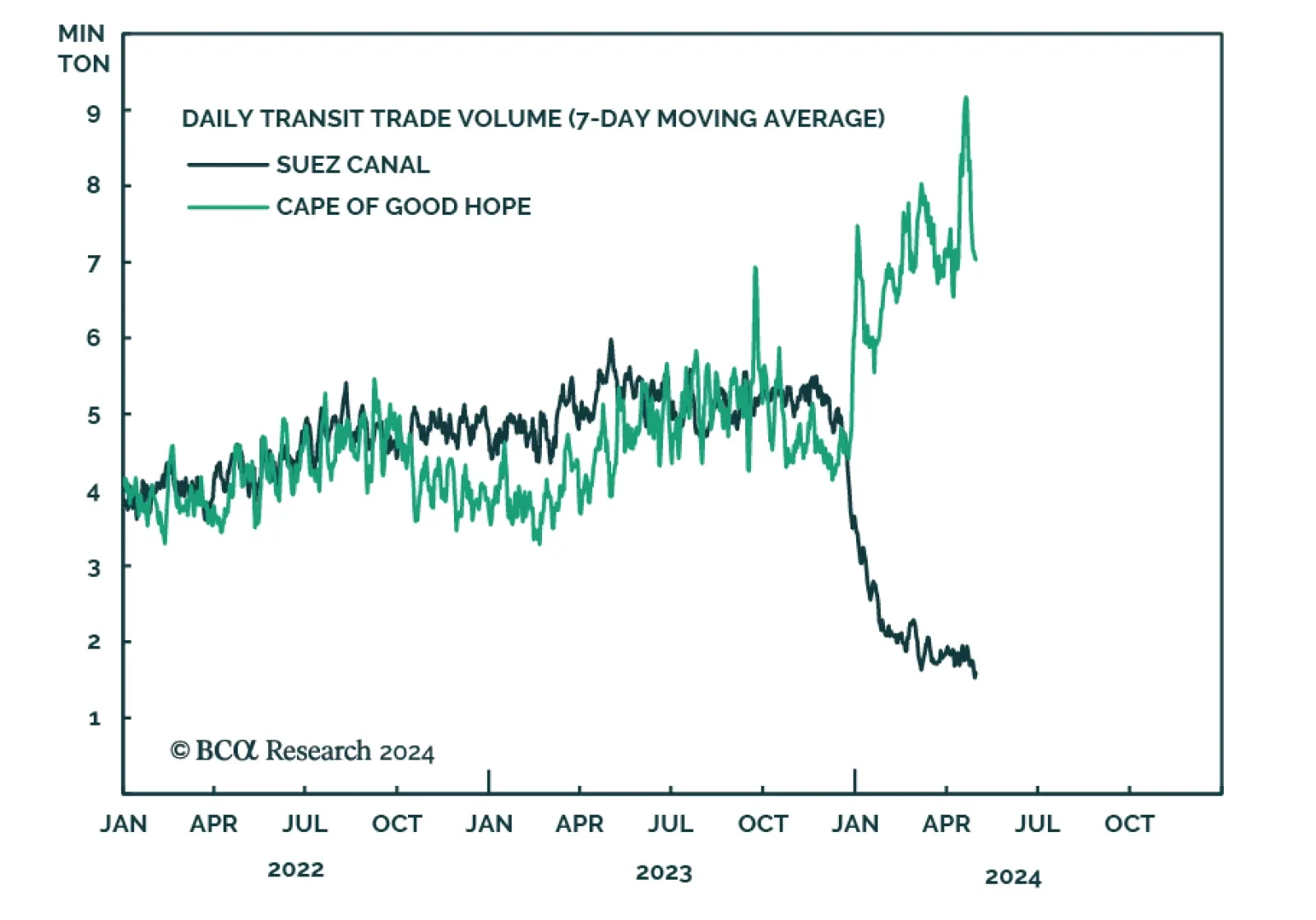

Transit through the Suez Canal has hit a new low. The 7-day moving average of daily ship transit calls is currently at 30, less than half of what it was at the end of 2023. The decline in volume has been even more severe, with…

