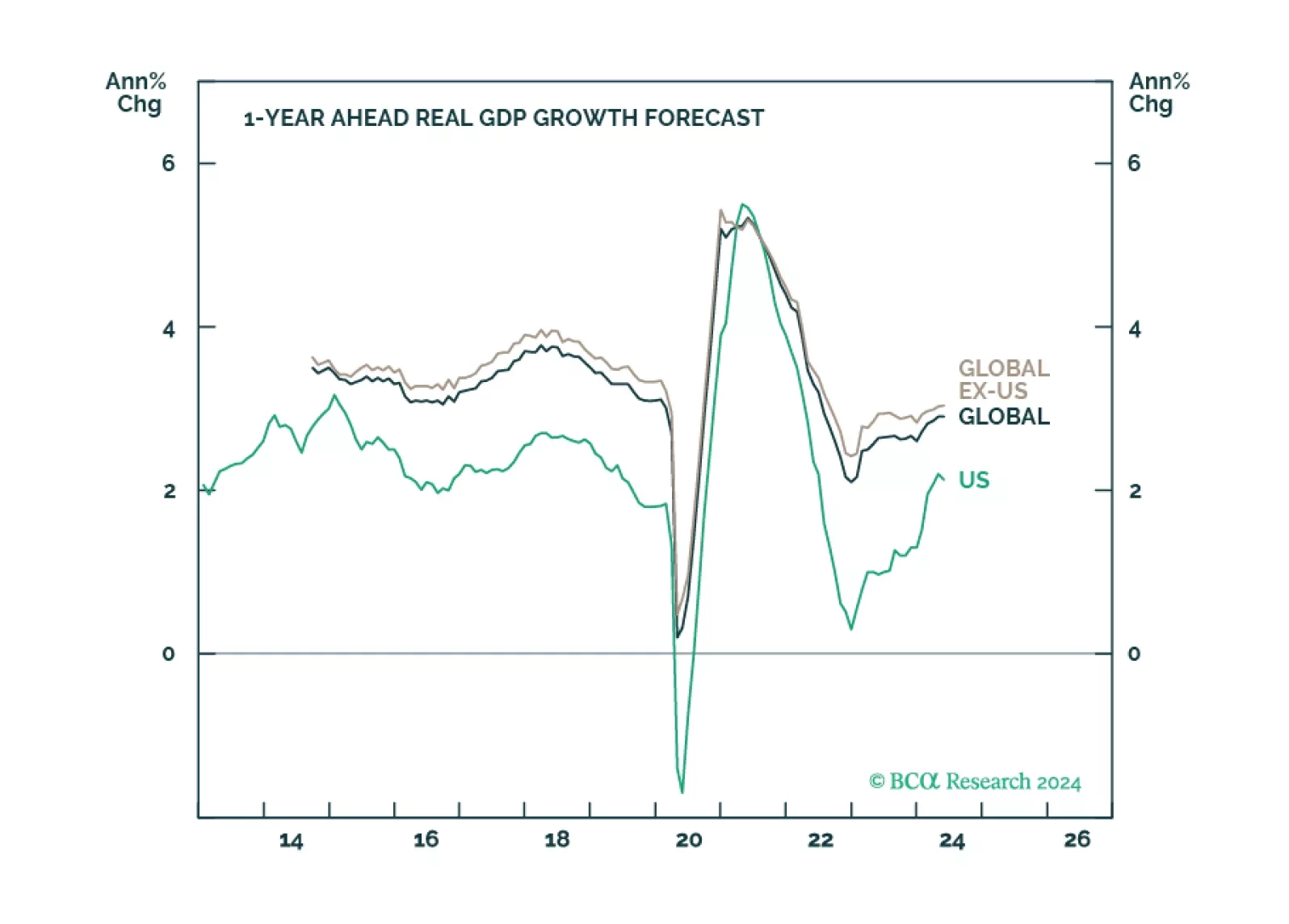

There is a path to a soft landing, but it is a narrow one. We estimate that there is only a 20% chance that the US will avoid a recession before the end of 2025. We are currently neutral on global equities, but expect to downgrade…

