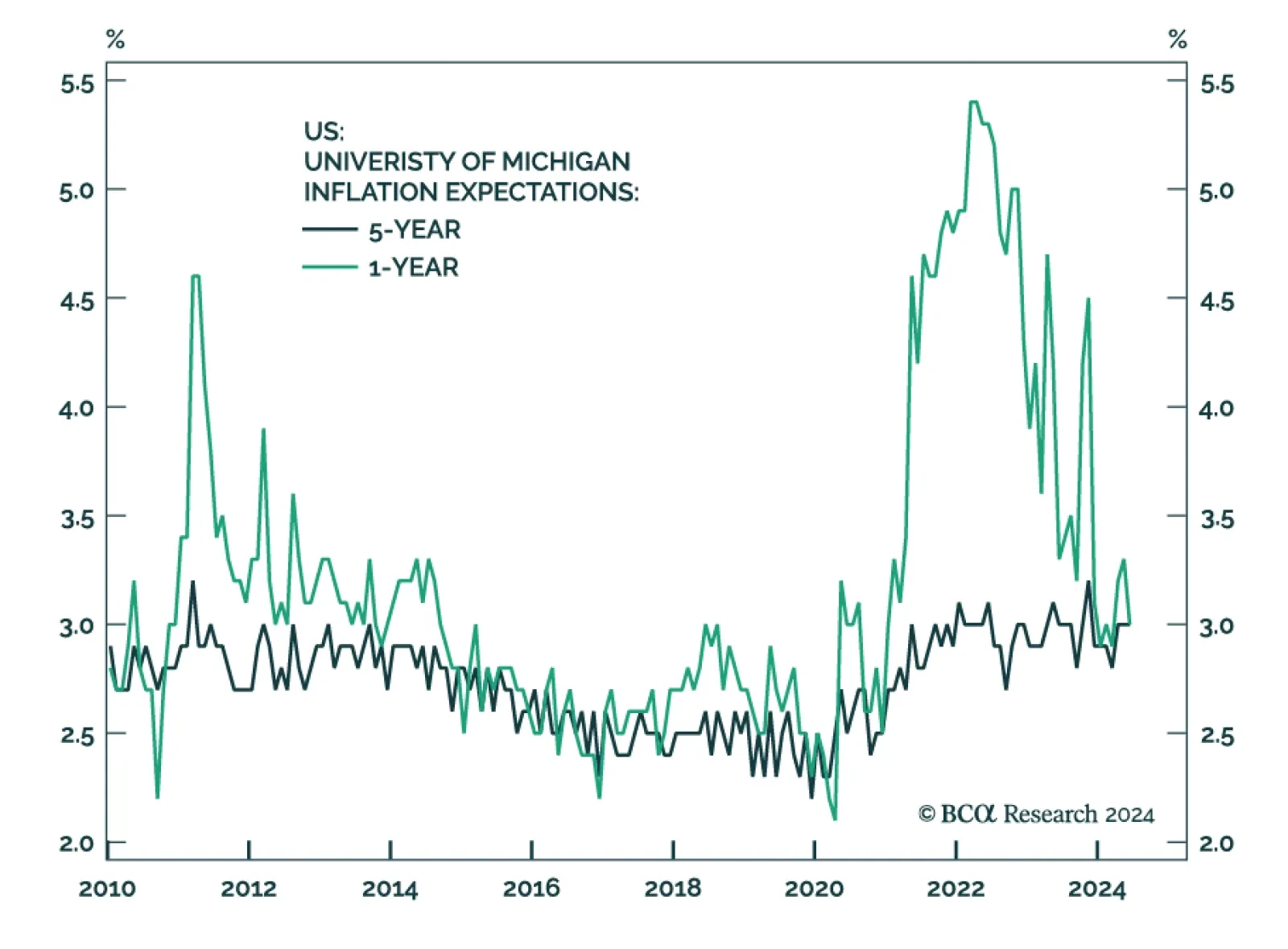

The University of Michigan survey of consumers was released on Friday. The sentiment measure increased from 65.6 to 68.2, beating consensus estimates of 66. Current conditions as well as expectations also increased, going from 62…