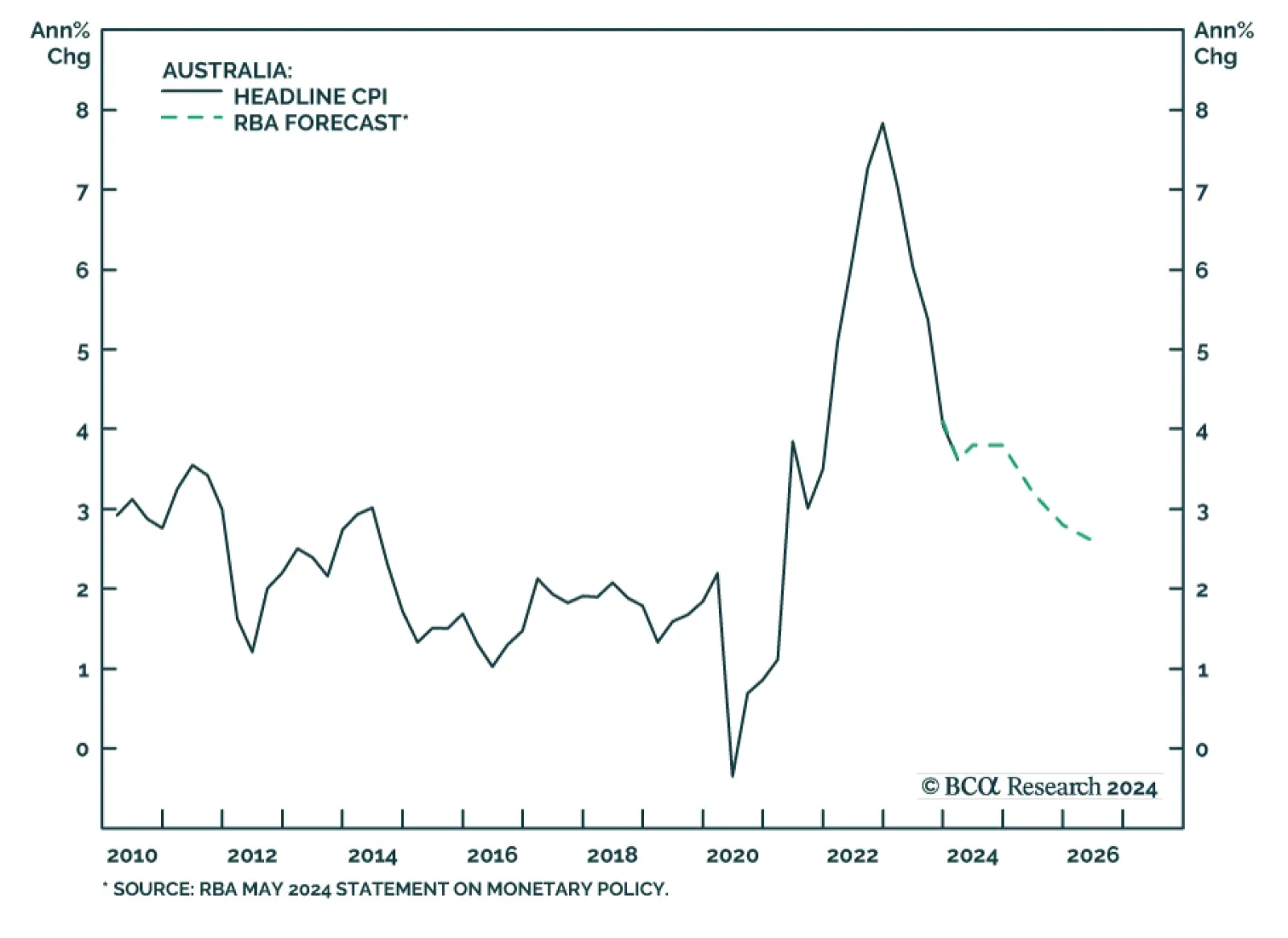

The Reserve Bank of Australia (RBA) left its policy rate unchanged at 4.35% at its May meeting, in line with expectations. The statement highlighted that inflation continues to moderate, though at a slower-than-expected pace.…

Our Portfolio Allocation Summary for May 2024.