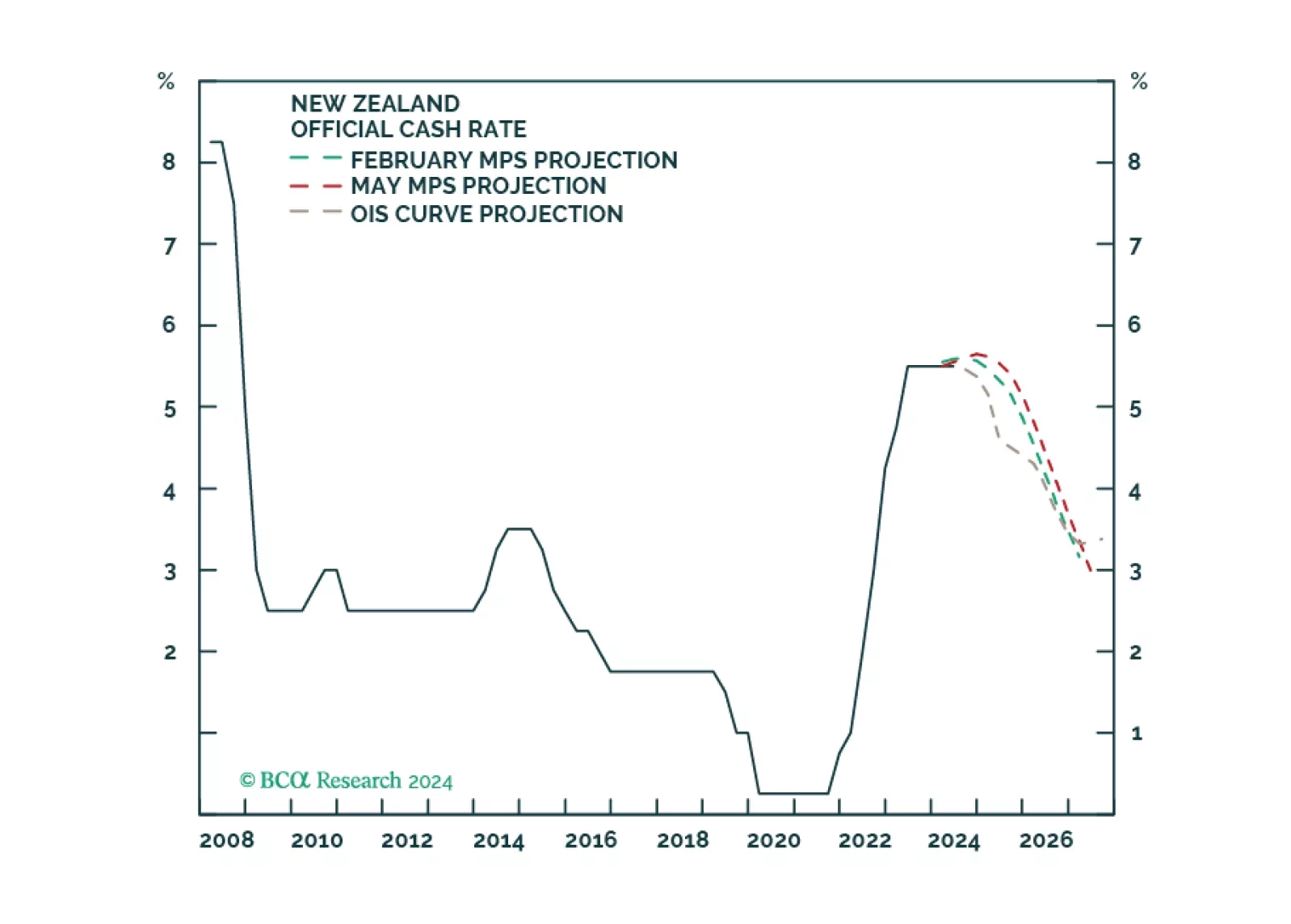

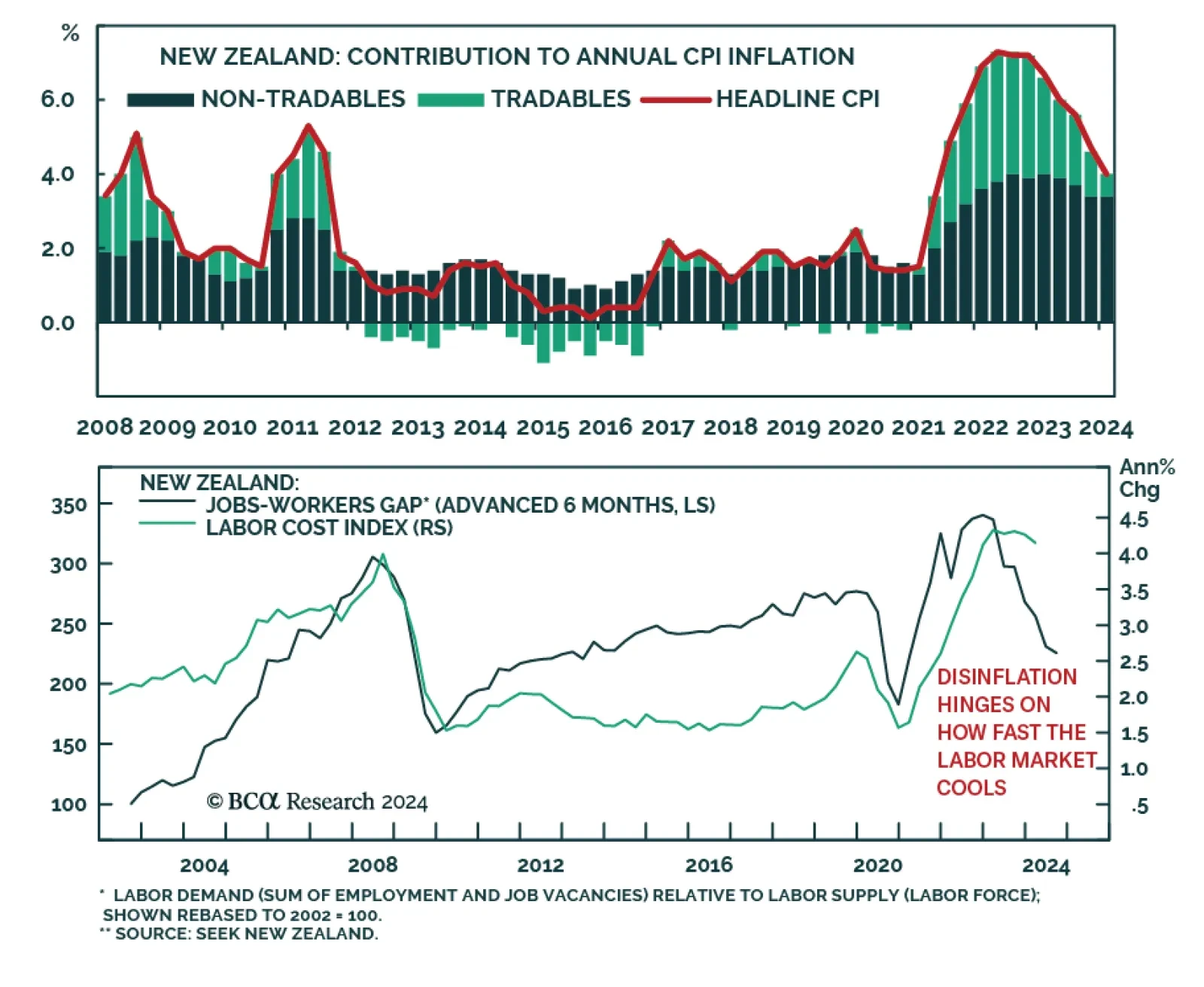

The Reserve Bank of New Zealand (RBNZ) kept interest rates on hold at this week’s monetary policy meeting, in line with expectations. However, there were three new notes from its monetary policy statement that will likely…

Minutes from the April 30 - May 1 FOMC meeting struck a hawkish tone on the latest discussions among Fed officials. Notably, the reference to “Various participants mention[ing] a willingness to tighten policy further should…

In this Insight, we revisit our "higher for longer" theme for the Reserve Bank of New Zealand, in light of the latest central bank meeting. In conclusion, we are inching towards a more dovish RBNZ ahead. Ergo, we recommend some fixed…

