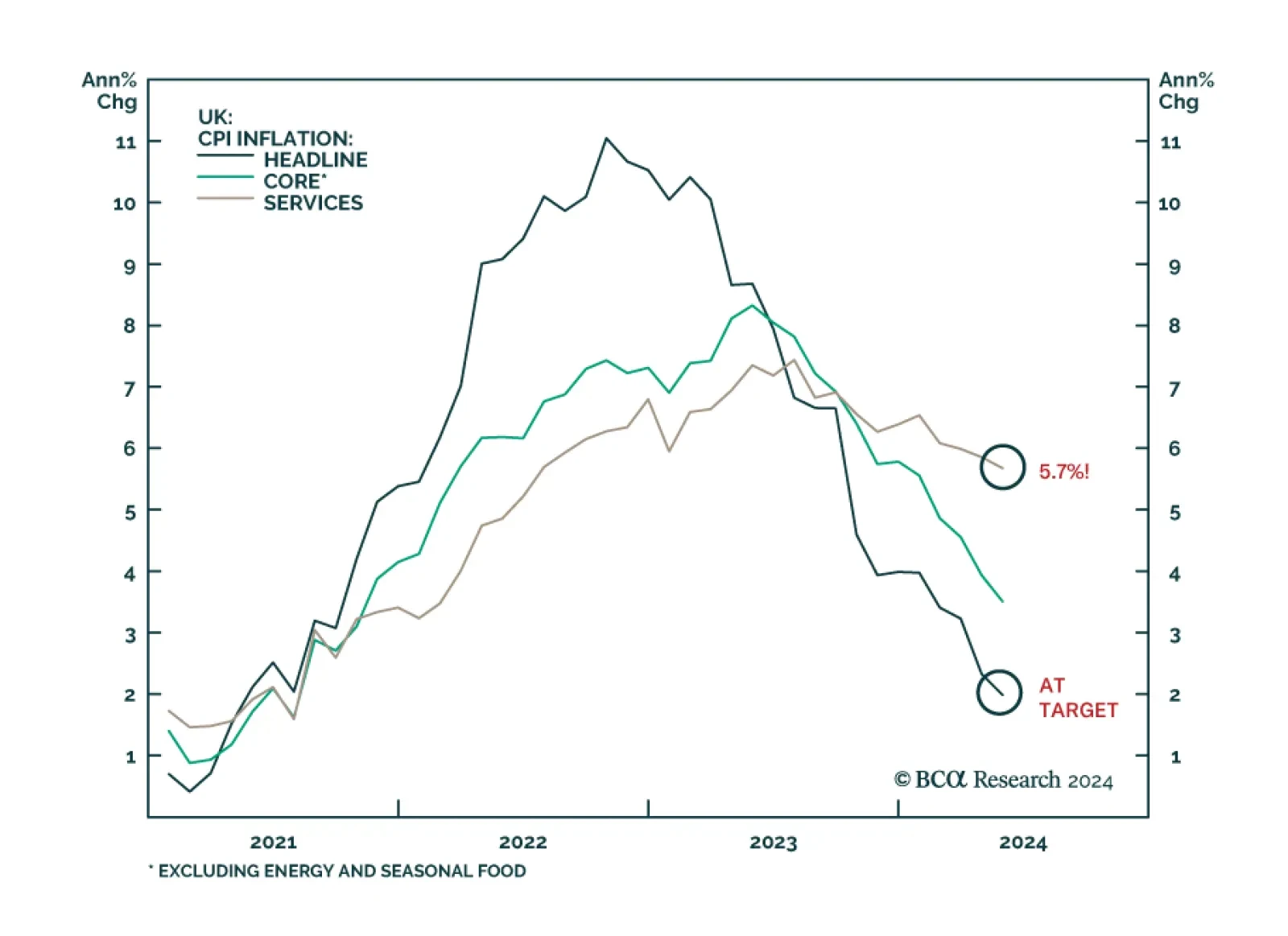

On the surface, UK inflation appears to be on the right track. The May CPI release came in broadly within expectations. Headline inflation eased from 2.3%y/y to 2.0%y/y – directly on the BoE’s target for the first…