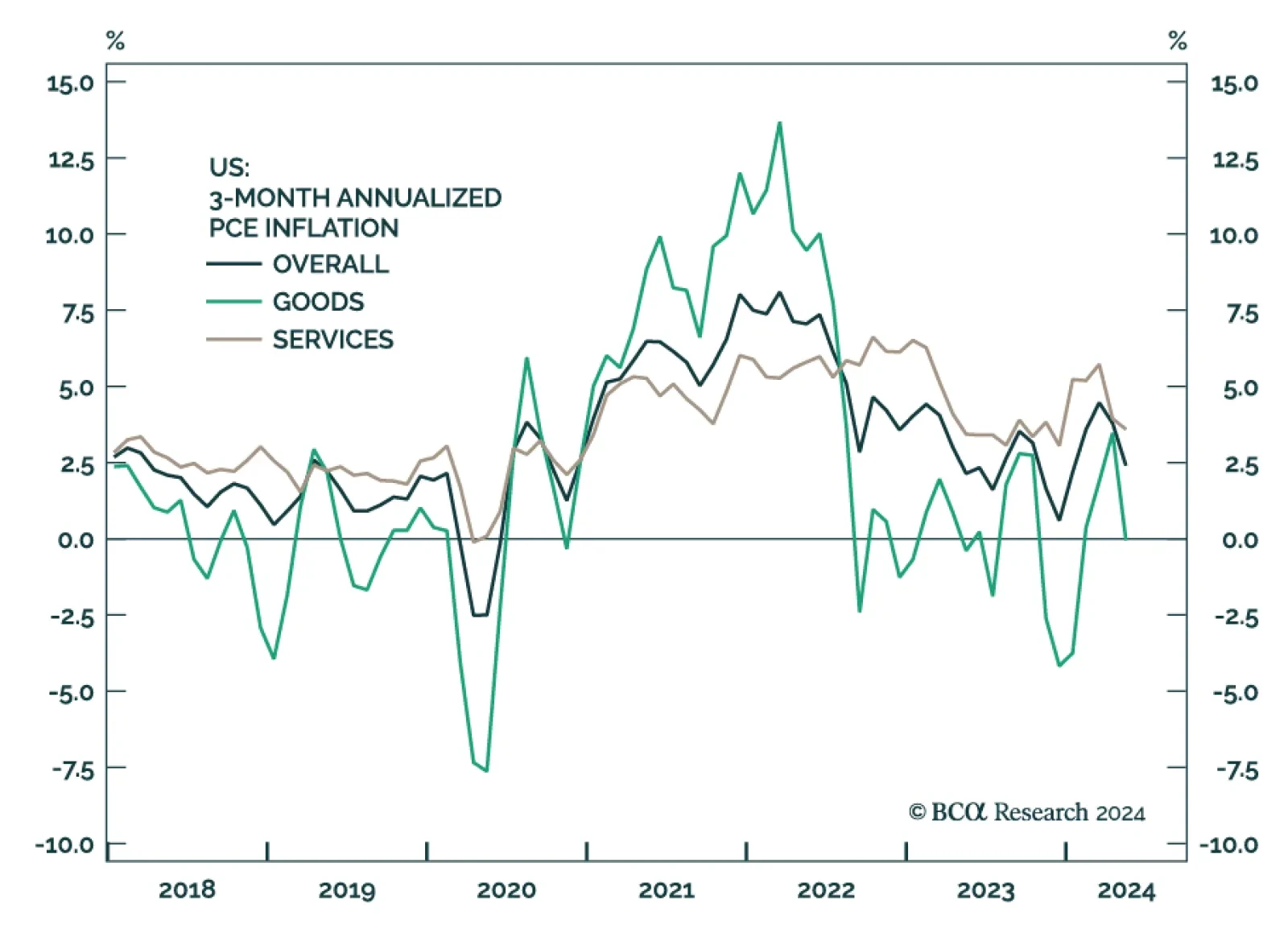

The US personal income and outlays report was released on Friday. Personal income grew by 0.5% versus 0.3% the previous month, beating consensus estimates. Real personal spending growth also increased, coming in at 0.3%…