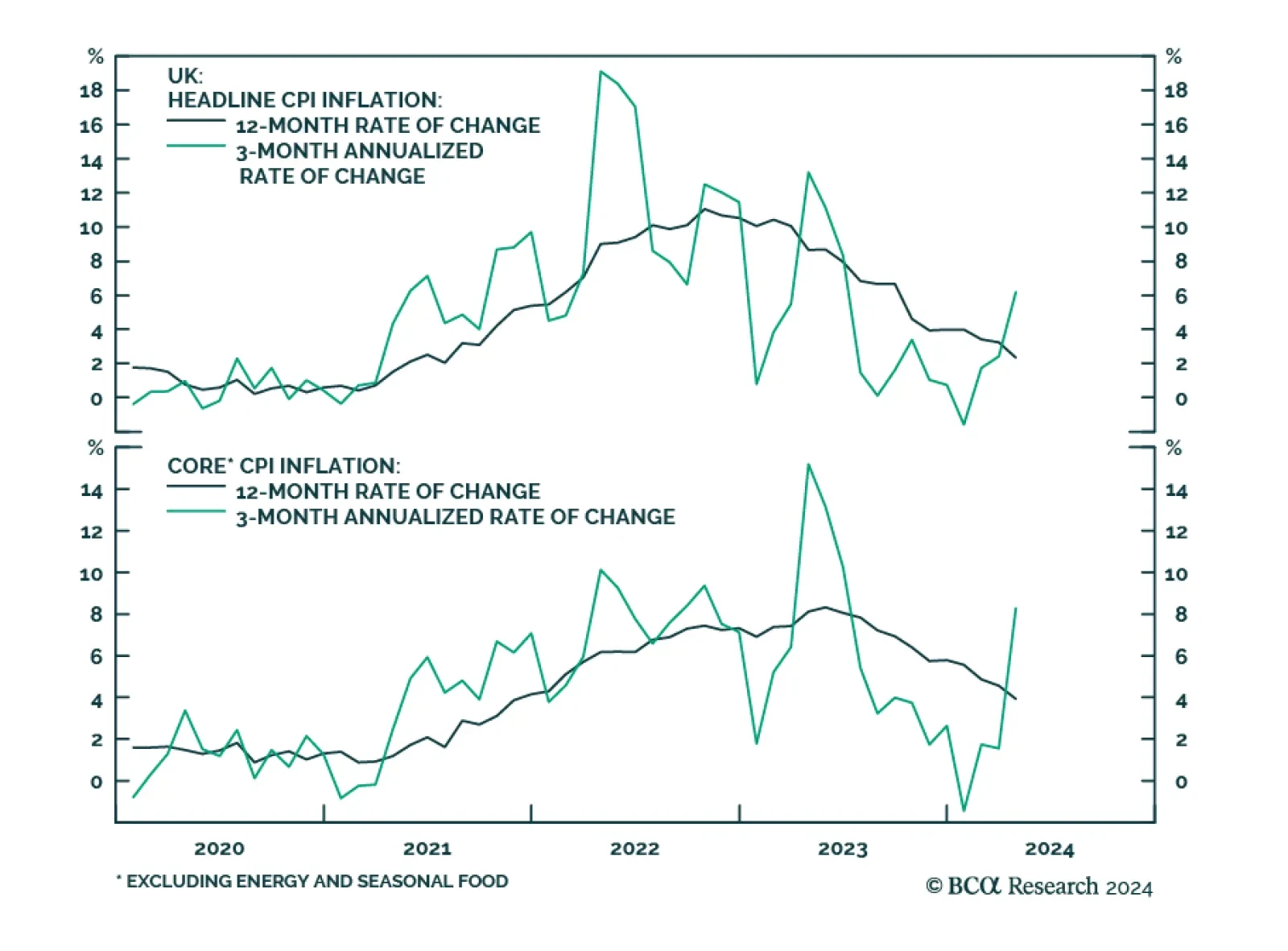

The UK CPI release surprised markets to the upside across the board on Wednesday. Headline CPI increased 2.3% year-on-year, above expectations of 2.1%. Core surprised to the upside as well, moderating from 4.2% to 3.9%y/y, less…