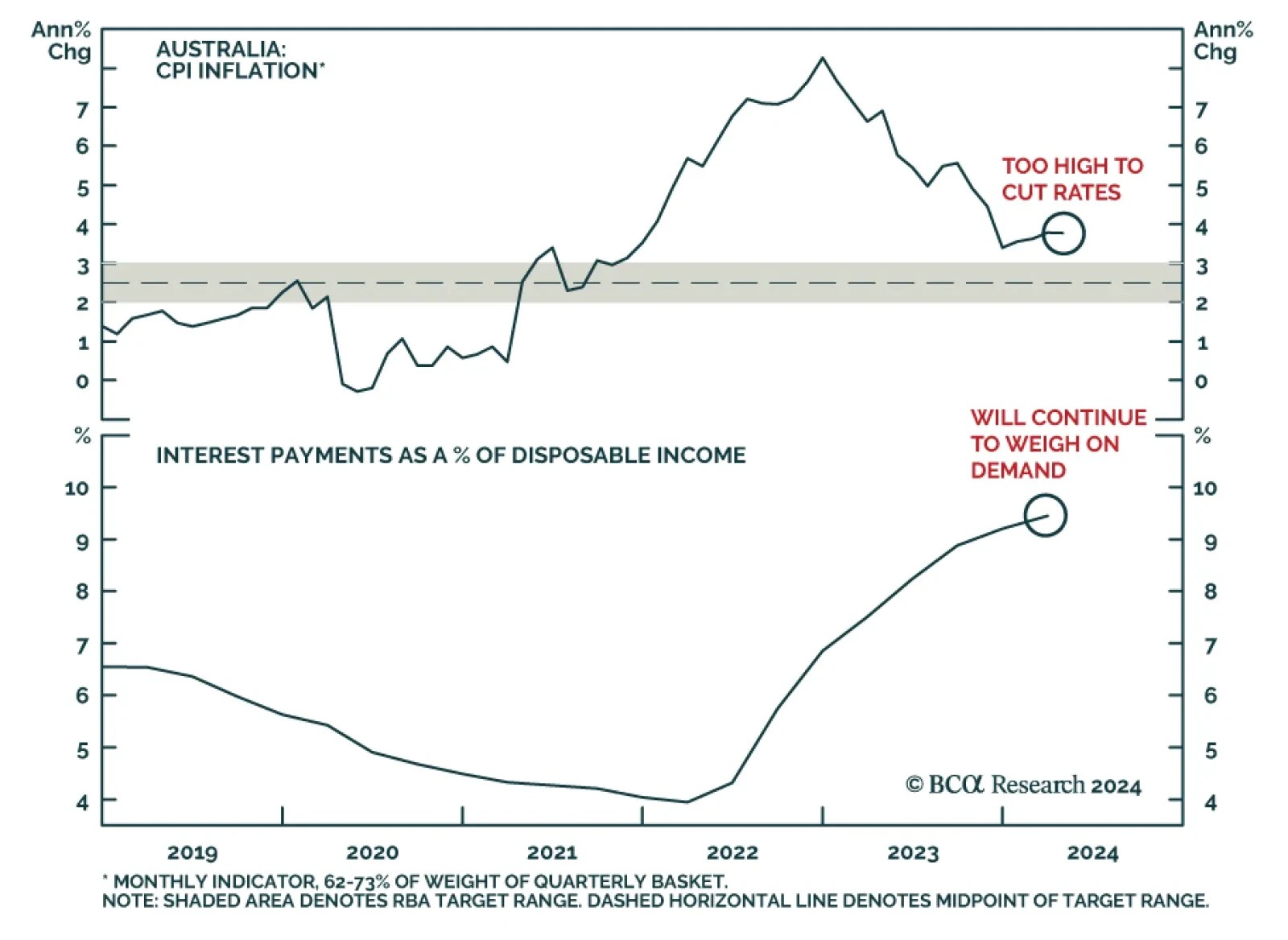

The Reserve Bank of Australia kept its cash rate at 4.35% at its policy meeting on Tuesday, in line with market expectations. Australia’s monthly measure of headline inflation came in at 3.6% in April, still considerably…