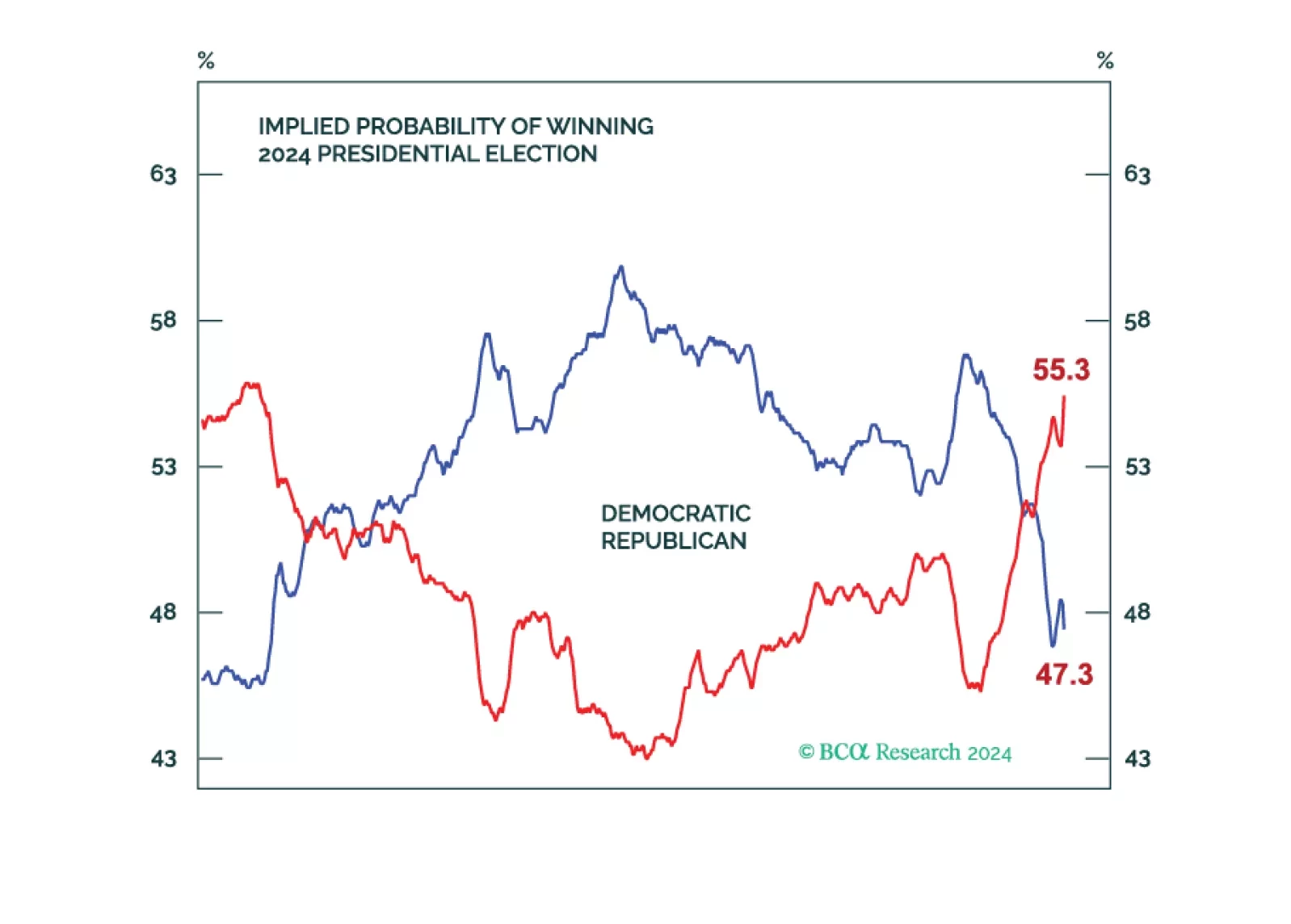

The bond market should sell off and drag stocks down on higher odds of a single-party sweep, policy uncertainty, unorthodox Trump presidency, aggressive tariffs, large tax cuts, large budget deficits, labor shortages, a fired Fed…