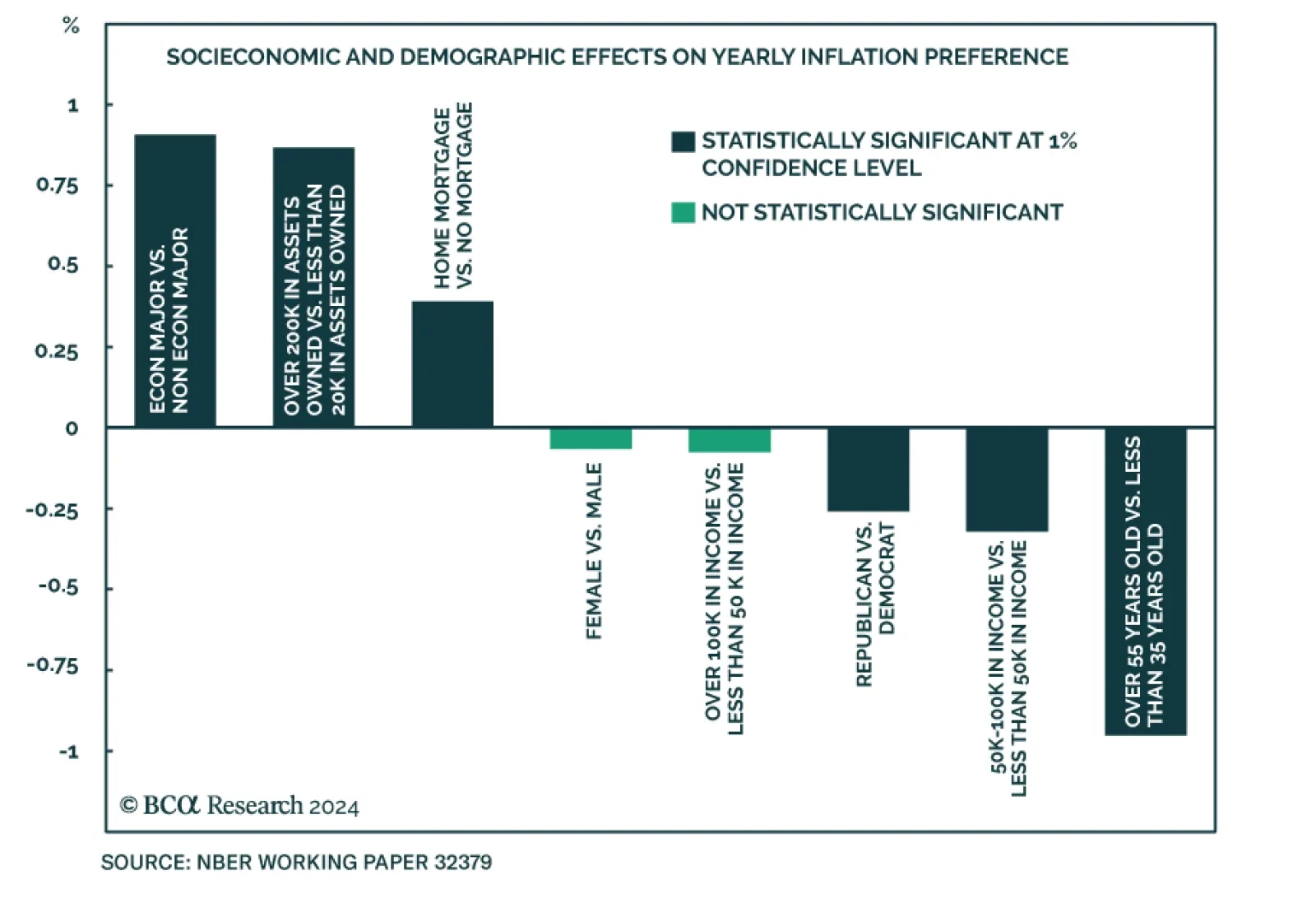

The Federal Reserve has a target inflation of 2%. But what level of inflation does the American public actually prefer? A recent NBER paper titled “Inflation Preferences” by Afrouzi, Dietrich, Myrseth, Priftis, and…