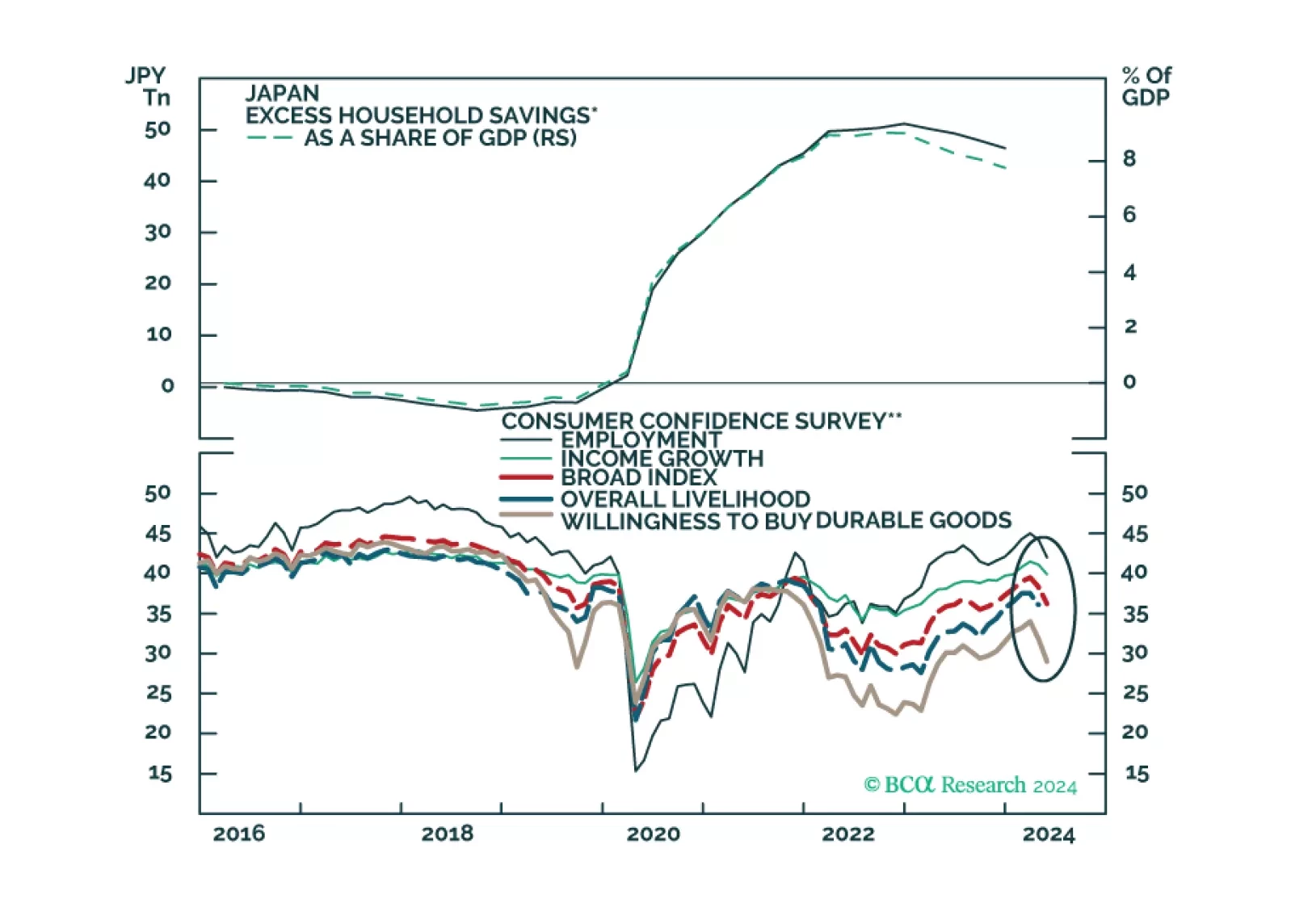

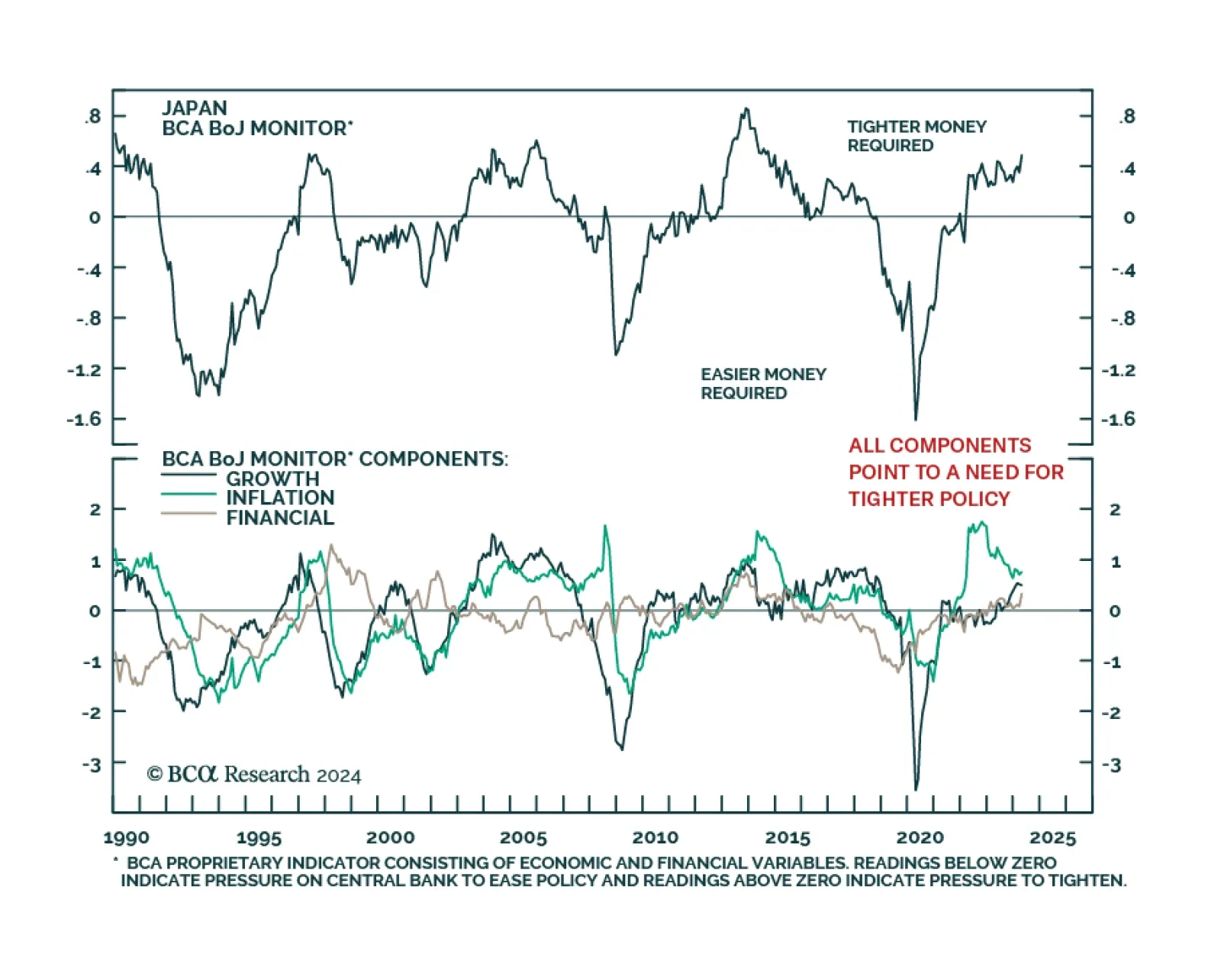

In this insight, we update our thinking on the recent BoJ move in terms of positioning for the yen and JGB yields.