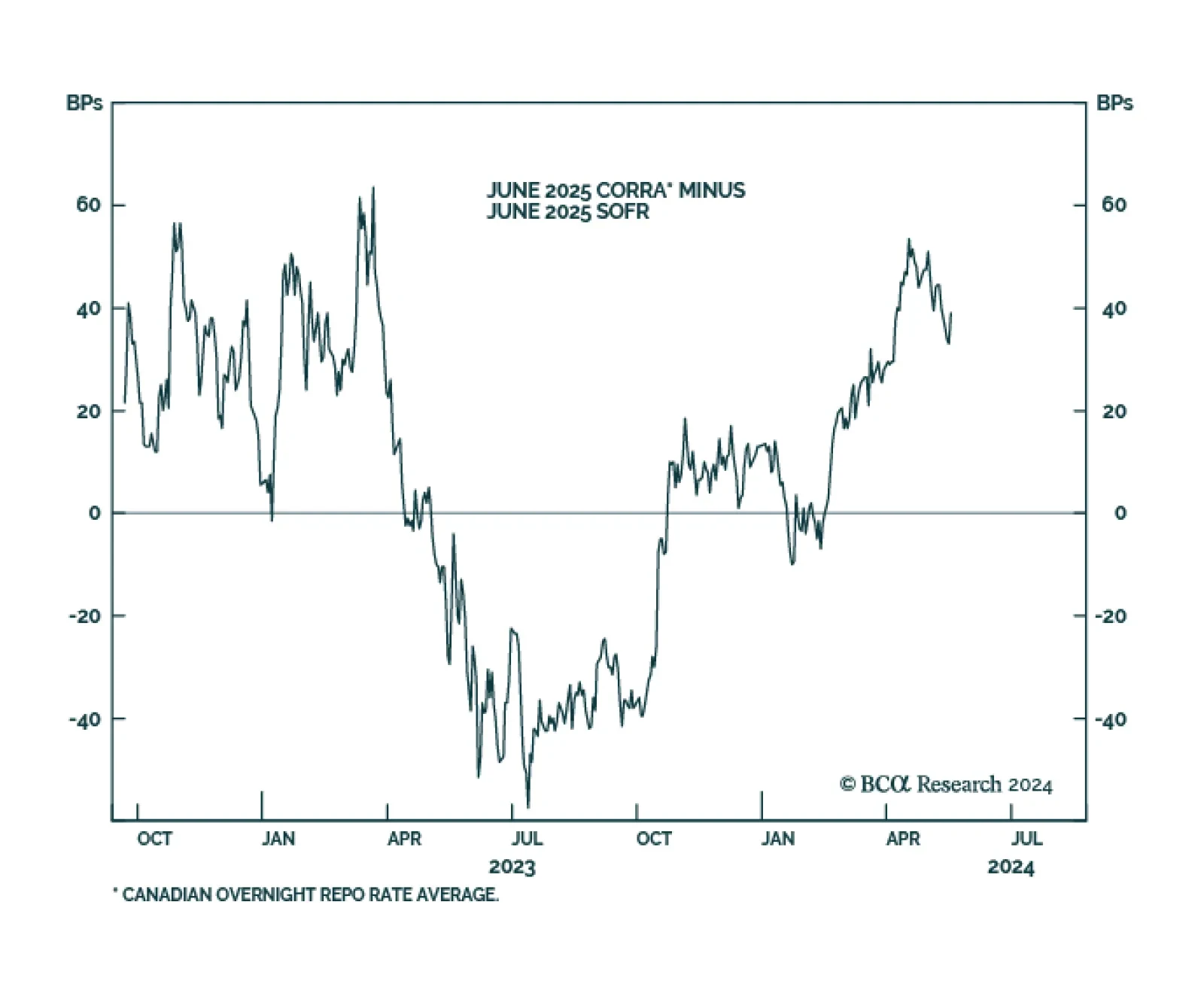

Canada’s headline CPI inflation decelerated in April from 2.9% y/y to 2.7% y/y. Notably, core median CPI eased from 2.9% y/y to a softer-than-anticipated 2.6% y/y and core trimmed-mean CPI ticked lower from 3.2% to 2.9…

According to BCA Research’s Global Investment Strategy service, the BoC should have sufficient evidence of Canadian disinflation to cut rates this summer. The market is pricing in a similar amount of rate cuts for the BoC…