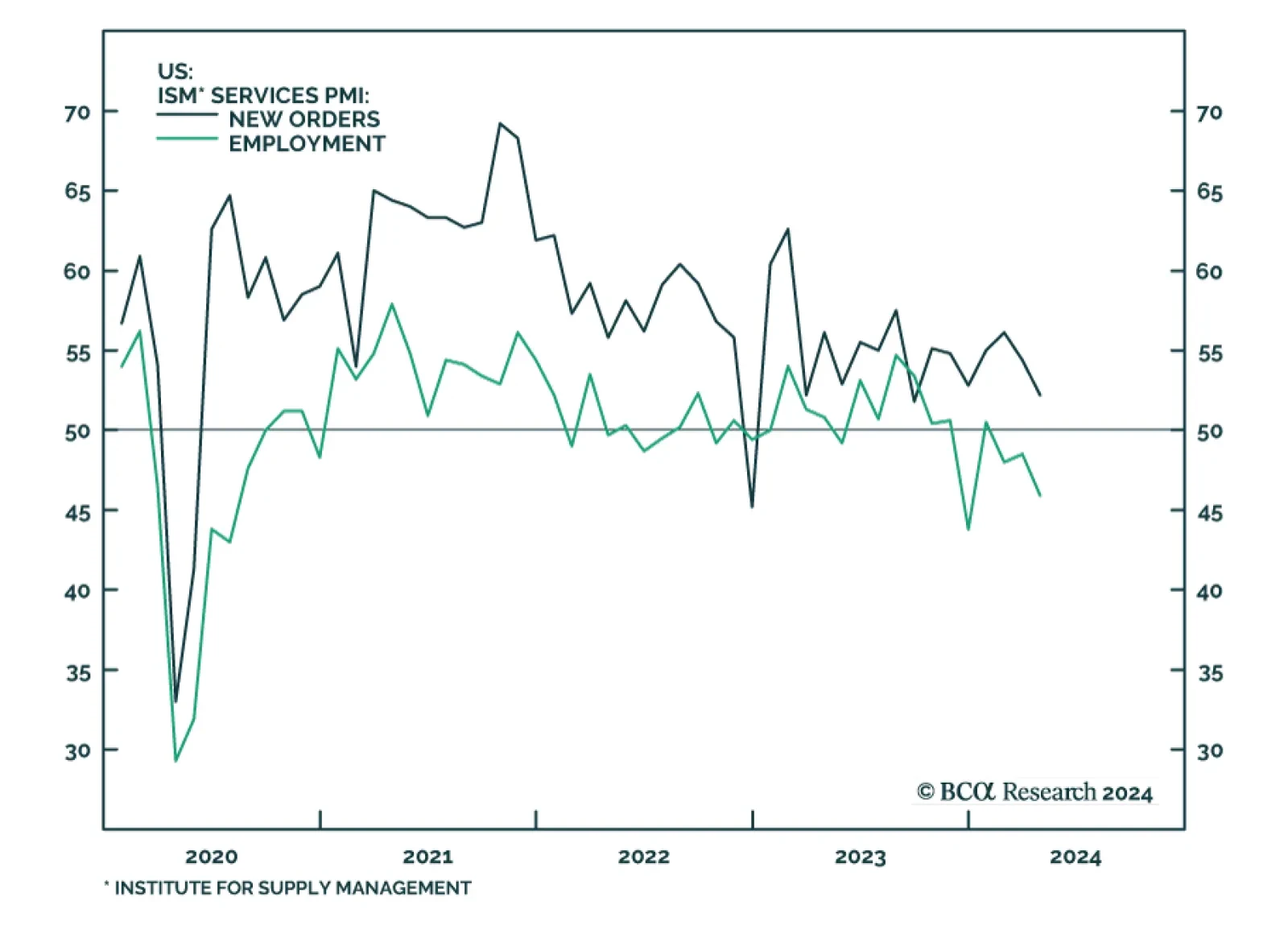

The ISM Services PMI largely disappointed in April. The headline index fell to 49.4 from 51.4, below expectations of a faster pace of growth. April’s contraction ends a streak of 15 consecutive months of services-sector…

Some thoughts on this morning’s employment report and recent trends in US economic data.