In a largely expected move, the Bank of Japan kept its policy rate unchanged at 0-0.1% in June. It maintained the pace of bond buying at JPY 6tr per month but signaled it would lay out a plan to reduce its balance sheet next…

The BoE had to deal with a stagflationary headache in the second half of 2023. Inflation was stickier and growth was weaker in the UK than in many of its DM peers. This trend turned around earlier this year with a late-cycle…

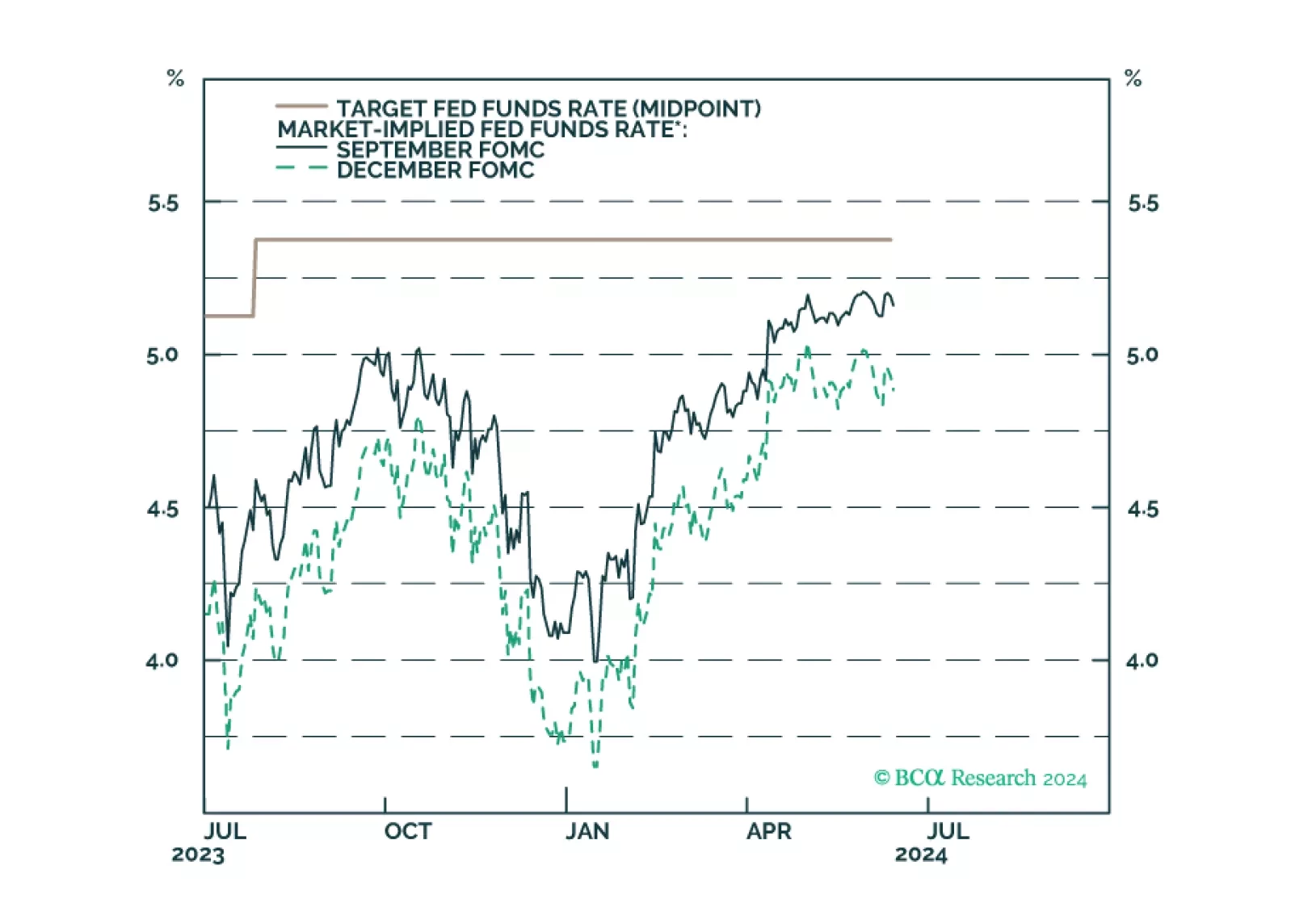

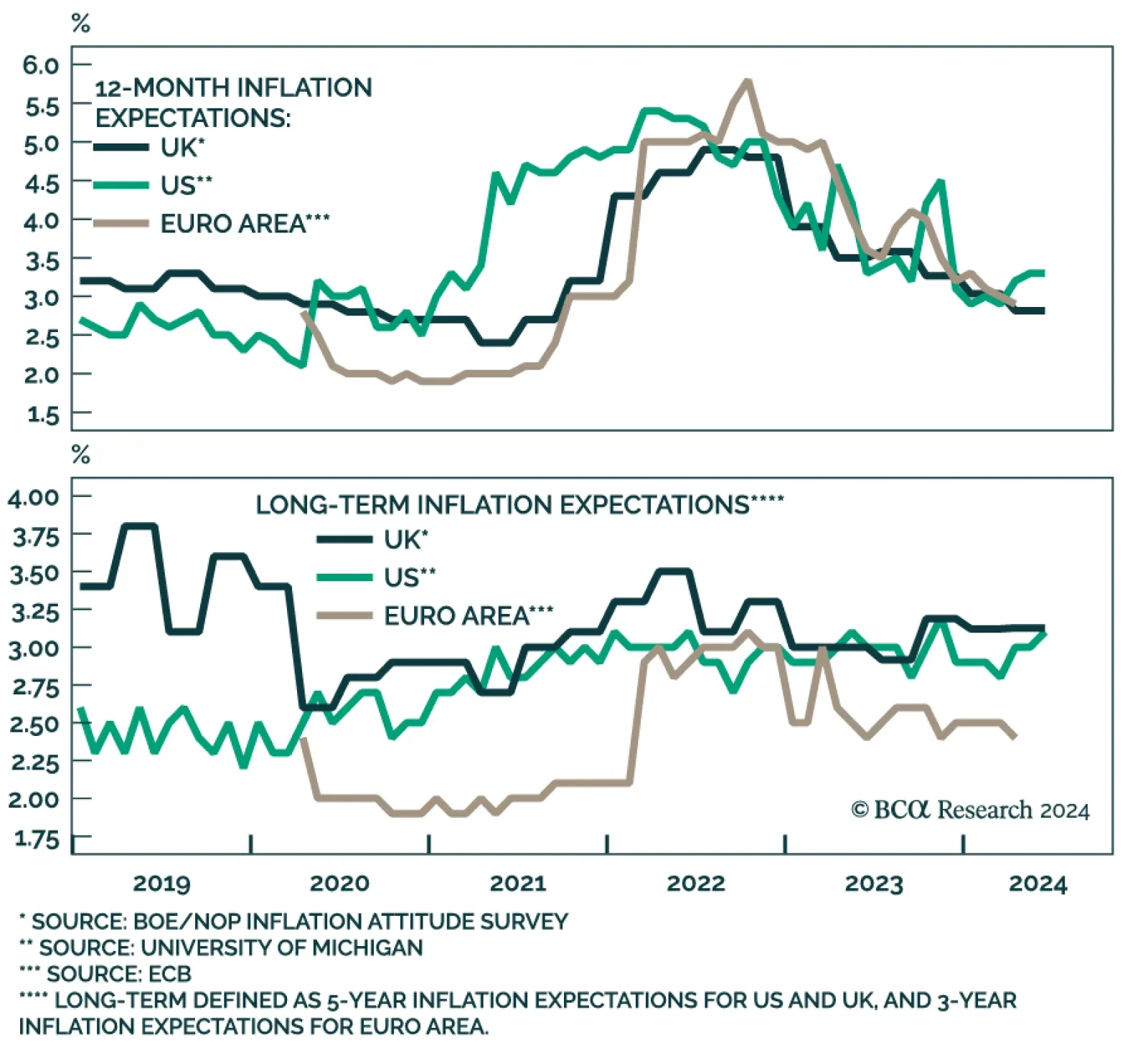