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

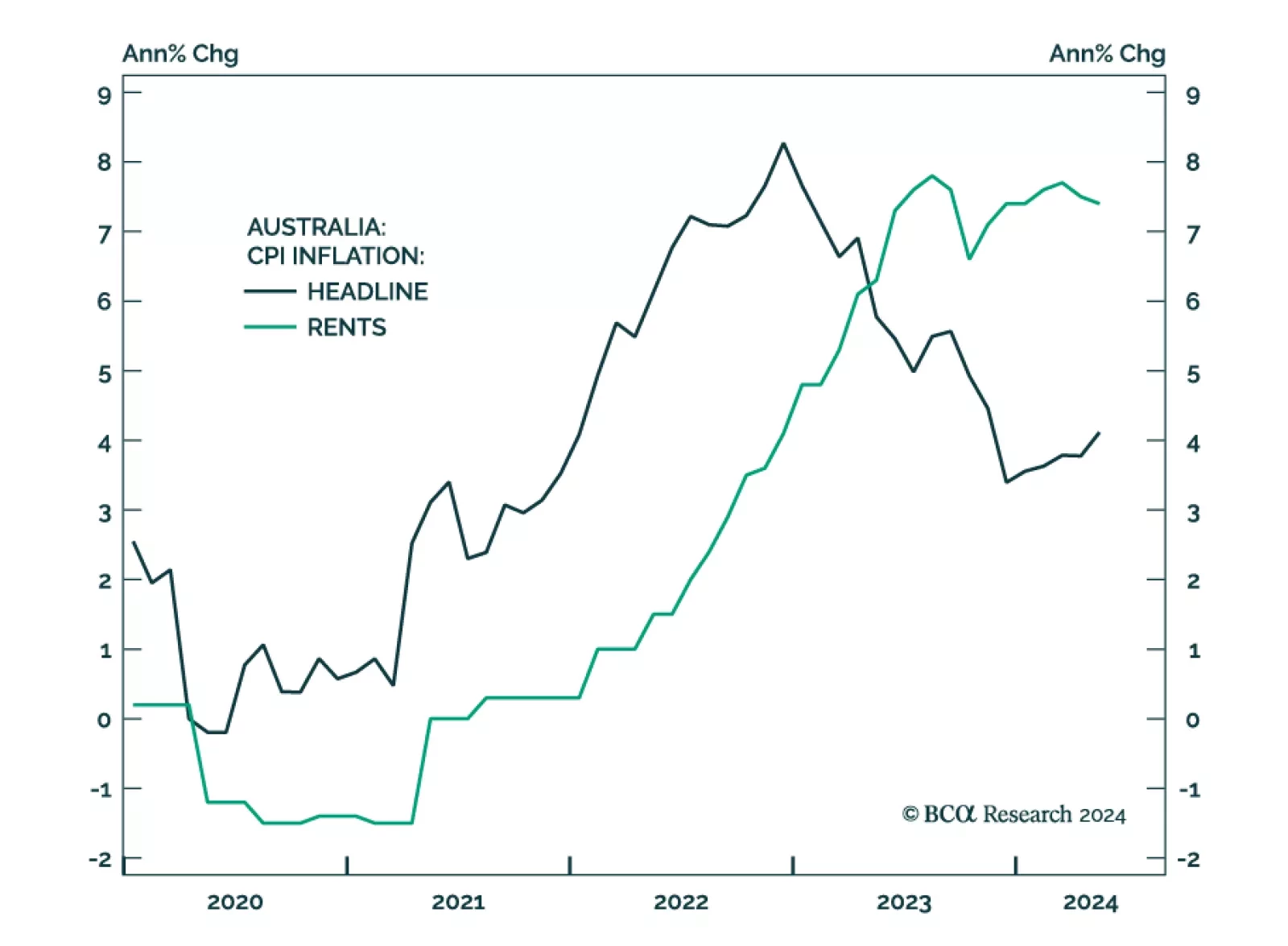

Australia’s inflation for May was released on Tuesday. Annual headline CPI increased from 3.6% in April to 4%, outpacing expectations of 3.8%. Trimmed-mean inflation also increased from 4.1% to 4.4%. Individual…