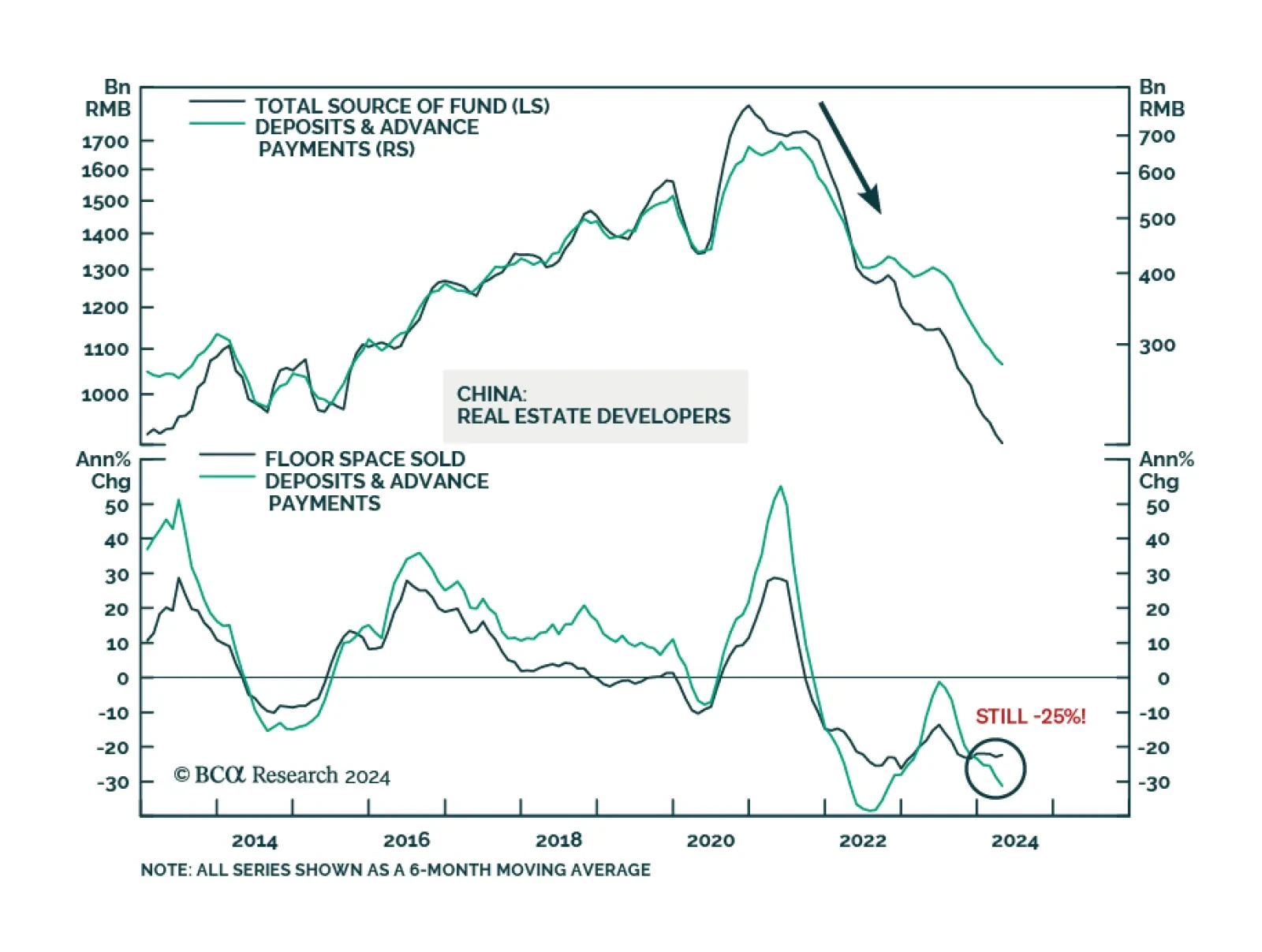

Several economic releases out of China disappointed in April. Retail sales decelerated from 3.1% y/y to 2.3% y/y and fixed asset investment growth slowed from 4.5% YTD y/y to 4.2% YTD y/y. Both were expected to accelerate.…