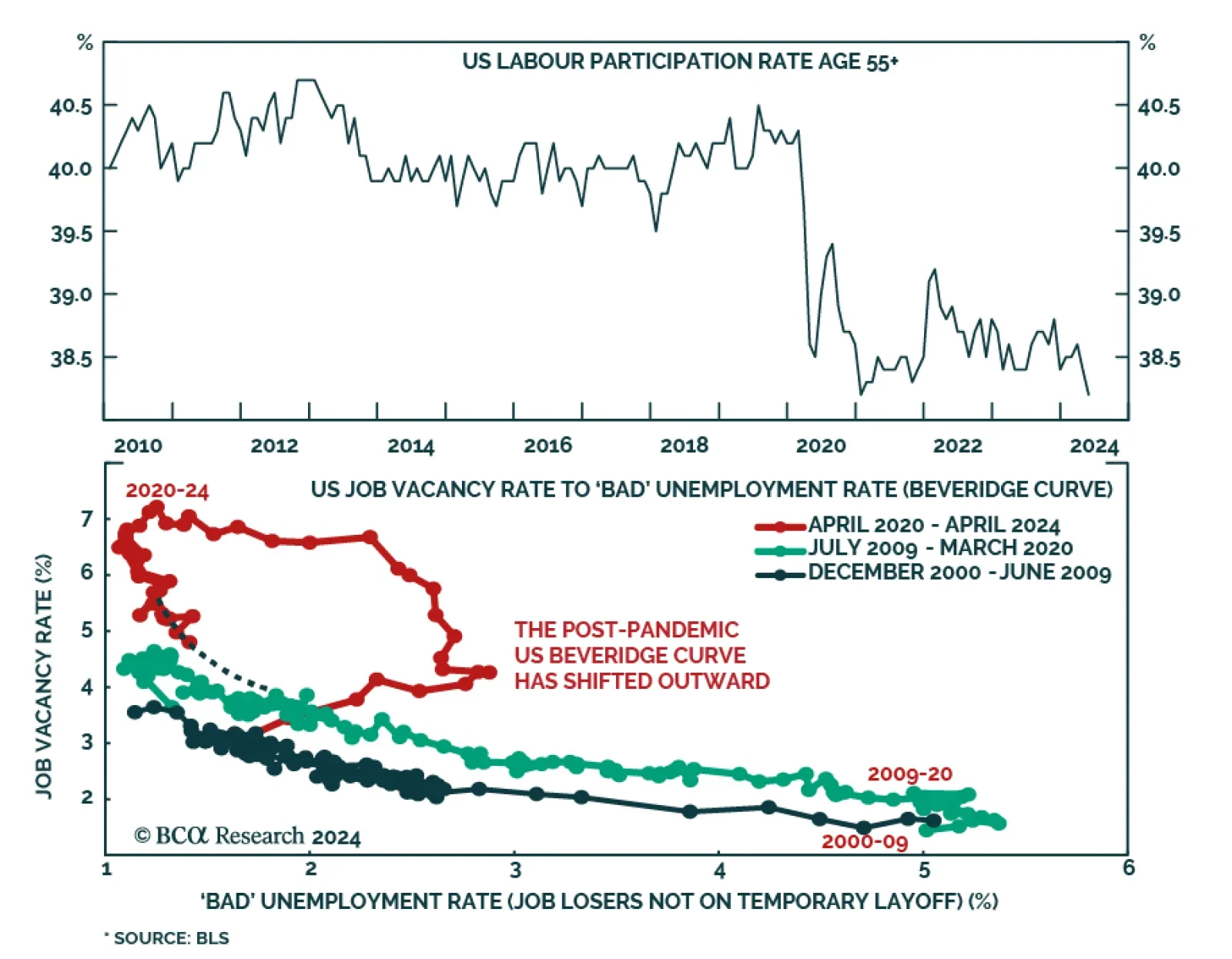

According to BCA Research’s Counterpoint service, job losers not on temporary layoff (‘bad’ unemployment) will need to rise further for the Fed to reach its 2 percent inflation target. Although prime-age…