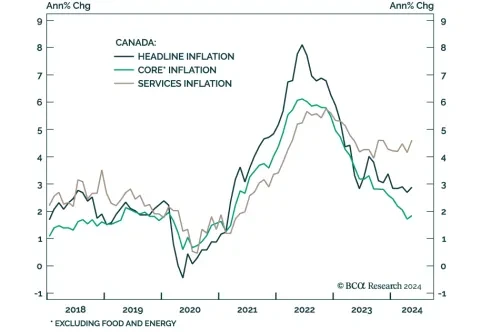

Canada’s headline inflation rate for May surprised to the upside on Tuesday. The 0.6% month-on-month print and 2.9% year-on-year increase came in above expectations of 0.3% m/m and 2.6% y/y, respectively. Both measures…

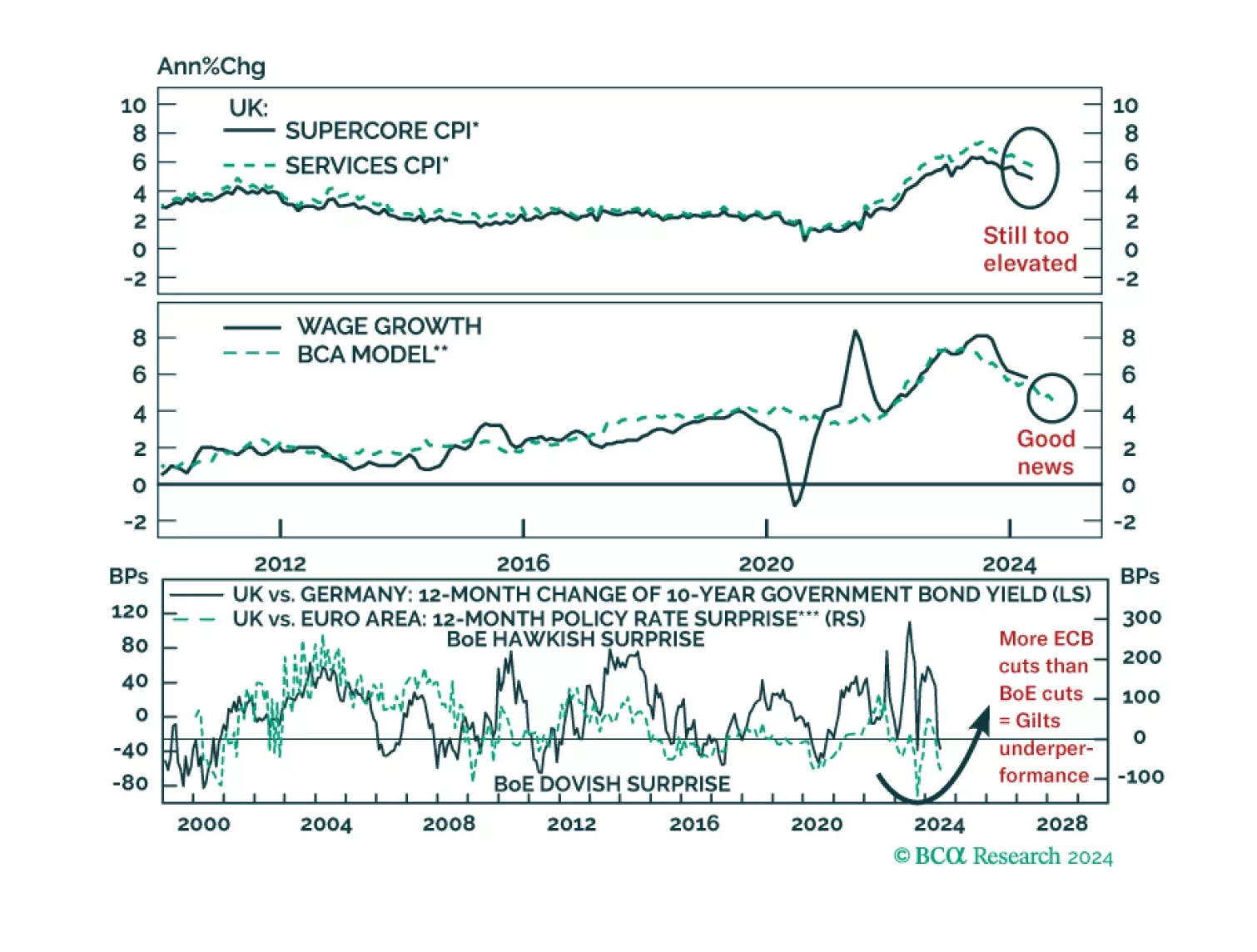

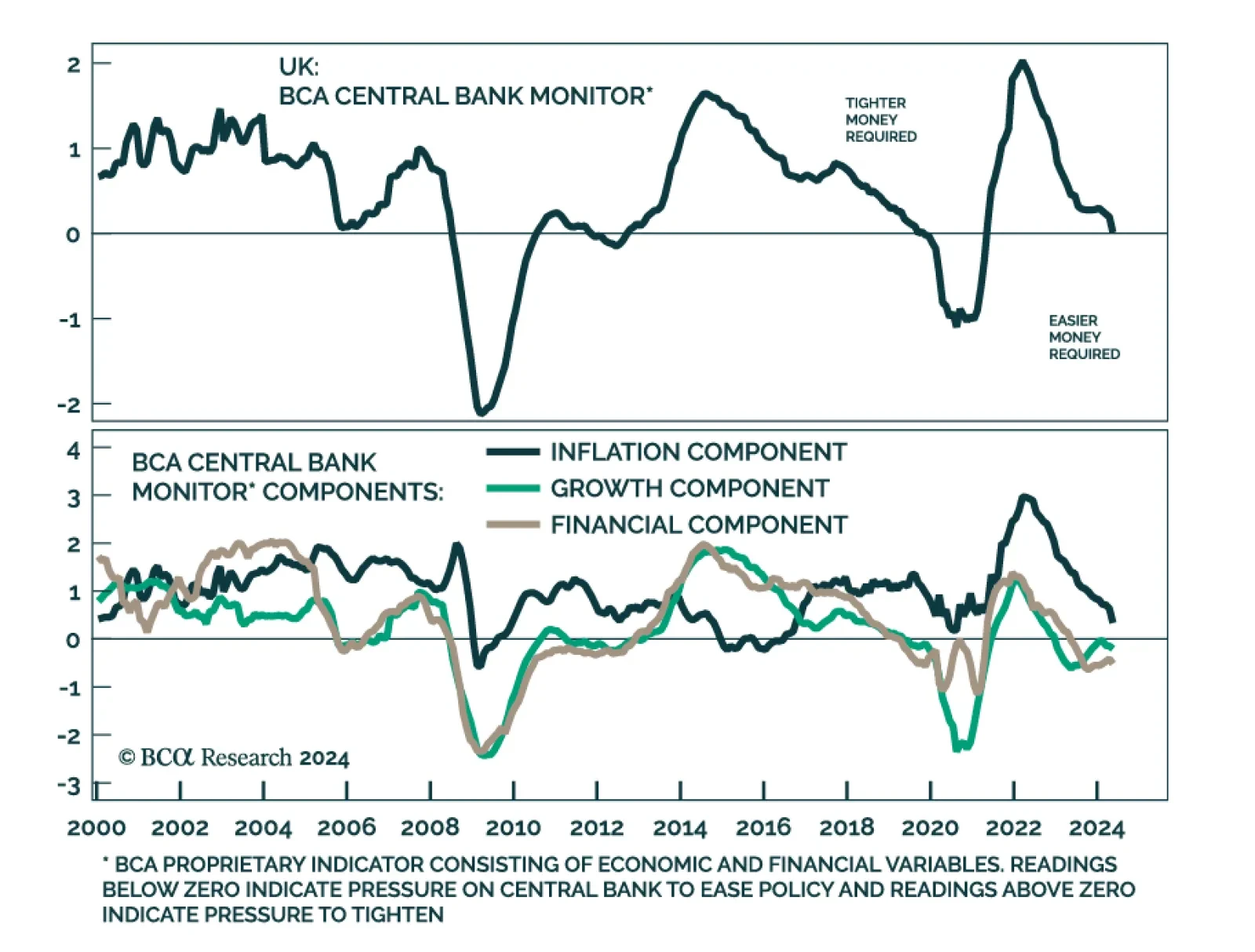

Is the BoE making a mistake moving toward rate cuts before the end of the summer? What would such a move mean for UK asset prices?