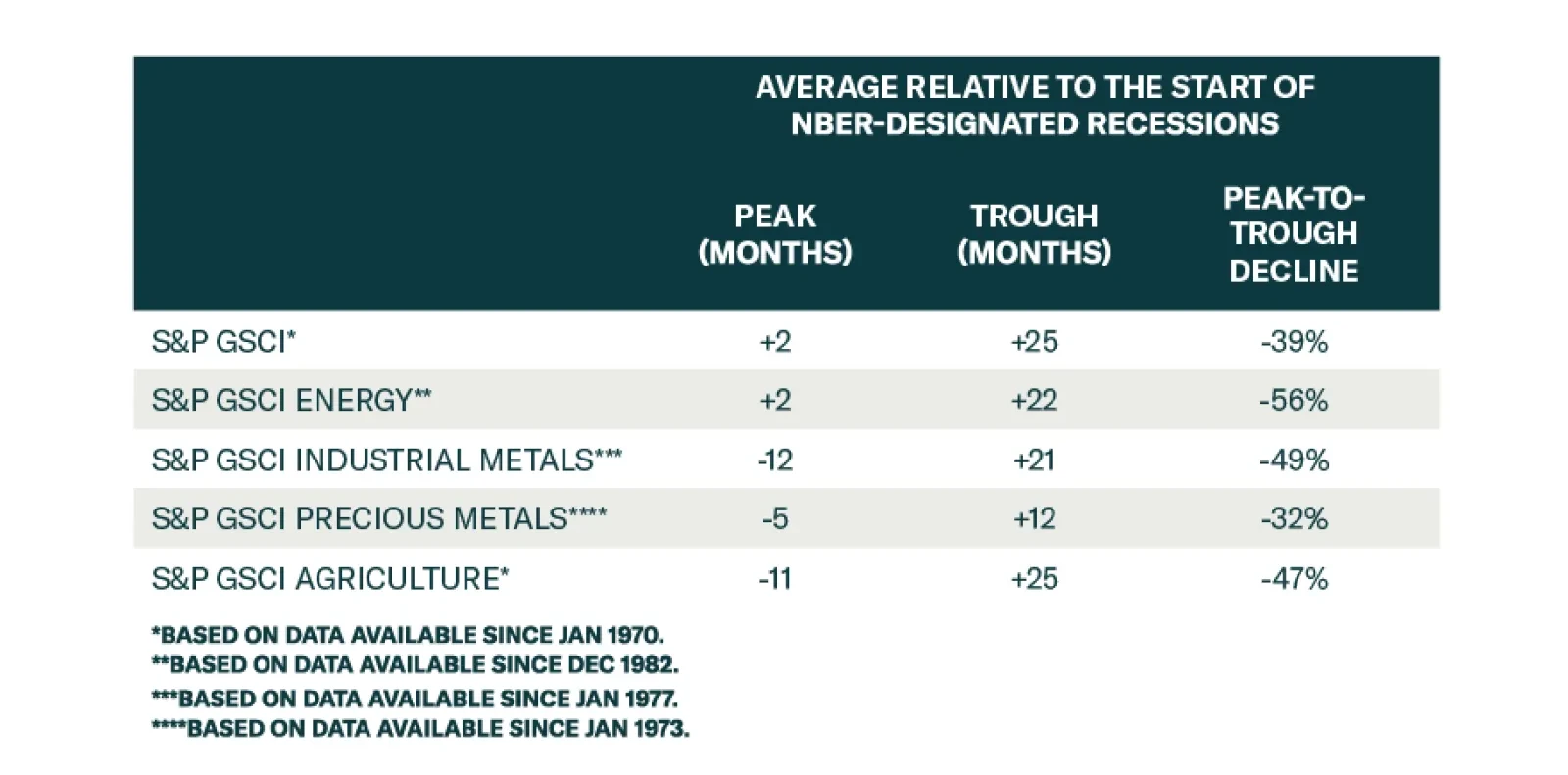

According to BCA Research’s Commodity & Energy Strategy service, among the commodity groups, industrial metals provide the most reliable leading signal that the US economy is heading toward recession. Industrial metals…