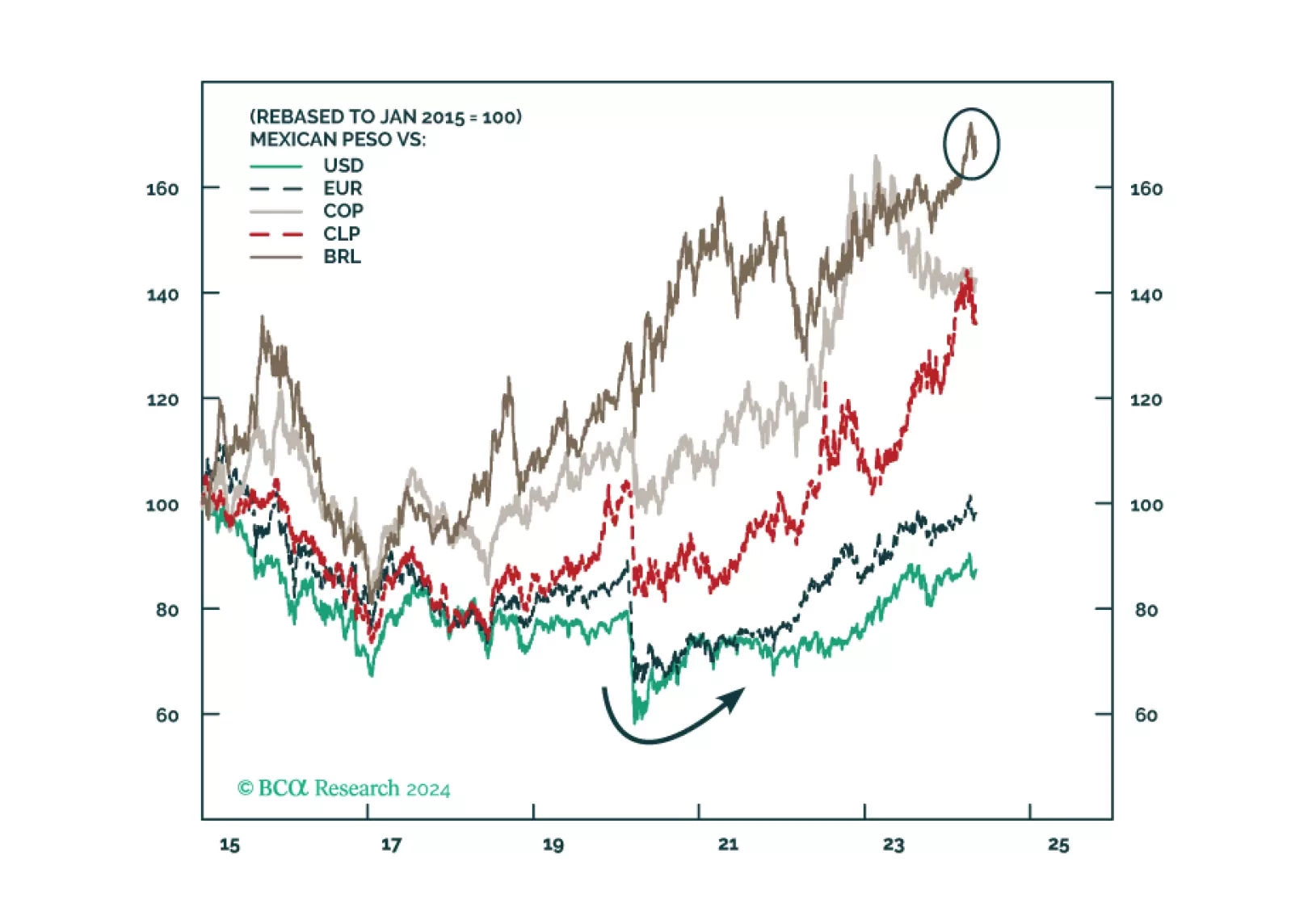