Today’s report recaps last week’s webcast and elaborates on its themes, delving into the empirical evidence underpinning our conviction that asset allocators should underweight equities sparingly and fleetingly. We remain tactically…

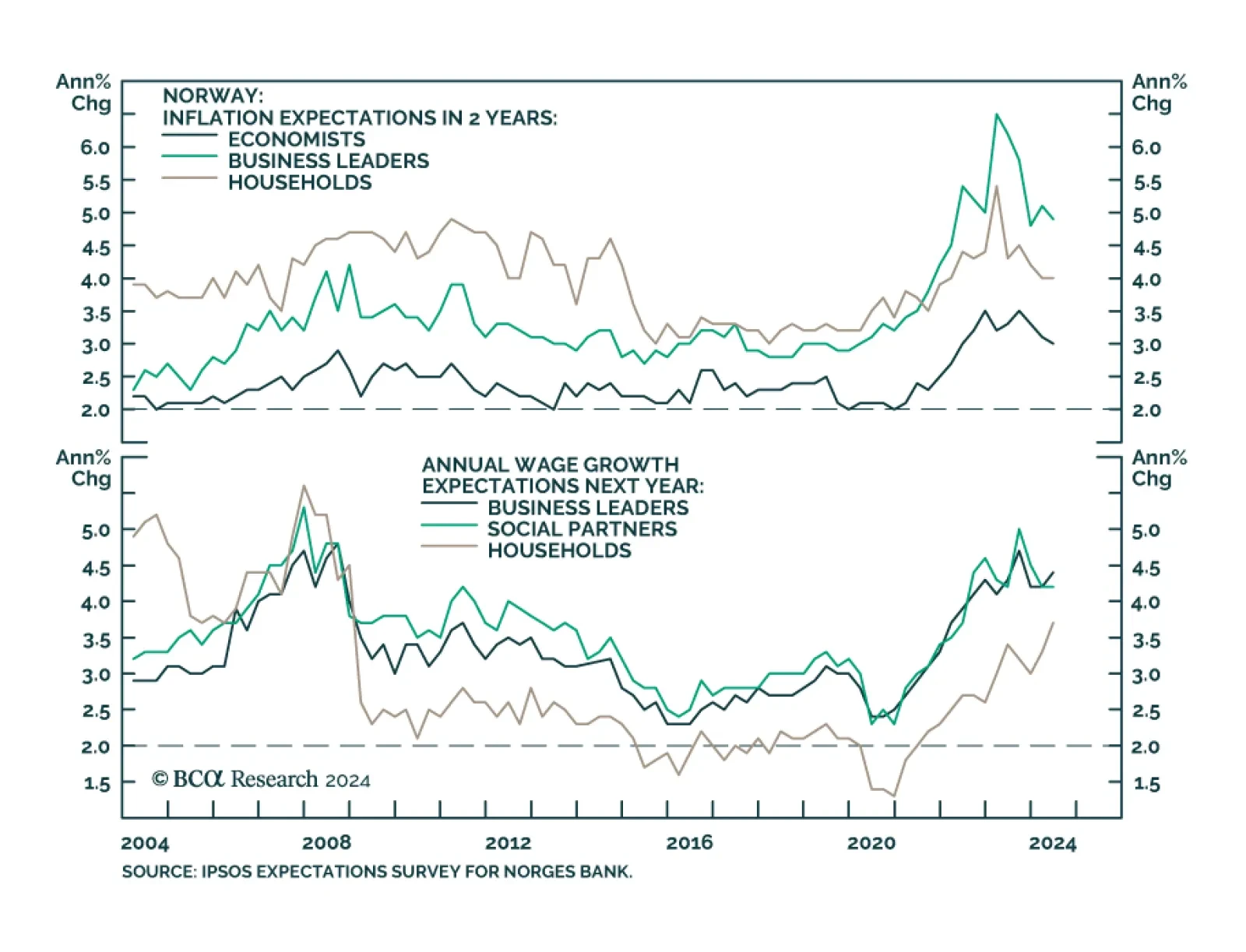

According to BCA Research’s Foreign Exchange Strategy service, the Norges Bank will be one of the last central banks to cut rates. The Swiss National Bank, Bank of England, and Norges Bank all held policy meetings on…

In a widely expected move, the Bank of England (BoE) kept its policy rate unchanged at 5.25% in June. Although MPC members voted seven-to-two in favor of not cutting rates, a tweak in communication noting that the decision was…