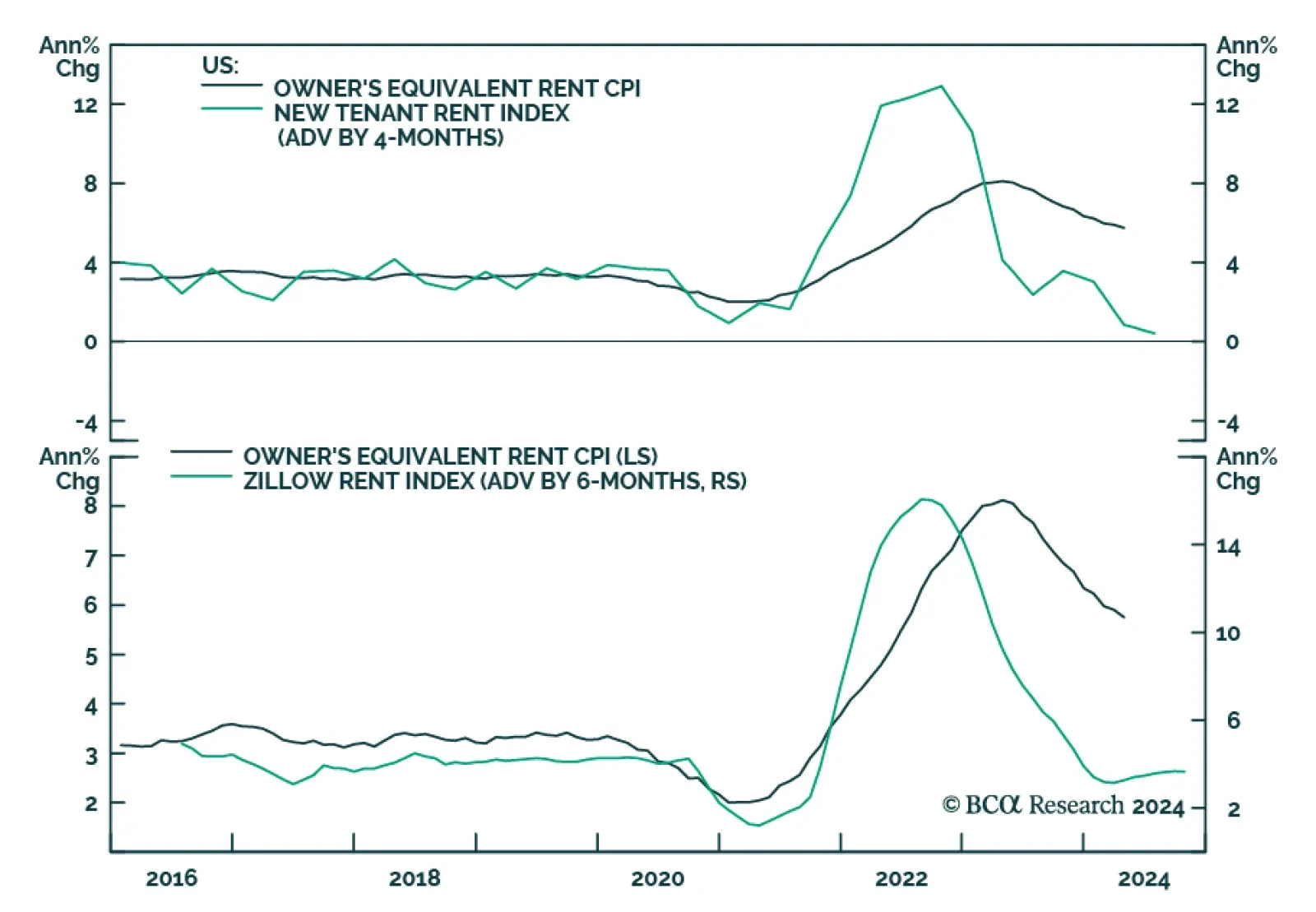

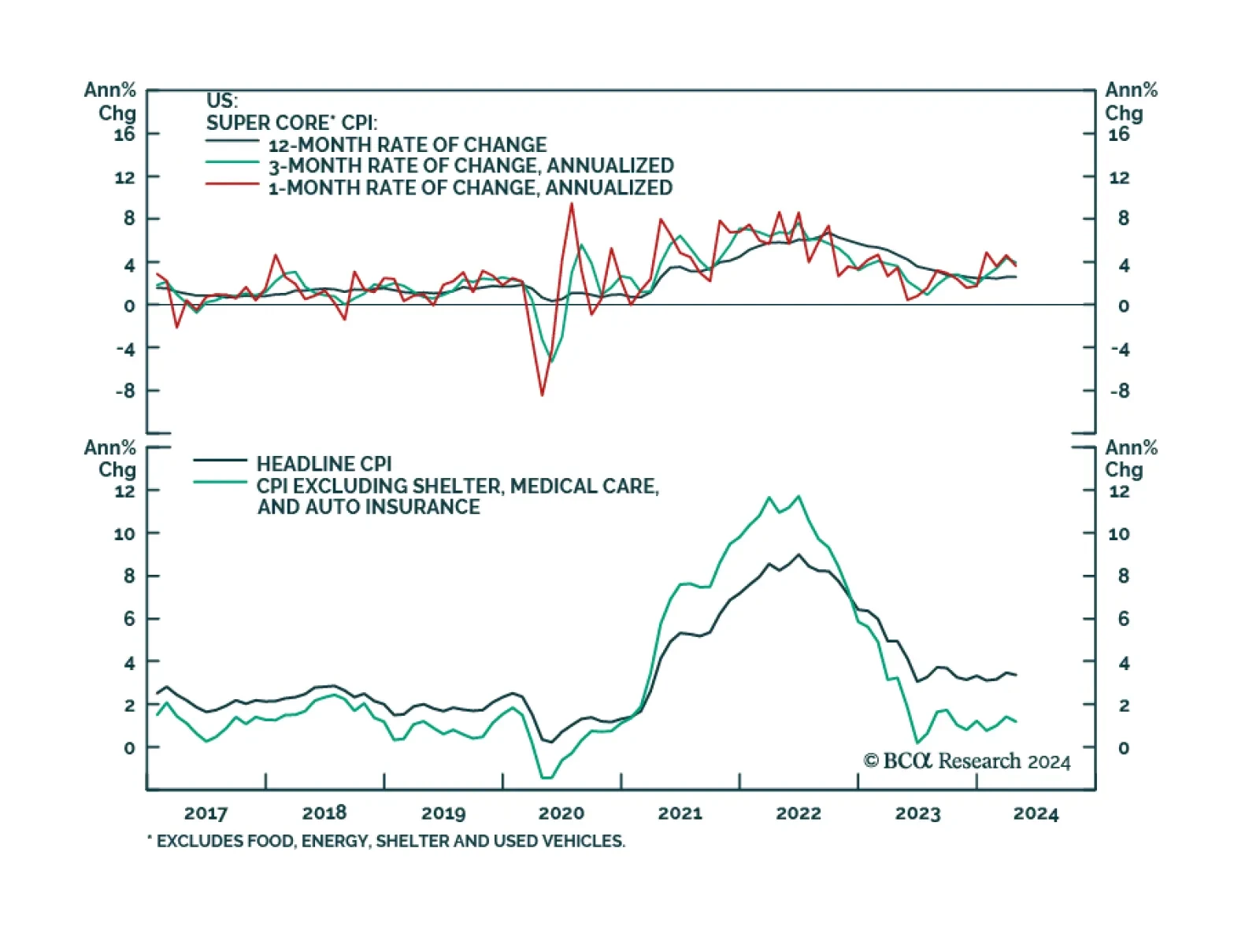

US headline CPI inflation decelerated to a softer-than-expected 0.3% m/m (3.4% y/y) in April, from 0.4% m/m (3.5% y/y). Core CPI eased from 0.4% m/m (3.5% y/y) to 0.3% m/m (3.4% y/y). Declines in new (-0.4% m/m) and used…