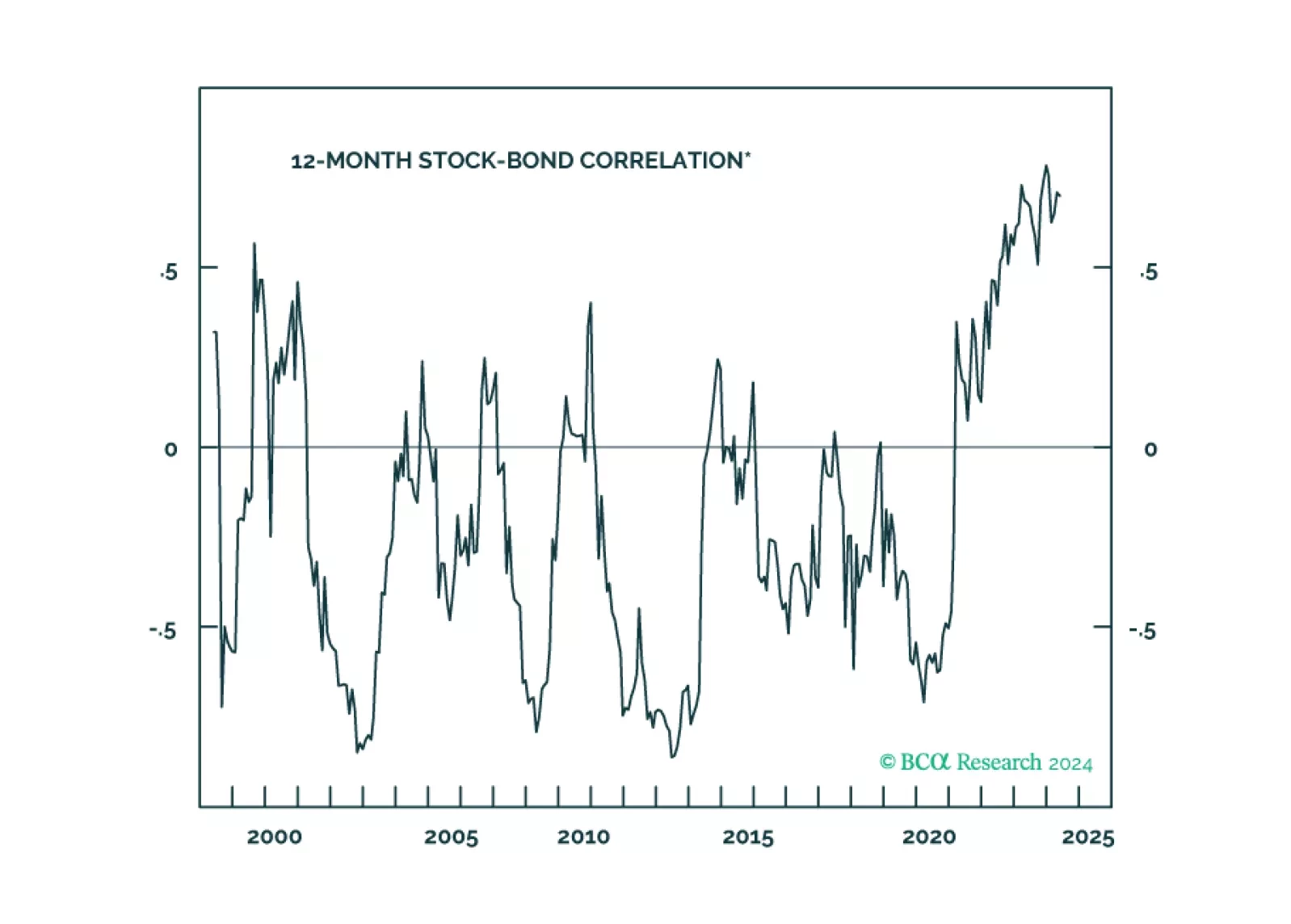

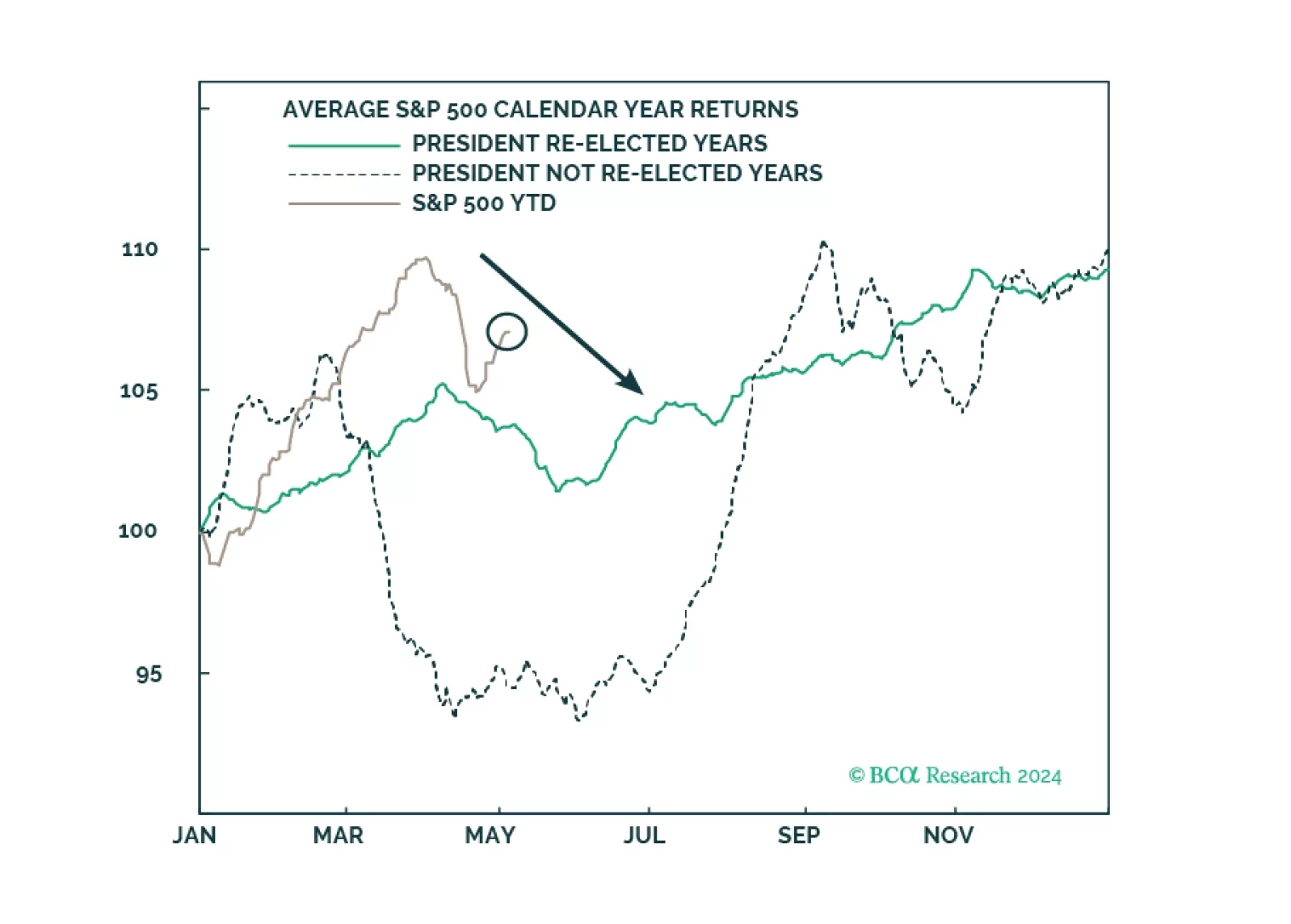

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.