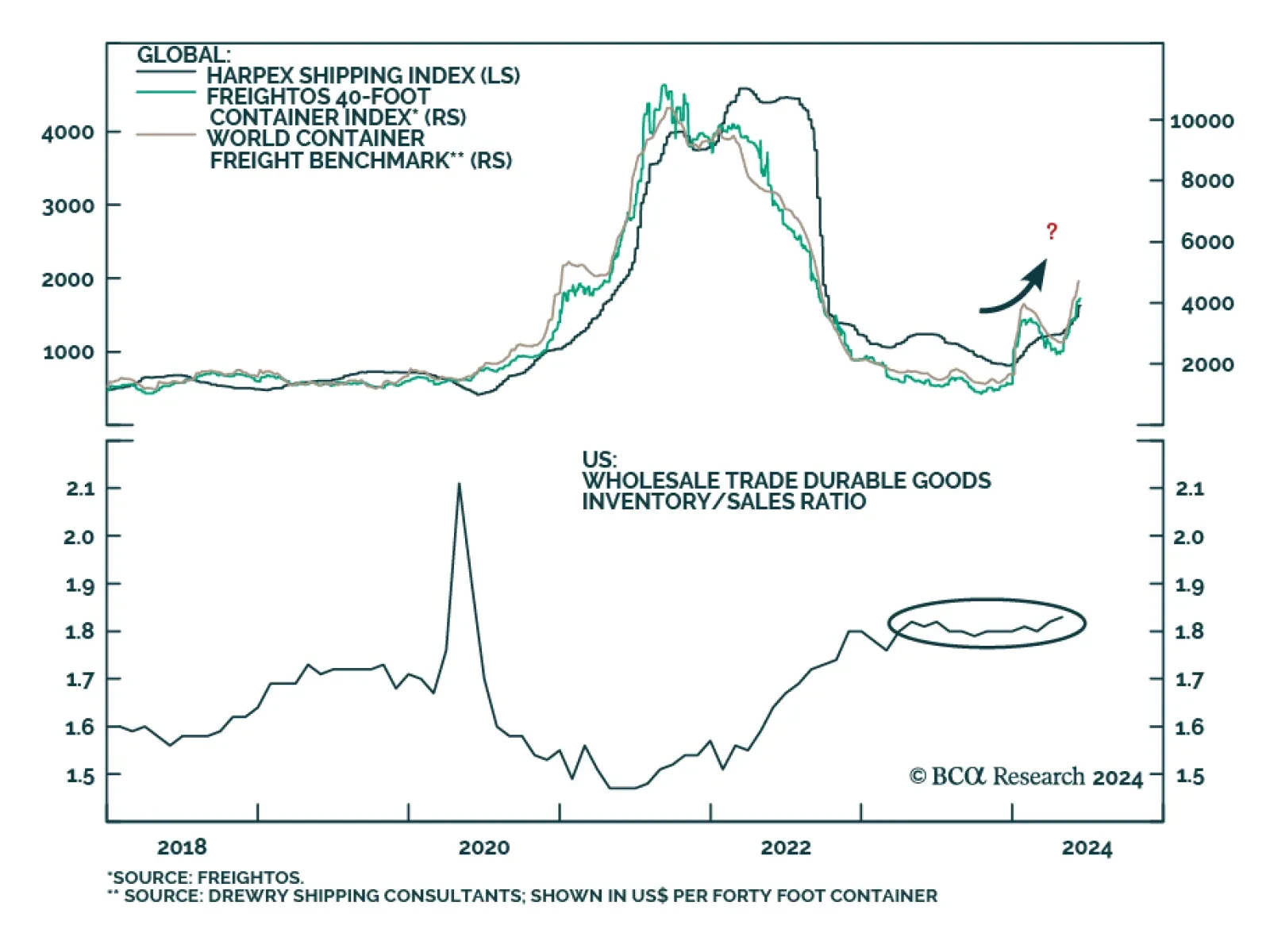

Goods prices have been normalizing following the pandemic binge on goods spending. The May CPI release indicated that durable goods and nondurable goods prices both continued to contract. Investors and policymakers have thus…

Our reaction to this morning’s CPI report and this afternoon’s FOMC meeting.